Middle East And Africa Pea Flour Market

Market Size in USD Million

CAGR :

%

USD

12,980.51 Million

USD

19,092.04 Million

2022

2030

USD

12,980.51 Million

USD

19,092.04 Million

2022

2030

| 2023 –2030 | |

| USD 12,980.51 Million | |

| USD 19,092.04 Million | |

|

|

|

Middle East and Africa Pea Flour Market Analysis and Size

Pea flour is being progressively used as a functional food ingredient in the global market and is derived from the green and yellow peas. Gluten causes dermatitis herpetiformis, celiac disease, digestive tract illnesses and other health difficulties. This has presented opportunities for the gluten-free foods in the global market. Gluten causes dermatitis herpetiformis, celiac disease, digestive tract illnesses and other health difficulties. As a result, the demand for the gluten-free foods such as pea flour is rapidly increasing which eventually enhances the market growth.

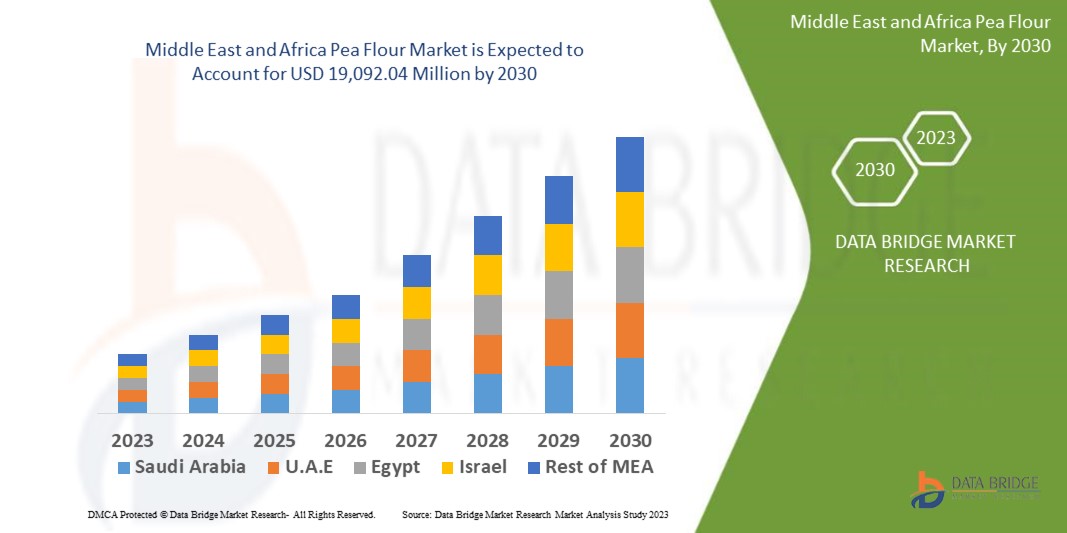

Data Bridge Market Research analyses that the Middle East and Africa pea flour market which was USD 12,980.51 million in 2022, is expected to reach USD 19,092.04 million by 2030, and is expected to undergo a CAGR of 4.9% during the forecast period 2023-2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the data bridge market research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Middle East and Africa Pea Flour Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Category (Organic, Inorganic), Type of Peas (Green, Yellow, Maple, Marrowfat), Application (Food and Beverages, Animal Feed, Household/Retail), Distribution Channel (Direct, Indirect) |

|

Countries Covered |

South Africa, U.A.E., Saudi Arabia, Oman, Qatar, Kuwait, and Rest of Middle East and Africa |

|

Market Players Covered |

Ingredion (U.S.), Grain Millers, Inc. (U.S.), AGT Food and Ingredients (Canada), Golden Grain Mills (Australia), A&B Ingredients, Inc. (U.S.), Midlands Holdings (China), Barry Farm Foods (U.S.), Murlidhar Industries (India), and Informa Markets (U.S.) |

|

Market Opportunities |

|

Market Definition

Pea flour is a type of flour which is mainly prepared from roasted yellow field peas. Roasting increases the nutritional value of flour by allowing more carbohydrates and proteins to be retrieved. Usually, peas were ground 3 times in stone mills motorized by water. The caramelization during roasting of yellow field pea gives the pea flour a brownish yellow color, and also gives the texture ranges from fine to resolute.

Middle East and Africa Pea Flour Pea Flour Market Dynamics

Drivers

- Increasing Demand for Yellow Pea Flour Among Consumers

The increasing demand for Yellow pea flour among consumers is expected to drive the growth rate of the market during the forecast period. Yellow pea flour is a major source of carbohydrates and photo protein. It also has medical appearances, which supports the market to grow. They are low in fat and rich in protein, fibre, and antioxidants. It's also been observed that the consumption of whole pulses lowers the level of glucose in blood after meals. It works well in scones, pancakes, cookies, batters, and other baked goods. Hence, increasing demand for yellow pea flour among consumers which will enhance the market growth.

- Growing Focus of Market Players on Consumer Health

Increasing focus of market players on consumer health is anticipated to restrain the usage of wheat and rice flour, thus leading to a positive impact on the growth of the pea flour market. Gluten-free nature and ability of the pea flour product to improve the shelf-life and texture of food are expected to boost the market growth. Pea flour improves the complete nutritional content of the foodstuff, which is expected to increase the demand of this flour in the global market.

Opportunities

- Rapidly Increasing Demand of Organic Pea Flour

The rapid growth of pea flour market is generally attributed to the increasing demand for organic products such as organic pea flour with the rising number of certified organic pea produce farms and growing trend of clean label products. The trend of clean label products is increasing as consumers opt for natural products such as organic pea flour, which have fewer additives and chemicals. Thus, increasing demand of organic pea flour will create lucrative opportunities for the market growth.

- Health Benefits Associated with Consumption of Pea Flour

The availability of various nutritional elements in pea flour such as sodium, selenium, iron, potassium and magnesium is anticipated to increase its demand during the forecast period. The consumption of pea flour aids in curbing health problems such as diabetes, and cancer, coronary heart disease, obesity thereby leading to augmented consumption and create ample opportunities for the market growth.

Restraint/Challenge

- Availability of Other Organic and Ordinary Protein Constituents

The Middle East and Africa Pea flour market may be hindered by the availability of other organic and ordinary protein constituents. The increasing demand for oil-seed and nut-based flours such as soy, hemp and almond will hamper the growth of the market. Moreover, the digestion of pea flour is very difficult which may operate as a major obstruct for the market growth during the forecast period.

This Middle East and Africa pea flour market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Middle East and Africa pea flour market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Development

- In 2020, according to the FORTUNE Magazine for the 12th year in a row, ADM has been most admired company overall the world in the food production industry. ADM has improved its brand image by getting this award which will increase more consumers to its portfolio

- In 2020, Limagrain Ingredients launched an extruded yellow pea flour product especially for pet food. This new ingredient offers a formulation with higher nutritional values while aiding manufacturers to meet consumer demands for clean-label and grain-free pet foods

Middle East and Africa Pea Flour Market Scope

Middle East and Africa pea flour market is segmented on the basis of category, type of peas, application, distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Category

- Organic

- Inorganic

Type of Peas

- Green

- Yellow

- Maple

- Marrowfat

Application

- Food and Beverages

- Animal Feed

- Household/Retail

Distribution Channel

- Direct

- Indirect

Middle East and Africa Pea Flour Market Regional Analysis/Insights

The Middle East and Africa pea flour market is analysed and market size insights and trends are provided by country, category, type of peas, application and distribution channels as referenced above.

The countries covered in the Middle East and Africa pea flour market report are UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa is dominating and is expected to witness significant growth in the Middle East and Africa pea flour market due high demand for the nutritious food products by the consumers. In order to fulfil the demand of the people the manufacturers are more focused in providing high quality pea flour that can be utilized by food and beverages sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the Market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Pea Flour Market Share Analysis

The pea flour market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Middle East and Africa pea flour market .

Some of the major players operating in the Middle East and Africa pea flour market are:

- Ingredion (U.S.)

- Grain Millers, Inc. (U.S.)

- AGT Food and Ingredients (Canada)

- Golden Grain Mills (Australia)

- A&B Ingredients, Inc. (U.S.)

- Midlands Holdings (China)

- Barry Farm Foods (U.S.)

- Murlidhar Industries (India)

- Informa Markets (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Pea Flour Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Pea Flour Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Pea Flour Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.