Global Yellow Pea Flour Market

Market Size in USD Billion

CAGR :

%

USD

6.25 Billion

USD

9.60 Billion

2024

2032

USD

6.25 Billion

USD

9.60 Billion

2024

2032

| 2025 –2032 | |

| USD 6.25 Billion | |

| USD 9.60 Billion | |

|

|

|

|

What is the Global Yellow Pea Flour Market Size and Growth Rate?

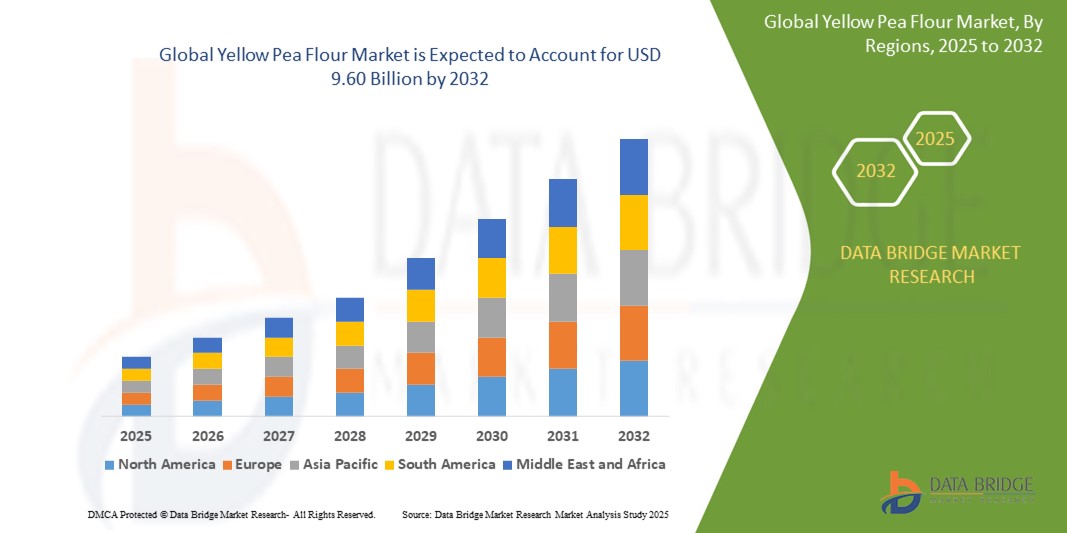

- The global yellow pea flour market size was valued at USD 6.25 billion in 2024 and is expected to reach USD 9.60 billion by 2032, at a CAGR of 5.50% during the forecast period

- The yellow pea flour market is experiencing notable growth driven by increasing consumer demand for plant-based and gluten-free products. Yellow pea flour is gaining popularity due to its high protein content, dietary fiber, and versatility, making it an attractive ingredient for various food applications. The rise in health-conscious consumers seeking nutrient-dense, allergen-friendly alternatives contributes to the growing adoption of yellow pea flour in both food and pet food sectors

- In addition, the trend towards clean-label and natural ingredients is fueling demand, as yellow pea flour fits well with these consumer preferences. The market is further supported by the expanding plant-based food industry and the increasing prevalence of vegetarian and vegan diets

What are the Major Takeaways of Yellow Pea Flour Market?

- The expansion in pet food applications driven by the growing demand for high-quality, grain-free pet food presents significant opportunities for the increased use of yellow pea flour in pet food formulations. Pet owners are becoming more discerning about their pets' diets, seeking out products that offer superior nutrition and address specific dietary needs. This shift is leading to a surge in demand for grain-free pet foods, which are perceived as being more natural and beneficial for pets with food sensitivities or allergies

- Yellow pea flour, known for its high protein content, excellent digestibility, and hypoallergenic properties, fits perfectly into this market trend. It provides a nutritious alternative to traditional grains and can enhance the overall protein profile of pet food products

- North America dominated the yellow pea flour market with the largest revenue share of 36.58% in 2024, driven by increasing consumer demand for plant-based protein alternatives, the growth of gluten-free and allergen-free food segments, and heightened awareness around health and sustainability

- Asia-Pacific is projected to grow at the fastest CAGR of 11.47% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and a growing preference for high-protein vegetarian diets across major economies such as China, Japan, and India

- The pea flour segment dominated the yellow pea flour market with the largest market revenue share of 61.3% in 2024, driven by its high protein and fiber content, making it a popular ingredient in gluten-free and plant-based diets

Report Scope and Yellow Pea Flour Market Segmentation

|

Attributes |

Yellow Pea Flour Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Yellow Pea Flour Market?

“Growing Demand for Clean-Label, Plant-Based Ingredients”

- A significant and accelerating trend in the global yellow pea flour market is the rising consumer preference for clean-label, plant-based, and gluten-free ingredients. Yellow pea flour aligns with these demands due to its natural, minimally processed profile, and high nutritional value

- For instance, Bob’s Red Mill Natural Foods and ADM have introduced yellow pea flour-based products to cater to vegan and gluten-intolerant consumers, responding to the broader shift toward transparency in food sourcing and labeling

- The flour’s high protein and fiber content, low allergenicity, and compatibility with a wide range of diets (vegan, keto, paleo) make it an ideal choice for formulators seeking to meet modern dietary trends

- It is increasingly used in applications such as gluten-free baking, plant-based snacks, and meat analogues, where clean-label appeal and nutritional density are key differentiators in crowded product categories

- The trend is further fueled by rising concerns over soy and wheat allergens, leading manufacturers to pivot toward pea-based alternatives that offer functional benefits without compromising taste or texture

- As a result, companies such as Ingredion Incorporated and AGT Foods are scaling their pea processing capacities to meet the growing industrial demand for yellow pea flour as a sustainable, health-oriented ingredient

What are the Key Drivers of Yellow Pea Flour Market?

- The increasing demand for plant-based protein sources, combined with the growth of gluten-free and non-GMO food segments, is a primary driver of the yellow pea flour market

- For instance, in June 2024, Ingredion Incorporated expanded its pea protein and flour production facility in Nebraska, U.S., to meet the surging consumer demand for allergen-friendly, sustainable ingredients

- Rising health awareness and the adoption of flexitarian and vegan diets have led consumers to seek nutrient-dense alternatives such as yellow pea flour that support digestive health and clean eating habits

- The flour’s low glycemic index, allergen-free nature, and high nutritional value make it ideal for use in functional foods, infant nutrition, and sports supplements, boosting its appeal across demographic

- In addition, yellow pea flour’s environmental sustainability, requiring less water and nitrogen fertilizer than other protein crops, aligns with the global push toward eco-conscious agriculture, attracting support from manufacturers and governments asuch as

Which Factor is challenging the Growth of the Yellow Pea Flour Market?

- One of the key challenges is the limited consumer awareness and acceptance of yellow pea flour, particularly in emerging markets where traditional flours (wheat, rice) dominate usage patterns

- For instance, despite its nutritional benefits, yellow pea flour is still underutilized in mainstream applications due to concerns about its distinct flavor and the need for formulation expertise to mask or balance its taste in end products

- Furthermore, price volatility and supply chain constraints related to yellow peas due to climatic conditions or geopolitical tensions can affect the consistent availability and pricing of the flour

- In regions with limited pea cultivation or processing infrastructure, import dependence raises production costs and limits local market penetration, especially for small and medium-scale food producers

- To overcome these challenges, companies must invest in consumer education, recipe innovation, and flavor-masking technologies, while governments and industry players may need to support local cultivation initiatives and supply chain resilience to enable market expansion

How is the Yellow Pea Flour Market Segmented?

The market is segmented on the basis of product type, origin, application, and distribution channel.

- By Product Type

On the basis of product type, the yellow pea flour market is segmented into pea flour and pea starch. The pea flour segment dominated the yellow pea flour market with the largest market revenue share of 61.3% in 2024, driven by its high protein and fiber content, making it a popular ingredient in gluten-free and plant-based diets. Pea flour’s versatility in baking, snacks, and extruded food products has contributed to its growing adoption across the food processing industry.

The pea starch segment is anticipated to witness the fastest growth rate of 20.8% from 2025 to 2032, owing to its rising usage in food and beverage as a thickening agent and in industrial applications such as biodegradable packaging. Its neutral taste, texture-enhancing qualities, and potential in clean-label formulations make it attractive to manufacturers seeking functional alternatives to synthetic starches.

- By Origin

On the basis of origin, the market is bifurcated into organic and inorganic. The inorganic segment held the largest market revenue share in 2024 due to its widespread availability, cost-effectiveness, and established supply chains that make it preferable for large-scale food processors and bulk buyers in emerging markets.

The organic segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing consumer demand for clean-label and chemical-free ingredients. The growth of organic food trends and rising health awareness are pushing brands to incorporate organic yellow pea flour into products targeted at health-conscious and premium consumers.

- By Application

On the basis of application, the yellow pea flour market is segmented into baking industry, nutrition industry, and others. The baking industry segment accounted for the largest market revenue share in 2024, as pea flour is increasingly used in gluten-free breads, cakes, and pastries to enhance protein content and improve texture. Its compatibility with other flours and rising demand for plant-based baked goods are driving its popularity.

The nutrition industry segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its adoption in protein bars, sports nutrition, and meal replacement products. The trend toward vegan protein sources and the shift away from soy and dairy proteins are major contributors to growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct and indirect. The indirect segment held the largest market revenue share in 2024 due to the expansive reach of supermarkets, health food stores, and e-commerce platforms, which allow brands to cater to a wide range of consumers through retail channels.

The direct segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by the increasing preference among food manufacturers and institutional buyers for bulk purchasing from suppliers or producers. This channel offers benefits such as better pricing, customized supply contracts, and traceability—especially critical for organic and specialty flour types.

Which Region Holds the Largest Share of the Yellow Pea Flour Market?

- North America dominated the yellow pea flour market with the largest revenue share of 36.58% in 2024, driven by increasing consumer demand for plant-based protein alternatives, the growth of gluten-free and allergen-free food segments, and heightened awareness around health and sustainability

- The region has witnessed rising interest in clean-label and functional ingredients, with yellow pea flour being increasingly used across snack foods, bakery products, and meat alternatives

- Furthermore, a well-established food processing industry, high consumer spending, and a trend towards vegetarian and vegan lifestyles continue to bolster the demand for yellow pea flour across both B2B and B2C segments

U.S. Yellow Pea Flour Market Insight

The U.S. dominated the North America market revenue share in 2024, supported by a sharp rise in vegan, keto, and flexitarian dietary trends. Increasing use of yellow pea flour in protein bars, baked goods, and plant-based meat products has fueled market expansion. Moreover, major food manufacturers are investing in pea-based ingredient R&D and clean-label product portfolios to cater to growing consumer demand for high-protein, gluten-free, and allergen-friendly food alternatives.

Europe Yellow Pea Flour Market Insight

The European market is projected to expand at a substantial CAGR throughout the forecast period, led by stringent regulations on food labeling and sustainability, and rising demand for plant-based protein in meat substitutes and health foods. The region's strong consumer inclination towards organic, non-GMO, and allergen-free food options promotes the use of yellow pea flour in nutrition and baking industries. Key players are also leveraging eco-friendly branding strategies to penetrate the evolving European consumer base.

U.K. Yellow Pea Flour Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, fueled by a nationwide shift towards sustainable and plant-forward diets. Consumers are increasingly turning to gluten-free baking ingredients, with yellow pea flour being a preferred choice due to its nutritional richness and neutral flavor. The rapid growth of online health food platforms and vegan-focused startups has significantly contributed to the visibility and accessibility of yellow pea-based products across retail and foodservice channels.

Germany Yellow Pea Flour Market Insight

The Germany market is expected to expand at a considerable CAGR, backed by rising consumer interest in functional ingredients and protein fortification in bakery and nutrition products. Germany’s progressive stance on environmentally sustainable food production aligns with yellow pea flour’s eco-friendly sourcing and production process. Food companies are increasingly incorporating pea flour in cereals, bread, and snacks, addressing both taste and health-conscious preferences of German consumers.

Which Region is the Fastest Growing in the Yellow Pea Flour Market?

Asia-Pacific is projected to grow at the fastest CAGR of 11.47% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and a growing preference for high-protein vegetarian diets across major economies such as China, Japan, and India. The booming food processing sector, along with government initiatives promoting sustainable agriculture and plant-based nutrition, is catalyzing market demand. Expanding health awareness and an evolving middle-class population with a growing appetite for convenient, affordable, and nutritious alternatives further position the region as a dynamic growth hub for yellow pea flour products.

Japan Yellow Pea Flour Market Insight

The Japan market is gaining momentum due to its strong focus on nutritional innovation, food quality, and senior health. Consumers are adopting yellow pea flour as a functional ingredient in instant soups, noodles, and dietary foods, especially appealing to Japan’s aging population. Food manufacturers are responding with new formulations that enhance both digestibility and protein intake, aligning with national wellness priorities and premium health food trends.

China Yellow Pea Flour Market Insight

China accounted for the largest share in the Asia-Pacific market in 2024, driven by a surge in demand for plant-based and clean-label products. The country's thriving food manufacturing industry and government-backed nutrition policies are enabling widespread incorporation of yellow pea flour in meat analogs, snacks, and meal replacements. As consumer awareness of health and sustainability grows, domestic manufacturers are expanding production and distribution channels to meet the increasing demand.

Which are the Top Companies in Yellow Pea Flour Market?

The yellow pea flour industry is primarily led by well-established companies, including:

- AGT Food and Ingredients (Canada)

- Bob’s Red Mill Natural Foods (U.S.)

- Batory Foods (U.S.)

- Groupe Limagrain (France)

- Hodmedod's British Wholefoods (U.K.)

- Avena Foods, Limited (Canada)

- Spice Mecca (South Africa)

- Woodland Foods (U.S.)

- Vestkorn (Norway)

- Diefenbaker Spice & Pulse (Canada)

- Mirfak Pty Ltd (Australia)

- Novofarina (France)

- Barry Farm Foods (U.S.)

- Cates Grain & Seed (U.S.)

- Hansco Distributors Inc. (U.S.)

- SpiceEE (U.S.)

- Ingredion Incorporated (U.S.)

- Midlands Holdings (New Zealand)

- ADM (U.S.)

- ANCHOR INGREDIENTS (U.S.)

- Hearthy Foods (U.S.)

- Golden Grain Mills (Australia)

What are the Recent Developments in Global Yellow Pea Flour Market?

- In September 2022, AGT Foods of Regina entered into a strategic partnership with Equinom to drive the development of advanced high-protein yellow pea varieties. This collaboration is expected to significantly strengthen innovation in the yellow pea flour sector

- In June 2022, Equinom joined forces with Peterson Farms Seed to cultivate identity-preserved seeds of Equinom’s yellow peas, featuring non-GMO and high-protein traits tailored for food-grade applications. The move is aimed at boosting supply chain transparency and premium product quality in yellow pea-based foods

- In March 2022, Beyond Meat and PepsiCo launched a joint venture to produce plant-based jerky using simple, non-GMO ingredients free from soy, gluten, and cholesterol. This partnership is anticipated to expand the footprint of yellow pea protein in mainstream snack products

- In June 2020, Limagrain Ingredients unveiled a new extruded yellow pea flour designed for the pet food industry, focusing on enhanced nutrition and clean-label, grain-free formulations. This development is such asly to elevate the use of yellow pea flour in premium pet food manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Yellow Pea Flour Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Yellow Pea Flour Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Yellow Pea Flour Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.