Middle East And Africa Projection Mapping Market

Market Size in USD Billion

CAGR :

%

USD

4.96 Billion

USD

24.14 Billion

2024

2032

USD

4.96 Billion

USD

24.14 Billion

2024

2032

| 2025 –2032 | |

| USD 4.96 Billion | |

| USD 24.14 Billion | |

|

|

|

|

Projection Mapping Market Size

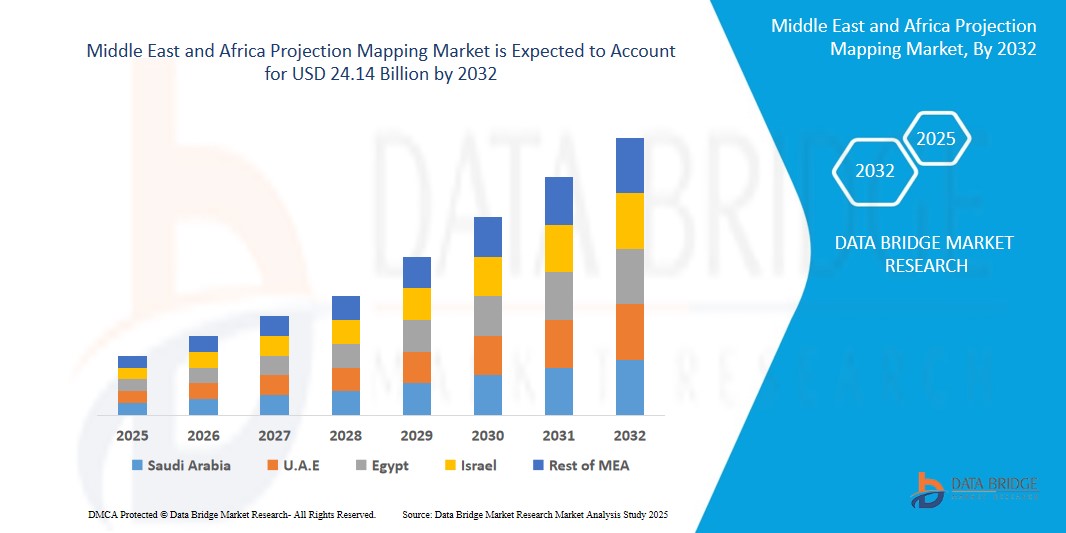

- The Middle East and Africa Projection Mapping Market size was valued at USD 4.96 billion in 2024 and is expected to reach USD 24.14 billion by 2032, at a CAGR of 25.4% during the forecast period

- The rapid market expansion is primarily driven by the growing adoption of immersive and experiential marketing strategies across industries such as entertainment, live events, retail, tourism, and religious gatherings. Brands and organizations across the region are leveraging projection mapping to create visually impactful experiences that captivate audiences and amplify brand messaging.

- Furthermore, technological advancements in projection hardware and software—such as high-lumen laser projectors, real-time 3D mapping software, and edge blending capabilities—are enabling larger, more precise, and interactive visual displays. These innovations are lowering deployment barriers and expanding use cases across public installations and commercial venues.

Projection Mapping Market Analysis

- Projection mapping, the technique of projecting visuals onto non-traditional and irregular surfaces to produce immersive, three-dimensional environments, is gaining significant traction across sectors such as entertainment, advertising, education, religious events, and cultural exhibitions in the Middle East and Africa. The technology’s ability to visually transform static structures into engaging, dynamic experiences is redefining audience interaction in both commercial and public domains.

- The market growth is primarily driven by the escalating demand for experiential marketing and the rising popularity of immersive events, festivals, and brand activations. Venues such as theme parks, heritage museums, architectural landmarks, and retail malls are increasingly using projection mapping to enhance visual engagement and drive visitor footfall.

- Saudi Arabia dominates the Middle East and Africa projection mapping market with a revenue share of over 38.7% in 2025, attributed to strong investments in Vision 2030 initiatives, rising consumer appetite for high-tech entertainment, and frequent hosting of mega-events like Riyadh Season, MDLBEAST Soundstorm, and Noor Riyadh Festival. These events extensively leverage projection mapping to create visually immersive narratives, enhancing attendee experience.

- The UAE is anticipated to be the fastest-growing market in the region throughout the forecast period. Growth is propelled by smart city initiatives, tourism-driven installations, and substantial investment in digital art exhibitions and public space innovation—such as the projection mapping-led Festival of Lights in Sharjah and Expo City Dubai activations.

- The Entertainment & Events application segment is expected to hold the largest market share of around 41.5% in 2025, driven by its widespread integration into concerts, sports events, live shows, and cultural festivals. The increasing deployment of projection mapping to craft immersive visual storytelling continues to reshape how audiences experience performances, reinforcing the segment's market dominance.

Report Scope and Projection Mapping Market Segmentation

|

Attributes |

Projection Mapping Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Projection Mapping Market Trends

“Cultural Tourism and Mega Events Fueling Immersive Projection Experiences”

- A dominant trend shaping the Middle East and Africa Projection Mapping Market is the increasing deployment of projection mapping in cultural tourism, mega festivals, and national celebrations, driven by government-backed initiatives aimed at transforming urban and heritage sites into interactive visual experiences.

- For instance, Saudi Arabia’s Noor Riyadh Festival 2024, one of the largest light and art events in the world, featured projection mapping installations across historic and contemporary landmarks. The event combined light-based artworks and immersive storytelling, attracting millions of visitors and reinforcing Saudi Arabia’s commitment to digital transformation through Vision 2030.

- Similarly, Dubai Expo City continues to host projection mapping-led digital art exhibitions, using large-scale 3D visuals and interactive surfaces to attract both tourists and residents. This aligns with the UAE’s focus on becoming a global hub for innovation and immersive technologies.

- Companies like Panasonic and Epson have been active in supplying high-lumen projectors and edge blending solutions for events like the Festival of Lights in Sharjah, demonstrating how high-definition, synchronized projection mapping systems are reshaping public spaces into storytelling canvases.

- Additionally, projection mapping is increasingly used in religious and cultural observances. In 2023, the AlUla Moments festival in Saudi Arabia incorporated projection visuals onto ancient rock formations to narrate historical tales, blending technology with heritage.

- Museums and indoor venues across Qatar and the UAE are also deploying interactive projection mapping for education and tourism, including the Qatar National Museum’s immersive galleries that integrate dynamic projections with artifact displays.

Projection Mapping Market Dynamics

Driver

“Government-Backed Cultural Revitalization and Tourism Development”

- The Middle East and Africa region is witnessing robust investment in projection mapping through national programs that seek to boost tourism, modernize infrastructure, and enhance public engagement via large-scale digital experiences.

- A clear example is the Diriyah Season 2024 in Saudi Arabia, which included digital light shows powered by projection mapping on heritage sites to depict historical narratives in real time. These immersive initiatives are intended to boost cultural pride while attracting global audiences.

- In the UAE, interactive projection mapping installations were showcased during the UAE National Day celebrations in 2023, combining animation, AI, and large-format visuals on architectural facades to deliver emotionally resonant content.

- The growing government-private partnerships in cities like Doha, Muscat, and Cape Town are channeling resources into interactive tourism attractions using 3D projection mapping, supporting both infrastructure modernization and economic diversification beyond oil.

- Moreover, educational institutions in the region are exploring projection-based learning environments, such as immersive domes and interactive lecture halls, promoting deeper engagement and multi-sensory learning experiences.

Restraint/Challenge

“Operational Cost and Environmental Constraints”

- Despite rising demand, the market in MEA faces challenges related to high setup and maintenance costs, especially for outdoor large-scale projections in desert climates, where heat, dust, and sand can interfere with equipment performance.

- Advanced high-brightness projectors (10,000+ lumens) from vendors like Barco, Christie, and Panasonic—commonly used for landmark projections—remain cost-prohibitive for smaller municipalities and independent creatives in the region.

- The complexity of aligning multiple projectors on intricate historical surfaces in heritage-rich regions like Saudi Arabia or Egypt adds further operational strain, requiring specialized calibration software and skilled technicians.

- Moreover, fluctuating lighting conditions in open public venues and lack of infrastructure in remote cultural sites can diminish projection clarity, reducing the effectiveness of installations during daytime or in poorly maintained areas.

- The region’s fragmented access to trained personnel and high-end creative studios can delay execution timelines for events, limiting scalability. While initiatives are underway to upskill local content creators, widespread adoption across Tier 2 and Tier 3 cities remains a challenge.

Projection Mapping Market Scope

The market is segmented on the basis throw distance, dimension, lumens, offering and application.

By Throw Distance

On the basis of throw distance, the market is segmented into Standard Throw and Short Throw.

- The Standard Throw segment held the largest market revenue share in 2025, driven by its widespread use in large-scale public displays, cultural festivals, and heritage projection events across Saudi Arabia and the UAE. These projectors are well-suited for long-distance, high-resolution mapping on architectural landmarks and desert landscapes.

- For instance, Barco’s UDX series was deployed during the Noor Riyadh Festival 2024 to project visuals onto cultural and government buildings across Riyadh, delivering vibrant imagery over long ranges.

- The Short Throw segment is projected to grow at the fastest CAGR during the forecast period, due to rising adoption in indoor museums, retail displays, and interactive tourism installations.

- In 2024, Epson Middle East launched short-throw laser projectors like the EB-800F, specifically targeting museums and galleries in Dubai and Doha, where space-efficient yet immersive visuals are required..

• By Dimension

On the basis of dimension, the market is segmented into 2-Dimensional, 3-Dimensional, and 4-Dimensional projection mapping.

- The 3-Dimensional segment dominated the market share in 2025, owing to its widespread use in live entertainment, religious celebrations, and public installations.

- For example, Panasonic’s 3D projection mapping was featured during Dubai’s 2024 New Year’s Eve celebrations at Burj Khalifa, creating high-impact animations layered over the skyscraper's surface.

- The 4-Dimensional segment is expected to register the fastest growth, with increasing integration of sound, scent, motion, and tactile effects.

- Attractions like AYA Universe in Wafi City, Dubai, are incorporating 4D immersive environments with projection mapping to offer multi-sensory storytelling.

- The 2-Dimensional segment continues to find application in budget-friendly installations like shopping malls, indoor events, and educational institutions, especially in secondary cities across Oman, Jordan, and Egypt..

• By Lumens

On the basis of brightness output, the market is segmented into 3,500–10,000 lumens, 10,000–30,000 lumens, and Above 30,000 lumens.

- The 10,000–30,000 lumens segment held the largest revenue share in 2025, as it offers an ideal balance of brightness and cost-efficiency for medium- to large-scale events, especially in concerts, museums, and government events.

- For example, Christie’s 20,000-lumen projectors were used at the Sharjah Light Festival 2024, enabling stunning visuals across the city’s mosques and academic institutions.

- The Above 30,000 lumens segment is anticipated to grow at the highest CAGR due to its demand in massive outdoor projections, particularly in desert festivals and landmark events.

- In February 2024, Panasonic Middle East provided its PT-RQ50K (50,000 lumens) projectors for Saudi Arabia’s Winter at Tantora Festival, delivering ultra-bright visuals on rocky terrains.

- The 3,500–10,000 lumens segment caters to indoor exhibitions, hotel lobbies, and boutique retail setups in cities like Muscat, Nairobi, and Addis Ababa, where immersive experiences are required within smaller, controlled spaces..

• By Offering

On the basis of offering, the market is segmented into Hardware and Software.

- The Hardware segment accounted for the largest share in 2025, supported by rising procurement of projection systems, lenses, and media servers for national and entertainment projects.

- In March 2024, Epson announced its expansion in the Middle East with a new distribution deal in the UAE, boosting access to its laser projection lineup for events and educational projects.

- The Software segment is expected to grow at the fastest pace, with artists and event companies adopting advanced tools like HeavyM, Vioso, and MadMapper to create interactive visuals.

- Companies in Dubai and Riyadh are increasingly offering projection mapping as a service (PMaaS), driven by demand from retail, tourism, and cultural sectors for dynamic and real-time storytelling platforms.

• By Application

On the basis of application, the market is segmented into Festivals, Events, Retail/Entertainment, Large Venue, and Others.

- The Festivals segment led the market in 2025, fueled by government-sponsored light festivals and national day celebrations that heavily integrate projection mapping.

- The Noor Riyadh Festival 2024, Sharjah Light Festival, and UAE National Day shows all used projection mapping to engage mass audiences through storytelling via digital art.

- The Large Venue segment is projected to witness the fastest growth, as stadiums, exhibition halls, and performance centers increasingly incorporate large-format projections.

- For instance, Etihad Arena in Abu Dhabi implemented projection mapping in May 2024 during a major esports championship, showcasing synchronized visuals across seating areas and stage floors.

- The Retail/Entertainment segment is rapidly expanding in malls and theme parks like Dubai Mall, Global Village, and Ferrari World, where projection mapping is used for product launches, promotional displays, and themed attractions.

- Events and Others segments continue to gain traction in corporate functions, educational exhibits, and government awareness campaigns, especially in sectors like healthcare and public safety where visual engagement enhances messaging impact

Projection Mapping Market Regional Analysis

- The Middle East and Africa (MEA) region is emerging as one of the fastest-growing markets for projection mapping, driven by rapid urban development, government-backed tourism projects, cultural heritage festivals, and a rising emphasis on smart city initiatives.

- Countries such as Saudi Arabia, the UAE, South Africa, and Egypt are investing in immersive visual technologies for entertainment, religious, retail, and national events, contributing significantly to regional demand.

- Growth is further supported by infrastructure development for large-scale venues, the expansion of event and exhibition industries, and increasing collaboration with international AV and creative technology firms.

- The availability of advanced projection equipment from global brands like Panasonic, Barco, Epson, and Christie, along with local system integrators, is enhancing adoption across multiple verticals.

Saudi Arabia Projection Mapping Market Insight

- Saudi Arabia dominated the MEA projection mapping market in 2025, accounting for over 37% of the regional revenue, fueled by the country’s Vision 2030 initiative which promotes large-scale cultural and entertainment projects.

- The government is actively integrating projection mapping in events like Riyadh Season, Noor Riyadh Festival, and Winter at Tantora, showcasing digital art across public buildings and heritage sites.

- For example, Barco’s UDX projectors were deployed during Noor Riyadh 2024, illuminating architectural icons with synchronized projection narratives that drew millions of visitors.

- The Ministry of Culture and General Entertainment Authority (GEA) are key stakeholders funding immersive installations as part of efforts to position Saudi Arabia as a global events destination.

- Additionally, the rise of tourism zones like AlUla, Diriyah, and NEOM is opening new opportunities for 3D/4D projection mapping in hospitality, retail, and heritage preservation.

United Arab Emirates (UAE) Projection Mapping Market Insight

- The UAE is a major hub for projection mapping in the MEA region, driven by its established event infrastructure, luxury retail sector, and global tourism appeal.

- The market is thriving across Dubai, Abu Dhabi, and Sharjah, with frequent use of projection mapping in concerts, national celebrations, malls, museums, and theme parks.

- In December 2024, Panasonic’s PT-RZ34K projectors were featured in Dubai Festival City’s IMAGINE Show, delivering choreographed light, water, and projection performances.

- Events like Expo 2020 Dubai (legacy installations) and UAE National Day celebrations continue to demonstrate the country’s commitment to using projection mapping for national branding and entertainment.

- With entities like Dubai Tourism and Abu Dhabi Events Bureau investing in immersive technologies, the market is set for sustained growth, especially in hospitality and retail innovation.

South Africa Projection Mapping Market Insight

- South Africa is witnessing growing adoption of projection mapping in art festivals, cultural events, and sports ceremonies, particularly in Cape Town and Johannesburg.

- The 2024 edition of the Spier Light Art Festival in Stellenbosch featured interactive projection-based installations across vineyards and public areas, attracting domestic and international visitors.

- Increasing corporate sponsorships and government funding for public engagement and education through digital art are bolstering the technology’s reach.

- Local AV firms and creative agencies are also adopting projection mapping software tools like MadMapper and HeavyM, supported by training initiatives in creative tech.

Egypt Projection Mapping Market Insight

- Egypt is investing in projection mapping for heritage preservation, tourism promotion, and public storytelling around its historical monuments and museums.

- In 2024, the Pyramids of Giza were illuminated with a projection show commemorating the centennial of Tutankhamun’s tomb discovery, in partnership with global tech firms like Christie and Epson.

- Museums in Cairo and Luxor are piloting interactive projection mapping exhibits to enhance the visitor experience while preserving original artifacts.

- With rising tourist inflows and ongoing government support for cultural tourism digitalization, Egypt is poised to become a key market for projection-based attractions.

Projection Mapping Market Share

The Projection Mapping industry is primarily led by well-established companies, including:

- Panasonic Corporation (Japan)

- Seiko Epson Corporation (Japan)

- BenQ Corporation (Taiwan)

- Christie Digital Systems USA, Inc. (U.S.)

- Barco NV (Belgium)

- AV Stumpfl GmbH (Austria)

- Optoma Corporation (Taiwan)

- Digital Projection (U.K.)

- Sharp NEC Display Solutions (Japan)

- Vivitek (Taiwan)

Latest Developments in Middle East and Africa Projection Mapping Market

- In November 2024, Saudi Arabia’s Noor Riyadh Festival, one of the largest light art festivals globally, featured over 120 installations, including large-scale 3D projection mapping displays across heritage landmarks such as King Abdullah Financial District (KAFD) and Al-Murabba Palace. The event used Barco UDX-4K32 projectors in collaboration with international and regional artists, demonstrating the growing scale of immersive urban projection in the kingdom.

- In October 2024, the AlUla Moments festival series in Saudi Arabia integrated architectural projection mapping on ancient sandstone formations and tombs at Hegra, combining storytelling with conservation. The installations, developed with Panasonic high-lumen projectors, aligned with the country's Vision 2030 tourism and cultural diversification goals.

- In December 2023, Dubai Festival City Mall launched an upgraded version of its “IMAGINE” multimedia show, now incorporating AI-powered projection mapping using Panasonic PT-RQ50K 4K projectors. The show delivered synchronized projections, water, and light effects on a 360-degree waterfront canvas, highlighting the integration of advanced mapping technologies in retailtainment.

- In May 2023, Cairo International Book Fair introduced interactive projection mapping walls developed by local creative tech firms in collaboration with Epson Middle East. The installation allowed users to interact with book-related visuals through motion sensors, promoting digital literacy and cultural engagement in educational contexts.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Projection Mapping Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Projection Mapping Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Projection Mapping Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.