Middle East And Africa Wheat Gluten Market

Market Size in USD Million

CAGR :

%

USD

73.71 Million

USD

108.14 Million

2021

2029

USD

73.71 Million

USD

108.14 Million

2021

2029

| 2022 –2029 | |

| USD 73.71 Million | |

| USD 108.14 Million | |

|

|

|

|

Middle East and Africa Wheat Gluten Market Analysis and Insights

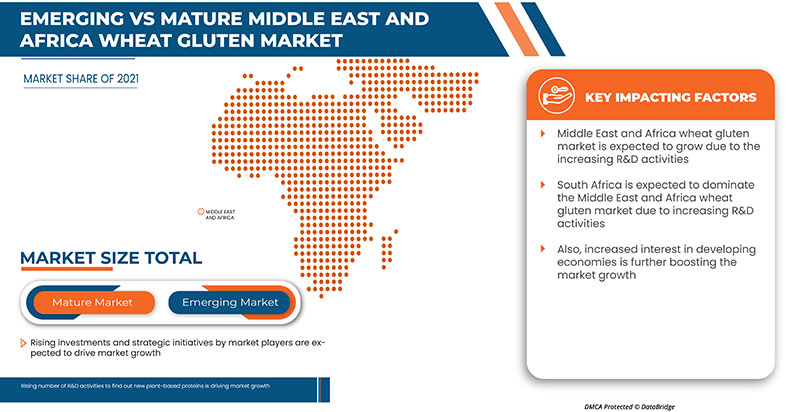

Middle East and Africa wheat gluten market is growing in the forecast year due to the rise in market players and the availability of various plant-based meat alternatives in the market. Along with this, the number of R&D activities to find out new plant-based proteins has increased in the market which is further boosting the market growth. However, the rising cases of hereditary and chronic disorders due to gluten intolerance might hamper the market growth in the forecast period.

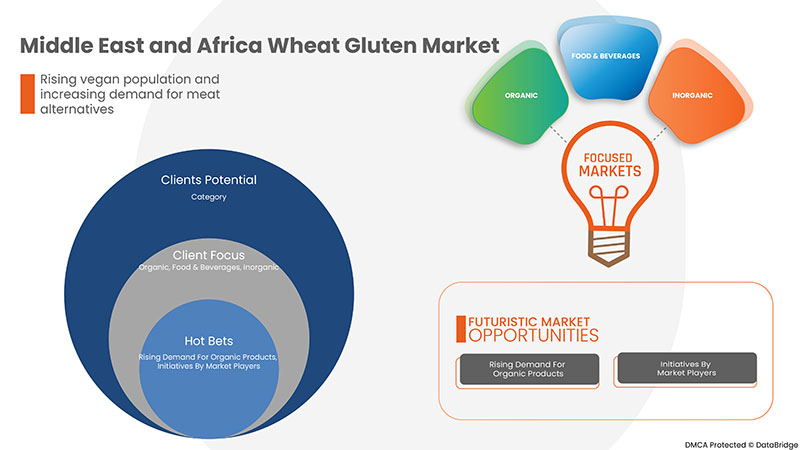

Growing awareness regarding the benefits of plant-based proteins, rising demand for organic products and initiatives by market players are giving opportunities to the market. However, the increased cost of production and manufacturing, gluten sensitivity and autoimmune reactions in people are the key challenges to market growth.

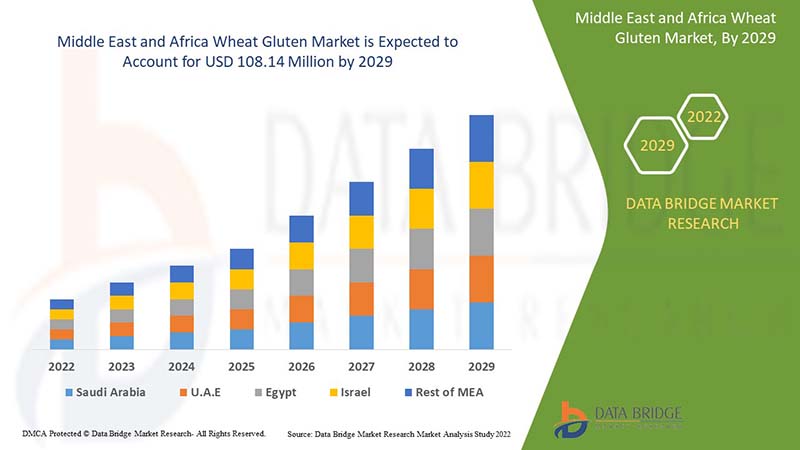

Middle East and Africa wheat gluten market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 5.1% in the forecast period of 2022 to 2029 and is expected to reach USD 108.14 million by 2029 from USD 73.71 million in 2021.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customisable to 2014-2019) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

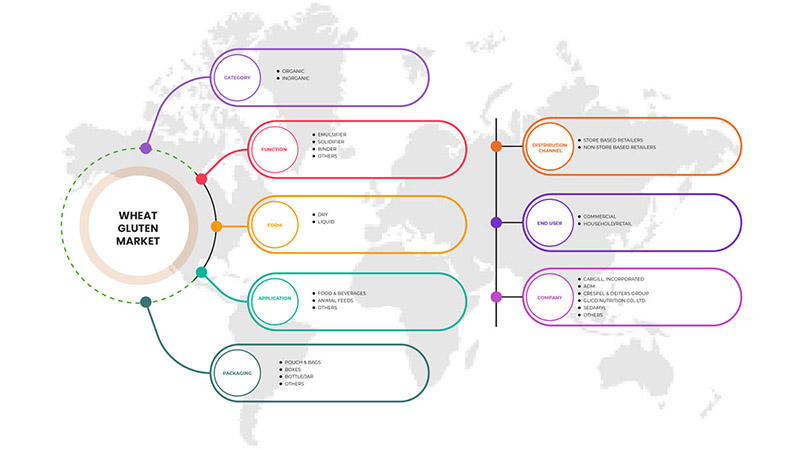

By Category (Organic and Inorganic), Function (Emulsifier, Solidifier, Binder and Others), Form (Liquid and Dry), Application (Food & Beverages, Animal Feed and Others), Packaging (Bottle/Jar, Pouch & Bags, Boxes and Others), Distribution Channel (Store Based Retailers and Non-Store Based Retailers), End User (Household/Retail and Commercial) |

|

Countries Covered |

South Africa, Oman, Qatar, Saudi Arabia, U.A.E, Kuwait and rest of Middle East and Africa |

|

Market Players Covered |

Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie B.V., Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke and z&f sungold corporation among others |

Market Definition

Wheat gluten is also known as seitan, wheat meat, gluten meat, or gluten. Wheat gluten is a protein that occurs naturally in wheat or wheat flour. It is made by washing wheat flour dough in water until all of the starch granules are removed. Wheat gluten powder is made by hydrating hard wheat flour to activate the gluten. After that, the hydrated mass is processed to remove starch while leaving gluten behind. Finally, the gluten is dried and ground into powder. Some gluten varieties have a stringy or chewy texture similar to meat.

Middle East and Africa Wheat Gluten Market Dynamics

Drivers

- Rising vegan population and increasing demand for meat alternatives

Gluten is a protein found naturally in some grains like wheat, barley and rye. Wheat glutens are made up of Gliadins and Glutenin protein fractions. Gliadins contain a single polypeptide chain associated with hydrogen bonds, hydrophobic bonds and intra-molecular disulfide interactions whereas Glutenins contain inter-molecular disulfide interactions. Wheat gluten and wheat starch are economically important co-products produced during the wet processing of wheat flour. Wheat gluten is a commodity food ingredient and its applications are predominantly in baked goods and processed meat products. It has unique properties such as, when it is hydrated and mixed, it forms a very extensible, elastic structure that is responsible for the gas-holding ability of bread dough. It can be used in combination with wheat flour and other additives to produce a soy-free texturized product.

The vegan population is increasing worldwide and the demand for meat alternatives is also increasing. People are more aware of the health benefits of plant-based proteins and getting shifted to vegan lifestyles where wheat gluten can act as a meat alternative for them.

- Rising preference of consumers toward high protein-rich diets

Most consumers prefer high-protein-rich diets due to several reasons. A few of them are: protein is the building block of the human body and muscles; it is vital for body and brain activities; it is important for healthy and active living. Gluten is one of the high protein-rich diets which can be extracted from wheat. Gluten has high protein content along with vitamins & minerals such as antioxidants, fiber, vitamin B, vitamin E, magnesium, iron, folic acid and others.

Furthermore, in recent years, high protein diets and products have made a real impression on nutrition and reshaped consumers’ attitudes towards protein in their food intake as adequate nutrition is an important aspect of a healthy lifestyle for all individuals. Various studies have shown the health benefits of plant-based proteins and public awareness has increased to a greater extent. As a result, consumers are preferring high protein-rich diets.

- Rising number of R&D activities to find out new plant-based proteins

The demand for high protein-rich diets is increasing among people and hence, the number of research has increased to find out proteins. As animal-based proteins are causing most health hazards, people are getting shifted to vegan lifestyles gradually, across the globe. Plant-based proteins are rich in vitamins as well as minerals and have great health benefits as per recent studies. Wheat gluten is one of the plant proteins which is used as a meat alternative and a protein-rich diet by most people worldwide.

Most of the human population is preferring high-protein diets from plant sources due to several health benefits and to overcome diseases caused by the intake of animal-based protein diets. So, the number of R&D is increasing to find out new plant-based proteins in various ways to fulfill the demand.

Opportunities

-

Growing awareness regarding the benefits of plant-based proteins

Various plant-based protein products are available in the market due to changing taste preferences of consumers. One of them is wheat gluten and its products which are in high demand. The plant-based protein market such as wheat gluten is having a strong demand and growth in bakeries, functional beverages and other food. The plant-based proteins are easily available due to their wide usage in various industries. Wheat gluten is used in various products such as animal feed products that help to minimize the farmers' dependence on traditional sources of protein. Wheat gluten and plant-based protein products include several nutrients and are infused with protein and flavors. Increasing awareness about healthy lifestyles and weight loss management, along with the demand for plant-based protein bars among consumers.

As a result, the need for wheat gluten in various products will act as an opportunity for market growth. Meanwhile, wheat gluten is used in carbonated products to enhance the added flavors.

-

Rising demand for organic products

The demand for organic products is increasing at a high speed. Organic food ingredients such as plant-based proteins are a perfect protein alternative to meat or other non-vegetarian products that consumers can consume daily. All essential amino acids and high fibers present in organic products make them an ideal substitute for animal proteins.

The demand for organic ingredients in wheat gluten and its products is due to nutritional diet plans as they have various health benefits such as low diabetes risk, easy digestibility, cardiovascular health and others. The increasing awareness among consumers about the health benefits offered by organic ingredients such as plant-based proteins increased the demand for food and beverage products.

Restraints/Challenges

- Increased cost of production and manufacturing

Wheat gluten has opened doors to improve and support health which plays a major role in the food and beverages industry. But on the other hand, it has led to major costs involved in its production and manufacturing

In some countries around the world, wheat gluten is seen as a solution to the problem of maintaining a healthy lifestyle. However, its manufacturing and production are faced with a multitude of challenges such as staff-intensive labor, increasing amount of raw materials and the need for faster production due to increased demand. These demands need to be met effectively and efficiently. Wheat gluten involves a high capital investment to maintain R&D. The new machinery and equipment include a lot of trials to test the functioning which leads to high capital investments for small and medium enterprises.

- Rising cases of hereditary and chronic disorders due to gluten intolerance

Gluten is a type of protein extracted from wheat and other grains. There are so many cases where gluten intolerance has been found. There are several potential causes of gluten intolerance, including celiac disease, non-celiac gluten sensitivity and wheat allergy. All three forms of gluten intolerance can cause widespread symptoms. Celiac disease is the most severe form of gluten intolerance. It is an autoimmune disease that affects about 1% of the population and may lead to damage to the digestive system. It can cause a wide range of symptoms, including skin problems, gastrointestinal issues, mood changes and more. The common symptoms associated with non-celiac disease are bloating, headache, stomach pain, fatigue, diarrhea and constipation among others. Similarly, the symptoms associated with wheat allergy are skin rash, digestive issues, nasal congestion and anaphylaxis among others.

Due to the impact of gluten intolerance, several disorders including celiac, non-celiac and wheat allergies are being caused which are chronic and hereditary in some cases.

Post-COVID-19 Impact on Middle East and Africa Wheat Gluten Market

COVID-19 had negatively affected the Middle East and Africa wheat gluten market. Lockdowns and isolation during the pandemic caused the closure of most of the shops and the plant-based protein diet supply was affected to a higher extent. Online purchases of plant-based meat alternatives had increased. Thus, COVID-19 affected the market negatively.

Recent Development

- In January 2022, ADM announced the opening of its first Science & Technology Center in China to establish its high-quality development in the nutrition and health industry. This has helped the company to provide better services to consumers through such innovations in the organization.

Middle East and Africa Wheat Gluten Market Scope

Middle East and Africa wheat gluten market is segmented into seven notable segments based on category, function, form, application, packaging, distribution channel and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

By Category

- Organic

- Inorganic

Based on category, the market is segmented into organic and inorganic.

By Function

- Emulsifier

- Solidifier

- Binder

- Others

Based on function, the market is segmented into emulsifier, solidifier, binder and others.

By Form

- Liquid

- Dry

Based on form, the market is segmented into liquid and dry.

By Application

- Food & Beverages

- Animal Feed

- Others

Based on application, the market is segmented into food & beverages, animal feed and others.

By Packaging

- Bottle/Jar

- Pouch & Bags

- Boxes

- Others

Based on packaging, the market is segmented into bottle/jar, pouch & bags, boxes and others.

By Distribution Channel

- Store Based Retailers

- Non-Store Based Retailers

Based on distribution channel, the market is segmented into store-based retailers and non-store based retailers.

By End User

- Household/Retail

- Commercial

Based on end user, the market is segmented into household/retail and commercial.

Middle East and Africa Wheat Gluten Market Regional Analysis/Insights

Middle East and Africa wheat gluten market is analyzed and market size insights and trends are provided by country, category, function, form, application, packaging, distribution channel and end user.

Middle East and Africa wheat gluten market comprises of the countries South Africa, Oman, Qatar, Saudi Arabia, U.A.E, Kuwait and rest of Middle East and Africa. South Africa dominates the Middle East and Africa wheat gluten market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

The growing awareness regarding the benefits of plant-based proteins is further fuelling the market growth. Moreover, the rising demand for organic products and initiatives by market players are also boosting market growth.

Competitive Landscape and Middle East and Africa Wheat Gluten Market Share Analysis

Middle East and Africa wheat gluten market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth and application dominance. The above data points provided are only related to the companies’ focus on the market.

Some of the major players operating in the Middle East and Africa wheat gluten market are Cargill, Incorporated, ADM, Crespel & Deiters Group, Glico Nutrition Co., Ltd., Sedamyl, Manildra Group, MGP, Roquette Frères, CropEnergies AG, Anhui Ante Food Co., Ltd., ARDENT MILLS, Bryan W Nash and Sons, Pioneer Industries Private Limited, Henan Tianguan Group Co. Ltd, Permolex, Meelunie B.V., Mühlenchemie GmbH & Co. KG, Royal Ingredients Group, Kröner Stärke and z&f sungold corporation among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Middle East and Africa vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors as you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PATENT ANALYSIS OF MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

4.2 CONSUMER BUYING BEHAVIOR

4.3 BRAND ANALYSIS

4.4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET SUPPLY CHAIN ANALYSIS

4.4.1 RAW MATERIAL PROCUREMENT

4.4.2 MANUFACTURING

4.4.3 TRANSPORTATION OR LOGISTICS

4.4.4 MARKETING AND DISTRIBUTION

4.4.5 END-USER

4.5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET UPCOMING TECHNOLOGIES AND TRENDS

4.5.1 CRISPR/CAS9 GENE EDITING OF GLUTEN IN WHEAT

4.5.2 RNA INTERFERENCE IN WHEAT GLUTEN

4.5.3 COLD ETHANOL TECHNOLOGY

5 REGULATORY FRAMEWORK

5.1 FDA

5.1.1 REGULATIONS ON ALLERGEN LABELING

5.2 EUROPEAN UNION (EU)

5.3 REGULATIONS IN INDIA

5.3.1 FSSAI PROPOSES STANDARDS RELATING TO GLUTEN AND NON-GLUTEN FOODS

5.4 REGULATIONS IN CHINA

5.5 REGULATIONS IN THE U.S.

5.6 REGULATIONS IN CANADA

5.7 REGULATIONS IN THAILAND

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING VEGAN POPULATION AND INCREASING DEMAND FOR MEAT-ALTERNATIVES

6.1.2 RISING PREFERENCE OF CONSUMERS TOWARDS HIGH PROTEIN-RICH DIETS

6.1.3 RISING NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES TO FIND OUT NEW PLANT-BASED PROTEINS

6.2 RESTRAINTS

6.2.1 RISING CASES OF HEREDITARY AND CHRONIC DISORDERS DUE TO GLUTEN INTOLERANCE

6.2.2 HIGHER COST OF PLANT-BASED PROTEINS

6.3 OPPORTUNITIES

6.3.1 GROWING AWARENESS REGARDING THE BENEFITS OF PLANT-BASED PROTEINS

6.3.2 RISING DEMAND FOR ORGANIC PRODUCTS

6.3.3 INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INCREASED COST OF PRODUCTION AND MANUFACTURING

6.4.2 RISING PREVALENCE OF DISEASES

6.4.3 GLUTEN SENSITIVITY AND AUTOIMMUNE REACTIONS IN PEOPLE

7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY

7.1 OVERVIEW

7.2 ORGANIC

7.3 INORGANIC

8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 BINDER

8.3 EMULSIFIER

8.4 SOLIDIFIER

8.5 OTHERS

9 MIDDLE EAST & AFRICA WHEAT GLUTEN, BY FORM

9.1 OVERVIEW

9.2 DRY

9.3 LIQUID

10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGES

10.2.1 BAKERY & CONFECTIONARY PRODUCTS

10.2.1.1 CAKES, MUFFINS & DOUGHNUTS

10.2.1.2 BREADS

10.2.1.3 COOKIES, CRACKERS

10.2.1.4 PIE CRUSTS & PIZZA DOUGH

10.2.1.5 BATTER

10.2.1.6 OTHERS

10.2.2 CONVENIENCE FOOD

10.2.2.1 NOODLES AND PASTA

10.2.2.2 SOUPS & SAUCES

10.2.2.3 SEASONING & DRESSING

10.2.2.4 SNACKS & EXTRUDED SNACKS

10.2.2.5 READY TO EAT MEALS

10.2.2.6 OTHERS

10.2.3 MEAT ANALOGUES

10.2.4 SPORTS NUTRITION

10.2.5 BREAKFAST CEREALS

10.2.6 MEAT & POULTRY PRODUCTS

10.2.7 NUTRITIONAL BARS

10.2.8 BEVERAGES

10.2.9 OTHERS

10.3 ANIMAL FEED

10.3.1 PET FOOD

10.3.2 RUMINANT

10.3.3 SWINE

10.3.4 POULTRY

10.3.5 OTHERS

10.4 OTHERS

11 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING

11.1 OVERVIEW

11.2 POUCH & BAGS

11.3 BOXES

11.4 BOTTLE/JAR

11.4.1 PLASTIC

11.4.2 GLASS

11.4.3 METAL

11.4.4 PAPER

11.5 OTHERS

12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 HYPERMARKETS/SUPER MARKETS

12.2.2 CONVENIENCE STORES

12.2.3 GROCERY STORES

12.2.4 SPECIALITY STORES

12.2.5 OTHERS

12.3 NON-STORE BASED RETAILERS

13 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.2.1 BAKERY STORES

13.2.2 RESTAURANTS AND CAFES

13.2.3 HOTELS

13.2.4 CLOUD KITCHEN

13.2.5 OTHERS

13.3 HOUSEHOLD/RETAIL

14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 U.A.E

14.1.3 SAUDI ARABIA

14.1.4 OMAN

14.1.5 QATAR

14.1.6 KUWAIT

14.1.7 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CRESPEL & DEITERS GROUP

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 GLICO NUTRITION CO., LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 SEDAMYL

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 ANHUI ANTE FOOD CO.,LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 ARDENT MILLS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BRYAN W NASH AND SONS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CROPENERGIES AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HENAN TIANGUAN GROUP CO., LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KRÖNER-STÄRKE GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MANILDRA GROUP

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEELUNIE B.V.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 MGP

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MUHLENCHEMIE GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERMOLEX

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIONEER INDUSTRIES PRIVATE LIMITED

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 ROQUETTE FRÈRES

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ROYAL INGREDIENTS GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 Z&F SUNGOLD CORPORATION

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA ORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INORGANIC IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BINDER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA EMULSIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SOLIDIFIER IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA DRY IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA LIQUID IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA POUCH & BAGS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BOXES IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA OTHERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, DISTRIBUTION CHANNEL 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA STORE-BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION

TABLE 28 MIDDLE EAST & AFRICA NON-STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HOUSEHOLD/RETAIL IN WHEAT GLUTEN MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SOUTH AFRICA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 57 SOUTH AFRICA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 58 SOUTH AFRICA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 61 SOUTH AFRICA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 U.A.E. WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 63 U.A.E. WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 64 U.A.E. WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 65 U.A.E. WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 U.A.E. FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 U.A.E. BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.A.E. CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 U.A.E. ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 U.A.E. WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 71 U.A.E. BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 72 U.A.E. WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SAUDI ARABIA ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 SAUDI ARABIA WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 85 SAUDI ARABIA BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 86 SAUDI ARABIA WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 SAUDI ARABIA STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 SAUDI ARABIA WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SAUDI ARABIA COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 OMAN WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 OMAN WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 92 OMAN WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 93 OMAN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 OMAN FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 OMAN BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 OMAN CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 OMAN ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 OMAN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 99 OMAN BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 100 OMAN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 OMAN STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 OMAN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 103 OMAN COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 QATAR WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 105 QATAR WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 106 QATAR WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 107 QATAR WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 QATAR FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 QATAR BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 QATAR CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 111 QATAR ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 QATAR WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 113 QATAR BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 114 QATAR WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 QATAR STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 QATAR WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 QATAR COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 KUWAIT WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

TABLE 119 KUWAIT WHEAT GLUTEN MARKET, BY FUNCTION, 2020-2029 (USD MILLION)

TABLE 120 KUWAIT WHEAT GLUTEN MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 121 KUWAIT WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 KUWAIT FOOD & BEVERAGES IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 123 KUWAIT BAKERY & CONFECTIONERY PRODUCTS IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 KUWAIT CONVENIENCE FOOD IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 KUWAIT ANIMAL FEED IN WHEAT GLUTEN MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 KUWAIT WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 127 KUWAIT BOTTLE/JAR IN WHEAT GLUTEN MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 128 KUWAIT WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 129 KUWAIT STORE BASED RETAILERS IN WHEAT GLUTEN MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 KUWAIT WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 131 KUWAIT COMMERCIAL IN WHEAT GLUTEN MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET, BY CATEGORY, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: SEGMENTATION

FIGURE 11 THE GROWING EXPENDITURE ON WHEAT GLUTEN TECHNOLOGY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 ORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET

FIGURE 14 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2021

FIGURE 15 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, 2022-2029 (USD MILLION)

FIGURE 16 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, CAGR (2022-2029)

FIGURE 17 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY CATEGORY, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2021

FIGURE 19 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, 2022-2029 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, CAGR (2022-2029)

FIGURE 21 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FUNCTION, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2021

FIGURE 23 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, 2022-2029 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, CAGR (2022-2029)

FIGURE 25 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2021

FIGURE 27 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: APPLICATION, CAGR (2022-2029)

FIGURE 29 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY FORM, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2021

FIGURE 31 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, 2022-2029 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, CAGR (2022-2029)

FIGURE 33 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY PACKAGING, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2021

FIGURE 35 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2021

FIGURE 39 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 40 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, CAGR (2022-2029)

FIGURE 41 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: SNAPSHOT (2021)

FIGURE 43 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021)

FIGURE 44 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2022 & 2029)

FIGURE 45 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: BY COUNTRY (2021 & 2029)

FIGURE 46 MIDDLE EAST AND AFRICA WHEAT GLUTEN MARKET: CATEGORY (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA WHEAT GLUTEN MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Wheat Gluten Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Wheat Gluten Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Wheat Gluten Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.