North America Architectural Coatings Market

Market Size in USD Billion

CAGR :

%

USD

20.35 Billion

USD

31.83 Billion

2024

2032

USD

20.35 Billion

USD

31.83 Billion

2024

2032

| 2025 –2032 | |

| USD 20.35 Billion | |

| USD 31.83 Billion | |

|

|

|

|

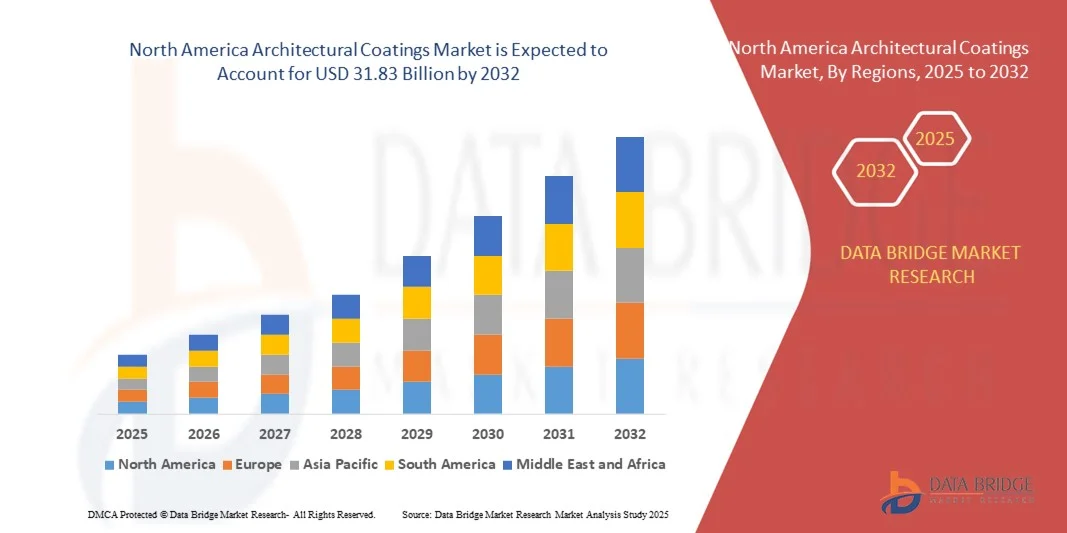

What is the North America Architectural Coatings Market Size and Growth Rate?

- The North America architectural coatings market size was valued at USD 20.35 Billion in 2024 and is expected to reach USD 31.83 Billion by 2032, at a CAGR of 5.75% during the forecast period

- Major factors that are expected to boost the growth of the architectural coatings market in the forecast period are the rise in the demand from the construction industry around the world. Furthermore, the environmentally-friendly coating systems and utilization of the coating to avoid corrosion & rusting of metallic parts of fences, tanks, radiators and metal furniture is further anticipated to propel the growth of the architectural coatings market

- Moreover, the rise in the need for high durability and eco-friendly coatings, and durable coatings with better performance and aesthetics is further estimated to cushion the growth of the architectural coatings market

What are the Major Takeaways of Architectural Coatings Market?

- The strict government regulations against the harmful VOCs emitted by certain architectural coatings is further projected to impede the growth of the architectural coatings market in the timeline period

- In addition, investments in advancing countries and acceptance of green coatings will further provide potential opportunities for the growth of the architectural coatings market in the coming years. However, concerns regarding the environment might further challenge the growth of the architectural coatings market in the near future

- The U.S. dominated the North America architectural coatings market with the largest revenue share of 68.3% in 2024, driven by rising investments in residential renovation, green buildings, and energy-efficient infrastructure

- The Canada architectural coatings market is witnessing steady growth with a CAGR of 7.2%, driven by the increasing adoption of sustainable, weather-resistant, and odor-free coatings

- The Acrylic segment dominated the market with a revenue share of 47.7% in 2024, attributed to its excellent color retention, UV resistance, and weather durability

Report Scope and Architectural Coatings Market Segmentation

|

Attributes |

Architectural Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Architectural Coatings Market?

Sustainability and Circular Economy Integration

- A major and accelerating trend in the global architectural coatings market is the adoption of eco-friendly formulations, low-VOC, and bio-based coatings to meet rising sustainability goals. Manufacturers are shifting toward waterborne, powder-based, and high-solid coatings to minimize carbon emissions and environmental impact

- Companies such as BASF SE and Akzo Nobel N.V. are pioneering recyclable and energy-efficient coating solutions, incorporating renewable raw materials and closed-loop production systems

- Advancements in nanotechnology and smart coatings are improving performance, enhancing durability, UV resistance, and self-cleaning properties while maintaining environmental compliance

- Strong regulatory frameworks in regions such as North America and North America—aimed at carbon neutrality and VOC emission control—are accelerating this transformation across the industry

- This shift is redefining material innovation, pushing firms to invest in bio-resins, renewable binders, and low-carbon coatings that meet both performance and green certification standards

- Consumer preference for sustainable home décor and corporate commitments toward green building certification (LEED, BREEAM) are further driving the demand for environmentally responsible coatings globally

What are the Key Drivers of Architectural Coatings Market?

- The global construction boom, particularly in residential and commercial sectors, is the primary driver, with increasing demand for protective and decorative coatings enhancing durability and aesthetics

- In 2024, The Sherwin-Williams Company expanded its low-VOC paint line for sustainable infrastructure projects across the U.S. and North America, aligning with the growing trend of eco-conscious construction

- Rapid urbanization in Asia-Pacific is fueling demand for cost-effective, weather-resistant coatings used in interior and exterior applications

- The rising consumer inclination toward premium finishes and customized color options is boosting product innovation in the decorative coatings segment

- Technological advancements in UV-curable and waterborne formulations are improving drying time, performance, and compliance with green standards, driving global market growth

Which Factor is Challenging the Growth of the Architectural Coatings Market?

- Volatile raw material prices, especially for titanium dioxide and resins, significantly impact production costs and profit margins across manufacturers

- Stringent environmental regulations on solvent-based coatings in North America and the U.K. compel companies to make costly transitions to sustainable alternative

- Limited availability of green raw materials and the high cost of advanced eco-friendly formulations create pricing pressure in competitive markets

- Fluctuations in construction activity due to economic uncertainty and rising housing costs further constrain demand in key region

- To overcome these challenges, the industry must expand R&D investment, improve supply chain resilience, and enhance recycling and waste reduction initiatives to achieve sustainable long-term growth

How is the Architectural Coatings Market Segmented?

The market is segmented on the basis of resin type, technology, function, and application.

- By Resin Type

On the basis of resin type, the architectural coatings market is segmented into Acrylic, Vinyl Acetate-Ethylene (VAE), Alkyds, Polyurethane, Epoxy, Polyesters, and Others. The Acrylic segment dominated the market with a revenue share of 47.7% in 2024, attributed to its excellent color retention, UV resistance, and weather durability. Acrylic coatings are widely used in both interior and exterior applications, offering fast drying and superior adhesion on various substrates. Their eco-friendly waterborne formulations further enhance compliance with environmental standards.

The Polyurethane segment is projected to witness the fastest CAGR of 6.9% during 2025–2032, driven by its exceptional gloss retention, chemical resistance, and mechanical strength. Rising demand in industrial and commercial infrastructure for high-performance and decorative finishes is supporting its growth. Ongoing R&D in bio-based and hybrid polyurethane systems continues to expand application opportunities in sustainable architectural coatings.

- By Technology

On the basis of technology, the architectural coatings market is segmented into Solventborne and Waterborne. The Waterborne segment dominated the market with a revenue share of 61.5% in 2024, driven by its low VOC emissions, easy cleanup, and environmental compliance. Increasing regulatory restrictions on solvent-based coatings in North America and North America have accelerated adoption of waterborne formulations. These coatings offer excellent film integrity, color retention, and application versatility across surfaces such as wood, concrete, and metal.

The Solventborne segment is expected to register the fastest CAGR of 5.8% during 2025–2032, supported by its superior adhesion and moisture resistance, particularly in harsh environments. Its continued use in industrial and heavy-duty applications where high performance and durability are critical ensures stable growth, though regulatory and sustainability pressures will gradually steer market preference toward waterborne alternatives.

- By Function

On the basis of function, the architectural coatings market is segmented into Paints, Primers, Varnishes, Stains, Sealers, Powder Coatings, Lacquers, Ceramics, and Others. The Paints segment dominated the market with a revenue share of 49.2% in 2024, owing to its extensive use in protective and decorative applications across residential and commercial structures. Demand is fueled by urbanization, renovation activities, and consumer preference for aesthetic finishes. Manufacturers are increasingly developing low-odor, quick-dry, and high-coverage paint formulations to enhance performance and user safety.

The Powder Coatings segment is projected to record the fastest CAGR of 7.1% during 2025–2032, driven by its solvent-free nature, high efficiency, and recyclability. Growing adoption in architectural metal finishes, furniture, and outdoor structures due to durability and environmental benefits is boosting market share. Technological advancements in curing and texture customization continue to strengthen the segment’s future prospects.

- By Application

On the basis of application, the architectural coatings market is segmented into Commercial, Residential, Coatings for Wood, Roof Coatings, and Floor Coatings. The Residential segment dominated the market with a revenue share of 49.8% in 2024, supported by rapid housing development, home renovation trends, and consumer demand for sustainable, decorative coatings. Increasing investments in eco-friendly paints and low-VOC formulations are enhancing residential product portfolios worldwide.

The Commercial segment is anticipated to witness the fastest CAGR of 6.6% during 2025–2032, driven by rising construction of offices, retail spaces, and public infrastructure. Demand for long-lasting, weather-resistant, and energy-efficient coatings in large-scale projects is supporting market expansion. In addition, innovations in reflective roof coatings and anti-bacterial wall paints are reshaping architectural applications across the commercial landscape.

Which Region Holds the Largest Share of the Architectural Coatings Market?

- The U.S. dominated the North America architectural coatings market with the largest revenue share of 68.3% in 2024, driven by rising investments in residential renovation, green buildings, and energy-efficient infrastructure. The country’s robust construction sector, growing demand for low-VOC and waterborne coatings, and emphasis on sustainable housing are propelling market expansion. Strong regulatory standards by EPA and increasing consumer preference for eco-friendly paints further solidify the U.S.’s leadership position

- Major players such as PPG Industries, Inc., The Sherwin-Williams Company, and Axalta Coating Systems, LLC are innovating in high-durability, anti-microbial, and bio-based coatings to enhance product performance and meet green building criteria.

- The U.S.’s focus on smart city development, infrastructure modernization, and technological R&D firmly positions it as the regional hub for North America’s architectural coatings innovation and exports.

Canada Architectural Coatings Market Insight

The Canada architectural coatings market is witnessing steady growth with a CAGR of 7.2%, driven by the increasing adoption of sustainable, weather-resistant, and odor-free coatings. Demand is especially high in residential renovation and energy-efficient construction projects supported by government green building programs. Growing investment in VOC-compliant waterborne formulations and R&D by local manufacturers is boosting market expansion. Canada’s emphasis on low-carbon construction and eco-friendly technologies positions it as a key player in North America’s sustainable building ecosystem.

Mexico Architectural Coatings Market Insight

The Mexico architectural coatings market is growing rapidly, projected to expand at a CAGR of 6.1% during 2025–2032, fueled by surging construction activities, urbanization, and rising disposable income. Demand for decorative, protective, and weatherproof coatings is increasing across residential and commercial segments. Government incentives for energy-efficient housing and the adoption of low-VOC, cost-effective waterborne paints are further accelerating growth. The presence of regional manufacturers focusing on durable, climate-adapted coatings positions Mexico as a fast-emerging contributor to North America’s architectural coatings landscape.

Which are the Top Companies in Architectural Coatings Market?

The architectural coatings industry is primarily led by well-established companies, including:

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- NIPSEA Group (Singapore)

- BASF SE (Germany)

- Asian Paints Limited (India)

- Axalta Coating Systems, LLC (U.S.)

- Brillux GmbH & Co. KG (Germany)

- Colorado Commercial & Residential Painting (U.S.)

- IFS Coatings (U.S.)

- Kansai Paint Co., Ltd. (Japan)

- KEIM Mineral Coatings of America, Inc. (U.S.)

- Kelly-Moore Paints (U.S.)

- Masco Corporation (U.S.)

- RPM International Inc (U.S.)

What are the Recent Developments in North America Architectural Coatings Market?

- In May 2022, PPG inaugurated its Architectural Paints and Coatings Color Automation Laboratory in Milan, aimed at accelerating the development of innovative paint color formulations and enhancing customization capabilities. This initiative strengthens PPG’s commitment to innovation and reinforces its leadership in advanced architectural coating solutions

- In April 2022, Hammerite Ultima was launched across multiple markets as a water-based exterior paint that can be applied directly to metal surfaces without requiring a primer, making it more user-friendly and sustainable. This launch broadens the company’s consumer reach and supports its focus on eco-efficient and durable coating solutions

- In March 2022, Brillux introduced a comprehensive product line under the Lignodur brand, featuring coatings for wood maintenance, protection, and design, including stains, paints, oils, and impregnations. This expansion highlights Brillux’s dedication to quality craftsmanship and innovation in sustainable wood coating applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Architectural Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Architectural Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Architectural Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.