North America Artificial Blood Substitutes Market

Market Size in USD Million

CAGR :

%

USD

8.81 Million

USD

57.40 Million

2025

2033

USD

8.81 Million

USD

57.40 Million

2025

2033

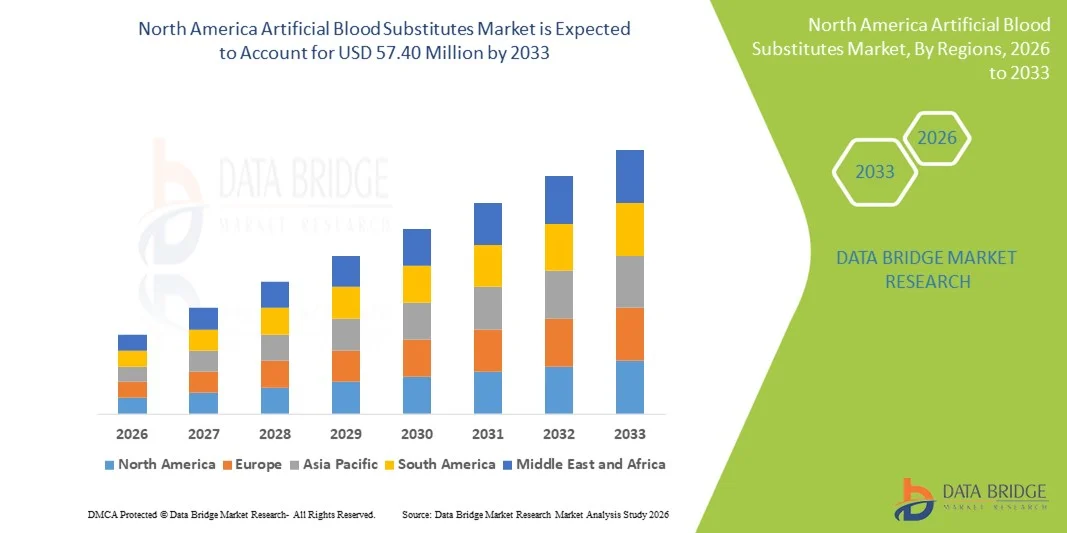

| 2026 –2033 | |

| USD 8.81 Million | |

| USD 57.40 Million | |

|

|

|

|

North America Artificial Blood Substitutes Market Size

- The North America artificial blood substitutes market size was valued at USD 8.81 million in 2025 and is expected to reach USD 57.40 million by 2033, at a CAGR of 26.4% during the forecast period

- The market growth is largely fueled by increasing clinical demand to overcome donor blood shortages, rising cases of trauma and emergency surgeries, and rapid technological advancements in oxygen‑carrying therapeutics

- Furthermore, growing adoption of hemoglobin‑based oxygen carriers (HBOCs), favorable regulatory frameworks, and heightened R&D investments across healthcare systems are strengthening North America’s leadership in artificial blood substitute solutions, driving sustained market uptake through the forecast period

North America Artificial Blood Substitutes Market Analysis

- Artificial blood substitutes, including hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbon-based solutions, are increasingly critical in addressing blood shortages, trauma care, and surgical transfusion needs, offering a synthetic alternative that can safely transport oxygen in both clinical and emergency settings

- The rising demand for artificial blood substitutes is primarily driven by increasing cases of trauma and surgical procedures, limited availability of donor blood, and advancements in biotechnology and clinical research, which are expanding the efficacy and safety of these substitutes

- The United States dominated the artificial blood substitutes market with the largest revenue share of 85.2% in 2025, supported by early adoption of advanced healthcare technologies, strong R&D infrastructure, favorable regulatory frameworks, and a high prevalence of trauma and surgical interventions, with continuous innovations in hemoglobin-based products driving hospital and emergency care adoption

- Canada is expected to be the fastest-growing country in the artificial blood substitutes market during the forecast period due to increasing healthcare investments, growing awareness of synthetic blood solutions, and rising surgical volumes

- Hemoglobin-based oxygen carriers (HBOCs) dominated the artificial blood substitutes market with a market share of 45.3% in 2025, driven by their established efficacy in oxygen transport and broader clinical adoption across trauma and surgical care settings

Report Scope and North America Artificial Blood Substitutes Market Segmentation

|

Attributes |

North America Artificial Blood Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Artificial Blood Substitutes Market Trends

Advancements in Hemoglobin-Based Oxygen Carriers (HBOCs)

- A significant and accelerating trend in the North America artificial blood substitutes market is the development of next-generation hemoglobin-based oxygen carriers that offer improved oxygen delivery and longer shelf life, enhancing their clinical applicability

- For instance, Hemopure® by OPK Biotech has demonstrated extended oxygen-carrying capacity and compatibility in trauma and surgical settings, supporting broader adoption in hospitals and emergency care units

- Technological improvements in HBOCs enable features such as reduced immunogenicity, enhanced stability, and targeted oxygen transport, which can improve patient outcomes and reduce transfusion-related complications

- The integration of artificial blood substitutes with hospital blood management systems allows clinicians to optimize transfusion protocols, monitor oxygen delivery, and improve patient care efficiency in critical care settings

- This trend towards safer, more effective, and clinically compatible artificial blood products is fundamentally reshaping transfusion practices in North America. Consequently, companies such as Sangart are advancing HBOC formulations with enhanced oxygen affinity and storage stability

- The demand for artificial blood substitutes with improved efficacy and safety profiles is growing rapidly across trauma, surgical, and emergency medicine sectors, as healthcare providers aim to mitigate donor blood shortages and enhance patient outcomes

- Integration of digital health technologies, such as patient monitoring systems, with artificial blood substitutes allows real-time assessment of oxygen delivery, enabling personalized transfusion strategies.

North America Artificial Blood Substitutes Market Dynamics

Driver

Increasing Demand Driven by Trauma and Surgical Interventions

- The growing prevalence of trauma cases, surgical procedures, and blood shortages is a major driver for the expanding adoption of artificial blood substitutes in hospitals and emergency care facilities

- For instance, in March 2025, OPK Biotech reported the successful use of Hemopure® in emergency trauma centers, demonstrating faster oxygen delivery and improved patient stabilization

- As hospitals face challenges in maintaining adequate blood supply, artificial blood substitutes offer a reliable alternative, particularly for rare blood types and urgent transfusion needs

- Furthermore, rising awareness among clinicians of the risks associated with donor blood transfusions, such as infections and immune reactions, is accelerating the adoption of synthetic alternatives

- The convenience of long-shelf-life formulations, ready-to-use products, and compatibility with existing transfusion protocols are key factors driving uptake across hospitals and surgical centers

- Government and private funding initiatives for emergency preparedness and blood supply resilience are providing additional incentives for adoption of artificial blood substitutes

- The rising prevalence of chronic conditions and aging population, which increases the demand for surgical interventions and transfusions, is further boosting market growth

Restraint/Challenge

Regulatory Hurdles and Safety Concerns

- Concerns surrounding clinical safety, potential adverse reactions, and strict FDA regulatory requirements pose significant challenges to broader market penetration of artificial blood substitutes

- For instance, reports of cardiovascular complications in early hemoglobin-based oxygen carrier trials have made some clinicians cautious about widespread adoption

- Addressing these safety and regulatory concerns through rigorous clinical trials, post-market surveillance, and compliance with FDA guidelines is critical for building healthcare provider confidence

- In addition, the high cost of advanced artificial blood substitutes compared to donor blood can limit adoption in smaller hospitals and budget-conscious healthcare facilities

- Overcoming these challenges through improved product safety, cost-effective manufacturing, and educational initiatives for healthcare providers will be vital for sustained market growth

- Limited awareness among some healthcare providers about the latest artificial blood substitute technologies may slow adoption despite clinical advantages

- Potential ethical concerns regarding synthetic blood products in certain patient populations may create regulatory scrutiny, affecting market penetration and acceptance

North America Artificial Blood Substitutes Market Scope

The market is segmented on the basis of product type, source, application, and end user.

- By Product Type

On the basis of product type, the market is segmented into Perfluorocarbon (PFCs) and Hemoglobin-Based Oxygen Carriers (HBOCs). The HBOCs segment dominated the market with the largest market revenue share of 45.3% in 2025, driven by their established efficacy in oxygen transport and broader clinical adoption across trauma and surgical care settings. HBOCs are preferred in hospitals due to their rapid oxygen delivery capabilities and compatibility with standard transfusion protocols. Clinicians favor HBOCs for critical care patients, particularly in emergency rooms and operating theaters, where donor blood may not be immediately available. The segment’s dominance is further supported by continuous product innovation, such as next-generation HBOCs with enhanced stability and reduced immunogenicity. High awareness and clinical validation in North American hospitals ensure strong adoption and consistent demand.

The PFCs segment is anticipated to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by their ability to dissolve large volumes of oxygen and deliver it to tissues in patients with severe anemia or respiratory distress. PFCs are gaining traction in neonatal and organ transplant applications due to their biocompatibility and rapid oxygen release. Research and clinical trials demonstrating their safety and effectiveness are encouraging broader hospital adoption. In addition, collaborations between biotech firms and medical centers are accelerating product trials and commercial availability. Their versatility across multiple emergency and surgical scenarios positions PFCs as the fastest-growing product type in the forecast period.

- By Source

On the basis of source, the market is segmented into human blood, animal blood, microorganism-based recombinant hemoglobin (rhb), synthetic polymers, and stem cells. The Microorganism-Based Recombinant Hemoglobin (rHb) segment dominated the market in 2025 due to its ability to produce consistent, pathogen-free oxygen carriers without relying on human or animal donors. rHb products are widely adopted in trauma and surgical care, offering predictable oxygen delivery and minimal immunogenic risk. Hospitals prefer rHb-based substitutes because they reduce dependency on traditional blood supplies and meet regulatory standards more easily. The segment’s dominance is strengthened by ongoing investments in biotechnology and scalable manufacturing processes. Clinical success stories and regulatory approvals in the United States reinforce confidence among healthcare providers.

The Synthetic Polymers segment is expected to witness the fastest growth from 2026 to 2033, driven by advances in polymer chemistry that allow creation of customizable oxygen carriers with enhanced stability and longer shelf life. Synthetic polymers can be tailored for specific medical applications, including organ preservation and emergency transfusions. Increased R&D funding and partnerships between universities and biotech startups are accelerating product innovation. The segment’s rapid adoption is also supported by rising awareness of synthetic alternatives in hospitals aiming to mitigate donor blood shortages. Its versatility and low immunogenicity make it highly appealing for expanding applications.

- By Application

On the basis of application, the market is segmented into cardiovascular diseases, malignant neoplasms, injuries, neonatal conditions, organ transplant, and maternal conditions. The Injuries segment dominated the market in 2025 with the largest revenue share, driven by the high prevalence of trauma cases, accidents, and emergency surgeries in North America. Artificial blood substitutes are critical in emergency care for rapid oxygen delivery when donor blood is unavailable. Hospitals prioritize this application because it improves patient survival rates and stabilizes critical cases. Growing awareness among clinicians and integration into trauma protocols further strengthen market dominance. Investments in trauma centers and emergency preparedness programs support sustained adoption. In addition, positive outcomes from clinical trials and real-world use in major hospitals reinforce trust in artificial blood substitutes for injury management.

The Neonatal Conditions segment is expected to witness the fastest growth rate from 2026 to 2033 due to increasing use of artificial blood substitutes in premature infants and neonates with low hemoglobin levels. PFCs and rHb products help manage oxygen delivery in neonatal intensive care units (NICUs), reducing complications from traditional transfusions. Rising awareness of neonatal care best practices and government support for advanced neonatal therapies drive growth. Research initiatives and hospital pilot programs further accelerate adoption. The segment benefits from its critical role in improving survival rates and developmental outcomes in vulnerable newborns.

- By End User

On the basis of end user, the market is segmented into hospitals & clinics, blood banks, and others. The Hospitals & Clinics segment dominated the market in 2025 with the largest revenue share due to their direct involvement in trauma care, surgeries, and emergency interventions. Hospitals are the primary adopters because artificial blood substitutes address immediate transfusion needs and reduce dependency on donor blood. The segment’s dominance is supported by high clinical acceptance, regulatory approvals, and extensive integration into patient care protocols. Large hospital networks and trauma centers in the U.S. and Canada facilitate rapid adoption of both HBOCs and PFCs. Ongoing education for clinicians on synthetic blood benefits further strengthens demand. The segment also benefits from strong collaborations with biotech firms for product trials and validation.

The Blood Banks segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the adoption of artificial blood substitutes to maintain emergency reserves and manage blood shortages. Blood banks increasingly integrate rHb and synthetic polymer products into storage protocols, ensuring availability for hospitals during peak demand. Growth is fueled by government initiatives to improve national blood supply resilience and investment in cold-chain storage solutions for synthetic substitutes. Rising awareness of donor blood limitations encourages blood banks to adopt artificial alternatives. The segment’s expansion is supported by cost-effective, long-shelf-life formulations that reduce wastage and improve readiness for emergencies.

North America Artificial Blood Substitutes Market Regional Analysis

- The United States dominated the artificial blood substitutes market with the largest revenue share of 85.2% in 2025, supported by early adoption of advanced healthcare technologies, strong R&D infrastructure, favorable regulatory frameworks, and a high prevalence of trauma and surgical interventions, with continuous innovations in hemoglobin-based products driving hospital and emergency care adoption

- Healthcare providers in the U.S. highly value the reliability, safety, and rapid oxygen delivery offered by artificial blood substitutes, particularly hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbons (PFCs), for critical care, emergency, and surgical applications

- This widespread adoption is further supported by a well-established network of hospitals and trauma centers, favorable FDA regulatory frameworks, and growing awareness of donor blood shortages, establishing artificial blood substitutes as a preferred solution for patient care across emergency and surgical settings

The U.S. Artificial Blood Substitutes Market Insight

The U.S. artificial blood substitutes market captured the largest revenue share of 85.2% in 2025 within North America, fueled by advanced healthcare infrastructure, high clinical adoption in trauma and surgical care, and substantial R&D investments in synthetic blood technologies. Hospitals and emergency care centers are increasingly prioritizing the use of hemoglobin-based oxygen carriers (HBOCs) and perfluorocarbons (PFCs) to address donor blood shortages. The growing preference for ready-to-use, long-shelf-life blood substitutes, combined with the integration of artificial blood into hospital transfusion protocols, further propels the market. Moreover, FDA approvals and ongoing clinical validation are significantly contributing to the market’s expansion, establishing the U.S. as the dominant hub for synthetic blood adoption.

Canada Artificial Blood Substitutes Market Insight

The Canada artificial blood substitutes market is projected to grow at a notable CAGR throughout the forecast period, primarily driven by increasing healthcare expenditure and government support for emergency preparedness programs. Hospitals are adopting artificial blood substitutes for trauma care, neonatal treatment, and surgical applications. The country’s healthcare providers are also leveraging these products to mitigate donor blood shortages, while ongoing clinical trials and research initiatives are fostering broader acceptance. Canada’s growing focus on patient safety, advanced hospital networks, and adoption of innovative medical technologies is expected to sustain market growth.

Mexico Artificial Blood Substitutes Market Insight

The Mexico artificial blood substitutes market is expected to expand at a considerable CAGR during the forecast period, driven by rising awareness of blood supply limitations and the need for rapid oxygen delivery in emergency medical services. Increasing investments in hospital infrastructure and training programs for clinical staff are encouraging the adoption of hemoglobin-based and perfluorocarbon-based substitutes. Mexico’s growing number of trauma centers and surgical facilities, coupled with supportive healthcare policies, is fostering the integration of artificial blood substitutes into standard care protocols. Moreover, international collaborations with U.S.-based biotech firms are further facilitating market development in Mexico.

North America Artificial Blood Substitutes Market Share

The North America Artificial Blood Substitutes industry is primarily led by well-established companies, including:

- Hemoglobin Oxygen Therapeutics LLC (U.S.)

- OxyVita, Inc. (U.S.)

- NuvOx Pharma LLC (U.S.)

- KaloCyte, Inc. (U.S.)

- Haemonetics Corporation (U.S.)

- OPK Biotech LLC (U.S.)

- NanoBlood LLC (U.S.)

- Prolong Pharmaceuticals LLC (U.S.)

- Boston Therapeutics, Inc. (U.S.)

- HbO2 Therapeutics LLC (U.S.)

- Sanguine Biosciences, Inc. (U.S.)

- FluorO2 Therapeutics, Inc. (U.S.)

- HemoBioTech Inc. (U.S.)

- Sangart, Inc. (U.S.)

- Baxter (U.S.)

- Synthetic Blood International, Inc. (U.S.)

- HemaFlo Therapeutics, Inc. (U.S.)

- Oxygen Biotherapeutics, Inc. (U.S.)

- Alpha Therapeutic Corporation (U.S.)

- VisusMed Medical Center (U.S.)

What are the Recent Developments in North America Artificial Blood Substitutes Market?

- In August 2025, University of Maryland scientists developed a shelf‑stable synthetic blood product called ErythroMer that can be stored for years at room temperature and reconstituted with water for emergency transfusions, potentially enabling life‑saving resuscitation before hospital arrival. The freeze‑dried synthetic blood uses hemoglobin‑containing nanoparticles and has shown success in animal models, with hopes for human trials to begin within the next few years

- In June 2025, clinical trials began in Japan for a universal artificial blood product that carries oxygen without blood‑type matching, marking a significant step toward global deployment of universal substitutes developments closely watched by North American researchers and investors as potential game‑changers in transfusion medicine

- In March 2025, a multi‑institutional research team led by Penn State University received a USD 2.7 million NIH grant to develop next‑generation synthetic blood designed to mimic human red blood cells, aiming to improve oxygen delivery and make freeze‑dried “Nano‑RBC” substitutes suitable for trauma and rural settings. This funding supports advanced research on deformable nanoparticle‑based blood substitutes that could function where stored donated blood isn’t accessible

- In February 2025, America’s Blood Centers spotlighted ongoing artificial blood research efforts in the U.S., noting work toward synthetically mimicking oxygen transport and highlighting initiatives such as DARPA‑backed projects on shelf‑stable substitutes that could transform trauma care and emergency transfusion protocols. The article discusses the long‑term quest for viable blood substitutes in clinical settings

- In July 2024, major media coverage reported the U.S. Department of Defense and federal agencies investing heavily in artificial blood substitute development, including projects focused on field‑deployable, stable blood equivalents for trauma resuscitation. These efforts reinforce military and emergency medicine interest in artificial transfusion alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.