North America Clinical Laboratory Services Market

Market Size in USD Billion

CAGR :

%

USD

136.52 Billion

USD

239.89 Billion

2024

2032

USD

136.52 Billion

USD

239.89 Billion

2024

2032

| 2025 –2032 | |

| USD 136.52 Billion | |

| USD 239.89 Billion | |

|

|

|

|

North America Clinical Laboratory Services Market Size

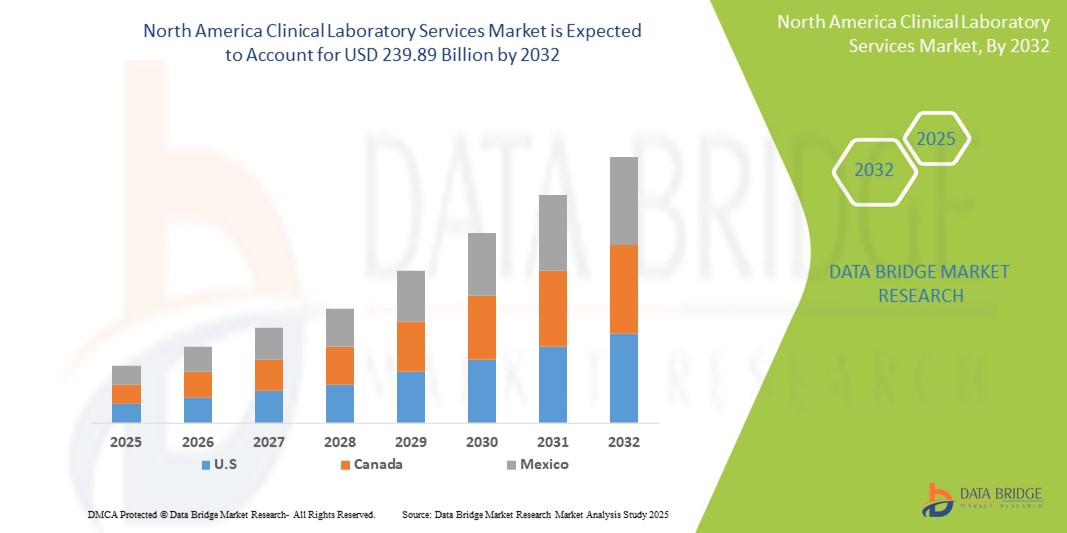

- The North America clinical laboratory services market size was valued at USD 136.52 billion in 2024 and is expected to reach USD 239.89 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by the increasing demand for early disease diagnosis, rising chronic disease prevalence, and a surge in preventive health checkups across the U.S. and Canada

- Furthermore, growing investments in diagnostic infrastructure, technological advancements in laboratory automation, and the rising integration of AI-driven testing platforms are enhancing service quality and operational efficiency. These factors are collectively driving the expansion of clinical laboratory services in the region, solidifying their role in modern healthcare systems

North America Clinical Laboratory Services Market Analysis

- Clinical laboratory services, encompassing diagnostic testing, pathology, and genetic analysis, are critical components of the healthcare ecosystem in both hospital-based and independent settings, ensuring timely detection and management of diseases through high-precision testing and data-driven insights

- The rising demand for clinical laboratory services is primarily fueled by increasing incidences of chronic conditions, a growing geriatric population, and an expanding focus on preventive healthcare and early diagnosis

- U.S. dominated the North America clinical laboratory services market with the largest revenue share in 2024, driven by its advanced healthcare infrastructure, extensive insurance penetration, and early adoption of precision diagnostics and molecular testing technologies, particularly in hospital-affiliated and independent labs

- Mexico is expected to witness the highest compound annual growth rate (CAGR) in the North America clinical laboratory services market due to rising healthcare awareness, increasing health insurance penetration, and expansion of private healthcare infrastructure.

- The routine testing segment dominated the North America clinical laboratory services market with a market share of 39.5% in 2024, driven by high testing volumes for general health assessments, chronic disease monitoring, and growing use of preventive health screening programs across urban populations

Report Scope and North America Clinical Laboratory Services Market Segmentation

|

Attributes |

North America Clinical Laboratory Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Clinical Laboratory Services Market Trends

“Digital Transformation and AI-Driven Diagnostics”

- A significant and accelerating trend in the North America clinical laboratory services market is the rapid digital transformation and increasing integration of artificial intelligence (AI) in diagnostic workflows, improving test accuracy, efficiency, and data interpretation. This advancement is reshaping the landscape of laboratory medicine and elevating the role of labs in patient-centric care

- For instance, Labcorp and Quest Diagnostics have adopted AI-enhanced platforms to streamline high-volume testing and pathology image analysis, enabling faster turnaround times and higher diagnostic precision. AI algorithms assist in detecting patterns in complex data sets, supporting earlier and more accurate disease identification

- AI-driven diagnostics are particularly impactful in areas such as oncology, where tools such as Tempus and PathAI apply machine learning to genomic and pathology data, aiding in personalized treatment planning. In addition, digital platforms offer predictive analytics for chronic disease progression and risk stratification

- Integration of digital health records with laboratory information systems (LIS) is enhancing clinical decision-making by enabling real-time access to patient test results and history across healthcare providers. This connectivity fosters collaboration and data sharing across the continuum of care

- This trend towards intelligent, automated, and connected laboratory ecosystems is driving innovation and efficiency in clinical diagnostics. As a result, key players are investing in AI-powered testing and digital infrastructure to meet growing demand for faster, more accurate, and scalable diagnostic solutions across North America

North America Clinical Laboratory Services Market Dynamics

Driver

“Rising Burden of Chronic Diseases and Demand for Early Diagnosis”

- The growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer across North America is a primary driver for the increasing demand for clinical laboratory services, as early and accurate diagnosis becomes essential for effective treatment and disease management

- For instance, in January 2024, Quest Diagnostics expanded its advanced diagnostic testing capabilities through a partnership with Paige AI to enhance digital pathology offerings aimed at improving cancer diagnostics in the U.S. Such collaborations underscore the market’s evolution toward precision and efficiency

- As the population ages and the burden of non-communicable diseases rises, clinical laboratories are becoming indispensable in delivering timely and data-driven insights that support proactive healthcare decisions and personalized treatment plans

- Furthermore, heightened awareness among patients and healthcare providers about the benefits of regular screening and early detection has resulted in increased test volumes, particularly for routine and specialized diagnostics

- The growing integration of laboratory services within value-based care models and the emphasis on preventive health checkups are further propelling the market. With advancements in laboratory automation, AI-driven diagnostics, and telehealth-compatible testing, clinical laboratory services are poised for sustained growth across the North American healthcare landscape

Restraint/Challenge

“Data Privacy Concerns and Complex Regulatory Landscape”

- Handling of sensitive patient data and biological samples places clinical laboratories under intense scrutiny, making data privacy concerns and regulatory compliance significant challenges to market expansion in North America. The region’s stringent frameworks, including HIPAA in the U.S. and PHIPA in Canada, mandate rigorous standards for data storage, access, and transmission

- For instance, the growing reliance on digital health records and cloud-based laboratory information systems (LIS) raises cybersecurity risks, prompting concerns over data breaches and unauthorized access. High-profile incidents involving compromised medical data have heightened public sensitivity, making healthcare providers cautious about adopting new diagnostic technologies without robust security assurances

- Adhering to evolving regulatory expectations, maintaining certification through bodies such as CLIA and CAP, and navigating state-specific laws create substantial operational burdens, especially for smaller independent labs

- Moreover, ensuring interoperability between laboratory systems and hospital EMRs can be technically complex and costly, slowing integration efforts that are essential for seamless patient care

- Addressing these challenges through investments in secure IT infrastructure, staff training on compliance, and collaboration with regulatory bodies will be essential. Enhancing transparency and reinforcing trust in digital diagnostics will play a critical role in driving sustainable growth of clinical laboratory services across the region

North America Clinical Laboratory Services Market Scope

The market is segmented on the basis of service type, specialty, provider, and application.

- By Service Type

On the basis of service type, the North America clinical laboratory services market is segmented into routine testing services, esoteric services, and anatomic pathology services. The routine testing services segment dominated the market with the largest revenue share of 39.5% in 2024, driven by high demand for tests such as complete blood counts, lipid profiles, and metabolic panels used in regular health monitoring and chronic disease management. These tests form the backbone of outpatient and preventive care strategies across hospitals and clinics.

The esoteric services segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the growing use of specialized and complex tests such as genetic panels and molecular diagnostics, particularly in oncology, cardiology, and infectious disease screening. Rising adoption of personalized medicine and advancements in biomarker research further support the expansion of esoteric testing.

- By Specialty

On the basis of specialty, the North America clinical laboratory services market is segmented into clinical chemistry testing, hematology testing, microbiology testing, immunology testing, drugs of abuse testing, cytology testing, and genetic testing. Clinical chemistry testing held the largest market share in 2024, attributed to the frequent need for metabolic, liver, and kidney function tests across a wide range of patient demographics.

The genetic testing segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by its increasing application in disease risk profiling, hereditary disorder screening, and pharmacogenomics. Technological advancements in next-generation sequencing (NGS) and rising public awareness of genetic health are accelerating demand in this category.

By Provider

On the basis of provider, the North America clinical laboratory services market is segmented into hospital-based laboratories, independent and reference laboratories, and nursing and physician office-based laboratories. Hospital-based laboratories led the market in 2024, owing to their integration within healthcare facilities, which allows for rapid test turnaround, alignment with clinical workflows, and enhanced trust among patients.

The independent and reference laboratories segment is expected to experience the highest growth rate over the forecast period. Their scalability, cost-efficiency, and focus on high-volume, specialized diagnostics—combined with partnerships with pharmaceutical and biotech firms—support their increasing role in the broader testing ecosystem.

- By Application

On the basis of application, the North America clinical laboratory services market is segmented into drug discovery related services, drug development related services, bioanalytical and lab chemistry services, toxicology testing services, cell and gene therapy related services, preclinical and clinical trial related services, and other clinical laboratory services. Bioanalytical and lab chemistry services accounted for the largest market share in 2024 due to their central role in validating drug safety and efficacy throughout research and development cycles.

The cell and gene therapy related services segment is anticipated to grow at the fastest rate over the forecast period, supported by the surge in clinical trials for advanced therapies, increasing investments in regenerative medicine, and the need for specialized laboratory infrastructure to handle complex biological materials.

North America Clinical Laboratory Services Market Regional Analysis

- The U.S. led the North America clinical laboratory services market with the largest revenue share in 2024, driven by its advanced healthcare infrastructure, extensive insurance penetration, and early adoption of precision diagnostics and molecular testing technologies, particularly in hospital-affiliated and independent labs

- U.S. patients and healthcare providers value high diagnostic accuracy, rapid test processing, and integration of laboratory data with electronic medical records, enabling efficient clinical decision-making and continuity of care

- The country’s strong market position is further supported by a large aging population, a high burden of chronic diseases, and favorable reimbursement systems, making the U.S. the primary driver of growth within the North American clinical laboratory services landscape

U.S. North America Clinical Laboratory Services Market Insight

The U.S. clinical laboratory services market captured the largest revenue share of 86.5% in 2024 within North America, driven by a well-established healthcare system, growing demand for personalized medicine, and a high volume of diagnostic testing. The U.S. benefits from widespread insurance coverage, an aging population, and increasing chronic disease prevalence. Technological advancements such as AI-driven diagnostics, digital pathology, and integrated laboratory information systems are further boosting service capabilities. Moreover, strong collaboration between healthcare providers, diagnostic firms, and research institutions supports the continuous evolution of lab services in the country

Canada North America Clinical Laboratory Services Market Insight

The Canada clinical laboratory services market is expected to grow at a steady CAGR throughout the forecast period, supported by an increasing focus on early disease detection and preventive healthcare. The Canadian government’s emphasis on universal healthcare access and public health programs contributes to routine testing demand. In addition, the growth of telemedicine and electronic health record integration is enhancing laboratory efficiency and accessibility. Provincial healthcare reforms and strategic partnerships between public health labs and private diagnostic providers are also driving market expansion across urban and remote regions

Mexico North America Clinical Laboratory Services Market Insight

The Mexico clinical laboratory services market is poised for notable growth during the forecast period, fueled by rising healthcare awareness, increasing health insurance penetration, and expansion of private healthcare infrastructure. Urbanization and a growing middle-class population are contributing to higher demand for routine and specialized testing. In addition, multinational diagnostic chains are expanding their presence in Mexico, improving access to high-quality laboratory services. Efforts to modernize public health systems and promote early disease detection are expected to accelerate market development across both urban and semi-urban areas.

North America Clinical Laboratory Services Market Share

The North America clinical laboratory services industry is primarily led by well-established companies, including:

- BD (U.S.)

- Abbott (U.S.)

- Charles River Laboratories (U.S.)

- Labcorp. (U.S.)

- Mayo Foundation for Medical Education and Research (U.S.)

- DaVita Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- ARUP Laboratories (U.S.)

- Lifelabs (Canada)

- BioReference Laboratories, Inc. (U.S.)

- NeoGenomics Laboratories, Inc. (U.S.)

- ACM Global Laboratories (U.S.)

What are the Recent Developments in North America Clinical Laboratory Services Market?

- In April 2024, Labcorp announced the expansion of its precision diagnostics offerings through the launch of a new multi-omics platform designed to integrate genomic, proteomic, and metabolomic data. This innovation aims to enhance early disease detection and personalized treatment strategies, reinforcing Labcorp’s leadership in advanced diagnostic services across North America. The initiative highlights the growing shift towards holistic, data-driven healthcare solutions within clinical laboratories

- In March 2024, Quest Diagnostics partnered with PathAI, a digital pathology company, to integrate artificial intelligence into pathology workflows, accelerating diagnostic accuracy and turnaround times. This collaboration emphasizes the increasing role of AI in transforming diagnostic operations and supports efforts to improve cancer detection and reporting efficiency across U.S. labs

- In February 2024, Mayo Clinic Laboratories unveiled a new AI-powered decision support tool integrated into its laboratory information system (LIS), designed to assist clinicians in test selection and interpretation. This tool improves diagnostic precision and supports value-based care initiatives, highlighting Mayo’s continued innovation in clinical diagnostics

- In January 2024, Sonic Healthcare USA acquired Medical Laboratory Associates, a regional independent laboratory in the Mid-Atlantic, to expand its service network and improve accessibility in underserved markets. The acquisition supports Sonic’s strategy to strengthen its footprint in high-demand urban and suburban locations across the U.S.

- In December 2023, Dynacare, a leading diagnostic provider in Canada, launched its Virtual Care Diagnostics Program, offering telehealth-compatible lab testing kits for chronic disease monitoring. This initiative reflects the growing trend of integrating digital health with laboratory diagnostics, aiming to enhance patient engagement and access to timely care in Canada’s evolving healthcare landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.