Market Analysis and Insights: North America Decor Paper Market

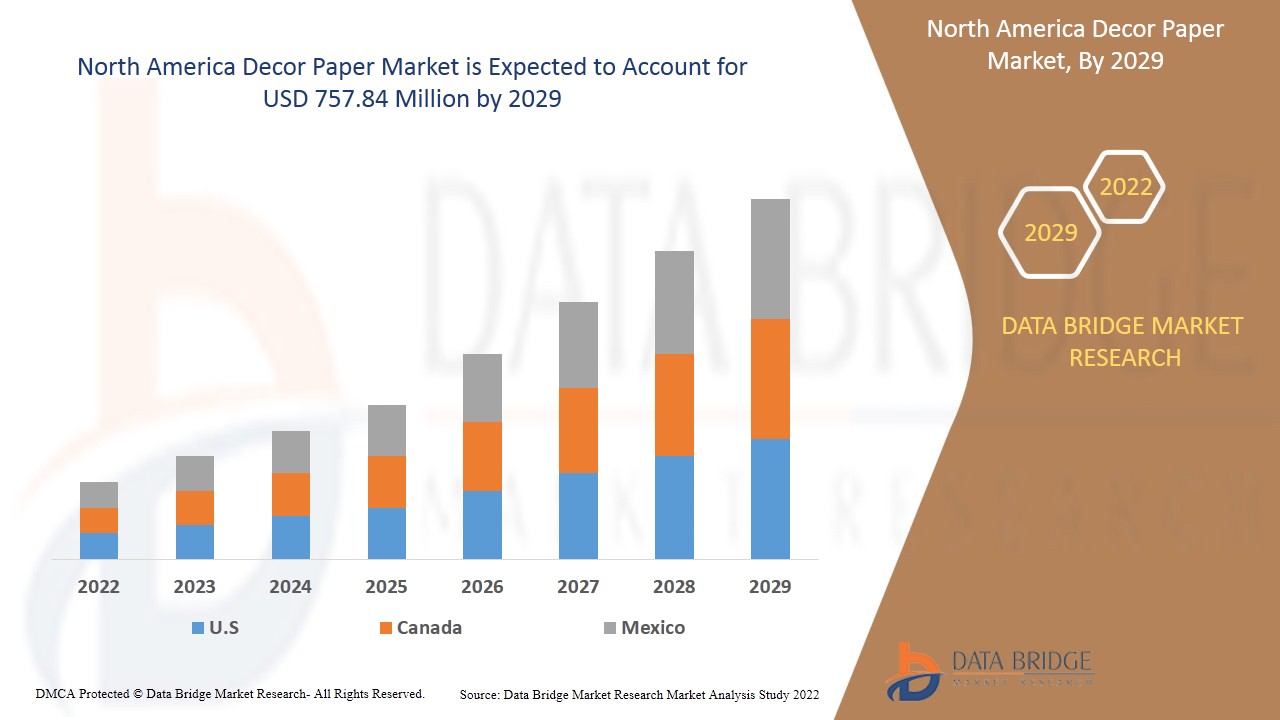

North America decor paper market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 5.3% in the forecast period of 2022 to 2029 and is expected to reach USD 757.84 million by 2029. Rising demand for interior designing in buildings is expected to drive the market growth.

Decor paper is used in getting quality finishes on wooden materials after impregnating. They are available in a variety of colors and weights. Recently, the machine-smoothed décor paper has gathered some steam among consumers. Flooring, paneling, and furniture surfaces are just a few of the primary application areas for the décor paper. The need for light-resistant, chemically inert décor paper has increased significantly with the rising demand for home décor. Furthermore, changing certification and standards criteria for products in wood-working markets vary from country to country. This has made a large bearing on the growth trajectories in the decor paper market.

Accelerating urbanization and consumer preferences toward modern product designs in home décor acts as a driver in the growth of the North America decor paper market. Shortage of raw materials for decor paper production prove to be a challenge. However, fundamental shift of demand for home décor amid the pandemic is expected to provide opportunities for the North America decor paper market. Stringent government norms & regulations regarding deforestation can prove to be a restrain for the market growth.

The North America decor paper market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the North America Decor Paper market scenario, contact Data Bridge Market Research for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Decor Paper Market Scope and Market Size

North America decor paper market is segmented based on product type, weight, color, application, raw material, end-use, and industry. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product type, the North America decor paper market is segmented into absorbent Kraft paper, print base paper, UNI paper, base paper for foil production, edge banding paper & others. In 2022, the print base paper is expected to dominate the market because it is highly loaded with white and color pigments that provide high opacity, and also possesses good absorbency and better-wet strength.

- On the basis of weight, the North America decor paper market is segmented into less than 65 GSM, 65-80 GSM, 81- 100 GSM, and above 100 GSM. In 2022, less than 65 GSM is expected to dominate the market as they are economical and lightweight which is perfect for fast printing.

- On the basis of color, the North America decor paper market is segmented into white, cream, beige, brown, grey, and black. In 2022, brown color is expected to dominate the market as it gives good surface finishing and more of a natural look in the home décor.

- On the basis of application, the North America decor paper market is segmented into low-pressure laminates, high-pressure laminates, and continuous pressure laminates. In 2022, high-pressure laminates are expected to dominate the market as they are commonly used in residential and commercial areas.

- On the basis of raw materials, the North America decor paper market is segmented into fillers & binders, pulp, coatings, additives, and others. In 2022, pulp is expected to dominate the market as the décor paper is mostly manufactured from pulp and is the most sustainable raw material for product design.

- On the basis of end-use, the North America decor paper market is segmented into furniture and cabinets, flooring, paneling, store fixture, wallpaper, wallcovering laminates, and direct printing. In 2022, flooring is expected to dominate the market as they are used to upgrading the surface of a wood-based panel in commercial and residential areas.

- On the basis of industry, the North America decor paper market is segmented into household type and commercial type. In 2022, the commercial type is expected to dominate the market as décor papers are highly used in commercial spaces to decorate the interior walls.

North America Decor Paper Market Country Level Analysis

North America decor paper market is analyzed, and market size information is provided by the product type, weight, color, application, raw material, end-use, and industry as referenced above.

The countries covered in the North America decor paper market report are U.S., Canada, and Mexico. The U.S. dominates the North America decor paper market due to the high demand in the housing industry and paper production in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Acceleration Urbanization and Consumer Preferences Toward Modern Product Designs in Home Décor Is Boosting the Market Growth

North America decor paper market also provides you with a detailed market analysis for every country's growth in a particular market. Additionally, it provides detailed information regarding the market players’ strategy and their geographical presence. The data is available for the historical period 2011 to 2020.

Competitive Landscape and North America Decor Paper Market Share Analysis

North America decor paper market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width, and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America decor paper market.

Some of the major companies which are dealing in the North America Decor Paper are Koehler Paper SE, KÄMMERER Paper GmbH, SURTECO GmbH, Onyx Papers, BMK GmbH, Pura Group, Felix Schoeller Holding GmbH & Co KG, Impress Surfaces GmbH, Ahlstrom-Munksjö, Schattdecor, Neenah Paper and Packaging, Pudumjee Paper Products, Lamigraf, Comtrad Strategic Sourcing, TOPPAN INC., Stora Enso, Ved Cellulose Ltd, CHIYODA, Impress Surfaces GmbH and DIC CORPORATION among others in domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies worldwide, which accelerates the North America decor paper market.

For instances,

- In August 2021, Koehler Paper SE announced that they are rebuilding paper machine 5 for a more sustainable production using Voith technologies. Also, the new technologically leading solution will help in increasing production capacity

- In October 2021, SURTECO GmbH had announced that the company had participated in SICAM, an international trade fair for components, technology products, and accessories for the furniture industry. In the exhibition, the company had showcased all its products such as finish foil, thermoplastic foil, decor paper, and many more

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA DECOR PAPER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ACCELERATION URBANIZATION AND CONSUMER PREFERENCES TOWARD MODERN PRODUCT DESIGNS IN HOME DECOR

5.1.2 RISING DEMAND FOR THE INTERIOR DESIGN IN BUILDINGS ACROSS THE REGION

5.1.3 LOW PRODUCT COST WITH HIGHER STRENGTH AND DURABILITY

5.2 RESTRAINTS

5.2.1 STRINGENT GOVERNMENT NORMS & REGULATIONS REGARDING DEFORESTATION

5.2.2 RISE IN CONCERNS OF DUST AND HARMFUL EMISSIONS IN THE DECOR PAPER PRODUCTION

5.3 OPPORTUNITIES

5.3.1 FUNDAMENTAL SHIFT OF DEMAND FOR HOME DECOR AMID THE PANDEMIC

5.3.2 INCREASE IN ACQUISITION AND PARTNERSHIPS BETWEEN ORGANIZATIONS IN EMERGING COUNTRIES

5.4 CHALLENGES

5.4.1 SHORTAGE OF RAW MATERIALS FOR DECOR PAPER PRODUCTION

5.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

5.4.3 LACK OF SKILLED LABOR AND FINANCIAL LOSSES IN PAPER MAKING INDUSTRY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA DECOR PAPER MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 STRATEGIC DECISION BY MANUFACTURERS AND GOVERNMENT INITIATIVES AFTER COVID-19

6.3 IMPACT ON DEMAND

6.4 IMPACT ON PRICE

6.5 IMPACT ON SUPPLY CHAIN

6.6 CONCLUSION

7 NORTH AMERICA DECOR PAPER MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PRINT BASE PAPER

7.3 ABSORBENT KRAFT PAPER

7.4 BASE PAPER FOR FOIL PRODUCTION

7.5 EDGE BANDING PAPER

7.6 UNI PAPERS

7.7 OTHERS

8 NORTH AMERICA DECOR PAPER MARKET, BY WEIGHT

8.1 OVERVIEW

8.2 LESS THAN 65 GSM

8.3 65-80 GSM

8.4 81-100 GSM

8.5 ABOVE 100 GSM

9 NORTH AMERICA DECOR PAPER MARKET, BY COLOR

9.1 OVERVIEW

9.2 BROWN

9.3 WHITE

9.4 BLACK

9.5 CREAM

9.6 BEIGE

9.7 GRAY

9.8 OTHERS

10 NORTH AMERICA DECOR PAPER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 HIGH-PRESSURE LAMINATES

10.3 LOW-PRESSURE LAMINATES

10.4 CONTINUOUS PRESSURE LAMINATES

11 NORTH AMERICA DECOR PAPER MARKET, BY RAW MATERIALS

11.1 OVERVIEW

11.2 PULP

11.3 COATING

11.4 ADDITIVES

11.5 FILLERS & BINDERS

11.6 OTHERS

12 NORTH AMERICA DECOR PAPER MARKET, BY END USE

12.1 OVERVIEW

12.2 FLOORING

12.2.1 COMMERCIAL TYPE

12.2.2 HOUSEHOLD TYPE

12.3 WALLPAPER

12.3.1 COMMERCIAL TYPE

12.3.2 HOUSEHOLD TYPE

12.4 FURNITURE AND CABINETS

12.4.1 COMMERCIAL TYPE

12.4.2 HOUSEHOLD TYPE

12.5 WALLCOVERING LAMINATES

12.5.1 COMMERCIAL TYPE

12.5.2 HOUSEHOLD TYPE

12.6 PANELLING

12.6.1 COMMERCIAL TYPE

12.6.2 HOUSEHOLD TYPE

12.7 STORE FIXTURE

12.7.1 COMMERCIAL TYPE

12.7.2 HOUSEHOLD TYPE

12.8 DIRECT PRINTING

12.8.1 COMMERCIAL TYPE

12.8.2 HOUSEHOLD TYPE

13 NORTH AMERICA DECOR PAPER MARKET, BY INDUSTRY

13.1 OVERVIEW

13.2 COMMERCIAL TYPE

13.2.1 HOSPITALITY

13.2.2 RETAIL OUTLETS/SHOPPING MALLS

13.2.3 BARS, PUBS & HOTELS

13.2.4 TRANSPORT HUBS

13.2.5 ENTERTAINMENT VENUES

13.2.6 OFFICES

13.2.7 CAFÉ

13.2.8 OTHERS

13.3 HOUSEHOLD TYPE

14 NORTH AMERICA DECOR PAPER MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA DECOR PAPER MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SURTECO GMBH

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 TOPPAN INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 KOEHLER PAPER SE

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 AHLSTROM-MUNKSJÖ

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 SCHATTDECOR

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENT

17.6 FELIX SCHOELLER GROUP

17.6.1 COMPANY SNAPSHOT

17.6.2 COMPANY SHARE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 BMK GMBH

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 COMTRAD STRATEGIC SOURCING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 CHIYODA

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DIC CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 IMPRESS SURFACES GMBH

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 KÄMMERER PAPER GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 KJ SPECIALITY PAPER CO., LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.14 LAMIGRAF

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 NEENAH PAPER AND PACKAGING

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 ONYX PAPERS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PUDUMJEE PAPER PRODUCTS

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 PURA GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 STORA ENSO

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENTS

17.2 TOPPAN INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 VED CELLULOSE LTD

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA PRINT BASE PAPER IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ABSORBENT KRAFT PAPER IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BASE PAPER FOR FOIL PRODUCTION IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA EDGE BANDING PAPER IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA UNI PAPER IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DECOR PAPER MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA LESS THAN 65 GSM IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA 65-80 GSM IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA 81-100 GSM IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA ABOVE 100 GSM IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DECOR PAPER MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA BROWN IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA WHITE IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BLACK IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CREAM IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA BEIGE IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA GRAY IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA OTHERS IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA DECOR PAPER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA HIGH-PRESSURE LAMINATES IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LOW-PRESSURE LAMINATES IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA CONTINUOUS PRESSURE LAMINATES IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA DECOR PAPER MARKET, BY RAW MATERIALS, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PULP IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA COATING IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ADDITIVES IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FILLERS & BINDERS IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DECOR PAPER MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA FLOORING IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA FLOORING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA WALLPAPER IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WALLPAPER IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA PANELLING IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA PANELLING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA STORE FIXTURE IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA STORE FIXTURE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA DIRECT PRINTING IN DECOR PAPER MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA DIRECT PRINTING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA DECOR PAPER MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL TYPE IN DECOR PAPER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA COMMERCIAL TYPE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA HOUSEHOLD TYPE IN DECOR PAPER MARKET, BY REGION , 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA DECOR PAPER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA DECOR PAPER MARKET, BY COUNTRY, 2020-2029 (MILLION TONS)

TABLE 52 NORTH AMERICA DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION TONS)

TABLE 54 NORTH AMERICA DECOR PAPER MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DECOR PAPER MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA DECOR PAPER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA DECOR PAPER MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA DECOR PAPER MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA FLOORING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA WALLPAPER IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA PANELLING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA STORE FIXTURE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA DIRECT PRINTING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA DECOR PAPER MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA COMMERCIAL TYPE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.S. DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.S. DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION TONS)

TABLE 70 U.S. DECOR PAPER MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 71 U.S. DECOR PAPER MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 72 U.S. DECOR PAPER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.S. DECOR PAPER MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 U.S. DECOR PAPER MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 75 U.S. FLOORING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. WALLPAPER IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 U.S. WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 U.S. PANELLING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.S. STORE FIXTURE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. DIRECT PRINTING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 U.S. DECOR PAPER MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 83 U.S. COMMERCIAL TYPE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 CANADA DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 CANADA DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION TONS)

TABLE 86 CANADA DECOR PAPER MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 87 CANADA DECOR PAPER MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 88 CANADA DECOR PAPER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 CANADA DECOR PAPER MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 90 CANADA DECOR PAPER MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 CANADA FLOORING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 CANADA WALLPAPER IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA PANELLING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 CANADA STORE FIXTURE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 CANADA DIRECT PRINTING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA DECOR PAPER MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 99 CANADA COMMERCIAL TYPE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 MEXICO DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 MEXICO DECOR PAPER MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION TONS)

TABLE 102 MEXICO DECOR PAPER MARKET, BY WEIGHT, 2020-2029 (USD MILLION)

TABLE 103 MEXICO DECOR PAPER MARKET, BY COLOR, 2020-2029 (USD MILLION)

TABLE 104 MEXICO DECOR PAPER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 MEXICO DECOR PAPER MARKET, BY RAW MATERIAL, 2020-2029 (USD MILLION)

TABLE 106 MEXICO DECOR PAPER MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO FLOORING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MEXICO WALLPAPER IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO FURNITURE AND CABINETS IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 MEXICO WALLCOVERING LAMINATES IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 MEXICO PANELLING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MEXICO STORE FIXTURE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO DIRECT PRINTING IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO DECOR PAPER MARKET, BY INDUSTRY, 2020-2029 (USD MILLION)

TABLE 115 MEXICO COMMERCIAL TYPE IN DECOR PAPER MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA DECOR PAPER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA DECOR PAPER MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA DECOR PAPER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA DECOR PAPER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA DECOR PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA DECOR PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA DECOR PAPER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA DECOR PAPER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA DECOR PAPER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA DECOR PAPER MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR INTERIOR DESIGNING IN BUILDINGS IS EXPECTED TO DRIVE THE NORTH AMERICA DECOR PAPER MARKET IN THE FORECAST PERIOD OF 2022 -2029

FIGURE 12 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA DECOR PAPER MARKET IN 2022 - 2029

FIGURE 13 ASIA PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE NORTH AMERICA DECOR PAPER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES FOR NORTH AMERICA DECOR PAPER MARKET

FIGURE 15 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 16 CONSTRUCTION OUTPUT ACTIVITIES IN EUROPEAN UNION (%)

FIGURE 17 NORTH AMERICA DECOR PAPER MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 NORTH AMERICA DECOR PAPER MARKET: BY WEIGHT, 2021

FIGURE 19 NORTH AMERICA DECOR PAPER MARKET: BY COLOR, 2021

FIGURE 20 NORTH AMERICA DECOR PAPER MARKET: BY APPLICATION, 2021

FIGURE 21 NORTH AMERICA DECOR PAPER MARKET: BY RAW MATERIALS, 2021

FIGURE 22 NORTH AMERICA DECOR PAPER MARKET: BY END USE, 2021

FIGURE 23 NORTH AMERICA DECOR PAPER MARKET: BY INDUSTRY, 2021

FIGURE 24 NORTH AMERICA DECOR PAPER MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA DECOR PAPER MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA DECOR PAPER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA DECOR PAPER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA DECOR PAPER MARKET: BY PRODUCT TYPE (2021-2029)

FIGURE 29 NORTH AMERICA DECOR PAPER MARKET: COMPANY SHARE 2021 (%)

North America Decor Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Decor Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Decor Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.