North America Diabetic Assays Market

Market Size in USD Billion

CAGR :

%

USD

127.00 Billion

USD

1.85 Billion

2024

2032

USD

127.00 Billion

USD

1.85 Billion

2024

2032

| 2025 –2032 | |

| USD 127.00 Billion | |

| USD 1.85 Billion | |

|

|

|

|

North America Diabetic Assays Market Size

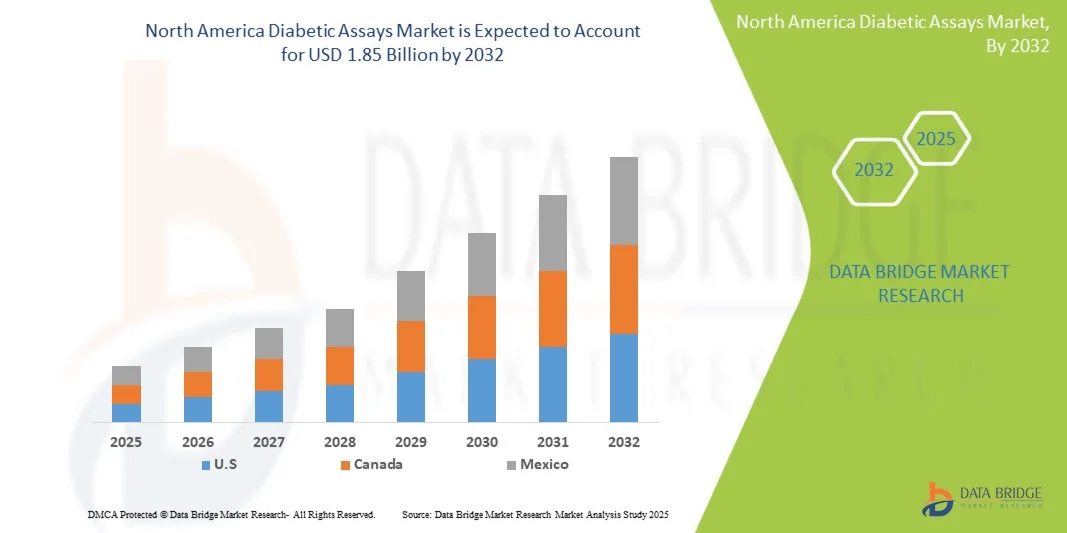

- The North America diabetic assays market size was valued at USD 127 billion in 2024 and is expected to reach USD 1.85 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by the rising prevalence of diabetes in the region, along with increasing technological advancements in diagnostic assays, which are improving accuracy and efficiency in diabetes detection

- Furthermore, strong healthcare infrastructure and growing demand for early diagnosis and personalized treatment solutions are establishing diabetic assays as the preferred choice for effective disease management. These converging factors are accelerating the adoption of diabetic assays, thereby significantly boosting the industry's growth

North America Diabetic Assays Market Analysis

- Diabetic assays, providing biochemical or immunoassay-based testing for blood glucose and related biomarkers, are increasingly vital components of diabetes management in both clinical and home settings due to their accuracy, rapid results, and integration with digital health platforms

- The escalating demand for diabetic assays is primarily fueled by the rising prevalence of diabetes in North America, increasing awareness of early diagnosis, and growing adoption of point-of-care testing and continuous glucose monitoring technologies

- The U.S. dominated the North American diabetic assays market with the largest revenue share of 39.6% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key diagnostic companies, experiencing substantial growth in assay utilization across hospitals, clinics, and home-based testing, driven by innovations from established diagnostics firms and startups focusing on AI-powered and connected health solutions

- Canada is expected to be the fastest-growing country in the North American diabetic assays market during the forecast period due to increasing healthcare investments, rising diabetes awareness, and adoption of advanced diagnostic technologies

- Type 2 Diabetes segment dominated the North American diabetic assays market with a market share of 61.7% in 2024, driven by its higher prevalence and the growing need for effective disease management and monitoring

Report Scope and North America Diabetic Assays Market Segmentation

|

Attributes |

North America Diabetic Assays Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Diabetic Assays Market Trends

Advancements in AI-Enabled and Connected Diagnostics

- A significant and accelerating trend in the North American diabetic assays market is the integration of artificial intelligence (AI) and connected digital health platforms, enhancing diagnostic accuracy, predictive analytics, and personalized patient care

- For Instance, Abbott’s FreeStyle Libre system connects with mobile apps and cloud platforms to provide continuous glucose monitoring data and predictive alerts, enabling proactive disease management

- AI integration in diabetic assays allows for early detection of abnormal glucose patterns, predictive risk assessment, and personalized recommendations. Instance, Dexcom G7 utilizes AI algorithms to improve glucose trend prediction and sends actionable alerts to patients and clinicians

- Integration with digital health ecosystems enables centralized monitoring of multiple biomarkers alongside glucose levels, providing patients and healthcare providers with holistic management of diabetes and associated conditions

- This trend toward more intelligent, connected, and patient-centric diagnostic solutions is transforming expectations for diabetes management. Consequently, companies such as Roche are developing AI-enabled assays that offer predictive analytics, automated reporting, and remote monitoring capabilities

- The demand for diabetic assays integrated with AI and connected platforms is growing rapidly across hospitals, clinics, and homecare settings as healthcare providers and patients increasingly prioritize convenience, accuracy, and proactive disease management

North America Diabetic Assays Market Dynamics

Driver

Rising Prevalence of Diabetes and Growing Awareness for Early Diagnosis

- The increasing incidence of diabetes in North America, coupled with growing patient and clinician awareness about the benefits of early diagnosis, is a significant driver for the heightened demand for diabetic assays

- For Instance, in March 2024, Quest Diagnostics launched expanded diabetes screening panels across its North American network, aiming to enhance early detection and monitoring of Type 2 Diabetes

- As more patients seek regular monitoring and early intervention, diabetic assays provide rapid, accurate results that support timely clinical decision-making and improved disease management

- Furthermore, government initiatives and healthcare programs promoting routine diabetes screening and preventive care are fueling the adoption of diabetic assays in hospitals, clinics, and homecare settings

- The convenience of point-of-care testing, continuous glucose monitoring, and integration with digital platforms enables healthcare providers to offer more personalized and timely treatment plans, further driving market growth

Restraint/Challenge

Data Security Concerns and High Cost of Advanced Diagnostic Systems

- Concerns regarding data privacy and cybersecurity of connected diagnostic devices pose a challenge to wider adoption of AI-enabled diabetic assays, as patient health information is sensitive and highly regulated

- For Instance, reports of vulnerabilities in connected glucose monitoring devices have made some patients and providers cautious about adopting fully integrated digital health solutions

- Addressing these concerns through secure cloud platforms, encryption, and regulatory compliance is essential for building trust among healthcare providers and patients. In addition, the relatively high cost of advanced AI-enabled assay systems can be a barrier for smaller clinics or price-sensitive patients

- While more affordable point-of-care solutions exist, premium features such as AI-driven predictive analytics, continuous monitoring, and remote clinician access often come at a higher price

- Overcoming these challenges through robust cybersecurity, patient education, and cost-effective diagnostic solutions will be crucial for sustained growth of the North American diabetic assays market

North America Diabetic Assays Market Scope

The market is segmented on the basis of type, disease type, deployment, end-users, and distribution channel.

- By Type

On the basis of type, the North American diabetic assays market is segmented into assays, devices, and consumables. The assays segment dominated the market with the largest revenue share of 52.4% in 2024, driven by its widespread use in routine diabetes monitoring and clinical diagnostics. Assays are preferred due to their high accuracy, ability to detect multiple biomarkers simultaneously, and compatibility with automated and manual systems. Healthcare providers rely heavily on assay-based diagnostics for early detection, ongoing monitoring, and personalized treatment planning. The growing prevalence of Type 2 Diabetes in the region further fuels demand. Integration with AI-enabled predictive tools and digital health platforms enhances the value of assays, offering actionable insights for clinicians and better disease management for patients. Assays are also increasingly integrated with telehealth solutions, enabling remote monitoring and real-time data sharing, which strengthens their adoption across hospitals and clinics.

The devices segment is expected to witness the fastest growth rate of 18.9% from 2025 to 2032, fueled by increasing adoption of point-of-care testing and continuous glucose monitoring devices. Devices provide real-time monitoring, patient convenience, and seamless integration with mobile apps and cloud platforms. They allow patients to track glucose levels at home and adjust lifestyle or medication accordingly. Advanced devices are compatible with AI and predictive analytics platforms, helping clinicians optimize treatment plans. Devices are particularly popular for homecare and specialty clinics due to ease of use and minimal training requirements. The growing focus on personalized healthcare and proactive disease management is driving the adoption of advanced diabetic devices across North America.

- By Disease Type

On the basis of disease type, the market is segmented into Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes. The Type 2 Diabetes segment dominated the market with a share of 61.7% in 2024, reflecting its higher prevalence in North America. Frequent testing is prioritized to manage complications and optimize treatment strategies. Healthcare providers focus on early detection and ongoing monitoring to prevent severe outcomes. Continuous advancements in assay accuracy and integration with digital health platforms further support the segment’s growth. Predictive analytics and AI-enabled insights enhance patient outcomes and strengthen the market position of Type 2 Diabetes assays. The high number of diagnosed patients and government-supported preventive screening programs reinforce the dominance of Type 2 Diabetes diagnostics.

The Gestational Diabetes segment is expected to be the fastest growing during the forecast period, driven by increasing maternal health awareness, routine prenatal screenings, and timely diagnosis to prevent complications for mother and child. Improved assay sensitivity, portability, and accessibility are key growth factors. Home-based monitoring kits and portable devices are being increasingly adopted. Integration with digital platforms allows expectant mothers and clinicians to track glucose trends efficiently. Rising awareness campaigns by healthcare authorities are boosting testing rates. The market is witnessing increased investment in specialized diagnostics for gestational diabetes, contributing to the rapid growth of this segment.

- By Deployment

On the basis of deployment, the market is segmented into automated and manual systems. The automated segment dominated in 2024, driven by faster, more accurate, and consistent results with minimal human error. Automated systems are widely adopted in hospitals, specialty clinics, and large diagnostic centers for high-throughput testing. Integration with laboratory information systems and digital health platforms enhances workflow efficiency and data management. Automation supports AI-driven analytics and predictive diagnostics, increasingly valued in diabetes management. The growing demand for centralized and connected testing solutions further reinforces the segment’s dominance. Automated systems also reduce operational costs in large facilities and improve patient turnaround time, strengthening their market position.

The manual segment is expected to witness the fastest growth during forecast period, due to lower cost and ease of adoption in small clinics and homecare settings. Manual assays remain relevant in regions with limited infrastructure or budget constraints. They require minimal technical training and are easy to deploy in decentralized healthcare setups. Manual testing allows flexible sample processing and rapid result interpretation. The segment benefits from increasing patient awareness and home-based monitoring trends. Growing demand for affordable diabetes testing solutions ensures steady expansion of manual systems across North America.

- By End-Users

On the basis of end-users, the market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment dominated the market with a share of 46.3% in 2024, owing to routine screening programs, high patient volume, and demand for accurate diagnostic assays. Hospitals benefit from integrated laboratory systems, enabling centralized testing, monitoring, and reporting. Government initiatives and preventive health programs often focus on hospital-based screenings. High patient trust, established clinical workflows, and availability of advanced assay technologies contribute to the dominance of hospitals. Hospitals also have the capacity to handle high-throughput testing, ensuring consistent supply and quality control. Strategic partnerships with assay manufacturers reinforce the hospitals’ central role in the market.

The homecare segment is expected to be the fastest growing during forecast period, driven by rising patient preference for self-monitoring, convenience, and connected platforms that allow real-time tracking and remote clinician support. Increased availability of portable devices, telehealth integration, and user-friendly kits is boosting adoption. Patients are empowered to manage diabetes independently while sharing data with clinicians remotely. Homecare solutions reduce hospital visits and improve patient engagement. Marketing campaigns and insurance coverage for home-testing devices further support growth. The trend toward patient-centered care is driving rapid expansion of the homecare segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment dominated the market in 2024 due to direct access to clinical facilities and integration with healthcare programs for routine testing and treatment monitoring. Hospital pharmacies provide reliable supply, technical support, and access to advanced assays and devices, making them the preferred channel for healthcare providers. Centralized inventory management, quality assurance, and professional guidance further strengthen hospital pharmacies’ market share. Hospitals often bundle testing with treatment plans, enhancing patient adherence. Established trust and long-standing relationships with assay manufacturers reinforce this dominance.

The online pharmacy segment is expected to witness the fastest growth during forecast period, driven by increasing e-commerce adoption, patient convenience, and the ability to order diagnostic kits and devices from home, particularly in remote areas or for home-based diabetes management. Easy accessibility, doorstep delivery, and seamless integration with telehealth platforms are key factors driving this growth. Online channels reduce geographic barriers and provide quick replenishment of consumables. Growing digital literacy and mobile app integration enhance patient engagement. Marketing initiatives targeting home-testing solutions further accelerate growth of online distribution.

North America Diabetic Assays Market Regional Analysis

- The U.S. dominated the North American diabetic assays market with the largest revenue share of 39.6% in 2024, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key diagnostic companies

- Patients and healthcare providers in the region highly value the accuracy, rapid results, and integration of diabetic assays with digital health platforms and connected monitoring devices, which support effective disease management and personalized treatment plans

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare spending, and government initiatives promoting routine diabetes screening and preventive care, establishing diabetic assays as a preferred diagnostic solution across hospitals, specialty clinics, and homecare settings

U.S. Diabetic Assays Market Insight

The U.S. diabetic assays market captured the largest revenue share in 2024 within North America, fueled by the high prevalence of diabetes and increasing focus on early diagnosis and disease management. Patients and healthcare providers are prioritizing accurate, rapid, and AI-enabled testing solutions for Type 2 Diabetes. The growing preference for home-based monitoring and connected devices, combined with integration with digital health platforms, further propels the diabetic assays market. Moreover, government initiatives and insurance coverage supporting preventive care and regular screenings are significantly contributing to the market’s expansion. The U.S. also benefits from a well-established healthcare infrastructure and high healthcare spending, which supports adoption of advanced assays and continuous glucose monitoring devices.

Canada Diabetic Assays Market Insight

The Canadian diabetic assays market is expected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of diabetes management and routine screening programs. Rising adoption of connected diagnostic devices in hospitals, clinics, and homecare settings is fostering market growth. Canadian patients are increasingly drawn to the convenience of self-monitoring and integration with mobile apps and telehealth platforms. The region is experiencing significant growth across hospital and homecare applications, with diabetic assays being incorporated into preventive healthcare initiatives and personalized treatment programs. Government support and patient education programs are further accelerating market adoption.

Mexico Diabetic Assays Market Insight

The Mexican diabetic assays market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of Type 2 Diabetes and growing awareness of early diagnosis. In addition, the need for accessible and affordable diagnostic solutions is encouraging hospitals, specialty clinics, and homecare providers to adopt advanced assay systems. Mexico’s improving healthcare infrastructure and increasing penetration of point-of-care testing devices are expected to stimulate market growth. Patients are increasingly relying on home-based monitoring solutions for convenience and timely disease management. Telemedicine integration and mobile health platforms are further boosting the adoption of diabetic assays in Mexico.

North America Diabetic Assays Market Share

The North America Diabetic Assays industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Medtronic (U.S.)

- Dexcom, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (U.K.)

- Siemens Healthineers AG (Germany)

- BD (U.S.)

- Sanofi (France)

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- Bayer AG (Germany)

- Amgen Inc. (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- GSK plc (U.K.)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

What are the Recent Developments in North America Diabetic Assays Market?

- In September 2024, Abbott introduced its over-the-counter continuous glucose monitoring (CGM) system, Lingo, in the United States. This move positions Abbott as the second company to offer such a device, following Dexcom's recent launch. Lingo is designed for adults not on insulin therapy and features adhesive skin patches that sync with smartphones, providing continuous glucose readings without the need for finger pricks

- In July 2023, Tandem Diabetes Care announced the FDA clearance of the Tandem Mobi insulin pump, designed as the world's smallest durable automated insulin delivery system. Fully controllable via a mobile app, it is intended for individuals aged 6 and up, expanding the company's portfolio of products

- In July 2023, The American Diabetes Association (ADA) and Abbott announced a collaboration to develop a first-of-its-kind therapeutic nutrition program aimed at improving the health of individuals with diabetes. This program focuses on providing personalized nutrition solutions to enhance diabetes management

- In June 2023, Topcon Healthcare's TRC-NW400 retinal camera received FDA clearance to assist in detecting diabetic retinopathy. Utilizing AI, it generates reports of color retinal fundus images in under 60 seconds, enhancing diagnostic efficiency

- In April 2023, Medtronic received FDA approval for its MiniMed™ 780G insulin pump system, featuring the world's first insulin pump with meal detection technology and 5-minute auto-corrections. This system is approved for users aged 7 and above with type 1 diabetes. Pre-orders began in May 2023, with shipments planned for later that summer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.