North America Digital Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

5.12 Billion

USD

19.94 Billion

2024

2032

USD

5.12 Billion

USD

19.94 Billion

2024

2032

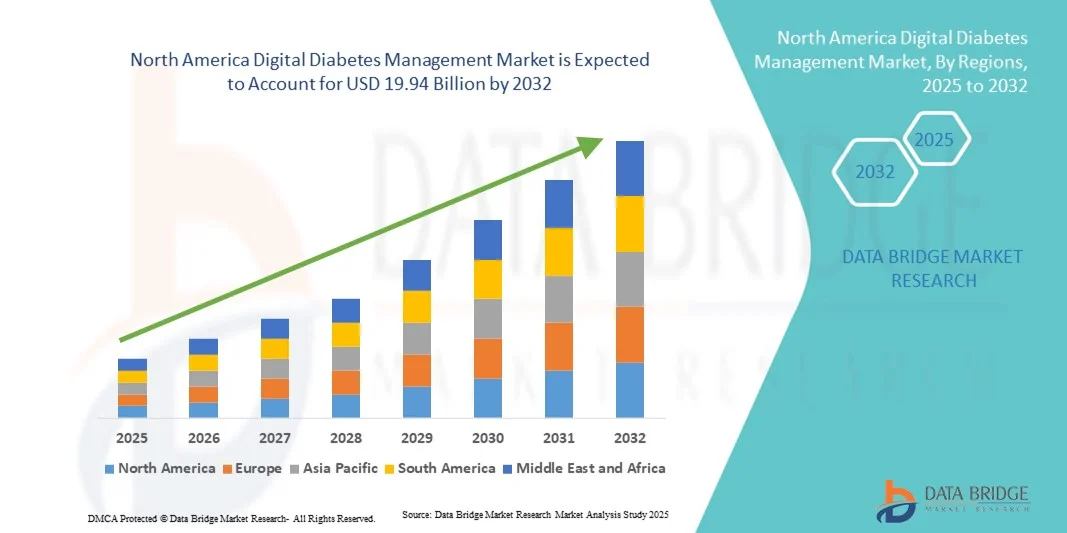

| 2025 –2032 | |

| USD 5.12 Billion | |

| USD 19.94 Billion | |

|

|

|

|

North America Digital Diabetes Management Market Size

- The North America digital diabetes management market size was valued at USD 5.12 billion in 2024 and is expected to reach USD 19.94 billion by 2032, at a CAGR of 18.5% during the forecast period

- The market growth is largely fueled by the growing adoption of digital diabetes management solutions technological progress in connected healthcare devices, and increasing digitalisation in both home‑care and clinical settings

- Furthermore, rising consumer and clinical demand for secure, user‑friendly, integrated solutions for diabetes monitoring and self‑management combined with supportive reimbursement policies, high smartphone/wearable penetration, and mature healthcare infrastructure in North America are establishing digital diabetes management as the modern standard for diabetes care.

North America Digital Diabetes Management Market Analysis

- Digital diabetes management solutions, including connected/continuous glucose monitors, smart insulin pens/pumps, apps, and telehealth platforms, are increasingly vital components of modern healthcare and home‑care systems in both residential and clinical settings due to their real‑time monitoring capabilities, remote access, and seamless integration with broader digital health ecosystems

- The escalating demand for digital diabetes management is primarily fueled by the rising prevalence of diabetes in the U.S., growing adoption of smartphones and wearable devices, favourable reimbursement frameworks, and a rising preference for self‑management and remote monitoring solutions

- The United States dominated the digital diabetes management market with the largest revenue share of 81% in 2024, characterized by high healthcare expenditure, advanced medical infrastructure, and a strong presence of key industry players, with substantial growth in device adoption and digital health integration, driven by innovations from both established medical technology companies and startups focusing on AI‑powered analytics and connected care solutions

- Canada is expected to be the fastest growing country in the digital diabetes management market during the forecast period due to increasing awareness of diabetes management, rising healthcare spending, and growing adoption of digital health technologies

- Devices segment dominated the U.S. digital diabetes management market with a market share of 45.3% in 2024, driven by high adoption of wearable devices and handheld devices for continuous glucose monitoring, home care, and clinical use

Report Scope and North America Digital Diabetes Management Market Segmentation

|

Attributes |

North America Digital Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Digital Diabetes Management Market Trends

Data‑Driven Personalised Care via Analytics & Connected Platforms

- A significant and accelerating trend in the North America digital diabetes management market is the deepening integration of connected devices mobile apps, cloud platforms, and advanced analytics, enabling real‑time glucose tracking, insulin dosing insights, and patient engagement

- For instance, a leading digital diabetes platform reported a 30% increase in patient engagement through remote monitoring and closed‑loop systems using networked CGMs and software

- Analytics integration enables predictive alerts personalised dosing suggestions, and remote clinician dashboards aggregated via platforms. Simultaneously, mobile apps and wearable CGMs allow users to monitor glucose trends, log meals/exercise, and share data with providers from home settings

- The seamless connection of devices, apps, and data platforms creates a unified ecosystem for diabetes management, patients use wearables and handhelds, data flows into cloud platforms, clinicians and caregivers monitor through dashboards, enabling more proactive and personalised care

- This trend toward more intuitive, data‑driven, and connected diabetes management is fundamentally reshaping user expectations for home care and clinic workflows. Consequently, companies are developing analytics‑enabled apps, interoperable platforms, and device ecosystems that support continuous monitoring and remote care

- The demand for digital diabetes solutions that offer seamless connectivity, real‑time insights, and integrated platforms is growing rapidly across home healthcare and diabetes clinics in North America, as patients and providers increasingly prioritise convenience, engagement, and evidence‑based outcomes

North America Digital Diabetes Management Market Dynamics

Driver

Rising Disease Burden and Technology Adoption

- The increasing prevalence of diabetes in North America, combined with greater adoption of smart devices, telehealth services, and connected health platforms, is a significant driver of heightened demand for digital diabetes management

- For instance, connected CGM and hybrid closed‑loop systems (wearables plus apps) are gaining traction, with studies showing improvements in time‑in‑range and reduction in complications

- As smartphone penetration, internet connectivity, and patient digital literacy increase, coupled with favourable reimbursement and regulatory frameworks, the uptake of digital diabetes tools in home care and outpatient settings is accelerating

- This translates into higher demand for devices digital apps, software platforms, and services across home care, diabetes clinics, and research settings, driving market expansion

- Rising patient awareness and proactive health management trends are motivating individuals to adopt digital diabetes solutions for real‑time monitoring, lifestyle tracking, and long-term disease management

- Technological advancements, including cloud-based platforms and IoT-enabled devices, are expanding remote patient monitoring capabilities, reducing hospital visits and improving overall disease management efficiency

Restraint/Challenge

Regulatory, Data Security and Reimbursement Complexities

- Regulatory compliance and data‑security concerns pose a significant challenge to the growth of digital diabetes management in North America, the more devices/apps connect and transmit health‑data, the greater the scrutiny and risk

- For instance, although advanced CGM systems and predictive algorithms are approved, smaller developers face complex documentation and approval hurdles, which slows product launches and market entry

- Reimbursement uncertainty (for telehealth, remote monitoring, digital therapeutics) and payer hesitancy in covering newer digital services can limit adoption, especially in home‑care and outpatient settings

- Overcoming these challenges through robust regulatory pathways, certifications, patient‑data protections, payer engagement, and cost‑effective offerings will be crucial for the digital diabetes management market's sustained growth in North America

- Fragmentation of digital health platforms and lack of standardization can impede interoperability between devices, apps, and clinical systems, limiting seamless data exchange and integration

- Concerns over data privacy and potential breaches continue to affect patient trust and adoption, requiring manufacturers to implement strict encryption, secure authentication, and compliance with HIPAA regulations

North America Digital Diabetes Management Market Scope

The market is segmented on the basis of product & services, type, and end user.

- By Product and Services

On the basis of product and services, the North America digital diabetes management market is segmented into devices, digital diabetes management apps, data management software and platforms, and services. The devices segment dominated the market in 2024, capturing the largest revenue share of 45.3%, driven by the widespread adoption of wearable and handheld devices for continuous glucose monitoring (CGM) and insulin delivery management. Devices are favored for their real-time monitoring, accuracy, and ability to integrate with apps and cloud platforms, providing both patients and healthcare providers with actionable insights. The presence of leading device manufacturers and high patient awareness in the U.S. further reinforces this dominance. Moreover, devices are crucial for home care and clinic-based monitoring, ensuring proper diabetes management. Continuous innovations in wearable and handheld devices, including improved battery life, compact design, and wireless connectivity, sustain their high demand.

The digital diabetes management apps segment is expected to witness the fastest growth during 2025–2032, propelled by increasing smartphone penetration, adoption of telehealth, and growing patient preference for mobile-based disease management. Apps allow tracking of blood glucose, insulin doses, diet, and physical activity while integrating with wearable devices for real-time analytics. They also facilitate remote monitoring by healthcare providers, enhancing patient engagement and adherence. Gamification features, AI-based recommendations, and personalized alerts in apps are further driving adoption. The low cost and easy accessibility of apps make them particularly appealing in both home care and outpatient clinic settings. Partnerships between device manufacturers and app developers are accelerating app-based ecosystem expansion.

- By Type

On the basis of type, the market is segmented into wearable devices and handheld devices. The wearable devices segment dominated the market in 2024, accounting for a major revenue share, owing to their ability to provide continuous glucose monitoring and seamless integration with smartphones and cloud-based platforms. Wearable devices enable patients to track real-time glucose trends without frequent finger-pricks, improving convenience and adherence to therapy. These devices are highly preferred in home-care settings and by patients seeking remote monitoring. Advanced wearables include features such as predictive alerts, data sharing with clinicians, and AI-based recommendations, enhancing their value proposition. The growth of telehealth and remote patient monitoring in North America supports continued dominance of wearables. Their integration with apps and platforms allows centralized data management and analytics, critical for personalized diabetes care.

The handheld devices segment is expected to witness the fastest CAGR during 2025–2032, fueled by demand for compact, portable solutions for spot glucose testing. Handheld glucometers offer ease of use, affordability, and portability, making them attractive for both home care and clinic use. They are particularly preferred in situations where continuous monitoring is not required or for patients new to digital diabetes solutions. Integration with apps and data platforms is increasing their appeal by enabling automatic logging, trend analysis, and remote sharing. Manufacturers are also innovating with enhanced accuracy, smaller form factors, and faster testing times to capture growth. Educational initiatives promoting patient self-management further contribute to adoption.

- By End User

On the basis of end user, the market is segmented into home care settings, diabetes clinics, academic and research institutes, and others. The home care settings segment dominated the market in 2024, driven by the growing prevalence of diabetes and increasing patient preference for self-management at home. Remote monitoring capabilities and seamless integration with digital platforms allow patients and caregivers to manage diabetes efficiently outside clinical environments. Devices, apps, and data platforms collectively support home care through real-time alerts, dose tracking, and teleconsultation. The convenience of self-management, coupled with cost savings from reduced hospital visits, makes home care the largest end-user segment. Adoption is further boosted by increasing patient awareness and supportive reimbursement policies in the U.S.

The diabetes clinics segment is expected to witness the fastest growth during 2025–2032, propelled by expanding adoption of digital diabetes management tools to enhance clinical care. Clinics are increasingly integrating wearables, handheld devices, apps, and data platforms for real-time patient monitoring, personalized treatment plans, and remote follow-up. The rising focus on improving patient outcomes, efficiency of care, and data-driven decision-making accelerates adoption. Partnerships between device providers and clinics facilitate comprehensive ecosystem deployment. Furthermore, the integration of analytics platforms with clinical workflows enables predictive care, improving disease management effectiveness and patient satisfaction

North America Digital Diabetes Management Market Regional Analysis

- The United States dominated the digital diabetes management market with the largest revenue share of 40.01% in 2024, characterized by high healthcare expenditure, advanced medical infrastructure, and a strong presence of key industry players, with substantial growth in device adoption and digital health integration, driven by innovations from both established medical technology companies and startups focusing on AI‑powered analytics and connected care solutions

- Patients and healthcare providers in the region highly value the convenience, real-time monitoring, and seamless integration offered by digital diabetes management solutions, including wearable devices, handheld glucometers, mobile apps, and cloud-based platforms

- This widespread adoption is further supported by high healthcare expenditure, advanced medical infrastructure, strong payer support, and the presence of key medical technology and digital health companies, establishing digital diabetes management as a preferred solution for both home care and clinical settings

U.S. Digital Diabetes Management Market Insight

The U.S. digital diabetes management market captured the largest revenue share of 81% in 2024 within North America, fueled by the swift adoption of connected devices, mobile apps, and cloud-based platforms for diabetes monitoring. Patients and healthcare providers are increasingly prioritizing real-time glucose tracking, insulin dosing insights, and remote patient management. The growing preference for integrated digital health solutions, combined with robust demand for wearable devices and handheld glucometers, further propels the market. Moreover, favorable reimbursement policies, high healthcare expenditure, and the presence of leading medical technology and digital health companies are significantly contributing to market expansion.

Canada Digital Diabetes Management Market Insight

The Canada digital diabetes management market is expected to grow at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of diabetes, rising adoption of connected devices, and supportive healthcare policies. The demand for convenient, real-time diabetes management solutions in home care and outpatient settings is fostering market growth. Canadian patients are increasingly valuing remote monitoring, mobile apps, and wearable devices to manage diabetes efficiently. The region is experiencing growth across both urban and semi-urban populations, with digital solutions being integrated into patient care plans and telehealth initiatives.

Mexico Digital Diabetes Management Market Insight

The Mexico digital diabetes management market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising prevalence of diabetes and growing demand for affordable, accessible digital health solutions. Increasing mobile penetration and adoption of wearable devices and apps are encouraging the uptake of digital diabetes management solutions. In addition, government initiatives to promote preventive healthcare and digitalization in healthcare infrastructure are expected to further stimulate market growth.

North America Digital Diabetes Management Market Share

The North America Digital Diabetes Management industry is primarily led by well-established companies, including:

- Glooko, Inc. (U.S.)

- Abbott (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic (Ireland)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- B. Braun SE (Germany)

- Sanofi (France)

- Insulet Corporation (U.S.)

- Novo Nordisk A/S (Denmark)

- Bayer AG (Germany)

- LifeScan, Inc. (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Ypsomed AG (Switzerland)

- Welldoc, Inc. (U.S.)

- Omada Health Inc (U.S.)

- Noom, Inc. (U.S.)

- Lark Technologies, Inc. (U.S.)

- Vida Health, Inc (U.S.)

- DarioHealth Corp. (U.S.)

What are the Recent Developments in North America Digital Diabetes Management Market?

- In April 2025, Dexcom, Inc. received FDA approval for the Dexcom G7 15 Day CGM system for use in adults, offering extended sensor wear time and improved accuracy. Investopedia Sensor wear time extension enhances convenience and value for users, reducing change frequency burden

- In June 2025, U.S. Department of Health & Human Services (HHS) announced a major campaign to encourage Americans to adopt wearable health monitoring under its “MAHA” initiative. The initiative emphasises real time physiological monitoring as part of preventive health and chronic disease management

- In September 2024, Abbott Laboratories launched its OTC (over the counter) continuous glucose monitor (CGM) system called Lingo in the U.S., targeting adults not on insulin. Reuters. The launch expands CGM access from prescription only users to a broader consumer/wellness segment, broadening the market

- In March 2024, the Peterson Health Technology Institute (PHTI) published an independent assessment of digital diabetes‑management tools in the U.S. which concluded that remote monitoring and behavioural/lifestyle digital interventions “do not deliver meaningful clinical benefits” and increased healthcare spending

- In July 2023, Tandem Diabetes Care announced U.S. U.S. Food & Drug Administration (FDA) clearance of the Tandem Mobi insulin pump for people with diabetes aged 6 and up; the device is fully controllable via a mobile app and is described as the world’s smallest durable automated insulin delivery system

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.