North America Digital Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

5.66 Billion

USD

30.43 Billion

2025

2033

USD

5.66 Billion

USD

30.43 Billion

2025

2033

| 2026 –2033 | |

| USD 5.66 Billion | |

| USD 30.43 Billion | |

|

|

|

|

North America Digital Therapeutic (DTx) Market Size

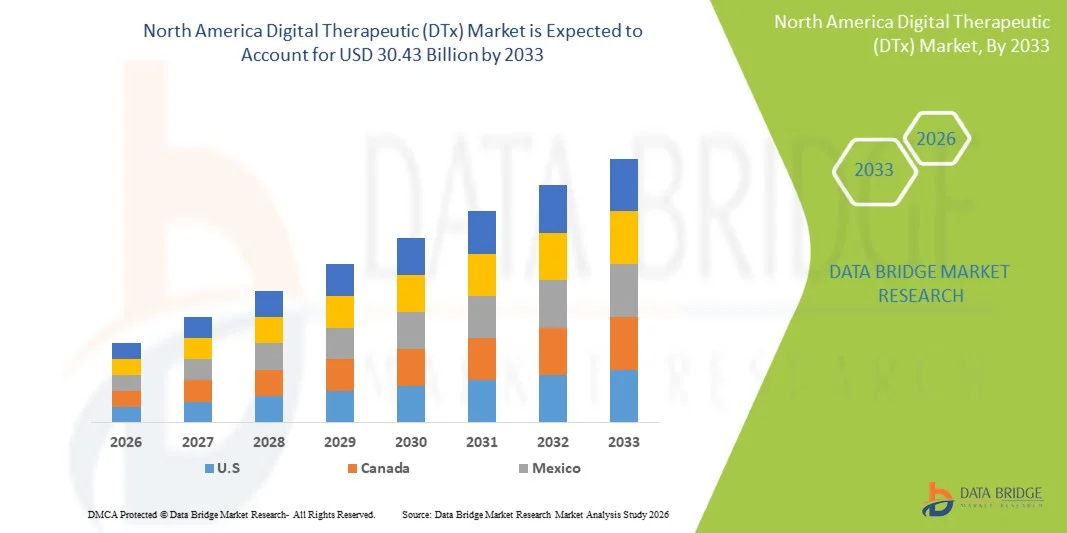

- The North America Digital Therapeutic (DTx) market size was valued at USD 5.66 billion in 2025 and is expected to reach USD 30.43 billion by 2033, at a CAGR of 23.4% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic diseases, supportive regulatory environments increased adoption of telemedicine and mobile health technologies, and expanded reimbursement coverage, which together enhance demand for evidence‑based, software‑enabled therapeutic interventions

- Furthermore, growing consumer and provider demand for effective, personalized, and accessible digital treatment solutions across mental health, diabetes, cardiovascular disease, and other conditions is positioning digital therapeutics as a key component of modern healthcare delivery in both clinical and outpatient settings; these converging factors are accelerating adoption and significantly boosting industry growth

North America Digital Therapeutic (DTx) Market Analysis

- Digital therapeutics (DTx), offering software-driven, evidence-based interventions for prevention, management, and treatment of medical conditions, are increasingly vital components of modern healthcare delivery in both clinical and outpatient settings due to their personalization, remote monitoring capabilities, and seamless integration with telehealth and electronic health record systems

- The escalating demand for DTx is primarily fueled by the rising prevalence of chronic diseases, growing mental health awareness, supportive regulatory frameworks, and an increasing preference for accessible, home-based, and patient-centric digital treatment solutions

- The United States dominated the North America DTx market with the largest revenue share of 88.4% in 2025, characterized by early adoption of digital health technologies, strong healthcare infrastructure, and a robust presence of key industry players, with significant growth in DTx deployment across hospitals, clinics, and individual care settings, driven by innovations from both established pharmaceutical and tech companies as well as startups focusing on AI-enabled and behavioral health solutions

- Canada is expected to be the fastest-growing country in the North America DTx market during the forecast period due to increasing smartphone penetration, supportive healthcare policies, and growing adoption of digital health solutions in both urban and remote areas

- Solutions/Software segment dominated the North America DTx market with a market share of 42.5% in 2025, driven by high demand for mobile applications, cloud-based platforms, and AI-enabled programs that provide scalable, personalized, and evidence-based interventions

Report Scope and North America Digital Therapeutic (DTx) Market Segmentation

|

Attributes |

North America Digital Therapeutic (DTx) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Digital Therapeutic (DTx) Market Trends

“Enhanced Personalization Through AI and Remote Monitoring”

- A significant and accelerating trend in the North America DTx market is the deepening integration with artificial intelligence (AI) and remote patient monitoring platforms. This fusion of technologies is significantly enhancing treatment personalization and patient engagement

- For instance, the Kaia Health platform uses AI to deliver tailored musculoskeletal therapy programs that adapt in real time based on user progress and adherence. Similarly, Omada Health leverages AI to optimize behavioral coaching and provide actionable insights for chronic disease management

- AI integration in DTx enables features such as predicting patient adherence, suggesting personalized interventions, and generating intelligent alerts for care providers. For instance, Pear Therapeutics’ reSET-O program uses AI-driven insights to improve therapy engagement and monitor potential relapse risks

- The seamless integration of DTx with mobile apps, telehealth platforms, and electronic health records facilitates centralized monitoring and intervention. Through a single interface, providers and patients can track therapy progress, medication adherence, and health outcomes, creating a unified and proactive care experience

- This trend towards more intelligent, adaptive, and patient-centered digital therapies is fundamentally reshaping expectations for healthcare delivery. Consequently, companies such as Click Therapeutics are developing AI-enabled programs with features such as adaptive treatment plans and real-time feedback to improve engagement and outcomes

- The demand for DTx solutions that offer seamless AI integration and remote monitoring is growing rapidly across both clinical and home-based care settings, as providers increasingly prioritize personalized, scalable, and accessible therapeutic solutions

North America Digital Therapeutic (DTx) Market Dynamics

Driver

“Rising Demand Due to Chronic Disease Prevalence and Digital Health Adoption”

- The increasing prevalence of chronic diseases, coupled with the accelerating adoption of digital health platforms, is a significant driver for the heightened demand for DTx solutions

- For instance, in March 2025, Omada Health expanded its diabetes prevention program to integrate AI-based behavioral coaching, targeting improved patient engagement and health outcomes. Such initiatives by key companies are expected to drive DTx market growth in the forecast period

- As patients and providers seek scalable, evidence-based, and accessible interventions, DTx offers features such as personalized therapy plans, progress tracking, and adherence support, providing a compelling alternative to traditional in-person care

- Furthermore, the growing popularity of mobile health applications and telemedicine, along with increasing reimbursement coverage for digital therapies, are making DTx an integral component of healthcare delivery

- The convenience of remote access, personalized feedback, and integration with wearable devices are key factors propelling DTx adoption in both clinical and home settings. The trend towards patient-centric care and the increasing availability of user-friendly digital platforms further contribute to market growth

Restraint/Challenge

“Regulatory Complexity and Data Privacy Concerns”

- Concerns surrounding regulatory compliance and patient data privacy pose a significant challenge to broader market penetration. As DTx relies on digital platforms and sensitive health data, companies must navigate complex FDA regulations and HIPAA compliance requirements

- For instance, high-profile reports of data breaches in digital health apps have made some patients and providers hesitant to adopt DTx solutions

- Addressing these concerns through robust encryption, secure authentication protocols, and clear regulatory guidance is crucial for building trust. Companies such as Pear Therapeutics emphasize compliance and data security in their platforms to reassure users. In addition, the relatively high development and implementation cost of advanced DTx solutions can be a barrier for smaller healthcare providers and budget-conscious patients

- While costs are gradually decreasing, the perceived premium for digital therapies can still hinder adoption, especially among populations less familiar with digital healthcare technologies

- Overcoming these challenges through enhanced regulatory support, consumer education on data privacy, and development of cost-effective DTx solutions will be vital for sustained market growth

North America Digital Therapeutic (DTx) Market Scope

The market is segmented on the basis of product and service type, application, purchase mode, and sales channel.

- By Product and Service Type

On the basis of product and service type, the market is segmented into hardware products, solutions/software, and service. The Solutions/Software segment dominated the North America DTx market in 2025 with the largest revenue share of 42.5%, driven by the growing adoption of mobile applications, cloud-based platforms, and AI-enabled therapeutic programs. Healthcare providers and patients increasingly rely on software solutions for chronic disease management, mental health interventions, and behavioral therapy, appreciating their scalability, personalization, and real-time data analytics. Software-based DTx programs also benefit from integration with telehealth systems, wearable devices, and electronic health records, making them central to modern healthcare delivery. The demand for software solutions is further fueled by supportive regulatory policies and increasing reimbursement coverage for evidence-based digital therapies.

The Hardware Products segment is expected to witness the fastest growth during the forecast period, as connected devices such as wearable sensors, smart inhalers, and remote monitoring tools are increasingly integrated with DTx programs. Hardware devices enhance the effectiveness of digital therapies by collecting real-time biometric data, monitoring adherence, and providing feedback to both patients and providers. The growth is particularly pronounced in remote patient monitoring, cardiac rehabilitation, and diabetes management, where continuous tracking improves outcomes. Rising consumer awareness of personalized care and proactive health management is driving adoption, alongside decreasing device costs and improved interoperability with software platforms.

- By Application

On the basis of application, the market is segmented into treatment/care-related applications and preventive applications. The Treatment/Care-Related Applications segment dominated the North America DTx market in 2025, holding the largest share, due to its widespread use in managing chronic conditions such as diabetes, cardiovascular disease, respiratory disorders, and mental health. Digital therapeutics provide structured interventions that can be tailored to individual patient needs, offering higher adherence and better outcomes compared to traditional methods. Healthcare providers increasingly integrate DTx programs into clinical care pathways, supplementing in-person treatment with remote monitoring and behavioral support. The availability of clinical evidence supporting efficacy, along with regulatory approval for treatment applications, further strengthens market dominance.

The Preventive Applications segment is expected to witness the fastest growth from 2026 to 2033, driven by rising awareness of lifestyle-related health risks and the growing adoption of DTx solutions for weight management, smoking cessation, stress reduction, and early intervention programs. Preventive DTx programs enable users to actively manage their health through continuous engagement, educational content, and personalized coaching. Integration with mobile apps and wearable devices allows real-time tracking and feedback, promoting behavioral change. Expansion of corporate wellness initiatives and health insurance incentives for preventive care are also driving adoption.

- By Purchase Mode

On the basis of purchase mode, the market is segmented into group purchase organization and individual. The Individual purchase mode dominated the market in 2025, as patients increasingly prefer self-managed, home-based digital therapy solutions that offer flexibility, convenience, and privacy. Individual purchases allow patients to select DTx programs suited to their specific needs, such as mental health apps or chronic disease management platforms. Growing smartphone penetration and user-friendly app interfaces facilitate direct consumer access, bypassing traditional healthcare intermediaries. Personalized feedback and adaptive therapy features further enhance the appeal of individually purchased solutions.

The Group Purchase Organization mode is expected to witness the fastest growth from 2026 to 2033, driven by hospitals, clinics, and corporate wellness programs procuring DTx solutions at scale for employees or patient populations. Bulk procurement allows organizations to integrate DTx into existing healthcare systems, enhance care coordination, and achieve cost efficiencies. Government health programs and insurance providers increasingly incentivize group adoption, particularly for chronic disease management and preventive health programs, accelerating market expansion.

- By Sales Channel

On the basis of sales channel, the market is segmented into B2B and B2C. The B2B segment dominated the North America DTx market in 2025 due to strong adoption by hospitals, healthcare providers, and insurance companies. B2B sales enable large-scale implementation of DTx programs across patient populations, facilitate integration with clinical workflows, and support reimbursement processes. Enterprise-level deployments often include software licenses, training, and technical support, making B2B the primary revenue-generating channel.

The B2C segment is expected to witness the fastest growth from 2026 to 2033, as individual consumers increasingly adopt mobile apps and subscription-based DTx platforms for mental health, wellness, and preventive care. Direct-to-consumer offerings provide flexibility, immediate access, and personalized engagement, with marketing through app stores, online platforms, and digital campaigns driving adoption. Rising consumer awareness, increased digital literacy, and enhanced accessibility are major factors contributing to the rapid growth of B2C channels.

North America Digital Therapeutic (DTx) Market Regional Analysis

- The United States dominated the North America DTx market with the largest revenue share of 88.4% in 2025, characterized by early adoption of digital health technologies, strong healthcare infrastructure, and a robust presence of key industry players

- Patients and healthcare providers in the region highly value the accessibility, personalization, and evidence-based outcomes offered by DTx solutions, along with seamless integration with telehealth platforms, wearable devices, and electronic health records

- This widespread adoption is further supported by supportive regulatory policies, increasing reimbursement coverage for digital therapies, and a robust presence of key industry players, establishing DTx as a preferred solution for both clinical and home-based care settings across North America

U.S. Digital Therapeutic (DTx) Market Insight

The U.S. DTx market captured the largest revenue share of 88.4% in 2025 within North America, fueled by the rapid adoption of digital health solutions and the growing focus on chronic disease management. Patients and healthcare providers are increasingly prioritizing evidence-based, software-driven therapies for conditions such as diabetes, cardiovascular disease, and mental health. The growing preference for home-based and remote care, combined with strong reimbursement support and regulatory frameworks, further propels the DTx industry. Moreover, the integration of AI-driven personalization, telehealth platforms, and wearable devices is significantly contributing to market expansion.

Canada Digital Therapeutic (DTx) Market Insight

The Canada DTx market is expected to expand at a notable CAGR during the forecast period, driven by rising awareness of preventive and chronic disease management solutions. The increasing adoption of mobile health apps, telemedicine, and digital therapeutic platforms is fostering growth. Canadian patients and providers value the accessibility, scalability, and personalization offered by DTx solutions, which are being increasingly integrated into both clinical care and corporate wellness programs. The government’s support for digital health initiatives and expanding insurance coverage are expected to further boost adoption.

Mexico Digital Therapeutic (DTx) Market Insight

The Mexico DTx market is anticipated to grow at a significant CAGR during the forecast period, driven by the growing penetration of smartphones, rising healthcare digitization, and a focus on managing chronic diseases in urban populations. Patients are increasingly seeking accessible, cost-effective, and home-based digital therapies, while healthcare providers integrate DTx into hospitals and clinics for improved patient monitoring and adherence. Awareness campaigns and partnerships between digital health companies and healthcare institutions are supporting market growth in Mexico.

North America Digital Therapeutic (DTx) Market Share

The North America Digital Therapeutic (DTx) industry is primarily led by well-established companies, including:

- Omada Health, Inc. (U.S.)

- Pear Therapeutics, Inc. (U.S.)

- Teladoc Health, Inc. (U.S.)

- ResMed Inc. (U.S.)

- 2Morrow, Inc. (U.S.)

- Noom, Inc. (U.S.)

- WellDoc, Inc. (U.S.)

- Click Therapeutics, Inc. (U.S.)

- Better Therapeutics, Inc. (U.S.)

- Voluntis, Inc. (U.S.)

- Canary Health, Inc. (U.S.)

- Ayogo Health Corp. (Canada)

- Mango Health, Inc. (U.S.)

- Cognoa, Inc. (U.S.)

- Mindstrong Health, Inc. (U.S.)

- Happify Health, Inc. (U.S.)

- Big Health Ltd. (U.S.)

- Kaia Health, Inc. (U.S.)

- Proteus Digital Health, Inc. (U.S.)

- Dthera Sciences, Inc. (U.S.)

What are the Recent Developments in North America Digital Therapeutic (DTx) Market?

- In March 2025, industry data shows Click Therapeutics’ prescription DTx CT‑132 received FDA marketing authorization for the preventive treatment of episodic migraine in adults, marking a notable regulatory milestone and expanded clinical indication for digital therapeutics

- In March 2025, ATA Action completed its acquisition of the Digital Therapeutics Alliance (DTA) to form the Advancing Digital Health Coalition, consolidating advocacy and policy influence for accelerating adoption, reimbursement, and innovation in digital therapeutic technologies across the U.S. healthcare system

- In October 2024, Click Therapeutics launched Click SE™, a first‑of‑its‑kind extension of its digital therapeutics platform combining software with pharmacotherapy (“software‑enhanced drug™” therapies) to deliver added clinical benefits beyond standalone DTx, following updated FDA guidance on prescription drug‑related software

- In September 2024, DeepWell Digital Therapeutics received FDA 510(k) clearance for its immersive biofeedback software development kit (SDK) designed for stress reduction and adjunctive hypertension treatment via interactive media and video games, potentially expanding DTx into over‑the‑counter platforms and reimbursable immersive treatment models

- In April 2024, Otsuka Pharmaceutical and Click Therapeutics announced that the U.S. FDA cleared Rejoyn™, the first prescription digital therapeutic authorized for adjunctive treatment of major depressive disorder (MDD) symptoms, enabling clinicians to prescribe a smartphone‑based CBT‑style treatment alongside antidepressant medication

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.