North America Endotracheal And Tracheal Suction Market

Market Size in USD Billion

CAGR :

%

USD

2.41 Billion

USD

4.00 Billion

2024

2032

USD

2.41 Billion

USD

4.00 Billion

2024

2032

| 2025 –2032 | |

| USD 2.41 Billion | |

| USD 4.00 Billion | |

|

|

|

|

North America Endotracheal and Tracheal Suction Market Size

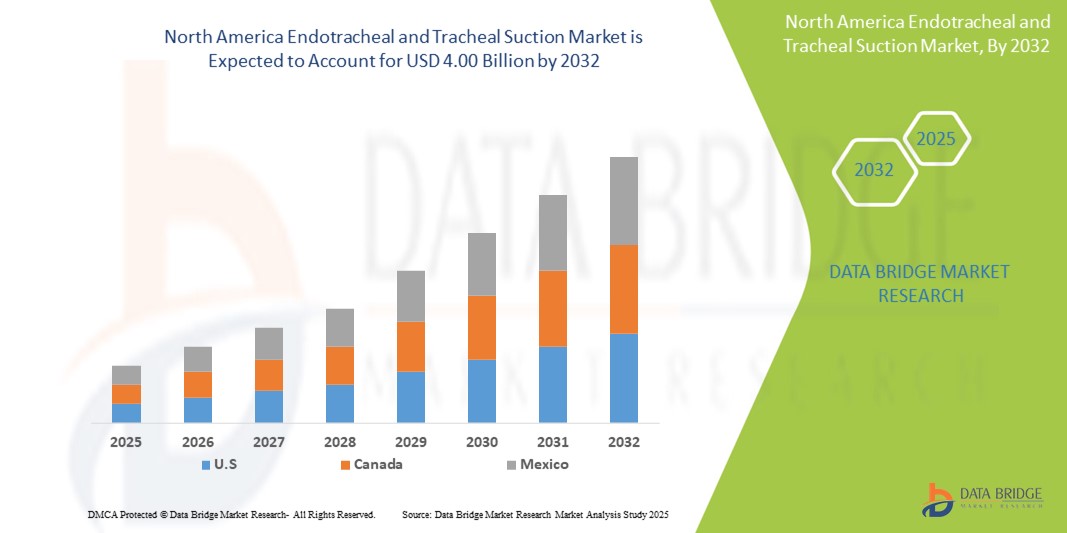

- The North America endotracheal and tracheal suction market size was valued at USD 2.41 billion in 2024 and is expected to reach USD 4.00 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth in North America is significantly fueled by the increasing prevalence of chronic respiratory diseases such as COPD and asthma, a rising geriatric population prone to respiratory complications, and a high number of surgical procedures requiring airway management

- ·Furthermore, advancements in medical technology, including the development of more efficient, user-friendly, and safer endotracheal and tracheal suction systems, along with a well-developed healthcare infrastructure and favorable reimbursement policies, are accelerating market expansion

North America Endotracheal and Tracheal Suction Market Analysis

- Endotracheal and tracheal suction systems are indispensable for maintaining clear airways in patients across diverse healthcare settings, including hospitals, ambulatory surgical centers, and homecare, driven by the increasing incidence of respiratory diseases, a growing number of surgical procedures, and continuous advancements in medical technology

- The escalating demand for these suction devices is primarily fueled by the rising prevalence of chronic respiratory conditions such as COPD and asthma, an expanding geriatric population susceptible to respiratory complications, and a growing volume of surgical procedures requiring effective airway management

- U.S. dominates the endotracheal and tracheal suction market, holding the largest revenue share of 76.1% within North America, supported by a strong healthcare infrastructure, high healthcare expenditure, and the presence of numerous key industry players

- U.S. also exhibits fasting growth rate within the region, propelled by its large patient pool and ongoing technological upgrades in medical devices

- Closed suction system segment is expected to dominate the North America endotracheal and tracheal suction market with a market share of 73.5% in 2025, driven by its increasing emphasis on infection control and patient safety, leading to widespread adoption of these systems for their ability to reduce healthcare-associated infections (HAIs) and maintain continuous ventilation during suctioning

Report Scope and North America Endotracheal and Tracheal Suction Market Segmentation

|

Attributes |

North America Endotracheal and Tracheal Suction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Endotracheal and Tracheal Suction Market Trends

“Advancing Patient Care Through Technological Innovation”

- A significant and accelerating trend in the North America endotracheal and tracheal suction market is the continuous integration of advanced technologies, focusing on improving patient safety, infection control, and procedural efficiency. This encompasses the development of more efficient and user-friendly suction systems, including closed suction systems and innovations in tube design

- For instance, advancements include the introduction of single-use and antimicrobial-coated tracheal tubes, which have been shown to improve patient safety and reduce infection risks. Manufacturers are also developing more advanced endotracheal tubes with features such as cuff pressure control and real-time monitoring, reflecting a strong focus on patient safety and comfort

- Technological integration also extends to the incorporation of artificial intelligence (AI) and smart features. AI is revolutionizing airway management by improving accuracy, efficiency, and safety, with AI-driven technologies being incorporated into video laryngoscopes for improved visualization and AI-powered monitoring systems that can predict tube displacement or blockage, enhancing patient safety

- Furthermore, there's a growing demand for miniaturization and portability, especially for use outside of traditional hospital settings, leading to the development of smaller, more portable devices. Innovations also include improvements in catheter design, incorporating features such as hydrophilic coatings and reduced trauma tips

- This trend towards more intelligent, safer, and interconnected airway management systems is fundamentally reshaping clinical practices and patient care expectations. Consequently, companies are investing in research and development to create innovative designs that minimize complications and improve patient outcomes, such as tubes with integrated cameras for real-time visualization or acoustic monitoring systems for real-time assessment of tube placement

- The demand for endotracheal and tracheal suction systems that offer these advanced features and technological integrations is growing rapidly across healthcare settings, as healthcare professionals increasingly prioritize enhanced safety, efficiency, and improved patient outcomes

North America Endotracheal and Tracheal Suction Market Dynamics

Driver

“Rising Burden of Chronic Respiratory Diseases, Aging Population, and Increasing Surgical Procedures”

- The increasing prevalence of chronic respiratory diseases such as COPD, asthma, and cystic fibrosis, coupled with a growing geriatric population highly susceptible to respiratory complications and post-operative needs, is a fundamental driver for the heightened demand for endotracheal and tracheal suction systems across North America

- For instance, the rising number of surgical procedures, encompassing both elective and emergency interventions across various medical specialties, significantly boosts the continuous need for effective airway management facilitated by these devices. The expanded use of mechanical ventilation in intensive care units further solidifies this demand

- As healthcare providers increasingly prioritize improving patient outcomes, enhancing safety, and mitigating the risks of hospital-acquired infections (HAIs), there's a strong impetus for adopting advanced suction technologies. These innovations offer superior infection control, reduced patient discomfort, and greater procedural efficiency, making them indispensable in modern respiratory and critical care

- Furthermore, continuous technological advancements within suction systems, including the development of sophisticated closed suction systems and more refined catheter designs, contribute to their growing adoption. These improvements offer enhanced clinical efficacy and ease of use in diverse healthcare settings, from acute care hospitals to expanding homecare environments

- The collective influence of these factors the growing patient pool, the expansion of medical interventions, the focus on safety, and ongoing innovation is steadily accelerating the uptake of endotracheal and tracheal suction solutions, thereby significantly boosting the industry's growth in North America

Restraint/Challenge

“Risk of Ventilator-Associated Pneumonia (VAP) and Reimbursement Challenge”

- Concerns regarding the risk of Ventilator-Associated Pneumonia (VAP) and other healthcare-associated infections (HAIs) associated with prolonged intubation and suctioning procedures pose a significant challenge to the growth and adoption of certain suction methods. As VAP can lead to increased morbidity, mortality, and healthcare costs, minimizing its incidence is a critical priority

- For instance, the constant presence of an endotracheal tube can compromise the natural airway defenses, making patients susceptible to bacterial colonization and subsequent lung infections. High-profile reports on VAP rates in critical care settings often lead healthcare providers to seek more advanced, infection-reducing alternatives, or to be highly cautious with existing methods

- Addressing these VAP concerns through the adoption of closed suction systems, implementation of strict infection control protocols, and continuous staff training on sterile techniques is crucial. Companies are actively developing products, such as antimicrobial-coated tubes and suction catheters with improved designs, to mitigate these risks. In addition, the complex and often stringent reimbursement policies for advanced medical devices, including specialized suction systems, can act as a financial barrier to widespread adoption for healthcare facilities

- While innovations such as closed suction systems offer clear benefits in infection control, the perceived higher upfront cost compared to traditional open systems, coupled with the complexities of navigating insurance and government reimbursement, can hinder their rapid and universal integration, particularly for budget-constrained facilities

- Overcoming these challenges through continuous product innovation focused on infection reduction, robust clinical evidence demonstrating cost-effectiveness, and efforts to streamline reimbursement processes will be vital for sustained market growth and broader adoption of advanced endotracheal and tracheal suction solutions

North America Endotracheal and Tracheal Suction Market Scope

The market is segmented on the basis of market, type, suction type, and end user.

- By Market

On the basis of market, the North America endotracheal and tracheal suction market is segmented into endotracheal suction and tracheal suction., Endotracheal suction dominated the market in 2024, driven by the specific airway management requirements of the patient population. Endotracheal suction, being an indispensable procedure for patients requiring mechanical ventilation and prolonged intubation in acute and critical care environments, unequivocally represents a substantial portion of the total market demand.

Tracheal suction is expected to be the fasting growing segment from 2025 to 2032, primarily employed for individuals who have undergone tracheostomy, often in contexts ranging from long-term care facilities to homecare settings. Both segments are consistently propelled by the rising incidence of various respiratory diseases and the increasing number of surgical interventions that necessitate effective and routine airway clearance.

- By Type

On the basis of type, the North America endotracheal and tracheal suction market is segmented into open suction system and closed suction system. The closed suction system segment is anticipated to dominate the market, projected to hold a substantial market share of 73.5% in 2025, driven by the paramount and growing emphasis on stringent infection control measures and enhanced patient safety across healthcare institutions. Closed systems dramatically reduce the risk of healthcare-associated infections (HAIs), notably Ventilator-Associated Pneumonia (VAP), by effectively maintaining a completely closed ventilation circuit. This critical advantage, coupled with minimized exposure for healthcare professionals, firmly establishes them as the preferred technology in demanding critical care environments.

The open suction system segment, while historically more common and often associated with lower initial costs, is experiencing a gradual decline in its market share due to evolving regulatory standards and the concerted industry-wide push for superior infection prevention protocols.

- By Suction Type

On the basis of suction type, the North America endotracheal and tracheal suction market is segmented into shallow suctioning and deep suctioning. Shallow suctioning dominated the market in 2024, as it is frequently favored for routine airway maintenance procedures given its generally lower association with complications.

Deep suctioning remains fastest growing segment as it is absolutely essential for the effective removal of highly tenacious secretions and for addressing specific acute clinical needs where more aggressive clearance is required. The ultimate choice between these two methodologies is driven by the clinician's expert judgment, patient tolerability, and the continuous evolution of clinical best practices that consistently prioritize both procedural efficacy and overall patient well-being

- By End User

On the basis of end user, the North America endotracheal and tracheal suction market is segmented into hospitals, homecare settings, outpatient clinic, physician’s office, medical transportation, long term assisted care, and rehabilitation center. The hospitals segment consistently accounts for the largest market revenue share, primarily driven by the exceptionally high volume of critical care admissions, surgical procedures requiring intubation, and the comprehensive management of a wide array of acute respiratory conditions that inherently take place within hospital settings.

The homecare settings segment, however, is anticipated to witness the fastest CAGR, fueled by the escalating prevalence of chronic respiratory diseases and a growing patient preference for receiving long-term, continuous care in the comfort and familiarity of a home environment. This burgeoning trend is further facilitated by ongoing advancements in portable suction devices and the expansion of comprehensive home healthcare services.

North America Endotracheal and Tracheal Suction Market Regional Analysis

- U.S. dominates the endotracheal and tracheal suction market, holding the largest revenue share within North America. The dominance is supported by a strong healthcare infrastructure, high healthcare expenditure, and the presence of numerous key industry players

- Consumers in the region highly value the advanced patient safety features, superior infection control capabilities (for instance, closed suction systems), and the overall efficacy offered by modern endotracheal and tracheal suction devices. There's a strong emphasis on utilizing cutting-edge medical technologies to improve patient outcomes

- This widespread adoption is further supported by high healthcare expenditures, a technologically inclined medical community, and a growing aging population more prone to respiratory illnesses and surgical needs, establishing advanced suction systems as essential solutions for both acute care and long-term respiratory management across the region

U.S. North America Endotracheal and Tracheal Suction Market Insight

The U.S. endotracheal and tracheal suction market consistently captures the largest revenue share within North America, holding a significant portion. This is overwhelmingly fueled by its highly advanced and comprehensive healthcare infrastructure, a robust prevalence of chronic respiratory diseases, and extensive investment in cutting-edge medical technologies. Healthcare providers in the U.S. increasingly prioritize advanced solutions that offer superior patient safety, effective infection control, and improved clinical outcomes, driving demand for sophisticated suction systems. The strong emphasis on continuous innovation in device design, combined with a high volume of surgical procedures and critical care admissions, further propels the market. Moreover, the U.S.'s substantial healthcare expenditure and a technologically forward-thinking medical community firmly establish it as the dominant force in the region.

Canada North America Endotracheal and Tracheal Suction Market Insight

The Canadian endotracheal and tracheal suction market is projected to expand at a noteworthy CAGR throughout the forecast period, primarily driven by its well-developed universal healthcare system and the rising prevalence of respiratory illnesses across its population. The country's strong commitment to patient safety and quality care fosters the adoption of advanced airway management devices. Canadian healthcare facilities are increasingly investing in sophisticated suction technologies to enhance efficiency and reduce the risk of healthcare-associated infections. Furthermore, the growing geriatric population and the increasing number of surgical procedures, particularly among the elderly, consistently contribute to the sustained demand for endotracheal and tracheal suction solutions in both acute and long-term care settings.

Mexico North America Endotracheal and Tracheal Suction Market Insight

The Mexican endotracheal and tracheal suction market is expected to expand at a considerable CAGR during the forecast period, fueled by ongoing improvements in its healthcare infrastructure, increasing access to medical services, and a growing awareness of modern treatment protocols. While facing challenges such as healthcare spending constraints and a need for more qualified personnel in some areas, the rising incidence of non-communicable diseases and an expanding patient base requiring respiratory support are driving demand. The market sees growth particularly in major urban centers where modern healthcare services are more developed, with a focus on improving patient outcomes through effective airway management. The integration of more advanced and safer suction solutions is becoming increasingly prevalent as the healthcare sector evolve

North America Endotracheal and Tracheal Suction Market Share

The North America endotracheal and tracheal suction industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- BD (U.S.)

- Teleflex Incorporated (U.S.)

- Ambu A/S (Denmark)

- ICU Medical, Inc. (U.S.)

- Medline Industries, LP (U.S.)

- ResMed Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- Vyaire Medical, Inc. (U.S.)

- Zoll Medical Corporation (U.S.)

- Drive DeVilbiss Healthcare (U.S.)

- Intersurgical Ltd. (U.K.)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Flexicare (Group) Limited (U.K.)

- Cook (U.S.)

- Armstrong Medical Inc. (U.K.)

- Amsino International, Inc. (U.S.)

- Boston Medical Products, Inc. (U.S.)

- SunMed LLC (U.S.)

- Pulmodyne, Inc. (U.S.)

Latest Developments in North America Endotracheal and Tracheal Suction Market

- In November 2023, Ambu announced a significant collaboration with Medtronic to integrate AI-powered software for intubation guidance with Ambu's leading video laryngoscope technology. This strategic alliance is designed to enhance the accuracy and efficiency of airway management treatments, specifically within the critical care and emergency medicine sectors in North America. The partnership leverages Medtronic's expertise in AI with Ambu's advanced visualization tools, aiming to improve patient safety during intubation procedures

- In August 2023, SourceMark Medical introduced the SuctionPlus Endotracheal Tube, a new addition to its Anesthesia and Airway Management product line. This innovative, latex- and DEHP-free tube features an evacuation lumen specifically designed to protect against aspiration and significantly reduce the risk of ventilator-associated pneumonia (VAP). It also incorporates a high-volume, low-pressure cylindrical cuff and a removable 15mm connector, highlighting SourceMark's commitment to enhancing patient safety and comfort in critical care settings

- In February 2023, Medtronic was noted for its novel design for its Shiley evac subglottic tracheostomy tube, which features a lateral suction port. Researchers were examining the efficacy of this new design in preclinical animal models, aiming to characterize its suction performance and potential for reducing tracheal wall injuries during mechanical ventilation. This ongoing research underscores Medtronic's continuous efforts to innovate and improve safety features in tracheostomy care to better manage secretions and prevent infections

- In January 2023, Inspira Technologies was granted a patent by the U.S. Patent and Trademark Office (USPTO) for its innovative dual-lumen cannula device. This cutting-edge respiratory support technology offers advanced solutions for respiratory management, providing a competitive edge in the market by potentially enhancing efficiency and patient outcomes. This patent signifies Inspira Technologies' commitment to developing novel approaches in respiratory care

- In October 2022, Drive DeVilbiss Healthcare introduced the Vacu-Aide 7325 Suction Machine, an updated version of its trusted Vacu-Aide® line, specifically designed to offer enhanced portability and quieter operation. This innovative device features an improved, longer-lasting lithium-ion battery and operates below 59dBA, significantly improving patient comfort and user convenience. This advancement underscores the company's dedication to refining existing solutions to meet evolving market demands for efficient and less disruptive patient care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.