North America Fatty Acids Market

Market Size in USD Billion

CAGR :

%

USD

4.75 Billion

USD

7.19 Billion

2024

2032

USD

4.75 Billion

USD

7.19 Billion

2024

2032

| 2025 –2032 | |

| USD 4.75 Billion | |

| USD 7.19 Billion | |

|

|

|

|

North America Fatty Acids Market Size

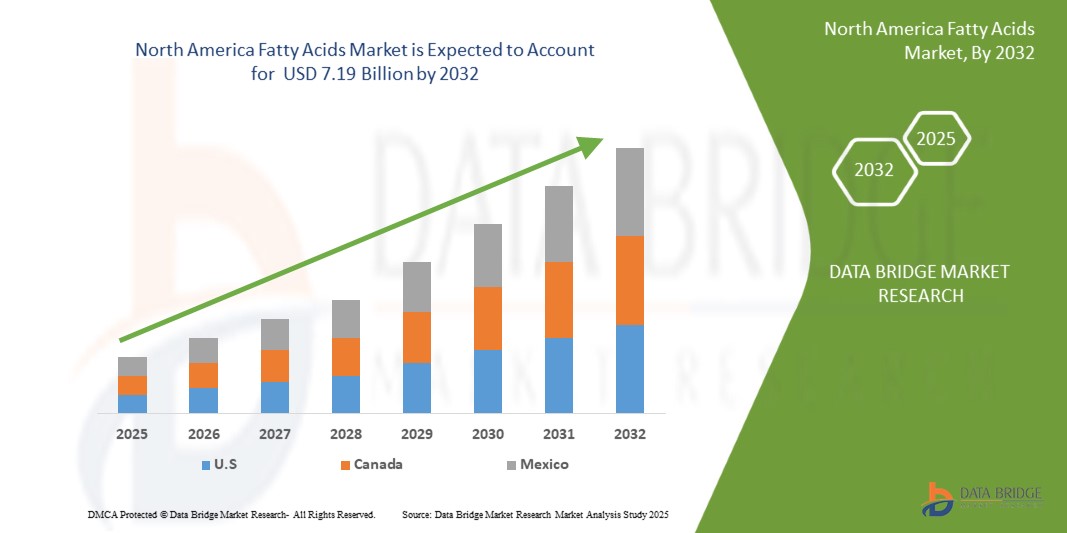

- The North America fatty acids market size was valued at USD 4.75 billion in 2024 and is expected to reach USD 7.19 billion by 2032, at a CAGR of 5.3% during the forecast period

- The market growth is largely fuelled by the rising demand for bio-based and sustainable chemicals across various end-use industries such as food and beverage, pharmaceuticals, personal care, and industrial applications

- Increasing health awareness and dietary changes promoting the use of omega-rich fatty acids in functional foods and supplements further contribute to market expansion

North America Fatty Acids Market Analysis

- The market is experiencing a growing shift toward plant-based sources such as palm oil, coconut oil, and soybean oil to meet the demand for non-animal-derived fatty acids

- Regulatory support for the use of renewable and biodegradable feedstocks in industrial production is also encouraging manufacturers to adopt eco-friendly fatty acid processing methods

- U.S. fatty acids market accounted for the largest revenue share of over 75% in North America in 2024, driven by the expanding demand for plant-based oils and health-conscious dietary practices

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America fatty acids market due to increasing health-consciousness, rising demand for plant-based nutrition, and a strong focus on natural and sustainable ingredient sourcing within the country’s food, pharmaceutical, and cosmetics sectors

- The saturated segment held the largest market revenue share in 2024, driven by its extensive use in food processing, bakery, and confectionery products. Saturated fatty acids offer superior shelf-life and texture enhancement properties, making them essential for packaged food formulations. The segment also benefits from strong demand in the cosmetics industry, particularly in soap and cream manufacturing

Report Scope and North America Fatty Acids Market Segmentation

|

Attributes |

North America Fatty Acids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Fatty Acids Market Trends

“Increasing Shift Toward Omega-3 Enriched Functional Products”

- Consumers are showing strong preference for omega-3 fortified foods, beverages, and supplements, due to growing awareness of their benefits for heart, brain, and joint health

- Plant-based omega-3 sources such as flaxseed oil, chia seeds, and algae oil are gaining popularity, especially among vegan and vegetarian consumers

- Manufacturers are reformulating everyday products—such as yogurts, smoothies, and snacks—to incorporate omega-3s without altering taste or shelf-life

- Rising cardiovascular concerns and a growing elderly population in North America are boosting the appeal of functional, omega-3 enriched products

- For instance, brands such as Silk and Vega have launched omega-3 fortified dairy alternatives and drinks to meet growing demand

North America Fatty Acids Market Dynamics

Driver

“Rising Demand From Personal Care And Cosmetics Industry”

- Fatty acids such as stearic acid, oleic acid, and lauric acid are increasingly used in personal care products for their emollient, surfactant, and cleansing properties

- Demand for natural, organic, and sustainable cosmetics is pushing manufacturers to replace synthetic chemicals with plant-derived fatty acids

- Growing awareness of skin hydration, anti-aging, and barrier protection is accelerating use of fatty acid-enriched lotions and creams

- Major beauty brands in North America are innovating bio-based product lines that cater to sensitive skin and sustainability-conscious buyers

- For instance, oleic acid sourced from olive oil is used in premium moisturizers for its deep hydration and anti-inflammatory benefits

Restraint/Challenge

“Price Volatility Of Raw Materials”

- The fatty acids market is heavily influenced by the fluctuating costs of raw materials such as palm oil, soybean oil, tallow, and coconut oil

- Supply chain disruptions, climate variability, and changing geopolitical conditions frequently impact feedstock pricing and availability

- Smaller manufacturers often face margin pressure as they struggle to absorb unpredictable input cost hikes in competitive markets

- High dependence on imported raw materials exposes the industry to global pricing risks and complicates inventory planning

- For instance, palm oil prices rose sharply in 2022 due to tight supply from Southeast Asia and increased global biofuel demand

North America Fatty Acids Market Scope

The market is segmented on the basis of product type, source, form, category, and application.

• By Product Type

On the basis of product type, the North America fatty acids market is segmented into saturated, monounsaturated, polyunsaturated, trans fat, and others. The saturated segment held the largest market revenue share in 2024, driven by its extensive use in food processing, bakery, and confectionery products. Saturated fatty acids offer superior shelf-life and texture enhancement properties, making them essential for packaged food formulations. The segment also benefits from strong demand in the cosmetics industry, particularly in soap and cream manufacturing.

The polyunsaturated segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing awareness of cardiovascular health and the expanding application of omega-3 and omega-6 fatty acids in functional foods and dietary supplements. This growth is supported by the rising popularity of plant and marine-based nutrition, especially in heart-healthy and brain-boosting product categories.

• By Source

On the basis of source, the market is segmented into plant-based, animal-based, and others. The plant-based segment dominated the market in 2024, driven by growing demand for clean-label, sustainable, and vegan ingredients in the food and cosmetics sectors. Oils derived from soy, palm, flaxseed, and algae are widely preferred for their favorable nutritional profiles and lower environmental footprint.

The animal-based segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the continued use of tallow, fish oil, and lard in various industrial applications including lubricants, pharmaceuticals, and pet food formulations.

• By Form

On the basis of form, the fatty acids market is segmented into oil, capsule, syrup, and powder. The oil segment held the largest revenue share in 2024, primarily due to its wide use in edible products, nutritional supplements, and industrial applications. Fatty acid oils are also commonly utilized in cosmetic and skincare products for their moisturizing and emollient properties.

The capsule segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising consumer preference for convenient dosage forms of omega fatty acids. The trend is particularly noticeable in the dietary supplements and pharmaceutical markets, where capsule formats offer high bioavailability and ease of consumption.

• By Category

On the basis of category, the market is segmented into natural and synthetic. The natural category led the market in 2024, driven by increasing consumer inclination toward plant-based and bio-derived ingredients across end-use sectors such as food, personal care, and nutrition.

The synthetic segment is expected to witness the fastest growth rate from 2025 to 2032, continues to serve niche applications in the industrial and specialty chemical sectors where precise formulation consistency is required, particularly in fuel additives and lubricant production.

• By Application

On the basis of application, the North America fatty acids market is segmented into oilfield chemicals, rubber and plastic lubricants, fuel additive, personal care, dietary supplements, pharmaceutical, food products, beverages, animal feed, and others. The food products segment accounted for the largest market revenue share in 2024 due to the high demand for fatty acid-rich ingredients in bakery, dairy, and processed food applications.

The dietary supplements segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increased consumer focus on heart, brain, and joint health. Meanwhile, the personal care and cosmetics industry is also witnessing robust growth as fatty acids find widespread use in moisturizing, cleansing, and conditioning products.

North America Fatty Acids Market Regional Analysis

- U.S. fatty acids market accounted for the largest revenue share of over 75% in North America in 2024, driven by the expanding demand for plant-based oils and health-conscious dietary practices

- Consumers are increasingly incorporating omega-rich and unsaturated fatty acids into daily nutrition through supplements and fortified foods

- The rise in clean-label trends and the shift toward natural ingredients in personal care and cosmetics have further accelerated market growth

- In addition, the U.S. food processing and pharmaceutical industries are actively leveraging fatty acids for their functional and therapeutic properties

- With strong innovation pipelines and consumer emphasis on preventive healthcare, the fatty acids market in the U.S. is poised for sustained growth during the forecast period

Canada Fatty Acids Market Insight

The Canada fatty acids market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the rising awareness of health and wellness among consumers. Demand for dietary supplements enriched with omega-3 and omega-6 fatty acids is increasing, supported by the country's aging population and growing prevalence of lifestyle-related disorders. In addition, Canada’s robust regulatory support for clean-label and natural ingredients is fostering the use of plant-based and bio-based fatty acids in food, beverages, and personal care sectors. The country also benefits from strong domestic oilseed production, particularly canola, which serves as a key raw material for fatty acid extraction. Together, these factors are expected to reinforce Canada’s role as a key contributor to the North America fatty acids market.

North America Fatty Acids Market Share

The North America Fatty Acids industry is primarily led by well-established companies, including:

- Vantage Specialty Chemicals (U.S.)

- Cargill, Incorporated (U.S.)

- KRATON CORPORATION (U.S.)

- Ashland (U.S.)

- Eastman Chemical Company (U.S.)

- Omega Protein Corporation (U.S.)

- 3M Company (U.S.)

- DuPont De Nemours, Inc. (U.S.)

- Stepan Company (U.S.)

- Lion Specialty Products (U.S.)

- ADM (Archer Daniels Midland Company) (U.S.)

Latest Developments in North America Fatty Acids Market

- In November 2022, Epax introduced Cetoleic 10, a long-chain monounsaturated fatty acid ingredient containing cetoleic acid (omega-11) and gondoic acid (omega-9), sourced from North Atlantic fish. With lower levels of DHA and EPA, this launch diversifies options in the fatty acids market, catering to specific dietary and nutritional requirements

- In August 2022, Seraphina Therapeutics introduced a study revealing a novel fatty acid, targeting C15:0 supplement development. This fatty acid plays a crucial role in the synthesis of PDC, the second-ever identified full-acting endocannabinoid. The discovery opens avenues for innovative formulations in the fatty acids market with potential health benefits

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Fatty Acids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Fatty Acids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Fatty Acids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.