North America Fetal Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.80 Billion

2025

2033

USD

1.08 Billion

USD

1.80 Billion

2025

2033

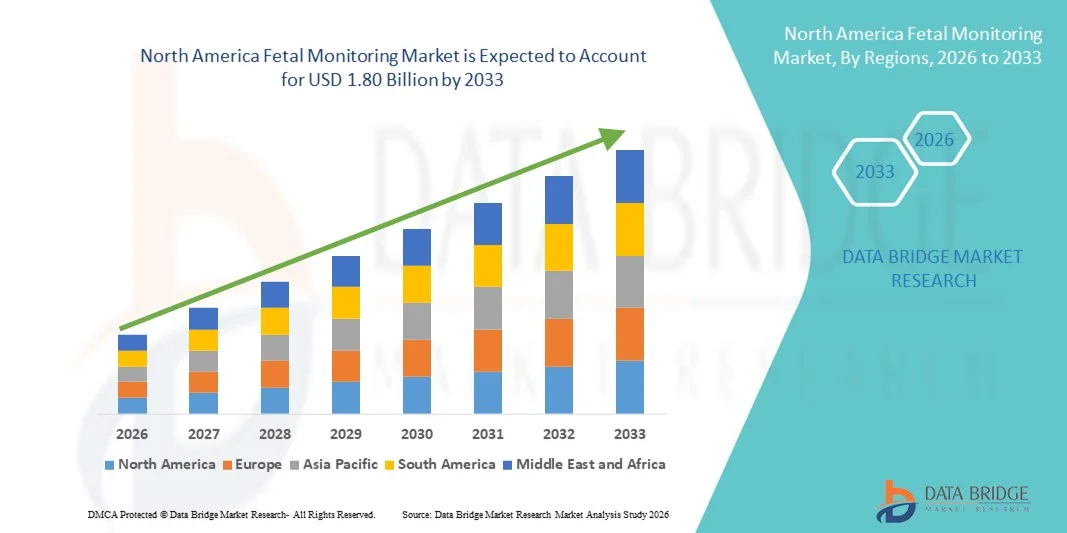

| 2026 –2033 | |

| USD 1.08 Billion | |

| USD 1.80 Billion | |

|

|

|

|

North America Fetal Monitoring Market Size

- The North America fetal monitoring market size was valued at USD 1.08 billion in 2025 and is expected to reach USD 1.80 billion by 2033, at a CAGR of 6.63% during the forecast period

- The market growth is largely fueled by significant technological advancements in monitoring solutions including non‑invasive and portable devices coupled with a well‑developed and digitally progressive healthcare infrastructure that supports high adoption across hospitals, clinics, and ambulatory settings in the U.S. and Canada

- Furthermore, rising awareness around maternal health, an increasing rate of high‑risk pregnancies, and supportive reimbursement and clinical care guidelines are driving demand for reliable, user‑friendly fetal monitoring systems, positioning North America as one of the leading regional markets globally

North America Fetal Monitoring Market Analysis

- Fetal monitoring, offering real-time electronic tracking of fetal heart rate and uterine activity, is increasingly vital in modern maternal and prenatal care across hospitals, clinics, and ambulatory settings due to its ability to enhance patient safety, enable early detection of complications, and support evidence-based clinical decision-making

- The escalating demand for fetal monitoring is primarily fueled by rising awareness of maternal health, increasing rates of high-risk pregnancies, and the growing preference for advanced, non-invasive monitoring technologies that improve both clinical outcomes and patient comfort

- The United States dominated the North America fetal monitoring market with the largest revenue share of 60.9% in 2025, characterized by well-established healthcare infrastructure, high adoption of digital health technologies, and a strong presence of leading medical device manufacturers

- Canada is expected to be the fastest-growing country during the forecast period due to increasing investments in hospital infrastructure, rising awareness of prenatal care, and adoption of technologically advanced monitoring solutions in both urban and semi-urban healthcare facilities

- Electronic Maternal/Fetal Monitor segment dominated the market with a share of 44.8% in 2025, driven by its widespread clinical adoption, real-time monitoring capabilities, and ease of integration with hospital information systems

Report Scope and North America Fetal Monitoring Market Segmentation

|

Attributes |

North America Fetal Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Fetal Monitoring Market Trends

Advancements in Wireless and AI-Enabled Monitoring

- A significant and accelerating trend in the North America fetal monitoring market is the adoption of wireless and AI-enabled monitoring systems, allowing continuous, non-invasive tracking of fetal heart rate and uterine activity with enhanced clinical insights

- For instance, GE Healthcare’s Corometrics wireless fetal monitors enable real-time remote monitoring and seamless integration with hospital EMR systems, while Philips Avalon CL fetal monitors offer AI-assisted pattern recognition for early detection of fetal distress

- AI integration in fetal monitoring enables predictive analytics, learning maternal and fetal patterns to provide alerts for potential complications, thereby assisting clinicians in timely interventions. Some advanced systems can detect subtle abnormalities in fetal heart rate trends and notify healthcare providers proactively

- Wireless fetal monitors and cloud-based platforms allow centralized management of multiple patients, enabling clinicians to access real-time data remotely and coordinate care efficiently across departments

- Integration with mobile apps and patient portals is becoming increasingly common, allowing expectant mothers to track their own fetal health metrics under clinician supervision, which enhances engagement and adherence to prenatal care plans

- This trend towards more intelligent, intuitive, and connected monitoring solutions is fundamentally reshaping expectations for prenatal care, with companies such as Sonicaid and Mindray developing systems that integrate AI analytics, wireless connectivity, and user-friendly dashboards

- The demand for AI-enabled, wireless fetal monitoring solutions is growing rapidly across hospitals, maternity clinics, and telehealth programs, as healthcare providers increasingly prioritize patient safety, efficiency, and improved clinical outcomes

North America Fetal Monitoring Market Dynamics

Driver

Rising Maternal Health Awareness and High-Risk Pregnancy Rates

- The increasing focus on maternal health and the rising prevalence of high-risk pregnancies are significant drivers for the growing adoption of fetal monitoring solutions in North America

- For instance, in 2024, Philips Healthcare introduced advanced fetal monitoring systems with AI-assisted analytics for high-risk pregnancies, supporting earlier interventions and improved neonatal outcomes

- As healthcare providers aim to reduce maternal and neonatal complications, fetal monitoring devices offering real-time insights, alerts, and data logging are becoming essential in clinical practice

- The expansion of telehealth and remote monitoring programs further drives demand, enabling continuous monitoring for patients outside hospital settings while maintaining clinical oversight

- The increasing adoption of digital health platforms, patient-centered care models, and technologically advanced monitoring systems is making fetal monitors integral to modern prenatal care, both in hospitals and specialty clinics

- Growing government initiatives and funding for maternal and child health programs in the U.S. and Canada are boosting procurement of advanced fetal monitoring systems in public hospitals and community clinics

- Rising consumer preference for safer childbirth experiences and proactive prenatal monitoring is encouraging hospitals and private clinics to upgrade to AI-powered, wireless fetal monitoring devices

Restraint/Challenge

High Costs and Regulatory Compliance Requirements

- The relatively high cost of advanced fetal monitoring systems, especially those with wireless connectivity and AI features, remains a challenge for adoption in smaller clinics or budget-constrained facilities

- Stringent regulatory requirements for medical devices, including FDA approvals and adherence to HIPAA for patient data security, create barriers to rapid product launch and deployment

- Clinicians may face challenges in integrating new AI-enabled systems into existing workflows and ensuring proper training for accurate data interpretation, which can slow adoption

- While costs are gradually decreasing and cloud-based solutions offer flexible pricing, the perceived premium of advanced fetal monitoring technologies can still limit uptake in certain healthcare settings

- Limited interoperability with legacy hospital systems can hinder adoption, as some fetal monitoring devices may not seamlessly integrate with existing electronic medical records or hospital IT infrastructure

- Power supply and connectivity reliability issues in remote or under-resourced healthcare facilities can restrict the deployment of wireless and AI-enabled fetal monitoring solutions, affecting continuous patient monitoring

- Overcoming these challenges through cost-effective solutions, robust regulatory compliance, and clinician education on system use will be vital for sustained market growth in North America

North America Fetal Monitoring Market Scope

The market is segmented on the basis of product type, portability, methods, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America fetal monitoring market is segmented into instruments and consumables, ultrasound, electronic maternal/fetal monitors, fetal electrodes, fetal Doppler, telemetry solutions, accessories and consumables, and software. The Electronic Maternal/Fetal Monitor segment dominated the market in 2025, holding the largest revenue share of 44.8%. This is due to its ability to provide real-time, high-resolution monitoring of fetal heart rate and uterine activity, which is critical in detecting fetal distress and guiding clinical interventions. Hospitals and maternity centers prefer these systems for their reliability and integration with EMR systems, allowing centralized patient monitoring. The systems are also equipped with advanced alarms and logging features, making them indispensable in high-volume delivery wards. Established adoption in U.S. hospitals and specialized clinics has reinforced this segment’s dominance. Overall, electronic maternal/fetal monitors are considered the gold standard for inpatient fetal care.

The Telemetry Solutions segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for wireless and remote monitoring solutions. These systems allow expectant mothers greater mobility during labor while clinicians continuously receive real-time data. Telemetry solutions are also integrated with cloud platforms and mobile apps, supporting telehealth and at-home monitoring programs. Their convenience and ability to reduce hospital congestion further fuel adoption. Hospitals and maternity units are increasingly implementing telemetry solutions for both low- and high-risk pregnancies. The segment is set to grow as healthcare providers focus on improving patient comfort without compromising clinical oversight.

- By Portability

On the basis of portability, the market is segmented into portable and non-portable fetal monitoring systems. The Non-Portable segment dominated the market in 2025 due to its extensive adoption in hospitals and maternity wards. Non-portable monitors provide superior signal quality, large display panels, and multi-parameter tracking capabilities, which are essential for accurate fetal assessment during labor and high-risk pregnancies. Hospitals favor non-portable systems for continuous in-hospital monitoring where high precision is required. Integration with EMR systems and advanced analytics makes these systems the backbone of inpatient fetal care. Their reliability and robustness ensure clinical confidence in critical situations. Overall, non-portable monitors remain the preferred choice for structured hospital environments.

The Portable segment is anticipated to witness the fastest growth from 2026 to 2033, driven by the rising trend of at-home monitoring and telehealth-based prenatal care. Portable monitors enable expectant mothers to track fetal health from home under clinician supervision, reducing hospital visits and enhancing comfort. These devices are lightweight, easy to operate, and increasingly equipped with wireless connectivity for real-time data sharing. Growing awareness of maternal health and high-risk pregnancy management supports adoption. Telehealth integration allows physicians to remotely review fetal patterns and intervene if necessary. The convenience and flexibility offered by portable monitors are key drivers for this segment’s growth.

- By Method

On the basis of method, the market is segmented into non-invasive and invasive fetal monitoring techniques. The Non-Invasive segment dominated the market in 2025 due to its safety, ease of use, and wide adoption across hospitals, clinics, and homecare settings. Non-invasive devices, such as external Dopplers and electronic maternal/fetal monitors, allow continuous monitoring without posing risks to the mother or fetus. Hospitals prefer non-invasive methods for both routine and high-risk cases because of their reliability and lower clinical complexity. These monitors can also integrate with EMR systems for centralized data management. Non-invasive monitoring has become standard practice for antepartum and intrapartum care in most North American healthcare facilities. Overall, the convenience, safety, and clinical effectiveness reinforce this segment’s dominance.

The Invasive segment is expected to witness the fastest growth during the forecast period. Invasive techniques, such as fetal scalp electrodes and intrauterine pressure catheters, are increasingly used in high-risk pregnancies and complicated labor where precise measurements are critical. Hospitals and specialized maternity units adopt these methods for accurate fetal heart rate tracking and uterine activity monitoring. Clinical studies support their efficacy in detecting fetal distress more reliably than non-invasive methods in certain scenarios. The growing awareness of invasive monitoring benefits and expanding use in tertiary hospitals are key growth drivers. Integration with telemetry and AI analytics further enhances the adoption potential of invasive solutions.

- By Application

On the basis of application, the market is segmented into intrapartum fetal monitoring and antepartum fetal monitoring. The Intrapartum Fetal Monitoring segment dominated the market in 2025 due to its essential role during labor and delivery. Hospitals rely heavily on intrapartum monitoring to detect fetal distress in real time and to guide timely interventions, directly impacting neonatal outcomes. Adoption of electronic and telemetry-based monitors has enhanced the accuracy and speed of detection. Intrapartum monitoring is a standard requirement in high-volume delivery wards across the U.S. and Canada. Integration with hospital EMRs enables seamless data tracking and post-delivery review. Continuous improvements in AI and wireless monitoring further strengthen this segment’s leading position.

The Antepartum Fetal Monitoring segment is expected to witness the fastest growth from 2026 to 2033. Antepartum monitoring focuses on fetal well-being during pregnancy, especially in high-risk cases, enabling early detection of complications and proactive management. Growing awareness of maternal and fetal health, coupled with telehealth expansion, is driving demand for remote antepartum monitoring solutions. Clinicians can monitor fetal patterns continuously and intervene early when anomalies are detected. Portable and AI-enabled antepartum devices provide convenience and real-time data analytics for both patients and providers. Rising government initiatives for maternal health also support segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals, gynecological/obstetrics clinics, homecare, and others. The Hospitals segment dominated the market in 2025, capturing the largest revenue share due to high patient volumes, specialized maternity wards, and integration with hospital EMRs. Hospitals adopt advanced fetal monitors, including telemetry and AI-enabled systems, to efficiently manage routine and high-risk pregnancies. Non-portable and invasive systems are predominantly used in inpatient care. Hospitals also leverage monitoring data for clinical research and quality control, supporting improved neonatal outcomes. The robust healthcare infrastructure in the U.S. and Canada strengthens hospitals’ role as the primary end user. Continuous upgrades and procurement through direct tenders further reinforce this dominance.

The Homecare segment is expected to witness the fastest growth during the forecast period. Growth is driven by portable, wireless fetal monitors and telehealth programs enabling monitoring at home, reducing hospital visits and providing convenience for expectant mothers. Homecare devices integrate with mobile apps, allowing clinicians to track fetal health remotely. Rising maternal awareness and preference for at-home care, especially for low- to moderate-risk pregnancies, fuel adoption. Manufacturers are launching user-friendly monitors for home use, supported by online retail channels. The shift toward patient-centered, remote prenatal care models is accelerating this segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender and retail. The Direct Tender segment dominated the market in 2025 due to hospitals and large maternity centers procuring fetal monitoring systems in bulk. Direct procurement allows customization, service agreements, and compliance with regulatory standards. Hospitals benefit from negotiated pricing, installation support, and long-term maintenance contracts. This segment is preferred for high-end and complex systems, including telemetry and AI-enabled devices. Integration with hospital IT infrastructure ensures seamless workflow. Direct tenders remain the primary procurement route for institutional buyers, driving dominance.

The Retail segment is expected to witness the fastest growth from 2026 to 2033. Growth is fueled by portable and home-use fetal monitors becoming widely available via online platforms and specialty stores. Consumers increasingly prefer convenient at-home monitoring solutions for low- to moderate-risk pregnancies. Retail distribution supports the adoption of wireless, AI-enabled, and user-friendly monitors. Rising maternal awareness and the growth of telehealth services further enhance retail sales. The convenience, accessibility, and lower barrier to entry make retail the fastest-growing channel.

North America Fetal Monitoring Market Regional Analysis

- The United States dominated the North America fetal monitoring market with the largest revenue share of 60.9% in 2025, characterized by well-established healthcare infrastructure, high adoption of digital health technologies, and a strong presence of leading medical device manufacturers

- Healthcare providers in the region prioritize accurate, real-time fetal monitoring to ensure maternal and neonatal safety, resulting in widespread adoption of electronic maternal/fetal monitors, telemetry solutions, and AI-enabled monitoring systems in hospitals and specialty clinics

- This dominance is further supported by high healthcare spending, strong insurance and reimbursement coverage, and growing awareness of maternal and fetal health. Hospitals and maternity centers increasingly prefer technologically advanced, integrated monitoring systems to enhance clinical efficiency, enable remote monitoring, and reduce risks during high-risk pregnancies

The U.S. Fetal Monitoring Market Insight

The U.S. fetal monitoring market captured the largest revenue share of 60.9% in 2025 within North America, driven by the presence of advanced healthcare infrastructure, high hospital birth rates, and proactive maternal health initiatives. Hospitals and maternity centers are increasingly adopting electronic maternal/fetal monitors, telemetry solutions, and AI-enabled monitoring systems to ensure maternal and fetal safety. The rising prevalence of high-risk pregnancies and demand for continuous monitoring has further fueled market growth. Integration with electronic medical records (EMRs) and telehealth platforms allows clinicians to track fetal health remotely, enhancing patient care. In addition, strong insurance coverage and reimbursement policies in the U.S. encourage the adoption of technologically advanced fetal monitoring devices. The focus on improving neonatal outcomes and minimizing complications has solidified the U.S. as the dominant market within North America.

Canada Fetal Monitoring Market Insight

The Canadian fetal monitoring market is experiencing steady growth, driven by increasing investments in hospital infrastructure, government initiatives supporting maternal health, and rising awareness of prenatal care. Hospitals and specialty clinics are upgrading to advanced monitoring solutions, including wireless and AI-assisted devices, to improve patient outcomes. Telehealth adoption and at-home monitoring programs are also contributing to market expansion, particularly for low- and moderate-risk pregnancies. Integration of fetal monitoring systems with hospital IT infrastructure ensures streamlined data management and clinical decision-making. The growth is further supported by urbanization, technological awareness among healthcare providers, and a patient population increasingly seeking safer childbirth experiences. Overall, Canada is emerging as a key growth contributor within North America.

Mexico Fetal Monitoring Market Insight

The fetal monitoring market in Mexico is witnessing gradual adoption due to increasing awareness of maternal and fetal health, improved healthcare access, and rising government initiatives promoting maternal care. Hospitals in urban centers are increasingly implementing electronic and telemetry-based fetal monitoring systems to enhance labor and delivery outcomes. Telehealth and remote monitoring programs are slowly gaining traction, allowing continuous fetal health tracking in semi-urban and rural areas. Demand for affordable and portable monitoring solutions is growing, addressing both hospital and homecare needs. The market is further supported by rising healthcare spending and initiatives aimed at reducing neonatal and maternal mortality rates. Mexico’s market growth is expected to accelerate as awareness and infrastructure continue to improve.

North America Fetal Monitoring Market Share

The North America Fetal Monitoring industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic (Ireland)

- BD (U.S.)

- Siemens Healthineers AG (Germany)

- Natus Medical Incorporated (U.S.)

- CooperSurgical, Inc. (U.S.)

- MedGyn Products (U.S.)

- Avante Health Solutions (U.S.)

- Spacelabs Healthcare (U.S.)

- Analogic Corporation (U.S.)

- Masimo Corporation (U.S.)

- Cetro America (U.S.)

- Clinical Innovations LLC (U.S.)

- PeriGen Inc. (U.S.)

- FUJIFILM Sonosite, Inc. (Japan)

- Edan Instruments, Inc. (China)

- Mindray Medical International Limited (China)

- Cardinal Health, Inc. (U.S.)

- Bionet Co., Ltd. (South Korea)

What are the Recent Developments in North America Fetal Monitoring Market?

- In February 2025, PeriGen received FDA clearance for Patterns 3.0, expanding its AI‑powered fetal heart rate pattern recognition technology to begin use as early as 32 weeks of gestation, enhancing clinical insights for high‑risk pregnancies

- In September 2024, Bloomlife Inc. secured USD 12.2 million in a Series A funding round to advance its remote maternal care platform and expand its maternal–fetal monitoring capabilities for high‑risk pregnancies, marking a significant investment milestone for prenatal remote monitoring solutions

- In June 2024, Clarius Mobile Health announced FDA clearance for its OB AI feature on handheld wireless ultrasound devices, enabling improved obstetric monitoring with AI‑assisted imaging capabilities that support fetal assessment at point‑of‑care

- In February 2024, GE HealthCare announced that its Novii+ Wireless Maternal and Fetal Monitoring Solution received FDA 510(k) clearance in the United States, enabling wireless, patch‑based antepartum and intrapartum monitoring of fetal heart rate, maternal heart rate, and uterine activity with greater mobility for patients

- In January 2024, Bloomlife announced FDA clearance for its Bloomlife MFM‑Pro wearable maternal and fetal monitoring device, designed to provide non‑invasive monitoring of both maternal and fetal heart rate for use in clinical and remote settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.