North America Forklift Truck Market

Market Size in USD Million

CAGR :

%

USD

14.06 Million

USD

22.59 Million

2024

2032

USD

14.06 Million

USD

22.59 Million

2024

2032

| 2025 –2032 | |

| USD 14.06 Million | |

| USD 22.59 Million | |

|

|

|

|

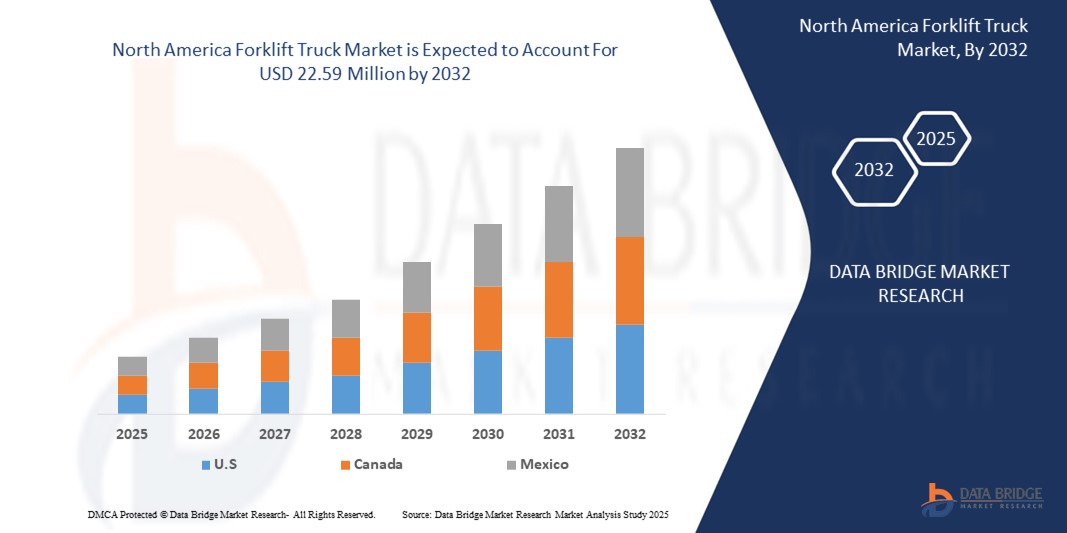

What is the North America Forklift Truck Market Size and Growth Rate?

- The North America forklift truck market size was valued at USD 14.06 million in 2024 and is expected to reach USD 22.59 million by 2032, at a CAGR of 6.10% during the forecast period

- In the market, technological advancements have led to safer and more efficient operations. Benefits abound, including increased productivity, reduced labor costs, and enhanced workplace safety

- These advancements encompass innovations such as electric forklifts, automated features, and IoT integration, offering businesses streamlined operations and improved bottom lines

What are the Major Takeaways of Forklift Truck Market?

- The surge in demand for connected forklift trucks is driven by the integration of AI robotics and IoT technology, revolutionizing material handling operations. Enhanced communication enables real-time responsiveness and end-to-end efficiency

- For instance, sensors and telematics allow for predictive maintenance, optimizing fleet management, and reducing downtime. This fosters a symbiotic relationship between forklift operators and management, propelling the industry towards increased automation and productivity

- U.S. dominated the North America forklift truck market in 2024, accounting for the largest revenue share of 38.6%, supported by the presence of a robust industrial base, expanding e-commerce logistics, and high automation adoption in warehousing

- Canada is projected to grow at the fastest CAGR in the North America region through 2032, led by rapid warehouse expansion and automation in retail supply chains. Major cities such as Toronto, Montreal, and Vancouver are witnessing heightened demand for electric and narrow-aisle forklifts to support high-density storage and fulfillment operations

- The Counterbalance segment dominated the market in 2024 with a market share of 61.4%, owing to its versatility in indoor and outdoor applications and its compatibility with various lifting attachments

Report Scope and Forklift Truck Market Segmentation

|

Attributes |

Forklift Truck Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Forklift Truck Market?

“Adoption of Electric and Autonomous Forklift Trucks”

- A key trend shaping the global forklift truck market is the rising adoption of electric and autonomous forklift trucks, driven by sustainability goals and labor shortage issues in warehouses and manufacturing plants

- Electric forklifts offer zero emissions, lower maintenance, and quieter operations, aligning with green warehouse initiatives and corporate ESG commitments

- For instance, in April 2024, Toyota Material Handling launched a new line of lithium-ion electric forklifts, targeting increased energy efficiency and productivity

- The integration of autonomous navigation systems is further enhancing operational efficiency by reducing dependency on manual labor and minimizing human error

- Companies such as KION Group and Jungheinrich AG are leading innovation in automated forklift fleets using AI, sensors, and telematics to support Industry 4.0 warehousing needs

- As a result, electrification and automation are becoming major differentiators in procurement decisions, reshaping the forklift industry’s competitive landscape

What are the Key Drivers of Forklift Truck Market?

- The surge in e-commerce and logistics operations, especially post-pandemic, is driving demand for efficient material handling solutions in warehouses and fulfillment centers

- For instance, in March 2024, Amazon announced the expansion of its smart fulfillment network across North America, increasing its fleet of electric forklifts for sustainable operations

- Growth in the construction, automotive, and food & beverage industries is fueling demand for versatile forklift trucks across diverse terrain and load capacities

- Rising investments in infrastructure development and smart manufacturing are also supporting forklift deployment across industrial segments in developing economies

- In addition, government policies supporting emission reduction and the rising popularity of warehouse automation are propelling the transition to electric and semi-autonomous forklift

Which Factor is challenging the Growth of the Forklift Truck Market?

- A significant challenge to the forklift truck market is the high upfront cost associated with electric and autonomous forklifts, deterring adoption among small and mid-sized businesses

- For instance, lithium-ion battery forklifts and AGV-integrated systems can cost 30–50% more than traditional IC engine models, impacting cost-sensitive operations

- Moreover, limited charging infrastructure and inconsistent standards for battery technology pose hurdles, particularly in developing regions with weak power grids

- The complexity of retrofitting existing facilities with autonomous navigation systems and workforce resistance to automation also affect adoption rates

- Overcoming these challenges requires financial incentives, training programs, and stronger supplier collaboration to enable widespread integration of smart and sustainable forklift solutions

How is the Forklift Truck Market Segmented?

The market is segmented on the basis of type, material, usage, style, capacity, distribution channel, application, and end-user.

• By Product Type

On the basis of product type, the forklift truck market is segmented into Counterbalance and Warehouse. The Counterbalance segment dominated the market in 2024 with a market share of 61.4%, owing to its versatility in indoor and outdoor applications and its compatibility with various lifting attachments.

The Warehouse segment is projected to register the fastest CAGR from 2025 to 2032, driven by growing automation in storage facilities and increased demand for compact and maneuverable trucks in space-constrained environments.

• By Power Source

On the basis of power source, the market is categorized into Internal Combustion Forklift Truck and Electric Forklift. The Internal Combustion Forklift Truck segment held the largest market share in 2024 at 54.7%, primarily due to its higher load-bearing capacity and extended operation time in heavy-duty applications.

The Electric Forklift segment is expected to grow at the fastest rate during the forecast period, supported by rising environmental regulations and increasing investments in clean, emission-free logistics.

• By Class

On the basis of class, the forklift truck market is segmented into Class I, Class II, Class III, Class IV, Class V, Class VI, and Class VII. The Class V segment dominated in 2024 with a market share of 29.3%, due to its widespread use in outdoor material handling and versatility across various terrains.

The Class I segment is anticipated to register the highest growth rate, driven by the transition toward electric-powered trucks in indoor warehousing and e-commerce operations.

• By Fuel Type

On the basis of fuel type, the market is segmented into Electric, LPG/CNG, Diesel, and Gasoline. The Electric segment accounted for the largest share in 2024 at 37.9%, attributed to its cost efficiency, low maintenance, and alignment with zero-emission policies.

The LPG/CNG segment is projected to grow significantly due to its balance between power output and lower emissions compared to diesel.

• By Tonnage

On the basis of tonnage, the market is segmented into Below 5 Ton, 5 to 10 Ton, 11 to 36 Ton, and 36 Ton and above. The Below 5 Ton segment led the market in 2024 with a share of 42.5%, as these forklifts are widely used in warehouses, distribution centers, and light industrial operations.

The 11 to 36 Ton segment is forecasted to grow rapidly, supported by increased demand in heavy industries and construction projects.

• By Industry

On the basis of industry, the forklift truck market is segmented into Construction, Freight and Logistics, Food Industry, Retail, Chemical, Paper and Wood, and Others. The Freight and Logistics segment dominated the market in 2024 with a market share of 31.6%, driven by the rising need for fast and efficient material handling in global supply chains.

The Food Industry segment is expected to exhibit the highest CAGR, owing to increasing demand for hygienic and temperature-sensitive product handling in food-grade storage and distribution centers.

Which Region Holds the Largest Share of the Forklift Truck Market?

- U.S. dominated the North America forklift truck market in 2024, accounting for the largest revenue share of 38.6%, supported by the presence of a robust industrial base, expanding e-commerce logistics, and high automation adoption in warehousing

- Demand is being driven by the need for faster and safer material handling in sectors such as automotive, retail, and third-party logistics (3PL)

- Technological innovation, labor shortages, and sustainability initiatives are pushing companies toward electric and autonomous forklift adoption across large fleets

Canada Forklift Truck Market Insight

Canada is projected to grow at the fastest CAGR in the North America forklift truck market through 2032, fueled by rapid warehouse expansion and automation in retail supply chains. Major cities such as Toronto, Montreal, and Vancouver are witnessing heightened demand for electric and narrow-aisle forklifts to support high-density storage and fulfillment operations. In addition, government programs promoting green energy use in industrial vehicles are accelerating the shift toward electric-powered forklift fleets.

Mexico Forklift Truck Market Insight

The Mexico forklift truck market is growing steadily, supported by industrial development zones, cross-border trade expansion, and rising infrastructure investments. Logistics hubs such as Monterrey, Guadalajara, and Mexico City are seeing increased adoption of forklift trucks in food, automotive, and electronics manufacturing. Government incentives for industrial modernization and training programs for forklift operators are also contributing to market penetration across SMEs and export-driven facilities.

Which are the Top Companies in Forklift Truck Market?

The forklift truck industry is primarily led by well-established companies, including:

- Hyster-Yale Materials Handling, Inc. (U.S.)

- Jungheinrich AG (Germany)

- KION GROUP AG (Germany)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- Komatsu Ltd. (Japan)

- MITSUBISHI LOGISNEXT CO., LTD. (Japan)

- Crown Equipment Corporation (U.S.)

- Hangcha Forklift (China)

- EP Equipment (China)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

What are the Recent Developments in North America Forklift Truck Market?

- In September 2023, Toyota Material Handling unveiled a new series of electric pneumatic forklifts in 48V and 80V configurations, offering six different lifting capacities ranging from 3,000 to 7,000 pounds. These models are engineered for optimal performance in varying weather conditions and incorporate Toyota’s System of Active Stability (SAS) and Operator Presence Sensing System (OPSS) to enhance operator safety and usability. This launch strengthens Toyota’s position in the high-performance electric forklift segment

- In April 2023, Crown Equipment opened a new sales and service facility in Stow, Ohio, aiming to serve regional clients with a complete range of material handling and warehousing solutions. The location offers access to Crown’s electric and internal combustion forklifts, rental and Encore refurbished units, fleet management systems such as InfoLink, and warehouse design services. This strategic expansion enhances Crown’s regional footprint and customer engagement capabilities

- In December 2022, Clark Material Handling Company introduced the SEC20-35 four-wheel electric forklift, expanding its S-SERIES lineup with load capacities from 4,000 to 7,000 pounds. The forklift features operator-friendly elements such as programmable performance modes, a turtle mode, an integrated Dampening Block Stability system, and the CLARK Performance Enhancement Package. This addition underscores Clark’s focus on safety, operator comfort, and customization

- In August 2022, Hyster-Yale Group, Inc. launched a lithium-ion-powered forklift truck tailored for the trucking industry, offering a lifting capacity of 4,000 pounds. The model, J40XNL, is optimized for loading and unloading operations from trailers, while providing improved acceleration, lower energy consumption, and enhanced operator comfort. This development supports the company’s push toward energy-efficient and ergonomic forklift solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.