North America Heart Valve Repair And Replacement Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

3.46 Billion

2025

2033

USD

1.57 Billion

USD

3.46 Billion

2025

2033

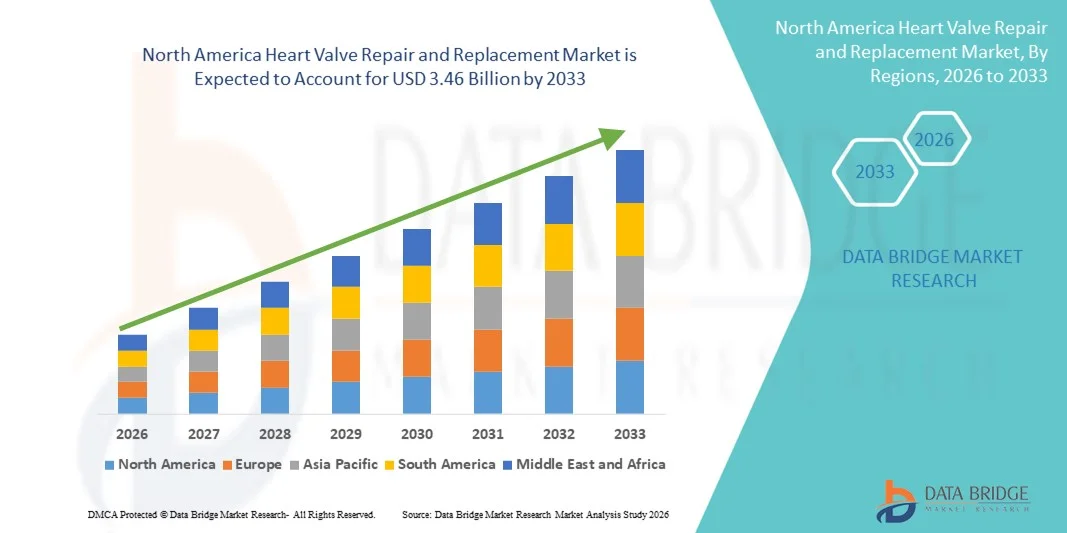

| 2026 –2033 | |

| USD 1.57 Billion | |

| USD 3.46 Billion | |

|

|

|

|

North America Heart Valve Repair and Replacement Market Size

- The North America heart valve repair and replacement market size was valued at USD 1.57 billion in 2025 and is expected to reach USD 3.46 billion by 2033, at a CAGR of 10.4% during the forecast period

- The market growth is largely fueled by the increasing prevalence of valvular heart diseases, an aging population, and rapid adoption of minimally invasive procedures such as TAVR/TMVR and advanced prosthetic valve technologies, which are becoming standard alternatives to open‑heart surgery in both clinical practice and patient demand

- Furthermore, North America’s advanced healthcare infrastructure, well‑established reimbursement frameworks, and high procedural volumes especially in the United States are driving clinical adoption and investment in novel repair and replacement solutions, resulting in greater integration of innovative access, imaging, and device technologies across cardiac care settings.

North America Heart Valve Repair and Replacement Market Analysis

- Heart valve repair and replacement procedures, including surgical and transcatheter approaches, are increasingly vital components of cardiovascular care in both hospital and specialized cardiac center settings due to their ability to effectively treat valvular heart diseases, improve patient outcomes, and reduce long‑term morbidity and mortality

- The escalating demand for these procedures is primarily fueled by the growing prevalence of valvular stenosis, valvular insufficiency, and mitral valve prolapse, an aging population, and advancements in minimally invasive technologies such as TAVI/TAVR valves, which offer reduced recovery times and lower procedural risks compared to traditional open-heart surgery

- The U.S. dominated the heart valve repair and replacement market with the largest revenue share of 78.3% in 2025, characterized by well-established healthcare infrastructure, high procedural volumes, advanced reimbursement frameworks, and a strong presence of key device manufacturers

- Canada is the fastest-growing country in the North America market, driven by rising adoption of minimally invasive procedures, expanding hospital capacities, increasing awareness of heart valve interventions, and supportive public healthcare initiatives that facilitate access to advanced cardiovascular care

- The TAVI/TAVR valves segment dominated the market with a share of 45% in 2025, driven by rapid clinical adoption, proven outcomes in high-risk patients, and expanding use in intermediate and low-risk populations

Report Scope and North America Heart Valve Repair and Replacement Market Segmentation

|

Attributes |

North America Heart Valve Repair and Replacement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Heart Valve Repair and Replacement Market Trends

Minimally Invasive and Image-Guided Procedures

- A significant and accelerating trend in the North America heart valve repair and replacement market is the growing adoption of minimally invasive and image-guided procedures such as TAVI/TAVR and robotic-assisted surgeries, which are enhancing procedural precision and patient recovery

- For instance, TAVR procedures are increasingly performed under real-time imaging guidance, allowing cardiologists to replace aortic valves with minimal incisions, reducing hospital stays and post-operative complications

- Integration of advanced imaging technologies and catheter-based interventions enables clinicians to perform more accurate valve sizing and placement, improve procedural outcomes, and reduce risks associated with traditional open-heart surgery

- The seamless incorporation of imaging and procedural guidance into cardiac care workflows facilitates real-time monitoring and assessment of valve function, improving overall patient safety and success rates

- This trend towards minimally invasive, image-guided interventions is fundamentally reshaping patient expectations and hospital practices, driving medical device manufacturers to innovate with smarter, more precise valve systems

- The adoption of advanced valve technologies and robotic-assisted systems is growing rapidly across both adult and geriatric populations, as hospitals increasingly prioritize faster recovery, lower complication rates, and reduced procedural trauma

- Emerging integration of AI and predictive analytics in heart valve procedures allows clinicians to anticipate complications and optimize patient-specific treatment plans, improving procedural success rates

North America Heart Valve Repair and Replacement Market Dynamics

Driver

Rising Prevalence of Valvular Heart Diseases and Aging Population

- The increasing incidence of valvular stenosis, valvular insufficiency, and mitral valve prolapse, combined with an aging population, is a significant driver for the heightened demand for heart valve repair and replacement procedures

- For instance, in 2025, Edwards Lifesciences reported increased adoption of TAVR valves among elderly patients, reflecting growing procedural volumes in hospitals across the U.S

- As patient awareness of minimally invasive options rises, hospitals are offering advanced valve repair and replacement solutions, providing alternatives to open-heart surgery with improved recovery profiles

- Furthermore, the expansion of healthcare infrastructure, reimbursement support, and specialized cardiac centers are making valve interventions more accessible, increasing procedural uptake

- The rising preference for procedures with lower procedural risk, shorter hospital stays, and better long-term outcomes is propelling the adoption of TAVI/TAVR valves, surgical valve replacements, and repair techniques across North America

- Growing investments by medical device companies in research and development for next-generation valve systems are driving innovation, expanding product portfolios, and improving procedural efficiency

- For instance, Medtronic and Abbott have launched improved TAVR valve designs with enhanced durability and ease of implantation, encouraging wider adoption among high-risk and intermediate-risk patient groups

Restraint/Challenge

High Procedure Costs and Regulatory Compliance Hurdles

- The relatively high cost of heart valve repair and replacement procedures, combined with complex regulatory requirements, poses a significant challenge to broader market growth

- For instance, TAVR and robotic-assisted procedures often require specialized equipment and highly trained personnel, resulting in higher upfront costs for hospitals and patients

- Strict FDA approvals and compliance requirements for new valve devices increase development timelines and costs for medical device manufacturers, slowing product launches

- In addition, limited insurance coverage and reimbursement restrictions in some cases can restrict patient access, particularly in smaller hospitals or for patients with non-traditional insurance plans

- Overcoming these challenges through cost-effective device innovations, streamlined regulatory approvals, and expanded reimbursement policies will be vital for sustained growth in the North America heart valve repair and replacement market

- Potential procedural complications and the need for follow-up interventions can also deter patients from opting for heart valve procedures, especially in high-risk populations

- For instance, hospitals are emphasizing post-operative monitoring programs and patient education to minimize complications and improve confidence in minimally invasive valve procedures

North America Heart Valve Repair and Replacement Market Scope

The market is segmented on the basis of product, procedure, indication, end user, and distribution channel.

- By Product

On the basis of product, the North America heart valve repair and replacement market is segmented into surgical heart valves replacement, surgical heart valves repair, TAVI/TAVR Valves, grafts, patches, medication, and others. The TAVI/TAVR valves segment dominated the market with the largest revenue share of 45% in 2025, driven by rapid adoption in elderly and high-risk patient populations. Hospitals and specialized cardiac centers increasingly prefer TAVR due to its minimally invasive nature, shorter recovery time, and reduced procedural risk compared to open-heart surgical replacement. Patients with comorbidities often prioritize TAVI procedures to avoid extended hospital stays, making this segment the most revenue-generating. The availability of advanced valve designs with improved durability and ease of implantation has also strengthened the dominance of TAVI/TAVR valves. In addition, increasing awareness among cardiologists and patients about minimally invasive interventions contributes to its continued market leadership. The segment is supported by robust R&D investments from key manufacturers, ensuring ongoing innovation and adoption.

The Surgical Heart Valves Replacement segment is expected to witness the fastest growth rate of 18.5% from 2026 to 2033, driven by increasing demand for durable and long-term solutions in intermediate-risk patients. Advancements in surgical techniques and improved postoperative outcomes are making traditional surgical replacements more appealing. Surgeons often prefer this approach for complex cases where TAVR is not suitable, and expanding cardiac surgery infrastructure in hospitals across the U.S. and Canada fuels adoption. Enhanced training programs and minimally invasive hybrid surgical approaches also encourage growth. Patients seeking definitive, long-lasting solutions for valvular dysfunction contribute to sustained expansion in this segment.

- By Procedure

On the basis of procedure, the market is segmented into surgical procedure and non-surgical procedure. The Surgical Procedure segment dominated the market with a share of 60% in 2025, owing to its established clinical adoption and proven long-term outcomes. Surgical procedures provide cardiologists with comprehensive control over valve repair or replacement, making it suitable for complex anatomical variations. Hospitals continue to invest in surgical infrastructure, supporting high procedural volumes and ensuring continued dominance. Patient preference for definitive correction and physician confidence in surgical outcomes contribute to its leadership. In addition, well-trained cardiac surgeons and specialized cardiac centers in North America reinforce the dominance of surgical procedures. Robust clinical evidence and favorable reimbursement policies also support growth in this segment.

The Non-Surgical Procedure segment is expected to witness the fastest CAGR of 19.2% from 2026 to 2033, driven by increasing adoption of minimally invasive TAVI/TAVR techniques. Non-surgical procedures reduce recovery time, hospital stays, and procedural risk, appealing to elderly and high-risk patients. Expansion of specialized cardiac catheterization labs and awareness campaigns regarding minimally invasive interventions further accelerate growth. For instance, many hospitals now prioritize TAVR over open-heart surgery in eligible patients. Continuous innovation in valve technology and delivery systems also supports the rapid adoption of non-surgical procedures.

- By Indication

On the basis of indication, the market is segmented into valvular stenosis, valvular insufficiency, mitral valve prolapse, and others. The Valvular Stenosis segment dominated the market with the largest share of 42% in 2025, driven by high prevalence in aging populations and the critical need for timely intervention. Severe stenosis often leads to heart failure and other complications, making early intervention essential. TAVI/TAVR adoption in stenosis patients is growing, further boosting market share. Hospitals prioritize treatment for stenosis due to clinical urgency, increasing procedural volumes. The segment benefits from ongoing R&D in valve design and imaging guidance to optimize patient outcomes. Physician awareness and guideline recommendations also reinforce its dominance.

The Valvular Insufficiency segment is expected to witness the fastest growth at a CAGR of 17.8% from 2026 to 2033, driven by rising diagnosis rates and improved treatment options. Early detection of insufficiency enables interventions before severe complications, increasing procedural adoption. For instance, combined surgical and catheter-based approaches allow flexible treatment plans. Growing awareness among cardiologists and patients about long-term benefits accelerates market growth. Advances in repair devices and minimally invasive techniques contribute to faster adoption of this segment.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty centres, cardiac catheterization labs, ambulatory surgical centres, and others. The Hospitals segment dominated the market with a share of 68% in 2025, due to high procedural volumes and well-established surgical and catheterization infrastructure. Hospitals provide comprehensive facilities for pre- and post-operative care, enabling complex interventions. Patient preference for hospital-based procedures due to perceived safety and access to experienced surgeons drives dominance. Large hospitals in the U.S. and Canada continue to invest in TAVR-capable catheterization labs and hybrid operating rooms. Strong partnerships with device manufacturers ensure availability of advanced valve technologies. Hospitals’ role in training and clinical trials also supports market leadership.

The Cardiac Catheterization Labs segment is expected to witness the fastest growth at 20.3% CAGR from 2026 to 2033, driven by the rising adoption of minimally invasive TAVI/TAVR procedures. For instance, these labs enable precise imaging-guided valve placement with shorter procedural times. Growth in specialized outpatient catheterization centers and enhanced patient awareness contribute to increasing procedural volumes. The trend toward reducing hospital stays and cost-effective interventions accelerates adoption. Investments in high-end imaging and delivery systems support rapid expansion in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The Direct Tender segment dominated the market with a 55% share in 2025, as hospitals and large cardiac centers often procure devices directly from manufacturers to ensure consistent supply and obtain volume discounts. Direct tenders allow for negotiation of service contracts, training, and post-sale support, improving operational efficiency. High-value TAVR and surgical valves are often purchased through this channel due to regulatory and quality requirements. Long-term supplier relationships and customization options reinforce dominance. Manufacturer support for device training and procedural guidance also encourages direct tender procurement.

The Retail Sales segment is expected to witness the fastest growth at a CAGR of 18.7% from 2026 to 2033, driven by growing availability of heart valve devices through authorized distributors and specialized cardiac device retailers. For instance, smaller specialty centers and emerging hospitals increasingly rely on retail channels for timely access to repair and replacement products. Expansion of regional distributors in Canada and the U.S. further accelerates growth. Ease of procurement, flexible order sizes, and faster delivery contribute to adoption. Rising awareness of minimally invasive valve options among practitioners also drives retail sales expansion.

North America Heart Valve Repair and Replacement Market Regional Analysis

- The U.S. dominated the heart valve repair and replacement market with the largest revenue share of 78.3% in 2025, characterized by well-established healthcare infrastructure, high procedural volumes, advanced reimbursement frameworks, and a strong presence of key device manufacturers

- Patients and healthcare providers in the U.S. highly value the efficacy, safety, and reduced recovery times offered by TAVI/TAVR and surgical heart valve interventions, which improve long-term outcomes and quality of life for high-risk and elderly populations

- This strong adoption is further supported by investments in hybrid operating rooms, specialized cardiac centers, and robust training programs for surgeons and interventional cardiologists, establishing heart valve repair and replacement procedures as the preferred solution across hospitals nationwide

The U.S. Heart Valve Repair and Replacement Market Insight

The U.S. dominated the North America heart valve repair and replacement market with the largest revenue share of 78.3% in 2025, driven by the high prevalence of valvular heart diseases and an aging population. Hospitals and specialized cardiac centers are increasingly adopting TAVI/TAVR and advanced surgical valve procedures due to their minimally invasive nature, reduced recovery times, and improved patient outcomes. The preference for innovative procedures, coupled with robust healthcare infrastructure and favorable reimbursement policies, is accelerating market growth. In addition, rising awareness among cardiologists and patients about minimally invasive options, along with ongoing R&D investments by key device manufacturers, supports continued expansion. The U.S. also benefits from a high volume of procedures and early adoption of next-generation valve technologies, ensuring leadership in North America.

Canada Heart Valve Repair and Replacement Market Insight

The Canada heart valve repair and replacement market is the fastest-growing country segment, driven by increasing adoption of minimally invasive procedures and expanding hospital capacities. Public healthcare initiatives and reimbursement coverage are enhancing patient access to advanced valve interventions. Hospitals are investing in hybrid operating rooms, cardiac catheterization labs, and specialized cardiac centers to meet rising demand. Patient awareness campaigns and physician training programs are contributing to higher procedural volumes. In addition, the increasing prevalence of valvular heart diseases and geriatric populations in Canada is creating opportunities for TAVI/TAVR and surgical valve procedures. Growth is further supported by government-backed research and partnerships with medical device companies for next-generation valve solutions.

Mexico Heart Valve Repair and Replacement Market Insight

The Mexico heart valve repair and replacement market is emerging as a developing contributor, with increasing investments in healthcare infrastructure and specialized cardiac care. Adoption of minimally invasive procedures is gradually rising, driven by growing awareness of valvular heart disease management and expanding hospital capacities. Key hospitals and private cardiac centers are beginning to implement TAVI/TAVR procedures alongside traditional surgical interventions. Supportive government healthcare programs and rising insurance coverage for high-risk patients are facilitating growth. Patient education initiatives and collaborations with device manufacturers are accelerating adoption. The market is expected to continue growth as infrastructure and access improve, particularly in urban centers.

North America Heart Valve Repair and Replacement Market Share

The North America Heart Valve Repair and Replacement industry is primarily led by well-established companies, including:

- Edwards Lifesciences Corporation (U.S.)

- Abbott (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Artivion Inc (U.S.)

- BioStable Science and Engineering Inc (U.S.)

- Colibri Heart Valve LLC (U.S.)

- JenaValve Technology Inc (U.S.)

- Micro Interventional Devices Inc (U.S.)

- Neovasc Inc (Canada)

- Valcare Medical (U.S.)

- LivaNova Plc (U.K.)

- Cardiac Dimensions Inc (U.S.)

- On-X Life Technologies (U.S.)

- Corcym Group (Italy)

- TTK Healthcare Limited (India)

- Symetis (U.S.)

- Meril Life Sciences (India)

- Sahajanand Medical Technologies) (India)

- BioGlue (U.S.)

What are the Recent Developments in North America Heart Valve Repair and Replacement Market?

- In December 2025, the U.S. FDA approved Edwards Lifesciences’ SAPIEN M3 mitral valve replacement system, marking the first transseptal transcatheter mitral valve therapy cleared in the United States for patients with symptomatic moderate‑to‑severe mitral regurgitation deemed unsuitable for surgery or repair. This system expands minimally invasive treatment options and is based on positive clinical trial data demonstrating significant MR reduction and quality‑of‑life improvements

- In May 2025, Abbott received U.S. FDA approval for its Tendyne™ transcatheter mitral valve replacement (TMVR) system, a first‑of‑its‑kind device for treating mitral valve disease in patients with severe mitral annular calcification (MAC) who are not candidates for open‑heart surgery or repair. Tendyne delivers a fully repositionable, minimally invasive alternative to traditional surgery

- In March 2025, Medtronic presented five‑year clinical outcome data for its Evolut™ TAVR system, showing durable performance and comparable rates of mortality and disabling stroke versus surgical replacement in low‑risk severe aortic stenosis patients. These long‑term results support broader adoption of TAVR as an alternative to open‑heart surgery

- In January 2025, MUSC Health became the first team in the United States to implant a new transcatheter device for treating tricuspid regurgitation, demonstrating the growing clinical adoption of novel heart valve prostheses beyond aortic and mitral positions and signaling innovation in heart valve therapies for underserved conditions

- In January 2025, TRiCares announced the first US implantations of the Topaz transcatheter tricuspid valve replacement (TTVR) system as part of a U.S. Early Feasibility Study (EFS). This breakthrough marks one of the first steps toward minimally invasive tricuspid valve replacement therapies for patients with severe tricuspid regurgitation at high surgical risk

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.