TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA METALS SPECIATION (METHYL MERCURY) IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA ATOMIC ABSORPTION SPECTROSCOPY (AAS) IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SOFTWARE IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA HARDWARE IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA FULLY AUTOMATIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA SEMI AUTOMATIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA MANUAL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MERCURY IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA CADMIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA LEAD IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA ARSENIC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA ZINC IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA TIN IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA CHROMIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SELENIUM IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA COPPER IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TUNGSTEN IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA NICKEL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA DIETARY SUPPLEMENT IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA PHARMACEUTICAL IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA PERSONAL CARE AND COSMETICS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA FATS & OILS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA BLOOD & OTHERS SAMPLES IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA OTHERS IN HEAVY METALS TESTING MARKET, BY REGION, 2021-2030 (USD THOUSAND)

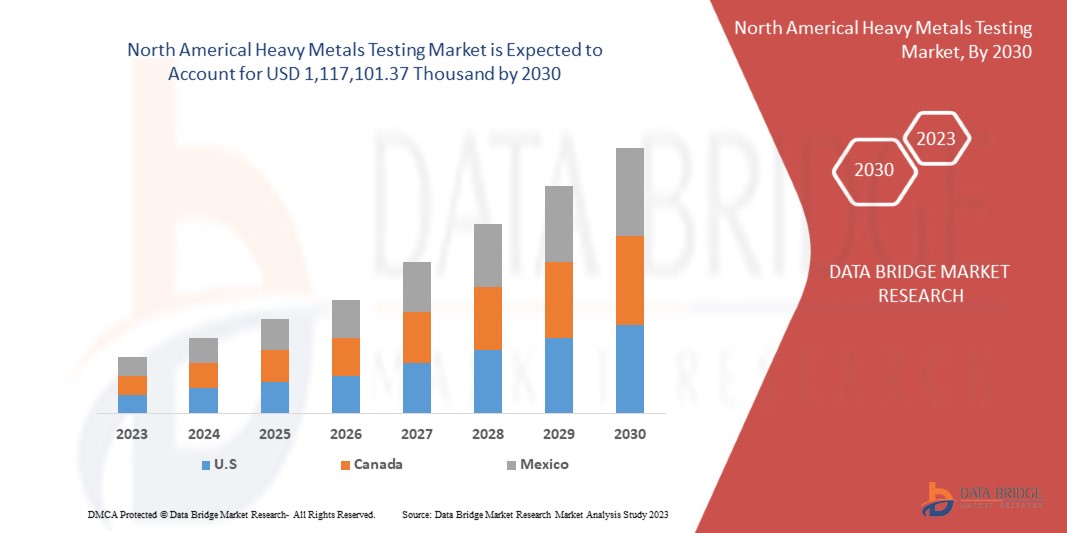

TABLE 52 NORTH AMERICA HEAVY METALS TESTING MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA SERVICES IN HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 U.S. SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 U.S. HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 77 U.S. HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 78 U.S. HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 79 U.S. FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 U.S. CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 U.S. PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.S. CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 U.S. BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 U.S. DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 U.S. BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 U.S. ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.S. NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 U.S. WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 U.S. FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.S. PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 CANADA HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 92 CANADA ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 CANADA HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 CANADA SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 CANADA HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 96 CANADA HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 97 CANADA HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 98 CANADA FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 CANADA CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 CANADA PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 CANADA CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 CANADA BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 CANADA DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 CANADA BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 CANADA ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 CANADA NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 CANADA WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 108 CANADA FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 CANADA PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 MEXICO HEAVY METALS TESTING MARKET, BY TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 111 MEXICO ICP IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 MEXICO HEAVY METALS TESTING MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 MEXICO SERVICES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 MEXICO HEAVY METALS TESTING MARKET, BY AUTOMATION, 2021-2030 (USD THOUSAND)

TABLE 115 MEXICO HEAVY METALS TESTING MARKET, BY TARGET METAL, 2021-2030 (USD THOUSAND)

TABLE 116 MEXICO HEAVY METALS TESTING MARKET, BY END-USE, 2021-2030 (USD THOUSAND)

TABLE 117 MEXICO FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 118 MEXICO CONVENIENCE FOOD IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MEXICO PROCESSED MEAT PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MEXICO CHOCOLATE & CONFECTIONERY IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 MEXICO BAKERY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 MEXICO DAIRY PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 MEXICO BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 MEXICO ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 MEXICO NON-ALCOHOLIC BEVERAGES IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 MEXICO WATER IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 MEXICO FEED PRODUCTS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 MEXICO PERSONAL CARE & COSMETICS IN HEAVY METALS TESTING MARKET, BY TYPE, 2021-2030 (USD THOUSAND)