Market Analysis and Insights

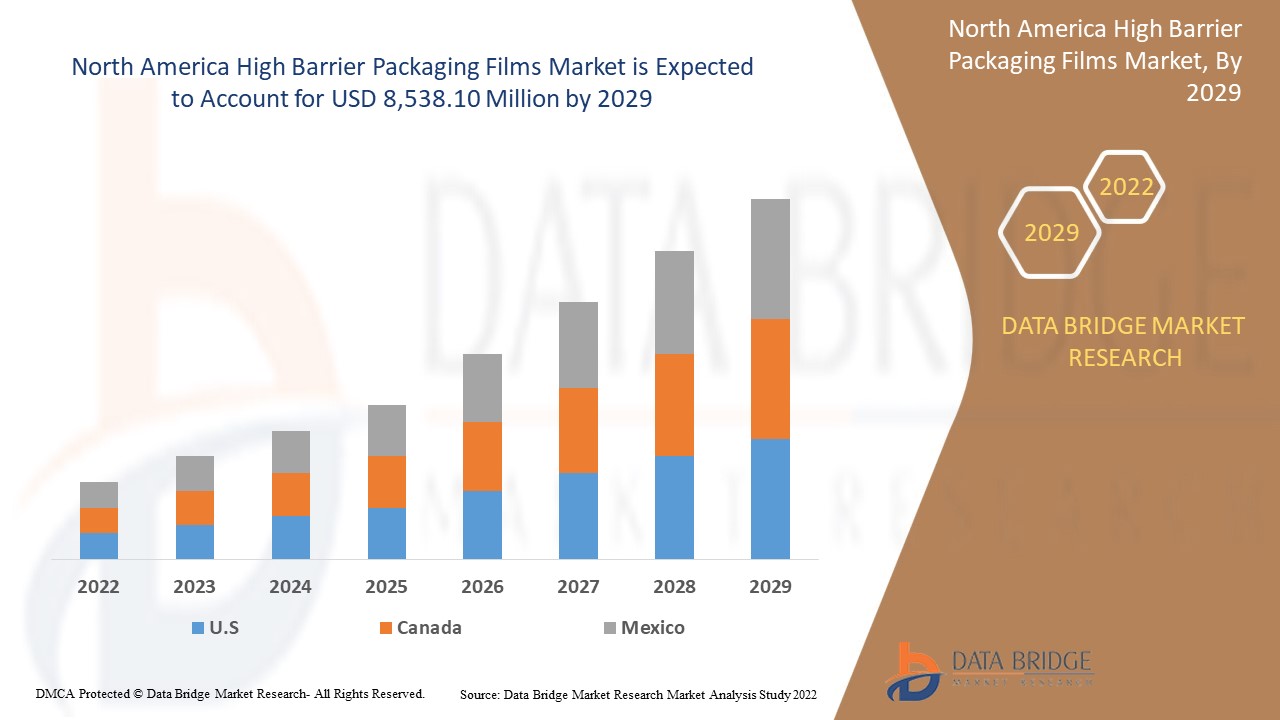

North America high barrier packaging films market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.3% in the forecast period of 2022 to 2029 and is expected to reach USD 8,538.10 million by 2029. The primary factor driving the growth of the high barrier packaging films market is the increasing demand for a multi-layer packaging for preventing oxygen and water permeation, the growing demand for high barrier packaging films for longer shelf-life, shifting consumer preference toward the packaged food, and the rising adoption of high barrier packaging films in pharmaceutical and agriculture industry.

The high barrier packaging films help prevent contact with oxygen, carbon dioxide, or moisture while restricting the effect of mineral oil and UV light. The powerful barrier created using functional materials used in the packaging film also holds the qualities of food such as color, taste, texture, aroma, and flavor. High barrier films play a major role in providing products with required properties and help extend the product's shelf life. It also helps make the structure recyclable with all layers relating to the same family of polymers. Moreover, high barrier films have an impermeable co-extruded & resilient structure. It is solvent-free and usually does not react with packaged food.

Moreover, the increasing popularity of ready-to-eat food influences the consumer shift toward packaged products. Hectic work-life balance and increasing workload also contribute to the rising demand for packaged foods by working professionals. Thus, with the growing demand for packaged food, the North America high barrier packaging films market is expected to propel the market's growth.

The North America high barrier packaging films market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Type (Non-Woven Metalized Films, Clear Films, Organic Coating Films, Inorganic Oxide Coating Films, Others), Material (Plastic, Aluminum, Oxides, Others), Packaging Type (Pouches, Bags, Lids, Shrink Films, Laminated Tubes, Others), End-User (Food, Beverages, Pharmaceuticals, Electronic Devices, Medical Devices, Agriculture, Chemicals). |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Advanced Converting Works, Constantia Flexibles, HPM NORTH AMERICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (a subsidiary of Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd. |

Market Definition

Flexible packaging solutions for high barrier packaging films include pouches, bags, lids, shrink films, laminated tubes, etc. Pouches can reseal with zippers, and replacing rigid pack designs, such as glass jars and metal tins as customers' growing requirement for product safety and convenience encourages pouches in high barrier packaging types. Pouches also protect the product against external influences, such as moisture, light, biological contamination, gases, and mechanical damage, affecting its quality or effectiveness.

North America High Barrier Packaging Films Market Dynamics

Drivers

- Increasing demand for multi-layer packaging to prevent oxygen and water

The multi-layering present in high barrier packaging films helps prevent contact with oxygen, moisture, and other gases such as carbon dioxide and restricts the effect of mineral oil and UV light. This powerful barrier created using functional materials helps hold up the integrity of the materials stored in them, such as food quality, such as its color, taste, texture, aroma, and flavor. For a product to keep its integrity intact, it is very important to provide them with all-important barrier properties such as moisture, gas, and aroma. High barrier films play a major role in providing products with these required properties. Moreover, high barrier films have an impermeable co-extruded & resilient structure, making them solvent-free and not react with packaged items such as medicines, foods, and others.

- Growing demand for high barrier packaging films for longer shelf-life

Sales of processed and frozen foods are also rising as many consumers are moving away from fresh foods to favor stockpiling foods with a longer shelf life. The increasingly busy lifestyle of consumers and the consequent demand for convenient food packaging is driving the need for high barrier films in the market. As consumers are becoming more aware of their behavior’s impact on the environment, they are increasingly interested in concrete ways to reduce their footprint. Now more than ever, consumers seek to purchase products that reflect their values and are sourced, produced, and packaged as sustainably as possible. Shelf-life longevity is the key factor consumers consider these days.

- Shifting consumer preference toward the packaged food

The high barrier packaging films are witnessing high demands from the food & beverage industry with the increased consumption and demand for processed and ready-to-eat packaged foods. Moreover, with the rising disposable income, working professionals and students are willing to spend more money on packed food and convenient products ready to eat, making the high barrier packaging films market grow in the near future. There is high demand for ready-to-cook and eat, freezer-to-microwave, ready-made packed meals, and processed foods, which are easy to carry, open, and require less time for preparation.

- Rising adoption of high barrier packaging films in the pharmaceutical and agriculture industry

The pharmaceutical sector poses different demands from the packaging solutions, such as insulation from external surroundings, high levels of protection, cost-effectiveness, and ease of handling. Thus, high barrier packaging films are widely used because these films do not allow the exchange of gases across the packaging and control the temperature within the package, thereby augmenting the market's growth as the primary packaging materials are plastic because it protects the pharmaceutical product against oxygen and odor, water vapor transmission, moisture, contamination, and bacteria. These properties make polypropylene material a good choice for high barrier packaging. Polypropylene high barrier films have a high melting point, making them suitable for boilable packages and serializable products.

Opportunities

- Growing adoption for biodegradable high barrier packaging films

Due to recyclable issues and biodegradable innovative packaging solutions, the high barrier packaging films market is estimated to grow in the near future as material producers continue to develop new and improved plastic films and additives for packaging production. These include high barrier and foil replacement films, sealant films and films that are more easily recyclable and degradable naturally. Reducing material usage is another key trend throughout the packaging and pouch-making industry, either through thinner films or fewer film layers.

- Upsurge in demand for customer-friendly packaging

There are some key points that consumers are looking into before selecting the packaging films. Some of them are hygiene and food safety, shelf life, ease of use, durability, information on the label, appearance, and environmental impacts. Consumers are more interested in fiber-based packaging found in recycled and recyclable plastic. Therefore, with the increasing trend and demand for customer-friendly packaging, there is a massive opportunity for the high barrier packaging films market to tap upon to register significant growth in the future. This can be done by launching more customer required products that are convenient in use and sustainable, and eco-friendly.

Restraints/Challenges

- Susceptibility to degradation

When exposed to heat, it can change the oxidation mechanism of plastic films. However, complete degradation of biodegradable polymers is only achievable under controlled conditions such as increased temperature and pressure, which are not found in the natural environment like aquatic and marine habitats. Therefore, when not in optimal conditions, these high barrier packaging films are expected to degrade and destroy their properties of these films. This may restrain the growth of the North America high barrier packaging films market.

- Fluctuation in prices of raw materials

Various high barrier packaging films are manufactured using a variety of raw materials. Some of these raw materials are plastic materials like polyethylene and polypropylene, and metals such as aluminum, among various others. These materials are non-biodegradable, hard to recycle, and harmful to the environment, including water and land. Selection of the raw material is primarily based on the end-usage of the barrier films. Some of the key raw materials used in packaging films include LDPE, LLDPE, HDPE, BOPP, CPP, BOPET, PVC, EVOH, PLA, PVDC, PVOH, and many others.

- Issue related to recycling of multi-layer films

While considering environmental effects, these packaging solutions are highly efficient, but the problem is that they are hardly recycled in the existing waste management infrastructure. Such as in Europe, the recycling units widely rely on traditional approaches of mechanical recycling in degranulation processes, which do combined processing of materials. The thermal incompatibility of the diverse combined materials is one major obstacle in reprocessing. However, new technologies such as chemical recycling are available, with promising results, but they need further and deep investigation and up-scaling, which will take time and huge capital investments. This, in turn, is posing a major challenge in the path of development and growth of the North America high barrier packaging films market.

- Strict government regulation and environmental concerns

High barrier packaging films are mainly made of plastic materials, i.e., polyethylene, polypropylene, etc. These materials are non-biodegradable, hard to recycle, and harmful to the environment, including water and land. Therefore, governments, regulatory bodies and environmentalists have been spreading awareness regarding the hazards of using such films. In the packaging segment, there is over 40% plastic usage. Plastic takes years to decompose, and hence, many countries do not favor its consumption and use in any industry.

COVID-19 had a Minimal Impact on North America High Barrier Packaging Films Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. However, a significant impact was noticed on the high barrier packaging films market. The operations and supply chain of high barrier packaging films, with multiple manufacturing facilities, were still operating in the region. The service providers continued offering high barrier packaging films following sanitation and safety measures in the post-COVID scenario.

Recent Development

In May 2021, DuPont's Mobility & Materials division invested USD 5 million in capital and operating resources at its manufacturing facilities in Germany and Switzerland to increase their capacity.

North America High Barrier Packaging Films Market Scope

The North America high barrier packaging films market is categorized based on type, material, packaging type, and end-user. The growth amongst these segments will help you analyze major industry growth segments and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Non-Woven Metalized Films

- Clear Films

- Organic Coating Films

- Inorganic Oxide Coating Films

- Others

Based on type, the North America high barrier packaging films market is classified into five segments: non-woven metalized films, clear films, organic coating films, inorganic oxide coating films, and others.

Material

- Plastic

- Aluminum

- Oxides

- Others

Based on material, the North America high barrier packaging films market is classified into four segments plastic, aluminum, oxides, and others.

Packaging Type

- Pouches

- Bags

- Lids

- Shrink Films

- Laminated Tubes

- Others

Based on the packaging type, the North America high barrier packaging films market is classified into six segments pouches, bags, lids, shrink films, laminated tubes, and others.

End-User

- Food

- Beverages

- Pharmaceuticals

- Electronic Devices

- Medical Devices

- Agriculture

- Chemicals

- Others

Based on end-user, the North America high barrier packaging films market is segmented into food, beverages, pharmaceuticals, electronic devices, medical devices, agriculture, chemicals, and others.

North America High Barrier Packaging Films Market Regional Analysis/Insights

The North American high barrier packaging films market in the packaging industry is segmented on type, material, packaging type, and end-user.

The North America high barrier packaging films market countries are the U.S., Canada, and Mexico. The U.S dominates North America high barrier packaging film market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the increase in footfalls in hospitals and diagnostic centers.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points downstream and upstream value chain analysis, technical test and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of the North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country data.

Competitive Landscape and North America High Barrier Packaging Films Market Share Analysis

North America high barrier packaging films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the North America high barrier packaging films market.

Some of the prominent participants operating in the North America High barrier packaging films market are Advanced Converting Works, Constantia Flexibles, HPM NORTH AMERICA INC, FLAIR Flexible Packaging Corporation, ClearBags, Perlen Packaging, OLIVER, Celplast Metallized Products, Toray Plastics (America), Inc. (a subsidiary of Toray Industries Inc), ISOFlex Packaging, KREHALON, MULTIVAC, BERNHARDT Packaging & Process, Sonoco Products Company, Sealed Air, WINPAL LTD., Schur Flexibles Holding GesmbH, Amcor Ltd.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning grids, Company Market Share Analysis, Standards of Measurement, North America Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 CLIMATE CHANGE SCENARIO

4.1.1 ENVIRONMENTAL CONCERNS

4.1.2 INDUSTRY RESPONSE

4.1.3 GOVERNMENT'S ROLE

4.1.4 ANALYST RECOMMENDATION

4.2 KEY PATENT LAUNCHED

4.3 PESTLE ANALYSIS

4.3.1 POLITICAL FACTORS

4.3.2 ECONOMIC FACTORS

4.3.3 SOCIAL FACTORS

4.3.4 TECHNOLOGICAL FACTORS

4.3.5 LEGAL FACTORS

4.3.6 ENVIRONMENTAL FACTORS

4.4 PORTER’S FIVE FORCES:

4.4.1 THREAT OF NEW ENTRANTS:

4.4.2 THREAT OF SUBSTITUTES:

4.4.3 CUSTOMER BARGAINING POWER:

4.4.4 SUPPLIER BARGAINING POWER:

4.4.5 INTERNAL COMPETITION (RIVALRY):

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 RAW MATERIAL PROCUREMENT

4.5.2 MANUFACTURING AND PACKING

4.5.3 MARKETING AND DISTRIBUTION

4.5.4 END USERS

4.6 TECHNOLOGY ADVANCEMENTS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATORY COVERAGE

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 MIDDLE EAST AND AFRICA

5.6 SOUTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN DEMAND FOR MULTI-LAYER PACKAGING FOR PREVENTING OXYGEN AND WATER

6.1.2 GROW IN DEMAND FOR HIGH BARRIER PACKAGING FILMS FOR LONGER SHELF-LIFE

6.1.3 SHIFTING CONSUMER PREFERENCE TOWARD THE PACKAGED FOOD

6.1.4 RISE IN ADOPTION OF HIGH BARRIER PACKAGING FILMS IN PHARMACEUTICAL AND AGRICULTURE INDUSTRY

6.2 RESTRAINTS

6.2.1 SUSCEPTIBILITY TO DEGRADATION

6.2.2 FLUCTUATION IN PRICES OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 GROW IN ADOPTION OF BIODEGRADABLE HIGH BARRIER PACKAGING FILMS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.4 CHALLENGES

6.4.1 ISSUE RELATED TO RECYCLING OF MULTI-LAYER FILMS

6.4.2 STRICT GOVERNMENT REGULATION AND ENVIRONMENTAL CONCERNS

7 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-WOVEN METALIZED FILMS

7.3 CLEAR FILMS

7.4 ORGANIC COATING FILMS

7.5 INORGANIC OXIDE COATING FILMS

7.6 OTHERS

7.6.1 ALUMINIUM FOIL

7.6.2 REST OF OTHERS

8 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 PLASTIC

8.2.1 POLYETHYLENE (PE)

8.2.2 POLYPROPYLENE (PP)

8.2.3 POLYETHYLENE TEREPHTHALATE (PET)

8.2.4 ETHYLENE VINYL ALCOHOL (EVOH)

8.2.5 POLYETHYLENE NAPHTHALATE (PEN)

8.2.6 POLYVINYLIDENE CHLORIDE (PVDC)

8.2.7 POLYAMIDE (NYLON)

8.2.8 OTHERS (LCD, PS, PVC, PLA, PA)

8.3 ALUMINIUM

8.4 OXIDES

8.4.1 SILICON OXIDE

8.4.2 ALUMINUM OXIDE

8.5 OTHERS

9 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 POUCHES

9.3 BAGS

9.4 LIDS

9.5 SHRINK FILMS

9.6 LAMINATED TUBES

9.7 OTHERS

10 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER

10.1 OVERVIEW

10.2 FOOD

10.2.1 MEAT, SEA FOOD & POULTRY

10.2.2 READY TO EAT MEALS

10.2.3 SNACKS

10.2.4 DAIRY FOODS

10.2.5 BAKERY & CONFECTIONARY

10.2.6 BABY FOOD

10.2.7 PET FOOD

10.2.8 OTHER FOOD

10.3 BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERAGES

10.3.2 ALCOHOLIC BEVERAGES

10.4 PHARMACEUTICALS

10.5 ELECTRONIC DEVICES

10.6 MEDICAL DEVICES

10.7 AGRICULTURE

10.8 CHEMICALS

10.9 OTHERS

11 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 ACQUISITION

12.3 PRODUCT LAUNCH

12.4 AWARD

12.5 CONFERENCE

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 AMCOR PLC

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATES

14.2 DUPONT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 SONOCO PRODUCTS COMPANY

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATES

14.4 BERRY NORTH AMERICA INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 SEALED AIR

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 ADVANCED CONVERTING WORKS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BERNHARDT PACKAGING & PROCESS

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CELPLAST METALLIZED PRODUCTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATE

14.9 CLEARBAGS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONSTANTIA FLEXIBLES

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATE

14.11 FLAIR FLEXIBLE PACKAGING CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT UPDATE

14.12 HPM NORTH AMERICA INC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATES

14.13 ISOFLEX PACKAGING

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATES

14.14 KREHALON

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT UPDATES

14.15 MULTIVAC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 OLIVER

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 PERLEN PACKAGING

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATE

14.18 SCHUR FLEXIBLES HOLDING GESMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 TORAY PLASTICS (AMERICA), INC. (SUBSIDIARY OF TORAY INDUSTRIES INC)

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT UPDATES

14.2 WINPAK LTD.

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 2 EXPORT DATA OF ARTICLES OF PLASTICS AND ARTICLES OF OTHER MATERIALS OF HEADING 3901 TO 3914, N.E.S; HS CODE – 392690 (USD THOUSAND)

TABLE 3 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 5 NORTH AMERICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA NON-WOVEN METALIZED FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 7 NORTH AMERICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEAR FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 9 NORTH AMERICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORGANIC COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 11 NORTH AMERICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INORGANIC OXIDE COATING FILMS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 13 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 15 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 17 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 19 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 21 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 23 NORTH AMERICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA ALUMINIUM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 25 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 27 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 29 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 31 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 33 NORTH AMERICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA POUCHES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS )

TABLE 35 NORTH AMERICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA BAGS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 37 NORTH AMERICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA LIDS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 39 NORTH AMERICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SHRINK FILM IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 41 NORTH AMERICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA LAMINATED TUBES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 43 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 45 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 47 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 49 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 51 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 53 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 55 NORTH AMERICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA PHARMACEUTICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 57 NORTH AMERICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA ELECTRONIC DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 59 NORTH AMERICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA MEDICAL DEVICES IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 61 NORTH AMERICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA AGRICULTURE IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 63 NORTH AMERICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA CHEMICALS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 65 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY REGION, 2020-2029 (KILO TONS)

TABLE 67 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY COUNTRY, 2020-2029 (KILO TONS)

TABLE 69 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 71 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 73 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 75 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 77 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 79 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 81 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 83 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 85 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 87 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 89 U.S. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 91 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 93 U.S. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 95 U.S. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 97 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 99 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 U.S. HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 101 U.S. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 U.S. FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 103 U.S. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 U.S. BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 105 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 107 CANADA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 109 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 110 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 111 CANADA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 CANADA PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 113 CANADA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 CANADA OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 115 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 117 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 118 CANADA HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 119 CANADA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 120 CANADA FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 121 CANADA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 122 CANADA BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 123 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 125 MEXICO OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 126 MEXICO OTHERS IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 127 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 128 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY MATERIAL, 2020-2029 (KILO TONS)

TABLE 129 MEXICO PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 MEXICO PLASTIC IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 131 MEXICO OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 MEXICO OXIDES IN HIGH BARRIER PACKAGING FILMS MARKET, BY TYPE, 2020-2029 (KILO TONS)

TABLE 133 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (USD MILLION)

TABLE 134 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY PACKAGING TYPE, 2020-2029 (KILO TONS)

TABLE 135 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 MEXICO HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 137 MEXICO FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 MEXICO FOOD IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

TABLE 139 MEXICO BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 MEXICO BEVERAGES IN HIGH BARRIER PACKAGING FILMS MARKET, BY END USER, 2020-2029 (KILO TONS)

List of Figure

FIGURE 1 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 2 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SHIFTING CONSUMER PREFERENCE TOWARDS THE PACKAGED FOOD IS EXPECTED TO DRIVE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET FROM 2022 TO 2029

FIGURE 16 NON-WOVEN METALIZED FILMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET IN 2022 & 2029

FIGURE 17 SUPPLY CHAIN ANALYSIS- NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET

FIGURE 20 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY PACKAGING TYPE, 2021

FIGURE 23 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY END USER, 2021

FIGURE 24 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA HIGH BARRIER PACKAGING FILMS MARKET: COMPANY SHARE 2021 (%)

North America High Barrier Packaging Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America High Barrier Packaging Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America High Barrier Packaging Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.