Market Analysis and Insights: North America Hyperspectral Imaging Systems Market

Market Analysis and Insights: North America Hyperspectral Imaging Systems Market

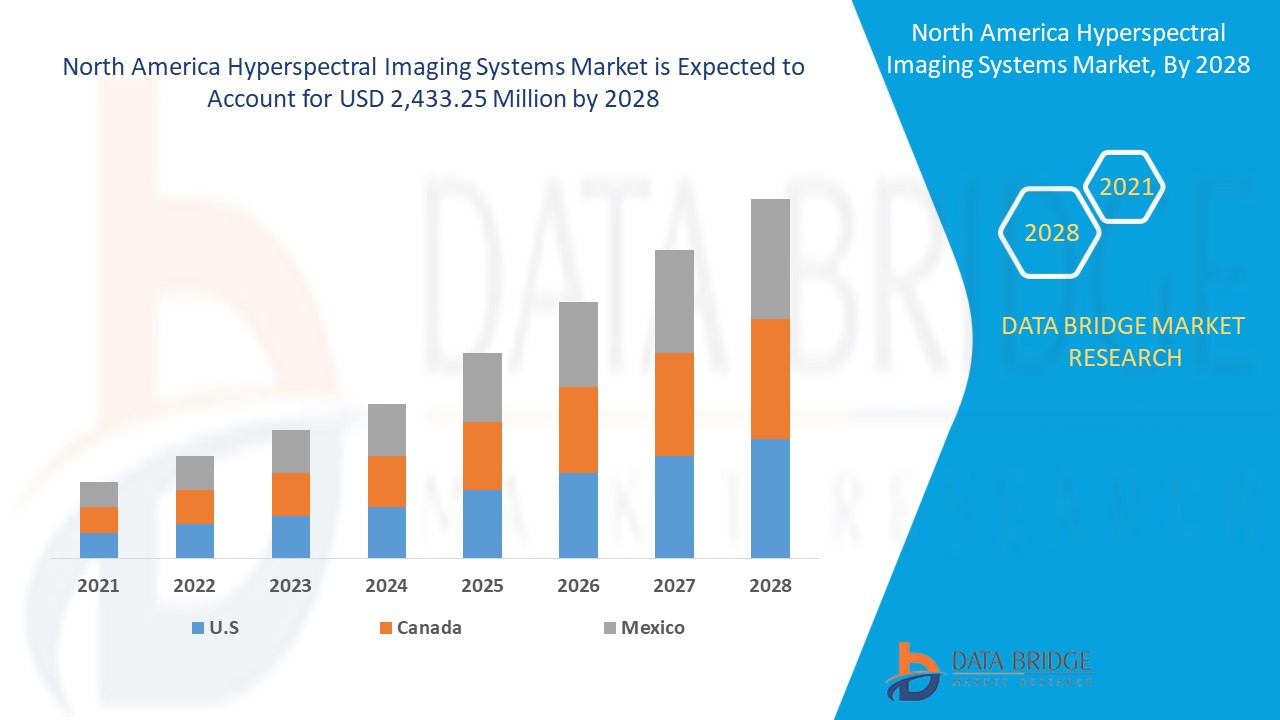

The North America hyperspectral imaging systems market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 18.4% in the forecast period of 2021 to 2028 and is expected to reach USD 2,433.25 million by 2028. Increased awareness and adoption of hyperspectral imaging technology for aerial remote sensing application and research is a major factor for the market's growth.

Hyperspectral Imaging is a spectroscopic technique that collects hundreds of images at different wavelengths over a linear spatial area. Hyperspectral imaging aims to collect spectra for each pixel in the sample to identify objects and processes. Hyperspectral imaging collects and processes information from across the electromagnetic spectrum. Hyperspectral imaging helps in identifying the chemical properties of materials, and thus differences in the materials can be analyzed. HSI systems are distinguished from color and multispectral imaging systems (MSI) in some main characteristics. Importantly the color and the MSI systems image the scene in just three to ten spectral bands while the HSI systems image in hundreds of co-registered bands. The technology has widespread applications in remote sensing, sorting industry, microscopy, military and defense applications, and agriculture. Hyperspectral imaging technology is becoming more popular and has spread into widespread ecology and surveillance, historical manuscript research, and others.

The factors driving the market are increasing government investments in hyperspectral satellite imaging and the surging utilization of airborne hyperspectral imaging solutions. The high cost associated with hyperspectral imaging restrains the North America hyperspectral imaging systems market growth. Leveraging AI in hyperspectral imaging for technological developments is one factor that opens lucrative opportunities for the market. Lack of skilled professionals is acting as a major challenge for the market growth.

This North America hyperspectral imaging systems market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief; our team will help you create a revenue impact solution to achieve your desired goal.

North America Hyperspectral Imaging Systems Market Scope and Market Size

North America Hyperspectral Imaging Systems Market Scope and Market Size

The North America hyperspectral imaging systems market is segmented based on product, scanning techniques, range, technology, and application. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of product, the North America hyperspectral imaging systems market has been segmented into cameras and accessories. In 2021, the cameras segment is expected to dominate the market, as the camera is the major product in the hyperspectral imaging system. Increased awareness and increasing regulators pressure on organizations are increasing the growth of hyperspectral imaging cameras in the North American region.

- On the basis of scanning techniques, the North America hyperspectral imaging systems market has been segmented into spatial scanning, spectral scanning, non-scanning, and spatiospectral scanning. In 2021, the spatial scanning segment is expected to dominate the market, as spatial scanning is one of the main methods used for hyperspectral data acquisition and provides high spectral resolution over a wide range of the spectrum. Spatial scanning is the reason for the usage of hyperspectral scanning, which fuels the adoption in the North American region.

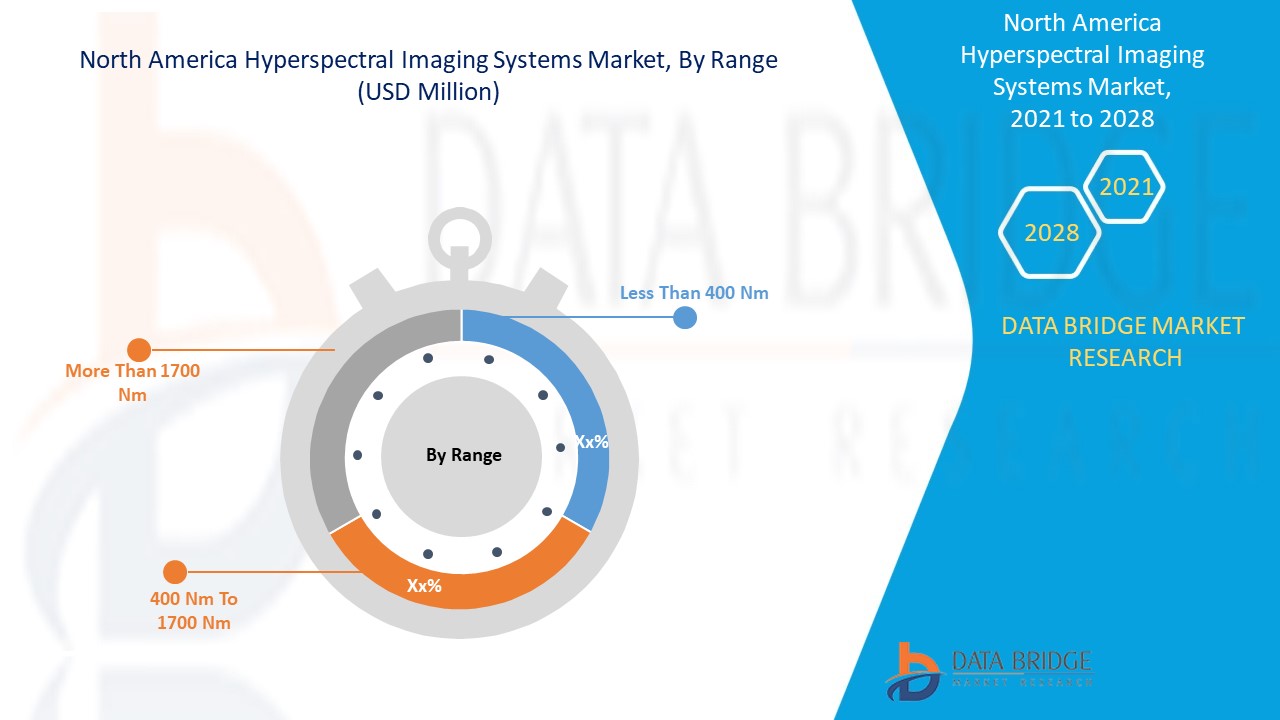

- On the basis of range, the North America hyperspectral imaging systems market has been segmented into less than 400 nm, 400 nm to 1700 nm, and more than 1700 nm. In 2021, the 400 nm to 1700 nm segment is expected to dominate the market, as the range is the most commonly used for hyperspectral imaging in countries such as the U.S. in applications such as detection of contaminants in food, medical diagnostics, military surveillance, plastic recycling, and others.

- On the basis of technology, the North America hyperspectral imaging systems market has been segmented into pushbroom (line scanning), snapshot (single shot), whiskbroom (point scanning), and others. In 2021, pushbroom (line scanning) segment is expected to dominate the market as pushbroom technology is faster than any other, gathers more light, has better radiometric and spatial resolution, and is the most popular and widely adopted hyperspectral imaging approach in the North American region.

- On the basis of application, the North America hyperspectral imaging systems market has been segmented into remote sensing, military surveillance, machine vision and optical sorting, life sciences and medical diagnostics, agriculture, food processing, environmental monitoring, mining/mineral mapping, mineralogy, civil engineering, and other applications. In 2021, the remote sensing segment is expected to dominate the market as hyperspectral imaging in many applications such as agriculture, mineral exploration, environmental monitoring, and others for remote sensing. Moreover, increased awareness and adoption of hyperspectral imaging technology for aerial remote sensing application and research contributes to the growth of the segment in the North American region.

- On the basis of speed, the North America hyperspectral imaging systems market is segmented into up to 20 MHz, 20 MHz to 40 MHz, and more than 40 MHz.

- On the basis of number of taps, the North America hyperspectral imaging systems market is segmented into one tap and two taps.

North America Hyperspectral Imaging Systems Market Country Level Analysis

The North America hyperspectral imaging systems market is analyzed, and market size information is provided by country, product, scanning techniques, range, technology, and application.

The countries covered in the North America hyperspectral imaging systems market report are the U.S., Canada, and Mexico.

The U.S. dominates the hyperspectral imaging systems market due to factors such as the strong presence of providers and the growing adoption of technological innovations in hyperspectral imaging systems. Moreover, increasing awareness benefits of hyperspectral imaging in commercial imaging applications acts as a market driver.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand for Hyperspectral Imaging Systems

The North America hyperspectral imaging systems market also provides you with detailed market analysis for every country's growth in the industry with sales, components sales, the impact of technological development in hyperspectral imaging systems, and changes in regulatory scenarios with their support for the market. The data is available for the historical period 2010 to 2019.

Competitive Landscape and North America Hyperspectral Imaging Systems Market Share Analysis

The North America hyperspectral imaging systems market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points are only related to the companies' focus on the North America hyperspectral imaging systems market.

The major players covered in the North America hyperspectral imaging systems market are Imec VZW, Corning Incorporated, HORIBA, Ltd, Hamamatsu Photonics K.K., Thorlabs, Inc., BaySpec, Inc., Brandywine Photonics LLC, ChemImage Corporation, Cubert GmbH, CytoViva, Inc., Headwall Photonics, Inc., Hinalea Imaging, HyperMed Imaging, Inc., Norsk Electro Optik AS, Photon Etc. Inc, Physical Sciences Inc., Raptor Photonics, Resonon Inc., SPECIM, SPECTRAL IMAGING LTD., STEMMER IMAGING AG, Surface Optics Corporation, Teledyne Digital Imaging Inc. (A Subsidiary of Teledyne Technologies Incorporated), Telops, XIMEA Group, and others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of the North America hyperspectral imaging systems market.

For instances,

- In April 2021, Headwall Photonics, Inc. announced the collaboration as an Industrial Practitioner Advisory Board member for NSF-funded Internet of Things for Precision Agriculture (IoT4Ag). NSF Engineering Research Center staff utilized Headwall's hyperspectral sensors by integrating them onto unmanned aerial vehicle (UAV) systems to create data-driven models to capture and analyze plant physiology, soil properties, management, and environmental variations. This enhanced the company's presence in the agricultural technology community

- In February 2021, ChemImage Corporation announced the launch of a new feature for the VeroVision Mail Screener. The new feature provided inmate mail detection capability, which might contain sprayed methamphetamine and certain kinds of synthetic cannabinoids. VeroVision Mail Screener scans mail articles using near-infrared hyperspectral imaging technology to detect hidden illicit drugs and common cutting agents. With this, the company enhanced the ability of the user to reject suspicious mail in an unbiased manner. The increasing smuggling scenarios in prison has increased the demand for such technology

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also benefits the organization to improve its offering for hyperspectral imaging systems through an expanded range of sizes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING INVESTMENTS IN SATELLITES INCORPORATED WITH HIS

5.1.2 SURGE IN UTILIZATION OF AIRBORNE HYPERSPECTRAL IMAGING SOLUTIONS

5.1.3 RISE IN USE OF HYPERSPECTRAL IMAGING FOR AGRICULTURE SECTOR

5.1.4 SURGE IN APPLICATIONS OF HSI FOR ENVIRONMENTAL MONITORING

5.1.5 GROW IN INDUSTRIAL APPLICATIONS OF HYPERSPECTRAL IMAGING

5.2 RESTRAINTS

5.2.1 HIGH COMPLEXITY AND DATA STORAGE ISSUES

5.2.2 HIGH COST ASSOCIATED WITH THE USE OF HYPERSPECTRAL IMAGING

5.3 OPPORTUNITIES

5.3.1 SURGING ADVANCEMENTS OF HYPERSPECTRAL IMAGING FOR REMOTE SENSING

5.3.2 RISE IN DEVELOPMENTS TOWARD THE ADOPTION OF PORTABLE HYPERSPECTRAL CAMERAS

5.3.3 INCREASING MEDICAL APPLICATIONS OF HSI

5.3.4 LEVERAGING AI IN HYPERSPECTRAL IMAGING FOR TECHNOLOGICAL DEVELOPMENTS

5.4 CHALLENGES

5.4.1 LACK OF SKILLED PROFESSIONALS

5.4.2 LACK OF LABELLED DATA FOR HSI INCORPORATING AI AND ML ALGORITHMS

6 COVID-19 IMPACT ON HYPERSPECTRAL IMAGING SYSTEMS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 CAMERAS

7.3 ACCESSORIES

8 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES

8.1 OVERVIEW

8.2 SPATIAL SCANNING

8.3 SPECTRAL SCANNING

8.4 SPATIO-SPECTRAL SCANNING

8.5 NON-SCANNING

9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE

9.1 OVERVIEW

9.2 NM TO 1700 NM

9.3 MORE THAN 1,700 NM

9.4 LESS THAN 400 NM

10 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 PUSHBROOM (LINE SCANNING)

10.3 WHISKBROOM (POINT SCANNING)

10.4 SNAPSHOT (SINGLE SHOT)

10.5 OTHERS

11 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 REMOTE SENSING

11.2.1 CAMERAS

11.2.2 ACCESSORIES

11.3 MILITARY SURVEILLANCE

11.3.1 CAMERAS

11.3.2 ACCESSORIES

11.4 MACHINE VISION & OPTICAL SORTING

11.4.1 CAMERAS

11.4.2 ACCESSORIES

11.5 LIFE SCIENCES & MEDICAL DIAGNOSTICS

11.5.1 CAMERAS

11.5.2 ACCESSORIES

11.6 AGRICULTURE

11.6.1 CAMERAS

11.6.2 ACCESSORIES

11.7 FOOD PROCESSING

11.7.1 CAMERAS

11.7.2 ACCESSORIES

11.8 ENVIRONMENTAL MONITORING

11.8.1 CAMERAS

11.8.2 ACCESSORIES

11.9 MINING/MINERAL MAPPING

11.9.1 CAMERAS

11.9.2 ACCESSORIES

11.1 MINEROLOGY

11.10.1 CAMERAS

11.10.2 ACCESSORIES

11.11 CIVIL ENGINEERING

11.11.1 CAMERAS

11.11.2 ACCESSORIES

11.12 OTHER APPLICATIONS

11.12.1 CAMERAS

11.12.2 ACCESSORIES

12 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SPEED

12.1 OVERVIEW

12.2 UP TO 20 MHZ

12.3 TO 40 MHZ

12.4 MORE THAN 40 MHZ

13 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY NUMBER OF TAPS

13.1 OVERVIEW

13.2 ONE TAP

13.3 TWO TAP

14 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 IMEC

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 CORNING INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 HORIBA, LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 HAMAMATSU PHOTONICS K.K.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 THORLABS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BAYSPEC, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECCENT DEVELOPMENTS

17.7 BRANDYWINE PHOTONICS LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CHEMIMAGE CORPORATION

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CUBERT GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 CYTOVIVA, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 DIASPECTIVE VISION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 HEADWALL PHOTONICS, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 HINALEA IMAGING

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 HYPERMED IMAGING, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 INNO-SPEC GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 LLA INSTRUMENTS GMBH & CO. KG

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 NORSK ELECTRO OPTIK AS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PHOTON ETC. INC

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 PHYSICAL SCIENCES INC.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 RAPTOR PHOTONICS

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 RESONON INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SPECIM, SPECTRAL IMAGING LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 STEMMER IMAGING AG

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENT

17.24 SURFACE OPTICS CORPORATION

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 TELEDYNE DIGITAL IMAGING INC. (A SUBSIDIARY OF TELEDYNE TECHNOLOGIES INCORPORATED)

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

17.26 TELOPS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 XIMEA GROUP

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA CAMERAS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA ACCESSORIES IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA SPATIAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION ,2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA SPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA SPATIOSPECTRAL SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA NON-SCANNING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028, (USD MILLION)

TABLE 9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA 400 NM TO 1700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA MORE THAN 1,700 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA LESS THAN 400 NM IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA PUSHBROOM (LINE SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA WHISKBROOM (POINT SCANNING) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA SNAPSHOT (SINGLE SHOT) IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA OTHERS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-202 (USD MILLION)

TABLE 32 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 44 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 45 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 46 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 47 NORTH AMERICA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 48 NORTH AMERICA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 49 NORTH AMERICA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 50 NORTH AMERICA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 51 NORTH AMERICA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 52 NORTH AMERICA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 53 NORTH AMERICA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 54 NORTH AMERICA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 55 NORTH AMERICA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 56 NORTH AMERICA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 57 NORTH AMERICA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 58 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 59 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 60 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 61 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 62 U.S. HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 63 U.S. REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 64 U.S. MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 65 U.S. MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 66 U.S. LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 67 U.S. AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 68 U.S. FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 69 U.S. ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 70 U.S. MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 71 U.S. MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 72 U.S. CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 73 U.S. OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 74 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 75 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 76 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 77 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 78 CANADA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 79 CANADA REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 80 CANADA MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 81 CANADA MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 82 CANADA LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 83 CANADA AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 84 CANADA FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 85 CANADA ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 CANADA MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 87 CANADA MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 88 CANADA CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 89 CANADA OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 90 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 91 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2019-2028 (USD MILLION)

TABLE 92 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2019-2028 (USD MILLION)

TABLE 93 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2019-2028 (USD MILLION)

TABLE 94 MEXICO HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 95 MEXICO REMOTE SENSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 96 MEXICO MILITARY SURVEILLANCE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 97 MEXICO MACHINE VISION & OPTICAL SORTING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 98 MEXICO LIFE SCIENCES & MEDICAL DIAGNOSTICS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 99 MEXICO AGRICULTURE IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 100 MEXICO FOOD PROCESSING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 101 MEXICO ENVIRONMENTAL MONITORING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 MEXICO MINING/MINERAL MAPPING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 103 MEXICO MINEROLOGY IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 104 MEXICO CIVIL ENGINEERING IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 105 MEXICO OTHER APPLICATIONS IN HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SEGMENTATION

FIGURE 11 INCREASING GOVERNMENT INVESTMENTS IN HYPERSPECTRAL SATELLITE IMAGING TO DRIVE NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 THE CAMERAS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET

FIGURE 14 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY PRODUCT, 2020

FIGURE 15 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY SCANNING TECHNIQUES, 2020

FIGURE 16 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY RANGE, 2020

FIGURE 17 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY TECHNOLOGY, 2020

FIGURE 18 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET, BY APPLICATION, 2020

FIGURE 19 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: SNAPSHOT (2020)

FIGURE 20 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020)

FIGURE 21 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 22 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 23 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: BY PRODUCT (2021-2028)

FIGURE 24 NORTH AMERICA HYPERSPECTRAL IMAGING SYSTEMS MARKET: COMPANY SHARE 2020 (%)

North America Hyperspectral Imaging Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Hyperspectral Imaging Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Hyperspectral Imaging Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.