North America Invisible Orthodontics Market

Market Size in USD Million

CAGR :

%

USD

2,715.63 Million

USD

7,927.50 Million

2021

2029

USD

2,715.63 Million

USD

7,927.50 Million

2021

2029

| 2022 –2029 | |

| USD 2,715.63 Million | |

| USD 7,927.50 Million | |

|

|

|

Market Analysis and Insights : North America Invisible Orthodontics Market

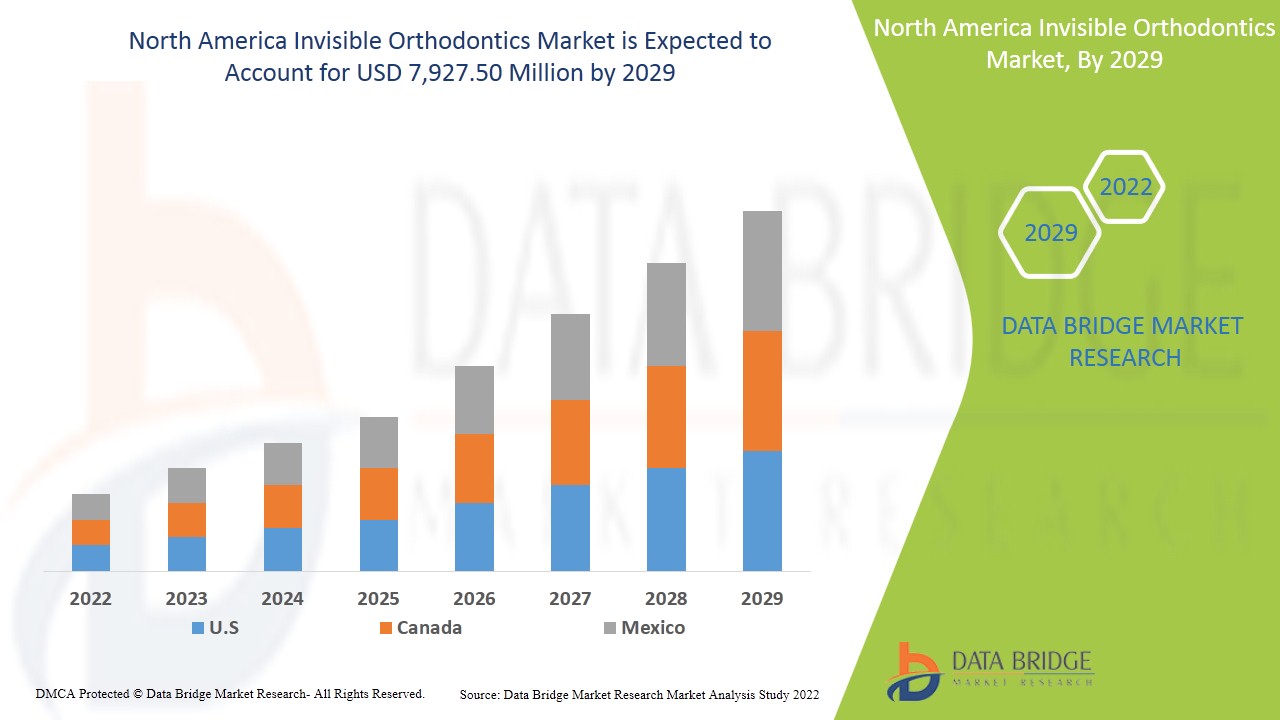

North America Invisible Orthodontics Market is expected to reach USD 7,927.50 million by 2029 from USD 2,715.63 million in 2021, growing with a CAGR of 14.3% in the forecast period of 2022 to 2029. The increasing demand for aesthetic appearance has further propelled the demand for orthodontic treatment worldwide. Thus, the growing prevalence of malocclusion acts as a driver for the growth of invisible orthodontics market.

Invisible orthodontics market deals in the products and services such as clear aligners, ceramic braces, lingual braces and clear retainers for the treatment of minor dental problems such as crowded teeth, excessive spacing and malocclusion. These treatment options are in great demand due to the aesthetic appeal provided by this treatment option along with the desired option, moreover, the increasing awareness of cosmetic dentistry which has further propelled the demand of the invisible orthodontics. Public, as well as private organizations are focusing on catering to the changing needs of the customers in terms of providing demos, conducting campaigns and dental check-ups. Thus, the employment of such strategies will promise the growth of the invisible orthodontics substantially.

The high prevalence of malocclusion and the rising awareness towards good oral hygiene is expected to act as driver for the growth of the invisible orthodontics market across the globe. However, the high cost of invisible orthodontics treatment is expected to act as restraint for its growth in the market. The presence of large number of players in the market which are making strategic initiatives to increase the market growth is expected to act as opportunity for the growth of the market. However, the stringent government regulations may act as challenge for the growth of the market.

The North America invisible orthodontics market provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Invisible Orthodontics Market Scope and Market Size

North America invisible orthodontics market is categorized into five notable segments which are based on product and services, age groups, application, end user and distribution channel.

- On the basis of product and services, the North America invisible orthodontics market is segmented into products and services. The products segment is sub-segmented into clear aligners, ceramic braces, clear retainers and lingual braces. In 2022, the products segment is expected to dominate the North America invisible orthodontics market due to the presence of various types of aligners in the market.

- On the basis of age groups, the North America invisible orthodontics market is segmented into children, adults and teenagers. In 2022, the adults segment is expected to dominate the North America invisible orthodontics market because of increasing demand of this treatment among adult population.

- On the basis of application, the North America invisible orthodontics market is segmented into crowding, excessive spacing, malocclusion and others. In 2022, the malocclusion segment is expected to dominate the North America invisible orthodontics market because of the advancement in technologies leading to the effective treatment of the disease.

- On the basis of end user, the North America invisible orthodontics market is segmented into hospitals, dental clinics, orthodontic clinics and others. In 2022, the hospitals segment in the end use is going to dominate the market, as patients visits the hospitals for diagnosis and treatment of disease.

- On the basis of distribution channel, the North America invisible orthodontics market is segmented into direct sales and third party distributors. In 2022, the direct sales segment in the distribution channel is going to dominate the market, due to growing demand from hospitals and dental clinics.

Invisible Orthodontics Market Country Level Analysis

The North America invisible orthodontics market is analysed and market size information is provided by product and services, by age group, by application, by end user, by distribution channel. The countries covered in the North America invisible orthodontics market report are U.S., Canada and Mexico.

North America is expected to grow with the CAGR of 14.3% in the forecasted period as in the North American countries; the demand for invisible orthodontics treatment is increasing. U.S. is expected to dominate in the North America market due to the presence of big market players in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

New Product Launches by Manufactures is Creating New Opportunities for Players in the invisible Orthodontics Market

Invisible orthodontics market also provides you with detailed market analysis for every country growth in aesthetic industry with invisible orthodontics market sales, impact of advancement in the invisible orthodontics market and changes in regulatory scenarios with their support for the invisible orthodontics market. The data is available for historic period 2011 to 2020.

Competitive Landscape and Invisible Orthodontics Market Share Analysis

Invisible orthodontics market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Invisible orthodontics market.

Some of the major players operating in the North America invisible orthodontics market are 3M, Candid Care Co., Henry Schein Orthodontics (A subsidiary of Henry Schein, Inc.), TP Orthodontics, Inc., G&H Orthodontics, Great Lakes Dental Technologies, DynaFlex, American Orthodontics, Align Technology, Inc., rocky mountain orthodontics, DB Orthodontics, DENTAURUM GmbH & Co. KG, ALIGNERCO, Institut Straumann AG, Ormco Corporation (A subisidiary of Envista), Dentsply Sirona and SmileDirectClub among others.

Many product launch and agreement are also initiated by the companies’ worldwide which are also accelerating the Invisible orthodontics market.

For instance,

- In April 2020, American Orthodontics announced the launch of its new product named Empower 2 Clear which is clear aesthetic brackets. This new product launched by the company and increased demand of invisible orthodontics have increased its demand and sales in the market leading to increased revenue in future.

This new product launched by the company has increased its protein estimation portfolio in the market. Collaboration, joint ventures and other strategies by the market player is enhancing the company market in the Invisible orthodontics market which also provides the benefit for organisation to improve their offering for invisible orthodontics market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS AND SERVICES LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 REGULATIONS OF INVISIBLE ORTHODONTICS MARKET

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN PREVALENCE OF MALOCCLUSION

5.1.2 GROWING ADULT ORTHODONTICS

5.1.3 INCREASED COSMETIC AWARENESS

5.1.4 GROWING NUMBER OF GPS OFFERING ORTHODONTIC SERVICES

5.1.5 RISING DEMAND FOR MINIMALLY INVASIVE SURGICAL TECHNIQUES

5.2 RESTRAINTS

5.2.1 HIGH PRICE OF INVISIBLE ORTHODONTICS

5.2.2 STRICT REGULATORY APPROVAL

5.3 OPPORTUNITIES

5.3.1 TECHNOLOGICAL ADVANCEMENT OF COSMETIC DENTISTRY TECHNIQUES

5.3.2 INTRODUCTION OF CAM/CAD TECHNOLOGY IN ORTHODONTICS

5.3.3 INCREASING HEALTH CARE EXPENDITURE

5.3.4 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 LIMITATIONS ASSOCIATED WITH THE INVISIBLE ORTHODONTICS

5.4.2 MARKET COMPETITION

5.4.3 EMERGENCE OF COVID-19

6 IMPACT OF COVID-19 ON NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON DEMAND

6.3 IMPACT ON SUPPLY CHAIN

6.4 STRATEGIC DECISIONS OF GOVERNMENT AND MANUFACTURERS

6.5 CONCLUSION

7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES

7.1 OVERVIEW

7.2 PRODUCTS

7.2.1 CLEAR ALIGNERS

7.2.2 CERAMIC BRACES

7.2.3 CLEAR RETAINERS

7.2.4 LINGUAL BRACES

7.3 SERVICES

8 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS

8.1 OVERVIEW

8.2 ADULTS

8.2.1 CLEAR ALIGNERS

8.2.2 CERAMIC BRACES

8.2.3 CLEAR RETAINERS

8.2.4 LINGUAL BRACES

8.3 TEENAGERS

8.3.1 CLEAR ALIGNERS

8.3.2 CERAMIC BRACES

8.3.3 CLEAR RETAINERS

8.3.4 LINGUAL BRACES

8.4 CHILDREN

8.4.1 CLEAR ALIGNERS

8.4.2 CERAMIC BRACES

8.4.3 CLEAR RETAINERS

8.4.4 LINGUAL BRACES

9 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MALOCCLUSION

9.2.1 CLEAR ALIGNERS

9.2.2 CERAMIC BRACES

9.2.3 CLEAR RETAINERS

9.2.4 LINGUAL BRACES

9.3 CROWDING

9.3.1 CLEAR ALIGNERS

9.3.2 CERAMIC BRACES

9.3.3 CLEAR RETAINERS

9.3.4 LINGUAL BRACES

9.4 EXCESSIVE SPACING

9.4.1 CLEAR ALIGNERS

9.4.2 CERAMIC BRACES

9.4.3 CLEAR RETAINERS

9.4.4 LINGUAL BRACES

9.5 OTHERS

10 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DENTAL CLINICS

10.4 ORTHODONTIC CLINICS

10.5 OTHERS

11 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 THIRD PARTY DISTRIBUTORS

12 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INVISIBLE ORTHODONTICS: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ALIGN TECHNOLOGY, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SMILEDIRECTCLUB

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 HENRY SCHEIN ORTHODONTICS (A SUBSIDIARY OF HENRY SCHEIN, INC.)

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 DENTSPLY SIRONA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 3M

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ALIGNERCO

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AMERICAN ORTHODONTICS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CANDID CARE CO.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DB ORTHODONTICS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 DENTAURUM GMBH & CO. KG

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DR SMILE DENTAL CLINIC

15.11.1 COMPANY SNAPSHOT

15.11.2 SERVICE PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 DYNAFLEX

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FORESTADENT - BERNHARD FOERSTER GMBH

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 G&H ORTHODONTICS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 GREAT LAKES DENTAL TECHNOLOGIES

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 INSTITUT STRAUMANN AG

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 ORMCO CORPORATION (A SUBSIDIARY OF ENVISTA)

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 ORTHO-CARE (UK) LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 ROCKY MOUNTAIN ORTHODONTICS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SMILE2IMPRESS SL

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 STRAIGHT TEETH DIRECT

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SUNSHINE SMILE GMBH

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 TP ORTHODONTICS, INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 WONDERSMILE

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 COST OF CERAMIC BRACES IN THE U.S.

TABLE 2 GENERAL AND MEDICAL INFLATION RATES FOR SELECTED COUNTRIES

TABLE 3 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SERVICES IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DENTAL CLINICS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ORTHODONTICS CLINICS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA DIRECT SALES IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2020 (USD MILLION)

TABLE 29 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INVISIBLE ORTHODONTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PRODUCTS IN INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 43 U.S. INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 44 U.S. INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 45 U.S. INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 46 U.S. ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 47 U.S. TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 48 U.S. CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 49 U.S. INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 U.S. MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 U.S. CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 U.S. EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 U.S. INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 U.S. INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 CANADA INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 56 CANADA INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 57 CANADA INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 58 CANADA ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 59 CANADA TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 60 CANADA CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 61 CANADA INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 63 CANADA CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CANADA EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 CANADA INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 CANADA INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 MEXICO INVISIBLE ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 68 MEXICO INVISIBLE PRODUCTS IN ORTHODONTICS MARKET, BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

TABLE 69 MEXICO INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ADULTS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 71 MEXICO TEENAGERS IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CHILDREN IN INVISIBLE ORTHODONTICS MARKET, BY AGE GROUPS, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 MEXICO MALOCCLUSION IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 MEXICO CROWDING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 MEXICO EXCESSIVE SPACING IN INVISIBLE ORTHODONTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 77 MEXICO INVISIBLE ORTHODONTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 MEXICO INVISIBLE ORTHODONTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 GROWING ADULT ORTHODONTICS IS EXPECTED TO DRIVE THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA INVISIBLE ORTHODONTICS MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, 2021

FIGURE 17 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, 2021

FIGURE 21 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, 2020-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY AGE GROUPS, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, 2021

FIGURE 25 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, 2021

FIGURE 29 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 33 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: SNAPSHOT (2021)

FIGURE 37 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2021)

FIGURE 38 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 39 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 40 NORTH AMERICA INVISIBLE ORTHODONTICS MARKET: BY PRODUCTS AND SERVICES (2022-2029)

FIGURE 41 NORTH AMERICA INVISIBLE ORTHODONTICS: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.