North America Lymphangioleiomyomatosis Lam Market

Market Size in USD Million

CAGR :

%

USD

56.72 Million

USD

80.67 Million

2024

2032

USD

56.72 Million

USD

80.67 Million

2024

2032

| 2025 –2032 | |

| USD 56.72 Million | |

| USD 80.67 Million | |

|

|

|

|

North America Lymphangioleiomyomatosis (LAM) Market Size

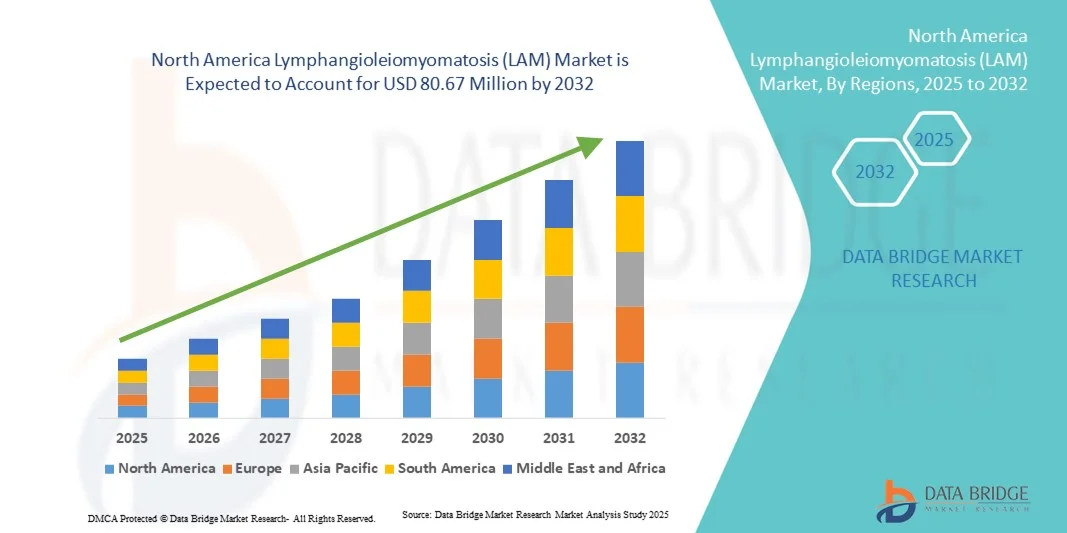

- The North America Lymphangioleiomyomatosis (LAM) market size was valued at USD 56.72 million in 2024 and is expected to reach USD 80.67 million by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is primarily driven by the increasing prevalence of rare lung disorders and heightened diagnostic awareness among healthcare professionals, leading to earlier identification and treatment of LAM cases across the region

- Furthermore, growing investments in rare disease research, advancements in mTOR inhibitor therapies, and supportive regulatory frameworks are strengthening treatment accessibility and innovation, thereby propelling the expansion of the North America LAM market

North America Lymphangioleiomyomatosis (LAM) Market Analysis

- Lymphangioleiomyomatosis (LAM), a rare lung disease that primarily affects women, is increasingly recognized across North America owing to improved diagnostic imaging, genetic testing, and heightened clinical awareness among pulmonologists and rare disease specialists

- The market’s expansion is largely fueled by advancements in molecular diagnostics, the availability of mTOR inhibitor therapies, and rising research funding focused on rare pulmonary disorders, contributing to improved disease management and patient outcomes

- The U.S. dominated the North America LAM market with the largest revenue share of 79.8% in 2024, supported by a strong presence of specialized healthcare centers, active clinical trials, and favorable reimbursement policies promoting access to advanced treatment options

- Canada is expected to witness the fastest growth during the forecast period due to the expansion of national rare disease frameworks, improved access to targeted therapies, and strengthening collaborations between hospitals and diagnostic laboratories

- The treatment segment dominated the North America LAM market with a market share of 64.6% in 2024, driven by the growing clinical adoption of targeted drug regimens such as sirolimus and everolimus, which have shown proven efficacy in stabilizing lung function and reducing disease-related complications

Report Scope and North America Lymphangioleiomyomatosis (LAM) Market Segmentation

|

Attributes |

North America Lymphangioleiomyomatosis (LAM) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Lymphangioleiomyomatosis (LAM) Market Trends

Advancements in Targeted Therapies and Genetic Research

- A significant and accelerating trend in the North America LAM market is the growing focus on targeted therapeutic development and genetic research aimed at understanding the molecular mechanisms driving the disease. This advancement is reshaping treatment strategies and patient management

- For instance, research institutions such as the National Institutes of Health (NIH) and the LAM Foundation are conducting extensive studies on mTOR pathway inhibitors and genetic mutations related to TSC1 and TSC2, providing new insights into disease modulation

- The adoption of precision medicine in LAM treatment is enabling tailored therapeutic approaches, improving patient outcomes, and reducing disease progression. For instance, the use of sirolimus and everolimus has demonstrated efficacy in stabilizing lung function and minimizing complications

- Furthermore, genetic testing and biomarker identification are facilitating early diagnosis and patient stratification, allowing clinicians to customize care plans more effectively. This integration of genomics is transforming traditional treatment paradigms

- The growing collaboration between academic research centers, pharmaceutical companies, and patient advocacy organizations is accelerating clinical trials and drug innovation for LAM, fostering a more research-driven and patient-centric treatment ecosystem

- This trend toward advanced molecular therapies and research-driven care is fundamentally redefining the LAM treatment landscape across North America, positioning the region as a hub for rare lung disease innovation and personalized medicine development

- The integration of artificial intelligence (AI) in diagnostic imaging is also enhancing detection accuracy and supporting clinicians in differentiating LAM from other pulmonary conditions at earlier stages

North America Lymphangioleiomyomatosis (LAM) Market Dynamics

Driver

Rising Awareness, Diagnostic Advancements, and Research Collaborations

- The increasing awareness of rare lung diseases among healthcare professionals, coupled with advancements in diagnostic imaging and genetic testing, is a significant driver of market growth for LAM in North America

- For instance, in February 2024, the LAM Foundation partnered with major research hospitals to expand LAM patient registries and facilitate early detection through enhanced diagnostic guidelines and physician training programs

- As awareness grows, patients benefit from earlier diagnosis and more effective treatment initiation, leading to better disease management and improved quality of life across the region

- Furthermore, strong collaboration among government bodies, research institutions, and biotech firms is fostering innovation in treatment pathways, expanding therapeutic options for patients with LAM

- The rising availability of clinical trials and access to mTOR inhibitor-based therapies are also driving adoption, supported by favorable reimbursement policies and rare disease funding programs across the U.S. and Canada. The growing recognition of LAM as a distinct rare disease entity further propels investment and clinical engagement

- Increasing patient advocacy and support organizations are raising awareness and influencing policy reforms to improve accessibility and funding for rare lung diseases

- The expansion of cross-border collaborations between North American and European research groups is strengthening data sharing and accelerating the development of next-generation LAM therapies

Restraint/Challenge

Limited Treatment Options and Delayed Diagnosis Hurdles

- The lack of disease-specific curative therapies and limited awareness of LAM symptoms among general practitioners remain major challenges, delaying diagnosis and access to timely treatment

- For instance, due to the rarity of LAM and overlapping symptoms with other lung disorders such as COPD or asthma, patients often experience diagnostic delays that affect disease management and outcomes

- Addressing these diagnostic challenges through better clinical education, awareness campaigns, and the adoption of standardized diagnostic criteria is crucial for improved detection rates and patient care

- In addition, the high cost of long-term LAM management, including imaging, drug therapy, and specialist consultations, can pose a financial burden for patients without comprehensive insurance coverage

- While healthcare initiatives are improving access, the small patient population limits commercial incentives for pharmaceutical investment, thereby restraining rapid innovation and drug pipeline expansion. Enhanced patient advocacy, funding, and regulatory support will be essential to overcome these barriers and ensure sustained market growth

- The side effects and tolerability issues associated with long-term mTOR inhibitor therapy can limit patient adherence and affect treatment outcomes, posing a challenge to therapy optimization

- Furthermore, limited awareness among payers regarding LAM’s chronic nature can delay reimbursement approvals for advanced therapies, thereby restricting patient access to innovative treatment options

North America Lymphangioleiomyomatosis (LAM) Market Scope

The market is segmented on the basis of disease type, type, complications, route of administration, end user, and distribution channel.

- By Disease Type

On the basis of disease type, the North America LAM market is segmented into tuberous sclerosis complex LAM (TSC-LAM) and sporadic LAM. The sporadic LAM segment dominated the market with the largest revenue share in 2024, driven by its higher prevalence among women without underlying genetic conditions. Sporadic LAM cases are more frequently diagnosed due to the increasing use of advanced imaging modalities such as HRCT and MRI, which enable early detection. The growing awareness among pulmonologists and improved access to genetic counseling programs have contributed significantly to diagnosis rates. Moreover, increased research funding and patient advocacy in the U.S. have accelerated the understanding of sporadic LAM pathogenesis. Hospitals and research centers are focusing on long-term disease management, improving treatment outcomes for this dominant segment.

The Tuberous Sclerosis Complex LAM segment is projected to witness the fastest growth rate during the forecast period, owing to increasing awareness of the association between LAM and the TSC gene mutations (TSC1 and TSC2). Genetic testing advancements and comprehensive screening programs for TSC patients are leading to earlier identification of LAM in this subgroup. Pharmaceutical companies are investing in targeted therapies and combination treatments for this form, supported by ongoing NIH and LAM Foundation studies. Moreover, the rising number of clinical trials exploring mTOR-based therapies specific to TSC-associated LAM is expected to further strengthen this segment’s rapid growth in the North American market.

- By Type

On the basis of type, the market is segmented into diagnosis and treatment. The treatment segment dominated the market with the largest revenue share of 64.6% in 2024, primarily due to the established efficacy of mTOR inhibitors such as sirolimus and everolimus in slowing LAM progression. The widespread clinical adoption of these drugs, supported by robust real-world evidence and physician preference, underpins the segment’s strong market performance. The availability of treatment guidelines from global respiratory societies and reimbursement coverage in the U.S. further encourage patient adherence. Hospitals and specialty clinics remain the leading distribution centers for these drugs, ensuring consistent access and monitoring. Moreover, increasing clinical trials exploring combination therapies and next-generation mTOR inhibitors are expected to sustain the dominance of this segment in the coming years.

The diagnosis segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by improvements in non-invasive diagnostic modalities, biomarker analysis, and genetic testing. The growing implementation of VEGF-D testing and HRCT imaging has significantly improved diagnostic accuracy. Furthermore, rising awareness initiatives by rare disease foundations are encouraging early screening and identification. The establishment of dedicated diagnostic centers and the integration of AI-based imaging tools are transforming the early detection landscape. Increasing collaboration among pulmonologists, radiologists, and genetic specialists is expected to further accelerate the growth of this segment across North America.

- By Complications

On the basis of complications, the market is segmented into pneumothorax, chylothorax, kidney tumor, pleural effusions, swelling & fluid build-up, and others. The pneumothorax segment dominated the market in 2024, accounting for the majority of hospital admissions among LAM patients. Pneumothorax, often one of the earliest signs of LAM, necessitates immediate medical intervention and long-term monitoring, driving significant healthcare spending. The rising incidence of recurrent pneumothorax and the growing adoption of advanced pleurodesis techniques contribute to the segment’s strong growth. Hospitals across North America are increasingly equipped with specialized thoracic surgical units and multidisciplinary teams to manage such cases effectively. Moreover, continuous improvements in imaging diagnostics and minimally invasive surgical procedures are helping reduce recurrence rates.

The chylothorax segment is expected to register the fastest growth during the forecast period, owing to a deeper understanding of lymphatic abnormalities in LAM pathogenesis. The adoption of targeted nutritional interventions and interventional radiology procedures such as thoracic duct embolization is improving patient survival outcomes. Increasing research on managing chylous effusions using novel therapies is further enhancing clinical management. Furthermore, rising clinical trial activity focusing on lymphatic involvement in LAM is expanding treatment options. Hospitals and specialty centers with advanced imaging and interventional capabilities are witnessing growing patient inflow for chylothorax-related complications, boosting this segment’s growth trajectory.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, parenteral, and others. The oral segment dominated the market in 2024, driven by the preference for oral mTOR inhibitors such as sirolimus and everolimus that provide convenience and sustained efficacy. Oral administration offers patient comfort, ease of long-term use, and reduced need for clinical visits, which enhances treatment adherence. The segment benefits from strong physician confidence in oral dosing protocols and favorable pharmacokinetic profiles. Furthermore, increasing availability of generic oral formulations and patient education programs by rare disease foundations are expanding accessibility. The oral route remains the most common and clinically approved method for managing LAM symptoms across North America.

The parenteral segment is projected to exhibit the fastest growth rate during the forecast period, primarily due to ongoing innovation in biologic and injectable therapies targeting rare lung diseases. The introduction of intravenous drug delivery in severe or refractory LAM cases is expected to enhance therapeutic efficacy. Hospitals and research centers are exploring injectable formulations for patients intolerant to oral medications. Moreover, clinical trials evaluating monoclonal antibodies and immune-modulating biologics are accelerating in North America. The shift toward precision-based, hospital-administered therapies is expected to expand this segment’s adoption in advanced treatment settings over the next decade.

- By End User

On the basis of end user, the market is divided into hospitals, specialty clinics, diagnostic centers, home healthcare, and others. The hospital segment dominated the North America LAM market in 2024, owing to the availability of comprehensive diagnostic and therapeutic infrastructure. Hospitals serve as primary treatment hubs offering pulmonary rehabilitation, surgical care, and access to clinical trials. The multidisciplinary approach in hospitals ensures better coordination between pulmonologists, radiologists, and geneticists for accurate disease management. In addition, hospitals handle a majority of LAM-related emergencies such as pneumothorax and pleural effusions, reinforcing their market share. Increasing hospital funding for rare disease units and partnerships with LAM foundations further contribute to this segment’s dominance.

The specialty clinics segment is expected to experience the fastest growth rate from 2025 to 2032, supported by the rising number of rare disease and pulmonary specialty centers across North America. Specialty clinics provide personalized care, long-term follow-up, and participation in rare disease research programs. The increasing role of specialized pulmonology centers and the establishment of dedicated LAM programs are fueling this growth. Moreover, patient awareness initiatives and access to expert consultations are driving preference toward these facilities. Technological integration, such as teleconsultation and remote monitoring, further enhances specialty clinics’ appeal for chronic LAM management.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, hospital pharmacies, retail pharmacies, online pharmacies, and others. The hospital pharmacies segment dominated the market in 2024 due to the centralized procurement and regulated distribution of LAM drugs within hospital systems. Hospital pharmacies ensure proper storage, dosage control, and patient counseling for long-term therapies such as sirolimus. These facilities also manage drug supply for clinical trials and hospital-based research programs. Moreover, partnerships between hospitals and pharmaceutical suppliers ensure consistent drug availability for inpatients and outpatients. Increasing hospital admissions for LAM management have strengthened this segment’s overall share.

The online pharmacies segment is forecasted to witness the fastest growth rate during the forecast period, propelled by the increasing acceptance of digital healthcare and e-commerce in pharmaceutical delivery. The growing trend of chronic disease management through virtual platforms supports the convenience of doorstep delivery. Patients benefit from automated refills, teleconsultation integration, and digital prescription uploads. In addition, collaborations between biopharma companies and licensed online distributors are improving access to rare disease medications. Expanding digital health infrastructure across the U.S. and Canada is further expected to drive this segment’s rapid growth over the coming years.

North America Lymphangioleiomyomatosis (LAM) Market Regional Analysis

- The U.S. dominated the North America LAM market with the largest revenue share of 79.8% in 2024, supported by a strong presence of specialized healthcare centers, active clinical trials, and favorable reimbursement policies promoting access to advanced treatment options

- The country’s leadership is reinforced by strong collaborations between pharmaceutical companies, academic research centers, and government-funded programs such as the NIH Rare Diseases Clinical Research Network

- Widespread availability of targeted therapies such as sirolimus and everolimus, along with increasing adoption of precision medicine approaches, has improved treatment accessibility and outcomes for patients

U.S. Lymphangioleiomyomatosis (LAM) Market Insight

The U.S. LAM market captured the largest revenue share of 79.8% in 2024 within North America, primarily driven by advanced diagnostic capabilities, strong clinical research activity, and growing patient awareness. The presence of leading research organizations, such as the National Institutes of Health (NIH) and the LAM Foundation, has accelerated the development of innovative therapeutic approaches. Increased adoption of targeted treatments such as mTOR inhibitors (sirolimus and everolimus) has improved patient outcomes, enhancing long-term management of LAM. Furthermore, robust healthcare infrastructure, rare disease funding initiatives, and supportive regulatory frameworks for orphan drugs continue to strengthen the market’s expansion in the U.S.

Canada Lymphangioleiomyomatosis (LAM) Market Insight

The Canada LAM market is projected to grow at a steady CAGR throughout the forecast period, supported by expanding healthcare awareness and enhanced access to rare disease diagnosis programs. The country’s universal healthcare system and collaborations with international rare disease networks are facilitating early detection and improved care pathways. Increased participation in global LAM research studies and clinical trials is also boosting treatment advancements. Moreover, government support through funding for rare lung disorders and rising patient advocacy are contributing to the market’s development in Canada, particularly within major provinces such as Ontario and British Columbia.

Mexico Lymphangioleiomyomatosis (LAM) Market Insight

The Mexico LAM market is anticipated to witness a moderate growth rate over the forecast period, primarily driven by the gradual strengthening of healthcare infrastructure and the expansion of specialty clinics catering to rare diseases. Growing public and private healthcare investments, along with improving diagnostic technologies, are helping address the historical underdiagnosis of LAM in the region. Increased cross-border collaborations with U.S.-based research institutions and the rising availability of affordable generic mTOR inhibitors are enhancing treatment accessibility. In addition, awareness initiatives led by patient organizations and healthcare professionals are expected to further improve early diagnosis and management outcomes for LAM patients in Mexico.

North America Lymphangioleiomyomatosis (LAM) Market Share

The North America Lymphangioleiomyomatosis (LAM) industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- Novartis AG (Switzerland)

- Intas Pharmaceuticals Ltd. (India)

- Apotex Inc. (Canada)

- Amneal Pharmaceuticals LLC (U.S.)

- Dr. Reddy's Laboratories Ltd (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Zydus Pharmaceuticals, Inc. (India)

- TransMedics, Inc. (U.S.)

- Terumo Corporation (Japan)

- Inogen, Inc. (U.S.)

- CareDx, Inc. (U.S.)

- XVIVO Perfusion AB (Sweden)

- Morgan Scientific Inc (U.S.)

- Taj Pharmaceuticals Limited (India)

- AstraZeneca (U.K.)

- Mallinckrodt Pharmaceuticals (U.S.)

- Catalent, Inc. (U.S.)

What are the Recent Developments in North America Lymphangioleiomyomatosis (LAM) Market?

- In January 2025, The LAM Foundation announced results from a study showing that the urotensin-II receptor (UT)-Gαq signalling pathway is hyper-active in TSC2-deficient LAM cells and operates independently of mTORC1 a major discovery in LAM biology

- In November 2024, the LAM Foundation reported the completion of the LAM-PREP survey phase, with over 750 community members responding, marking a major patient-engagement milestone. The preliminary findings revealed that while new treatments remain the top research priority, patients also strongly prioritise understanding hormonal influences on disease, mental-health support, and improved access to comprehensive care

- In May 2024, pre-clinical results on the bi-steric mTORC1-selective inhibitor RMC‑5552 were published, demonstrating that it more durably inhibits LAM-associated fibroblast growth than rapamycin and may eradicate LAM cancer stem-such as cells

- In March 2024, the The LAM Foundation (TLF) launched the second phase of the “LAM Patient Research & Priorities” Survey (LAM-PREP), inviting the broader LAM community patients, caregivers, clinicians—to rank research and health-care priorities

- In February 2022, researchers at the National Heart, Lung, and Blood Institute (NHLBI) reported that LAM lung nodules contain cells exhibiting a “mixed blood-lymphatic endothelial cell phenotype” meaning the same cells co-express markers typical of both blood vascular and lymphatic endothelial cells

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.