North America Medical Foods For Inborn Errors Of Metabolism Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

3.51 Billion

2024

2032

USD

1.32 Billion

USD

3.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 3.51 Billion | |

|

|

|

|

North America Medical Foods for Inborn Errors of Metabolism Market Size

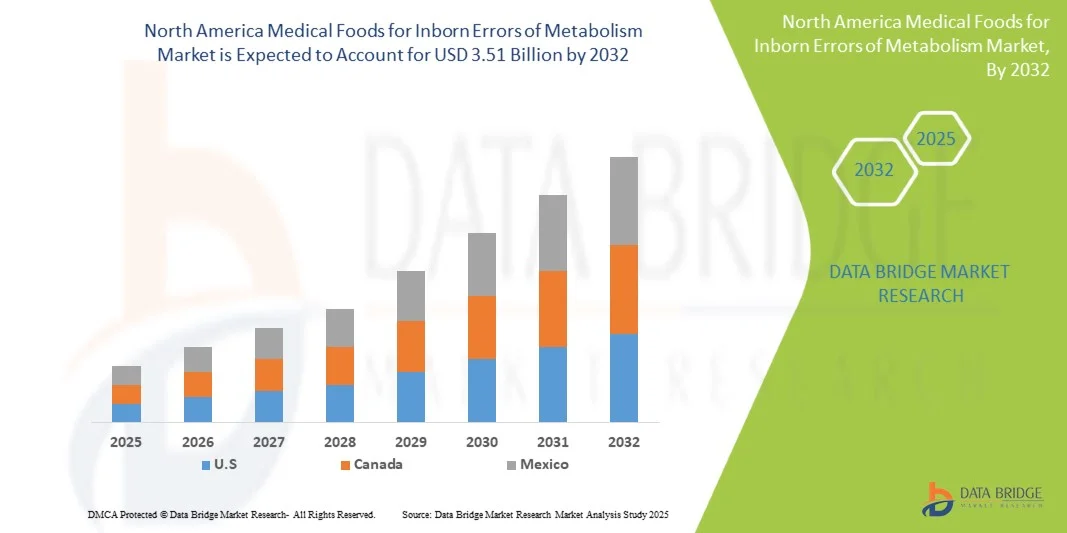

- The North America medical foods for inborn errors of metabolism market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 3.51 billion by 2032, at a CAGR of 13.00% during the forecast period

- This growth is primarily driven by the increasing prevalence of inborn errors of metabolism (IEMs) in the region, advancements in newborn screening programs, and the rising demand for specialized medical foods tailored to manage these genetic disorders

- The market is further supported by the expansion of online distribution platforms, which enhance accessibility to medical foods for patients and caregivers, thereby facilitating timely and consistent management of IEMs

North America Medical Foods for Inborn Errors of Metabolism Market Analysis

- Medical foods for inborn errors of metabolism (IEMs) in North America, including specialized formulas, supplements, and low-protein foods, are increasingly essential for managing genetic metabolic disorders in both pediatric and adult populations due to their role in preventing complications and supporting nutritional needs

- The market growth is primarily driven by the rising prevalence of IEMs, expansion of newborn screening programs, and increasing awareness among healthcare providers and caregivers about the importance of early dietary management for these disorders

- The United States dominated the market with the largest revenue share of 82% in 2024, supported by well-established healthcare infrastructure, higher healthcare expenditure, and the presence of leading medical foods manufacturers. U.S. hospitals, clinics, and home care providers are increasingly implementing medical foods as standard care for IEM patients

- Canada is expected to be the fastest-growing country in the market during the forecast period, due to improved diagnostic capabilities, growing awareness, and increasing government support for rare disease management

- Amino acid segment dominated the market with a market share of 45.5% in 2024, driven by their proven effectiveness in managing disorders such as phenylketonuria (PKU) and maple syrup urine disease (MSUD), as well as their broad availability through hospitals, pharmacies, and online channels

Report Scope and North America Medical Foods for Inborn Errors of Metabolism Market Segmentation

|

Attributes |

North America Medical Foods for Inborn Errors of Metabolism Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Medical Foods for Inborn Errors of Metabolism Market Trends

Expansion of Personalized and Disease-Specific Formulations

- A significant and accelerating trend in the North American medical foods market for inborn errors of metabolism (IEMs) is the development of personalized and disease-specific formulations, including amino acid-based supplements and low-protein foods, tailored to individual patient needs

- For Instance, Nestlé Health Science introduced PKU-specific formulas that cater to patient-specific dietary requirements, ensuring precise nutrient management. Similarly, Vitaflo launched low-protein modular foods that can be customized for multiple metabolic disorders

- Advanced formulation technologies allow manufacturers to improve taste, palatability, and nutrient bioavailability, which enhance patient adherence to long-term dietary regimens and overall treatment outcomes. Instance, Abbott Laboratories optimized phenylalanine-free formulas with improved flavor profiles to encourage consistent consumption

- The integration of medical foods with digital health platforms, such as apps for monitoring nutrient intake and metabolic levels, facilitates personalized dietary management and better patient compliance. Instance, Danone Nutricia provides digital tracking tools alongside its metabolic formulas for monitoring patient intake

- This trend towards personalized, patient-centric, and technology-supported medical foods is reshaping treatment standards for IEMs, with companies focusing on innovations that combine clinical efficacy and patient convenience. Instance, Cambrooke Therapeutics developed AI-assisted recommendations for IEM dietary planning

- The demand for highly specialized, safe, and effective medical foods is growing rapidly across pediatric and adult populations, driven by increasing awareness among caregivers and healthcare providers about the importance of early and precise dietary management

North America Medical Foods for Inborn Errors of Metabolism Market Dynamics

Driver

Rising Prevalence of IEMs and Growing Awareness

- The increasing incidence of inborn errors of metabolism in North America, combined with heightened awareness among healthcare professionals and caregivers, is a key driver for market growth

- For Instance, in 2023, Abbott Laboratories expanded distribution of amino acid-based medical foods in U.S. hospitals, aiming to improve access for newborns diagnosed with PKU and other metabolic disorders

- Medical foods provide targeted nutritional support, preventing metabolic complications, supporting growth, and reducing hospitalizations, making them essential for patient management

- Furthermore, government programs and newborn screening initiatives are facilitating early diagnosis and intervention, thereby increasing the demand for specialized dietary products for IEM patients

- Increased adoption of home care and remote dietary management solutions is also propelling market growth, as families and caregivers prefer accessible, safe, and clinically approved medical foods

- Rising research and development in novel formulations and supplements tailored for rare metabolic disorders is creating new growth avenues. Instance, Vitaflo’s research on low-protein pediatric nutrition is expanding treatment options

- Collaborations between medical food companies and academic institutions to develop evidence-based nutritional therapies are driving innovation and boosting market credibility. Instance, Danone Nutricia partnered with a U.S. university to study long-term metabolic outcomes in IEM patients

Restraint/Challenge

High Costs and Limited Awareness in Certain Populations

- The relatively high cost of specialized medical foods compared to standard dietary products poses a challenge to widespread adoption, particularly among uninsured or underinsured populations

- For Instance, smaller clinics in rural U.S. regions report difficulty in stocking premium metabolic formulas due to budget constraints, limiting access for patients in need

- In addition, limited awareness among some caregivers and healthcare providers about the full benefits of medical foods for IEMs can hinder timely adoption and adherence to dietary protocols

- While digital tools and patient education programs are improving knowledge, lack of comprehensive insurance coverage for medical foods continues to restrict market penetration

- Addressing these challenges through reimbursement support, cost-reduction strategies, and targeted awareness campaigns will be critical for ensuring broader access and sustained growth of the market

- Regulatory compliance requirements for medical foods, including strict labeling, safety, and efficacy standards, can delay product launches and increase operational costs for manufacturers. Instance, Nutricia faced delays in FDA approval for a new PKU formula due to labeling compliance requirements

- Logistical challenges in distributing temperature-sensitive or specialized medical foods across remote or underserved regions can limit market reach. Instance, small healthcare providers report difficulty maintaining cold-chain storage for certain amino acid-based products

North America Medical Foods for Inborn Errors of Metabolism Market Scope

The market is segmented on the basis of products, age group, diseases, forms, packaging, and distribution channels.

- By Products

On the basis of products, the market is segmented into Amino Acid, Glytactin with GMP Amino Acid-Modified Infant Formula With Iron, Low-Calcium/Vitamin D-Free Infant Formula With Iron, Low Protein Food, and Others. The Amino Acid segment dominated the market with the largest revenue share of 46.5% in 2024, driven by its essential role in managing disorders such as PKU, MSUD, and homocystinuria. These formulations are highly specialized, clinically tested, and widely adopted in hospitals and home care settings due to their effectiveness in preventing metabolic complications. Amino acid-based medical foods are also supported by increased newborn screening programs and physician recommendations for early intervention. Growing patient awareness and acceptance, coupled with improved taste and palatability, further reinforce its dominant position in the market. Long-term clinical outcomes and adherence benefits make this segment a critical choice for metabolic disorder management.

The Low Protein Food segment is anticipated to witness the fastest growth rate of 15.8% from 2025 to 2032, fueled by rising consumer awareness of dietary management for IEMs outside clinical settings. These foods are gaining popularity among adolescents and adults who require long-term metabolic control, providing convenience, taste, and compliance support. Innovations in nutrient fortification and ready-to-consume formulations are further enhancing their adoption. Increased home-based care and focus on quality-of-life improvements drive growth in this segment. Patients and caregivers are seeking accessible and palatable options, making low protein foods a fast-growing category.

- By Age Group

On the basis of age group, the market is segmented into Infants, Weaning, Adolescents, and Adults. The Infants segment dominated the market with the largest revenue share of 52% in 2024, owing to the critical need for early dietary intervention in conditions such as PKU and MSUD. Hospitals, pediatric clinics, and neonatal care units increasingly rely on specialized infant formulas to manage metabolic disorders effectively from birth. Early intervention through infant medical foods helps prevent severe complications and supports normal growth and cognitive development. Government and private screening initiatives promote early adoption of infant-specific formulations. Clinician recommendations and parental awareness strongly favor the use of infant medical foods. Advanced formulations with improved taste and nutrient balance make this segment widely preferred.

The Adolescents segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increased focus on maintaining dietary control during transitional years when patients may move from supervised care to self-management. Nutritional products tailored for adolescents, including low-protein snacks and amino acid supplements, are seeing growing adoption in home and school environments. The growing availability of palatable and convenient formulations encourages adherence. Awareness programs in schools and clinics are supporting this trend. Technological integration, such as app-based dietary tracking, further supports adolescent management. Lifestyle flexibility and dietary independence needs make this age group highly responsive to innovative products.

- By Diseases

On the basis of diseases, the market is segmented into Phenylketonuria (PKU), Maple Syrup Urine Disease (MSUD), Homocystinuria, Methylmalonic Acidemia, Organic Acidurias, Propionic Acidemia, Isovaleric Acidemia, Disorders of Leucine Metabolism, Glutaric Acidemia Type I, Renal Disease, Tyrosinemia Types I and II, Urea Cycle Disorders, and Others. The PKU segment dominated the market with the largest revenue share of 38% in 2024, owing to its high prevalence and the established effectiveness of dietary management through amino acid-based formulas. Continuous nutritional therapy is essential to prevent cognitive impairment and metabolic crises, driving demand for PKU-specific medical foods. Hospitals and specialty clinics actively promote PKU dietary interventions. The segment benefits from strong clinical validation and patient adherence programs. Growing awareness among caregivers and healthcare providers reinforces PKU formula adoption. Insurance coverage for medical foods also contributes to sustained growth in this segment.

The Urea Cycle Disorders segment is expected to witness the fastest CAGR from 2025 to 2032 due to rising awareness, improved diagnosis, and the introduction of targeted medical foods designed to manage nitrogen accumulation effectively. Specialized formulas tailored for this disorder are gaining popularity in hospitals and home care. Caregiver education programs and nutritional counseling support adherence. Innovations in taste and formulation make the products more acceptable to patients. Growth is also driven by increasing incidence reporting and early detection. Online and retail availability enhances patient access, supporting rapid adoption.

- By Forms

On the basis of forms, the market is segmented into Powder, Liquids, Gels, and Others. The Powder segment dominated the market with a revenue share of 55% in 2024, favored for its longer shelf life, ease of storage, and suitability for mixing customized quantities for patient-specific needs. Healthcare providers and caregivers prefer powders for their versatility in administering exact dosages and ensuring metabolic control. The segment is widely adopted across hospitals, pharmacies, and home care. Enhanced taste and nutrient stability make powder forms highly desirable. Powdered formulations also allow for flexible packaging and portioning. Their compatibility with both infant and adult products reinforces dominance.

The Liquids segment is expected to witness the fastest CAGR from 2025 to 2032, driven by convenience, ready-to-consume formulations, and increasing acceptance in pediatric and adult patients who require easy-to-administer products. Hospitals, clinics, and home care settings increasingly favor liquid medical foods for immediate use. Enhanced palatability and flavor variety encourage patient compliance. Technological advancements in shelf-stable liquid formulations support growth. Online distribution further boosts accessibility. Liquids also simplify dosing for caregivers managing multiple patients or age groups.

- By Packaging

On the basis of packaging, the market is segmented into can, jar, packets, bottle, and others. The Can segment dominated the market with the largest revenue share of 47% in 2024, due to its durability, long shelf life, and suitability for bulk purchase and storage in hospital and home environments. Cans also allow for precise measurement and extended usage without compromising product quality. The segment is favored for infant and adolescent products. Hospitals and specialty clinics prefer canned formulations for consistent supply. The robust packaging ensures protection against contamination. Cans are cost-effective for long-term storage and distribution.

The Packets segment is expected to witness the fastest CAGR from 2025 to 2032, driven by convenience, portability, and individual serving sizes, making it easier for patients and caregivers to maintain daily dietary compliance outside the home or clinic. Ready-to-use packets encourage adherence in adolescents and adults. Portability and pre-measured doses simplify dosing for caregivers. Innovative packaging also allows for travel-friendly options. Growth is supported by online and retail sales expansion. Packets are increasingly preferred for school, work, and travel scenarios.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Retail Pharmacies, Hospital Pharmacies, Drug Stores, Online Pharmacies, and Others. Hospital Pharmacies dominated the market with the largest revenue share of 50% in 2024, as hospitals and clinics are primary points of access for prescribed medical foods, ensuring supervised usage and patient adherence. Hospitals also facilitate patient education, follow-up, and dosage customization. The segment benefits from strong clinical integration and professional guidance. Hospital pharmacies are key for early interventions and emergency supplies. Regulatory compliance and safety monitoring reinforce reliance on hospitals. Bulk procurement by hospitals ensures consistent availability.

The Online Pharmacies segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing digital adoption, convenience of home delivery, and the growing trend of e-commerce in healthcare. Online channels provide easier access to specialized medical foods, particularly for patients in remote or underserved areas. Subscription services and doorstep delivery improve adherence. Patients and caregivers prefer online platforms for product variety. Online pharmacies also enable discreet purchasing of medical foods. Technological tools integrated with online sales support patient tracking and reminders.

North America Medical Foods for Inborn Errors of Metabolism Market Regional Analysis

- The U.S. dominated the market with the largest revenue share of 82% in 2024, supported by well-established healthcare infrastructure, higher healthcare expenditure, and the presence of leading medical foods manufacturers. U.S. hospitals, clinics, and home care providers are increasingly implementing medical foods as standard care for IEM patients

- Patients and caregivers in the region highly value the availability of specialized medical foods, including amino acid-based formulas and low-protein foods, which are clinically proven to manage conditions such as PKU, MSUD, and homocystinuria effectively

- This widespread adoption is further supported by high healthcare expenditure, growing awareness among healthcare providers and parents, and the expanding presence of leading medical foods manufacturers, establishing the United States as the primary market for both pediatric and adult IEM management

Canada Medical Foods for Inborn Errors of Metabolism Market Insight

The Canada medical foods market is projected to expand at a notable CAGR during the forecast period, driven by increased awareness of inborn errors of metabolism and improved diagnostic capabilities. Healthcare providers and caregivers are adopting specialized formulas for PKU, MSUD, and urea cycle disorders to ensure proper metabolic control. Government programs and public health initiatives supporting rare disease management are facilitating access to medical foods. The growing integration of telemedicine and digital dietary management tools is further supporting adoption across pediatric and adult patient populations. Canada’s emphasis on healthcare accessibility and patient education enhances market growth, with hospitals and clinics serving as primary distribution channels.

Mexico Medical Foods for Inborn Errors of Metabolism Market Insight

The Mexico medical foods market is expected to grow at a considerable CAGR during the forecast period, fueled by rising awareness of metabolic disorders and expanding healthcare infrastructure. Early diagnosis through newborn screening and the increasing availability of hospital-based dietary programs support market adoption. Patients and caregivers are seeking convenient, clinically approved dietary solutions for conditions such as PKU and homocystinuria. Government and private initiatives promoting rare disease management further drive growth. The increasing presence of specialized medical foods manufacturers and distribution partnerships with pharmacies and hospitals is boosting accessibility. Mexico’s urban population and rising healthcare expenditure are contributing to higher market penetration.

North America Medical Foods for Inborn Errors of Metabolism Market Share

The North America Medical Foods for Inborn Errors of Metabolism industry is primarily led by well-established companies, including:

- Nutricia (U.S.)

- Abbott (U.S.)

- Baxter (U.S.)

- Nestlé Health Science (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- Hexagon Nutrition Ltd (India)

- Kate Farms (U.S.)

- Primus Pharmaceuticals, Inc. (U.S.)

- Ajinomoto Cambrooke, Inc. (U.S.)

- Galen Limited (U.K.)

- Piam Farmaceutici S.P.A. (Italy)

- Orpharma Pty Ltd. (Australia)

- PKU-Mdmil.com (U.S.)

- B. Braun SE (Germany)

- Pristine Organics Pvt Ltd. (India)

- Mead Johnson & Company, LLC. (U.S.)

- EBM Medical (U.S.)

- Biovencer Healthcare Pvt Ltd (India)

- Solace Nutrition (U.S.)

What are the Recent Developments in North America Medical Foods for Inborn Errors of Metabolism Market?

- In May 2025, A leading manufacturer introduced a new formulation of Glytactin with GMP amino acid-modified infant formula with iron, specifically designed for the dietary management of inborn errors of metabolism. This product aims to provide essential nutrients while minimizing the intake of specific amino acids, catering to infants diagnosed with conditions such as phenylketonuria (PKU). The launch reflects the industry's commitment to developing specialized nutritional solutions for metabolic disorders

- In October 2023, Nestlé Health Science and Amwell announced a collaboration to develop digital solutions for nutrition and health. This partnership aims to integrate innovative digital tools with nutritional care to improve patient outcomes, particularly for those with chronic conditions that require specialized nutrition

- In July 2023, the U.S. Food and Drug Administration (FDA) released a revised draft guidance for the industry, titled "Inborn Errors of Metabolism That Use Dietary Management: Considerations for Optimizing and Standardizing Diet in Clinical Trials for Drug Product Development." This guidance is significant because it provides recommendations for incorporating dietary management, which often includes medical foods, into clinical trials for new drug products

- In October 2022, Galen launched TYR EASY Tablets in the UK, a solid-dose protein substitute for tyrosinemia. While the primary market mentioned in this article is the UK, this development is relevant to the North American market as it demonstrates a significant trend toward more convenient and patient-friendly product forms. Galen's products are often available globally, and this innovation directly addresses a key challenge in IEM management: adherence to lifelong dietary therapy

- In December 2021, SFI Health launched two new medical foods in the U.S., including EQUAZEN PRO, a medical food for the dietary management of ADHD. While not exclusively for IEMs, this development aligns with the broader trend of targeted nutritional therapies. The launch of such specialized products demonstrates a continued focus on creating precise nutritional interventions for complex metabolic and neurological conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.