North America Molecular Point Of Care Testing Using Naat Market

Market Size in USD Billion

CAGR :

%

USD

20.07 Billion

USD

50.05 Billion

2024

2032

USD

20.07 Billion

USD

50.05 Billion

2024

2032

| 2025 –2032 | |

| USD 20.07 Billion | |

| USD 50.05 Billion | |

|

|

|

|

North America Molecular Point of Care Testing (using NAAT) Market Size

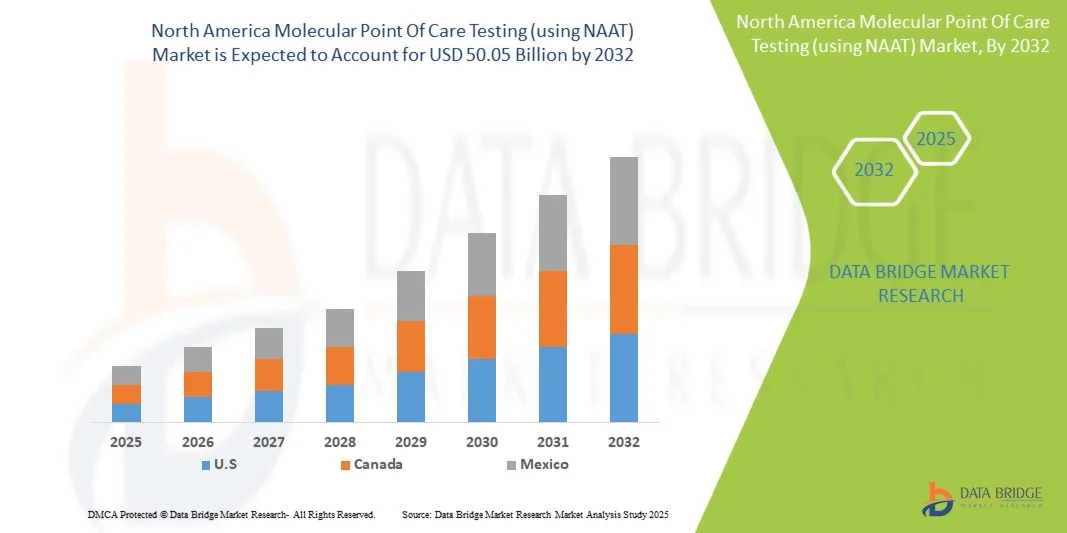

- The North America molecular point of care testing (using NAAT) market size was valued at USD 20.07 billion in 2024 and is expected to reach USD 50.05 billion by 2032, at a CAGR of 12.1% during the forecast period

- The market growth is largely fueled by increasing prevalence of infectious diseases, rising demand for rapid and accurate diagnostics, and technological advancements in NAAT platforms, enabling efficient point-of-care testing outside traditional laboratory settings

- Furthermore, the shift towards decentralized healthcare, along with growing adoption of portable, automated, and user-friendly NAAT-based POCT solutions, is driving market expansion across hospitals, clinics, and other healthcare facilities, thereby significantly boosting the industry’s growth

North America Molecular Point Of Care Testing (using NAAT) Market Analysis

- North Molecular point of care testing (POCT) using NAAT, offering rapid and highly accurate nucleic acid-based diagnostics at or near the patient site, is increasingly becoming a critical component of modern healthcare delivery in both clinical and decentralized settings due to its speed, precision, and ease of integration with existing diagnostic workflows

- The escalating demand for North America molecular POCT is primarily fueled by the rising prevalence of infectious diseases, growing need for timely diagnosis, and increasing adoption of portable, automated, and user-friendly testing platforms

- The United States dominated the North America molecular POCT market with the largest revenue share of 45.6% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players, with substantial growth in NAAT-based POCT adoption across hospitals, clinics, and community health centers, driven by innovations from both established diagnostics companies and startups focusing on multiplex testing and rapid-result platforms

- Canada is expected to be the fastest-growing country in the North America molecular POCT market during the forecast period due to increasing government initiatives for early disease detection and expanding adoption of point-of-care diagnostics in clinical and remote healthcare settings

- Respiratory infections segment dominated the North America molecular POCT market with a market share of 34.6% in 2024, driven by the high incidence of diseases such as influenza and COVID-19 and the need for rapid and accurate testing in both hospital and outpatient settings

Report Scope and North America Molecular Point of Care Testing (using NAAT) Market Segmentation

|

Attributes |

North America Molecular Point of Care Testing (using NAAT) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Molecular Point Of Care Testing (using NAAT) Market Trends

Enhanced Convenience Through Rapid, Portable Testing

- A significant and accelerating trend in the North America NAAT POCT market is the development of highly portable, rapid diagnostic devices that enable testing at or near the patient site, significantly reducing turnaround times for infectious disease detection

- For instance, the Cepheid GeneXpert Omni allows healthcare providers to perform molecular testing for tuberculosis or COVID-19 in remote clinics, delivering results within an hour without the need for central laboratory infrastructure

- Advanced NAAT platforms now incorporate automated sample preparation, multiplex testing, and touchscreen interfaces, allowing non-laboratory staff to perform accurate diagnostics with minimal training, improving patient outcomes and operational efficiency

- The seamless integration of NAAT POCT devices with electronic health records (EHRs) and mobile applications allows centralized monitoring, data reporting, and workflow optimization, facilitating rapid response to infectious disease outbreaks

- This trend towards faster, more user-friendly, and interconnected molecular testing systems is fundamentally reshaping expectations for point-of-care diagnostics. Consequently, companies such as Abbott and Roche are developing NAAT POCT solutions with real-time connectivity and intuitive interfaces for clinicians

- The demand for rapid, portable, and integrated NAAT POCT solutions is growing steadily across hospitals, clinics, and community health centers, as healthcare providers increasingly prioritize timely diagnosis and decentralized testing capabilities

North America Molecular Point Of Care Testing (using NAAT) Market Dynamics

Driver

Growing Need Due to Rising Infectious Disease Burden and Decentralized Healthcare

- The increasing prevalence of infectious diseases, coupled with the accelerating shift towards decentralized healthcare delivery, is a significant driver for the heightened demand for NAAT-based POCT

- For instance, in 2024, Abbott launched the ID NOW platform for rapid molecular testing of respiratory infections in urgent care centers, highlighting how innovations by key companies drive market growth in the forecast period

- As healthcare providers focus on early and accurate diagnosis to improve patient outcomes, NAAT POCT devices offer high sensitivity and specificity, enabling timely intervention and disease containment

- Furthermore, government initiatives supporting rapid diagnostics in community and rural health settings are making NAAT POCT an essential component of healthcare infrastructure

- The ease of use, rapid turnaround time, and the ability to test multiple pathogens simultaneously are key factors propelling NAAT POCT adoption in both hospital and outpatient settings, while the increasing availability of user-friendly devices further supports market expansion

Restraint/Challenge

Technical Complexity and Regulatory Compliance Hurdle

- Concerns surrounding device accuracy, operational errors, and regulatory compliance pose a significant challenge to broader adoption of NAAT POCT, particularly in decentralized or low-resource settings

- For instance, reports of invalid or inconclusive results from improperly handled samples have made some clinicians cautious in deploying NAAT POCT outside traditional laboratories

- Addressing these concerns through robust device validation, quality control protocols, and comprehensive training is crucial for building confidence among healthcare providers. Companies such as Cepheid and Roche emphasize device reliability, automated workflows, and regulatory certifications in their product offerings to reassure users

- In addition, high costs of advanced NAAT POCT platforms compared to conventional laboratory testing can limit adoption, especially in smaller clinics or rural areas with budget constraints

- While costs are gradually decreasing and portable solutions are becoming more accessible, the perceived complexity and initial investment for NAAT POCT can still hinder widespread implementation, particularly where staff training or infrastructure is limited

North America Molecular Point Of Care Testing (using NAAT) Market Scope

The market is segmented on the basis of product, indication, end user, mode of testing, and distribution channel.

- By Product

On the basis of product, the NAAT POCT market is segmented into instruments and consumables & reagents. The instruments segment dominated the market with the largest revenue share in 2024, driven by the critical role of automated NAAT devices in enabling rapid, accurate molecular testing at point-of-care sites. Hospitals, clinics, and laboratories prioritize investing in high-performance instruments due to their reliability, reproducibility, and capacity for multiplex testing. Instruments support tests for respiratory, STI, and gastrointestinal infections, making them versatile for diverse clinical needs. Portability and compact designs have increased adoption in decentralized healthcare settings, including community clinics and urgent care centers. Technological advancements such as integrated sample preparation, touchscreen interfaces, and real-time reporting further enhance workflow efficiency and patient outcomes. Robust after-sales support and service agreements also contribute to sustained instrument adoption across North America.

The consumables & reagents segment is anticipated to witness the fastest growth from 2025 to 2032 due to the recurring need for test kits, cartridges, and reagents to perform NAAT assays. Growth is supported by rising testing volumes driven by infectious disease outbreaks and routine screening programs. Manufacturers are developing ready-to-use kits with longer shelf life and simplified protocols, reducing operational complexity and enabling faster deployment in clinical and non-clinical settings. Increasing focus on cost-effective reagents with consistent performance is driving adoption in small clinics and decentralized healthcare units. The growth of the consumables market also benefits from partnerships between diagnostic companies and distributors to ensure seamless supply. Rising awareness among healthcare professionals about using high-quality reagents to improve test accuracy further accelerates demand.

- By Indication

On the basis of indication, the market is segmented into respiratory infections testing, sexually transmitted infection (STI) testing, gastrointestinal tract infections testing, and others. The respiratory infections testing segment dominated the market in 2024 with a market share of 34.6% due to high prevalence of diseases such as influenza, RSV, and COVID-19, which require rapid and accurate diagnostics to prevent outbreaks. Hospitals and clinics prioritize NAAT POCT for respiratory infections because of its high sensitivity, rapid turnaround time, and ability to facilitate timely clinical decisions. Government initiatives for respiratory disease surveillance and hospital preparedness programs further reinforce the segment’s dominance. Increasing outbreaks in community settings and urgent care centers have boosted the demand for rapid testing solutions. High adoption is also driven by technological enhancements such as multiplex detection for multiple respiratory pathogens in a single assay. Strategic collaborations between diagnostic manufacturers and healthcare institutions strengthen market penetration.

The STI testing segment is expected to witness the fastest growth from 2025 to 2032 due to increasing awareness, rising prevalence of infections such as chlamydia, gonorrhea, and HIV, and emphasis on early diagnosis and treatment. NAAT POCT for STIs offers advantages such as minimal sample preparation, quick results, and suitability for decentralized testing, making it attractive for clinics, mobile testing units, and community health programs. Initiatives promoting sexual health education and home-based testing kits further drive segment growth. Integration with electronic health records enables seamless reporting and follow-up care. Expanding private healthcare and telemedicine channels are also contributing to the segment’s rapid adoption.

- By End User

On the basis of end user, the market is segmented into laboratories, hospitals, clinics, home care, ambulatory centers, assisted living facilities, and others. The hospitals segment dominated the market in 2024 due to large patient volumes, high testing demand, and the need for rapid diagnosis in critical care settings. Hospitals benefit from integrated NAAT POCT systems that support multiple assays, automated workflows, and connectivity with electronic health records. Regulatory requirements for timely reporting of infectious diseases and the growing emphasis on patient safety drive adoption. Hospitals also prefer standardized instruments to ensure consistent performance across multiple departments. Training programs for staff and strong technical support from manufacturers further reinforce instrument deployment. Strategic procurement contracts with leading suppliers enhance cost-efficiency and availability.

The clinics segment is expected to witness the fastest growth from 2025 to 2032, fueled by the expansion of outpatient services and urgent care centers that require on-site rapid diagnostics. Clinics increasingly rely on portable and easy-to-use NAAT POCT devices to provide same-day results, enhance patient satisfaction, and reduce burden on centralized laboratories. The growth is further supported by telemedicine integration and mobile testing units. Rising healthcare accessibility in suburban and rural regions is driving adoption in clinic settings. Cost-effective devices with minimal training requirements are preferred for smaller clinics. Partnerships with diagnostic companies for supply and technical support facilitate rapid deployment and market expansion.

- By Mode of Testing

On the basis of mode of testing, the market is segmented into prescription-based testing and OTC-based testing. The prescription-based testing segment dominated the market in 2024 due to its wide acceptance among healthcare providers and strict regulatory oversight ensuring accuracy and reliability. Prescription-based NAAT POCT is preferred in clinical settings where trained professionals handle sample collection, testing, and interpretation. It supports integration with healthcare systems for patient management and reporting. Hospitals and laboratories benefit from standardized protocols that reduce errors. Government healthcare programs often promote prescription-based testing to ensure quality control. The segment also dominates due to higher reimbursement coverage in insurance plans.

The OTC-based testing segment is expected to witness the fastest growth from 2025 to 2032, driven by rising consumer awareness, home testing convenience, and availability of FDA-approved NAAT kits for self-collection and testing. OTC tests empower patients to conduct diagnostics at home for respiratory infections and STIs, offering rapid results while reducing clinic visits. Expansion of online sales channels further fuels adoption. Home-based testing solutions are increasingly integrated with mobile apps for guidance and result tracking. Marketing campaigns targeting early detection and convenience enhance consumer acceptance. Partnerships between manufacturers and pharmacies support widespread OTC distribution.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, third-party distributors, and online sales. The direct sales segment dominated the market in 2024 due to strong relationships between NAAT instrument manufacturers and large hospitals or laboratories, ensuring reliable supply, technical support, and maintenance. Direct sales also allow manufacturers to offer customized solutions and bundled service contracts for high-volume testing facilities. Personalized training and on-site installation services enhance adoption. Hospitals and laboratories benefit from long-term service agreements ensuring minimal downtime. Manufacturers leverage direct sales to gather feedback for product improvements. Direct channels also facilitate compliance with local regulatory requirements.

The online sales segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing adoption of e-commerce platforms for procuring consumables, reagents, and compact NAAT POCT devices. Online channels provide convenience, faster delivery, and competitive pricing, particularly for small clinics, home care providers, and rural healthcare settings. Ease of repeat orders and access to multiple product variants support user preferences. Telemedicine expansion encourages online procurement for home testing. Manufacturers also leverage online platforms for educational content and customer support. The convenience and accessibility offered by online channels accelerate market penetration across decentralized healthcare facilities.

North America Molecular Point Of Care Testing (using NAAT) Market Regional Analysis

- The United States dominated the North America molecular POCT market with the largest revenue share of 45.6% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- Healthcare providers in the U.S. highly value the speed, accuracy, and reliability of NAAT-based POCT, which enables timely detection and management of respiratory infections, STIs, and gastrointestinal diseases

- This strong adoption is further supported by high healthcare spending, a robust presence of key industry players, and government initiatives promoting decentralized and point-of-care diagnostics, establishing NAAT POCT as a preferred testing solution across hospitals, clinics, laboratories, and urgent care centers

The U.S. Molecular Point of Care Testing (using NAAT) Market Insight

The U.S. NAAT POCT market captured the largest revenue share of 45.6% in 2024 within North America, fueled by advanced healthcare infrastructure, high prevalence of infectious diseases, and rapid adoption of decentralized testing solutions. Healthcare providers are increasingly prioritizing rapid, accurate diagnostics for respiratory infections, STIs, and gastrointestinal diseases. The growing demand for portable and user-friendly NAAT devices, combined with integration into electronic health records and telemedicine platforms, further propels the market. Moreover, continuous innovations by established diagnostic companies and startups, including multiplex testing and real-time connectivity, are significantly contributing to market expansion.

Canada Molecular Point of Care Testing (using NAAT) Market Insight

The Canadian NAAT POCT market is projected to expand at a notable CAGR during the forecast period, primarily driven by government initiatives to improve access to rapid diagnostics and the rising prevalence of infectious diseases in community and rural settings. The increasing adoption of point-of-care solutions in hospitals, clinics, and public health programs is fostering market growth. Canadian healthcare providers are also drawn to the convenience and clinical efficiency offered by NAAT POCT, particularly for respiratory and STI testing. Integration with digital health systems and electronic reporting platforms is enhancing adoption and operational efficiency.

Mexico Molecular Point of Care Testing (using NAAT) Market Insight

The Mexican NAAT POCT market is anticipated to grow at a considerable CAGR during the forecast period, driven by rising awareness of early diagnosis and the demand for reliable, rapid testing solutions in hospitals and clinics. The expansion of healthcare infrastructure and government programs supporting infectious disease testing are key growth factors. Mexico’s adoption of portable NAAT devices, along with training programs for healthcare professionals, is facilitating rapid deployment in both urban and semi-urban areas. The preference for accurate and easy-to-use diagnostic platforms is expected to continue to stimulate market growth.

North America Molecular Point Of Care Testing (using NAAT) Market Share

The North America Molecular Point Of Care Testing (using NAAT) industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Hologic, Inc. (U.S.)

- BD (U.S.)

- BIOMÉRIEUX (France)

- LUCIRA (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Danaher (U.S.)

- Cepheid (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Binx Health, Inc. (U.S.)

- Grifols, S.A. (Spain)

- Mesa Biotech, Inc. (U.S.)

- AccuBioTech Co., Ltd. (China)

- Mylab Discovery Solutions (India)

- Molecular Testing Labs, Inc. (U.S.)

- OraSure Technologies, Inc. (U.S.)

- Genetic Signatures (Australia)

What are the Recent Developments in North America Molecular Point Of Care Testing (using NAAT) Market?

- In May 2025, Roche received FDA clearance and CLIA waiver for its cobas® liat CTNG & CTNG/MG tests. These molecular point-of-care tests are designed to detect Chlamydia trachomatis, Neisseria gonorrhoeae, and Mycoplasma genitalium, expanding the scope of NAAT POCT beyond respiratory infections. The CLIA waiver allows for use in non-laboratory settings, facilitating broader access to STI diagnostics

- In February 2025, An article in the journal Microbiology Spectrum detailed a clinical evaluation of the Abbott ID NOW™ COVID-19 2.0 assay, a rapid NAAT point-of-care test. The study highlights its suitability for diagnosing COVID-19 in symptomatic subjects and its use in point-of-care and low-resource settings. This provides a real-time, peer-reviewed look at a specific product's performance

- In December 2024, A full-length article published by Taylor & Francis discusses the implementation of molecular diagnostic testing for Group A Streptococcal pharyngitis. The article highlights that many of the NAAT POC platforms used for COVID-19 testing can be leveraged for strep throat, pointing to a strategic repurposing of existing technology and partnerships formed during the pandemic

- In May 2024, Sherlock Bio commenced a trial for its over-the-counter rapid test designed to detect sexually transmitted infections (STIs) such as chlamydia and gonorrhea. The company aims to launch the test by mid-2025, potentially becoming the first to offer a non-prescription rapid test for these infections. The test utilizes self-collected swabs and provides results within 30 minutes, enhancing accessibility and comfort for users. This initiative is supported by the Bill and Melinda Gates Foundation and Novalis Lifesciences

- In March 2023, BioFire Diagnostics, a subsidiary of bioMérieux, received U.S. Food and Drug Administration (FDA) approval for its FilmArray Torch System. This molecular diagnostic platform is designed for rapid detection of infectious diseases at the point of care. The system integrates multiple assays, enabling comprehensive testing for various pathogens, including those responsible for respiratory and gastrointestinal infections

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.