North America Nail Gun Market

Market Size in USD Billion

CAGR :

%

USD

1.22 Billion

USD

1.68 Billion

2024

2032

USD

1.22 Billion

USD

1.68 Billion

2024

2032

| 2025 –2032 | |

| USD 1.22 Billion | |

| USD 1.68 Billion | |

|

|

|

Nail Gun Market Analysis

The North America nail gun market is witnessing significant expansion, primarily driven by significant growth in the construction and woodworking industries. Nail guns, also known as nailers, are crucial tools used for fast and accurate fastening in various applications, replacing traditional manual hammering methods. Their popularity continues to rise as their speed, efficiency, and precision directly contribute to improving productivity, cost-effectiveness, and operational safety.

The increasing use of nail guns in prefabricated construction offers significant growth opportunities for the North America nail gun market. Prefabricated construction involves assembling building components in a factory or off-site environment before transporting them to the construction site for final assembly. This method is gaining popularity due to its efficiency, cost-effectiveness, and ability to speed up the construction process. Nail guns, as essential tools for driving nails into wooden beams, panels, and other materials, are seeing rising demand in this sector.

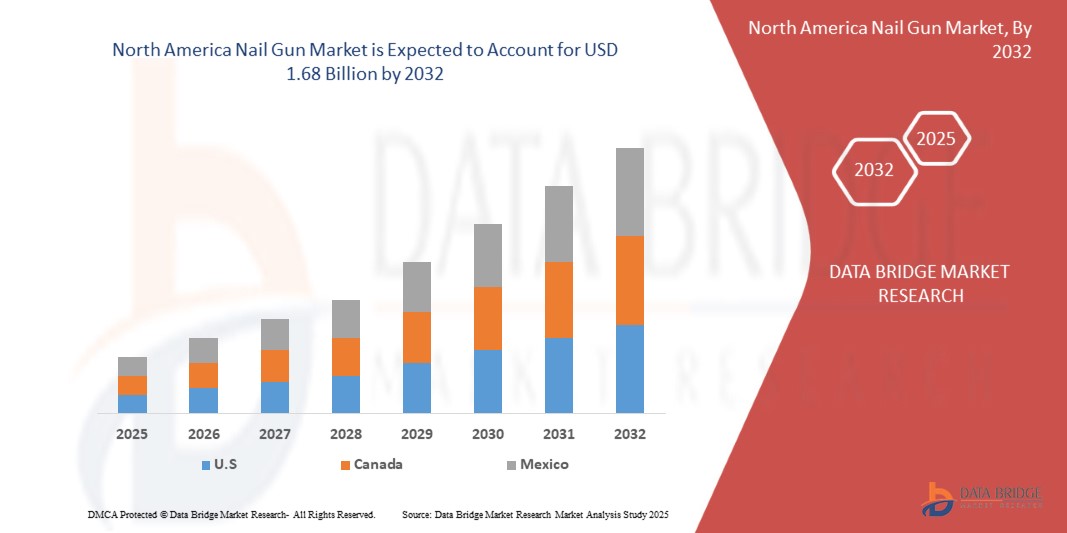

Nail Gun Market Size

The North America nail gun market is expected to reach USD 1.68 billion by 2032 from USD 1.22 billion in 2024, growing with a substantial CAGR of 5.31% in the forecast period of 2024 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Nail Gun Market Trends

“Labor Shortages and Increased Demand for Efficiency”

Labor shortages, coupled with the growing demand for operational efficiency, are significantly influencing the North America nail gun market. As industries face challenges in recruiting skilled labor, especially in construction and woodworking sectors, the need for advanced tools that enhance productivity has become more pronounced. Nail guns, known for their ability to perform fast and accurate fastening tasks, are emerging as a solution to mitigate the impacts of labor shortages and meet escalating project demands.

In the construction industry, a shortage of skilled workers has become a persistent issue, particularly in developed economies. This shortfall has forced companies to rely more on automation and power tools to maintain project timelines and quality. Nail guns, which can drive fasteners with minimal physical effort, enable workers to complete tasks more quickly and with greater precision than traditional manual methods. This increased efficiency allows construction firms to maintain productivity levels despite a reduced workforce, making nail guns indispensable tools for modern construction practices.

Report Scope and Nail Gun Market Segmentation

|

Attributes |

Nail Gun Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Stanley Black & Decker, Inc. (U.S.), Illinois Tool Works Inc. (U.S.), Makita U.S.A., Inc. (U.S.), Emerson Electric Co. (U.S.), Powernail Companys (U.S.), MAX USA CORP.(U.S.), Grex Power Tools (U.S.), Prime Global Products, Inc.(U.S.), and PORTER-CABLE (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nail Gun Market Definition

A nail gun, also known as a pneumatic nailer or nailer, is a power tool designed to drive nails into wood, metal, or other materials with precision and speed. It operates using compressed air (pneumatic), electricity, or gas, depending on the model. Nail guns are widely used in construction, carpentry, and DIY projects for tasks such as framing, roofing, decking, and upholstery. They significantly increase work efficiency by reducing manual labor and the time needed to drive nails, compared to using a hammer. Nail guns come in various types, including coil, stick, and brad nailers, each suited for specific applications. Safety features such as trigger mechanisms and depth adjustment are incorporated to ensure safe and accurate nail placement.

Nail Gun Market Dynamics

Drivers

- Growth in Construction and Woodworking Industries

The North America nail gun market is witnessing significant expansion, primarily driven by significant growth in the construction and woodworking industries. Nail guns, also known as nailers, are crucial tools used for fast and accurate fastening in various applications, replacing traditional manual hammering methods. Their popularity continues to rise as their speed, efficiency, and precision directly contribute to improving productivity, cost-effectiveness, and operational safety. The surge in construction activities worldwide is a key driver for nail gun demand. With increased investments in residential, commercial, and infrastructure development, nail guns have become indispensable for professionals in framing, roofing, finishing, and flooring tasks. Emerging economies are experiencing rapid urbanization, with governments and private sectors heavily investing in building projects, further fueling market growth. In mature markets, renovation, remodeling, and green building trends are also contributing to the expansion of the nail gun segment. Nail guns reduce project completion time, offering higher efficiency and precision, making them a preferred choice among contractors and builders. For instance,

For Instances:

In March 2024, according to an article published by Kairos Media Group Srl website India's construction sector is experiencing rapid growth, significantly boosting the economy. In the third quarter of 2023, it expanded by 13.3% compared to the previous year, spurred by a housing boom, rising per capita income, and a severe urban housing shortage. The sector has created millions of jobs and driven GDP growth, with forecasts predicting further expansion as government initiatives support affordable housing development across cities

- Labor Shortages and Increased Demand for Efficiency

Labor shortages, coupled with the growing demand for operational efficiency, are significantly influencing the North America nail gun market. As industries face challenges in recruiting skilled labor, especially in construction and woodworking sectors, the need for advanced tools that enhance productivity has become more pronounced. Nail guns, known for their ability to perform fast and accurate fastening tasks, are emerging as a solution to mitigate the impacts of labor shortages and meet escalating project demands.

In the construction industry, a shortage of skilled workers has become a persistent issue, particularly in developed economies. This shortfall has forced companies to rely more on automation and power tools to maintain project timelines and quality. Nail guns, which can drive fasteners with minimal physical effort, enable workers to complete tasks more quickly and with greater precision than traditional manual methods. This increased efficiency allows construction firms to maintain productivity levels despite a reduced workforce, making nail guns indispensable tools for modern construction practices.

For instance,

In June 2024, according to an article published by Network18 Media & Investments Limited India's construction sector is facing a significant skilled labor shortage, with major companies like Larsen & Toubro reporting a deficit of 25,000 to 30,000 workers. This challenge has been exacerbated by the migration of workers during the pandemic, extreme weather conditions, and workers' failure to return after traveling for elections. This increasing complexity and scale of construction projects and labor shortages are driving the adoption of advanced technologies like cordless and pneumatic nail guns, which offer enhanced performance and convenience

Opportunities

- Increasing Use of Nail Guns In Prefabricated Construction

The increasing use of nail guns in prefabricated construction offers significant growth opportunities for the North America nail gun market. Prefabricated construction involves assembling building components in a factory or off-site environment before transporting them to the construction site for final assembly. This method is gaining popularity due to its efficiency, cost-effectiveness, and ability to speed up the construction process. Nail guns, as essential tools for driving nails into wooden beams, panels, and other materials, are seeing rising demand in this sector.

One key driver of this growth is the growing trend towards modular and off-site construction methods. Prefabricated construction, which allows for quicker assembly of homes, offices, and other buildings, requires tools that can ensure precise and efficient assembly.

For instance,

In August 2023, according to an article by The Wells Companies, the article highlights that prefabrication accelerates construction by assembling components off-site. Nail guns are increasingly used in this process to enhance speed, precision, and efficiency. By automating nailing, these tools reduce labor costs and ensure consistent quality, making them indispensable in the growing prefabricated construction sector

- Product Innovations and Incorporation of Smart Features

Product innovations and the incorporation of smart features are creating substantial growth opportunities for the North America nail gun market. As construction practices evolve, there is an increasing demand for tools that improve efficiency, precision, and safety. Nail guns, being essential in a variety of construction and DIY applications, are undergoing significant advancements to meet these needs. These innovations not only enhance the functionality of the tools but also open up new markets, particularly in industries like prefabricated construction, residential, and commercial building projects.

One of the key innovations driving the market is the development of cordless nail guns. Traditional pneumatic models, which require a compressor, are being replaced by battery-powered models that offer greater portability and ease of use. Cordless nail guns are especially beneficial in areas without easy access to power sources, making them ideal for remote construction sites. Additionally, advancements in battery technology have led to longer runtimes, faster recharging, and lighter tool designs, increasing their appeal for both professionals and DIY enthusiasts.

For instance,

According to an article by AIE METAL PRODUCTS CO., LTD, highlights advancements in the nail gun industry, focusing on innovations like cordless models, improved battery technology, and smart features. Modern nail guns now include digital controls, sensors, and Bluetooth connectivity, allowing for real-time performance monitoring, customizable firing modes, and enhanced safety, boosting both efficiency and user experience

Restraints/Challenges

- High Initial Cost of High-End Models

The high initial cost of high-end nail gun models is a significant restraint on the growth of the North America nail gun market. While advanced models with improved features, such as brushless motors, cordless functionality, and automation, offer increased efficiency and convenience, they come with a price premium that can deter potential buyers, especially in price-sensitive segments. This is particularly true for small construction businesses, DIY enthusiasts, and individuals in emerging markets, where budget constraints play a crucial role in purchasing decisions.

For instance,

A basic pneumatic nail gun can cost between USD 50 to USD 150, while a premium cordless model, such as the DeWalt DCN680D1 or Makita XNB02Z (both equipped with brushless motors and lithium-ion batteries), can cost USD 300 or more. These high-end models may offer superior performance and features but in developing region these models are often out of budget for casual users or small contractors operating with thin profit margins

- Regular Maintenance and Repair Requirement

Regular maintenance and repair requirements for nail guns present a significant restraint to the growth of the North America nail gun market, particularly for commercial and high-end users. Unlike simpler manual tools, nail guns, especially advanced pneumatic, gas-powered, and cordless electric models—require frequent maintenance to ensure optimal performance and safety. This includes routine cleaning, lubricating moving parts, checking for air leaks or battery issues, and occasionally replacing worn components such as triggers, seals, and valves. For businesses and individual users, these ongoing needs can lead to increased operational costs and downtime, diminishing productivity and reducing the perceived value of investment in these tools.

For instance,

According to an article published by Texas Department of Insurance Nail gun injuries are frequent and often serious. Over the past four years in the U.S., 25% of work-related nail gun injuries led to over two weeks off, with 14% resulting in absences exceeding a month. Regular maintenance—such as cleaning and inspecting power supplies—reduces safety risks. However, for businesses, maintenance costs and time may be a restraint, potentially affecting productivity

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Industrial Machine Vision Market Scope

The market is segmented on the basis of product type, type, fastener length, magazine type, nail gauge, application, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Pneumatic Nail Gun

- Combustion Powered Nail Gun

- Electric Nail Gun

Type

- Framing Nailers

- Roofing Nailers

- Flooring Nailers

- Brad Nailer

- Decking Nailers

- Pin Nailers

- Siding Nailers

- Finishing Nailers

Fastener Length

- 1-3/4" -3-1/2"

- More Than 3-1/2

- Less Than 1-3/4

Magazine Type

- Strip

- Coil

Nail Gauges Type

- 15-Gauge

- 16-Gauge

- 18-Gauge

- 20-Guage

- 23-Gauge

- 10-Gauge

Application

- Commercial

- Industrial

- Residential / Household

Distribution Channel

- Indirect Sales

- Direct Sales

Nail Gun Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, type, fastener length, magazine type, nail gauge, application, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the market due to its aggressive expansion of solar energy, supported by federal incentives like the Investment Tax Credit (ITC) and state-level policies that encourage renewable energy adoption.

The U.S. is projected to be the fastest-growing country for nail guns market because of largest solar markets globally, with a rapidly increasing number of installations across residential, commercial, and utility-scale segments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Nail Gun Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Nail Gun Market Leaders Operating in the Market Are:

- Stanley Black & Decker, Inc. (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Makita U.S.A., Inc. (U.S.)

- Emerson Electric Co. (U.S.)

- Powernail Companys (U.S.)

- MAX USA CORP.(U.S.)

- Grex Power Tools (U.S.)

- Prime Global Products, Inc.(U.S.)

- PORTER-CABLE (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BUYER/CUSTOMER BARGAINING POWER

4.2.4 SUPPLIER BARGAINING POWER

4.2.5 INTERNAL COMPETITION

4.3 PRICING ANALYSIS

4.4 BRAND OUTLOOK

4.5 PRODUCT VS BRAND OVERVIEW

4.6 FACTORS AFFECTING BUYING DECISIONS

4.6.1 PRODUCT PERFORMANCE AND FEATURES

4.6.2 PRICE AND COST EFFICIENCY

4.6.3 TECHNOLOGICAL FEATURES AND INNOVATION

4.6.4 BRAND LOYALTY AND TRUST

4.6.5 CONCLUSION

4.7 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.7.1 PRODUCT INNOVATION AND DEVELOPMENT

4.7.2 EXPANSION INTO EMERGING MARKETS

4.7.3 STRATEGIC ACQUISITIONS AND MERGERS

4.7.4 STRENGTHENING DISTRIBUTION CHANNELS AND E-COMMERCE INTEGRATION

4.7.5 STANLEY BLACK & DECKER, INC

4.7.6 TECHTRONIC INDUSTRIES CO. LTD.

4.7.7 EMERSON ELECTRIC CO.

4.8 PRODUCT ADOPTION SCENARIO

4.8.1 EARLY ADOPTERS: PNEUMATIC NAIL GUNS IN COMMERCIAL AND INDUSTRIAL SECTORS

4.8.2 TECHNOLOGICAL DISRUPTION: RISE OF CORDLESS AND BATTERY-POWERED NAIL GUNS

4.8.3 EXPANDING MARKET: RESIDENTIAL AND DIY SEGMENTS GAIN MOMENTUM

4.8.4 NORTH AMERICA EXPANSION: EMERGING MARKETS AND E-COMMERCE REACH

4.8.5 INNOVATION AND SUSTAINABILITY: FUTURE TRENDS IN PRODUCT ADOPTION

4.8.6 CONCLUSION

4.9 PRODUCT DEVELOPMENT RECOMMENDATIONS

4.9.1 EXPANDING CORDLESS AND BATTERY-POWERED NAIL GUN OFFERINGS

4.9.1.1 Key Developments

4.9.2 DEVELOPING MULTI-GAUGE NAIL GUNS FOR VERSATILITY ACROSS APPLICATIONS

4.9.2.1 Key Developments

4.9.3 INTEGRATING SMART FEATURES FOR ENHANCED USABILITY AND PERFORMANCE TRACKING

4.9.3.1 Key Developments

4.9.4 PRIORITIZING ERGONOMICS AND SAFETY FOR IMPROVED USER COMFORT

4.9.4.1 Key Developments

4.9.5 DEVELOPING GAUGE-SPECIFIC INNOVATIONS FOR TARGETED APPLICATIONS

4.9.5.1 15-Gauge Nail Guns (Heavy-Duty Framing)

4.9.5.2 16-Gauge Nail Guns (General Trim and Woodworking)

4.9.5.3 18-Gauge Nail Guns (Precision Finishing)

4.9.5.4 23-Gauge Pin Nailers (Fine Detailing and Crafts)

4.9.6 ENHANCING PNEUMATIC MODELS FOR SUSTAINABILITY AND EFFICIENCY

4.9.6.1 Key Developments

4.9.7 INCREASING FOCUS ON PROFESSIONAL AND DIY SEGMENTATION

4.9.7.1 Professional-Grade Models

4.9.7.2 DIY Models

4.1 PRODUCTION CONSUMPTION OUTLOOK

4.10.1 PRODUCTION OUTLOOK

4.10.2 CONSUMPTION OUTLOOK

4.10.3 REGIONAL DYNAMICS

4.10.4 CONCLUSION

4.11 RAW MATERIAL SOURCING ANALYSIS

4.11.1 STEEL

4.11.2 ALUMINIUM

4.11.3 PLASTIC

4.11.4 COPPER

4.11.5 RUBBER

4.11.6 CONCLUSION

4.12 SUPPLY CHAIN ANALYSIS

4.12.1 OVERVIEW

4.12.2 LOGISTIC COST SCENARIO

4.12.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.12.4 CONCLUSION

4.13 TREND ANALYSIS

4.13.1 MARKET OVERVIEW

4.13.2 REGIONAL TRENDS

4.13.3 GAUGE-SPECIFIC TRENDS DRIVING ADOPTION AND DEVELOPMENT

4.13.3.1 15-Gauge Nail Guns (Heavy-Duty Framing and Structural Applications)

4.13.3.2 16-Gauge Nail Guns (Versatile for Trim and General Woodworking)

4.13.3.3 18-Gauge Nail Guns (Precision and Finish Work)

4.13.3.4 23-Gauge Pin Nailers (High-Precision and Delicate Applications)

4.13.4 KEY TRENDS ACROSS ALL GAUGE CATEGORIES

4.13.5 CHALLENGES AND CONSTRAINTS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN CONSTRUCTION AND WOODWORKING INDUSTRIES

6.1.2 LABOR SHORTAGES AND INCREASED DEMAND FOR EFFICIENCY

6.1.3 RISE IN DIY AND HOME IMPROVEMENTS PROJECTS

6.1.4 TECHNOLOGICAL ADVANCEMENTS AND AUTOMATION IN NAIL GUNS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COST OF HIGH-END MODELS

6.2.2 REGULAR MAINTENANCE AND REPAIR REQUIREMENT

6.3 OPPORTUNITIES

6.3.1 INCREASING USE OF NAIL GUNS IN PREFABRICATED CONSTRUCTION

6.3.2 PRODUCT INNOVATIONS AND INCORPORATION OF SMART FEATURES

6.3.3 RISING DEMAND FOR LIGHTWEIGHT, ERGONOMIC DESIGNS AND SPECIALIZED NAIL GUNS

6.4 CHALLENGES

6.4.1 BATTERY LIFE AND POWER LIMITATIONS IN CORDLESS MODELS

6.4.2 FLUCTUATING RAW MATERIAL PRICES

7 NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 PNEUMATIC NAIL GUN

7.3 COMBUSTION POWERED NAIL GUN

7.4 ELECTRIC NAIL GUN

7.4.1 ELECTRIC NAIL GUN, BY TYPE

8 NORTH AMERICA NAIL GUN MARKET, BY TYPE

8.1 OVERVIEW

8.2 FRAMING NAILERS

8.3 ROOFING NAILERS

8.4 FLOORING NAILERS

8.5 BRAD NAILER

8.6 DECKING NAILERS

8.7 PIN NAILERS

8.8 SIDING NAILERS

8.9 FINISHING NAILERS

9 NORTH AMERICA NAIL GUN MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMERCIAL

9.2.1 COMMERCIAL, BY CATEGORY

9.2.2 COMMERCIAL, BY PRODUCT TYPE

9.3 INDUSTRIAL

9.3.1 INDUSTRIAL, BY CATEGORY

9.3.2 INDUSTRIAL, BY PRODUCT TYPE

9.4 RESIDENTIAL/ HOUSEHOLD

9.4.1 RESIDENTIAL/ HOUSEHOLD, BY CATEGORY

9.4.2 RESIDENTIAL/ HOUSEHOLD, BY PRODUCT TYPE

10 NORTH AMERICA NAIL GUN MARKET, BY FASTENER LENGTH

10.1 OVERVIEW

10.2 1 -3/4" -3-1/2"

10.3 MORE THAN 3-1/2

10.4 LESS THAN 1-3/4

11 NORTH AMERICA NAIL GUN MARKET, BY MAGAZINE TYPE

11.1 OVERVIEW

11.2 STRIP

11.3 COIL

12 NORTH AMERICA NAIL GUN MARKET, BY NAIL GAUGE

12.1 OVERVIEW

12.2 15-GAUGE

12.3 16-GAUGE

12.4 18-GAUGE

12.5 20-GAUGE

12.6 23-GAUGE

12.7 10-GAUGE

13 NORTH AMERICA NAIL GUN MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 INDIRECT SALES

13.3 DIRECT SALES

14 NORTH AMERICA NAIL GUN MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA NAIL GUN MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 STANLEY BLACK & DECKER, INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ILLINOIS TOOL WORKS INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 MAKITA U.S.A., INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHTRONIC INDUSTRIES CO. LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KOKI HOLDINGS CO., LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 EMERSON ELECTRIC CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 EVERWIN PNEUMATIC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 GREX POWER TOOLS

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 HILTI INDIA PRIVATE LIMITED

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 JITOOL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 KYOCERA SENCO NETHERLANDS B.V.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 MAX USA CORP.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MEITE USA

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 NANSHAN

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 PORTER-CABLE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 POSITEC TOOL CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 POWERNAIL COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 PRIME NORTH AMERICA PRODUCTS, INC.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 PUMA INDUSTRIAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 RAIMUND BECK KG

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 RONGPENG AIR TOOLS CO.,LTD.

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 UNICATCH

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 BRAND COMPARATIVE ANALYSIS

TABLE 2 PRODUCT VS BRAND OVERVIEW

TABLE 3 REGULATORY COVERAGE

TABLE 4 NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 6 NORTH AMERICA NAIL GUN MARKET, AVERAGE SELLING PRICE, BY PRODUCT TYPE, 2018-2032, (USD/UNIT)

TABLE 7 NORTH AMERICA PNEUMATIC NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA PNEUMATIC NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (THOUSAND UNIT)

TABLE 9 NORTH AMERICA COMBUSTION POWERED NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA COMBUSTION POWERED NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (THOUSAND UNIT)

TABLE 11 NORTH AMERICA ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY REGION, 2018-2032 (THOUSAND UNIT)

TABLE 13 NORTH AMERICA ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA NAIL GUN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA FARMING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA ROOFING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA FLOORING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA BRAD NAILER IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA DECKING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PIN NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SIDING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA FINISHING NAILERS IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA NAIL GUN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA COMMERCIAL IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA COMMERCIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA COMMERCIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA INDUSTRIAL IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA INDUSTRIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA INDUSTRIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA NAIL GUN MARKET, BY FASTENER LENGTH, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA 1-3/4" -3-1/2" IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA MORE THAN 3-1/2 IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA LESS THAN 1-3/4 IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA NAIL GUN MARKET, BY MAGAZINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA STRIP IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA COIL IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA NAIL GUN MARKET, BY NAIL GAUGE 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA 15-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA 16-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA 18-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA 20-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA 23-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA 10-GAUGE IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA INDIRECT SALES IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA INDIRECT SALES IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA OFFLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA ONLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA MORE THAN 3-1/2 IN NAIL GUN MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA NAIL GUN MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA NAIL GUN MARKET, BY COUNTRY, 2018-2032 (THOUSAND UNITS)

TABLE 55 NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 57 NORTH AMERICA ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA NAIL GUN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA NAIL GUN MARKET, BY FASTENER LENGTH, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA NAIL GUN MARKET, BY MAGAZINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA NAIL GUN MARKET, BY NAIL GAUGE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA NAIL GUN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA COMMERCIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA COMMERCIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA INDUSTRIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA INDUSTRIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA INDIRECT SALES IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA OFFLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA ONLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 75 U.S. ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. NAIL GUN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. NAIL GUN MARKET, BY FASTENER LENGTH, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. NAIL GUN MARKET, BY MAGAZINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. NAIL GUN MARKET, BY NAIL GAUGE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. NAIL GUN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. COMMERCIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. COMMERCIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. INDUSTRIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. INDUSTRIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. INDIRECT SALES IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. OFFLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. ONLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 CANADA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CANADA NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 93 CANADA ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CANADA NAIL GUN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CANADA NAIL GUN MARKET, BY FASTENER LENGTH, 2018-2032 (USD THOUSAND)

TABLE 96 CANADA NAIL GUN MARKET, BY MAGAZINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA NAIL GUN MARKET, BY NAIL GAUGE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA NAIL GUN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA COMMERCIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA COMMERCIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA INDUSTRIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA INDUSTRIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA INDIRECT SALES IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA OFFLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA ONLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 MEXICO NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MEXICO NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (THOUSAND UNITS)

TABLE 111 MEXICO ELECTRIC NAIL GUN IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO NAIL GUN MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO NAIL GUN MARKET, BY FASTENER LENGTH, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO NAIL GUN MARKET, BY MAGAZINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO NAIL GUN MARKET, BY NAIL GAUGE, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO NAIL GUN MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO COMMERCIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO COMMERCIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO INDUSTRIAL IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO INDUSTRIAL IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO RESIDENTIAL/ HOUSEHOLD IN NAIL GUN MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO INDIRECT SALES IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO OFFLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO ONLINE IN NAIL GUN MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA NAIL GUN MARKET

FIGURE 2 NORTH AMERICA NAIL GUN MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA NAIL GUN MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA NAIL GUN MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA NAIL GUN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA NAIL GUN MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA NAIL GUN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA NAIL GUN MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA NAIL GUN MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA NAIL GUN MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA NAIL GUN MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA NAIL GUN MARKET: -EXECUTIVE SUMMARY

FIGURE 13 THREE SEGMENTS COMPRISE THE NORTH AMERICA NAIL GUN MARKET, BY PRODUCT TYPE

FIGURE 14 NORTH AMERICA NAIL GUN MARKET:-STRATEGIC DECISIONS

FIGURE 15 GROWTH IN CONSTRUCTION AND WOODWORKING INDUSTRIES IS EXPECTED TO DRIVE THE NORTH AMERICA NAIL GUN MARKET IN THE FORECAST PERIOD

FIGURE 16 THE PNEUMATIC NAIL GUN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA NAIL GUN MARKET IN 2025 AND 2032

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 NORTH AMERICA NAIL GUN MARKET, 2022-2032, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR NORTH AMERICA NAIL GUN MARKET

FIGURE 21 NORTH AMERICA NAIL GUN MARKET: BY PRODUCT TYPE, 2024

FIGURE 22 NORTH AMERICA NAIL GUN MARKET: BY TYPE, 2024

FIGURE 23 NORTH AMERICA NAIL GUN MARKET: BY APPLICATION, 2024

FIGURE 24 NORTH AMERICA NAIL GUN MARKET: BY FASTENER LENGTH, 2024

FIGURE 25 NORTH AMERICA NAIL GUN MARKET: BY MAGAZINE TYPE, 2024

FIGURE 26 NORTH AMERICA NAIL GUN MARKET: BY NAIL GAUGE, 2024

FIGURE 27 NORTH AMERICA NAIL GUN MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 NORTH AMERICA NAIL GUN MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA NAIL GUN ARKET: COMPANY SHARE 2024 (%)

North America Nail Gun Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Nail Gun Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Nail Gun Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.