North America Psychedelic Drugs Market

Market Size in USD Billion

CAGR :

%

USD

3.07 Billion

USD

8.39 Billion

2024

2032

USD

3.07 Billion

USD

8.39 Billion

2024

2032

| 2025 –2032 | |

| USD 3.07 Billion | |

| USD 8.39 Billion | |

|

|

|

|

North America Psychedelic Drugs Market Size

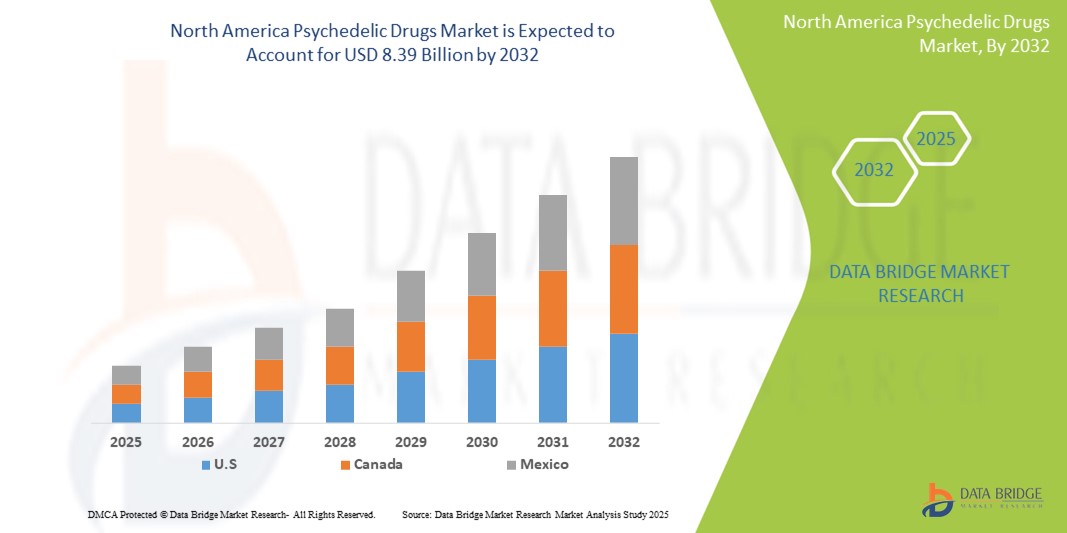

- The North America psychedelic drugs market size was valued at USD 3.07 billion in 2024 and is expected to reach USD 8.39 billion by 2032, at a CAGR of 13.40% during the forecast period

- The market growth is largely fueled by increasing research activities and growing acceptance of psychedelic-assisted therapies for mental health conditions such as depression, PTSD, and anxiety, particularly in the U.S. and Canada

- Furthermore, supportive regulatory developments, decriminalization efforts, and rising public awareness regarding mental health treatments are positioning psychedelic drugs as promising therapeutic alternatives. These converging factors are accelerating clinical adoption and investment in the sector, thereby significantly boosting the industry's growth

North America Psychedelic Drugs Market Analysis

- Psychedelic drugs, encompassing substances such as psilocybin, MDMA, and LSD, are gaining significant traction in North America for their potential therapeutic benefits in treating mental health disorders, including depression, PTSD, anxiety, and addiction, with increasing incorporation into clinical research and emerging treatment models.

- The escalating demand for psychedelic drugs is primarily fueled by rising mental health awareness, a growing body of scientific evidence supporting their efficacy, and the gradual shift in public and regulatory attitudes towards decriminalization and medical legalization.

- U.S. dominated the North America psychedelic drugs market with the largest revenue share of 86.5% in 2024, characterized by active clinical trials, the involvement of major pharmaceutical players, and growing acceptance of psychedelic-assisted therapies by mental health professionals

- Canada is expected to witness the highest compound annual growth rate (CAGR) in the North America psychedelic drugs market due to federal exemptions for psilocybin-assisted therapy and expanding research initiatives

- Psilocybin segment dominated the North America psychedelic drugs market with a market share of 40.3% in 2024, driven by its demonstrated effectiveness in treating major depressive disorders and its progressive movement through FDA’s breakthrough therapy designation pathway

Report Scope and North America Psychedelic Drugs Market Segmentation

|

Attributes |

North America Psychedelic Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Psychedelic Drugs Market Trends

“Advancement of Psychedelic-Assisted Therapy and Regulatory Momentum”

- A significant and accelerating trend in the North America psychedelic drugs market is the advancement of psychedelic-assisted therapy within clinical and therapeutic settings, driven by regulatory momentum and growing institutional support. This shift is redefining treatment paradigms for mental health conditions such as depression, PTSD, and substance use disorders

- For instance, the Multidisciplinary Association for Psychedelic Studies (MAPS) has led Phase 3 clinical trials using MDMA-assisted therapy for PTSD, demonstrating strong therapeutic efficacy and receiving breakthrough therapy designation from the FDA. Similarly, Compass Pathways has advanced psilocybin therapy for treatment-resistant depression, marking key milestones in regulatory approval pathways

- Emerging public health policies are supporting controlled access frameworks. In Oregon, the state has already legalized psilocybin for supervised therapeutic use, while Colorado passed legislation decriminalizing certain psychedelics and establishing a regulated therapeutic framework. These regulatory trends signal a growing institutional and societal openness to therapeutic psychedelics

- Academic institutions, such as Johns Hopkins Center for Psychedelic and Consciousness Research, are playing a pivotal role in mainstreaming these therapies by publishing influential clinical data and training future practitioners, thereby accelerating clinical integration and acceptance

- This trend toward structured, evidence-based psychedelic therapies is influencing healthcare providers, pharmaceutical firms, and investors to explore scalable treatment models, from ketamine clinics to upcoming MDMA- and psilocybin-assisted therapy networks

- The demand for regulated, science-backed psychedelic treatment programs is growing rapidly across North America, as patients, clinicians, and lawmakers increasingly prioritize innovative solutions for the mental health crisis.

North America Psychedelic Drugs Market Dynamics

Driver

“Rising Mental Health Crisis and Advancements in Psychedelic Therapeutics”

- The growing mental health crisis across the U.S. and Canada—characterized by rising rates of depression, PTSD, anxiety, and substance use disorders—is a major driver behind the increasing demand for psychedelic drugs as alternative treatment options

- For instance, in January 2024, MAPS PBC submitted a New Drug Application (NDA) to the U.S. FDA for MDMA-assisted therapy for PTSD, a landmark step that could potentially make MDMA the first FDA-approved psychedelic treatment. Such developments are expected to significantly accelerate market expansion

- Psychedelics offer rapid and sustained therapeutic effects, often after just one or two sessions, in contrast to traditional antidepressants, making them particularly attractive to clinicians and patients seeking faster, more durable outcomes

- Furthermore, increasing acceptance by health professionals, supportive clinical data from Phase 2 and 3 trials, and fast-track regulatory designations from the FDA and Health Canada are building confidence in the clinical utility and safety of psychedelic-assisted therapies.

- The evolving legal landscape—especially in states such as Oregon and Colorado, and under Canada’s Special Access Program (SAP)—is making these treatments more accessible under regulated, supervised conditions

- The surge in investment from biotech firms and mental health startups, along with the establishment of specialized psychedelic therapy clinics, is reinforcing infrastructure and access, propelling both medical adoption and commercial growth across the North American market

Restraint/Challenge

“Stigma, Safety Concerns, and Regulatory Complexity”

- Despite growing scientific support and promising clinical outcomes, lingering stigma and misconceptions surrounding psychedelic substances continue to pose a significant challenge to broader adoption across the North American market. Public concerns over safety, misuse potential, and long-standing associations with illicit drug use often fuel skepticism among patients, providers, and policymakers

- For instance, although the FDA has granted “breakthrough therapy” status to several psychedelic treatments, these drugs still face classification under Schedule I in the U.S., creating complex regulatory and logistical barriers for research, development, and therapeutic deployment

- Addressing these regulatory and societal hurdles requires robust educational outreach, continued advocacy from medical institutions, and clear clinical evidence supporting the safety and efficacy of psychedelic-assisted therapies. Organizations such as MAPS and Usona Institute are actively working to shift public perception and provide rigorous data to regulators

- In addition, the infrastructure for administering psychedelics—such as certified therapists, specialized clinics, and safe environments for guided sessions—is still in the early stages of development and varies significantly across states and provinces, slowing down scalability

- The high cost of psychedelic therapy, which includes multiple preparatory, dosing, and integration sessions, is another barrier to accessibility, particularly in the absence of insurance coverage

North America Psychedelic Drugs Market Scope

The market is segmented on the basis of source, type, drugs, application, route of administration, end user, and distribution channel.

- By Source

On the basis of source, the North America psychedelic drugs market is segmented into synthetic and natural. The synthetic segment dominated the market with the largest market revenue share in 2024, primarily due to the standardized composition, high purity, and controlled dosing these drugs offer in clinical settings. Substances such as MDMA and ketamine, which are produced synthetically, are widely used in advanced research trials and regulated therapeutic environments.

The natural segment, including psilocybin derived from mushrooms and ayahuasca compounds, is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by increased interest in plant-based healing, the rise of natural psychedelic retreats, and ongoing studies that highlight the therapeutic potential of naturally sourced compounds.

- By Type

On the basis of type, the North America psychedelic drugs market is segmented into empathogens, dissociatives, and others. Dissociatives held the largest market share in 2024, driven by the extensive use of ketamine in off-label treatments for depression and anxiety. Ketamine’s fast-acting therapeutic effect and expanding use in clinical settings contributed to this dominance.

Empathogens, such as MDMA, are anticipated to witness the fastest growth rate during forecast period, due to increasing success in late-stage clinical trials for PTSD treatment. Their ability to enhance emotional connectivity and reduce fear responses during therapy makes them promising candidates for psychiatric use.

- By Drugs

On the basis of drugs, the North America psychedelic drugs market is segmented into Gamma-Hydroxybutyric Acid (GHB), Ketamine, Psilocybin, and Others. Psilocybin dominated the market with market share of 40.3% in 2024 due to its expanding clinical trials, FDA breakthrough designations, and decriminalization efforts across multiple states and Canadian regions

Ketamine is projected to grow at the fastest rate during forecast period, spurred by established legal status, availability through ketamine clinics, and rapid adoption in treating depression and suicidal ideation.

- By Application

On the basis of application, the North America psychedelic drugs market segments include narcolepsy, treatment-resistant depression, major depressive disorder, opiate addiction, PTSD, and others. Treatment-resistant depression held the largest share in 2024, reflecting the unmet need in this population and the success of ketamine and psilocybin in clinical response where conventional antidepressants have failed.

Post-traumatic stress disorder (PTSD) is expected to witness the fastest growth during forecast period, largely due to promising MDMA-assisted therapy trials showing sustained symptom reduction and regulatory support for PTSD-specific protocols.

- By Route Of Administration

On the basis of route of administration, the North America psychedelic drugs market is segmented into oral, inhalation, and injectable. Injectable psychedelics, particularly ketamine, led the market in 2024, supported by the widespread availability of IV and IM ketamine therapy in clinics.

The oral route is expected to grow fastest during forecast period, primarily driven by psilocybin capsules and tablets being tested in ongoing clinical trials, which offer ease of administration and better patient compliance in outpatient settings.

- By End User

On the basis of user, the North America psychedelic drugs market is segmented into hospitals, specialty clinics, homecare, and others. Specialty clinics dominated the segment in 2024, supported by the rising number of ketamine-assisted therapy centers and the anticipated launch of psilocybin and MDMA clinics post-approval.

Homecare is expected to witness significant growth during forecast period, especially for sublingual or nasal spray formulations, as regulatory pathways evolve to permit monitored at-home dosing under telehealth supervision.

- By Distribution Channel

On the basis of distribution channel, the North America psychedelic drugs market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacy held the largest share in 2024 due to the clinical nature of psychedelic therapies and the current requirement for administration in controlled environments.

Online pharmacy is projected to see the fastest growth during forecast period, as future regulatory shifts may enable the digital prescription and delivery of approved psychedelic medications, enhancing patient access and convenience.

Psychedelic Drugs Market Regional Analysis

- U.S. dominated the North America psychedelic drugs market with the largest revenue share of 86.5% in 2024, characterized by active clinical trials, the involvement of major pharmaceutical players, and growing acceptance of psychedelic-assisted therapies by mental health professionals

- Widespread prevalence of treatment-resistant depression, PTSD, and anxiety disorders, along with a supportive ecosystem of academic institutions and startups, is reinforcing demand and accelerating innovation in psychedelic drug development across North America

- In addition, the region benefits from increasing government and private funding for psychedelic-assisted therapy research, helping translate experimental treatments into viable, market-ready solutions.

U.S. Psychedelic Drugs Market Insight

The U.S. psychedelic drugs market held the dominant share of 86.5% in 2024 within North America, supported by a robust ecosystem of biotech startups, academic partnerships, and a progressive regulatory framework. The widespread adoption of ketamine in treatment-resistant depression has laid the foundation for future approvals of psilocybin and MDMA. Legislative changes at the state level, such as Oregon’s psilocybin services program and decriminalization efforts in Colorado and California, are also shaping a more open market landscape. The U.S. continues to lead in clinical trials, investment, and commercial development, reinforcing its central role in the North America psychedelic drug ecosystem.

Canada Psychedelic Drugs Market Insight

The Canada psychedelic drugs market is expected to grow at a substantial CAGR over the forecast period, driven by federal exemptions for psilocybin-assisted therapy and expanding research initiatives. Health Canada’s Special Access Program allows approved use of psychedelics in certain therapeutic contexts, which is accelerating demand from healthcare providers and patients. The country is also home to several licensed producers and research institutions focused on psychedelic drug development. Canada's progressive stance on drug policy and mental health innovation is fostering a supportive environment for the commercial rollout of psychedelic therapies, particularly in depression, anxiety, and PTSD treatments.

Mexico Psychedelic Drugs Market Insight

The Mexico psychedelic drugs market is gaining significant traction over the forecast period, driven by the country’s deep-rooted cultural use of natural psychedelics and the rising interest in mental health therapies. Mexico's long-standing traditional practices involving psilocybin mushrooms and other plant-based substances have laid a foundation for modern therapeutic exploration. The market is experiencing growing adoption across applications such as depression, PTSD, and addiction treatment. The country is also becoming a hub for psychedelic retreat tourism, attracting individuals seeking guided therapeutic experiences with psilocybin and ayahuasca. Furthermore, Mexico’s regulatory environment, which permits personal possession of small quantities of some psychedelics, supports ongoing interest in clinical research and therapeutic use

North America Psychedelic Drugs Market Share

The North America psychedelic drugs industry is primarily led by well-established companies, including:

- Mind Medicine Inc. (U.S.)

- Cybin Corp. (Canada)

- Multidisciplinary Association for Psychedelic Studies (U.S.)

- Field Trip Health (Canada)

- Tryptamine Therapeutics (U.S.)

- Small Pharma Inc. (Canada)

- Numinus Wellness Inc. (Canada)

- Delic Holdings Corp. (Canada)

- Clearmind Medicine Inc. (Canada)

- Mydecine Innovations Group Inc. (Canada)

- PsyBio Therapeutics Corp. (Canada)

- Revive Therapeutics Ltd. (Canada)

- NeonMind Biosciences Inc. (Canada)

- Tryp Therapeutics Inc. (U.S.)

- Entheon Biomedical Corp. (Canada)

- Braxia Scientific Corp. (Canada)

What are the Recent Developments in North America Psychedelic Drugs Market?

- In March 2024, MindMed (U.S.) announced promising results from its Phase 2b clinical trial evaluating MM-120 (lysergide) for the treatment of generalized anxiety disorder (GAD). The study demonstrated significant, durable symptom reduction compared to placebo, marking a critical step forward in psychedelic-based therapy and reinforcing MindMed’s leadership in the clinical psychedelic drug development space

- In February 2024, COMPASS Pathways (U.S./U.K.) expanded its collaboration with the U.S. Department of Veterans Affairs to explore the use of psilocybin therapy for veterans suffering from PTSD. This initiative reflects growing governmental and institutional support for the therapeutic potential of psychedelics in addressing mental health conditions affecting service members

- In January 2024, Cybin Inc. (Canada) received FDA approval to proceed with its Phase 2 clinical trial of CYB003, a deuterated psilocybin analog, for the treatment of major depressive disorder (MDD). The approval signifies continued regulatory momentum in North America for novel psychedelic therapeutics

- In October 2023, MAPS Public Benefit Corporation (U.S.) completed its Phase 3 clinical trials for MDMA-assisted therapy in patients with PTSD. The trials showed statistically significant results, laying the groundwork for a potential FDA New Drug Application (NDA) submission, anticipated in 2025

- In August 2023, Alberta became the first Canadian province to regulate the use of psychedelics for therapeutic purposes under professional supervision. This policy shift enables qualified medical professionals to administer substances such as psilocybin and MDMA, setting a precedent for structured psychedelic-assisted therapy across Canada

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.