North America Skin Tightening Market

Market Size in USD Million

CAGR :

%

USD

540.50 Million

USD

1,291.20 Million

2025

2033

USD

540.50 Million

USD

1,291.20 Million

2025

2033

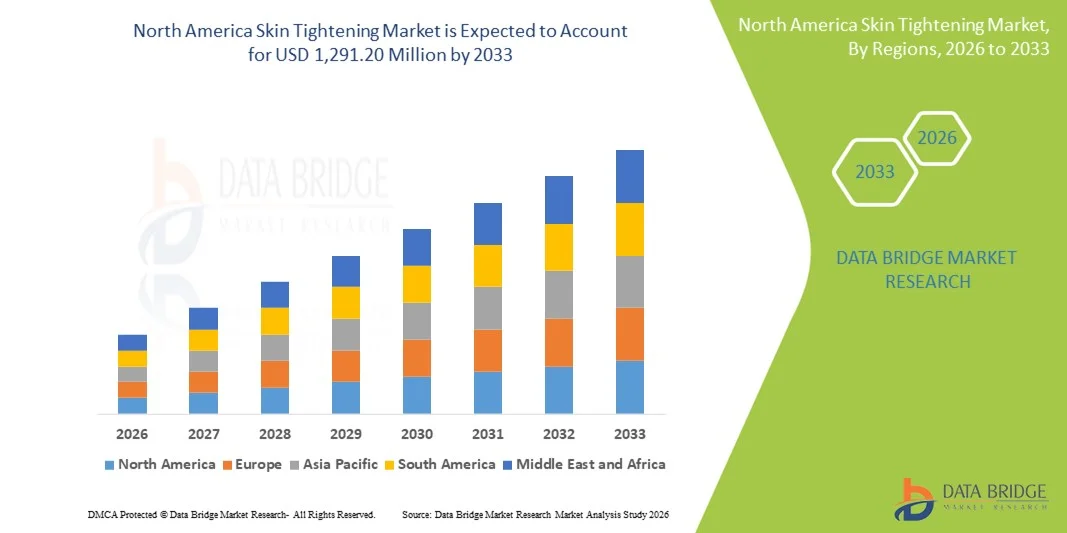

| 2026 –2033 | |

| USD 540.50 Million | |

| USD 1,291.20 Million | |

|

|

|

|

North America Skin Tightening Market Size

- The North America skin tightening market size was valued at USD 540.50 million in 2025 and is expected to reach USD 1,291.20 million by 2033, at a CAGR of 11.5% during the forecast period

- The market growth is largely driven by increasing consumer awareness regarding aesthetic treatments and the rising demand for non-invasive cosmetic procedures, coupled with technological advancements in laser, radiofrequency, and ultrasound-based devices

- Furthermore, growing investments by key market players in product innovation, coupled with rising disposable incomes and the popularity of minimally invasive procedures among millennials and aging populations, are positioning skin tightening treatments as a preferred choice in dermatology and cosmetic clinics. These factors are collectively accelerating market adoption, thereby significantly propelling the industry’s growth

North America Skin Tightening Market Analysis

- Skin tightening treatments, encompassing non-invasive and minimally invasive procedures such as radiofrequency, ultrasound, and laser-based technologies, are becoming increasingly essential in aesthetic and dermatology practices due to their effectiveness, minimal downtime, and growing consumer preference for non-surgical cosmetic solutions

- The rising demand for skin tightening procedures is primarily driven by increasing awareness of anti-aging treatments, the popularity of minimally invasive cosmetic interventions, and technological advancements enhancing safety and efficacy of devices

- The U.S. dominated the skin tightening market with the largest revenue share of 62.7% in 2025, supported by high consumer disposable incomes, early adoption of advanced aesthetic technologies, and a robust presence of leading medical device companies

- Canada is projected to be the fastest-growing country in the North America skin tightening market during the forecast period due to rising consumer awareness, increasing demand for minimally invasive procedures, and growing investments in aesthetic clinics and advanced treatment technologies

- Non-invasive segment dominated the skin tightening market with a market share of 46.5% in 2025, driven by its popularity for minimal downtime, reduced risk, and effectiveness in achieving skin rejuvenation without surgical intervention

Report Scope and North America Skin Tightening Market Segmentation

|

Attributes |

North America Skin Tightening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Skin Tightening Market Trends

Rise of Non-Invasive and Device-Based Procedures

- A major and accelerating trend in the North America skin tightening market is the increasing adoption of non-invasive and minimally invasive device-based treatments such as radiofrequency, ultrasound, and laser therapies. This trend is enhancing treatment convenience and reducing downtime for patients

- For instance, the Venus Legacy device combines multipolar radiofrequency and pulsed electromagnetic fields to tighten skin and improve body contouring results, gaining popularity in dermatology clinics and medspas

- Technological innovations in skin tightening devices now allow for personalized treatment protocols, automated energy delivery, and improved efficacy, improving patient satisfaction and repeat adoption. For instance, the Thermage FLX system utilizes AI-driven adjustments to deliver optimized radiofrequency energy based on individual skin characteristics

- Integration of skin tightening treatments with comprehensive aesthetic programs, including facials, fillers, and skincare regimens, is creating a more holistic patient experience and enhancing clinic loyalty

- This trend towards advanced, efficient, and non-surgical aesthetic solutions is redefining consumer expectations in North America, prompting key companies such as InMode and Lutronic to develop device innovations with automated settings and enhanced patient comfort

- Demand for quick, minimally invasive procedures with visible outcomes is growing across dermatology clinics and medical spas, as patients increasingly prioritize convenience, safety, and overall skin health

- Increasing social media influence and rising beauty-conscious consumers are encouraging more people to opt for skin tightening treatments, contributing to higher procedure adoption rates

- Collaborations between device manufacturers and skincare brands to offer bundled treatment solutions are further driving consumer interest and expanding market reach in North America

North America Skin Tightening Market Dynamics

Driver

Growing Demand Due to Anti-Aging Awareness and Aesthetic Consciousness

- The rising awareness of anti-aging treatments, coupled with increasing aesthetic consciousness among consumers, is a significant driver for the North America skin tightening market

- For instance, in March 2025, InMode launched its next-generation FormaV device in the U.S., featuring enhanced radiofrequency technology designed for non-invasive facial and body tightening. Such innovations are expected to fuel market growth

- Patients are seeking minimally invasive alternatives to surgical procedures, preferring treatments that offer efficacy with lower risks and shorter recovery times

- Furthermore, the popularity of aesthetic procedures among millennials and aging populations is expanding the potential patient base for skin tightening treatments

- High disposable incomes, coupled with the increasing number of dermatology clinics and medspas offering advanced devices, are making skin tightening more accessible and contributing to higher procedure volumes

- Convenience, visible outcomes, and safety of device-based treatments are driving their adoption in both urban and suburban markets, making them an integral part of cosmetic and dermatology services. Expansion of insurance coverage for select non-invasive cosmetic procedures and financing options is enabling a larger consumer base to access skin tightening treatments

- Strategic marketing campaigns highlighting minimally invasive and fast-recovery benefits are boosting consumer awareness and driving higher procedure demand across North America

Restraint/Challenge

Side Effects and High Device Costs

- Concerns related to potential side effects such as redness, swelling, or temporary discomfort during and after procedures pose challenges to broader adoption of skin tightening treatments

- For instance, reports of mild post-treatment erythema or discomfort with certain laser or radiofrequency devices have made some patients cautious about undergoing procedures.

- Addressing these concerns through proper clinician training, patient education, and device improvements is essential to maintain consumer confidence and minimize adverse events.

- In addition, the relatively high cost of advanced skin tightening devices and treatment sessions compared to basic cosmetic procedures can be a barrier for price-sensitive patients or smaller clinics.

- While some entry-level devices and treatments are becoming more affordable, premium systems with advanced features, including AI-assisted energy delivery and multi-modality treatment, still command high prices.

- Overcoming these challenges through improved safety profiles, patient awareness, and cost-effective solutions will be critical for sustained market growth in North America. Limited availability of trained professionals to operate advanced devices may slow adoption in certain regions, especially in smaller clinics or rural areas.

- Strict regulatory compliance and certification requirements for aesthetic devices can increase entry barriers for new players and affect the launch speed of innovative skin tightening technologies

North America Skin Tightening Market Scope

The market is segmented on the basis of product type, portability, treatment type, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into radio frequency (RF) skin tightening, laser skin tightening, and ultrasound skin tightening. The RF skin tightening segment dominated the market with the largest revenue share in 2025, driven by its effectiveness in stimulating collagen and improving skin elasticity. Dermatology clinics and medspas prefer RF devices for their safety, versatility, and ability to treat both facial and body areas. RF devices offer adjustable energy levels suitable for different skin types, enhancing treatment personalization and patient satisfaction. Technological advancements such as multipolar and fractional RF systems have increased treatment precision and comfort. Non-invasive nature and minimal downtime further strengthen its adoption. Growing consumer awareness of anti-aging solutions also contributes to the segment’s strong position.

The laser skin tightening segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by innovations in non-ablative and fractional laser technologies. Laser treatments provide precise targeting of wrinkles and sagging skin, ensuring visible results with minimal recovery time. Rising demand among millennials and aging populations is accelerating adoption in both clinics and medspas. Multi-functional laser platforms that combine skin tightening with other aesthetic treatments are increasing efficiency and patient throughput. Strong marketing emphasizing fast, effective, and safe results is boosting consumer acceptance. Clinics are adopting combined RF-laser systems for synergistic outcomes, enhancing growth potential.

- By Portability

On the basis of portability, the market is segmented into portable and standalone devices. The standalone segment dominated in 2025 due to higher power output, advanced features, and suitability for professional clinical use. Standalone devices provide consistent energy delivery across multiple treatment types, making them ideal for dermatology clinics and medspas with high patient volumes. They integrate with digital interfaces for treatment tracking and outcome monitoring. Clinics value their reliability, durability, and professional-grade performance. Many standalone systems include AI-assisted adjustments for precision. Their adaptability across different treatment protocols supports widespread clinical adoption.

The portable segment is expected to witness the fastest growth from 2026 to 2033, driven by rising homecare and at-home treatment adoption. Portable devices offer convenience, affordability, and usability for consumers who prefer non-invasive treatments at home. Improvements in battery life, device safety, and energy efficiency are boosting consumer confidence. E-commerce and direct-to-consumer sales channels increase accessibility. Social media influence and at-home beauty trends are driving demand. Growing popularity of compact, lightweight devices that deliver professional-grade results supports rapid growth.

- By Treatment Type

On the basis of treatment type, the market is segmented into non-invasive and minimally invasive procedures. The non-invasive segment dominated in 2025 with a revenue share of 46.5% due to safety, minimal downtime, and high consumer preference for non-surgical procedures. Clinics and medspas offer non-invasive options to cater to patients seeking quick and effective anti-aging treatments. Integration with complementary therapies, such as facials and topical skincare, enhances patient satisfaction. Non-invasive procedures reduce risk and attract repeat visits. Awareness campaigns and marketing emphasize their safety and effectiveness. Clinics prefer these procedures to attract larger patient volumes.

The minimally invasive segment is expected to witness the fastest growth from 2026 to 2033, fueled by demand for longer-lasting results with moderate intervention. Treatments such as microneedling with RF or thread lifts offer enhanced skin tightening effects. Growing expertise among dermatologists is increasing adoption rates. Combination therapies with non-invasive treatments improve outcomes. Rising awareness and patient willingness to invest in longer-term solutions are driving growth. Technological innovations that reduce downtime and improve precision support higher adoption rates.

- By Application

On the basis of application, the market is segmented into reduce wrinkles, face lifting, body lifting, anti-aging, and others. The face lifting segment dominated in 2025 due to high consumer demand for youthful appearance, improved skin elasticity, and visible facial contouring. Clinics focus on sagging cheeks, jawlines, and forehead areas, leveraging RF and laser devices. Social media influence and aesthetic trends encourage non-surgical facial rejuvenation. Face lifting procedures are often repeatable, generating recurring revenue. Advanced devices allow customized treatments for individual facial structures. High awareness of anti-aging benefits drives consistent adoption in dermatology and medspa clinics.

The body lifting segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising consumer focus on overall body aesthetics. Non-invasive and minimally invasive devices target sagging skin, cellulite, and loose areas, driving demand. Homecare and clinic-based body lifting devices are becoming popular. Multi-applicator devices improve efficiency and treatment coverage. Consumers increasingly seek full-body solutions for aging or post-weight-loss skin laxity. Rising social media influence and influencer endorsements encourage adoption.

- By End User

On the basis of end user, the market is segmented into dermatology clinics, hospitals, beauty salons and cosmetic centers, and homecare. The dermatology clinics segment dominated in 2025 due to professional expertise, advanced device availability, and high patient trust. Clinics offer comprehensive packages, combining multiple technologies for better outcomes. They handle high procedure volumes with skilled staff. Repeat procedures ensure steady revenue streams. Clinics also invest in latest devices to attract premium clients. The professional environment enhances patient confidence in results.

The homecare segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing demand for convenient at-home treatments. Portable RF, laser, and ultrasound devices designed for safe consumer use are gaining traction. Rising awareness of non-invasive treatments, social media campaigns, and e-commerce availability boost adoption. Consumers prefer treatments that minimize clinic visits and downtime. Manufacturers are introducing user-friendly devices with safety features. Homecare treatments appeal to younger demographics seeking self-care and convenience.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct, tenders, and retail. The direct channel dominated in 2025 due to strong relationships between device manufacturers and clinics or medspas. Direct sales ensure training, installation, and after-sales support. Clinics benefit from device customization and ongoing maintenance. High-value devices are typically sold through this channel for reliability. Direct engagement enhances trust and repeat business. Manufacturers often provide clinical demonstrations to maximize adoption.

The retail channel is expected to witness the fastest growth from 2026 to 2033, fueled by increasing homecare and portable device demand. E-commerce, online marketplaces, and beauty retailers improve accessibility for consumers. Aggressive marketing and promotions drive purchases. Financing options and discounts enhance affordability. Rising awareness of home-use devices contributes to rapid adoption. Retail channels enable brand expansion beyond professional clinics into consumer segments.

North America Skin Tightening Market Regional Analysis

- The U.S. dominated the skin tightening market with the largest revenue share of 62.7% in 2025, supported by high consumer disposable incomes, early adoption of advanced aesthetic technologies, and a robust presence of leading medical device companies

- Consumers in the country increasingly seek treatments that offer minimal downtime, visible anti-aging results, and enhanced skin health, boosting the adoption of advanced technologies such as radiofrequency, laser, and ultrasound devices

- The strong presence of dermatology clinics, medspas, and cosmetic centers, combined with high disposable incomes and early adoption of innovative aesthetic solutions, is further supporting market growth

The U.S. Skin Tightening Market Insight

The U.S. skin tightening market captured the largest revenue share of 62.7% in 2025 within North America, fueled by growing consumer awareness of non-invasive cosmetic procedures and advanced aesthetic technologies. Consumers are increasingly prioritizing minimally invasive treatments that offer visible anti-aging results with minimal downtime. The rising preference for device-based solutions, such as radiofrequency, laser, and ultrasound treatments, further propels the market. Moreover, the expansion of dermatology clinics and medspas, along with strategic product launches and marketing campaigns by key companies, is significantly contributing to market growth. The country’s high disposable incomes and strong inclination toward cosmetic self-care are also driving adoption. These factors collectively position the U.S. as the dominant contributor to North America’s skin tightening market.

Canada Skin Tightening Market Insight

The Canada skin tightening market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing aesthetic awareness and rising demand for non-invasive procedures among urban consumers. The growing number of medspas, cosmetic centers, and dermatology clinics is facilitating access to advanced skin tightening technologies. Canadians are drawn to treatments that improve facial and body contours, reduce wrinkles, and provide anti-aging benefits without surgery. Furthermore, rising disposable incomes and the popularity of minimally invasive aesthetic treatments are fostering adoption. The market is also supported by innovations in device-based solutions and the integration of multi-modality treatment platforms. These factors are contributing to steady growth across both residential and professional cosmetic applications.

Mexico Skin Tightening Market Insight

The Mexico skin tightening market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing consumer demand for affordable and effective aesthetic treatments. Rising urbanization and a growing middle class are encouraging investments in dermatology clinics and beauty centers offering skin tightening procedures. The adoption of non-invasive technologies, such as RF, laser, and ultrasound devices, is gaining traction due to their minimal downtime and safety profile. Marketing initiatives highlighting anti-aging benefits and visible results are attracting new patients. In addition, collaborations between device manufacturers and local cosmetic centers are increasing availability. These factors are expected to continue propelling market growth in Mexico.

North America Skin Tightening Market Share

The North America Skin Tightening industry is primarily led by well-established companies, including:

- Cutera, Inc (U.S.)

- Cynosure, LLC (U.S.)

- BTL Group of Companies (U.S.)

- Alma Lasers (U.S.)

- Candela Corporation (U.S.)

- Lumenis Be Ltd. (U.S.)

- Venus Concept (U.S.)

- Solta Medical (U.S.)

- EndyMed Medical Ltd. (U.S.)

- ThermiGen LLC (U.S.)

- Sciton (U.S.)

- InMode Ltd. (U.S.)

- Fotona (U.S.)

- Pollogen (U.S.)

- Hologic, Inc. (U.S.)

- Merz Pharma (Germany)

- BRERA MEDICAL TECHNOLOGIES SRL. (Italy)

- OPATRA (U.K.)

- DEKA M.E.L.A. srl (Italy)

- Bison Medical (U.S.)

What are the Recent Developments in North America Skin Tightening Market?

- In September 2025, Sofwave Medical Ltd received U.S. FDA 510(k) clearance for its standalone EMS device branded Pure Impact VIP™, which expands its non‑invasive firming/tightening portfolio to multi‑body areas including abdomen, arms and thighs

- In August 2025, Cynosure Lutronic, Inc. announced U.S. FDA clearance of its RF‑based skin tightening system XERF™, a non‑invasive solution for skin revitalization across all skin types, enhancing the competitive device landscape in North America

- In November 2024, Cartessa Aesthetics entered into a partnership with Classys, Inc. to bring the monopolar RF skin tightening system Everesse to the U.S. market via Cartessa’s distribution network, enhancing availability of advanced tightening solutions

- In September 2024, Merz Aesthetics launched its next‑generation platform Ultherapy PRIME for non‑surgical skin lifting and tightening, combining advanced ultrasound technology with real‑time imaging for personalized treatments

- In February 2022, Sinclair Pharma announced the acquisition of Viora, a company focused on energy-based aesthetic devices in the U.S., thereby expanding Sinclair’s portfolio in non‑invasive skin tightening technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.