North America Smart Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

33.96 Billion

USD

143.03 Billion

2025

2033

USD

33.96 Billion

USD

143.03 Billion

2025

2033

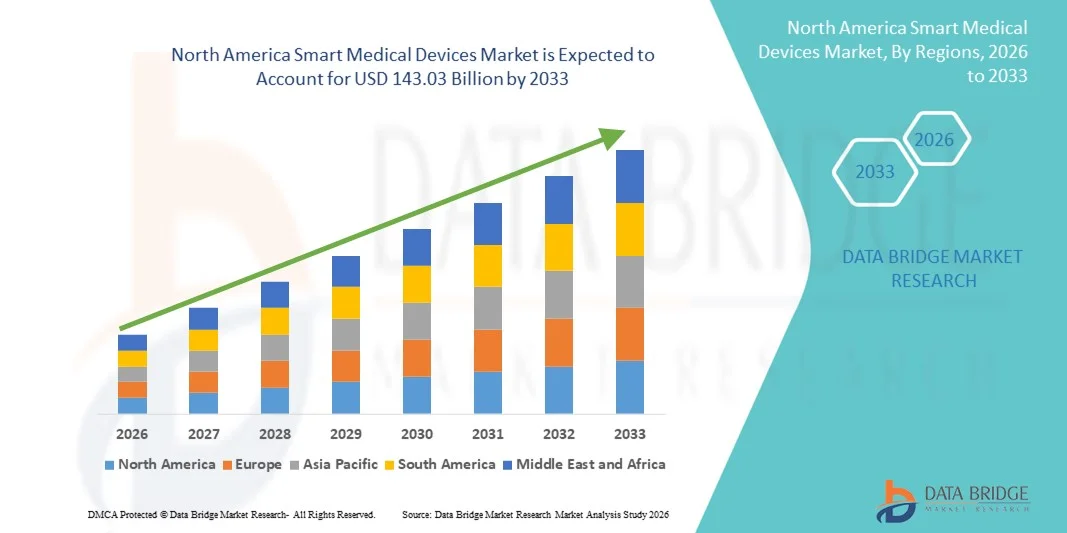

| 2026 –2033 | |

| USD 33.96 Billion | |

| USD 143.03 Billion | |

|

|

|

|

North America Smart Medical Devices Market Size

- The North America smart medical devices market size was valued at USD 33.96 billion in 2025 and is expected to reach USD 143.03 billion by 2033, at a CAGR of 19.69% during the forecast period

- The market growth is largely fueled by rapid technological advancements in IoT‑enabled and connected healthcare technologies, expanding use of wearable and remote patient monitoring devices, and increased healthcare digitalization across both clinical and home care settings. High healthcare spending and strong adoption of advanced medical technologies in the U.S. and Canada underpin ongoing expansion in the region

- Furthermore, rising demand for real‑time health tracking, personalized treatment platforms, and integrated smart solutions for chronic disease management is establishing smart medical devices as essential tools in modern healthcare. These converging factors are accelerating uptake and significantly boosting the industry’s growth trajectory throughout the forecast period

North America Smart Medical Devices Market Analysis

- Smart medical devices, including wearable monitors, IoT-enabled diagnostics, and remote patient care solutions, are increasingly vital components of modern healthcare systems in both clinical and home care settings due to their ability to provide real-time health monitoring, personalized treatment, and seamless integration with digital health platforms

- The escalating demand for smart medical devices is primarily fueled by the growing adoption of connected healthcare technologies, rising chronic disease prevalence, and increased preference for remote monitoring and telehealth solutions among patients and healthcare providers

- The United States dominated the North America smart medical devices market with the largest revenue share of 78.9% in 2025, characterized by early adoption of advanced healthcare technologies, high healthcare spending, and a strong presence of key industry players

- Canada is expected to be the fastest-growing country in the North America smart medical devices market during the forecast period due to increasing healthcare infrastructure investments, rising patient awareness, and growing adoption of digital health technologies

- Wearable devices segment dominated the North America smart medical devices market with a market share of 42.5% in 2025, driven by their proven effectiveness in continuous health monitoring, patient convenience, and compatibility with existing digital health platforms

Report Scope and North America Smart Medical Devices Market Segmentation

|

Attributes |

North America Smart Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

North America Smart Medical Devices Market Trends

Enhanced Convenience Through AI and Remote Monitoring

- A significant and accelerating trend in the North America smart medical devices market is the growing integration of artificial intelligence (AI) and cloud-based remote monitoring platforms. This fusion of technologies is enhancing patient convenience, treatment personalization, and clinical decision-making

- For instance, the BioSticker wearable continuously monitors patient vitals and transmits data to healthcare providers in real time, enabling proactive interventions. Similarly, Fitbit Health Solutions integrates AI algorithms for trend analysis and predictive health alerts

- AI integration in smart medical devices enables features such as predictive diagnostics, adaptive treatment recommendations, and intelligent alerts for anomalies. For instance, some Omron connected blood pressure monitors use AI to detect irregular heartbeats and notify patients and doctors immediately

- The seamless integration of smart medical devices with electronic health record (EHR) systems and telehealth platforms allows healthcare providers to manage multiple patients’ data from a centralized dashboard, improving operational efficiency and patient outcomes

- This trend toward more intelligent, intuitive, and interconnected medical devices is reshaping patient expectations for remote healthcare. Consequently, companies such as iRhythm are developing AI-powered wearables that detect cardiac irregularities and integrate with hospital monitoring systems

- The demand for smart medical devices offering AI-driven insights and real-time remote monitoring is growing rapidly across hospitals, clinics, and home care, as both patients and providers increasingly prioritize convenience, efficiency, and proactive healthcare

- Increasing consumer adoption of mobile health apps and companion platforms that pair with smart devices is driving market expansion by enabling patients to track health trends, set reminders, and share data with providers seamlessly

- Growing collaborations between device manufacturers, software developers, and healthcare institutions are accelerating innovation, enabling the development of more personalized and multifunctional smart medical devices

North America Smart Medical Devices Market Dynamics

Driver

Growing Need Due to Chronic Diseases and Digital Health Adoption

- The increasing prevalence of chronic diseases, aging populations, and the rapid adoption of digital health solutions are significant drivers for heightened demand for smart medical devices

- For instance, in March 2025, Dexcom announced AI-enabled continuous glucose monitors for diabetes management, improving real-time care and patient adherence. Such strategies by leading companies are expected to drive market growth during the forecast period

- As patients and providers seek continuous monitoring and timely interventions, smart medical devices offer advanced features such as real-time data transmission, alerts for abnormal readings, and predictive analytics, providing a compelling upgrade over traditional monitoring methods

- Furthermore, growing telehealth adoption and digital health ecosystem expansion are making smart medical devices integral for connected care, allowing seamless integration with mobile apps and clinical management platforms

- The convenience of remote monitoring, personalized data insights, and automated reporting to healthcare providers are key factors propelling smart medical device adoption. The trend towards home-based monitoring and user-friendly device designs further contributes to market growth

- Increasing government initiatives and reimbursement policies in the U.S. supporting remote patient monitoring and digital health adoption are further accelerating market demand

- Expansion of health insurance coverage and incentives for remote monitoring solutions are motivating both providers and patients to adopt smart medical devices for chronic disease management and post-operative care

Restraint/Challenge

Data Security Concerns and Regulatory Compliance Hurdles

- Concerns surrounding patient data security, privacy, and regulatory compliance pose a significant challenge to broader market penetration. As smart medical devices rely on network connectivity, they are vulnerable to cyber threats, raising anxieties about data integrity and patient confidentiality

- For instance, high-profile reports of vulnerabilities in connected health devices have made some hospitals and patients cautious about adopting remote monitoring solutions, including smart medical devices

- Addressing cybersecurity and compliance concerns through encryption, secure authentication protocols, and adherence to FDA or HIPAA standards is crucial for building trust. Companies such as Medtronic emphasize advanced security features and regular software updates to reassure users

- In addition, the relatively high cost of advanced AI-enabled devices compared to conventional monitoring tools can limit adoption among cost-sensitive healthcare providers and patients. While basic devices from brands such as Withings are more affordable, premium features such as continuous ECG or predictive analytics command higher prices

- Overcoming these challenges through robust data security, regulatory compliance, consumer education, and the development of cost-effective devices will be vital for sustaining market growth in North America

- Rapid technological obsolescence and frequent software updates may pose challenges for healthcare providers and patients, requiring continuous training and investment in compatible systems

- Variability in state-level regulations and approval timelines for connected medical devices can slow product launch and adoption, particularly in multi-state healthcare systems

North America Smart Medical Devices Market Scope

The market is segmented on the basis of product type, type, technology, modality, application, end user, and distribution channel.

- By Product Type

On the basis of product type, the North America smart medical devices market is segmented into diagnostics and monitoring devices and therapeutic devices. The Diagnostics and Monitoring Devices segment dominated the market with the largest revenue share of 52.3% in 2025. This dominance is driven by the growing adoption of continuous monitoring solutions for chronic diseases such as diabetes and cardiovascular disorders. Hospitals and clinics increasingly prefer diagnostic wearables and remote monitoring tools to improve patient outcomes and reduce readmission rates. Patients at home are also using devices such as glucose monitors, wearable ECGs, and pulse oximeters for real-time tracking, which boosts segment growth. The integration of AI and cloud-based analytics further enhances the value of diagnostic and monitoring devices by providing predictive insights and early detection capabilities. The increasing focus on preventive healthcare and telehealth initiatives is fueling sustained demand for this segment.

The Therapeutic Devices segment is expected to witness the fastest growth, with a CAGR of 13.8% from 2026 to 2033. Growth is primarily driven by innovations in connected therapy solutions, such as insulin pumps, neurostimulation devices, and rehabilitation robotics. For instance, AI-enabled wearable infusion pumps allow precise dosage and remote monitoring, improving patient adherence and therapy outcomes. Home healthcare expansion and rising chronic disease prevalence are accelerating the adoption of therapeutic devices. Integration with mobile apps and digital health platforms enhances patient engagement and therapy personalization. Moreover, increased reimbursement policies and insurance coverage for home-use therapeutic devices are supporting rapid market uptake.

- By Type

On the basis of type, the market is segmented into on-body (adhesive patch), off-body (belt clip), and hand held devices. The On-Body (Adhesive Patch) segment dominated the market with the largest revenue share of 45.7% in 2025. This segment’s leadership is driven by patient preference for continuous, non-intrusive monitoring, particularly in chronic disease management. Adhesive patch devices provide real-time vital tracking, including ECG, glucose levels, and temperature, which is valuable for remote care. Hospitals and home healthcare providers are increasingly adopting patch-based devices to reduce hospital visits. Their compact, lightweight design ensures comfort, enhancing patient compliance. Integration with mobile apps and cloud-based dashboards allows clinicians to monitor patients remotely and make timely interventions.

The Hand Held segment is projected to witness the fastest growth during the forecast period, driven by increasing demand for portable and point-of-care diagnostic solutions. Devices such as handheld ultrasound scanners, portable glucometers, and digital stethoscopes enable rapid testing in both clinical and home settings. For instance, portable devices allow field healthcare workers to monitor patients in rural areas with limited access to hospitals. The convenience of immediate results and wireless connectivity for data transmission fuels adoption. Handheld devices are also increasingly integrated with AI-based decision support for enhanced diagnostic accuracy. Rising awareness of preventive healthcare and the need for rapid diagnostics support strong growth for this segment.

- By Technology

On the basis of technology, the market is segmented into spring-based, motor-driven, rotary pump, expanding battery, pressurized gas, and others. The Rotary Pump segment dominated the market with the largest revenue share of 41.5% in 2025. This is primarily due to its extensive application in drug delivery systems such as insulin pumps and infusion devices. Rotary pump technology offers precise and consistent dosing, which is critical for therapeutic effectiveness and patient safety. Hospitals and clinics rely on this technology for both inpatient and outpatient care. The technology’s durability and reliability in long-term use drive adoption in home healthcare as well. Integration with digital monitoring and mobile apps enhances dosing control and compliance.

The Expanding Battery segment is expected to witness the fastest growth during the forecast period, driven by portable and wearable devices requiring longer operation times without frequent recharging. For instance, wearable cardiac monitors and continuous glucose monitors use expanding battery technology to ensure uninterrupted monitoring. The technology supports compact device design and patient comfort, which is critical for home-based care. Increased demand for remote patient monitoring and telehealth integration is accelerating adoption. The battery technology enables multi-day continuous monitoring, reducing the need for device downtime and improving patient outcomes. Growing investment in energy-efficient healthcare devices further supports segment expansion.

- By Modality

On the basis of modality, the market is segmented into wearable and non-wearable devices. The Wearable segment dominated the market with the largest revenue share of 42.5% in 2025. Wearable medical devices allow continuous monitoring of patient health metrics such as heart rate, glucose, and blood pressure. Hospitals, clinics, and home healthcare providers increasingly adopt wearables to enable remote care, improve patient adherence, and reduce hospital readmissions. Wearables offer seamless integration with smartphones and digital health platforms for real-time monitoring and alerts. Their convenience, accuracy, and mobility contribute to strong adoption. The rising focus on preventive healthcare and chronic disease management further boosts demand.

The Non-Wearable segment is projected to witness the fastest growth from 2026 to 2033, fueled by point-of-care devices, bedside monitors, and stationary therapeutic equipment. For instance, non-wearable respiratory monitoring and dialysis devices in clinics are witnessing rapid adoption. The technology is being enhanced with IoT and AI capabilities for remote monitoring and predictive analytics. Expansion of outpatient care and home-based rehabilitation programs is driving demand. Non-wearable devices are preferred in clinical settings for their high precision and ability to handle complex diagnostics and treatments. Integration with hospital management systems further strengthens market growth.

- By Application

On the basis of application, the market is segmented into oncology, diabetes, auto-immune disorders, infection diseases, sports and fitness, sleep disorders, and others. The Diabetes segment dominated the market with the largest revenue share of 49.2% in 2025. This dominance is attributed to the high prevalence of diabetes in the U.S., rising demand for continuous glucose monitoring (CGM) devices, and integration with mobile apps for real-time data and insulin dosing. Hospitals and home care providers widely adopt CGM and connected insulin pumps for improved patient outcomes. The availability of AI-enabled analytics enhances predictive care and personalized treatment.

The Sports and Fitness segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of wearable fitness monitors, heart rate trackers, and smart rehabilitation devices. For instance, devices that monitor heart rate, oxygen saturation, and performance metrics are increasingly used in gyms, sports clubs, and by individual athletes. Rising health awareness and the integration of AI for personalized recommendations boost adoption. The segment benefits from the trend of home-based fitness and tele-rehabilitation programs. Integration with digital platforms and mobile apps for data tracking and coaching further accelerates growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home care, sports club, and others. The Hospitals segment dominated the market with the largest revenue share of 44.5% in 2025, due to high adoption of smart medical devices for inpatient monitoring, critical care, and chronic disease management. Hospitals increasingly implement AI-enabled diagnostic and therapeutic devices to improve operational efficiency and patient outcomes. Large-scale adoption is driven by integration with electronic health record systems, telehealth platforms, and patient monitoring networks.

The Home Care segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing demand for remote monitoring, wearable devices, and therapeutic solutions for chronic diseases. For instance, patients with diabetes, cardiovascular diseases, or sleep disorders use connected devices at home for daily monitoring and remote consultations. Growing focus on home-based care, aging population, and rising awareness of digital health solutions drive adoption. Insurance reimbursement for home-use devices also supports growth. The convenience, comfort, and cost-effectiveness of home care solutions further accelerate adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into pharmacies, online channel, and others. The Online Channel segment dominated the market with the largest revenue share of 38.9% in 2025, driven by increasing consumer preference for direct-to-consumer purchases, convenience, and home delivery of smart medical devices. Online platforms provide detailed product information, comparison tools, and subscription-based device management services, enhancing adoption.

The Pharmacies segment is expected to witness the fastest growth during the forecast period, due to accessibility, professional guidance, and increasing partnerships with medical device manufacturers. For instance, smart glucose monitors and blood pressure devices are increasingly distributed through retail pharmacies, enabling customers to purchase devices alongside medications. Pharmacists also provide guidance on device usage, calibration, and integration with mobile apps. Rising trust in pharmacy-based health services and expansion of pharmacy chains in urban and semi-urban regions support strong growth.

North America Smart Medical Devices Market Regional Analysis

- The United States dominated the North America smart medical devices market with the largest revenue share of 78.9% in 2025, characterized by early adoption of advanced healthcare technologies, high healthcare spending, and a strong presence of key industry players

- Healthcare providers and patients in the region highly value the convenience, real-time monitoring, and predictive insights offered by smart medical devices, including wearable diagnostic tools, remote monitoring solutions, and connected therapeutic devices

- This widespread adoption is further supported by a technologically savvy population, strong government initiatives promoting remote patient monitoring, and the presence of key medical device manufacturers, establishing smart medical devices as essential tools in both clinical and home care settings

U.S. Smart Medical Devices Market Insight

The U.S. smart medical devices market captured the largest revenue share of 78.9% in 2025 within North America, driven by the rapid adoption of connected healthcare technologies and expanding telehealth initiatives. Patients and healthcare providers increasingly prioritize remote monitoring, continuous diagnostics, and personalized treatment solutions. The growing trend of home-based care, combined with robust demand for AI-enabled wearables and mobile application integration, further propels the smart medical devices industry. Moreover, the integration of smart devices with electronic health records (EHRs) and predictive analytics platforms is significantly contributing to market expansion.

Canada Smart Medical Devices Market Insight

The Canada smart medical devices market is projected to grow at a substantial CAGR during the forecast period, fueled by increasing investments in healthcare infrastructure and a strong focus on digital health initiatives. Rising patient awareness, coupled with the adoption of remote patient monitoring and telemedicine solutions, is fostering the uptake of smart medical devices. Canadian healthcare providers are adopting connected devices for chronic disease management, inpatient monitoring, and preventive care. Integration with mobile health apps and AI analytics is also driving improved patient outcomes and operational efficiency.

Mexico Smart Medical Devices Market Insight

The Mexico smart medical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expanding healthcare coverage and increasing adoption of advanced medical technologies. Rising urbanization, improvements in hospital infrastructure, and government initiatives to modernize healthcare services are boosting market growth. Mexico’s growing preference for home-based monitoring devices and wearable therapeutics is contributing to demand. Moreover, partnerships between domestic and international medical device manufacturers are facilitating access to affordable and innovative smart medical solutions.

North America Smart Medical Devices Market Share

The North America Smart Medical Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Abbott (U.S.)

- Dexcom, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Masimo Corporation (U.S.)

- ResMed Inc. (U.S.)

- iRhythm Technologies, Inc. (U.S.)

- AliveCor, Inc. (U.S.)

- Qardio, Inc. (U.S.)

- Sempulse Corporation (U.S.)

- Zephyr Technology Corporation (U.S.)

- Apple Inc. (U.S.)

- Fitbit LLC (U.S.)

- GE HealthCare (U.S.)

- Stryker (U.S.)

- Omron Healthcare, Inc. (U.S.)

- Welch Allyn, Inc. (U.S.)

- Hill-Rom Services, Inc. (U.S.)

- NeuroMetrix, Inc. (U.S.)

What are the Recent Developments in North America Smart Medical Devices Market?

- In October 2024, EmeTerm Smart and HeadaTerm 2 wearable medical devices received Health Canada Medical Device Licences (MDLs), enabling these devices to be marketed in Canada for motion sickness and migraine relief, illustrating cross‑North America regulatory progress and expanded adoption of wearable therapeutic technologies beyond the U.S. FDA framework

- In August 2024, Masimo W1® Medical Watch received FDA 510(k) clearance for integration with the Masimo SafetyNet® telemonitoring system, enabling wrist‑based continuous vital sign transmission (e.g., SpO₂, pulse rate) to caregivers and clinicians via secure cloud connectivity a significant advancement in remote patient monitoring

- In March 2024, the U.S. FDA cleared the first over‑the‑counter continuous glucose monitor, the Dexcom Stelo Glucose Biosensor System, expanding access to real‑time glucose monitoring to adults without a prescription, enabling broader self‑monitoring of blood glucose outside clinical settings

- In January 2024, Nanowear’s SimpleSense‑BP wearable platform received FDA 510(k) clearance for AI‑enabled, cuffless continuous blood pressure monitoring, representing a step forward for at‑home, non‑invasive hypertension diagnostics

- In November 2023, Masimo’s W1™ medical watch gained FDA 510(k) clearance for both over‑the‑counter and prescription use, allowing continuous oxygen saturation and pulse rate monitoring for adults across home and clinical environments, signaling expansion of wearable diagnostics into mainstream healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.