North America Spirometer Market

Market Size in USD Million

CAGR :

%

USD

398.41 Million

USD

737.43 Million

2024

2032

USD

398.41 Million

USD

737.43 Million

2024

2032

| 2025 –2032 | |

| USD 398.41 Million | |

| USD 737.43 Million | |

|

|

|

|

North America Spirometer Market Size

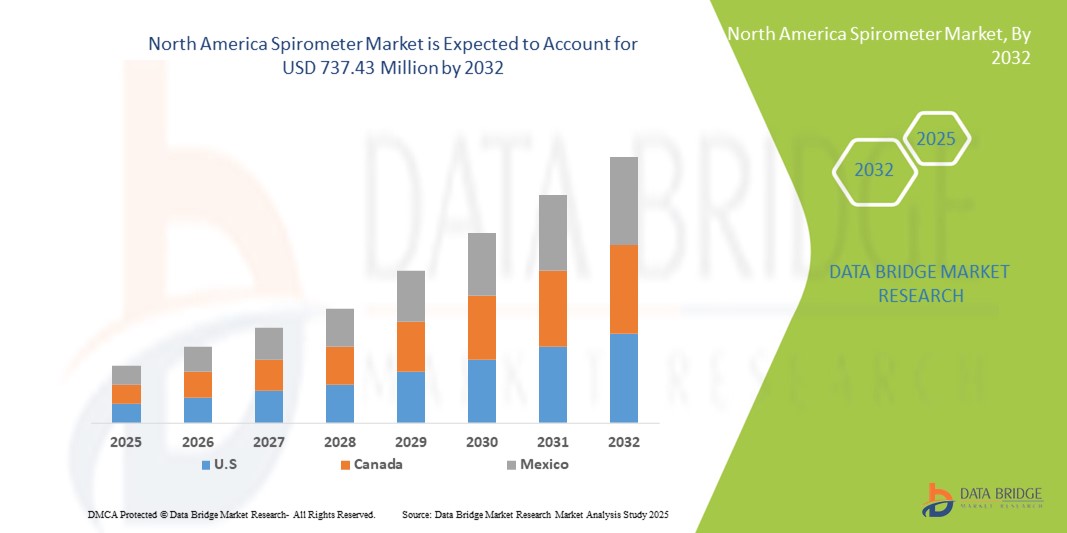

- The North America spirometer market size was valued at USD 398.41 million in 2024 and is expected to reach USD 737.43 million by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic respiratory diseases, such as COPD and asthma, which require regular monitoring of lung function

- Furthermore, advancements in spirometer technology, including portable and integrated devices, along with the expansion of telehealth services, are enhancing accessibility and convenience, establishing spirometers as essential tools in both clinical and home healthcare settings

North America Spirometer Market Analysis

- Spirometers, offering precise measurement of lung function and respiratory capacity, are increasingly vital tools in modern healthcare for diagnosing, monitoring, and managing respiratory conditions in both clinical and homecare settings due to their accuracy, ease of use, and integration with digital health platforms

- The escalating demand for spirometers is primarily fueled by the rising prevalence of chronic respiratory diseases such as COPD and asthma, growing awareness of respiratory health, and the increasing adoption of telehealth and remote patient monitoring solutions

- The United States dominated the North American spirometer market with the largest revenue share of 72.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players, with hospitals and clinical laboratories experiencing substantial adoption of portable and connected spirometer devices, driven by innovations from both established medical device companies and startups focusing on AI-enabled diagnostics

- Canada is expected to be the fastest growing market in North America during the forecast period due to rising respiratory disease prevalence and expanding healthcare access

- Devices and software segment dominated the North America spirometer market with a market share of 62% in 2024, driven by their critical role in diagnostics and integration with digital health systems

Report Scope and North America Spirometer Market Segmentation

|

Attributes |

North America Spirometer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Spirometer Market Trends

Advancements in Connected and AI-Enabled Spirometers

- A significant and accelerating trend in the North American spirometer market is the integration of artificial intelligence (AI) and connectivity features, enabling real-time data sharing, remote monitoring, and predictive analytics for respiratory health management

- For instance, the MIR Spirobank Smart device connects to mobile apps and cloud platforms, allowing healthcare providers to track patient lung function remotely and analyze trends over time

- AI integration in spirometers enables features such as automated interpretation of lung function results, detection of irregular breathing patterns, and personalized health recommendations. For instance, some CareFusion spirometers utilize AI to improve diagnostic accuracy and generate alerts for abnormal patient readings

- The seamless integration of spirometers with telehealth platforms and electronic health records (EHRs) facilitates centralized patient monitoring, allowing healthcare providers to manage multiple patients’ respiratory data efficiently and remotely

- This trend towards connected, intelligent, and user-friendly spirometers is reshaping clinical and home-based respiratory care expectations. Consequently, companies such as ndd Medical are developing AI-enabled spirometers with cloud-based analytics and mobile app integration for improved patient adherence

- The demand for spirometers with AI and connected features is growing rapidly across hospitals, clinical laboratories, and homecare settings, as providers and patients increasingly prioritize convenient, accurate, and data-driven respiratory monitoring

North America Spirometer Market Dynamics

Driver

Rising Prevalence of Chronic Respiratory Diseases and Telehealth Adoption

- The increasing prevalence of COPD, asthma, and other respiratory disorders, coupled with the expanding adoption of telehealth and remote monitoring solutions, is a key driver for the rising demand for spirometers

- For instance, in March 2024, ndd Medical reported increased utilization of its wireless spirometers for home-based COPD monitoring, reflecting growing clinical and patient adoption of connected respiratory devices

- As awareness of respiratory health grows, spirometers provide accurate diagnostic and monitoring capabilities, offering a compelling solution for early detection and continuous disease management

- Furthermore, the expansion of digital health infrastructure and integration with mobile applications and cloud platforms makes spirometers essential in modern healthcare workflows, enhancing patient engagement and adherence

- The convenience of portable, user-friendly spirometers for homecare settings, alongside hospital and clinic adoption, is propelling market growth in both preventive and therapeutic respiratory applications

Restraint/Challenge

High Cost of Advanced Devices and Regulatory Compliance Hurdles

- The relatively high price of advanced connected and AI-enabled spirometers compared to traditional devices poses a challenge for widespread adoption, particularly in price-sensitive patient segments and smaller healthcare facilities

- For instance, premium spirometers from CareFusion or ndd Medical with cloud connectivity and AI features can cost significantly more than basic handheld devices, limiting accessibility

- Regulatory compliance requirements for medical devices, including FDA approvals and data privacy regulations, add complexity and slow the introduction of new spirometer models into the market

- Addressing these challenges requires companies to offer cost-effective devices, provide education on clinical benefits, and ensure adherence to regulatory standards to build trust among healthcare providers and patients

- While prices are gradually decreasing and more portable options are emerging, the perceived premium for advanced connected spirometers can still hinder adoption, especially for homecare users who do not require full-featured clinical capabilities

North America Spirometer Market Scope

The market is segmented on the basis of product, type, mechanism, disposable components, diseases, application, end use, and distribution channel.

- By Product

On the basis of product, the North America spirometer market is segmented into consumables and accessories, and devices and software. The devices and software segment dominated the market with the largest market revenue share of 62% in 2024, driven by the increasing adoption of portable and connected spirometers for clinical diagnostics and homecare monitoring. Healthcare providers often prioritize devices and software for their accuracy, ease of integration with electronic health records (EHRs), and ability to deliver real-time data for remote patient management. The segment benefits from continuous technological advancements, including AI-assisted analysis, cloud connectivity, and mobile app integration. In addition, rising awareness of respiratory health and the need for continuous monitoring in COPD and asthma patients further boosts adoption. Devices and software solutions are also favored for their compatibility with telehealth platforms, enabling seamless patient-provider communication. The segment’s established clinical utility and growing homecare applications make it the largest contributor to market revenue.

The consumables and accessories segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing demand for disposable filters, sensors, and tubes required for hygiene and accuracy during pulmonary function tests. Consumables are essential for single-patient use, minimizing cross-contamination risks in hospitals and clinics. Rising homecare monitoring also contributes to consumables demand, as patients require regular replacements for accurate readings. Innovations in sensor technology and compact disposable kits are attracting homecare users and smaller clinics. Manufacturers are introducing user-friendly and cost-effective consumable packs, encouraging repeat purchases and driving market growth. The growth of the consumables segment is further supported by stringent regulatory requirements ensuring patient safety.

- By Type

On the basis of type, the market is segmented into pneumotachometer, incentive, wind-mill type spirometer, tilt-compensated spirometer, and others. The pneumotachometer segment dominated the market in 2024, accounting for the largest share, owing to its high accuracy and preference among hospitals and diagnostic laboratories for clinical assessments. Pneumotachometers provide precise measurements of airflow and volume, making them suitable for complex respiratory disease management. Healthcare professionals often rely on pneumotachometers for both adult and pediatric patient testing due to their reliability. The devices are compatible with digital platforms and cloud-based monitoring solutions, further driving adoption in modern healthcare facilities. Continuous innovations in portable and handheld pneumotachometers have increased accessibility for homecare monitoring as well. In addition, the segment’s integration with AI-enabled diagnostic tools enhances its clinical relevance.

The incentive spirometer segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing use in post-operative care and pulmonary rehabilitation programs. Incentive spirometers are widely recommended to prevent respiratory complications following surgery or prolonged hospitalization. Their simple design, low cost, and proven efficacy in improving lung capacity make them popular in both homecare and hospital settings. Awareness programs by healthcare providers promoting incentive spirometer use among at-risk patients support growth. Integration with digital monitoring platforms for patient adherence tracking further boosts adoption. Rising post-surgical procedures and preventive respiratory care initiatives are key factors driving segment expansion.

- By Mechanism

On the basis of mechanism, the market is segmented into flow-sensing spirometer and peak flow meters. The flow-sensing spirometer segment dominated in 2024 due to its superior accuracy, suitability for both clinical and home use, and integration capabilities with AI and telehealth platforms. Flow-sensing spirometers are preferred for detailed lung function analysis and monitoring chronic respiratory conditions. Their digital outputs allow for seamless data sharing with healthcare providers, supporting remote diagnostics. Continuous innovation in portable and wireless flow-sensing devices has enhanced usability and patient compliance. The segment’s dominance is also attributed to its versatility across various healthcare settings, including hospitals, clinical labs, and homecare. High reliability and regulatory approvals further strengthen adoption in the U.S. market.

The peak flow meter segment is expected to witness the fastest growth from 2025 to 2032, driven by rising homecare monitoring for asthma and COPD management. Peak flow meters are portable, easy to use, and affordable, making them suitable for self-monitoring and daily use. Integration with mobile apps allows patients to track lung function trends and share data with clinicians. Growing awareness of asthma management and preventive care is increasing adoption. Innovations in digital peak flow meters with automated readings and alerts further enhance usability. The segment benefits from widespread patient acceptance and healthcare provider recommendations.

- By Disposable Components

On the basis of disposable components, the market is segmented into filters, sensors, and tubes. The sensors segment dominated the market in 2024 due to its critical role in ensuring accurate respiratory measurements and enabling integration with AI-enabled devices. Sensors are vital for measuring airflow, volume, and patient effort, and their quality directly affects diagnostic precision. High adoption in hospitals and clinical laboratories for single-patient use further strengthens demand. Continuous technological advancements in sensor accuracy and miniaturization have enhanced usability and portability. Regulatory standards emphasizing patient safety and hygiene boost the preference for high-quality sensors. The sensors segment also benefits from growing telehealth adoption and remote monitoring needs.

The filters segment is expected to witness the fastest growth rate from 2025 to 2032, driven by hygiene requirements in hospitals, clinics, and homecare settings. Disposable filters prevent cross-contamination and maintain device accuracy, making them essential for repeated use across multiple patients. Rising awareness about infection control in respiratory care contributes to increasing adoption. Manufacturers are developing cost-effective and easy-to-replace filter kits for homecare users. The segment also benefits from increasing disposable device usage for telehealth applications. Growth is further supported by rising COPD and asthma prevalence requiring regular monitoring.

- By Diseases

On the basis of diseases, the market is segmented into COPD, asthma, and other respiratory conditions. The COPD segment dominated in 2024 due to the high prevalence of chronic obstructive pulmonary disease in the U.S. and the necessity of regular lung function monitoring for disease management. COPD patients require continuous assessment of airflow obstruction, making spirometers essential diagnostic tools. Hospitals and clinics extensively use advanced devices for clinical decision-making. Homecare adoption of connected spirometers further drives segment growth. Awareness programs and government initiatives supporting COPD management contribute to rising demand. Technological innovations in AI-enabled monitoring improve patient adherence and disease management outcomes.

The asthma segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing incidence among children and adults and the adoption of homecare monitoring devices. Portable spirometers and peak flow meters allow patients to self-monitor lung function and detect early exacerbations. Integration with mobile apps and telehealth platforms enhances remote care and personalized treatment. Awareness campaigns and preventive care programs promote adoption. Technological advancements in digital asthma monitoring devices further accelerate segment growth. Rising patient and caregiver focus on proactive management of asthma drives market expansion.

- By Application

On the basis of application, the market is segmented into diagnostics and therapeutics. The diagnostics segment dominated in 2024 due to its critical role in early detection and monitoring of respiratory diseases. Spirometers are widely used in hospitals, clinical laboratories, and homecare settings for routine and preventive assessments. Integration with EHRs and AI-enabled analytics enhances clinical utility. Growing prevalence of respiratory diseases increases demand for precise diagnostics. The diagnostic segment benefits from established protocols and continuous technological upgrades. Telehealth integration further strengthens its adoption across various healthcare settings.

The therapeutics segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing use of spirometers in pulmonary rehabilitation, post-operative care, and preventive therapy. Homecare adoption of therapeutic devices is growing rapidly due to convenience and continuous monitoring. Integration with mobile apps and cloud platforms allows healthcare providers to remotely track patient adherence. Rising awareness of respiratory therapy benefits and government initiatives supporting rehabilitation programs contribute to growth. Technological innovations in connected therapeutic devices enhance usability and patient outcomes.

- By End Use

On the basis of end use, the market is segmented into hospitals, clinical laboratories, homecare settings, and industrial settings. The hospitals segment dominated in 2024 due to the high patient volume, advanced infrastructure, and adoption of digital and AI-enabled spirometers for accurate diagnostics and monitoring. Hospitals are primary buyers of sophisticated spirometer devices, ensuring clinical accuracy and regulatory compliance. Integration with hospital management systems and telehealth platforms further supports adoption. Continuous training and awareness programs enhance the utilization of advanced devices. The segment benefits from growing respiratory disease prevalence and increasing demand for in-patient and out-patient monitoring.

The homecare settings segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing prevalence of chronic respiratory diseases, rising awareness of preventive care, and expanding telehealth services. Portable and connected spirometers allow patients to monitor lung function remotely. Integration with mobile apps and AI-based analytics improves patient adherence and physician oversight. Increasing healthcare expenditure on home-based care and government initiatives supporting chronic disease management contribute to growth. The convenience and cost-effectiveness of homecare monitoring drive adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into over the counter (OTC) and direct tender. The direct tender segment dominated in 2024 due to the procurement of advanced spirometer devices by hospitals, clinics, and government healthcare programs. Bulk purchases through tenders ensure cost efficiency, warranty support, and service contracts for large-scale healthcare facilities. Direct tender distribution allows manufacturers to establish long-term partnerships with healthcare institutions. Hospitals and laboratories prefer direct tender procurement for high-value diagnostic equipment to ensure compliance with regulatory and technical standards. Continuous expansion of healthcare infrastructure and modernization programs support direct tender growth.

The over the counter (OTC) segment is expected to witness the fastest growth from 2025 to 2032, driven by rising homecare adoption and the availability of user-friendly portable spirometers and peak flow meters. OTC sales enable patients and caregivers to access devices directly without prescriptions, facilitating preventive care. Integration with mobile apps and cloud platforms enhances self-monitoring and data tracking. Increasing awareness of respiratory health and chronic disease management supports growth. Technological advancements in compact, affordable OTC devices contribute to the segment’s rapid adoption.

North America Spirometer Market Regional Analysis

- The United States dominated the North American spirometer market with the largest revenue share of 72.8% in 2024, characterized by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players

- Patients and healthcare providers in the region highly value the accuracy, portability, and real-time data capabilities offered by modern spirometers, which can be integrated with mobile apps, cloud platforms, and electronic health records for seamless monitoring and management of respiratory conditions

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare expenditure, and the presence of key market players offering innovative AI-enabled and connected spirometer solutions, establishing these devices as essential tools in hospitals, clinical laboratories, and homecare settings

U.S. Spirometer Market Insight

The U.S. spirometer market captured the largest revenue share of 72.8% in 2024 within North America, driven by the high prevalence of chronic respiratory diseases such as COPD and asthma, and the increasing adoption of telehealth and remote patient monitoring solutions. Patients and healthcare providers are prioritizing portable, AI-enabled, and connected spirometer devices for accurate lung function assessment. The growing trend of homecare monitoring, combined with robust demand for integration with mobile apps and cloud platforms, further propels the spirometer industry. Moreover, advancements in digital spirometry and the availability of user-friendly devices are significantly contributing to market expansion.

Canada Spirometer Market Insight

The Canada spirometer market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of respiratory health, increasing prevalence of chronic respiratory disorders, and the need for continuous lung function monitoring. The growing adoption of telehealth solutions and connected healthcare platforms is fostering demand for advanced spirometer devices. Canadian patients and healthcare providers are also drawn to the convenience and accuracy offered by portable and AI-enabled spirometers. The market is witnessing significant growth across hospitals, clinical laboratories, and homecare settings, with devices being integrated into both new healthcare setups and rehabilitation programs.

Mexico Spirometer Market Insight

The Mexico spirometer market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising respiratory disease prevalence and increasing investments in healthcare infrastructure. In addition, growing patient awareness about preventive care and home-based monitoring is encouraging the adoption of spirometers. Mexico’s expanding telehealth network and the availability of cost-effective, portable spirometer devices are expected to stimulate market growth. Healthcare providers are increasingly incorporating connected spirometers into clinical and homecare workflows, enhancing the management of chronic respiratory conditions.

North America Spirometer Market Share

The North America Spirometer industry is primarily led by well-established companies, including:

- ndd Medical Technologies (U.S.)

- Jones Medical Instrument Company (U.S.)

- MIR Corporation (U.S.)

- Queset Medical (U.S.)

- CMI Health Inc. (U.S.)

- Micro Direct, Inc. (U.S.)

- OHD, LLLP (U.S.)

- Master Medical Equipment (U.S.)

- Futuremed America Inc. (U.S.)

- Bionet America, Inc. (U.S.)

- SDI Diagnostics (U.S.)

- CareFusion Corporation (U.S.)

- Medtronic (Ireland)

- Cosmed (Italy)

- Schiller AG (Switzerland)

- NIHON KOHDEN CORPORATION (Japan)

- Contec Medical Systems Co., Ltd. (China)

- Microlife Corporation (Switzerland)

- Fysiomed (Canada)

What are the Recent Developments in North America Spirometer Market?

- In August 2025, the FDA issued a warning letter to Uscom Kft concerning its SpiroSonic AIR spirometer. The agency noted that the device, which had been submitted for 510(k) clearance in April 2022, was being marketed without the necessary approval. The SpiroSonic AIR is intended for performing basic lung function tests in adults and children over the age of four. This development underscores the importance of regulatory compliance in the medical device industry

- In November 2024, coinciding with World COPD Day, ndd Medical Technologies launched the EasyOne Sky spirometer. This device is designed to provide accurate and reliable lung function testing, featuring wireless connectivity and a user-friendly interface. The EasyOne Sky aims to enhance patient care by facilitating easier and more efficient spirometry testing in both clinical and home settings. The launch underscores ndd Medical Technologies' commitment to advancing respiratory diagnostics and improving patient outcomes

- In January 2024, NuvoAir announced that its Air Next spirometer had received 510(k) clearance from the FDA for in-home use. This device allows for continuous lung monitoring, providing patients with chronic respiratory conditions a reliable tool for managing their health from home. The approval supports NuvoAir's expansion of clinical operations, aiming to ensure comprehensive care for all patients with heart or lung conditions

- In September 2023, Alveofit received 510(k) clearance from the U.S. Food and Drug Administration for its Alveoair digital spirometer. This portable device is designed for patients with chronic respiratory conditions such as asthma, COPD, cystic fibrosis, or interstitial lung disease. The Alveoair enables accurate lung function testing and integrates with mobile applications for real-time monitoring, enhancing patient engagement and care

- In April 2021, Vitalograph introduced the Pneumotrac spirometer in the United States, accompanied by its upgraded Spirotrac 6 software. This combination offers enhanced functionality for pulmonary function testing, featuring improved data analysis capabilities and user-friendly interfaces. The integration of the Pneumotrac spirometer with Spirotrac 6 software aims to streamline diagnostic workflows and provide healthcare professionals with more accurate and efficient tools for assessing lung health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.