North America Uterine Cancer Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

4.20 Billion

USD

9.82 Billion

2024

2032

USD

4.20 Billion

USD

9.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.20 Billion | |

| USD 9.82 Billion | |

|

|

|

|

North America Uterine Cancer Diagnostics Market Size

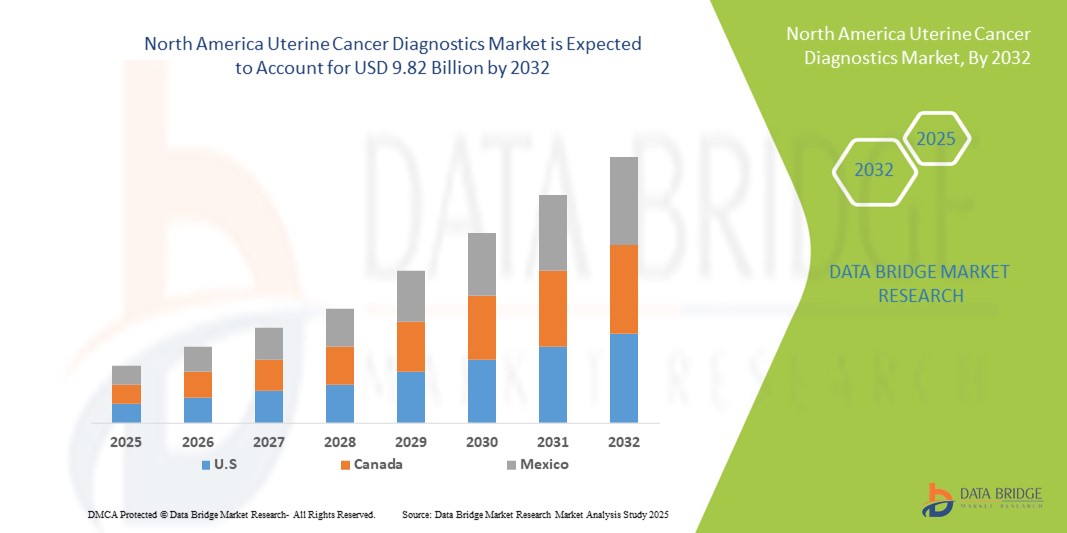

- The North America uterine cancer diagnostics market size was valued at USD 4.20 billion in 2024 and is expected to reach USD 9.82 billion by 2032, at a CAGR of 11.2% during the forecast period

- The market growth is largely fueled by the rising prevalence of uterine cancer, growing awareness of early detection, and increasing adoption of advanced diagnostic tools such as molecular testing, imaging technologies, and biomarker-based screening

- Furthermore, supportive government initiatives, expanding access to healthcare infrastructure, and the integration of precision diagnostics in oncology are strengthening the region’s diagnostic capabilities. These converging factors are accelerating the adoption of uterine cancer diagnostic solutions, thereby significantly boosting the market’s growth

North America Uterine Cancer Diagnostics Market Analysis

- Uterine cancer diagnostics, encompassing instrument-based and procedure-based approaches, are increasingly vital for early detection, accurate staging, and effective treatment monitoring, with adoption across hospitals, diagnostic centers, and specialized cancer facilities in the region

- The escalating demand for advanced diagnostic solutions is primarily fueled by the rising incidence of uterine cancer, growing awareness of women’s health, and the rapid integration of molecular and genetic testing that supports precision oncology

- U.S. dominated the North America uterine cancer diagnostics market with the largest revenue share of 82.5% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, and strong research capabilities driving adoption of innovative diagnostic tools

- Canada is expected to be the fastest growing country in the uterine cancer diagnostics market during the forecast period, driven by rising healthcare expenditure, government-backed cancer screening initiatives, and increasing access to advanced oncology services

- Instrument-based diagnostics segment dominated the uterine cancer diagnostics market with a market share of 61.8% in 2024, owing to the widespread use of imaging and laboratory platforms that enable reliable early detection and guide treatment decisions

Report Scope and North America Uterine Cancer Diagnostics Market Segmentation

|

Attributes |

North America Uterine Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Uterine Cancer Diagnostics Market Trends

Advancement of Precision Medicine and Biomarker-Based Testing

- A significant and accelerating trend in the North America uterine cancer diagnostics market is the growing adoption of precision medicine approaches supported by biomarker-based and genomic testing. This is significantly enhancing accuracy in detection, staging, and personalized treatment planning

- For instance, Guardant Health expanded its liquid biopsy offerings in 2024, enabling earlier detection and monitoring of gynecological cancers, including uterine malignancies, through non-invasive molecular testing platforms

- The integration of biomarker-driven diagnostics allows oncologists to tailor therapies to patient-specific tumor characteristics, improving treatment outcomes while minimizing unnecessary interventions. Companies such as Caris Life Sciences are actively developing molecular profiling tools that aid in guiding treatment pathways

- The use of next-generation sequencing (NGS) and companion diagnostics is expanding rapidly, enabling clinicians to identify genetic mutations and actionable targets linked to uterine cancer. This trend is reshaping diagnostic practices by embedding genomics as a standard in cancer management

- The seamless integration of biomarker diagnostics with digital health platforms and data analytics is creating a unified patient care pathway, ensuring clinicians can manage diagnostic, therapeutic, and monitoring decisions from a single interface

- This trend toward precision-driven, genomic-enabled diagnostic solutions is fundamentally reshaping the North America market. Consequently, companies are investing heavily in companion diagnostics to support immunotherapy and targeted drug development for uterine cancer patients

- The demand for biomarker-based diagnostics and personalized cancer testing is growing rapidly across hospitals and specialized cancer centers, as patients and providers increasingly prioritize individualized treatment strategies and improved survival outcomes

North America Uterine Cancer Diagnostics Market Dynamics

Driver

Rising Incidence and Early Detection Awareness

- The increasing prevalence of uterine cancer cases across North America, combined with heightened public awareness about the importance of early detection, is a significant driver fueling the demand for advanced diagnostic solutions

- For instance, in March 2024, the American Cancer Society highlighted a year-on-year rise in uterine cancer cases, with strong emphasis on earlier detection initiatives to reduce mortality, pushing healthcare providers to adopt innovative diagnostic tools

- As women become more aware of risk factors and screening benefits, demand is increasing for procedures that include molecular testing, imaging, and biopsy-based methods, offering superior accuracy over conventional screening

- Furthermore, the integration of public health campaigns and insurance-backed screening programs in the U.S. is making uterine cancer diagnostics more accessible, ensuring larger populations benefit from earlier intervention strategies

- The ability of diagnostic platforms to not only detect but also guide treatment planning is propelling their adoption across hospitals, cancer research centers, and diagnostic laboratories, strengthening the overall market demand

- Rising investment in women’s healthcare and supportive government initiatives are also contributing to the faster adoption of advanced diagnostics, with ongoing partnerships between biotech firms and oncology networks boosting innovation in uterine cancer testing

Restraint/Challenge

High Diagnostic Costs and Accessibility Barriers

- Concerns surrounding the high cost of advanced diagnostic methods, including genomic sequencing and biomarker assays, pose a significant challenge to broader adoption across the North America uterine cancer diagnostics market

- For instance, despite clinical benefits, advanced tests such as next-generation sequencing remain expensive, limiting widespread use, particularly among patients with limited insurance coverage or in regions with budget-constrained healthcare systems

- Addressing affordability challenges through expanded insurance reimbursement, value-based pricing, and government-funded screening initiatives will be crucial for expanding access and building confidence in advanced diagnostics

- Companies such as Foundation Medicine emphasize affordability programs and partnerships with payers to mitigate cost-related adoption hurdles while promoting the clinical utility of comprehensive genomic profiling for uterine cancers

- In addition to cost, access disparities remain a barrier, particularly in rural or underserved regions where advanced cancer diagnostic facilities are limited, making early detection difficult for certain populations

- While technological innovation continues, overcoming these economic and geographic challenges will be vital to ensure broader access, patient equity, and sustained growth of the uterine cancer diagnostics market in North America

North America Uterine Cancer Diagnostics Market Scope

The market is segmented on the basis of diagnostic type, type, age group, end user, and distribution channel.

- By Diagnostic Type

On the basis of diagnostic type, the North America uterine cancer diagnostics market is segmented into instrument-based and procedure-based diagnostics. The instrument-based segment dominated the market with the largest revenue share of 61.8% in 2024, driven by the widespread adoption of imaging modalities such as ultrasound, MRI, and CT scans, alongside advanced molecular platforms. Hospitals and diagnostic centers prefer these technologies because they deliver rapid, reliable, and non-invasive detection, which is crucial for early intervention. Furthermore, instrument-based diagnostics are increasingly integrated with AI and digital pathology solutions, enhancing accuracy and reducing interpretation errors. Their scalability across both urban and specialized cancer facilities also reinforces their strong dominance.

The procedure-based segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising adoption of biopsies, hysteroscopies, and genetic profiling techniques that provide definitive diagnosis. Advances in minimally invasive procedures are reducing patient discomfort and improving diagnostic turnaround time, making them increasingly favorable. The demand is further supported by the shift toward precision oncology, where tissue-based and molecular procedures play a central role in guiding targeted therapies. As clinical practice evolves, procedure-based methods are expected to see accelerated adoption in both hospital and outpatient cancer care settings.

- By Type

On the basis of type, the North America uterine cancer diagnostics market is segmented into endometrial cancer and uterine sarcoma. The endometrial cancer segment dominated the market with the largest revenue share of 78.6% in 2024, as it represents the most prevalent form of uterine cancer in North America. High incidence rates among postmenopausal women and well-established screening pathways ensure consistent demand for related diagnostic services. The segment also benefits from strong public awareness campaigns and the inclusion of endometrial cancer in national screening guidelines. The availability of advanced tests, such as biomarker panels and next-generation sequencing (NGS), further drives adoption.

The uterine sarcoma segment is anticipated to grow at the fastest CAGR from 2025 to 2032, despite its lower prevalence, due to the increasing emphasis on early detection of rare cancers. Growing clinical awareness and advances in molecular profiling are improving diagnostic accuracy for uterine sarcoma, which is often difficult to detect in its early stages. Furthermore, research investments in rare cancer diagnostics and the push for precision medicine are accelerating innovation in this category. As clinical trial pipelines expand, diagnostic solutions for uterine sarcoma are expected to witness rapid adoption.

- By Age Group

On the basis of age group, the North America uterine cancer diagnostics market is segmented into <30, 31–40, 41–50, 51–60, and >60 years. The >60 years segment dominated the market with a share of 46.9% in 2024, as the risk of uterine cancer significantly increases with age, particularly after menopause. High diagnostic demand in this group is driven by elevated incidence rates, routine screening, and greater healthcare utilization by older women. Hospitals and cancer research centers are particularly focused on this demographic due to their higher such aslihood of comorbidities, necessitating comprehensive diagnostic evaluation. Moreover, insurance coverage and government-funded screening programs are more accessible for this age group, strengthening its dominance.

The 41–50 years segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by rising incidence among younger women driven by lifestyle factors, obesity, and genetic predisposition. Increased awareness of reproductive health and proactive screening behaviors in this age group are accelerating demand for advanced diagnostic services. Moreover, clinicians are increasingly recommending biomarker and molecular testing for this cohort, enabling earlier detection and better treatment planning. The growing healthcare focus on women in midlife, along with expanded insurance coverage for preventive diagnostics, will support strong growth in this segment.

- By End User

On the basis of end user, the North America uterine cancer diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, ambulatory surgical centers, specialized clinics, and others. The hospitals segment dominated the market with the largest revenue share of 49.2% in 2024, driven by their ability to offer comprehensive diagnostic facilities including imaging, pathology, and molecular testing under one roof. Hospitals also benefit from access to skilled oncologists and pathologists, as well as favorable reimbursement structures, making them the preferred point of care. Large patient volumes and established referral networks further reinforce their leadership. In addition, hospitals are at the forefront of adopting AI-integrated imaging and genomic diagnostics, strengthening their role in this market.

The cancer research centers segment is anticipated to witness the fastest CAGR from 2025 to 2032, as they play a critical role in the development and clinical validation of new diagnostic technologies. These centers are heavily involved in molecular research, biomarker discovery, and clinical trials for uterine cancer diagnostics. Collaborations with biotechnology firms and pharmaceutical companies are fueling innovation in this space. Growing funding for oncology research, particularly in the U.S. and Canada, is enhancing their ability to adopt and scale advanced testing platforms, driving accelerated growth.

- By Distribution Channel

On the basis of distribution channel, the North America uterine cancer diagnostics market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated the market with the largest revenue share of 57.8% in 2024, owing to the procurement of diagnostic instruments and consumables directly by hospitals, research centers, and large diagnostic laboratories. Direct tendering allows institutions to negotiate better pricing, ensure reliable supply, and secure long-term partnerships with manufacturers. This approach also provides greater control over product quality and after-sales service, which is crucial for high-value diagnostic equipment.

The third-party distributors segment is expected to grow at the fastest CAGR from 2025 to 2032, as smaller clinics, ambulatory centers, and independent diagnostic labs increasingly rely on distributor networks for access to advanced technologies. These distributors enable broader market penetration by supplying to facilities that cannot engage in large-scale direct procurement. In addition, the rise of digital distribution platforms and value-added reseller services is improving access to specialized diagnostic products in rural and underserved areas, fueling their growth potential.

North America Uterine Cancer Diagnostics Market Regional Analysis

- The U.S. dominated the North America uterine cancer diagnostics market with the largest revenue share of 82.5% in 2024, supported by advanced healthcare infrastructure, favorable reimbursement policies, and strong research capabilities driving adoption of innovative diagnostic tools

- Patients and healthcare professionals in the U.S. highly value the accuracy, reliability, and integration of diagnostics such as imaging, biopsies, and molecular assays, which are increasingly incorporated into precision oncology and treatment planning

- This leadership position is further supported by advanced healthcare infrastructure, favorable reimbursement systems, and significant R&D investments, establishing the U.S. as the primary hub for innovation and adoption in uterine cancer diagnostics across North America

U.S. Uterine Cancer Diagnostics Market Insight

The U.S. uterine cancer diagnostics market captured the largest revenue share of 82.5% in 2024 within North America, fueled by the high incidence of uterine cancer and the widespread adoption of advanced diagnostic technologies. Patients and providers are increasingly prioritizing early detection through imaging, biopsies, and molecular testing solutions that support personalized treatment planning. The growing use of next-generation sequencing, companion diagnostics, and biomarker assays is further propelling demand. Moreover, the presence of advanced healthcare infrastructure, favorable reimbursement policies, and significant investment in oncology research is strengthening the U.S. market’s leadership.

Canada Uterine Cancer Diagnostics Market Insight

The Canada uterine cancer diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, driven by government-backed cancer screening programs and rising healthcare spending. Increasing awareness of women’s health and growing access to advanced diagnostic services are fostering adoption. Canadian healthcare providers are increasingly integrating biomarker and genomic testing into clinical workflows, improving diagnostic precision. The region is experiencing notable growth in both urban and regional cancer centers, with expanding collaborations between diagnostic companies and hospitals fueling further adoption.

Mexico Uterine Cancer Diagnostics Market Insight

The Mexico uterine cancer diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by improving access to healthcare infrastructure and rising investments in oncology services. Growing government initiatives to expand cancer screening programs and the availability of cost-effective diagnostic solutions are accelerating adoption. Patients and healthcare providers are showing increased interest in molecular and biomarker-based testing to enable earlier detection and better outcomes. The gradual modernization of diagnostic laboratories, along with collaborations with U.S. and international companies, is strengthening the country’s diagnostic capabilities

North America Uterine Cancer Diagnostics Market Share

The North America Uterine Cancer Diagnostics industry is primarily led by well-established companies, including:

- Caris Life Sciences. (U.S.)

- Guardant Health (U.S.)

- Natera, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- Tempus Labs, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Labcorp (U.S.)

- NeoGenomics Laboratories (U.S.)

- Mayo Clinic (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- PerkinElmer (U.S.)

- Agilent Technologies, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Exact Sciences Corporation (U.S.)

- LGC SeraCare (U.S.)

- Adaptive Biotechnologies Corporation (U.S.)

- Invitae Corporation (U.S.)

What are the Recent Developments in North America Uterine Cancer Diagnostics Market?

- In July 2025, Gnosis launched EdenDx, the first U.S. commercially available, non-invasive liquid cytology test for early-stage endometrial cancer detection. The test uses a cervical brush or broom during a routine pelvic exam, analyzes methylation of CDO1 and CELF4 genes, and delivers results in 3-7 days offering a less invasive early-detection tool than biopsy and imaging

- In July 2025, the American Association for Cancer Research (AACR) presented projections from Columbia University researchers showing a sharp increase in uterine cancer incidence and mortality by 2050, with notable racial disparities particularly that Black women may experience nearly triple the mortality by incidence compared to white women

- In March 2025, Caris Life Sciences announced a strategic collaboration with members of the Caris Precision Oncology Alliance (POA) comprising 96 cancer centers, academic institutions, and research consortia to standardize molecular testing and improve real-world evidence generation for gynecologic malignancies. This collaboration aims to accelerate precision-diagnostic workflows and improve patient outcomes across uterine cancer diagnostics

- In January 2024, Mayo Clinic Laboratories released a news bulletin titled “A substantial step toward earlier endometrial cancer detection”, reporting a study led by Mayo Clinic researchers who identified and validated methylated DNA markers detectable in vaginal fluid collected using a tampon. This work represents progress toward a less-invasive, earlier detection approach to endometrial cancer that could supplement or replace traditional biopsy-based diagnostics

- In January 2023, Foundation Medicine announced a collaboration with Karyopharm Therapeutics to develop its FoundationOne CDx as a companion diagnostic for selinexor (XPOVIO®) as a potential maintenance therapy for advanced or recurrent TP53 wild-type endometrial cancer

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.