North America Volumetric Video Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

11.85 Billion

2024

2032

USD

1.19 Billion

USD

11.85 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 11.85 Billion | |

|

|

|

|

Volumetric Video Market Size

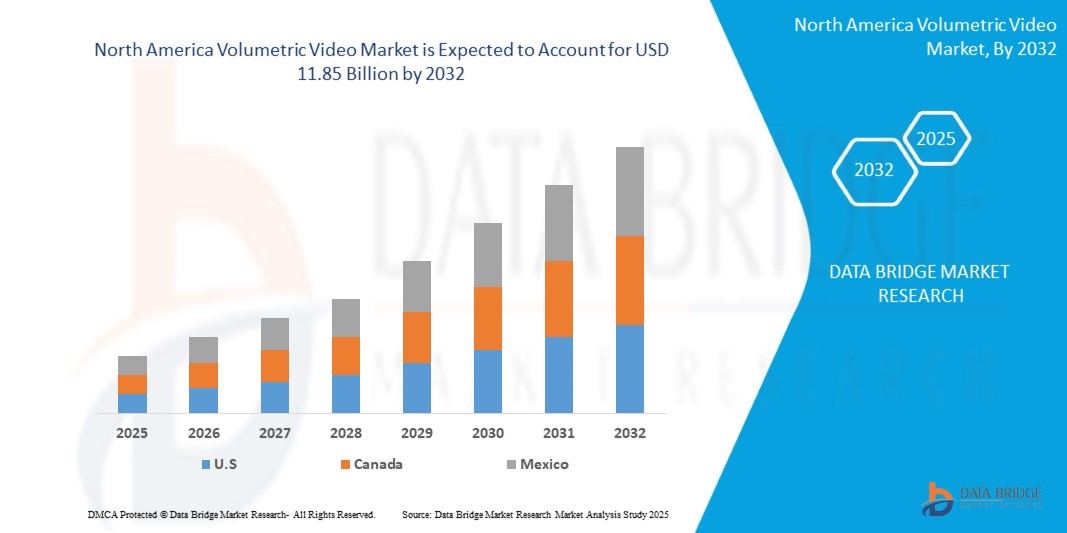

- The North America Volumetric Video market size was valued at USD 1.19 billion in 2024 and is expected to reach USD 11.85 billion by 2032, at a CAGR of 29.1% during the forecast period

- The region’s market growth is primarily driven by the increasing adoption of digital transformation technologies, especially within smart home ecosystems, retail, and immersive entertainment applications. As more households and commercial entities embrace connected and automated systems, the demand for high-fidelity 3D imaging solutions like volumetric video has accelerated.

- Additionally, rising consumer expectations for immersive content—in sectors such as virtual shopping, remote collaboration, telemedicine, and tourism—are propelling the market forward. Volumetric video solutions are increasingly viewed as key enablers of spatial computing and real-time 3D experiences, offering realistic, lifelike interactions.

Volumetric Video Market Analysis

- Volumetric Video technology in North America is witnessing significant adoption, particularly across industries such as media & entertainment, sports broadcasting, virtual training, real estate, and healthcare. The ability to deliver lifelike 3D visuals and immersive storytelling experiences is transforming how brands, educators, and developers engage with their audiences.

- The U.S. dominates the North America Volumetric Video market, accounting for a revenue share of 78.6% in 2025, attributed to its strong ecosystem of tech companies, high consumer demand for AR/VR content, and presence of numerous volumetric studios such as Microsoft Mixed Reality Capture Studios and 8i. Integration of volumetric video in live events, gaming, and e-commerce is driving cross-industry innovation.

- The Canadian market is also expanding rapidly, supported by national investments in digital media infrastructure and collaborative innovation hubs. Cities like Toronto and Vancouver are emerging as creative tech centers, fostering startups and research institutions working on next-gen volumetric and immersive content solutions.

- The Entertainment & Sports application segment is expected to dominate in North America with a projected market share of 35.4% in 2025, driven by increasing deployment in live event broadcasting, interactive fan engagement, and immersive concert experiences. Companies such as Canon, Intel Studios, and Verizon are actively investing in capturing dynamic 3D video content for immersive consumer delivery.

- The Software segment is set to witness the fastest growth, thanks to the rising demand for 3D rendering engines, compression algorithms, and volumetric video editing tools. With the integration of volumetric video into platforms like Unreal Engine and Unity, developers are creating more lifelike and scalable content for metaverse and enterprise training applications.

Report Scope and Volumetric Video Market Segmentation

|

Attributes |

Volumetric Video Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Volumetric Video Market Trends

“Widespread Integration with XR Platforms and Cloud Streaming”

- A key trend driving the North America Volumetric Video market is the rapid integration of volumetric video content into XR (Extended Reality) platforms and real-time cloud-based streaming. This trend enhances immersive storytelling and training applications across entertainment, enterprise, and education sectors.

- In March 2024, Microsoft Mesh was integrated with Azure-powered volumetric capture tools, enabling cross-platform collaboration in immersive 3D environments. This development supports volumetric content sharing for use in mixed reality applications such as remote training and holographic meetings.

- Unity Technologies, in January 2024, enhanced its real-time 3D engine with plug-ins for volumetric video editing and rendering. This update allows developers to integrate realistic 3D humans and scenes in metaverse applications and games, reflecting growing demand for lifelike digital interactions.

- Startups like Evercoast and 4DViews have expanded their cloud-based volumetric capture offerings across the U.S. and Canada, enabling studios and enterprises to create, edit, and stream volumetric content remotely.

- The growing demand for remote collaboration tools, particularly in healthcare and workforce training, is accelerating volumetric video’s role in providing interactive and spatially aware experiences across platforms like Meta Quest, HoloLens, and Apple Vision Pro.

Volumetric Video Market Dynamics

Driver

“High Demand for Immersive Content in Entertainment and Live Events”

- The booming entertainment and sports broadcasting sectors in North America are key drivers, with volumetric video being increasingly used to deliver immersive fan experiences, cinematic visual effects, and interactive live content.

- In August 2023, Canon U.S.A. announced the expansion of its Free Viewpoint Video System in NBA arenas to offer real-time volumetric replays during live broadcasts, significantly enhancing viewer engagement.

- Verizon partnered with Pixotope in November 2023 to deploy volumetric video production capabilities for live sporting events using 5G and edge computing, enabling ultra-low latency rendering of immersive AR content.

- Intel Studios continues to lead in North America with large-scale volumetric video production, working with entertainment brands to create lifelike holographic performances and 3D avatars for XR content.

- The demand for engaging virtual event formats, especially post-pandemic, has led to increased use of volumetric capture in virtual concerts, trade shows, and education sessions—solidifying the market’s upward momentum.

Restraint/Challenge

“Scalability and Bandwidth Limitations for Real-Time Experiences”

- Despite technological progress, real-time streaming of volumetric content faces hurdles due to high data requirements, latency issues, and the need for robust cloud and edge computing infrastructure.

- In December 2023, Unity and AWS jointly addressed scalability challenges by launching cloud-native volumetric video streaming solutions. However, real-time delivery of high-resolution 3D content still strains current broadband infrastructure in rural or underserved areas.

- Bandwidth-intensive volumetric files also pose challenges for widespread adoption in consumer-grade networks, especially for home users relying on standard broadband rather than fiber or 5G connectivity.

- Moreover, storage and post-processing costs remain high for large-scale volumetric content production. Companies like Volograms and Arcturus are working on compression technologies, but affordability and scalability are ongoing concerns for smaller studios and educational institutions.

- Overcoming these bottlenecks will require continued investment in edge processing, 5G rollouts, and next-gen compression algorithms to make volumetric content more accessible across devices and geographies.

Volumetric Video Market Scope

The market is segmented on the basis Volumetric Capture, Content Delivery, Application, and End-Use Industry.

- By Volumetric Capture

Hardware leads the North American Volumetric Video market in 2025, fueled by increased deployment of depth-sensing cameras, multi-camera arrays, and specialized rigs in entertainment, sports broadcasting, and education. Companies like Intel Studios and Microsoft Mixed Reality Capture Studios are investing in cutting-edge capture facilities to meet growing demand for hyper-realistic 3D content.

The Software segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by the adoption of AI-enhanced volumetric reconstruction tools and real-time 3D rendering software. In January 2024, Arcturus launched updates to its HoloSuite software enabling advanced editing and compression for streaming volumetric content, making it more accessible for media creators and developers.

Services, including scanning, content post-processing, and cloud-based rendering, are rapidly scaling, particularly as enterprises outsource complex volumetric video production. In 2023, Evercoast and 8i expanded their studio partnerships across U.S. cities, providing scalable volumetric content creation as a service for events, virtual retail, and training modules.

- By Content Delivery

Smartphones remain the dominant delivery channel in 2025 due to their ubiquity and growing ability to render AR-enhanced volumetric video through devices like iPhones with LiDAR and Snapdragon-powered Androids. Brands like Snapchat have integrated volumetric video into AR filters and lenses, increasing mainstream exposure to the format.

AR/VR HMDs (Head-Mounted Displays) are projected to witness the fastest growth, particularly with the commercial availability of Apple Vision Pro (launched February 2024) and Meta Quest 3. These platforms support real-time rendering of spatial content, creating immersive user experiences across gaming, healthcare, and collaboration.

Projectors are primarily used in immersive art and entertainment installations. For example, in October 2023, The Infinite Experience — a traveling immersive VR exhibit — used volumetric projections to simulate life aboard the International Space Station, drawing large audiences in U.S. cities like Houston and New York.

Volumetric Displays, though niche, are being adopted in luxury retail, trade shows, and museum exhibits. In August 2023, Looking Glass Factory introduced its latest light field display, allowing brands to showcase products in lifelike 3D without headgear, catering to high-end marketing experiences.

- By Application

Film & TV Production dominates in 2025 as North America leads in volumetric content development for cinematic use. Studios such as Warner Bros., Disney, and Netflix have begun integrating volumetric tools for character modeling, VFX, and set visualization. Intel Studios continues to support Hollywood-scale productions with full-body 3D capture.

Gaming is experiencing significant momentum, especially with the rise of immersive multiplayer XR games and esports platforms. In 2023, Epic Games announced enhancements to Unreal Engine 5 with native support for volumetric content, enabling developers to create lifelike 3D avatars and worlds.

3D Product Visualization is rapidly expanding in automotive, real estate, and consumer electronics, where brands like Tesla, IKEA, and Best Buy are adopting volumetric video for interactive demos and showroom experiences—both in-store and online.

Medical Training & Education is increasingly leveraging volumetric tools for surgical simulation, anatomical visualization, and patient education. In February 2024, Stanford Medicine deployed volumetric video in XR classrooms to train future surgeons through spatially interactive modules.

Others include real estate virtual tours, sports analytics, and cultural heritage preservation. For instance, Google Arts & Culture collaborates with museums to digitize historical artifacts using volumetric capture, expanding accessibility and engagement.

- By End-Use Industry

Media & Entertainment commands the largest share in North America due to the extensive presence of XR content producers, broadcast companies, and immersive entertainment providers. Strategic investments from Meta, Niantic, and Epic Games are fueling content creation and XR hardware adoption.

Healthcare is projected to grow at the fastest CAGR (2025–2032), supported by the integration of volumetric content in telemedicine, rehabilitation programs, and medical simulations. In April 2024, Cedars-Sinai Medical Center partnered with XRHealth to implement volumetric 3D environments in physical therapy sessions using VR headsets.

Education & Training is also witnessing robust growth. Institutions like MIT and Arizona State University have launched XR learning labs using volumetric content to teach complex concepts in physics, engineering, and biology.

Retail & E-Commerce are seeing rising adoption of virtual try-on and 3D advertising solutions. In December 2023, Amazon piloted volumetric try-on features for fashion and eyewear through its AR View platform, allowing customers to visualize products in 3D.

Others include defense simulations, industrial inspections, and smart city planning. The U.S. Department of Defense continues to explore volumetric technologies for mission rehearsal and battlefield simulation applications.

Volumetric Video Market Regional Analysis

- North America dominates the Volumetric Video market with the largest revenue share of 40.01% in 2024, driven by the region's strong technological infrastructure, widespread smart home adoption, and high consumer demand for immersive content and security solutions.

- The market benefits from elevated integration of volumetric video across smart homes, healthcare, education, and media. Households increasingly utilize volumetric-enabled smart access, while enterprises deploy it for virtual training, medical simulation, and product visualization.

- The presence of leading volumetric technology providers such as Intel, Microsoft, Arcturus, Evercoast, and 8i, along with strategic public-private R&D collaborations, reinforces the region’s innovation edge.

- U.S. and Canadian smart city initiatives — including Smart Columbus (Ohio) and Toronto’s Quayside project — actively incorporate volumetric video for spatial planning and citizen engagement, further amplifying adoption.

United States Volumetric Video Market Insight

- The United States leads North American market revenue due to its large consumer base, innovation-friendly ecosystem, and robust media & entertainment industry.

- In June 2024, Meta integrated volumetric capture capabilities into its Meta Quest platform, enhancing user-generated XR experiences and driving demand for capture hardware and editing software.

- Hollywood production studios, including Warner Bros. and Netflix, are using volumetric studios like Intel Studios in Los Angeles for immersive storytelling, while NFL and NBA teams are integrating volumetric replays for fan engagement.

- The healthcare sector is also adopting volumetric tools for telemedicine and surgical training. For example, Cedars-Sinai and UCLA Health began pilot programs in 2024 using 3D volumetric visualization in remote diagnostics.

Canada Volumetric Video Market Insight

- Canada is an emerging hub for volumetric innovation, supported by strong governmental support for immersive technologies and a flourishing XR startup ecosystem.

- In 2023, Canada’s National Research Council (NRC) launched funding for immersive media R&D, including volumetric video applications in education and cultural preservation.

- Universities like University of Toronto and Simon Fraser University are developing volumetric video content for virtual classrooms and collaborative research. The Canadian Film Centre (CFC) also supports indie producers using volumetric video for immersive cinema.

- Demand is increasing in telehealth and real estate, especially in metropolitan areas like Toronto, Vancouver, and Montreal, where developers use volumetric walkthroughs for luxury property showings.

Mexico Volumetric Video Market Insight

- Mexico is witnessing steady growth in volumetric video adoption, particularly in retail, marketing, and education.

- With rising internet and smartphone penetration (over 80% in 2024) and government support for digital inclusion, volumetric content delivery via smartphones is expanding, especially for AR-powered e-commerce.

- In 2024, Walmart Mexico piloted volumetric 3D advertising displays in flagship stores to improve customer engagement, while universities like Tecnológico de Monterrey are experimenting with 3D learning modules using volumetric video.

- Mexican creative agencies are collaborating with U.S.-based firms to produce localized volumetric content for brand campaigns and cultural exhibitions, supported by regional tech parks in Guadalajara and Mexico City.

Volumetric Video Market Share

The Volumetric Video industry is primarily led by well-established companies, including:

- Microsoft Corporation (U.S.)

- Intel Corporation (U.S.)

- Google LLC (U.S.)

- Sony Corporation (Japan)

- 8i (New Zealand)

- 4Dviews (France)

- Unity Technologies (U.S.)

- Evercoast (U.S.)

- Meta Platforms, Inc. (U.S.)

- Voxel (U.K.)

Latest Developments in North America Volumetric Video Market

- In May 2024, Microsoft Mixed Reality Capture Studios partnered with Lucid Dreams Productions, a California-based XR studio, to deliver real-time volumetric avatars for enterprise collaboration and virtual training. This marks a significant advancement in integrating volumetric video into hybrid workspaces and professional simulations across the U.S.

- In April 2024, Arcturus announced the rollout of HoloSuite 3.0, a major update to its volumetric video editing software, including AI-based compression and real-time cloud streaming. The new version was piloted by NBCUniversal to enhance XR content delivery for upcoming entertainment experiences across North America.

- In March 2024, Intel Studios collaborated with Warner Bros. to produce a fully volumetric scene for an upcoming sci-fi film, shot entirely in its Los Angeles-based volumetric capture facility. This initiative exemplifies Hollywood’s increasing investment in immersive storytelling technologies.

- In February 2024, Evercoast, a U.S.-based volumetric capture company, launched a cloud-based volumetric rendering platform targeting medical institutions. The solution was adopted by Mayo Clinic to provide 3D surgical simulations and patient education, marking a leap forward in healthcare training.

- In January 2024, Meta integrated volumetric video import/export functionality into its Spark AR platform, enhancing tools for creators developing immersive Instagram and Facebook experiences. This upgrade allows North American creators to build high-fidelity, interactive 3D content, boosting content creation scalability.

- In December 2023, Unity Technologies announced a strategic investment in Depthkit, a volumetric capture tool, to strengthen support for real-time 3D content production within Unity’s engine. This collaboration is expected to accelerate adoption of volumetric workflows in game development, education, and live performances.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Volumetric Video Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Volumetric Video Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Volumetric Video Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.