Uk Industrial Embedded Pc Market

Market Size in USD million

CAGR :

%

USD

171,189.44 million

USD

171,189.44 million

2023

2030

USD

171,189.44 million

USD

171,189.44 million

2023

2030

| 2024 –2030 | |

| USD 171,189.44 million | |

| USD 171,189.44 million | |

|

|

|

U.K. Industrial Embedded PC Market Analysis and Insights

The U.K. industrial embedded PC market is fragmented in nature, as it consists of many global players and regional players as well. The presence of these companies produces competitive industrial embedded PCs, technological development, and services with various features and characteristics at a competitive price. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products and services for different budgets. The growth in advantages and capabilities of industrial PC and the increase in adoption of 4.0 practices are expected to drive market growth. The constant need for computing solutions for harsh environments is expected to further fuel the market. However, high initial investment associated with industrial-embedded PC and continuous data privacy and cybersecurity risk is expected to act as a restraint for the growth of the market. Moreover, a shortage of skilled professionals is expected to challenge the market growth. However, the rising importance of data analytics in industries and the increase in demand for remote monitoring and maintenance are expected to provide lucrative opportunities for market growth in the future.

Data Bridge Market Research analyzes that the U.K. industrial embedded PC market is expected to reach a value of USD 171,189.44 thousand by 2030, at a CAGR of 4.7% during the forecast period.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 – 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

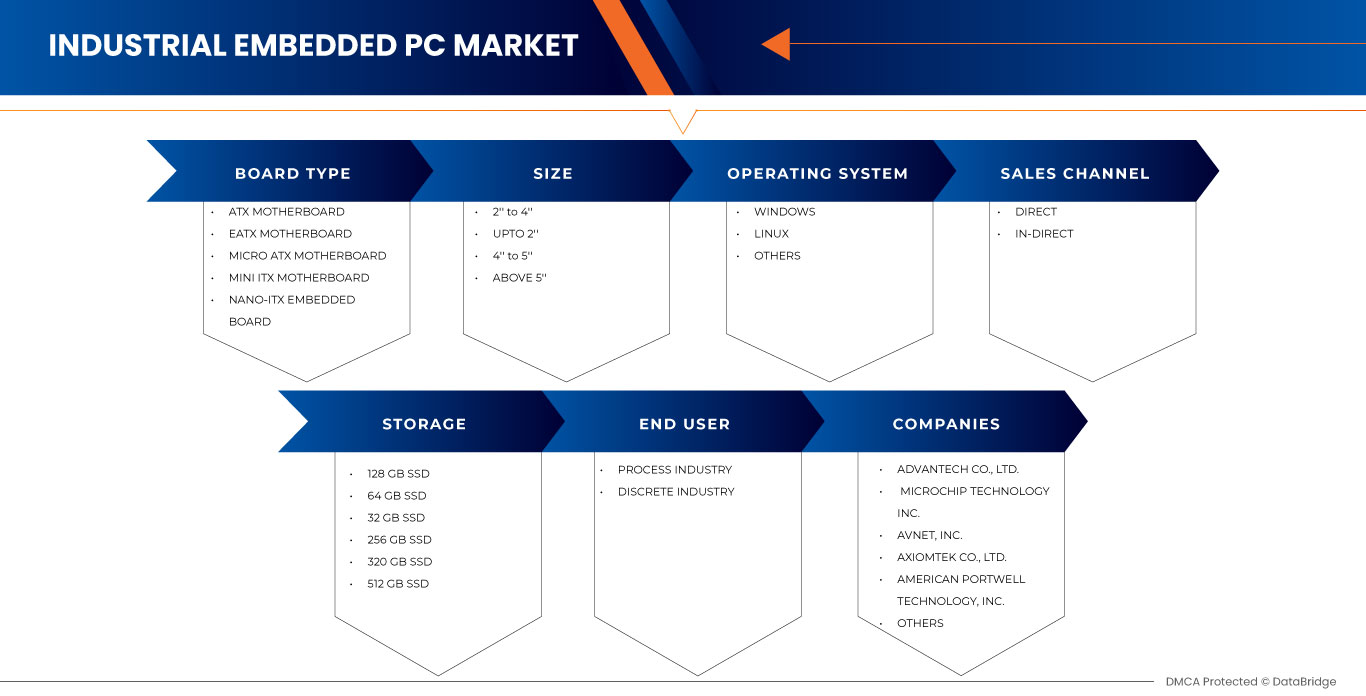

Segments Covered |

Board Type (ATX Motherboard, EATX Motherboard, Micro ATX Motherboard, Mini ITX Motherboard, and Nano-ITX Embedded Board), Size (2'' to 4'', Upto 2'', 4'' to 5'', and Above 5''), Operating System (Windows, Linux, and Others), Storage (128 GB SSD, 64 GB SSD, 32 GB SSD, 256 GB SSD, 320 GB SSD, and 512 GB SSD), Sales Channel (Direct and In-Direct), End User (Process Industry and Discrete Industry) |

|

Country Covered |

U.K. |

|

Market Players Covered |

Advantech Co., Ltd (Taiwan), Axiomtek Co., Ltd. (Taiwan), Avnet, Inc.(Germany), American Portwell Technology, Inc.(U.S.), BVM Ltd (U.K.), Microchip Technology Inc (U.S.), AAEON Technology Inc.(Taiwan), Kontron (Germany), DFI (Taiwan) and Impulse Embedded Limited (U.K.), among others |

Market Definition

Industrial embedded PCs are specialized computers designed for use in industrial environments. They are built to withstand harsh conditions, such as extreme temperatures, dust, humidity, and vibrations, making them suitable for various industrial applications. These PCs are compact, typically in a small form factor, and are often integrated directly into machinery or industrial equipment. They serve as control units, enabling automation, monitoring, and data processing tasks in industries like manufacturing, automation, transportation, energy, and more. The U.K. industrial embedded PCs market is the segment of the industrial computing industry in the United Kingdom that focuses on the design, production, and distribution of specialized computers known as industrial embedded PCs. These computers are built to operate reliably and efficiently in demanding industrial environments, offering real-time control, automation, and data processing capabilities. In the context of the U.K. market, industrial embedded PCs cater to various industries such as manufacturing, transportation, energy, automation, and more. They are designed to withstand harsh conditions like extreme temperatures, dust, vibration, and humidity, making them suitable for deployment in factories, warehouses, outdoor installations, and other industrial settings.

U.K. Industrial Embedded PC Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Driver

- Growing Demand for Digitalization & Adoption of Communication and Networking Technologies

The market is experiencing a significant boost due to the growing demand for digitalization and the widespread adoption of communication and networking technologies. These factors are acting as drivers of growth, transforming various sectors and industries across the country. the rise of digitalization is revolutionizing the industrial landscape in the U.K. Businesses are increasingly integrating digital technologies to enhance operational efficiency, automation, and data-driven decision-making. Industrial embedded PCs play a crucial role in this transformation, serving as the backbone of connected systems. They enable real-time data processing, control, and monitoring, making them essential for smart manufacturing, process automation, and Industry 4.0 initiatives.

Opportunity

- Growing Demand for Customized Embedded Boards

The market is witnessing a significant opportunity driven by the growing demand for customized embedded boards. This trend is primarily attributed to the increasing need for tailored solutions to meet the specific requirements of various industries. Embedded systems, including single-board computers (SBCs), motherboards, and modules, play a crucial role in the development of these customized solutions. Firstly, SBCs are at the forefront of the industrial embedded PC market. These compact and integrated computing solutions are highly customizable, allowing businesses to select the hardware and software components that best fit their application. Industries such as manufacturing, healthcare, and transportation benefit from SBCs as they can be tailored to address unique challenges, resulting in enhanced efficiency and productivity.

Restraints/Challenges

- Limited availability of raw components of embedded board

The limited availability of raw components for embedded boards has emerged as a significant challenge for the U.K industrial embedded PC market. Embedded PCs play a crucial role in various industrial applications, from manufacturing automation to data acquisition and control systems. These systems require specialized components tailored to meet the demands of rugged and reliable operation. However, the global shortage of semiconductor chips and other essential raw materials has disrupted the supply chain, creating several adverse effects.

- High Cost of Embedded Systems

The high cost of embedded systems is indeed acting as a restraint for the market. This issue stems from several factors that impact the adoption and growth of embedded systems in industrial applications.The initial investment required for implementing embedded systems in industrial settings can be significant. These systems are designed to meet rigorous performance and reliability standards, which often necessitate specialized components and customizations. As a result, the upfront cost of procurement and installation can be a substantial barrier for many industrial organizations, especially smaller enterprises with limited budgets.

Recent Developments

- In July 2023, Microchip Technology Inc. is investing USD300 million in expanding its presence in India, recognizing the nation's rapid growth in the semiconductor industry. This initiative includes facility enhancements, engineering lab expansions, talent acquisition, and support for technology consortia and educational institutions. As India's semiconductor market is set to triple by 2026, Microchip's commitment reinforces its position in a crucial global hub for semiconductor research and design, benefiting both the company and India's semiconductor ecosystem.

- In In March 2023, Avnet, Inc. has been honoured as a 2023 CIO 100 award winner, recognizing their leadership in digital strategies and innovative technology solutions. This award reflects Avnet's commitment to excellence in IT and its dedication to delivering cutting-edge solutions to its customers, showcasing their ongoing innovation in various fields, from AI to sustainability and beyond.

- In January 2023, Advantech Co., Ltd. introduced embedded platforms with 13th Gen Intel processors, delivering high computing power for machine vision, healthcare, and automation. These solutions offer outstanding performance, Intel's hybrid architecture, DDR5 memory, and PCIe Gen5 for breakthrough performance. With high-speed industrial I/O and design-in services, Advantech empowers IoT device developers with stability, scalability, and efficient management.

- In October 2022, Kontron, has introduced the D3724-R mSTX, a new AMD-based industrial motherboard in the space-saving Mini-STX format. With up to four independent displays in 4K resolution, this high-performance motherboard is ideal for graphics-intensive applications like casino gaming, digital signage, medical displays, and more. Based on the AMD Ryzen Embedded R2000 series processors with integrated AMD Radeon Vega graphics, the D3724-R mSTX offers significantly higher performance than its predecessor R1000 series. The availability of three motherboard versions allows customers to choose the computing power that best suits their requirements. This addition to Kontron's portfolio expands their offerings for industrial applications in the U.K. market, providing more options and performance capabilities for graphics-centric embedded PC solutions.

- In February 2022, Axiomtek Co., Ltd. introduced the CAPA55R, a high-performance 3.5" embedded SBC powered by 11th Gen Intel processors, featuring triple-display capability and a wide operating temperature range. With up to 64GB of DDR4 memory, multiple M.2 slots, and various connectivity options, it is an ideal choice for graphics-intensive industrial IoT applications. Its design, with a focus on heat dissipation and system integration, aims to streamline development and reduce time to market, making it a valuable asset in industrial control, machine vision, digital signage, and other IoT-related applications.

U.K. Industrial Embedded PC Market Scope

The U.K. industrial embedded PC market is segmented into six notable segments based on board type, size, operating system, storage, sales channel, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Board Type

- ATX Motherboard

- EATX Motherboard

- Micro ATX Motherboard

- Mini ITX Motherboard

- Nano-ITX Embedded Board

On the basis of board type, the market is segmented into ATX motherboard, EATX motherboard, micro ATX motherboard, mini ITX motherboard, and nano-ITX embedded board.

Size

- 2'' to 4''

- Upto 2''

- 4'' to 5''

- Above 5''

On the basis of Size, the market is segmented into 2'' to 4'', upto 2'', 4'' to 5'', and above 5''.

Operating System

- Windows

- Linux

- Others

On the basis of operating system, the market is segmented into windows, linux, and others.

Storage

- 128 GB SSD

- 64 GB SSD

- 32 GB SSD

- 256 GB SSD

- 320 GB SSD

- 512 GB SSD

On the basis of storage, the market is segmented into 128 GB SSD, 64 GB SSD, 32 GB SSD, 256 GB SSD, 320 GB SSD, and 512 GB SSD.

Sales Channel

- Direct

- In-Direct

On the basis of sales channel, the market is segmented into direct and in-direct.

End User

- Process Industry

- Discrete Industry

On the basis of end user, the market is segmented into process industry and discrete industry.

Competitive Landscape and U.K. Industrial Embedded PC Market Share Analysis

The U.K. industrial embedded PC market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the U.K. industrial embedded PC market are ADLINK Technology Inc., Axiomtek Co., Ltd., OnLogic, American Portwell Technology, Inc., BVM Ltd, Beckhoff Automation, Siemens, Kontron, Simply NUC., and Impulse Embedded Limited among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.K. INDUSTRIAL EMBEDDED PC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 SCREEN TYPE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN ADVANTAGES AND CAPABILITIES OF INDUSTRIAL PC

5.1.2 INCREASE IN ADOPTION OF 4.0 PRACTICES

5.1.3 CONSTANT NEED FOR COMPUTING SOLUTIONS FOR HARSH ENVIRONMENT

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENT ASSOCIATED WITH INDUSTRIAL EMBEDDED PC

5.2.2 CONTINUOUS DATA PRIVACY AND CYBERSECURITY RISK

5.3 OPPORTUNITIES

5.3.1 RISING IMPORTANCE OF DATA ANALYTICS IN INDUSTRIES

5.3.2 INCREASE IN DEMAND OF REMOTE MONITORING AND MAINTENANCE

5.3.3 INCREASING PARTNERSHIP, ACQUISITION, AND EXPANSION BY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 SHORTAGE OF SKILLED PROFESSIONAL

6 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY SALES CHANNEL

6.1 OVERVIEW

6.2 DIRECT

6.3 IN-DIRECT

6.3.1 WHOLESALER/DISTRIBUTOR

6.3.2 OTHERS

7 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY END USER

7.1 OVERVIEW

7.2 PROCESS INDUSTRY

7.2.1 OIL & GAS

7.2.2 ENERGY & POWER

7.2.3 FOOD & BEVERAGES

7.2.4 PHARMACEUTICAL

7.2.5 CHEMICAL

7.2.6 OTHERS

7.3 DISCRETE INDUSTRY

7.3.1 AUTOMOTIVE

7.3.2 AEROSPACE & DEFENSE

7.3.3 SEMICONDUCTOR & ELECTRONICS

7.3.4 OTHERS

8 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY SCREEN TYPE

8.1 OVERVIEW

8.2 LCD

8.3 LED

8.4 TOUCH SCREEN

8.5 WIDE SCREEN

9 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY DISPLAY SIZE

9.1 OVERVIEW

9.2 20'' TO 40''

9.3 ABOVE 40''

9.4 UPTO 20''

10 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY OPERATING SYSTEM

10.1 OVERVIEW

10.2 WINDOWS

10.3 LINUX

10.4 OTHERS

11 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY STORAGE

11.1 OVERVIEW

11.2 128 GB SSD

11.3 64 GB SSD

11.4 32 GB SSD

11.5 256 GB SSD

11.6 320 GB SSD

11.7 512 GB SSD

12 U.K. INDUSTRIAL EMBEDDED PC MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.K.

13 SWOT ANALYSIS

14 COMPANY PROFILINGS

14.1 SIEMENS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 KONTRON

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 BECKHOFF AUTOMATION

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 ADLINK TECHNOLOGY INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 AMERICAN PORTWELL TECHNOLOGY, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENTS

14.6 AXIOMTEK CO., LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 BVM LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 IMPULSE EMBEDDED LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 ONLOGIC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 SIMPLY NUC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 U.K INDUSTRIAL EMBEDDED PC MARKET, BY SALES CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 2 U.K. IN-DIRECT IN INDUSTRIAL EMBEDDED PC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 U.K. INDUSTRIAL EMBEDDED PC MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 4 U.K. PROCESS INDUSTRY IN INDUSTRIAL EMBEDDED PC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 U.K. DISCRETE INDUSTRY IN INDUSTRIAL EMBEDDED PC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 U.K INDUSTRIAL EMBEDDED PC MARKET, BY SCREEN TYPE, 2021-2030 (USD THOUSAND)

TABLE 7 U.K INDUSTRIAL EMBEDDED PC MARKET, BY DISPLAY SIZE, 2021-2030 (USD THOUSAND)

TABLE 8 U.K INDUSTRIAL EMBEDDED PC MARKET, BY OPERATING SYSTEM, 2021-2030 (USD THOUSAND)

TABLE 9 U.K INDUSTRIAL EMBEDDED PC MARKET, BY STORAGE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 U.K. INDUSTRIAL EMBEDDED PC MARKET: SEGMENTATION

FIGURE 2 U.K. INDUSTRIAL EMBEDDED PC MARKET: DATA TRIANGULATION

FIGURE 3 U.K. INDUSTRIAL EMBEDDED PC MARKET: DROC ANALYSIS

FIGURE 4 U.K. INDUSTRIAL EMBEDDED PC MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.K. INDUSTRIAL EMBEDDED PC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.K. INDUSTRIAL EMBEDDED PC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.K. INDUSTRIAL EMBEDDED PC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.K. INDUSTRIAL EMBEDDED PC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 U.K. INDUSTRIAL EMBEDDED PC MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 U.K. INDUSTRIAL EMBEDDED PC MARKET: MULTIVARIATE MODELLING

FIGURE 11 U.K. INDUSTRIAL EMBEDDED PC MARKET: TYPE

FIGURE 12 U.K. INDUSTRIAL EMBEDDED PC MARKET: SEGMENTATION

FIGURE 13 GROWTH IN ADVANTAGES AND CAPABILITIES OF INDUSTRIAL PC IN DEMAND FOR MRO SERVICES IS EXPECTED TO BE KEY DRIVERS FOR U.K. INDUSTRIAL EMBEDDED PC MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 LCD IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.K. INDUSTRIAL EMBEDDED PC MARKET FROM 2023 TO 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.K. INDUSTRIAL EMBEDDED PC MARKET

FIGURE 16 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY SALES CHANNEL, 2022

FIGURE 17 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY END USER, 2022

FIGURE 18 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY SCREEN TYPE, 2022

FIGURE 19 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY DISPLAY SIZE, 2022

FIGURE 20 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY OPERATING SYSTEM, 2022

FIGURE 21 U.K. INDUSTRIAL EMBEDDED PC MARKET: BY STORAGE, 2022

FIGURE 22 U.K. INDUSTRIAL EMBEDDED PC MARKET: COMPANY SHARE 2022 (%)

Uk Industrial Embedded Pc Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Uk Industrial Embedded Pc Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Uk Industrial Embedded Pc Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.