Europe Blood Plasma And Plasma Derived Medicinal Products Market

Размер рынка в млрд долларов США

CAGR :

%

USD

7.96 Billion

USD

13.75 Billion

2024

2032

USD

7.96 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 7.96 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Сегментация европейского рынка плазмы крови и лекарственных препаратов на ее основе по видам продукции ( иммуноглобулины , факторы свертывания крови (при нарушениях свертываемости крови), альбумин (препарат, увеличивающий объем плазмы), ингибиторы протеазы (при генетических дефицитах), моноклональные антитела (полученные из плазматических клеток) и другие белки плазмы), области применения (иммунология, гематология, интенсивная терапия, неврология, пульмонология, гематоонкология , ревматология и другие области применения), технология обработки (ионообменная хроматография, аффинная хроматография, криопреципитация, ультрафильтрация и микрофильтрация), режим (современное и традиционное фракционирование плазмы), конечный потребитель (больницы и клиники, исследовательские лаборатории, академические институты и другие), канал сбыта (прямой тендер, сторонние дистрибьюторы и (Другие) – Тенденции отрасли и прогноз до 2032 года

Размер рынка плазмы крови и лекарственных препаратов на ее основе

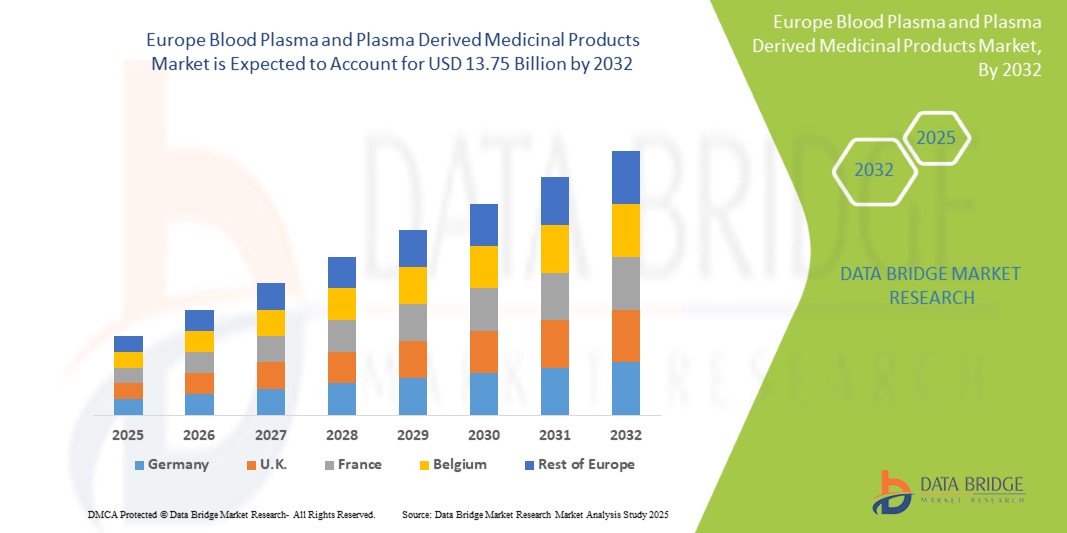

- Европейский рынок плазмы крови и лекарственных препаратов на ее основе оценивался в 7,96 млрд долларов США в 2024 году и, как ожидается, достигнет 13,75 млрд долларов США к 2032 году при среднегодовом темпе роста 7,11% в течение прогнозируемого периода .

- Рост рынка во многом обусловлен растущей распространенностью редких и хронических заболеваний.

- Кроме того, технологические достижения в области фракционирования плазмы крови и лекарственных препаратов на ее основе. Эти факторы ускоряют внедрение решений в области плазмы крови и лекарственных препаратов на ее основе, тем самым значительно стимулируя рост отрасли.

Анализ рынка плазмы крови и лекарственных препаратов на ее основе

- Рынок расширяется из-за возросшего спроса на терапию на основе плазмы для лечения таких состояний, как гемофилия, иммунодефицитные состояния и аутоиммунные заболевания, чему способствуют рост осведомленности и достижения в области трансфузионной медицины.

- Технологические достижения в области сбора крови, фракционирования и логистики холодовой цепи повышают качество и срок годности продукции, способствуя более широкому ее внедрению в больницах, травматологических центрах и диагностических лабораториях по всему миру.

- Ожидается, что Германия будет доминировать на рынке плазмы крови и лекарственных препаратов на ее основе с долей 18,16% в 2025 году благодаря улучшению инфраструктуры здравоохранения, росту спроса на плазменную терапию, усилению государственной поддержки и росту распространенности хронических и инфекционных заболеваний.

- Ожидается, что Германия станет регионом с самыми быстрыми темпами роста на рынке плазмы крови и лекарственных препаратов на ее основе благодаря увеличению инвестиций в здравоохранение, росту распространенности хронических и инфекционных заболеваний, улучшению диагностических возможностей, повышению осведомленности о безопасности крови и государственным инициативам по повышению доступности и развитию инфраструктуры плазменной терапии.

- Ожидается, что сегмент иммуноглобулинов будет доминировать на рынке плазмы крови и лекарственных препаратов на ее основе с долей 42,20% в 2025 году из-за растущего спроса на целевые терапии, усовершенствованных технологий очистки и растущей распространенности заболеваний, связанных с иммунитетом.

Область применения отчета и сегментация рынка плазмы крови и лекарственных препаратов на ее основе

|

Атрибуты |

Ключевые данные о рынке плазмы крови и лекарственных препаратов на ее основе |

|

Охваченные сегменты |

|

|

Охваченные страны |

|

|

Ключевые игроки рынка |

|

|

Рыночные возможности |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, отчеты о рынке, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативную базу. |

Тенденции рынка плазмы крови и лекарственных препаратов на ее основе

«Рост распространенности редких и хронических заболеваний»

- Основной движущей силой рынка плазмы крови и лекарственных препаратов на ее основе является растущая распространенность редких и хронических заболеваний во всем мире, чему способствуют достижения в области диагностических технологий и повышение осведомленности среди поставщиков медицинских услуг и пациентов.

- Например, по данным Центров по контролю и профилактике заболеваний (CDC), в апреле 2025 года 76,4% взрослых в США имели как минимум одно хроническое заболевание, а 51,4% — несколько. Эта растущая тенденция, наблюдаемая также среди молодых людей, усилила спрос на пожизненную помощь, особенно при таких заболеваниях, как гемофилия, первичные иммунодефициты и болезнь Виллебранда.

- Терапия, основанная на использовании плазмы крови, такой как иммуноглобулины, факторы свёртывания крови и альбумин, критически важна для лечения этих хронических заболеваний. Пациентам с первичным иммунодефицитом для поддержки иммунитета необходимы внутривенные иммуноглобулины (ВВИГ), а пациентам с гемофилией необходимы регулярные инфузии факторов свёртывания крови для предотвращения кровотечений.

- Глобальное старение населения еще больше усиливает эту тенденцию, поскольку пожилые люди все чаще страдают от таких заболеваний, как цирроз печени, множественная миелома и воспалительные заболевания, каждое из которых требует вмешательства с использованием плазмы.

- В марте 2025 года исследование, опубликованное в журнале PMC, выявило огромное глобальное бремя редких заболеваний, особенно среди детей. Несмотря на прогресс в геномной медицине и разработке орфанных препаратов, задержки в диагностике и ограниченные возможности лечения сохраняются, что подчёркивает необходимость междисциплинарной и постоянной помощи.

- Растущий спрос на безопасные, эффективные и высококачественные методы лечения на основе плазмы крови является ключевым фактором, определяющим рынок плазмы крови и лекарственных препаратов на ее основе, поскольку эти продукты играют решающую роль в лечении хронических заболеваний и удовлетворении неудовлетворенных потребностей в лекарственных средствах в Европе.

Динамика рынка плазмы крови и лекарственных препаратов на ее основе

Водитель

«Расширение гериатрического населения»

- Растущий спрос на плазму крови и лекарственные препараты на ее основе в значительной степени обусловлен старением населения мира, которое более подвержено хроническим и дегенеративным заболеваниям, таким как нарушения иммунной системы, неврологические заболевания, осложнения печени и проблемы с кровью, требующие терапии на основе плазмы, включая иммуноглобулины, альбумин и факторы свертывания.

- Например, опубликованное в марте 2025 года исследование, опубликованное в журнале PMC, анализирующее данные Национальной выборки пациентов стационаров США (NIS) за период с 2010 по 2024 год, показало, что быстрый рост численности пожилых пациентов привёл к значительному увеличению числа госпитализаций, увеличению продолжительности пребывания в стационаре и повышению частоты повторных госпитализаций. Эта тенденция, в значительной степени обусловленная хроническими заболеваниями и множественной патологией, свидетельствует о растущей нагрузке на системы здравоохранения и соответствующем спросе на терапию препаратами, полученными из плазмы крови.

- С возрастом иммунная система ослабевает, что повышает восприимчивость к инфекциям и аутоиммунным заболеваниям. Иммуноглобулиновая терапия часто применяется при лечении таких заболеваний, как хроническая воспалительная демиелинизирующая полинейропатия (ХВДП), а альбумин играет важную роль в поддержании водного баланса во время хирургических операций и интенсивной терапии у пожилых пациентов.

- В странах с высокой долей пожилых людей наблюдается устойчивый рост потребления плазмозаменителей. Эта демографическая тенденция оказывает огромное давление на национальные системы здравоохранения, требуя обеспечения бесперебойных поставок и адекватного сбора плазмы.

- Прогнозируемое увеличение численности населения мира в возрасте 60 лет и старше — с 1,1 млрд человек в 2023 году до 2,1 млрд человек к 2050 году, согласно оценкам ВОЗ, — ещё раз подчёркивает важнейшую роль гериатрической помощи. Этот демографический сдвиг не только усиливает потребность в долгосрочной терапевтической поддержке, но и превращает пожилых людей в ключевой и устойчивый сегмент рынка для программ PDMP в Европе.

Сдержанность/Вызов

« Высокозатратный и сложный производственный процесс »

- Высокая стоимость и сложность производства плазмы крови и лекарственных препаратов на её основе представляют собой серьёзное препятствие для расширения рынка. Этот процесс требует строгих протоколов сбора плазмы, тщательного скрининга на патогены и многоэтапного фракционирования в стерильных условиях, соответствующих требованиям GMP, что делает производство крайне ресурсоёмким и длительным.

- Например, подробный анализ, проведённый компанией Aykon Biosciences, показал, что производство сложных биологических препаратов, таких как препараты на основе плазмы крови, сталкивается с растущим давлением затрат из-за дороговизны сырья, необходимости в квалифицированной рабочей силе и всё более строгих нормативных требований. Переход к специализированной и персонализированной терапии ещё больше повышает затраты, требуя применения передовых технологий и строгих систем контроля качества.

- Кроме того, производственный цикл ПДМП может длиться до 12 месяцев, что требует логистики в рамках холодильной цепи для хранения и транспортировки на протяжении всего процесса. Эти факторы значительно увеличивают капитальные и эксплуатационные расходы, ограничивая масштабируемость и не позволяя более мелким игрокам и развивающимся странам эффективно участвовать в рынке.

- Высокая стоимость производства также способствует высокой цене конечного продукта, что снижает его доступность и финансовую доступность, особенно в странах с низким и средним уровнем дохода, где бюджеты здравоохранения ограничены. Это финансовое бремя затрудняет удовлетворение растущего мирового спроса, тем самым сдерживая более широкое внедрение PDMP во всем мире.

- Хотя продолжающиеся технологические инновации могут постепенно повышать рентабельность, текущие высокие затраты на производство и переработку остаются основным сдерживающим фактором. Решение этих проблем посредством совершенствования производственных технологий, расширения донорской инфраструктуры и поддержки финансирования здравоохранения будет иметь решающее значение для расширения доступа к рынку и обеспечения равноправного охвата населения лекарственными средствами.

Рынок плазмы крови и лекарственных препаратов на ее основе

Рынок сегментирован по признаку продукта, области применения, технологии обработки, режима, конечного пользователя и канала сбыта.

- По продукту

По видам продукции рынок сегментирован на иммуноглобулины, факторы свёртывания крови (для лечения нарушений свёртываемости крови), альбумин (плазмозаменитель), ингибиторы протеаз (для лечения генетических дефектов), моноклональные антитела (полученные из плазматических клеток) и другие белки плазмы крови. Ожидается, что в 2025 году сегмент иммуноглобулинов будет доминировать на рынке с долей рынка 42,20%, что обусловлено ростом числа диагностированных иммунодефицитов, аутоиммунных заболеваний и увеличением использования внутривенных иммуноглобулинов (ВВИГ).

Ожидается, что сегмент факторов свертывания крови (для лечения нарушений свертываемости крови) продемонстрирует самые высокие темпы роста — 7,27% в период с 2025 по 2032 год, что будет обусловлено ростом числа случаев гемофилии, улучшением доступа к диагностике, государственной поддержкой и расширением использования рекомбинантных и плазменных методов лечения.

- По применению

По области применения рынок сегментирован на иммунологию, гематологию, реанимацию, неврологию, пульмонологию, гематоонкологию, ревматологию и другие области применения. Сегмент иммунологии занимал наибольшую долю рынка по выручке в 2025 году благодаря широкому применению препарата при лечении первичных иммунодефицитов, аутоиммунных заболеваний и растущему мировому спросу на внутривенные иммуноглобулины (ВВИГ).

Ожидается, что в сегменте иммунологии будут наблюдаться самые быстрые темпы среднегодового роста в период с 2025 по 2032 год, что будет обусловлено ростом распространенности аутоиммунных заболеваний, старением населения и расширением клинического применения терапии иммуноглобулинами.

- По технологии обработки

В зависимости от технологии обработки рынок сегментируется на ионообменную хроматографию, аффинную хроматографию, криопреципитацию, ультрафильтрацию и микрофильтрацию. Сегмент ионообменной хроматографии занял наибольшую долю рынка в 2025 году благодаря высокой эффективности, масштабируемости и результативности очистки плазменных белков, таких как иммуноглобулины, альбумин и факторы свертывания крови.

Ожидается, что сегмент аффинной хроматографии будет демонстрировать самые быстрые темпы среднегодового роста в период с 2025 по 2032 год, чему способствуют его высокая специфичность, способность выделять целевые белки и растущее применение в области очистки передовых биологических препаратов.

- По режиму

В зависимости от способа фракционирования плазмы рынок сегментирован на два сегмента: современный и традиционный. В 2025 году на современный сегмент пришлась наибольшая доля выручки рынка благодаря передовым технологиям переработки, повышению чистоты продукта, улучшению профилей безопасности и более широкому внедрению рекомбинантных и высокоэффективных методов лечения, полученных из плазмы.

Ожидается, что современный сегмент будет демонстрировать самые быстрые темпы среднегодового роста в период с 2025 по 2032 год, что будет обусловлено инновациями в методах очистки, растущим спросом на более безопасные биологические препараты и растущими инвестициями в технологии плазменной обработки нового поколения.

- Конечным пользователем

По типу конечного потребителя рынок сегментируется на больницы и клиники, исследовательские лаборатории, академические институты и другие. Сегмент больниц и клиник обеспечил наибольшую долю выручки рынка в 2025 году благодаря большому количеству пациентов, доступности специализированной помощи, расширению доступа к лечению хронических заболеваний и доступу к передовым методам лечения на основе плазмы крови.

Ожидается, что сегмент больниц и клиник будет демонстрировать самые быстрые темпы среднегодового темпа роста в период с 2025 по 2032 год, что будет обусловлено расширением инфраструктуры здравоохранения, ростом числа госпитализаций и растущей зависимостью от плазменной терапии при сложных состояниях.

- По каналу распространения

По каналам сбыта рынок сегментирован на сегменты прямых тендеров, сторонних дистрибьюторов и т.д. На сегмент прямых тендеров пришлась наибольшая доля выручки рынка в 2025 году, что обусловлено оптовыми закупками государственными органами, экономической эффективностью, гарантированными цепочками поставок и ростом государственных инвестиций в лекарственные препараты, получаемые из плазмы крови.

Ожидается, что сегмент прямых тендеров также продемонстрирует самые быстрые среднегодовые темпы роста в период с 2025 по 2032 год, чему будут способствовать расширение государственных программ здравоохранения, централизованная политика закупок и растущий спрос на экономически эффективное, масштабное распределение плазменной терапии.

Региональный анализ рынка плазмы крови и лекарственных препаратов на ее основе

- Германия доминирует на рынке плазмы крови и лекарственных препаратов на ее основе, имея наибольшую долю выручки в 18,16% и, по прогнозам, будет расти самыми быстрыми темпами в 7,56% в 2025 году, что обусловлено развитой инфраструктурой здравоохранения, ростом показателей диагностики редких и хронических заболеваний и высокими расходами на здравоохранение на душу населения.

- Прочная нормативно-правовая база страны, надежные системы возмещения расходов и присутствие на рынке таких крупных игроков, как Grifols, CSL Behring и Takeda, способствуют лидерству в Европе по сбору плазмы и распространению терапевтических препаратов.

- Крупнейшие экономики вкладывают значительные средства в биофармацевтические исследования и разработки, расширяя сети сбора плазмы и улучшая доступ к плазменному лечению в иммунологии, гематологии и неврологии.

Обзор рынка плазмы крови и лекарственных препаратов на ее основе во Франции

Ожидается, что Франция продемонстрирует значительный рост в европейском регионе в период с 2025 по 2032 год благодаря хорошо развитой системе здравоохранения, растущему числу пациентов с редкими и хроническими заболеваниями и активным государственным инициативам по поощрению донорства плазмы. Большое количество центров сбора плазмы в стране и ускоренное одобрение программ плазмаферезных препаратов (PDMP) повышают доступность лечения и стимулируют расширение рынка.

Обзор рынка плазмы крови и лекарственных препаратов на ее основе в Великобритании

Ожидается, что Великобритания будет демонстрировать значительный среднегодовой темп роста в регионе в период с 2025 по 2032 год благодаря всеобщей системе здравоохранения, повышению осведомленности о редких заболеваниях и государственным инвестициям в расширение возможностей по сбору плазмы внутри страны. Стратегические партнерства и достижения в производстве биологических препаратов укрепляют позиции страны в сфере PDMP.

Доля рынка плазмы крови и лекарственных препаратов на ее основе

Отрасль производства плазмы крови и лекарственных препаратов на ее основе в основном представлена хорошо зарекомендовавшими себя компаниями, среди которых:

- CSL (Австралия)

- Takeda Pharmaceutical Company Limited (Япония)

- Grifols, SA (Испания)

- Octapharma AG (Швейцария)

- Кедрион (Италия)

- Bharat Serums (Индия)

- Biotest AG (Германия)

- Fresenius Kabi AG (Германия)

- Intas Pharmaceuticals Ltd. (Индия)

- Kamada Pharmaceuticals (Израиль)

- KM Biologics (Япония)

- LFB (США)

- Reliance Life Sciences (Индия)

- SK Plasma (Южная Корея)

- Synthaverse SA (Польша)

- VIRCHOW BIOTECH (Индия)

Последние разработки на рынке плазмы крови и лекарственных препаратов на ее основе

- В ноябре 2024 года компания CSL Plasma расширила внедрение передовой системы донации плазмы Rika в шести центрах донации крови в США недалеко от Денвера, штат Колорадо. Эти новые устройства, разработанные совместно с Terumo Blood & Cell Technologies, сокращают время сбора крови примерно на 30%, повышая при этом комфорт, безопасность и эффективность работы донора.

- В декабре 2022 года компания CSL открыла новый завод по фракционированию плазмы в Бродмидоуз (штат Виктория, Австралия) — крупнейший завод по переработке плазмы в Южном полушарии. Мощность этого завода составляет 9,2 млн литров эквивалента плазмы в год, что позволяет ему стоимостью 900 млн долларов США удовлетворять глобальный спрос на плазменную терапию для лечения иммунодефицитов, неврологических расстройств и критических состояний, таких как трансплантация и ожоги.

- В июне 2024 года компания Takeda объявила о расширении своего завода по фракционированию плазмы в Лос-Анджелесе стоимостью 30 миллионов долларов США, являющегося мировым лидером по мощности. Ожидается, что эта модернизация позволит увеличить объём производства до 2 миллионов литров в год, что поможет удовлетворить растущий мировой спрос на препараты на основе плазмы, используемые для лечения иммунодефицитов и нарушений свертываемости крови.

- В 2023 году компания Takeda выделила около 765 миллионов долларов США на строительство нового завода по производству терапевтических препаратов на основе плазмы в Осаке (Япония), что почти в пять раз увеличит мощности существующего завода в Нарите. Ожидается, что этот завод будет полностью введен в эксплуатацию к 2030 году и будет обслуживать как японский, так и мировой рынок.

- В марте 2025 года Grifols заключила партнерское соглашение с Inpeco для интеграции передовой автоматизированной робототехники (FlexLab X), диагностики и реагентов, создав «лаборатории будущего» для высокопроизводительного, безопасного и прослеживаемого анализа крови и плазмы при переливании крови. Медицинские лаборатории анализируют биологические образцы для диагностики, мониторинга и исследования заболеваний.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Содержание

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 SUPPLY CHAIN IMPACT ON THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL AVAILABILITY

4.3.3 MANUFACTURING CAPACITY

4.3.4 LOGISTICS AND LAST-MILE HURDLES

4.3.5 PRICING MODELS AND MARKET POSITIONING

4.4 INNOVATION STRATEGIES

4.4.1 KEY INNOVATION STRATEGIES

4.4.2 EMERGING DELIVERY TECHNIQUES

4.4.3 STRATEGIC IMPLICATIONS

4.4.4 CONCLUSION

4.5 RISK AND MITIGATION

4.6 VENDOR SELECTION DYNAMICS

4.6.1 PRODUCT QUALITY AND REGULATORY COMPLIANCE

4.6.2 SUPPLY CHAIN CAPABILITIES AND RELIABILITY

4.6.3 CLINICAL EFFICACY AND INNOVATION

4.6.4 COST COMPETITIVENESS AND REIMBURSEMENT COMPATIBILITY

4.6.5 LOCAL MARKET PRESENCE AND SUPPORT INFRASTRUCTURE

4.6.6 ETHICAL SOURCING, ESG COMPLIANCE, AND TRANSPARENCY

4.6.7 CONCLUSION

4.7 TARIFFS AND THEIR IMPACT ON MARKET

4.7.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.7.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.7.3 VENDOR SELECTION CRITERIA DYNAMICS

4.7.4 IMPACT ON SUPPLY CHAIN

4.7.5 IMPACT ON PRICES

4.7.6 REGULATORY INCLINATION

4.7.6.1 GCC TRADE ALIGNMENT & FTAS

4.7.6.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.7.6.3 LOCAL SUBSIDY & POLICY RESPONSE

4.7.6.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF RARE AND CHRONIC DISEASES

6.1.2 EXPANDING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN PLASMA FRACTIONATION

6.1.4 GOVERNMENT AND INSTITUTIONAL SUPPORT

6.2 RESTRAINTS

6.2.1 HIGH COST AND COMPLEX MANUFACTURING PROCESS

6.2.2 LACK OF PLASMA SUPPLY AND DONOR

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN PLASMA PROCESSING TECHNOLOGIES TO ENHANCE YIELD AND REDUCE COSTS

6.3.2 REIMBURSEMENT FRAMEWORKS AND INCREASED GOVERNMENTAL FOCUS ON RARE DISEASE TREATMENT

6.3.3 STRATEGIC ALLIANCES, MERGERS, AND ACQUISITIONS TO STRENGTHEN EUROPE MARKET PENETRATION

6.4 CHALLENGES

6.4.1 COMPETITIVE PRESSURE FROM RECOMBINANT AND ALTERNATIVE BIOLOGICAL THERAPIES

6.4.2 INFRASTRUCTURE LIMITATIONS IN COLD CHAIN LOGISTICS IMPACTING PRODUCT DISTRIBUTION

7 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 IMMUNOGLOBULINS

7.3 COAGULATION FACTORS (FOR BLEEDING DISORDERS)

7.4 ALBUMIN (PLASMA VOLUME EXPANDER)

7.5 PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)

7.6 MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS)

7.7 OTHER PLASMA DERIVED PROTEINS

8 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IMMUNOLOGY

8.3 HEMATOLOGY

8.4 CRITICAL CARE

8.5 NEUROLOGY

8.6 PULMONOLOGY

8.7 HAEMATO-ONCOLOGY

8.8 RHEUMATOLOGY

8.9 OTHER APPLICATIONS

9 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ION EXCHANGE CHROMATOGRAPHY

9.3 AFFINITY CHROMATOGRAPHY

9.4 CRYOPRECIPITATION

9.5 ULTRAFILTRATION

9.6 MICROFILTRATION

10 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE

10.1 OVERVIEW

10.2 MODERN

10.3 TRADITIONAL PLASMA FRACTIONATION

11 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 RESEARCH LABS

11.4 ACADEMIC INSTITUTES

11.5 OTHERS

12 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

12.4 OTHERS

13 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 POLAND

13.1.11 DENMARK

13.1.12 SWEDEN

13.1.13 BELGIUM

13.1.14 IRELAND

13.1.15 NORWAY

13.1.16 FINLAND

13.1.17 REST OF EUROPE

14 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CSL

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GRIFOLS, S.A.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 OCTAPHARMA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KEDRION

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ADMA BIOLOGICS, INC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AEGROS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BHARAT SERUMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIOTEST AG.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FRESENIUS KABI AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GC BIOPHARMA CORPORATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ICHOR

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTAS PHARMACEUTICALS LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KAMADA PHARMACEUTICALS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KM BIOLOGICS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LFB

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PLASMAGEN BIOSCIENCES PVT. LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PROLIANT HEALTH & BIOLOGICALS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PROMEA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 RELIANCE LIFE SCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 BUSINESS PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SICHUAN YUANDA SHYUANG PHARMACEUTICAL CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SK PLASMA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SYNTHAVERSE S. A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TAIBANG BIO GROUP CO., LTD

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 VIRCHOW BIOTECH

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Список таблиц

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 3 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 4 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 5 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 6 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 7 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 8 EUROPE COAGULATION FACTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 9 EUROPE FACTOR IX IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 10 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 11 EUROPE FACTOR VIII IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 13 EUROPE FIBRINOGEN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 14 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE VON WILLEBRAND FACTOR (VWF) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 16 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 17 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 18 IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 19 EUROPE ALBUMIN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 20 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS )IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE IMMUNOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE HEMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE CRITICAL CARE IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE NEUROLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE PULMONOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 35 EUROPE HEMATOLOGY -ONCOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 36 EUROPE RHEUMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 37 EUROPE OTHER APPLICATIONS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 38 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

TABLE 39 EUROPE ION EXCHANGE CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 40 EUROPE AFFINITY CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 41 EUROPE CRYOPRECIPITATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 42 EUROPE ULTRAFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 43 EUROPE MICROFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 44 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2025-2032 (USD THOUSAND)

TABLE 45 EUROPE MODERN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 46 EUROPE TRADITIONAL PLASMA FRACTIONATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 47 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2025-2032 (USD THOUSAND)

TABLE 48 EUROPE HOSPITALS & CLINICS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 49 EUROPE RESEARCH LABS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 50 EUROPE ACADEMIC INSTITUTES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 51 EUROPE OTHERS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 52 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 53 EUROPE DIRECT TENDERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 54 EUROPE THIRD PARTY DISTRIBUTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 56 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 FRANCE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 FRANCE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 FRANCE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.K. ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 160 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 ITALY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ITALY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ITALY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ITALY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 ITALY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 ITALY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 ITALY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 ITALY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ITALY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 ITALY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 ITALY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 ITALY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 188 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 SPAIN IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SPAIN INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SPAIN COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SPAIN RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SPAIN RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SPAIN FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RUSSIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RUSSIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RUSSIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 RUSSIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 RUSSIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 RUSSIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 RUSSIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 RUSSIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 RUSSIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 RUSSIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 RUSSIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 236 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 238 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 240 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 TURKEY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 TURKEY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 TURKEY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 TURKEY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 TURKEY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 TURKEY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 TURKEY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 TURKEY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 TURKEY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 TURKEY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 TURKEY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 TURKEY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 TURKEY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 TURKEY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 TURKEY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 TURKEY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 TURKEY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 TURKEY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 TURKEY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 TURKEY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 262 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 264 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 266 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 267 NETHERLANDS IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 NETHERLANDS INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 NETHERLANDS INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 NETHERLANDS COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 NETHERLANDS FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 NETHERLANDS RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 NETHERLANDS FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 NETHERLANDS RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 NETHERLANDS FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 NETHERLANDS PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 NETHERLANDS VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 NETHERLANDS FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 NETHERLANDS FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 NETHERLANDS ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 NETHERLANDS PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 NETHERLANDS ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 NETHERLANDS C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 NETHERLANDS MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 NETHERLANDS OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 NETHERLANDS ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 288 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 289 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 290 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 292 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 293 SWITZERLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 POLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 POLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 POLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 POLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 POLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 POLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 POLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 POLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 POLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 POLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 POLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 340 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 341 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 342 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)