Global Organic Baby Toiletries Market

Размер рынка в млрд долларов США

CAGR :

%

USD

8.00 Billion

USD

15.03 Billion

2024

2032

USD

8.00 Billion

USD

15.03 Billion

2024

2032

| 2025 –2032 | |

| USD 8.00 Billion | |

| USD 15.03 Billion | |

|

|

|

Global Organic Baby Toiletries Market Segmentation, By Product (Skin Care, Bathing Products, Diapers, WipesHair care, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, and Others), Formulation (Liquid, Cream, and Gel), End User (Infants and Toddlers) - Industry Trends and Forecast to 2032

Organic Baby Toiletries Market Size

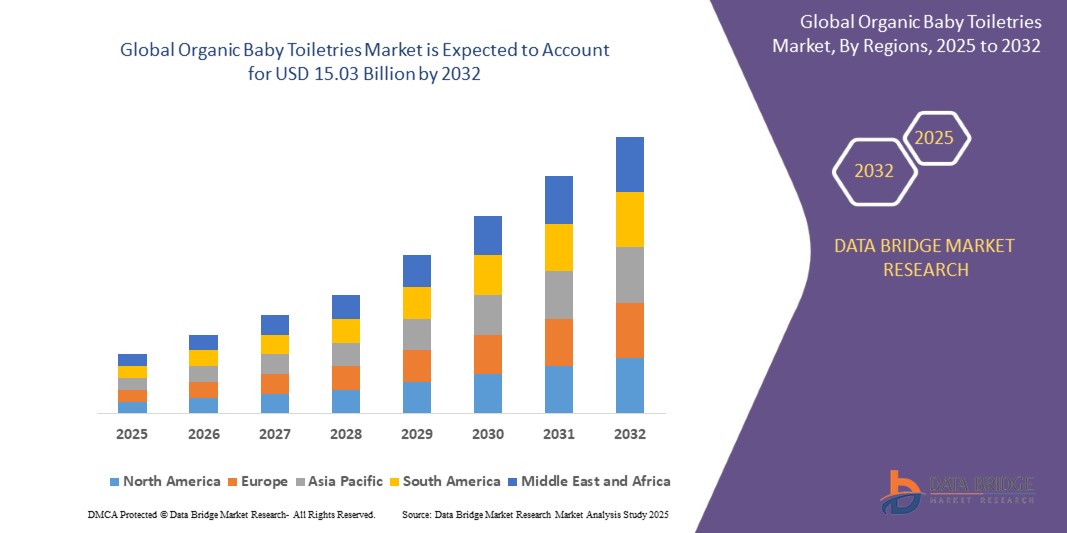

- The global Organic Baby Toiletries market was valued at USD 8.00 billion in 2024 and is expected to reach USD 15.03 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.20%, primarily driven by parental awareness of natural and chemical-free products

- This growth is driven by rising concerns over infant skin sensitivity and the growing preference for sustainable and eco-friendly alternatives

Organic Baby Toiletries Market Analysis

- The organic baby toiletries market has gained widespread popularity due to increasing parental awareness and the rising demand for natural skincare solutions that ensure safety and nourishment for infants. Modern innovations, such as plant-based formulations and biodegradable packaging, have made organic baby care more accessible, driving market expansion across various regions

- The demand for organic baby toiletries is significantly driven by the growing preference for chemical-free products, rising cases of infant skin sensitivities, and the expansion of eco-conscious parenting trends worldwide

- North America dominates the market, primarily due to high consumer spending on premium baby care products, the presence of leading organic skincare brands, and increasing support for sustainable product innovations

- For instance, in the U.S., the demand for organic baby toiletries has surged, with retailers reporting a steady increase in sales across premium and mass-market segments. The region continues to drive innovation, with manufacturers introducing hypoallergenic formulas and vegan-certified baby skincare to meet evolving consumer expectations

- Globally, the organic baby toiletries segment ranks among the fastest-growing categories in baby care, with advancements such as waterless formulations, probiotic-infused skincare, and recyclable packaging solutions playing a pivotal role in market expansion

Report Scope and Organic Baby Toiletries Market Segmentation

|

Attributes |

Organic Baby Toiletries Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Organic Baby Toiletries Market Trends

“Rising Demand for Natural and Functional Baby Care Products”

- One of the key trends in the global organic baby toiletries market is the growing preference for natural and multifunctional skincare solutions, driven by increasing parental awareness and the shift toward chemical-free formulations

- These innovations include plant-based ingredients and biodegradable packaging, ensuring safety, sustainability, and enhanced nourishment for infant skin while catering to eco-conscious consumers

- For instance, many leading baby care brands are launching multi-purpose organic skincare products, such as moisturizers with sun protection and probiotic-infused baby lotions, addressing various skin concerns with a single formulation

- Manufacturers are also integrating waterless formulations and recyclable packaging solutions, reducing environmental impact while improving product longevity and usability

- This trend is transforming the baby care industry, making organic toiletries more accessible, sustainable, and preferred by modern parents worldwide

Organic Baby Toiletries Market Dynamics

Driver

“Increasing Parental Preference for Chemical-Free Baby Products”

- Growing awareness of infant skin sensitivity and the potential harm caused by synthetic ingredients have led parents to prefer organic and natural baby toiletries

- The demand for non-toxic, hypoallergenic, and dermatologically tested baby care products is rising, as consumers seek gentle yet effective formulations that ensure infant well-being

- Regulatory bodies are supporting chemical-free baby products, pushing brands to develop eco-friendly and plant-based alternatives that align with evolving safety standards

For instance,

- In March 2024, Johnson’s Baby expanded its organic skincare line with plant-based lotions and tear-free shampoos, meeting the rising demand for gentle formulations

- In November 2023, The Moms Co. introduced a certified organic baby wash and lotion, catering to parents seeking natural, toxin-free skincare for infants

- In July 2023, Mustela launched its eco-designed cleansing gel, made with biodegradable ingredients, reinforcing the shift toward sustainable baby care solutions.

- With parents prioritizing safety and sustainability, the organic baby toiletries market is expected to witness continuous growth, prompting further innovation in natural and chemical-free baby products

Opportunity

“Expanding Retail and E-Commerce Presence for Organic Baby Toiletries”

- The increasing availability of organic baby toiletries through online marketplaces, specialty stores, and major retail chains is creating significant growth opportunities

- Brands are leveraging direct-to-consumer (DTC) models, subscription services, and digital marketing strategies to enhance customer reach and brand loyalty

- The rise of sustainable packaging and refillable product lines is further attracting eco-conscious consumers, driving market expansion

For Instance,

- In February 2024, Honest Company partnered with major retailers such as Walmart and Target to expand the in-store presence of its organic baby care range, boosting accessibility

- In September 2023, Earth Mama Organics launched a dedicated e-commerce platform, allowing direct sales of its plant-based baby toiletries while offering subscription-based discounts

- In June 2023, Pipette Baby introduced an exclusive online bundle deal, promoting its vegan and EWG-certified baby skincare products to digital-first consumers

- With the growing influence of e-commerce and retail expansion, the organic baby toiletries market is set to experience sustained growth, driven by enhanced accessibility, consumer convenience, and digital engagement strategies

Restraint/Challenge

“High Production Costs and Price Sensitivity among Consumers”

- The use of premium organic ingredients, eco-friendly packaging, and sustainable production methods significantly increases manufacturing costs, making organic baby toiletries more expensive than conventional alternatives

- Price sensitivity remains a challenge, as many consumers, especially in price-conscious markets, hesitate to pay a premium for natural baby care products despite their benefits

- Limited consumer awareness and misconceptions about organic certifications further slow adoption, requiring brands to invest heavily in education and marketing efforts

For Instance,

- In January 2024, Babyganics had to revise its pricing strategy after facing resistance from budget-conscious consumers, introducing smaller, affordable pack sizes

- In October 2023, Burt’s Bees Baby expanded its product line with a mid-range organic skincare range, catering to a broader audience without compromising ingredient quality

- In May 2023, Mamaearth launched an educational campaign highlighting the benefits of organic baby toiletries, addressing consumer skepticism and justifying premium pricing

- With cost concerns limiting mass adoption, companies must balance affordability and sustainability, ensuring organic baby toiletries remain accessible while maintaining product quality and ethical sourcing

Organic Baby Toiletries Market Scope

The market is segmented on the basis of product, distribution channel, formulations, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Distribution Channel |

|

|

By Formulations |

|

|

By End User |

|

Organic Baby Toiletries Market Regional Analysis

“North America is the Dominant Region in the Organic Baby Toiletries Market”

- North America holds the largest market share in the global Organic Baby Toiletries market, driven by increasing awareness of natural ingredients, rising demand for chemical-free formulations, and a growing preference for eco-friendly baby products

- The U.S. leads the region due to strong consumer interest in organic skincare, a well-established network of specialty baby stores, and growing investments in sustainable manufacturing

- The availability of hypoallergenic formulations, including plant-based wipes and biodegradable diapers, has further fueled market expansion

- In addition, increasing concerns over skin sensitivity, rising sales through e-commerce platforms, and growing influence of celebrity endorsements contribute to the growth of the Organic Baby Toiletries market across North America

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is projected to witness the highest CAGR in the Organic Baby Toiletries market, driven by increasing awareness of baby skincare, rising demand for chemical-free baby products, and a growing preference for sustainable packaging

- Countries such as China, Japan, and India are leading the market due to strong consumer interest in organic formulations, expanding retail distribution, and the influence of social media parenting trends

- The rapid growth of e-commerce platforms, coupled with continuous innovations in plant-based ingredients, is further accelerating market expansion

- In addition, government initiatives promoting infant health, rising investments in natural product development, and increasing adoption of hypoallergenic baby toiletries are contributing to the rapid development of the Organic Baby Toiletries market across Asia-Pacific

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Earth Mama (U.S.)

- California Baby (U.S.)

- Nature’s Baby Organics (U.S.)

- The Honest Company, Inc. (U.S.)

- Green People (U.K.)

- Ayablu Incorporated (U.S.)

- LittleTwig (U.S.)

- ERBAVIVA (U.S.)

- Babyganics (U.S.)

- Charlie Banana (Hong Kong)

- Seventh Generation Inc. (U.S.)

- Burt's Bees (U.S.)

- Avalon Natural Products, Inc. (U.S.)

- Procter and Gamble (U.S.)

- Weleda (Switzerland)

- Kenvue Brands LLC (U.S.)

- Cotton Babies, Inc. (U.S.)

- CeraVe (U.S.)

- Coconut Hedgehog (U.K.)

- Laboratoires Expanscience (France)

Latest Developments in Global Organic Baby Toiletries Market

- In November 2024, The Good Glamm Group completed the full acquisition of The Moms Co., finalizing its majority stake initially acquired in 2021. This marks the complete exit of the company’s founders and investors, though financial details of the transaction remain undisclosed

- In August 2024, Nala’s Baby launched in Sainsbury’s, bringing its dermatologist-approved, pediatrician-approved, cruelty-free, vegan, and fully recyclable infant skincare range to the retailer. The brand is rapidly growing its presence across major U.K. retail chains

- In January 2024, PureBorn expanded into Europe, strengthening its presence through a partnership with Swiss distributor Laboratoire Naturel. The company, known for its hypoallergenic diapers made with up to 43% organic bamboo, introduced a dedicated European website with country-specific portals for seamless product accessibility

- In October 2023, Birch Babe introduced the Birch Baby collection, featuring three all-natural, vegan, and fragrance-free infant skincare products made with organic ingredients. In addition, 1% of sales from this range will support the David Suzuki Foundation, reinforcing the brand’s commitment to sustainability

- In August 2023, Terra launched its premium plant-based diapers and wipes in the U.S. and Canada, offering 85% plant-based materials with 360-degree absorbency and over 12 hours of wetness protection

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.