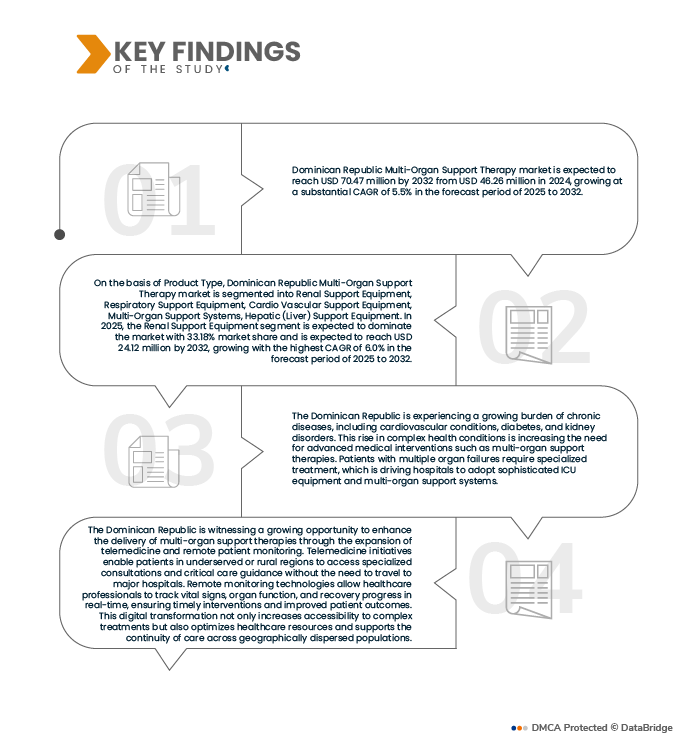

The Dominican Republic is experiencing a growing burden of chronic diseases, including cardiovascular conditions, diabetes, and kidney disorders. This rise in complex health conditions is increasing the need for advanced medical interventions such as multi-organ support therapies. Patients with multiple organ failures require specialized treatment, which is driving hospitals to adopt sophisticated ICU equipment and multi-organ support systems.

To address this growing healthcare demand, the Dominican healthcare system is focusing on strengthening critical care infrastructure and enhancing treatment protocols. Efforts include expanding ICU capacity, improving access to advanced therapies, and training healthcare professionals in multi-organ support techniques. These initiatives are fueling the adoption of multi-organ support therapies, aiming to improve patient outcomes and manage the rising incidence of chronic and complex illnesses effectively.

For Instance,

- As reported by the Ministry of Public Health in March 2024, the Robert Reid Cabral Children’s Hospital in Santo Domingo expanded its ICU capacity with multi-organ support systems to manage an increasing number of pediatric patients with severe organ failures. This investment helps improve critical care outcomes and addresses the growing burden of chronic and acute illnesses in the country.

- In July 2025, the U.S. Navy hospital ship USNS Comfort docked in Puerto Plata, Dominican Republic, to provide free healthcare services, including multi-organ support therapies, to around 1,200 local residents over a three-day humanitarian medical mission.

- In a Financial Times report from January, 2025, Scotland announced a GBP 2 billion investment in a subsea cable factory at a former coal-handling port in North Ayrshire, aiming to manufacture HVDC cables for offshore wind, interconnectors, and grid reinforcement. The project—backed by the Scottish National Investment Bank—will support the UK’s transition to net zero, meet surging HVDC cable demand (forecast at 10,000 km/year by 2030), and contribute to long-term subsea infrastructure growth across the North Sea region.

- In November 2024, Médico Express inaugurated a new state-of-the-art gastroenterology unit in the Dominican Republic, enhancing its capacity to provide advanced digestive care, including multi-organ support therapies, to patients with complex gastrointestinal conditions.

The rising prevalence of chronic diseases and organ failures in the Dominican Republic is creating a significant demand for multi-organ support therapies. Hospitals and healthcare institutions across the country are expanding ICU capacities, adopting advanced multi-organ support equipment, and implementing specialized treatment protocols to manage the growing patient load. Both public and private healthcare providers are actively investing in critical care infrastructure to improve patient outcomes and address complex health conditions. These initiatives highlight the Dominican Republic’s commitment to strengthening its critical care capabilities and underline the central role of multi-organ support therapies in meeting the country’s evolving healthcare needs.

Access Full Report @ https://www.databridgemarketresearch.com/reports/dominican-republic-multi-organ-support-therapy-market

Data Bridge market research analyzes that Dominican Republic Multi-Organ Support Therapy Market is expected to reach USD 70.47 million by 2032 from USD 46.26 million in 2024, growing at a substantial CAGR of 5.5% in the forecast period of 2025 to 2032.

Key Findings of the Study

Expansion of Telemedicine and Remote Patient Monitoring to Enhance Organ Support Therapy Delivery in Underserved Regions

The Dominican Republic is witnessing a growing opportunity to enhance the delivery of multi-organ support therapies through the expansion of telemedicine and remote patient monitoring. Telemedicine initiatives enable patients in underserved or rural regions to access specialized consultations and critical care guidance without the need to travel to major hospitals. Remote monitoring technologies allow healthcare professionals to track vital signs, organ function, and recovery progress in real-time, ensuring timely interventions and improved patient outcomes. This digital transformation not only increases accessibility to complex treatments but also optimizes healthcare resources and supports the continuity of care across geographically dispersed populations.

For Instance,

- In January 2023, the Pan American Health Organization (PAHO) launched a digital platform aimed at bringing telehealth services to remote populations in Latin America and the Caribbean. This initiative seeks to make telemedicine the "new normal" for healthcare workers and patients managing chronic diseases, thereby improving access to specialized care in underserved areas.

- In April 2020, the Quisqueya Mobile Clinic, supported by a grant from the Baxter International Foundation, began providing mobile healthcare services to approximately 8,000 underserved residents in 23 batey communities outside of San Pedro de Macoris. The initiative aims to increase healthcare accessibility through mobile clinic outreach, including telemedicine consultations.

- In February 2023, the International Bar Association (IBA) conducted a survey indicating that telemedicine is allowed in the Dominican Republic, defined as contactless medical support. The survey highlighted that telemedicine services must be enabled by the competent sanitary authority and have management agreements with specific local health establishments, ensuring compliance with national regulations.

The expansion of telemedicine and remote patient monitoring in the Dominican Republic presents a promising opportunity to improve access to complex organ support therapies, particularly for patients in underserved and rural regions. By leveraging digital health technologies, healthcare providers can offer specialized consultations, real-time monitoring, and timely interventions without requiring patients to travel long distances. This approach not only increases accessibility and continuity of care but also optimizes hospital resources and enhances overall patient outcomes. Continued investments in telehealth infrastructure, regulatory support, and training for healthcare professionals will be critical in fully realizing the potential of these technologies to strengthen the country’s critical care delivery system.

Report Scope and Dominican Republic Multi-Organ Support Therapy Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD million

|

|

Segments Covered

|

By Product Type (Renal Support Equipment, Respiratory Support Equipment, Cardio Vascular Support Equipment, Multi-Organ Support Systems, Hepatic (Liver) Support Equipment), By Patient Type (Pediatric, Adults, Geriatric), By End User (Hospitals, Clinics, Trauma centers, Ambulatory Surgical Centers (ASCS), Academic & Research Institutes, and Others), By Distribution Channel (Direct Tender, Third Party Distributors, and Others)

|

|

Market Players Covered

|

BAXTER (U.S.), Fresenius Kabi AG (Germany), B. Braun SE (Germany), Medtronic (Ireland), Asahi Kasei Corporation (Japan), Teleflex Incorporated (U.S.), TERUMO (Japan), ResMed (U.S.), Nikkiso Co., Ltd. (Japan), LivaNova PLC (U.K.), Getinge (Sweden), MicroPort Medical (Group) Co.,Ltd. (China), Drägerwerk AG & Co. KGaA, (Germany), Johnson & Johnson (U.S.), Koninklijke Philips N.V. (Netherlands), Macrotech (Dominican Republic)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Dominican Republic Multi-Organ Support Therapy Market is segmented into four notable segments based on product type, Patient Type, end user, distribution channel.

- On the basis of product type, the market is segmented into Renal Support Equipment, Respiratory Support Equipment, Cardio Vascular Support Equipment, Multi-Organ Support Systems, Hepatic (Liver) Support Equipment

In 2025, the Renal Support Equipment segment is expected to dominate the market

In 2025, Renal Support Equipment is expected to dominate the market with a market share of 33.18% due to the high and growing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) in the country, which creates a consistent, high-volume demand for renal replacement therapies. This segment's dominance is further reinforced by its well-established reimbursement pathways and the widespread availability of essential technologies like Hemodialysis Machines, Dialyzers, and Peritoneal Dialysis Systems across both public and private healthcare facilities. Compared to more complex and costly systems like ECMO or liver support devices, renal support equipment is more deeply integrated into standard care protocols, making it the most accessible and frequently utilized form of organ support therapy in the Dominican Republic's healthcare system.

- On the basis of Patient Type, the market is segmented into geriatric, adults, and pediatric

In 2025, the Adults segment is expected to dominate the market

In 2025, the Adults segment is expected to dominate the market with a market share of 78.53% due to several key factors. This demographic represents the largest portion of the working-age population, which is disproportionately affected by the primary drivers of organ failure, such as complications from hypertension, diabetes, and cardiovascular diseases. Furthermore, adults have a higher incidence of trauma and workplace accidents that can lead to acute conditions requiring multi-organ support. This segment also has relatively better access to health insurance and financial resources compared to the pediatric and often less-insured geriatric populations, enabling greater utilization of these advanced, costly therapies. The clinical focus and device design of many multi-organ support systems are also primarily calibrated and approved for the adult physiology, solidifying this segment's leading market position.

- On the basis of end user, the market is segmented into Hospitals, Clinics, Trauma centers, Ambulatory Surgical Centers (ASCS), Academic & Research Institutes, and Others.

In 2025, the hospitals segment is expected to dominate the market

In 2025, the Hospitals segment is expected to dominate the market with a market share of 67.47% due to their central role as the primary hub for critical care. Hospitals, especially large public tertiary facilities and major private institutions, are the only settings with the necessary infrastructure—including fully-equipped Intensive Care Units (ICUs), 24/7 laboratory services, and access to blood banks—required to administer complex multi-organ support therapies like CRRT and ECMO. They concentrate the specialized medical professionals, including intensivists, perfusionists, and critical care nurses, who are trained to operate this advanced equipment and manage critically ill patients. Furthermore, the high cost of these systems and the acute, life-threatening nature of the conditions they treat necessitate an inpatient hospital setting, consolidating the majority of market revenue and procedures within this segment.

- On the basis of distribution channel, the market is segmented into Direct Tender, Third Party Distributors, and Others

In 2025, the direct tender segment is expected to dominate the market

In 2025, the Direct Tender segment is expected to dominate the market with a market share of 77.29% due to its role as the primary procurement mechanism for the public healthcare system. The Dominican Republic government, through its Ministry of Public Health, heavily relies on centralized, bulk-purchase tenders to acquire high-value medical equipment and supplies. This channel allows the government to leverage its purchasing power to negotiate lower prices for complex and expensive multi-organ support systems, which is crucial for cost-conscious public hospitals. Furthermore, direct tenders provide a structured, transparent, and regulated framework for sourcing critical care technology, ensuring compliance with national standards and enabling long-term planning for infrastructure upgrades. As government initiatives continue to drive investments in critical care, the direct tender channel will remain the most significant route to market for major manufacturers.

Major Players

BAXTER, Fresenius Kabi AG, B. Braun SE, Medtronic, Asahi Kasei Corporation, Teleflex Incorporated, TERUMO, ResMed, Nikkiso Co., Ltd., LivaNova PLC, Getinge, MicroPort Medical (Group) Co.,Ltd., Drägerwerk AG & Co. KGaA,, Johnson & Johnson, Koninklijke Philips N.V. among others.

Latest Developments in Dominican Republic Multi-Organ Support Therapy Market

- In September 2025, Medtronic plc, the global leader in medical technology, has announced the launch of its groundbreaking VitalFlow™ ECMO System. This innovative platform is a fully configurable one-system ECMO solution, engineered to deliver superior performance while prioritizing operational simplicity.

- In July 2025, Getinge entered a strategic partnership with Zimmer Biomet to expand their offerings in the Ambulatory Surgical Center (ASC) sector. This collaboration combines Getinge’s OR infrastructure and sterilization solutions with Zimmer Biomet’s surgical technologies, enabling integrated, turnkey solutions for outpatient centers. The partnership enhances Getinge’s market reach, strengthens its ASC positioning, and supports growth in minimally invasive surgical care.

- In September 2024, Johnson & Johnson shared that its medical technology businesses – Ethicon, DePuy Synthes, Biosense Webster, Abiomed and CERENOVUS – will now go by the name Johnson & Johnson MedTech. This expansion builds leadership in medical technology with focus on cardiovascular, orthopaedic, surgery and vision solutions.

- In October 2023, Getinge acquired Healthmark Industries Co. Inc. for approximately USD 320 million. Healthmark is a key provider of instrument care and infection control consumables. This acquisition strengthens Getinge’s position in sterile reprocessing, particularly in the U.S., while supporting global expansion of Healthmark’s product offerings.

- In June 2023, Baxter International launched the Hillrom Progressa+ ICU bed in the U.S., with plans for global expansion. Developed in collaboration with nurses and therapists, the bed incorporates advanced technology to support management of pulmonary, skin, and mobility challenges common in critical care. This development enhances Baxter’s connected care portfolio, aiming to reduce caregiver burden and improve patient recovery outcomes in intensive care environments.

For more detailed information about the Dominican Republic Multi-Organ Support Therapy Market report, click here – https://www.databridgemarketresearch.com/reports/dominican-republic-multi-organ-support-therapy-market