Rising consumer awareness about nutrition and functional foods is a key driver for the global specialty food ingredients market, as consumers increasingly focus on health, wellness, and disease prevention through everyday food choices. Greater access to nutritional information, health campaigns, and digital media has strengthened understanding of the role of food in supporting immunity, digestive health, heart health, and overall well-being. This shift has led to growing demand for foods and beverages enriched with functional ingredients such as probiotics, antioxidants, dietary fibers, plant-based proteins, and omega fatty acids. Food manufacturers respond to these preferences by reformulating products and introducing innovative offerings that deliver enhanced nutritional value without compromising taste, texture, or shelf life. Specialty food ingredients are essential in achieving these goals, as they improve functionality, stability, and bioavailability while supporting clean-label and natural product trends. The increasing prevalence of lifestyle-related health conditions, including obesity and diabetes, further reinforces consumer preference for functional and fortified foods. Expanding adoption of health-focused categories such as functional beverages, sports nutrition, and fortified staples continues to accelerate the use of specialty ingredients across global markets. As a result, sustained demand for nutrition-enhancing and health-promoting ingredients directly drives innovation, production, and investment, acting as a strong driver for the growth of the global specialty food ingredients market.

For Instance,

- In January 2022, according to the article published by NCBI, A global scoping review analyzing 75 empirical studies highlights that growing prevalence of chronic diseases has significantly increased societal interest in healthy and functional foods. The study identifies strong consumer acceptance driven by health awareness and nutrition-related factors, reinforcing demand for functional food ingredients, thereby acting as a key driver for the global specialty food ingredients market.

- In December 2024, as per the article published by Journal of Experimental Food Chemistry, growing consumption of fortified foods, probiotic and prebiotic products, and antioxidant-rich natural foods reflects rising consumer awareness of the link between diet and health. Increased preference for vitamin- and mineral-enriched milk, functional beverages, and fiber-rich foods drives higher usage of specialty ingredients, thereby acting as a strong driver for the global specialty food ingredients market.

- In December 2025, as published by Research on nutraceutical-fortified ready-to-eat foods shows a strong consumer preference for products enriched with bioactive ingredients such as probiotics, omega-3 fatty acids, and antioxidants. Improved nutritional value and sensory appeal drive acceptance of these functional RTE foods, increasing demand for specialty ingredients and thereby acting as a key driver for the global specialty food ingredients market.

Rising consumer awareness and preference for health-promoting and functional foods are driving significant growth in the global specialty food ingredients market. Empirical studies and recent research highlight that increasing prevalence of chronic diseases, growing demand for fortified and bioactive-rich foods, and consumer inclination toward nutraceutical-fortified ready-to-eat products are boosting the adoption of specialty ingredients. This sustained demand encourages innovation, product development, and investment, firmly establishing nutrition and functional food ingredients as a key growth driver for the market

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-specialty-food-ingredients-market

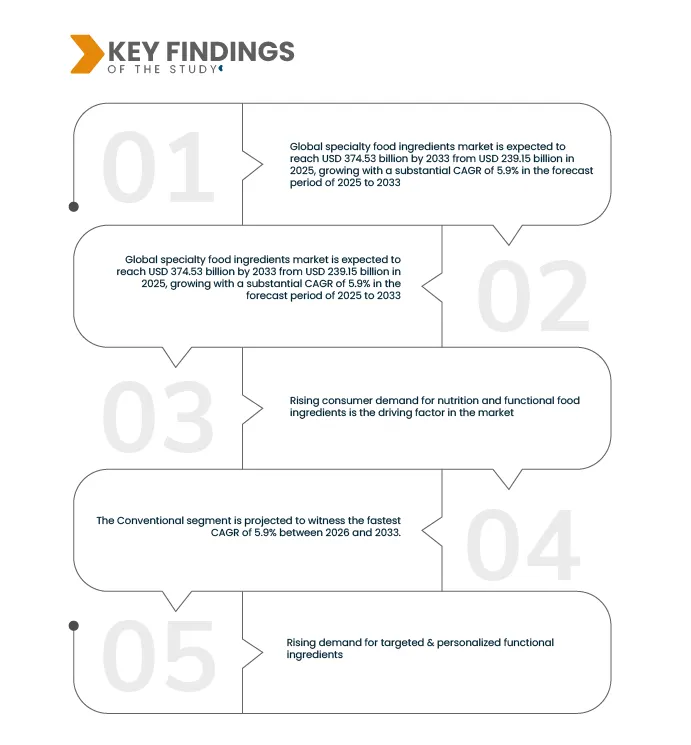

Data Bridge market research analyzes that Global Specialty Food Ingredients Market is expected to reach USD 374.53 billion by 2033 from USD 239.15 billion in 2025, growing with a substantial CAGR of 5.9% in the forecast period of 2026 to 2033.

Key Findings of the Study

Expansion into New Application Verticals

The emergence of new application verticals such as pet nutrition, sports foods, infant nutrition, and alternative beverages presents a significant opportunity for the global specialty food ingredients market. These sectors demand innovative, high-quality specialty ingredients tailored to specific dietary needs and functional benefits, driving diversification and expansion beyond traditional food markets. The growth of these niche categories stimulates product innovation and broadens market reach, thereby acting as a strong opportunity for the global specialty food ingredients market.

For instance,

- In May 2025, according to the article published by Shaanxi Green Agri Co., Ltd.., The evolving pet food market in Europe shows increasing demand for functional ingredients that provide health benefits beyond basic nutrition. These ingredients support immunity, digestion, mobility, skin and coat health, and overall well-being across various product forms such as kibble, chews, and supplements. This growing focus on pet wellness creates new application verticals, driving innovation and expanding the specialty food ingredients market opportunity.

- In April 2025, as per the article published by Gillco Products, LLC., The rising demand for clean, functional ingredients in sports nutrition reflects a new application vertical within the specialty food ingredients market. Consumers seek ethically sourced, scientifically backed compounds that enhance performance, recovery, and muscle building. This trend towards transparency and efficacy drives product innovation and supplier partnerships, thereby creating significant growth opportunities for the global specialty food ingredients market.

- In January 2024, as published by nutrition insight, The infant nutrition sector, despite slowing overall growth, shows strong demand for innovative specialty ingredients like human milk oligosaccharides (HMOs), probiotics, and bioactive peptides that support gut health, immunity, and cognitive development. Advances in biotechnology and formulation bring infant formula closer to breast milk, driving premiumization and niche product development. This growing focus creates a valuable opportunity for the global specialty food ingredients market.

The expansion into new application verticals such as pet nutrition, sports foods, and infant nutrition is driving significant growth opportunities within the global specialty food ingredients market. These sectors require specialized, high-quality ingredients that address specific health and functional needs, fostering innovation and market diversification. This broadening of application areas enhances the market’s reach and supports sustained development, establishing a strong foundation for future growth

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

By Type (Sweeteners, Nutritional & Fortification Ingredients, Flavor & Sensory Ingredients, Fermentation & Dough Improvement Ingredients, Hydrocolloids & Structural Agents, Preservatives, pH Control Agents & Acidulants, Leavening Agents, Humectants, Color Additives, Emulsifiers, Firming Agents, Enzymes, Fat Replacers and Anti-Caking Agents), By Nature (Organic and Conventional), By Source (Plant-Based, Animal-Based, Chemical Synthesis and Microbial), By Application (Beverages, Baked Goods & Grains, Confections & Sweet; Sauces, Dressings & Condiments, Oils, Margarines & Fats, Dairy & Dairy Products, Processed & Snack Foods, Meat & Protein Products and Others)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East And Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global specialty food ingredients market is segmented into four notable segments based on the type, nature, source and application.

- On the basis of type, the global specialty food ingredients market is segmented into Sweeteners, Nutritional & Fortification Ingredients, Flavor & Sensory Ingredients, Fermentation & Dough Improvement Ingredients, Hydrocolloids & Structural Agents, Preservatives, pH Control Agents & Acidulants, Leavening Agents, Humectants, Color Additives, Emulsifiers, Firming Agents, Enzymes, Fat Replacers, and Anti-Caking Agents.

In 2026, the Sweeteners segment is expected to dominate the market

In 2026, the Sweeteners segment is expected to dominate the global specialty food ingredients market share of 35.30% due to rising consumption of processed foods and beverages, increasing demand for sugar reduction and low-calorie formulations, and the widespread use of both natural and artificial sweeteners to improve taste, stability, and shelf life across food and beverage applications.

- On the basis of nature, the global specialty food ingredients market is segmented into Organic and Conventional

In 2026, the Conventional segment is expected to dominate the market

In 2026, Conventional segment is expected to dominate the global specialty food ingredients market share of 72.57% due to its cost-effectiveness, wide availability, established supply chains, consistent quality, and extensive use across large-scale food and beverage manufacturing operations, particularly in processed and packaged food products.

- On the basis of source, the global specialty food ingredients market is segmented into Plant-Based, Animal-Based, Chemical Synthesis and Microbial.

In 2026, the Plant-Based segment is expected to dominate the market

In 2026, the Plant-Based segment is anticipated to dominate the global specialty food ingredients market share of 43.69% due to increasing consumer preference for clean-label, natural, vegan, and plant-derived ingredients, rising demand for sustainable food solutions, and the growing use of plant-based sources in functional foods, beverages, and nutritional formulations.

- On the basis of application, the global specialty food ingredients market is segmented into Beverages, Baked Goods & Grains, Confections & Sweet, Sauces, Dressings & Condiments, Oils, Margarines & Fats, Dairy & Dairy Products, Processed & Snack Foods, Meat & Protein Products and Others.

In 2026, the Beverages segment is expected to dominate the market

In 2026, the Beverages segment is anticipated to dominate the global specialty food ingredients market share of 22.12% due to high consumption of functional and fortified drinks, increasing demand for flavor enhancement, sweeteners, stabilizers, and preservatives, and continuous product innovation in ready-to-drink, energy, and health-focused beverage categories.

Major Players

ADM (Archer Daniels Midland Company) (U.S.), Kerry Group (Ireland), Ajinomoto Co., Inc. (Japan), International Flavors & Fragrances (IFF) (U.S.), Givaudan (Switzerland) among others.

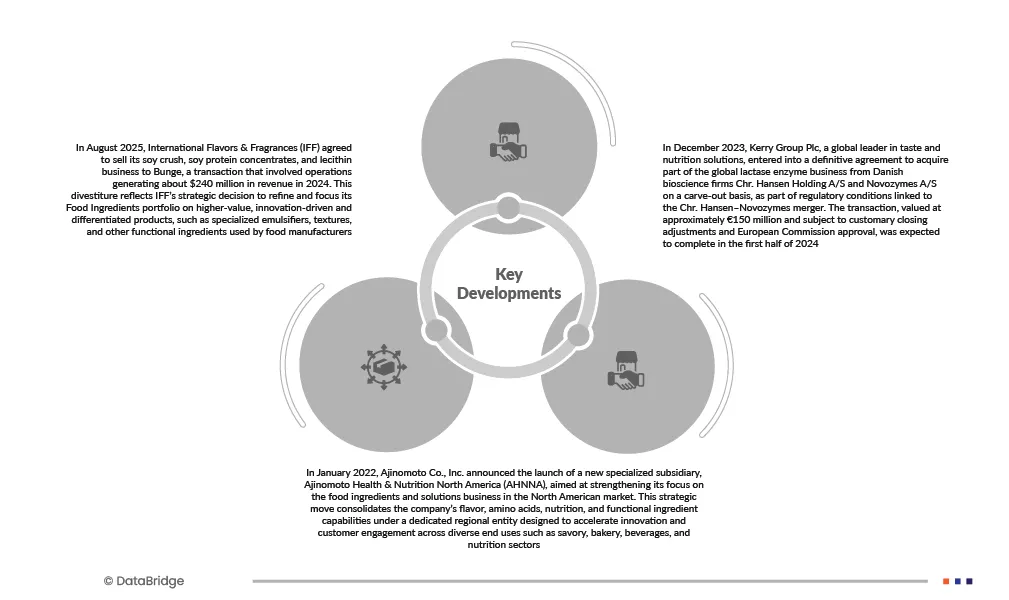

Latest Developments in Specialty Food Ingredients Market

- In November 2025, ADM (Archer Daniels Midland Company) announced a USD 350,000 contribution to Feeding America, the largest U.S. hunger-relief network, aimed at supporting local food banks and distribution centers across the country. The funding, provided through ADM’s corporate social investment program ADM Cares, will aid operations in six states, enhancing meal access for individuals and families facing food insecurity.

- In October 2025, Givaudan’s Taste & Wellbeing division initiated construction of a new state‑of‑the‑art liquids production facility in Reading, Ohio, marking one of the company’s most substantial investments in the United States in recent years. The project, aligned with Givaudan’s global 2030 strategic priorities, underscores the company’s commitment to expanding its operational footprint in North America and supporting long‑term growth in the food and beverage sector.

- In August 2025, International Flavors & Fragrances (IFF) agreed to sell its soy crush, soy protein concentrates, and lecithin business to Bunge, a transaction that involved operations generating about $240 million in revenue in 2024. This divestiture reflects IFF’s strategic decision to refine and focus its Food Ingredients portfolio on higher‑value, innovation‑driven and differentiated products, such as specialized emulsifiers, textures, and other functional ingredients used by food manufacturers.

- In December 2023, Kerry Group Plc, a global leader in taste and nutrition solutions, entered into a definitive agreement to acquire part of the global lactase enzyme business from Danish bioscience firms Chr. Hansen Holding A/S and Novozymes A/S on a carve-out basis, as part of regulatory conditions linked to the Chr. Hansen–Novozymes merger. The transaction, valued at approximately €150 million and subject to customary closing adjustments and European Commission approval, was expected to complete in the first half of 2024

- In January 2022, Ajinomoto Co., Inc. announced the launch of a new specialized subsidiary, Ajinomoto Health & Nutrition North America (AHNNA), aimed at strengthening its focus on the food ingredients and solutions business in the North American market. This strategic move consolidates the company’s flavor, amino acids, nutrition, and functional ingredient capabilities under a dedicated regional entity designed to accelerate innovation and customer engagement across diverse end uses such as savory, bakery, beverages, and nutrition sectors.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the global specialty food ingredients market are North America, Europe, Asia-Pacific, South America, Middle East & Africa. North America is sub-segmented into the U.S., Canada and Mexico. Europe is sub-segmented into Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Switzerland, Denmark, Norway, Finland, Sweden and Rest of Europe. Asia-Pacific is sub-segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, New Zealand, Hong Kong, Taiwan and Rest of Asia-Pacific. South America is sub-segmented into Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela and Rest of South America. Middle East and Africa is sub-segmented into South Africa, Egypt, Saudi Arabia, U.A.E., Israel, Bahrain, Kuwait, Oman, Qatar and Rest of Middle East & Africa.

Asia-Pacific is the dominating country in global specialty food ingredients market

Asia-Pacific is the global specialty food ingredients market, driven by rising health and wellness awareness, rapid urbanization, and changing dietary patterns across key economies such as China, India, Japan, and Southeast Asia. Increasing disposable incomes are supporting demand for premium, functional, and fortified foods, while strong growth in processed and convenience foods is boosting the use of ingredients that enhance nutrition, taste, texture, and shelf life. Additionally, rising preference for clean-label, natural, and plant-based ingredients, along with expansion of food processing infrastructure, modern retail, and technological advancements in formulation and fermentation, continues to accelerate market growth in the region.

Asia-Pacific is expected to be the fastest growing country in global specialty food ingredients market

Asia-Pacific is expected to be the fastest-growing region in the global specialty food ingredients market, driven by increasing health and wellness awareness that is prompting consumers to seek functional, natural, and fortified food products. Rapid urbanization and lifestyle changes are expanding demand for convenience and processed foods, which rely on specialty ingredients to improve taste, texture, and shelf life. Rising disposable incomes across emerging economies are supporting greater consumption of premium and nutritious food products. Additionally, growing preference for clean-label and plant-based ingredients, alongside expansion of modern retail and food processing infrastructure, is further accelerating market growth in the region.

For more detailed information about the global specialty food ingredients market report, click here – https://www.databridgemarketresearch.com/reports/global-specialty-food-ingredients-market