COVID-19 Impact on Thermal Insulating Materials in Chemical and Materials Industry

INTRODUCTION

Home insulation is an emerging trend in most of the countries. There are multiple benefits of insulating a building. Insulating can help in saving energy and reduce bill amounts, add comforts to the building and also create healthier and positive environmental impact. The major functioning of insulation material is to regulate the temperature of a building and thus making living a pleasant experience even at those places where weather is either extreme cold or extreme hot. The use of insulating materials or insulated building have an advantage that they require less amount of heating and cooling appliances and thus saving lot of money for the consumer.

Around 50%-60% of the insulation material is consumed by building and construction sector followed by consumer goods and transportation industry. As these sectors have faced major hit due to the breakout of coronavirus, the entire insulation industry is struggling for margins. Regions such as Europe and North America where thermal insulation regulations are very stringent are also under the pressure. People are avoiding building any type of new constructions or purchasing any electronics until the need is really high. Also, region such as Asia-Pacific which was growing with the highest rate in thermal insulation consumption as residential building area is still untouched and have a lot of scope for expansion, is also struggling.

IMPACT OF COVID-19 ON DEMAND

The demand for thermal insulation has faced a dip due to the breakdown of COVID-19 globally. As most of the countries are running under lockdown, new construction activities are kept on hold and thus no insulation material is getting consumed. Also the old buildings that are compelled to get insulated due to the new rules and regulations passed by the local government are also on hold as neither the material is available nor the labor to install.

As per the Crisil, the Indian construction industry has witnessed a decline of 12-16% in the current fiscal year due to the breakout of COVID-19. According to the same agency, as the construction activities has declined, major players in the construction sector are expected to register a 13 to 17% drop in revenue in fiscal year 2021. Also there have been changes in the budgetary support from the government for the next fiscal year keeping the revised estimate of this fiscal year in concern.

Another application of thermal insulation is in consumer goods and transportation industry. Since the automotive industry has registered very poor sales during this pandemic, the demand of foam insulation from OEMs has also declined.

IMPACT ON SUPPLY DURING COVID-19

As thermal insulation materials are made up of polymer resins, any crunch in supply of these materials will have direct impact on the thermal insulation supply. Before the COVID-19, the polymer industry has mostly suffered shortages of the product. And to avoid this, the manufacturers keep stock of polymers and polymeric resins to overcome the shortage. But due to the outbreak of COVID-19, the supply chain has suffered abruptly. Manufacturers of raw materials have stock but they are not getting demand for it. Moreover, companies are facing issue with the supply of raw materials as most of the countries are under complete shutdown. In this situation, both manufacturers and consumers are facing the timely availability of raw materials.

The restriction over transportation and labor availability is another factor that has affected the supply chain of thermal insulation. At several parts, the manufacturers are struggling for raw material reach and at the same time, some are struggling for delivering the product. For few manufacturers, the end-product is ready but are not able to reach their customers due to restriction on transportation and thus losing money. Thus, the impact on supply is not due to one factor but is facing hit from multiple points.

IMPACT ON PRICE

Due to breakdown of COVID-19, the prices of insulation materials such as thermal insulation has fallen a bit especially post May 2019. In countries such as Germany, France and Poland, where the maximum demand is generated and fulfilled with the local production, a decline in price has impacted the overall market of thermal insulation. Manufacturers are struggling to recover their cost prices and look for profits. Many local and small players have made an exit from the market as the pandemic is spreading aggressively. For many vendors, the saving has fallen short to run the business at such low cost and with low demand.

STRATEGIC DECISION BY GOVERNMENT TO BOOST THE MARKET

The first and foremost step that government is planning to take towards the comeback of insulation industry on track is to make the industry less dependent on imports. Most of the manufacturers have decided to reduce its dependence on China for the supply of polymers and polymer resins. Many companies are trying to shift their supplies from China to other countries such as Germany and France. This is one of the step suggested by government in discussion with the foam insulation manufacturing companies to de-risk the supply chain.

Also, keeping an eye on the crises, government is planning to postpone the fiscal consolidation and even relax states' fiscal deficits. As the demand for foam has gone down tremendously, it has forced the manufacturers to cut the production to almost 50% of the capacity. The production cut has led to the less requirement of insulation materials and thus, has impacted the whole industry. To cope up this, government is planning to provide some fiscal incentives to manufacturers including tax cuts and exemptions to recover from the disruption. Other important steps that government may take to pop up the production once the lockdown is over are raising depreciation limits and moratorium on interest payment. The government is also planning to reduce the rate of consumption tax on high foam insulation consuming sectors as automotive and construction. But the slow pickup in these industries and a step-up in discretionary spending on healthcare sector may act as a challenge for insulation industry.

SUCCEEDING STEPS

The sudden outbreak of coronavirus has created a pandemic all over the world and has changed the meaning of ‘normal’ for everyone. Both consumers and manufacturers have to change their way of business accordingly. Consumers buying pattern has completely changed and so the manufacturers have to mold their manufacturing according to it. The consumer behavior has become so unpredictable, that even after passing more than 2 quarter in the pandemic, it is difficult to comment on the next step or requirement of consumers. The demand, supply, price and all the other factors that are impacted from the outbreak of COVID-19 are now looked from a different perspective. Majority of the changes have taken place in man (labor), materials and money.

In the insulation industry, it is expected that the focus will change towards automation, mechanization and off-site fabrication. This will be a major step to reduce dependency on labor. As in the pandemic, labor was an important concern and due to lockdown, availability of labor was difficult. Another major step was to be more towards technology mainly to maintain balance between manpower and demand required. To stop reverse migration in future, the companies are planning to provide better on-site facilities for health and hygiene.

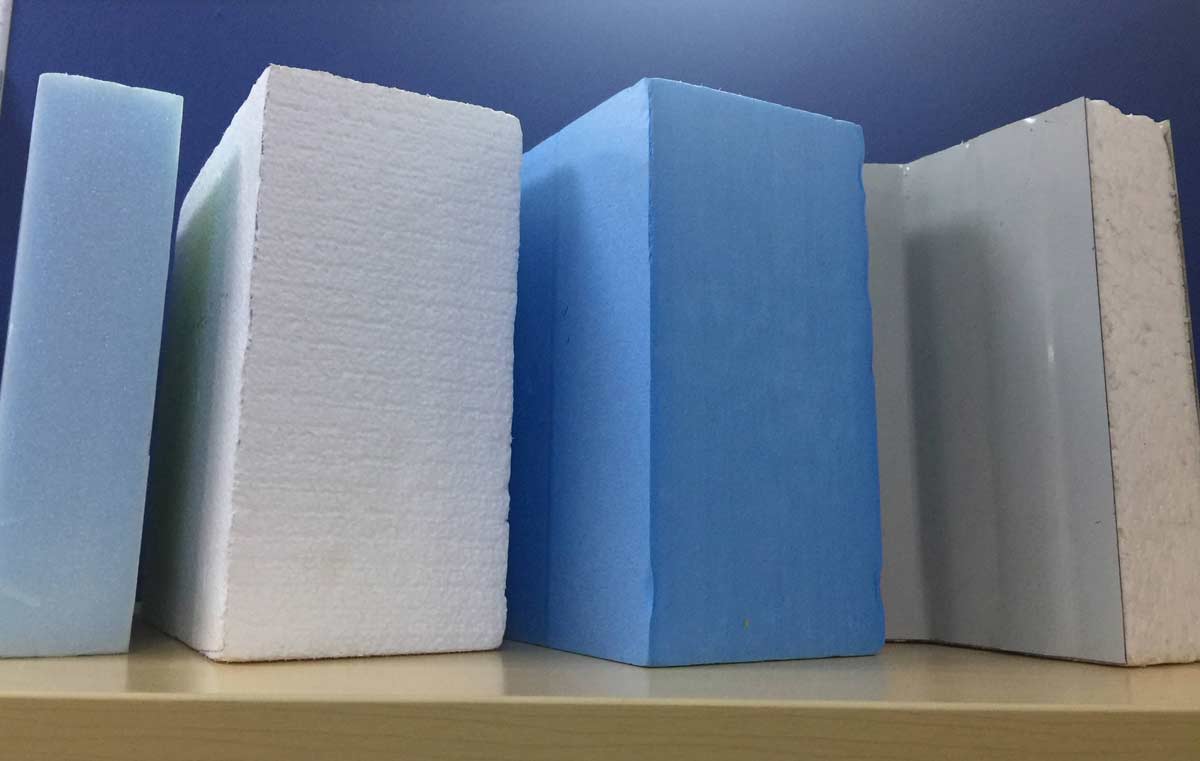

The insulation industry has one important part and that is raw materials. It is very important that which material is used for thermal insulation. This pandemic has resulted in crunch of raw materials for thermal insulation. Thus, manufacturers are planning to source their supplies from alternate suppliers. Also, there will be more flexibility to avoid any further potential disruptions in supply chain.

Apart from these changes, the developers need to focus on the right balance between the market forces such as financings, customer demands and materials. Manufacturers need to analyze the demand supply once again by using the advanced construction technologies to support forecasting.

CONCLUSION

Thermal insulation is mainly used in construction and automotive industry. Any impact on these industries has direct implication on thermal insulation materials market. Due to dip in the construction and infrastructure activities, the demand for thermal insulation materials mainly foam insulation materials has faced decline especially in Europe and Asia-Pacific region which is the among the largest consumer of thermal insulation.

Few manufacturers are facing issue with supply of raw materials. But at the same time, the manufacturers are struggling to maintain the supply as per the demand. Many manufacturers are facing issues due to lockdown and shutdown. They are not even able to cater the existing demand. Also, the gap in supply chain is hampering the timely availability of end-product in the thermal insulation materials market. Thus, government is taking various initiatives to curb the demand-supply imbalance. Government is also providing various financial benefits to small and medium sized enterprises to maintain the equilibrium in the thermal insulation materials market.