The rising integration of parental control solutions are being greatly increased globally by the growing integration of parental control features into mobile operating systems, gaming consoles, and smart tvs. In response to increased worries about screen time, internet safety, and age-inappropriate content, tech manufacturers and platform providers are integrating native parental control functions as digital content consumption spreads across devices. While smart TV brands and game console manufacturers are improving their user interfaces with parental dashboards, major operating systems like Android, ios, and Windows now come with built-in tools for tracking app usage, establishing time limits, and filtering web content.

This ecosystem-level integration is speeding up mass-market acceptance and lowering entry hurdles for parents who are less tech-savvy. Additionally, the need for comprehensive, user-friendly parental control systems that work flawlessly across many platforms and devices is being driven by parents' increased awareness of cyberthreats such online grooming, exposure to explicit content, and digital addiction. Because of this, the market for parental control software is expanding rapidly due to a combination of changing consumer demands for safer online spaces for kids and governmental pressures.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-brazil-and-latin-america-parental-control-software-market

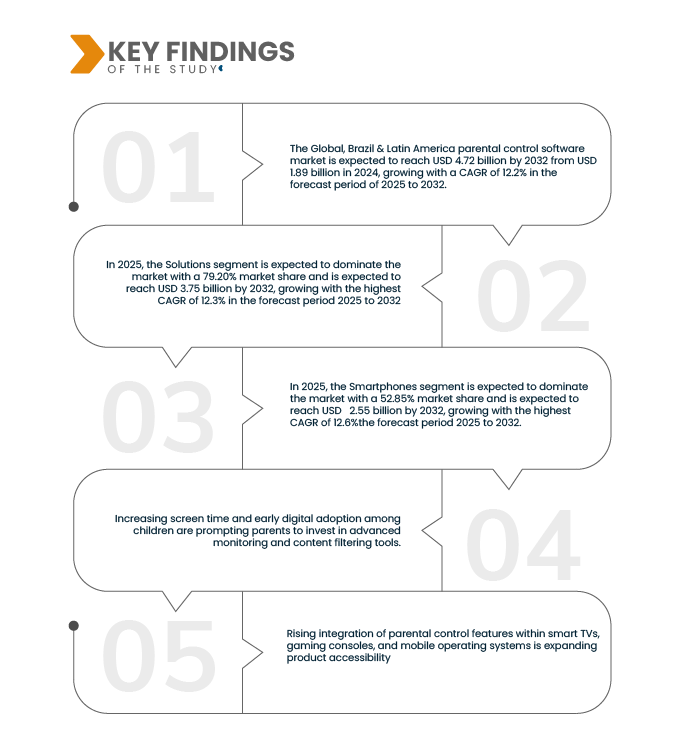

Data Bridge market research analyzes that Global, Brazil & Latin America Parental Control Software Market is expected to reach USD 4.72 billion by 2032 from USD 1.89 billion in 2024, growing with a substantial CAGR of 12.2% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing screen time and early digital adoption among children are prompting parents to invest in advanced monitoring and content filtering tools

Increasing screen time and early digital adoption among children are reshaping parenting dynamics and driving demand for advanced monitoring and content filtering tools. Parents are taking a more active approach to controlling their children's digital exposure as smartphones, tablets, smart tvs, and laptops become an essential part of their everyday lives, whether for social contact, education, or enjoyment. With kids as young as preschool using internet-enabled devices, this trend is especially noticeable in tech-savvy homes. Parental anxiety has increased due to the proliferation of potentially dangerous content, online predators, and excessive screen time, which has prompted the purchase of advanced parental control software.

These systems enable age-appropriate material filtering, screen time management, real-time activity tracking, and app usage monitoring—often across various platforms and devices. In order to provide parents more control and peace of mind, contemporary parental control software now also has capabilities like location tracking, social media monitoring, and warnings for harmful behavior. In order to satisfy the demands of families navigating a world that is becoming more interconnected, the market for digital safety products is consequently changing quickly.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Offering (Solutions and Services), Deployment Mode (On-Premise, Cloud, and Hybrid), Device (Smartphones, Tablets, Laptops & Desktops, Gaming Consoles, Smart TVs, Wearables & IoT Devices, and Others), Platform (Android, Windows, iOS, macOS, Linux, and Others), Subscription Model (Premium, Monthly, Annual, Lifetime License, and Pay-Per-Use), Age Group (Children (6–12 Years), Teens (13–18 Years), and Toddlers (0–5 Years)), Application (Home Use/Individual Parents, Educational Institutions, Government & Public Sector, NGOs & Child Welfare Organizations, and Others)

|

|

Countries Covered

|

Brazil, Mexico, Guatemala ,Honduras, El Salvador. Nicaragua, Costa Rica, Panama, Argentina, Bolivia, Chile, Colombia, Ecuador, Cuba

|

|

Market Players Covered

|

Google (USA), Microsoft (USA), Gen Digital Inc. (Czech Republic), McAfee LLC (USA), AO Kaspersky Lab (Russia), AT&T Intellectual Property (USA), Wondershare (China), Cisco Systems Inc. (USA), Trend Micro Incorporated (Japan), Qustodio LLC (USA), MSPY (UK), ESET spol. s r.o., Aura (USA), SafeToNet Limited (UK), Kiddoware (USA), Mobicip LLC (USA), Intego (France), Mobistealth (UAE), Safe Lagoon Software (UK), CleanRouter (USA), Canopy (UK), Family Time (India), Bitdefender (Romania), Parent Geenee (India), MMGuardian (Pervasive Group Inc) (UK), Salfeld Computer GmbH (Germany), Screen Time Labs Ltd (UK), Spyrix (USA), Eturi Corp (Canada), Find My Kids (Israel), SentryPC (USA).

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment analysis

The Global, Brazil & Latin America parental control software market is segmented into seven notable segments based on the offering, deployment model, device, platform, subscription model, age group, application.

- On the basis of offering, the Global, Brazil & Latin America parental control software market is segmented into solutions and services

In 2025, the solutions segment is expected to dominate the Global, Brazil & Latin America parental control software market

In 2025, the solutions segment is expected to dominate the market with a market share of 79.20% due to the comprehensive nature of software solutions that directly address the core needs of parents and institutions. These solutions offer a wide array of features, including content filtering, screen time management, and location tracking, providing direct control and monitoring capabilities.

- On the basis of deployment model, the market is segmented into on-premise, cloud and hybrid.

In 2025, the on-premise segment is expected to dominate the Global, Brazil & Latin America parental control software market

In 2025, the on-premise segment is expected to dominate the market with a market share of 60.58% due to the perceived security and control it offers to users, particularly for institutions and privacy-conscious families. The solutions allow parents and organizations to store data locally and manage settings directly, reducing reliance on external cloud services and alleviating concerns about data breaches or third-party access.

- On the basis of device, the market is segmented into ready to smartphones, laptops & desktops, tablets, smart TVS, gaming consoles, wearables & IoT devices and others. In 2025, the smartphones segment is expected to dominate the market with a market share of 52.85% due to their ubiquitous presence and primary role in children's digital lives. As the most common device for internet access, gaming, and social interaction among minors, smartphones represent the greatest area of parental concern regarding screen time, content exposure, and online safety.

- On the basis of platform, the market is segmented into android, windows, iOS, macOS, Linux and others. In 2025, the android segment is expected to dominate the market with a market share of 40.43% due to its overwhelming market share in the smartphone and tablet landscape across the region, particularly in Brazil and Latin America. The affordability and accessibility of android devices make them the primary digital tools for a vast majority of children and teenagers.

- On the subscription model, the market is segmented into premium, monthly, annual, lifetime license, pay-per-use. In 2025, the premium segment is expected to dominate the market with a market share of 46.34% due to the increasing recognition among parents of the value in advanced features and comprehensive protection for their children's digital well-being. While freemium options may attract initial users, the desire for robust content filtering, real-time monitoring, AI-driven insights, and priority customer support drives conversion to premium subscriptions.

- On the basis of age group, the market is segmented into children (6–12 years), teens (13–18 years) and toddlers (0–5 years). In 2025, the children (6–12 years) segment is expected to dominate the market with a market share of 60.63% due to this age group's increasing exposure to digital devices and online content, coupled with their developing understanding of online risks. Parents of children in this age range are highly proactive in seeking solutions to manage screen time, filter inappropriate content, and monitor online interactions as their children begin to explore the internet independently.

- On the basis of application, the market is segmented into home use/individual parents, educational institutions, government & public sector, NGOS & child welfare organizations and others. In 2025, the home use/individual parents segment is expected to dominate the market with a market share of 60.84% due to the universal concern among parents to protect their children in the digital realm. The primary application of parental control software is within individual households, where parents directly manage their children's device usage, monitor online activities, and set boundaries.

Major Players

Data Bridge Market Research Analyses that Google LLC (USA), Microsoft Corporation (USA), Gen Digital Inc. (Czech Republic), McAfee LLC (USA), AO Kaspersky Lab (Russia) as the major players operating in the market.

Market Developments

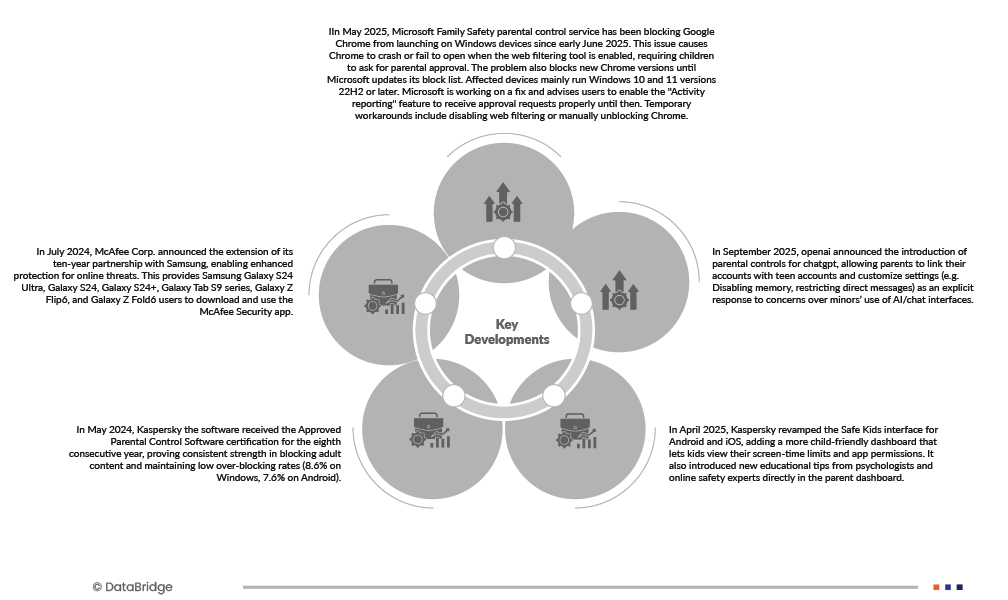

- In September 2025, openai announced the introduction of parental controls for chatgpt, allowing parents to link their accounts with teen accounts and customize settings (e.g. Disabling memory, restricting direct messages) as an explicit response to concerns over minors’ use of AI/chat interfaces.

- In June 2025, Apple announced expanded tools to help parents protect kids and teens online, including new ways to manage Child Accounts, the ability to share a child’s age range to receive age-appropriate experiences within an app, updated age ratings on the App Store, and more. This initiative enhances the accessibility and effectiveness of parental control features across Apple devices

- In September 2025, Sony launched the playstation Family App, allowing parents to monitor and manage child accounts, including content filters and playtime limits, directly from their mobile devices. This integration simplifies parental control management for families using playstation consoles.

- In October 2025, Apple introduced ios 26, extending automatic safety settings to teenagers aged 13 to 17, providing them with protections similar to those of younger kids. This update includes age-appropriate restrictions, even for teens using a standard Apple Account, thereby enhancing parental control features across ios devices.

As per Data Bridge Market Research analysis:

For more detailed information about the Global Parental Control Software Market report, click here – https://www.databridgemarketresearch.com/reports/global-brazil-and-latin-america-parental-control-software-market