The increasing global shift toward preventive healthcare and personalized wellness is a major driver of the personalized dietary supplements market. Consumers are becoming more proactive about health management, seeking customized solutions that target specific needs such as immunity, metabolism, cognition, and gut health.

The growth of chronic lifestyle diseases such as diabetes, obesity, and cardiovascular disorders has accelerated interest in preventive nutrition. Personalized supplements allow individuals to manage long-term wellness goals based on biometric and lifestyle data, reducing dependency on pharmaceutical interventions.

Health-conscious millennials, aging populations, and fitness enthusiasts are driving demand for tailored supplementation plans developed through online health assessments, genetic testing, and diet tracking. The rise of telehealth, fitness wearables, and digital nutrition coaching platforms has further popularized this approach by integrating supplement regimens into holistic wellness programs.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-personalized-dietary-supplements-market

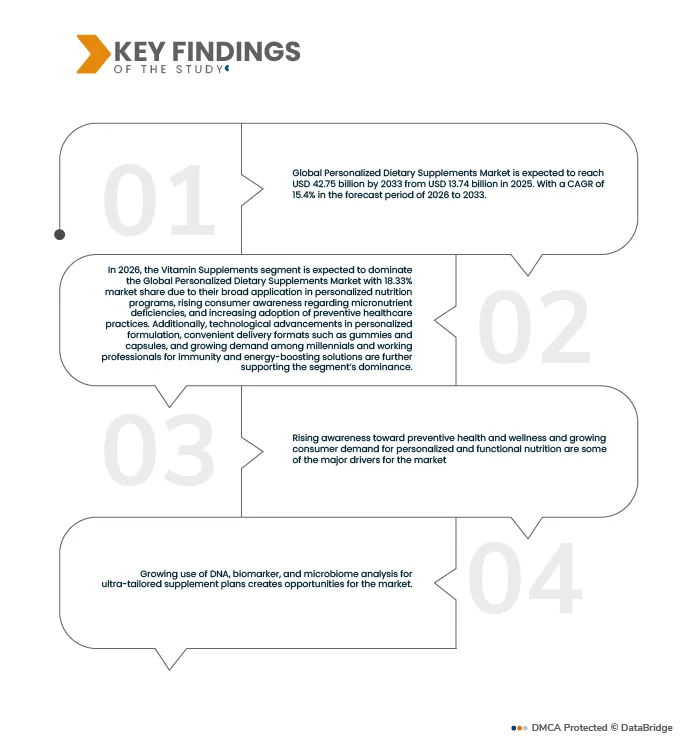

The Global Personalized Dietary Supplements Market is expected to reach USD 42.75 billion by 2033 from USD 13.73 billion. In 2025 growing with a substantial CAGR of 15.4% in the forecast period of 2026 to 2033.

Key Findings of the Study

Growing Consumer Demand for Personalized and Functional Nutrition

The expansion of tannins into nutraceuticals and functional foods is being driven by their natural origin and bioactive properties, including antioxidant, anti-inflammatory, and antimicrobial effects. These compounds are being incorporated into dietary supplements, functional beverages, and health-focused formulations aligned with clean-label and plant-based consumer preferences.

Scientific interest in the bioavailability and therapeutic potential of tannins has supported their growing use in preventive health applications, particularly in digestive health and immune support. Formulation efforts are being focused on enhancing stability, taste, and efficacy, supported by cross-industry collaborations. Favorable regulatory attitudes toward natural bioactives are further enabling market entry across diverse regions.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD thousand

|

|

Segments Covered

|

By Type (Vitamin Supplements, Vitamin & Mineral Complexes/Blends, Mineral Supplements, Probiotic Supplements, General Well-Being Supplements, Collagen Supplements, Immunity Supplements, Digestive Health Supplements, Sports Nutrition Supplements, Weight Management Supplements, Skin Health Supplements, Heart Health Supplements, Hair Health Supplements, Brain Health Supplements, Chondroprotective Supplements, Nail Health Supplements, Others), Ingredient Type (Vitamins, Minerals, Amino Acids, Probiotics, Fatty Acids, Prebiotics, Collagen, Carotenoids, Botanicals, Others), Source (Plant-Based, Animal-Based, Algae-Based), Technology (Genetic Testing & AI, Microbiome Testing, 3D Printing, Others), Dosage Form (Capsules, Tablets, Soft Gels, Powders, Gummies & Jellies, Drinks/Shots, Premixes, Tinctures), Products (Blended / Fortified Supplements, Single Compound Supplements), Price Range(Premium, Regular, Super-Premium, Packaging Type(Bottles, Bags & Pouches, Blister Packs, Cans & Jars, Cartons, Stick Packs, Others), End Use(Adults, Children, Senior Citizens), Distribution Channel(Non-Store Retailers, Store Based Retailers)

|

|

Countries Covered

|

China, India, Japan, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, New Zealand, Hong Kong, Taiwan, Rest of Asia-Pacific, U.S., Canada, Mexico, Italy, Germany, France, Spain, U.K., Russia, Turkey, Belgium, Netherlands, Switzerland, Sweden, Denmark, Norway, Finland, Rest of Europe, Brazil, Argentina, Colombia, Peru, Chile, Paraguay, Uruguay, Bolivia, Ecuador, Venezuela, Rest of South America, South Africa, Saudi Arabia, United Arab Emirates, Egypt, Israel, Bahrain, Kuwait, Oman, Qatar, Rest of Middle East and Africa

|

|

Market Players Covered

|

DSM-Firmenich (Switzerland), Amway Corporation (U.S.), Herbalife Nutrition Ltd. (Cayman Islands), The Bountiful Company (U.S.), Symrise AG (Germany), Pfizer Inc. (U.S.), Bayer AG (Germany), Glanbia PLC (Ireland), Archer Daniels Midland Company (U.S.), Nature’s Sunshine Products, Inc. (U.S.), Cuure (France), Nourished (U.K.), Vitamins & Me (U.K.), Freedom to Formulate (U.K.), Craft Health Pte. Ltd. (Singapore), Bioniq Health-Tech Solutions (Germany) among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The Global Personalized Dietary Supplements Market is segmented into seven segments based on type, ingredient type, source, technology, dosage form, product, price range, packaging type, end use and distribution channel.

- On the basis of type, the market is segmented into Vitamin Supplements, Vitamin & Mineral Complexes/Blends, Mineral Supplements, Probiotic Supplements, General Well-Being Supplements, Collagen Supplements, Immunity Supplements, Digestive Health Supplements, Sports Nutrition Supplements, Weight Management Supplements, Skin Health Supplements, Heart Health Supplements, Hair Health Supplements, Brain Health Supplements, Chondroprotective Supplements, Nail Health Supplements, Others.

In 2026, the Vitamin Supplements segment is expected to dominate the market

In 2026, the Vitamin Supplements segment is expected to dominate the market with a market share of 18.33% market due to their broad application in personalized nutrition programs, rising consumer awareness regarding micronutrient deficiencies, and increasing adoption of preventive healthcare practices. Additionally, technological advancements in personalized formulation, convenient delivery formats such as gummies and capsules, and growing demand among millennials and working professionals for immunity and energy-boosting solutions are further supporting the segment’s dominance

- On the basis of ingredient type, the market is segmented into Vitamins, Minerals, Amino Acids, Probiotics, Fatty Acids, Prebiotics, Collagen, Carotenoids, Botanicals, Others.

In 2026, the Vitamins segment is expected to dominate the market

In 2026, the Vitamins segment is expected to dominate the market with a market share of 31.38% due to its widespread use in personalized nutrition plans, growing awareness about micronutrient deficiencies, and the rising adoption of preventive healthcare practices. Furthermore, the increasing availability of customized vitamin blends, technological advancements in formulation and delivery systems, and strong consumer demand for immunity, energy, and metabolism support are driving the segment’s continued dominance in the personalized dietary supplements market

- On the basis of source, the Global Personalized Dietary Supplements Market is segmented into Plant-Based, Animal-Based, and Algae-Based.

In 2026, the Plant-Based segment is expected to dominate the market

In 2026, the Plant-Based segment is expected to dominate the market with a share of 48.64% due to rising consumer preference for natural and clean-label ingredients, growing awareness regarding the health benefits of botanical and herbal sources, and increasing demand for vegan and sustainable dietary supplements. Additionally, the expansion of personalized nutrition platforms offering plant-derived formulations and advancements in extraction technologies enhancing bioavailability and potency are further contributing to the segment’s dominance

- On the basis of technology, the Global Personalized Dietary Supplements Market is segmented into Genetic Testing & AI, Microbiome Testing, 3D Printing, and Others.

In 2026, the Genetic Testing & AI segment is expected to dominate the market

In 2026, the Genetic Testing & AI segment is expected to dominate the market with a share of 46.10% due to the growing integration of advanced genomic analysis and artificial intelligence in personalized nutrition planning, enabling precise identification of individual nutrient needs and health risks. Additionally, AI-driven data analytics, machine learning algorithms, and DNA-based dietary recommendations are enhancing the accuracy and effectiveness of personalized supplement formulations. Rising consumer interest in precision health solutions and the increasing affordability of genetic testing kits further contribute to the segment’s dominance.

- On the basis of dosage form, the Global Personalized Dietary Supplements Market is segmented into Capsules, Tablets, Soft Gels, Powders, Gummies & Jellies, Drinks/Shots, Premixes, Tinctures.

In 2026, the Capsules segment is expected to dominate the market

In 2026, the Capsules segment is expected to dominate the market with a share of 12.51% due to their high consumer preference for convenience, accurate dosage, and ease of consumption. Capsules offer better bioavailability, longer shelf life, and the ability to encapsulate both liquid and solid ingredients, making them suitable for a wide range of personalized formulations.

- On the basis of product, the market is segmented into Blended / Fortified Supplements, Single Compound Supplements.

In 2026, the Blended / Fortified Supplements segment is expected to dominate the market

In 2026, the Blended / Fortified Supplements segment is expected to dominate the market with a market share of 67.33% due to their ability to provide comprehensive nutritional benefits by combining multiple vitamins, minerals, and bioactive compounds in a single formulation. This approach supports personalized health goals such as immunity, energy, and cognitive function, catering to a broad range of consumer needs. Additionally, growing demand for multifunctional supplements, advancements in nutrient fortification technologies, and the rising trend of customized blends targeting specific deficiencies or lifestyle requirements are further driving the segment’s dominance

- On the basis of price range, the market is segmented into Premium, Regular, Super-Premium.

In 2026, the Premium segment is expected to dominate the market

In 2026, the Premium segment is expected to dominate the market with a market share of 50.24% due to increasing consumer willingness to spend on high-quality, science-backed, and clinically validated personalized supplements. This growth is driven by rising health consciousness, greater awareness of ingredient transparency, and a preference for products offering superior efficacy, purity, and customization. Moreover, the expansion of premium brands offering DNA-based, organic, and sustainably sourced formulations, along with enhanced digital consultation and subscription models, further supports the segment’s dominance in the personalized dietary supplements market

- On the basis of packaging type, the market is segmented into Bottles, Bags & Pouches, Blister Packs, Cans & Jars, Cartons, Stick Packs, Others.

In 2026, the Bottles segment is expected to dominate the market

In 2026, the Bottles segment is expected to dominate the market with a market share of 39.58% due to their widespread use in packaging personalized dietary supplements owing to durability, convenience, and effective protection against moisture and contamination. Bottles also offer high versatility for various supplement forms such as capsules, tablets, and gummies, along with easy storage, resealability, and enhanced shelf life. Furthermore, the growing adoption of recyclable and lightweight plastic bottles, coupled with increasing innovations in eco-friendly and smart packaging designs, is further driving the segment’s dominance

- On the basis of end use, the market is segmented into Adults, Children, Senior Citizens.

In 2026, the Adults segment is expected to dominate the market

In 2026, the Adults segment is expected to dominate the market with a market share of 61.87% due to the rising awareness of preventive healthcare, growing adoption of personalized nutrition for managing stress, fatigue, and lifestyle-related disorders, and increasing preference for customized supplement formulations that cater to specific needs such as energy, metabolism, and immunity. Additionally, the working-age population’s focus on maintaining overall wellness and fitness through targeted dietary solutions further drives the dominance of this segment

- On the basis of distribution channel, the Global Personalized Dietary Supplements Market is segmented into Non-Store Retailers and Store Based Retailers.

In 2026, the Non-Store Retailers segment is expected to dominate the market

In 2026, the Non-Store Retailers segment is expected to dominate the market due to the rapid expansion of e-commerce platforms and direct-to-consumer brand websites offering personalized supplement solutions with convenient accessibility and customization options. This growth is further supported by the rising adoption of digital health platforms, subscription-based models, and AI-driven recommendation systems. Additionally, increasing consumer preference for online purchasing due to product variety, easy comparison, and doorstep delivery is further propelling the dominance of this segment in the personalized dietary supplements market

Major Players

DSM-Firmenich (Switzerland), Amway Corporation (U.S.), Herbalife Nutrition Ltd. (Cayman Islands), The Bountiful Company (U.S.), Symrise AG (Germany), Pfizer Inc. (U.S.), Bayer AG (Germany), Glanbia PLC (Ireland), Archer Daniels Midland Company (U.S.), Nature’s Sunshine Products, Inc. (U.S.), Cuure (France), Nourished (U.K.), Vitamins & Me (U.K.), Freedom to Formulate (U.K.), Craft Health Pte. Ltd. (Singapore), Bioniq Health-Tech Solutions (Germany). among others.

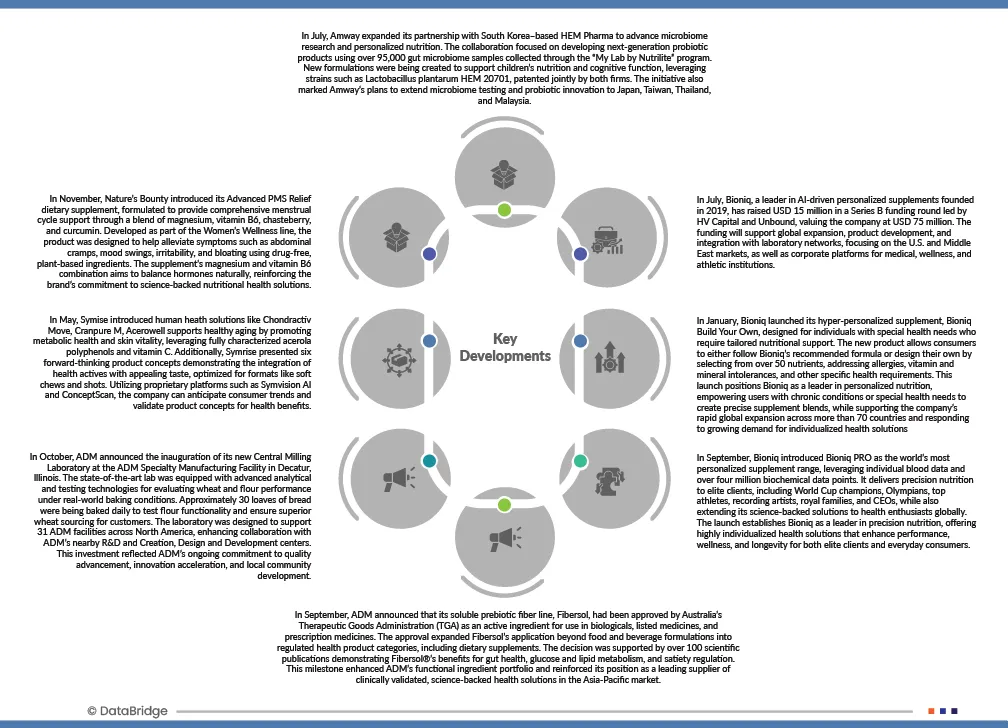

Market Developments

- In July 2025, Amway expanded its partnership with South Korea–based HEM Pharma to advance microbiome research and personalized nutrition. The collaboration focused on developing next-generation probiotic products using over 95,000 gut microbiome samples collected through the “My Lab by Nutrilite” program. New formulations were being created to support children’s nutrition and cognitive function, leveraging strains such as Lactobacillus plantarum HEM 20701, patented jointly by both firms. The initiative also marked Amway’s plans to extend microbiome testing and probiotic innovation to Japan, Taiwan, Thailand, and Malaysia.

- In November 2025, Nature’s Bounty introduced its Advanced PMS Relief dietary supplement, formulated to provide comprehensive menstrual cycle support through a blend of magnesium, vitamin B6, chasteberry, and curcumin. Developed as part of the Women’s Wellness line, the product was designed to help alleviate symptoms such as abdominal cramps, mood swings, irritability, and bloating using drug-free, plant-based ingredients. The supplement’s magnesium and vitamin B6 combination aims to balance hormones naturally, reinforcing the brand’s commitment to science-backed nutritional health solutions.

- In May 2025, Symise introduced human heath solutions like Chondractiv Move, Cranpure M, Acerowell supports healthy aging by promoting metabolic health and skin vitality, leveraging fully characterized acerola polyphenols and vitamin C. Additionally, Symrise presented six forward-thinking product concepts demonstrating the integration of health actives with appealing taste, optimized for formats like soft chews and shots. Utilizing proprietary platforms such as Symvision AI and ConceptScan, the company can anticipate consumer trends and validate product concepts for health benefits.

- In October 2025, ADM announced the inauguration of its new Central Milling Laboratory at the ADM Specialty Manufacturing Facility in Decatur, Illinois. The state-of-the-art lab was equipped with advanced analytical and testing technologies for evaluating wheat and flour performance under real-world baking conditions. Approximately 30 loaves of bread were being baked daily to test flour functionality and ensure superior wheat sourcing for customers. The laboratory was designed to support 31 ADM facilities across Middle East and Africa, enhancing collaboration with ADM’s nearby R&D and Creation, Design and Development centers. This investment reflected ADM’s ongoing commitment to quality advancement, innovation acceleration, and local community development.

- In September 2025, ADM announced that its soluble prebiotic fiber line, Fibersol, had been approved by Australia’s Therapeutic Goods Administration (TGA) as an active ingredient for use in biologicals, listed medicines, and prescription medicines. The approval expanded Fibersol’s application beyond food and beverage formulations into regulated health product categories, including dietary supplements. The decision was supported by over 100 scientific publications demonstrating Fibersol’s benefits for gut health, glucose and lipid metabolism, and satiety regulation. This milestone enhanced ADM’s functional ingredient portfolio and reinforced its position as a leading supplier of clinically validated, science-backed health solutions in the Asia-Pacific market.

- In September 2023, Bioniq introduced Bioniq PRO as the world’s most personalized supplement range, leveraging individual blood data and over four million biochemical data points. It delivers precision nutrition to elite clients, including World Cup champions, Olympians, top athletes, recording artists, royal families, and CEOs, while also extending its science-backed solutions to health enthusiasts globally. The launch establishes Bioniq as a leader in precision nutrition, offering highly individualized health solutions that enhance performance, wellness, and longevity for both elite clients and everyday consumers.

- In January 2025, Bioniq launched its hyper-personalized supplement, Bioniq Build Your Own, designed for individuals with special health needs who require tailored nutritional support. The new product allows consumers to either follow Bioniq’s recommended formula or design their own by selecting from over 50 nutrients, addressing allergies, vitamin and mineral intolerances, and other specific health requirements. This launch positions Bioniq as a leader in personalized nutrition, empowering users with chronic conditions or special health needs to create precise supplement blends, while supporting the company’s rapid global expansion across more than 70 countries and responding to growing demand for individualized health solutions.

- In July 2024, Bioniq, a leader in AI-driven personalized supplements founded in 2019, has raised USD 15 million in a Series B funding round led by HV Capital and Unbound, valuing the company at USD 75 million. The funding will support global expansion, product development, and integration with laboratory networks, focusing on the U.S. and Middle East markets, as well as corporate platforms for medical, wellness, and athletic institutions.

As per Data Bridge Market Research analysis:

For more detailed information about the Global Personalized Dietary Supplements Market report, click here – https://www.databridgemarketresearch.com/reports/global-personalized-dietary-supplements-market