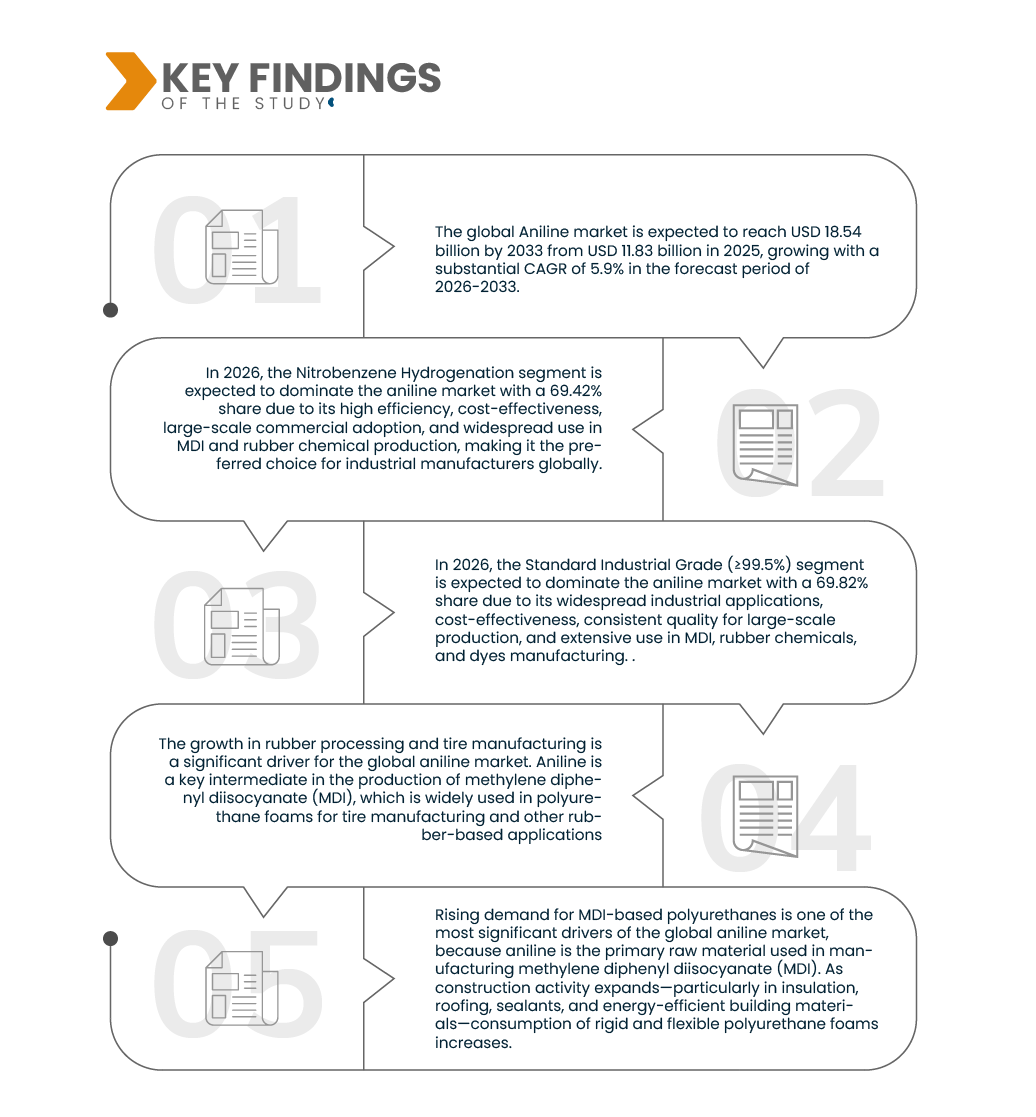

Rising demand for MDI-based polyurethanes is one of the most significant drivers of the global aniline market, because aniline is the primary raw material used in manufacturing methylene diphenyl diisocyanate (MDI). As construction activity expands—particularly in insulation, roofing, sealants, and energy-efficient building materials—consumption of rigid and flexible polyurethane foams increases. These foams rely heavily on MDI, so higher demand directly boosts aniline production requirements. Growth in infrastructure development across emerging economies, along with stricter energy-efficiency regulations, continues to amplify the need for polyurethane thermal insulation, further strengthening aniline demand..

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-aniline-market

Data Bridge market research analyzes The Global Aniline Market is expected to reach USD 18.54 billion by 2033 from USD 11.83 billion in 2025, growing with a substantial CAGR of 5.9% in the forecast period of 2026-2033.

Key Findings of the Study

Growth in Rubber Processing and Tire Manufacturing.

The growth in rubber processing and tire manufacturing is a significant driver for the global aniline market. Aniline is a key intermediate in the production of methylene diphenyl diisocyanate (MDI), which is widely used in polyurethane foams for tire manufacturing and other rubber-based applications. As the automotive and transportation industries expand, the demand for tires and high-performance rubber products has surged, directly boosting the consumption of aniline. Additionally, the adoption of advanced synthetic rubber materials, which require aniline-derived chemicals for improved elasticity, durability, and heat resistance, has further strengthened the link between tire production and aniline demand.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2023)

|

|

Quantitative Units

|

Revenue in USD Billions

|

|

Segments Covered

|

By Product Type (sheets & strips, cores & core types, ribbons & foils, powders & granules, assembled components, ingots, others), Material Type (electrical steels (fe-si), amorphous & nanocrystalline alloys, soft ferrites, powdered iron & metal powders, soft magnetic alloys, thin films & magnetic coatings, others), Manufacturing Process (Cold Rolling & Annealing, Melt Spinning, Powder Metallurgy, Others), Application (electromagnetic induction, electromagnetic energy conversion, magnetic shielding, electromagnetic sensing and detection, power conditioning and conversion, signal processing and noise suppression, energy storage and transfer, magnetic recording and data storage, magnetization & demagnetization systems, others), End User (automotive industry, electrical & power utilities, consumer electronics, it & telecommunications, industrial manufacturing, aerospace & defence, healthcare & medical, renewable energy, construction industry, others), Distribution Channel (direct sales, indirect sales)

|

|

Countries Covered

|

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Turkey, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Switzerland, Belgium, Rest of Europe, China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America. U.A.E., Saudi Arabia, South Africa, Egypt, Israel, and Rest of the Middle East and Africa

|

|

Market Players Covered

|

BASF (Germany), Covestro AG (Germany), Wanhua Chemical Group (China), China Risun Group Limited (China), Bondalti (Portugal), Sumitomo Chemical Co., Ltd. (Japan), Gujarat Narmada Valley Fertilizers & Chemicals Limited (India), Merck & Co., Inc. (United States), LANXESS (Germany), Panoli Intermediates India Pvt. Ltd. (India), Huntsman International LLC (United States), Tokyo Chemical Industry Co., Ltd. (Japan)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The global Aniline market is segmented into seven segments based on Production process, grade & purity, application, end-user and distribution channel.

- On the basis of production process, the aniline market is segmented into Nitrobenzene Hydrogenation, Integrated Nitration–Hydrogenation (Benzene-to-Aniline), Bio-Based Routes (Pilot/Emerging) and Other Emerging Pathways..

In 2026, the Nitrobenzene Hydrogenation segment is expected to dominate the market

In 2026, the Nitrobenzene Hydrogenation segment is expected to dominate the aniline market with a 69.42% share due to its high efficiency, cost-effectiveness, large-scale commercial adoption, and widespread use in MDI and rubber chemical production, making it the preferred choice for industrial manufacturers globally..

- On the basis of grade & purity, the aniline market is segmented into Standard Industrial Grade (≥99.5%), High Purity Grade (≥99.9%) and Salts and Formulations.

In 2026, the Standard Industrial Grade (≥99.5%)l segment is expected to dominate the market

In 2026, the Standard Industrial Grade (≥99.5%) segment is expected to dominate the aniline market with a 69.82% share due to its widespread industrial applications, cost-effectiveness, consistent quality for large-scale production, and extensive use in MDI, rubber chemicals, and dyes manufacturing. .

- On the basis of application, the aniline market is segmented into Methylene Diphenyl Diisocyanate (MDI) Production, Rubber Processing Chemicals, Dyes & Pigments, Agrochemicals, Pharmaceuticals, Others.

In 2026, the Methylene Diphenyl Diisocyanate (MDI) Production segment is expected to dominate the market

In 2026, the Methylene Diphenyl Diisocyanate (MDI) Production segment is expected to dominate the aniline market with a 55.68% share due to growing demand for polyurethane foams in furniture, construction, and automotive industries, large-scale industrial usage, and increasing adoption in insulation and packaging applications globally.

- On the basis of end user, the aniline market is segmented into automotive, furniture & appliances, textiles & leather, electrical & electronics, construction and others.

In 2026, the automotive profile segment is expected to dominate the market

In 2026, the automotive segment is expected to dominate the aniline market with a 39.14% share due to rising vehicle production, increasing use of polyurethane in seating and interior components, demand for lightweight materials, and growth in automotive electronics and components requiring aniline-derived chemicals..

- On the basis of distribution channel, the aniline market is segmented into direct and indirect..

In 2026, the Standard Malt segment is expected to dominate the market

In 2026, the Standard Malt segment is expected to dominate the market with a 72.38% share due to its widespread use in food and beverage applications, consistent quality, cost-effectiveness, and high demand in brewing, confectionery, and bakery industries globally..

Major Players

BASF (Germany), Covestro AG (Germany), Wanhua Chemical Group (China), China Risun Group Limited (China), Bondalti (Portugal), Sumitomo Chemical Co., Ltd. (Japan), Gujarat Narmada Valley Fertilizers & Chemicals Limited (India), Merck & Co., Inc. (United States), LANXESS (Germany), Panoli Intermediates India Pvt. Ltd. (India), Huntsman International LLC (United States), Tokyo Chemical Industry Co., Ltd. (Japan)

Market Developments

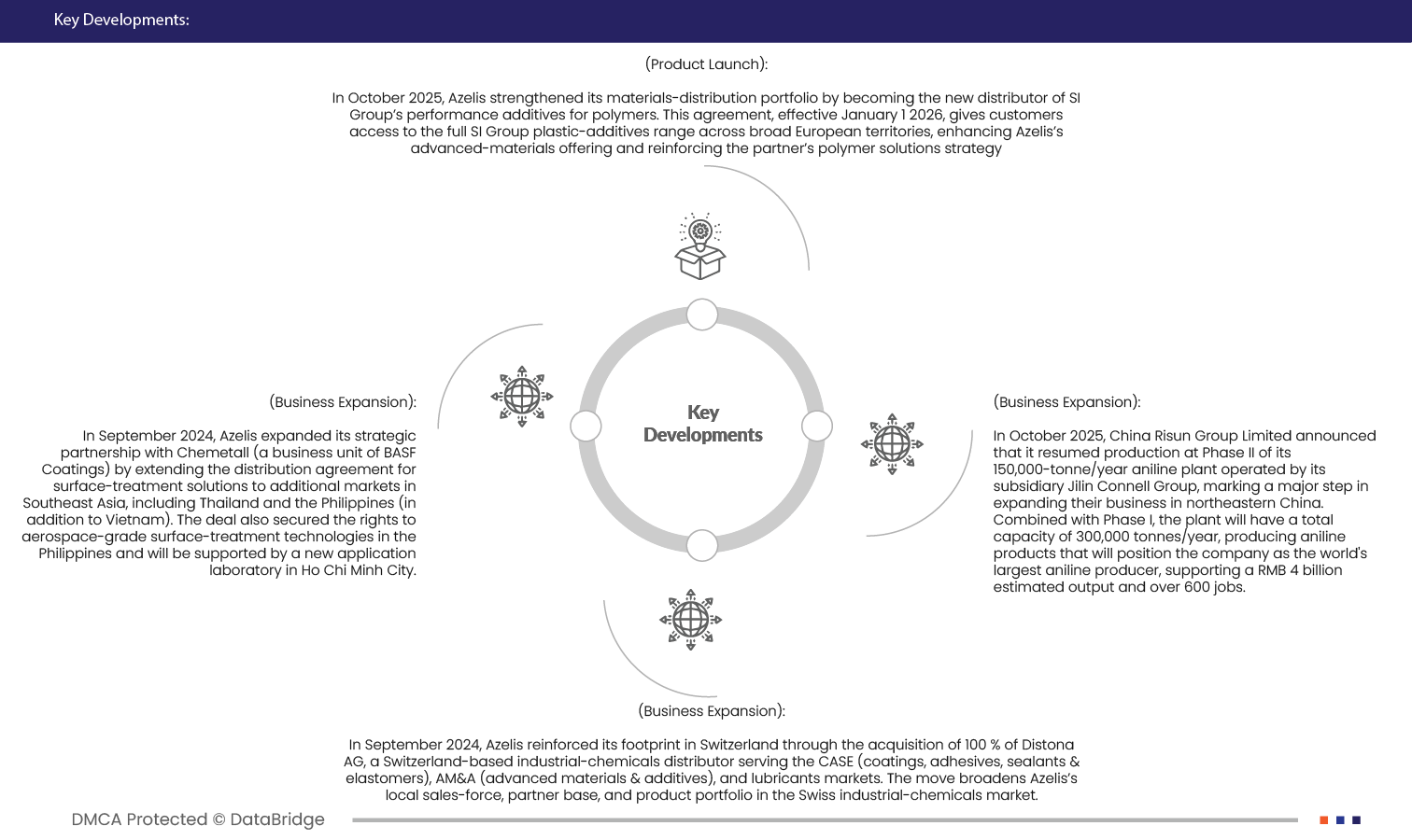

- In October, Azelis strengthened its materials-distribution portfolio by becoming the new distributor of SI Group’s performance additives for polymers. This agreement, effective January 1 2026, gives customers access to the full SI Group plastic-additives range across broad European territories, enhancing Azelis’s advanced-materials offering and reinforcing the partner’s polymer solutions strategy.

- In September, Azelis expanded its strategic partnership with Chemetall (a business unit of BASF Coatings) by extending the distribution agreement for surface-treatment solutions to additional markets in Southeast Asia, including Thailand and the Philippines (in addition to Vietnam). The deal also secured the rights to aerospace-grade surface-treatment technologies in the Philippines and will be supported by a new application laboratory in Ho Chi Minh City.

- In September, Azelis reinforced its footprint in Switzerland through the acquisition of 100 % of Distona AG, a Switzerland-based industrial-chemicals distributor serving the CASE (coatings, adhesives, sealants & elastomers), AM&A (advanced materials & additives), and lubricants markets. The move broadens Azelis’s local sales-force, partner base, and product portfolio in the Swiss industrial-chemicals market.

- In October, China Risun Group Limited announced that it resumed production at Phase II of its 150,000-tonne/year aniline plant operated by its subsidiary Jilin Connell Group, marking a major step in expanding their business in northeastern China. Combined with Phase I, the plant will have a total capacity of 300,000 tonnes/year, producing aniline products that will position the company as the world's largest aniline producer, supporting a RMB 4 billion estimated output and over 600 jobs.

As per Data Bridge Market Research analysis:

For more detailed information about the Global aniline market report, click here – https://www.databridgemarketresearch.com/reports/global-aniline-market