Sustainability and Environmental Consciousness is a primary driver for the corrugated box market in the Philippines. As global and local awareness around climate change and environmental degradation intensifies, there is a growing demand for packaging solutions that are renewable, recyclable, and biodegradable. Corrugated boxes, primarily made from kraft paper and recycled fiber, align well with these sustainability goals, making them increasingly attractive to environmentally conscious consumers and businesses alike.

This shift is further supported by rising regulatory pressures and corporate sustainability targets, especially in industries such as food & beverage, e-commerce, and consumer goods. Companies are proactively seeking to reduce their environmental footprint by replacing plastic and non-recyclable packaging materials with corrugated alternatives. Moreover, consumer preferences are also evolving, with greater demand for eco-friendly packaging influencing brand loyalty and purchasing decisions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/philippines-corrugated-boxes-market

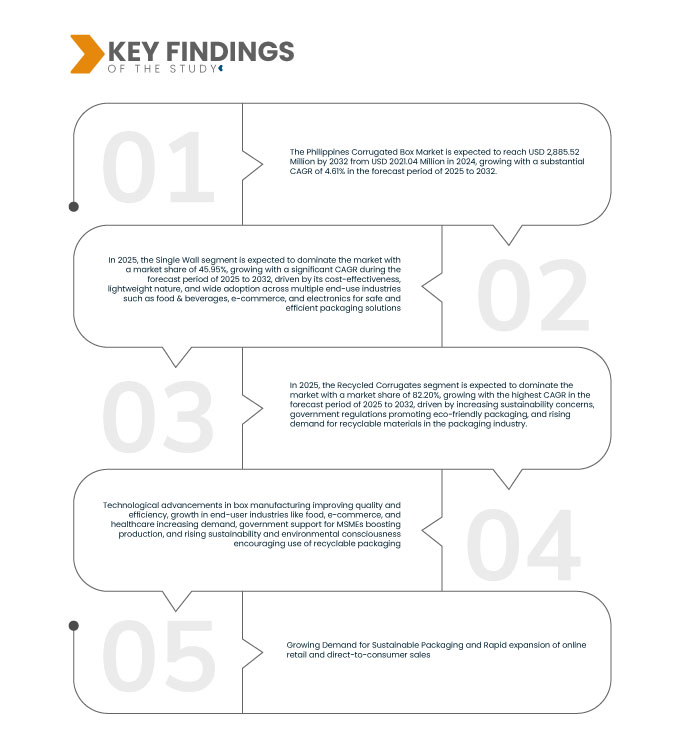

Data Bridge market research analyzes that The Philippines Corrugated Box Market is expected to reach 2,885.52 million USD by 2032 from 2,021.04 million USD in 2024, growing with a substantial CAGR of 4.6% in the forecast period of 2025 to 2032.

Key Findings of the Study

Increasing Adoption of Radiotherapy Devices and Procedures

The development of sustainable and recyclable corrugated box materials is a significant driver for the Philippines Corrugated Box Market. As environmental concerns become more central to both consumers and businesses, there is a growing push to replace traditional packaging materials with eco-friendly alternatives. Corrugated boxes made from recycled paper, biodegradable coatings, and water-based inks are gaining popularity for their ability to reduce environmental impact while maintaining packaging performance. This shift is strongly supported by government policies on waste reduction and growing demand from sectors such as e-commerce, agriculture, and consumer goods, all of which seek greener supply chains.

Ongoing research and innovation are accelerating the transition to more sustainable packaging solutions. Manufacturers are developing advanced corrugated materials that are not only fully recyclable but also stronger, lighter, and more resistant to moisture. These innovations help companies meet sustainability goals while optimizing logistics and reducing costs. As businesses align with circular economy practices and consumers increasingly favor eco-conscious brands, the emphasis on recyclable corrugated box materials is expected to play a key role in shaping the market’s future growth trajectory.

Report Scope and Philippines Corrugated Box Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD

|

|

Segments Covered

|

By Product (Single-Phase, Single Wall, Double Wall, and Triple Wall), By Material Type (Virgin Pulp, and Recycled Pulp), By Print (Non-Printed, and Printed), By Flute ((Type a Flute, Type b Flute, Type c Flute, Type e Flute and Type f Flute), By Style, (Slotted Boxes, Telescope Boxes, Rigid Boxes, Folders & Trays, and Others), By Function (Primary Packaging Boxes, Secondary Packaging Boxes, and Tertiary Packaging Boxes), By End-Use (Food and Beverages, Cosmetics, Healthcare & Pharmaceuticals, Personal Care, Shipping & Logistics, Electronics, Textiles, E-Commerce, and Others), By Shape (0201, 0711, 0300, 0406, 0210, 0211, 0212, 0217, 0300, 0306, and Others), By Quality Grade (Low Tier, Mid-Tier, and High-Tier), By Distribution Channel (Direct, and Retail)

|

|

Countries Covered

|

Philippines

|

|

Market Players Covered

|

Cahon Mfg. (Philippines), Liberty Corrugated Boxes Manufacturing Corporation (Philippines), Malinta Corrugated Boxes Mfg. Corp (Philippines), Prime Worldwide Paper Packaging Corporation (Philippines), PRIMEPACK TECHNOLOGIES, INC. (Philippines), BASIC BOX IND. CORP. (Philippines), Fineland Enterprises (Philippines), KPGroup Philippines (Philippines), GagMax Packaging Solutions Inc. (Philippines), Davao Fibreboard Packaging Inc. (Philippines), San Miguel Yamamura Packaging Corporation (Philippines), United Pulp and Paper Co., Inc. (Philippines), Goodyear Container Corp. (Philippines), Well-Pack Container Corporation (Philippines), Steniel Graham Packaging Philippines Corporation (Philippines).

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Philippines corrugated box market is segmented into ten notable segments based on product, material type, print, flute, style, function, end-use, shape, quality grade, and distribution channel.

- On the basis of Product, the market is segmented into Single Wall, Double Wall, Single-Phase, and Triple Wall.

In 2025, the Single Wall segment is expected to dominate the market with a market share of 45.95% growing with a CAGR of 5.04% in the forecast period of 2025 to 2032, driven by its cost-effectiveness, wide application in various industries, and easier manufacturing process.

- On the basis of Material Type, the market is segmented into Recycled Corrugates and Virgin Corrugates.

In 2025, the Recycled Corrugates segment is expected to dominate the market with a market share of 82.20% growing with a CAGR of 4.57% due to increasing environmental awareness, government regulations promoting recycling, and cost advantages.

- On the basis of Print, the market is segmented into Printed and Non-Printed.

In 2025, the Printed segment is expected to dominate the market with a market share of 61.40% growing with a CAGR of 4.41%, driven by the rising demand for customized and branded packaging, which enhances product visibility and marketing.

- On the basis of Flute, the market is segmented into Type C Flute, Type B Flute, Type A Flute, Type E Flute, and Type F Flute.

In 2025, the Type C Flute segment is expected to dominate the market with a market share of 40.45% growing with a CAGR of 3.7%, due to its superior cushioning properties, making it ideal for protecting fragile products during transportation.

- On the basis of Style, the market is segmented into Slotted Boxes, Telescope Boxes, Rigid Boxes, Folders & Trays, and Others.

In 2025, the Slotted Boxes segment is expected to dominate the market with a market share of 54.20% growing with a CAGR of 5.05%, driven by its simplicity, ease of assembly, and versatility for multiple applications.

- On the basis of Function, the market is segmented into Primary Packaging Boxes, Secondary Packaging Boxes, and Tertiary Packaging Boxes.

In 2025, the Primary Packaging Boxes segment is expected to dominate the market with a market share of 64.50% growing with a CAGR of 6.5%, driven by the increasing demand for direct product packaging to ensure product protection and safety.

- On the basis of End-Use, the market is segmented into Food and Beverages, Healthcare & Pharmaceuticals, Shipping & Logistics, E-Commerce, Electronics, Cosmetics, Personal Care, Textiles, and Others.

In 2025, the Food and Beverages segment is expected to dominate the market with a market share of 24.66% growing with a CAGR of 4.1%, driven by the growing demand for safe and sustainable packaging solutions in the food industry.

- On the basis of Shape, the market is segmented into 201, 300, 711, 306, 406, 210, 211, 212, 217, and Others.

In 2025, the 201 segment is expected to dominate the market with a market share of 21.22%growing with a CAGR of 4.6%, due to its widespread use in standard packaging applications and compatibility with various products.

- On the basis of Quality Grade, the market is segmented into Low-Tier, Mid-Tier, and High-Tier.

In 2025, the Mid-Tier segment is expected to dominate the market with a market share of 44.60%growing with a CAGR of 7.4%, driven by its balanced price-quality ratio meeting most customer requirements across industries.

- On the basis of Distribution Channel, the market is segmented into Retail and Direct.

In 2025, the Retail segment is expected to dominate the market with a market share of 57.20% growing with a CAGR of 6.7%, due to extensive reach, better customer accessibility, and the growing trend of small and medium enterprises purchasing via retail channels.

Major Players

Cahon Mfg. (Philippines), Liberty Corrugated Boxes Manufacturing Corporation (Philippines), Malinta Corrugated Boxes Mfg. Corp (Philippines), Prime Worldwide Paper Packaging Corporation (Philippines), PRIMEPACK TECHNOLOGIES, INC. (Philippines), BASIC BOX IND. CORP. (Philippines), Fineland Enterprises (Philippines), KPGroup Philippines (Philippines), GagMax Packaging Solutions Inc. (Philippines), Davao Fibreboard Packaging Inc. (Philippines), San Miguel Yamamura Packaging Corporation (Philippines), United Pulp and Paper Co., Inc. (Philippines), Goodyear Container Corp. (Philippines), Well-Pack Container Corporation (Philippines), Steniel Graham Packaging Philippines Corporation (Philippines).

Latest Developments in the Philippines Corrugated Box Market

- In July 2025, San Miguel Yamamura Packaging Corporation announced a capacity expansion project in its CALABARZON plant, adding a new high-speed corrugator line to meet increasing demand from e-commerce and FMCG clients. The upgrade is expected to reduce lead times and improve production flexibility for both printed and non-printed boxes

- In May 2025, United Pulp and Paper Co., Inc. introduced a new range of corrugated packaging made from 100% Recycled Corrugates, targeting export customers in the electronics and agricultural sectors seeking sustainable shipping solutions

- In December 2024, Goodyear Container Corp. partnered with a local digital printing firm to integrate on-demand printing capabilities for short-run, high-graphic corrugated packaging, catering to small online retailers and seasonal product launches

- In September 2024, Primepack Technologies, Inc. secured a long-term supply contract with a leading national supermarket chain for custom-branded corrugated produce trays, supporting the chain’s expansion of fresh produce distribution nationwide

- In August 2024, Liberty Corrugated Boxes Manufacturing Corporation opened a new distribution hub in Cebu to better serve Visayas and Mindanao markets, improving delivery efficiency and reducing freight costs for regional clients

As per Data Bridge Market Research analysis:

For more detailed information about the Philippines Corrugated Box Market report, click here – https://www.databridgemarketresearch.com/reports/philippines-corrugated-boxes-market