Europe Feed Yeast Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

461.83 Million

USD

658.16 Million

2024

2032

USD

461.83 Million

USD

658.16 Million

2024

2032

| 2025 –2032 | |

| USD 461.83 Million | |

| USD 658.16 Million | |

|

|

|

|

Segmentación del mercado europeo de levaduras para piensos por tipo ( levadura viva /probiótica, levadura agotada, derivados de levadura, levadura autolizada y otras), presentación (seca, líquida y granulada), tipo de ganado (aves de corral, cerdos, rumiantes, ganado vacuno, acuicultura, mascotas, equinos y otros): tendencias del sector y pronóstico hasta 2032.

Tamaño del mercado de levaduras forrajeras

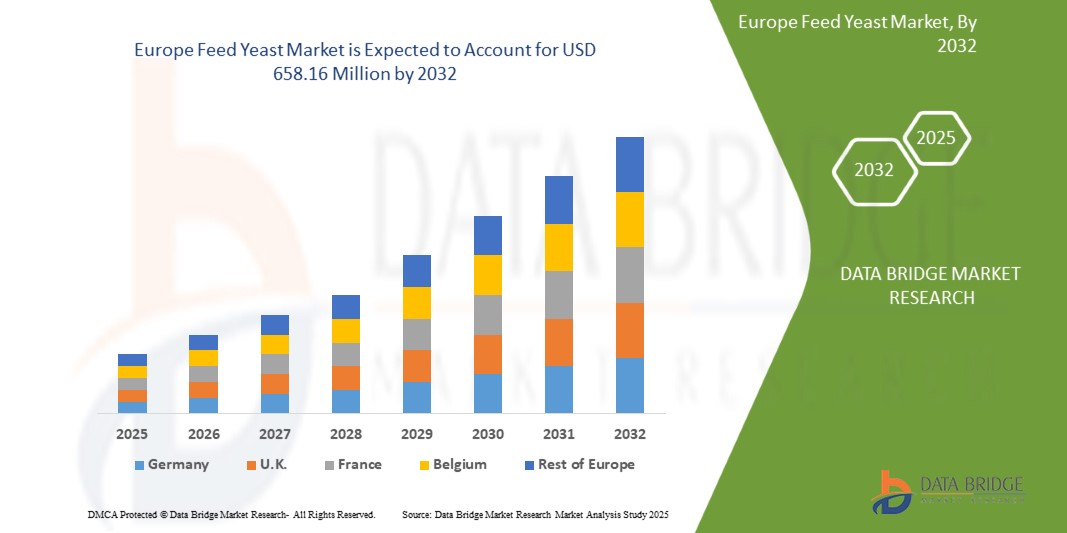

- El tamaño del mercado europeo de levadura alimentaria se valoró en USD 461,83 millones en 2024 y se espera que alcance los USD 658,16 millones para 2032 , con una CAGR del 4,75 % durante el período de pronóstico.

- Este crecimiento está impulsado por factores como el crecimiento del mercado de levaduras alimentarias, la inclinación hacia la incorporación de aditivos alimentarios naturales como soluciones sostenibles y la creciente importancia de la salud intestinal en el sector de la alimentación animal.

Análisis del mercado de levaduras para piensos

- En Europa, los productores ganaderos priorizan cada vez más el enriquecimiento de proteínas en los alimentos para animales para impulsar el crecimiento animal, el desarrollo muscular y la productividad general.

- La creciente demanda de una producción animal eficiente, en particular en cerdos, aves de corral y productos lácteos, está impulsando la necesidad de fuentes de proteínas digestibles y de alta calidad.

- La industria ganadera europea está siendo testigo de un fuerte cambio hacia la sostenibilidad y las prácticas de alimentación natural, impulsado por la creciente conciencia de los consumidores sobre los impactos ambientales y de salud de la producción de alimentos.

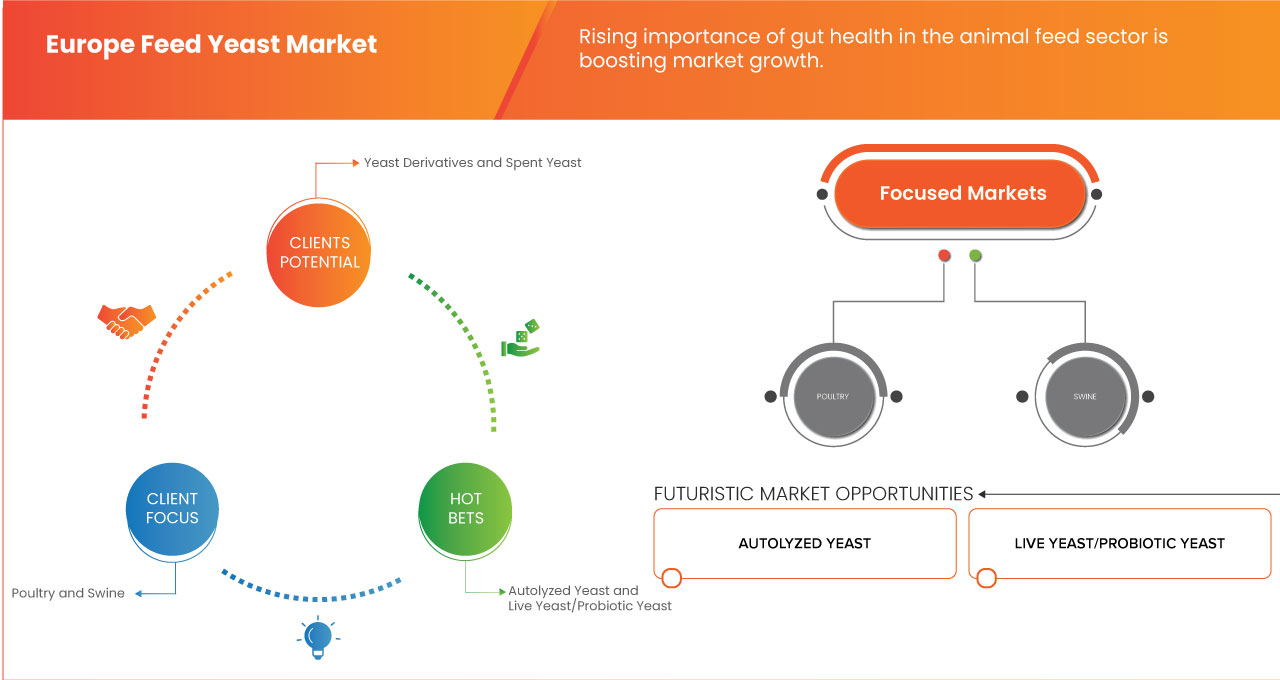

- Se espera que el segmento de levadura viva/levadura probiótica domine el mercado en el segmento de tipo debido a sus beneficios comprobados en la mejora de la salud intestinal, la absorción de nutrientes y la función inmunológica en el ganado, lo que mejora directamente la eficiencia alimentaria y el rendimiento animal.

- El cambio creciente hacia aditivos alimentarios naturales y sin antibióticos, junto con la mayor demanda de productos animales sostenibles y de alta calidad, respalda aún más la creciente adopción de levadura viva en la nutrición animal en todo el mercado europeo.

- Se prevé que el segmento seco domine el mercado de productos en forma de levadura debido a su mayor vida útil, facilidad de almacenamiento y rentabilidad en comparación con las formas líquidas y en gránulos. La levadura seca para piensos también ofrece mayor versatilidad en su manipulación, mezcla e incorporación al pienso, lo que la convierte en la opción preferida de los grandes fabricantes de piensos.

- Se espera que Alemania domine el mercado europeo de levadura alimentaria debido a los avances en el desarrollo de productos de levadura en el país.

Alcance del informe y segmentación del mercado de levaduras forrajeras

|

Atributos |

Perspectivas clave del mercado de la levadura alimentaria |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis en profundidad de expertos, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de levaduras para piensos

Aumento de la adopción de aditivos de levadura enriquecidos con proteínas para optimizar el crecimiento y la productividad animal.

- En Europa, los productores ganaderos priorizan cada vez más el enriquecimiento de proteínas en los alimentos para animales para impulsar el crecimiento animal, el desarrollo muscular y la productividad general.

- La proteína es esencial para el desarrollo del tejido corporal, el apoyo del sistema inmunológico y la función metabólica en los animales.

- La creciente demanda de una producción animal eficiente, en particular en cerdos, aves de corral y productos lácteos, está impulsando la necesidad de fuentes de proteínas digestibles y de alta calidad.

- La levadura alimentaria, incluida la levadura hidrolizada y los extractos de levadura, proporciona una fuente biodisponible de aminoácidos esenciales.

- Las proteínas a base de levadura son fácilmente digeribles, lo que mejora la absorción de nutrientes y promueve un aumento de peso más rápido en comparación con los insumos alimenticios tradicionales.

Por ejemplo,

- En un artículo publicado en WATT Global Media, se destacó que Leiber GmbH, un importante especialista alemán en levaduras, presentó "Leiber YeaFi Plus", un producto de levadura de nueva generación que combina complejos de levadura y fibra para mejorar el aporte proteico y la digestibilidad en el alimento para el ganado. Esta innovación refleja la tendencia del mercado hacia aditivos funcionales para piensos enriquecidos con proteínas.

- Las proteínas de levadura mejoran el perfil de aminoácidos de los alimentos compuestos, mejorando la eficiencia alimentaria general.

- El mayor enfoque en el enriquecimiento de proteínas está impulsando la demanda de levadura para piensos en Europa, gracias a su digestibilidad, contenido de aminoácidos e impacto en el crecimiento animal y la calidad de la producción.

Dinámica del mercado de levaduras forrajeras

Conductor

Cambio de tendencia hacia la incorporación de aditivos naturales en piensos como soluciones sostenibles

- La industria ganadera europea está siendo testigo de un fuerte cambio hacia la sostenibilidad y las prácticas de alimentación natural, impulsado por la creciente conciencia de los consumidores sobre los impactos ambientales y de salud de la producción de alimentos.

- Esta tendencia está impulsando la demanda de productos animales producidos naturalmente y libres de antibióticos, aumentando la adopción de aditivos alimentarios naturales como la levadura como alternativas a los productos químicos sintéticos y los antibióticos.

- La levadura alimentaria está ganando popularidad debido a su perfil ecológico y sus beneficios funcionales, que incluyen una mejor salud intestinal, una mejor absorción de nutrientes, una mayor inmunidad y una mayor eficiencia digestiva en los animales.

- Las regulaciones de la UE, como el Green Deal, están acelerando las prácticas sostenibles, y los aditivos a base de levadura respaldan los principios de la economía circular al utilizar subproductos de otras industrias para el cultivo de levadura, lo que reduce los desechos y la huella de carbono.

Por ejemplo ,

- Lallemand Animal Nutrition, empresa francesa, ha ampliado su línea de levaduras probióticas en toda Europa para promover la salud y la eficiencia alimentaria de los rumiantes. Su producto Levucell SC, basado en Saccharomyces cerevisiae, ha experimentado una creciente adopción gracias a su capacidad para mejorar la digestión de la fibra y reducir las emisiones de metano.

- La Comisión Europea publicó un artículo que destaca que el Pacto Verde Europeo y la Estrategia «De la Granja a la Mesa» están impulsando a los productores ganaderos a adoptar prácticas de alimentación sostenibles, incluido el uso de aditivos naturales como levaduras autolizadas y probióticas, para reducir el impacto ambiental de la agricultura y cumplir los objetivos de neutralidad de carbono.

- A medida que la sostenibilidad se vuelve central para la producción ganadera, el mercado europeo de levaduras forrajeras está destinado a crecer, ofreciendo una solución funcional, eficaz y ambientalmente responsable, alineada con las expectativas de los consumidores y las regulaciones.

Oportunidad

“Innovación en ingredientes funcionales para piensos”

- La industria ganadera europea se centra en mejorar la salud animal, la eficiencia alimentaria y la productividad, impulsando la demanda de ingredientes alimentarios funcionales como levadura enriquecida con compuestos bioactivos como nucleótidos, β-glucanos y mananos.

- Con regulaciones más estrictas sobre el uso de antibióticos, hay un cambio notable hacia aditivos naturales de origen biológico como la levadura alimentaria que promueven la salud intestinal, la inmunidad y la absorción de nutrientes sin contribuir a la resistencia a los antimicrobianos.

- Los productores están invirtiendo en productos innovadores a base de levadura que apuntan a funcionalidades específicas como la reducción del estrés, mejores índices de conversión alimenticia y resistencia a enfermedades, alineándose con las tendencias de la agricultura sustentable y los productos animales premium.

- La creciente demanda de los consumidores de productos sin antibióticos está impulsando a los fabricantes de alimentos a adoptar ingredientes avanzados derivados de levadura, mientras que las empresas están respondiendo con soluciones personalizadas para aves de corral, cerdos y rumiantes para aumentar su presencia en el mercado.

Por ejemplo,

- Crédit Agricole Centre France ha lanzado la Plataforma Abierta Biotecnológica para impulsar la tecnología de fermentación de precisión. Esta fermentación de precisión, una tecnología de vanguardia que utiliza microorganismos como la levadura para producir proteínas y enzimas específicas, está ganando terreno en Europa. Este avance permite el desarrollo de nuevos ingredientes funcionales para piensos, mejorando el perfil nutricional y la eficacia de los alimentos para animales.

- Un estudio reciente, publicado en noviembre de 2024, demostró la eficacia de los probióticos de levadura para mejorar la salud ruminal y la eficiencia alimentaria en vacas lecheras. Por ejemplo, la suplementación con probióticos de levadura produjo un aumento del 3,2 % en la digestibilidad de la materia seca y del 6,2 % en la digestibilidad de la fibra detergente neutra, lo que destaca el potencial de los ingredientes funcionales a base de levadura para mejorar el rendimiento animal.

- La innovación en alimentos funcionales a base de levadura se está convirtiendo en un motor clave del crecimiento en Europa, ofreciendo nuevas oportunidades de ingresos y aportando un mayor valor en toda la cadena de suministro de alimentos para el ganado mediante una mejor nutrición y sostenibilidad.

Restricción/Desafío

“Complejidad regulatoria y restricciones de estandarización”

- La Unión Europea aplica regulaciones estrictas sobre los ingredientes de los alimentos para garantizar la salud animal, la seguridad y la sostenibilidad ambiental, lo que crea una alta carga de cumplimiento para los fabricantes de alimentos.

- La aprobación de nuevos aditivos a base de levadura requiere el cumplimiento de múltiples regulaciones de la UE, como el Reglamento (CE) n.º 183/2005 (seguridad de los piensos) y el Reglamento (UE) n.º 68/2013 (comercialización de materias primas para piensos), lo que implica evaluaciones costosas y que requieren mucho tiempo de seguridad, eficacia y valor nutricional.

- La complejidad regulatoria se ve incrementada por la falta de estandarización entre los diferentes productos a base de levadura (como levadura viva, levadura hidrolizada y derivados de levadura), que pueden requerir aprobaciones separadas o enfrentar diferentes estándares regulatorios.

- Las inconsistencias en los marcos regulatorios nacionales en los estados miembros de la UE complican aún más el acceso al mercado, ya que algunos países imponen estándares más estrictos que otros, lo que dificulta la aprobación uniforme de productos en toda la región.

Por ejemplo,

- Según un artículo publicado por la Comisión Europea, los productos de levadura alimentaria deben cumplir con el Reglamento (CE) n.º 1831/2003 sobre aditivos para uso en nutrición animal, pero a veces los estados miembros individuales interpretan las cepas microbianas permitidas de manera diferente, lo que genera retrasos en la aprobación y requisitos de certificación adicionales.

- En 2023, las discrepancias regulatorias entre Alemania y Francia con respecto a los niveles aceptables de células de levadura vivas en aditivos alimentarios provocaron inconsistencias en los estándares de etiquetado de productos, lo que causó complicaciones para las empresas que intentaban comercializar un solo producto en ambos mercados.

- Estos desafíos pueden retrasar el lanzamiento de productos, aumentar los costos de cumplimiento y limitar la adopción oportuna de soluciones innovadoras de alimentación a base de levadura en el mercado europeo.

Alcance del mercado de levaduras para piensos

El mercado europeo de levadura alimentaria está segmentado en tres segmentos según el tipo, la forma y el tipo de ganado.

|

Segmentación |

Subsegmentación |

|

Por tipo |

|

|

Por formulario |

|

|

Por tipo de ganado |

|

En 2025, se proyecta que el segmento de levadura viva/levadura probiótica domine el mercado con la mayor participación en el segmento de tipo

En 2025, se prevé que el segmento de levaduras vivas/probióticas domine el mercado gracias a sus comprobados beneficios para mejorar la salud intestinal, la absorción de nutrientes y la función inmunitaria del ganado, lo que mejora directamente la eficiencia alimentaria y el rendimiento animal. La creciente tendencia hacia aditivos alimentarios naturales y sin antibióticos, junto con la mayor demanda de productos animales sostenibles y de alta calidad, impulsa la creciente adopción de levaduras vivas en la nutrición animal en el mercado europeo.

En 2025, se espera que el segmento seco represente la mayor participación durante el período de pronóstico en el segmento de forma

En 2025, se prevé que el segmento seco domine el mercado de productos en forma de levadura debido a su mayor vida útil, facilidad de almacenamiento y rentabilidad en comparación con las formas líquidas y granuladas. La levadura seca para piensos también ofrece mayor versatilidad en su manipulación, mezcla e incorporación al pienso, lo que la convierte en la opción preferida de los grandes fabricantes de piensos.

Análisis regional del mercado europeo de levaduras forrajeras

Alemania es el país dominante en el mercado europeo de levaduras para piensos.

- Alemania lidera el mercado europeo de levaduras para alimentación animal, impulsada por su sector ganadero bien establecido, su infraestructura avanzada de producción de alimentos y su fuerte enfoque en la nutrición animal sin antibióticos.

- El país se beneficia de la adopción temprana de soluciones de alimentación sostenible, con los principales fabricantes de alimentos integrando aditivos basados en levadura para mejorar la salud y la productividad animal.

- Las estrictas regulaciones en torno al uso de antibióticos y la alta demanda de productos cárnicos orgánicos y de primera calidad respaldan el uso generalizado de aditivos alimentarios funcionales como la levadura.

- El papel de Alemania como líder tecnológico en innovación de alimentos y prácticas de cría de animales consolida aún más su dominio en el mercado regional de levaduras para piensos.

“Se proyecta que España registre la mayor tasa de crecimiento”

- Se espera que España sea testigo del crecimiento más rápido en el mercado europeo de levaduras para piensos, impulsado por la expansión de las industrias porcina y avícola y el aumento de las inversiones en soluciones de piensos naturales.

- La creciente producción de carne orientada a la exportación del país está impulsando la demanda de aditivos alimentarios de alta eficiencia que cumplan con los estándares internacionales de calidad.

- Las iniciativas gubernamentales de apoyo que promueven prácticas ganaderas sostenibles están acelerando el cambio hacia ingredientes alimentarios naturales como la levadura.

- La creciente conciencia entre los productores y consumidores españoles sobre los beneficios de los productos animales libres de antibióticos está impulsando aún más la adopción de soluciones de alimentación basadas en levadura.

Cuota de mercado de la levadura alimentaria

El panorama competitivo del mercado ofrece detalles por competidor. Se incluye información general de la empresa, sus estados financieros, ingresos generados, potencial de mercado, inversión en investigación y desarrollo, nuevas iniciativas de mercado, presencia regional, plantas de producción, capacidad de producción, fortalezas y debilidades de la empresa, lanzamiento de productos, alcance y variedad de productos, y dominio de las aplicaciones. Los datos anteriores se refieren únicamente al enfoque de mercado de las empresas.

Los principales líderes del mercado que operan en el mercado son:

- Nutreco (Países Bajos)

- Phileo (Parte de Lesaffre) (Francia)

- DSM-Firmenich (Suiza)

- Alltech (EE. UU.)

- ADM (EE. UU.)

- Lallemand Inc (Canadá)

- Associated British Foods plc (Reino Unido)

- Biorigin (Brasil)

- Leiber (Alemania)

- CPI (Brasil)

- Diamond V (Cargill, Incorporated) (EE. UU.)

- Baffeed (Turquía)

- Arm & Hammer Animal Nutrition (Church & Dwight Co.) (EE. UU.)

- Aleris (Brasil)

Últimos avances en el mercado europeo de levaduras para piensos

- En febrero de 2025, Nutreco recibió una subvención de OPZuid para colaborar con los productores lecheros neerlandeses en la reducción de las emisiones de nitrógeno. Esta financiación permite el desarrollo de soluciones en las explotaciones ganaderas adaptadas al exigente sector lácteo neerlandés, preparándonos para los futuros desafíos globales. El proyecto se centra en estrategias innovadoras de alimentación, tecnologías de agricultura de precisión y herramientas basadas en datos para reducir el impacto ambiental sin comprometer la productividad. Mediante la estrecha colaboración con los productores, Nutreco busca cocrear soluciones escalables y con base científica que sirvan de modelo para una producción lechera sostenible en todo el mundo.

- En octubre de 2024, Lesaffre completó con éxito la adquisición del negocio de extractos de levadura de dsm-firmenich, consolidando su posición en el mercado de ingredientes salados. Con esta adquisición, la unidad de negocio de Lesaffre, Biospringer, se hace con las tecnologías de procesamiento de derivados de levadura de dsm-firmenich, 46 empleados especializados en extractos de levadura y una gama de productos innovadores. Esta estrategia refuerza la capacidad de Biospringer para atender a sus clientes en aplicaciones saladas y basadas en la fermentación. La experiencia de Lesaffre en biofabricación, tendencias de consumo y mercados locales impulsará el crecimiento continuo y el éxito de los nuevos clientes. El proceso de integración está en marcha, garantizando una transición fluida para empleados, clientes y socios, manteniendo al mismo tiempo la calidad del producto.

- En abril de 2024, DSM-Firmenich completó la venta de su negocio de extractos de levadura, incluyendo su planta de producción en Delft, Países Bajos, a Lesaffre. Esta desinversión estratégica refuerza el enfoque de DSM-Firmenich en sus segmentos principales —salud, nutrición y belleza— mediante la optimización de su cartera. Para Lesaffre, empresa global en fermentación, la adquisición refuerza su posición en soluciones de ingredientes naturales y amplía sus capacidades en los sectores de alimentación y bebidas.

- En septiembre de 2023, Alltech presenta Microbuild, una nueva fibra prebiótica para la salud intestinal de las mascotas. Microbuild se basa en la ciencia de vanguardia de la nutrigenómica, que estudia la relación única entre la genética y la nutrición. Su cepa de levadura específica, Saccharomyces cerevisiae, ha sido seleccionada específicamente por los científicos de Alltech para lograr la máxima eficacia en la promoción de la salud intestinal.

- En octubre de 2023, Aleris Nutrition amplió su capacidad de producción en un 60 % con la puesta en marcha de dos nuevas unidades de producción, consolidando su posición como proveedor líder de aditivos a base de levadura para la nutrición animal multiespecie. Esta expansión busca garantizar un suministro constante, satisfacer la creciente demanda nacional e internacional y reducir los riesgos relacionados con la estacionalidad de los cultivos, reforzando así el compromiso de Aleris con la calidad y la innovación en salud y nutrición animal.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE FEED YEAST MARKET

4.1.1 IMPACT OF PRICE

4.1.2 IMPACT ON SUPPLY CHAIN

4.1.3 IMPACT ON SHIPMENT

4.1.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.1.5 CONCLUSION

4.2 CONSUMER-LEVEL TRENDS

4.2.1 REFERENCE FOR NATURAL AND ORGANIC FEED ADDITIVES

4.2.2 DEMAND FOR FUNCTIONAL BENEFITS IN FEED

4.2.3 TRANSPARENCY AND LABEL LITERACY

4.2.4 INFLUENCE OF ANIMAL WELFARE ON PURCHASE DECISIONS

4.2.5 TECHNOLOGICAL INTEGRATION IN PRODUCT SELECTION

4.2.6 CONCLUSION

4.3 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.3.1 KEY FACTORS INFLUENCING FEED YEAST PRICES

4.3.1.1 RAW MATERIAL COSTS:

4.3.1.2 LIVESTOCK INDUSTRY DEMAND:

4.3.1.3 ENERGY AND MANUFACTURING COSTS:

4.3.1.4 TRADE AND IMPORT DYNAMICS:

4.3.1.5 REGULATORY AND SUSTAINABILITY PRESSURES:

4.3.2 CONCLUSION

4.4 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.5 BRAND OUTLOOK

4.5.1 PRODUCT VS BRAND OVERVIEW

4.5.2 PRODUCT OVERVIEW

4.5.3 BRAND OVERVIEW

4.5.4 CONCLUSION

4.6 FACTORS INFLUENCING PURCHASING DECISIONS

4.6.1 RECOMMENDATION FROM FAMILY & FRIENDS

4.6.2 RESEARCH

4.6.3 IMPULSIVE PURCHASES

4.6.4 ADVERTISEMENT

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVES IN EUROPE FEED YEAST MARKET

4.7.1 RISING DEMAND FOR FUNCTIONAL FEED INGREDIENTS

4.7.2 INCREASING ADOPTION OF SUSTAINABLE FEED SOLUTIONS

4.7.3 TECHNOLOGICAL ADVANCEMENTS IN FERMENTATION AND PROCESSING

4.7.4 GROWTH OF ORGANIC AND NON-GMO FEED SEGMENTS

4.7.5 EXPANSION OF AQUACULTURE AND PET FOOD SECTORS

4.7.6 FUTURE PERSPECTIVES

4.8 CONSUMER-LEVEL TRENDS

4.8.1 REFERENCE FOR NATURAL AND ORGANIC FEED ADDITIVES

4.8.2 DEMAND FOR FUNCTIONAL BENEFITS IN FEED

4.8.3 TRANSPARENCY AND LABEL LITERACY

4.8.4 INFLUENCE OF ANIMAL WELFARE ON PURCHASE DECISIONS

4.8.5 TECHNOLOGICAL INTEGRATION IN PRODUCT SELECTION

4.8.6 CONCLUSION

4.9 NEW PRODUCT LAUNCH STRATEGY

4.9.1 OVERVIEW

4.9.2 INNOVATION THROUGH ADVANCED RESEARCH AND DEVELOPMENT

4.9.3 STRATEGIC ACQUISITIONS TO EXPAND PRODUCT OFFERINGS

4.9.4 EMPHASIS ON SUSTAINABILITY AND ENVIRONMENTAL IMPACT

4.9.5 DIVERSIFICATION INTO COMPANION ANIMAL NUTRITION

4.9.6 INNOVATIVE YEAST-BASED SOLUTIONS FOR HEALTH AND SUSTAINABILITY

4.9.7 EXPANSION INTO THE U.S. MARKET WITH SUSTAINABLE PRACTICES

4.9.8 SIGNIFICANT EXPANSION TO MEET GROWING DEMAND

4.1 PRIVATE LABEL VS. BRAND ANALYSIS

4.10.1 MARKET PRESENCE AND BRAND POSITIONING

4.10.2 INNOVATION AND PRODUCT DEVELOPMENT

4.10.3 PRICING AND MARGIN STRATEGY

4.10.4 DISTRIBUTION AND MARKET PENETRATION

4.10.5 CONSUMER PERCEPTION AND LOYALTY

4.10.6 REGULATORY AND QUALITY ASSURANCE

4.10.7 CONCLUSION

4.11 PROMOTIONAL ACTIVITIES

4.11.1 PARTICIPATION IN AGRICULTURAL TRADE FAIRS AND LIVESTOCK EXPOS

4.11.2 TECHNICAL SEMINARS AND ON-FARM DEMONSTRATIONS

4.11.3 DISTRIBUTION OF FREE SAMPLES AND TRIAL PACKS

4.11.4 DIGITAL MARKETING CAMPAIGNS

4.11.5 PRODUCT BRANDING AND PACKAGING INNOVATIONS

4.11.6 COLLABORATIONS WITH VETERINARY PROFESSIONALS

4.11.7 LOYALTY AND REFERRAL PROGRAMS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 FOCUS ON PRODUCT QUALITY AND EFFICACY

4.12.2 SUSTAINABILITY AND ECO-FRIENDLY PREFERENCES

4.12.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATION

4.12.4 PRICE SENSITIVITY AND BULK BUYING PREFERENCES

4.12.5 REGULATORY INFLUENCE AND COMPLIANCE

4.12.6 CONSUMER ENGAGEMENT AND DECISION-MAKING PROCESS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 RAW MATERIAL SOURCING

4.13.3 MANUFACTURING & PROCESSING

4.13.4 LOGISTICS & DISTRIBUTION

4.13.5 END-USE & MARKET DEMAND

4.13.6 CHALLENGES & FUTURE OUTLOOK

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING IMPORTANCE OF PROTEIN ENRICHMENT IN THE ANIMAL FEED SEGMENT

6.1.2 SHIFTING INCLINATION TOWARDS INCORPORATION OF NATURAL FEED ADDITIVES AS SUSTAINABLE SOLUTIONS

6.1.3 RISING IMPORTANCE OF GUT HEALTH IN THE ANIMAL FEED SECTOR

6.2 RESTRAINTS

6.2.1 HIGH PRICE ASSOCIATED WITH PREMIUM YEAST PRODUCTS

6.2.2 REGULATORY COMPLEXITY AND STANDARDIZATION CONSTRAINTS

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN FUNCTIONAL FEED INGREDIENTS

6.3.2 ADVANCEMENTS IN YEAST PRODUCT DEVELOPMENT

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FEED ADDITIVES

6.4.2 VOLATILITY IN RAW MATERIAL PRICING AND SUPPLY CHAIN DYNAMICS

7 EUROPE FEED YEAST MARKET, BY TYPE

7.1 OVERVIEW

7.2 LIVE YEAST/PROBIOTIC YEAST

7.3 SPENT YEAST

7.4 YEAST DERIVATIVES

7.5 AUTOLYZED YEAST

7.6 OTHERS

8 EUROPE FEED YEAST MARKET, BY FORM

8.1 OVERVIEW

8.2 DRY

8.3 LIQUID

8.4 PELLET

9 EUROPE FEED YEAST MARKET, BY LIVESTOCK TYPE

9.1 OVERVIEW

9.2 POULTRY

9.3 SWINE

9.4 RUMINANTS

9.5 CATTLE

9.6 AQUACULTURE

9.7 PETS

9.8 EQUINE

9.9 OTHERS

10 EUROPE FEED YEAST MARKET BY COUNTRIES

10.1 EUROPE

10.1.1 GERMANY

10.1.2 SPAIN

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 NETHERLANDS

10.1.6 U.K.

10.1.7 ROMANIA

10.1.8 POLAND

10.1.9 TURKEY

10.1.10 RUSSIA

10.1.11 GREECE

10.1.12 IRELAND

10.1.13 BELGIUM

10.1.14 SWEDEN

10.1.15 DENMARK

10.1.16 SWITZERLAND

10.1.17 CZECH REPUBLIC

10.1.18 FINLAND

10.1.19 AUSTRIA

10.1.20 PORTUGAL

10.1.21 BULGARIA

10.1.22 SERBIA

10.1.23 HUNGARY

10.1.24 CROATIA

10.1.25 CYPRUS

10.1.26 ESTONIA

10.1.27 LITHUANIA

10.1.28 LATVIA

10.1.29 SLOVAKIA

10.1.30 SLOVENIA

10.1.31 NORWAY

10.1.32 LUXEMBOURG

10.1.33 MALTA

10.1.34 REST OF EUROPE

11 EUROPE FEED YEAST MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 NUTRECO

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 PHILEO (PART OF LESAFFRE)

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 DSM-FIRMENICH

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT/NEWS

13.4 ALLTECH

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 ADM

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ALERIS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARM & HAMMER ANIMAL NUTRITION (CHURCH & DWIGHT CO., INC)

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 ASSOCIATED BRITISH FOODS PLC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAFFEED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 BIORIGIN

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 DIAMOND V (CARGILL INCORPORATED)

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 ICC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 LALLEMAND INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 LEIBER

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT/NEWS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tablas

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS OF EUROPE FEED YEAST MARKET

TABLE 3 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 4 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 7 EUROPE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE FEED YEASTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE FEED YEASTS MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FEED YEAST MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE FEED YEAST MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 27 GERMANY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 GERMANY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 GERMANY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GERMANY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GERMANY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 GERMANY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 33 GERMANY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 GERMANY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 GERMANY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 GERMANY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 GERMANY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 SPAIN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 SPAIN FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 SPAIN LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 SPAIN YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SPAIN SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 SPAIN FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 53 SPAIN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SPAIN POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SPAIN POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SPAIN SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SPAIN RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SPAIN RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SPAIN CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SPAIN AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SPAIN FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SPAIN AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SPAIN PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SPAIN PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SPAIN EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SPAIN OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 69 FRANCE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 FRANCE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 FRANCE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 FRANCE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 FRANCE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 89 ITALY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ITALY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ITALY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 ITALY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 ITALY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 ITALY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 ITALY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 ITALY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 ITALY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 ITALY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 ITALY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 ITALY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 ITALY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 ITALY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 ITALY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 ITALY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 ITALY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 ITALY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NETHERLANDS FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 109 NETHERLANDS LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NETHERLANDS FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 NETHERLANDS EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 NETHERLANDS OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.K. FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.K. FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 129 U.K. LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.K. FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.K. POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 ROMANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ROMANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 149 ROMANIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 ROMANIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 ROMANIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ROMANIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 153 ROMANIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ROMANIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ROMANIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 ROMANIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ROMANIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ROMANIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ROMANIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ROMANIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 ROMANIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 ROMANIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 ROMANIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ROMANIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ROMANIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ROMANIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 POLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 POLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 169 POLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 POLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 POLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 POLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 173 POLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 POLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 POLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 POLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 POLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 POLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 POLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 POLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 POLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 POLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 POLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 POLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 POLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 POLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 TURKEY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 TURKEY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 TURKEY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 TURKEY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 TURKEY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 TURKEY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 TURKEY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 TURKEY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 TURKEY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 TURKEY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 TURKEY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 TURKEY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 TURKEY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 TURKEY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 TURKEY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 TURKEY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 TURKEY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 TURKEY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 TURKEY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 TURKEY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 RUSSIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 RUSSIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 209 RUSSIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 RUSSIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 RUSSIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 RUSSIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 213 RUSSIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RUSSIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RUSSIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RUSSIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 GREECE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 GREECE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 229 GREECE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 GREECE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 GREECE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 GREECE FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 233 GREECE FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 GREECE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 GREECE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 GREECE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 GREECE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 GREECE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 GREECE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 GREECE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 GREECE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 GREECE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 GREECE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 GREECE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 GREECE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 GREECE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 IRELAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 IRELAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 249 IRELAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 IRELAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 IRELAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 IRELAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 253 IRELAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 IRELAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 IRELAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 IRELAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 IRELAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 IRELAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 IRELAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 IRELAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 IRELAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 IRELAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 IRELAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 IRELAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 IRELAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 IRELAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 BELGIUM FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 BELGIUM FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 269 BELGIUM LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 BELGIUM YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 BELGIUM SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 BELGIUM FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 273 BELGIUM FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 BELGIUM POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 BELGIUM POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 BELGIUM SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 BELGIUM RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 BELGIUM RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 BELGIUM CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 BELGIUM AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 BELGIUM FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 BELGIUM AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 BELGIUM PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 BELGIUM PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 BELGIUM EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 BELGIUM OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SWEDEN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SWEDEN FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 289 SWEDEN LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SWEDEN YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SWEDEN SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SWEDEN FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 293 SWEDEN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWEDEN POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWEDEN POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWEDEN SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWEDEN RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWEDEN RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWEDEN CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWEDEN AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWEDEN FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWEDEN AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SWEDEN PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWEDEN PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWEDEN EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWEDEN OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 DENMARK FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 DENMARK FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 309 DENMARK LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 DENMARK YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 DENMARK SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 DENMARK FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 313 DENMARK FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 DENMARK POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 DENMARK POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 DENMARK SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 DENMARK RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 DENMARK RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 DENMARK CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 DENMARK AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 DENMARK FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 DENMARK AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 DENMARK PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 DENMARK PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 DENMARK EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 DENMARK OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SWITZERLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SWITZERLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 329 SWITZERLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 SWITZERLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 SWITZERLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SWITZERLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 333 SWITZERLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 SWITZERLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 SWITZERLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 SWITZERLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 SWITZERLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 SWITZERLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 SWITZERLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 SWITZERLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SWITZERLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 SWITZERLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 SWITZERLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SWITZERLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SWITZERLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SWITZERLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 CZECH REPUBLIC FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 CZECH REPUBLIC FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 349 CZECH REPUBLIC LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 CZECH REPUBLIC YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 CZECH REPUBLIC SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 CZECH REPUBLIC FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 353 CZECH REPUBLIC FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 CZECH REPUBLIC POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 CZECH REPUBLIC POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 CZECH REPUBLIC SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 CZECH REPUBLIC RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 CZECH REPUBLIC RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 CZECH REPUBLIC CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 CZECH REPUBLIC AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 CZECH REPUBLIC FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 CZECH REPUBLIC AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 CZECH REPUBLIC PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 CZECH REPUBLIC PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 CZECH REPUBLIC EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 CZECH REPUBLIC OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 FINLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 FINLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 369 FINLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 FINLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 FINLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 FINLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 373 FINLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 FINLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 FINLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 FINLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 FINLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 FINLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 FINLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 FINLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 FINLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 FINLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 FINLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 FINLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 FINLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 FINLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 AUSTRIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 AUSTRIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 389 AUSTRIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 AUSTRIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 AUSTRIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 AUSTRIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 393 AUSTRIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 AUSTRIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 AUSTRIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 AUSTRIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 AUSTRIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 AUSTRIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 AUSTRIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 AUSTRIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 AUSTRIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 AUSTRIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 AUSTRIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 AUSTRIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 AUSTRIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 AUSTRIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 PORTUGAL FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 PORTUGAL FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 409 PORTUGAL LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 PORTUGAL YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 PORTUGAL SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 PORTUGAL FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 413 PORTUGAL FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 PORTUGAL POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 PORTUGAL POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 PORTUGAL SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 PORTUGAL RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 PORTUGAL RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 PORTUGAL CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 PORTUGAL AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 PORTUGAL FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 PORTUGAL AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 PORTUGAL PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 PORTUGAL PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 PORTUGAL EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 PORTUGAL OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 BULGARIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 BULGARIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 429 BULGARIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 BULGARIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 431 BULGARIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 432 BULGARIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 433 BULGARIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 BULGARIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 BULGARIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 BULGARIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 BULGARIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 438 BULGARIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 BULGARIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 BULGARIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 BULGARIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 BULGARIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 BULGARIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 BULGARIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 BULGARIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 BULGARIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 SERBIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 SERBIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 449 SERBIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 450 SERBIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 451 SERBIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 452 SERBIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 453 SERBIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 454 SERBIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 455 SERBIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 456 SERBIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 457 SERBIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 SERBIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 SERBIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 SERBIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 SERBIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 462 SERBIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 SERBIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 SERBIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 465 SERBIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 466 SERBIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 467 HUNGARY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 468 HUNGARY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 469 HUNGARY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 HUNGARY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 HUNGARY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 HUNGARY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 473 HUNGARY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 474 HUNGARY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 475 HUNGARY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 476 HUNGARY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 477 HUNGARY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 478 HUNGARY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 479 HUNGARY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 480 HUNGARY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 481 HUNGARY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 482 HUNGARY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 483 HUNGARY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 484 HUNGARY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 485 HUNGARY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 486 HUNGARY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 CROATIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 CROATIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 489 CROATIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 490 CROATIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 491 CROATIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 CROATIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 493 CROATIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 CROATIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 CROATIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 496 CROATIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 CROATIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 CROATIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 CROATIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 CROATIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 501 CROATIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 502 CROATIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 503 CROATIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 504 CROATIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 505 CROATIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 506 CROATIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 507 CYPRUS FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 508 CYPRUS FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 509 CYPRUS LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 510 CYPRUS YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 511 CYPRUS SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 512 CYPRUS FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 513 CYPRUS FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 514 CYPRUS POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 515 CYPRUS POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 516 CYPRUS SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 517 CYPRUS RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 518 CYPRUS RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 519 CYPRUS CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 520 CYPRUS AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 521 CYPRUS FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 522 CYPRUS AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 523 CYPRUS PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 524 CYPRUS PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 525 CYPRUS EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 526 CYPRUS OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 527 ESTONIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 528 ESTONIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 529 ESTONIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 530 ESTONIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 531 ESTONIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 532 ESTONIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 533 ESTONIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 534 ESTONIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 535 ESTONIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 536 ESTONIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 537 ESTONIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 538 ESTONIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 539 ESTONIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 540 ESTONIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 541 ESTONIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 542 ESTONIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 543 ESTONIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 544 ESTONIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 545 ESTONIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 546 ESTONIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 547 LITHUANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 548 LITHUANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 549 LITHUANIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 550 LITHUANIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 551 LITHUANIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 552 LITHUANIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 553 LITHUANIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)