Europe Premium Chocolate Market, By Type (Milk Chocolate, Dark Chocolate and White Chocolate), Product Type (Regular/Plain Chocolate and Filled Chocolate), Inclusion (With Inclusions Chocolates and Regular/No Inclusions Chocolates), Nature (Conventional, And Organic), Category (Standard Premium, and Super Premium), Cocoa Content (50-60%, 71-80%, 61-70%, 81-90%, and 91-100%), Flavor (Flavor, Classic/Regular), Packaging (Plastic Wrap, Gift Boxes/Assorted, Pouches, Board Box, Sachets, and Others), Distribution Channel (Store Based Retailers And Non-Store Retailers) - Industry Trends and Forecast to 2030.

Europe Premium Chocolate Market Analysis and Size

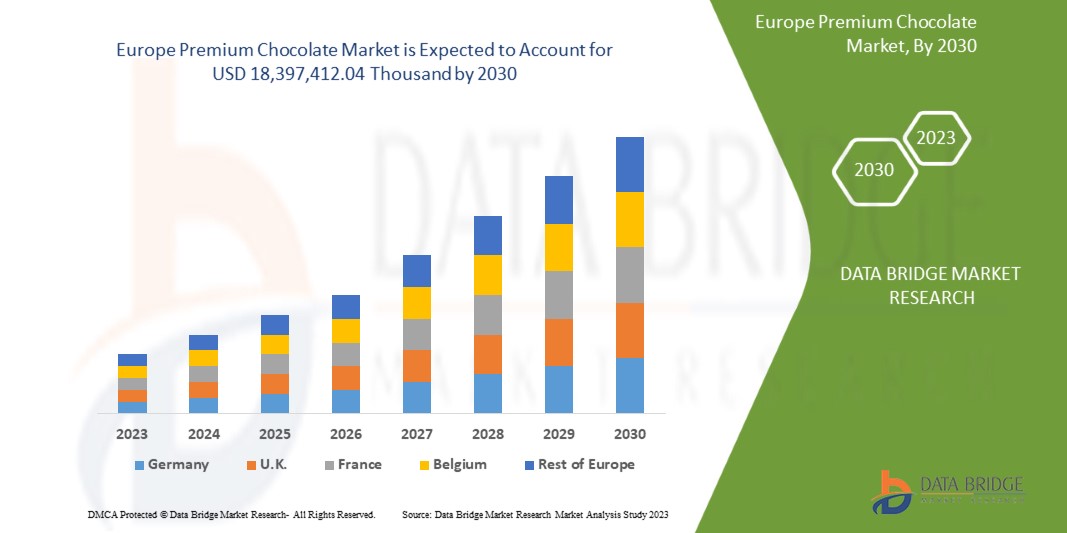

The Europe premium chocolate market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.4% in the forecast period of 2023 to 2040 and is expected to reach USD 18,397,412.04 thousand by 2030. The major factor driving the growth of the Europe premium chocolate market is the rise in demand for highly luxurious chocolates.

Premium chocolates are known to have more cocoa content compared to regular ones. It comes in varieties like infused with nuts, fruits, and sometimes alcohol. The presence of all these ingredients gives the premium chocolates a better and more luxurious feel. Customers can get a smoother and richer taste.

The Europe premium chocolate market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in Thousand and Pricing in USD |

|

Segments Covered |

Type (Milk Chocolate, Dark Chocolate and White Chocolate), Product Type (Regular/Plain Chocolate and Filled Chocolate), Inclusion (With Inclusions Chocolates and Regular/No Inclusions Chocolates), Nature (Conventional, And Organic), Category (Standard Premium, and Super Premium), Cocoa Content (50-60%, 71-80%, 61-70%, 81-90%, and 91-100%), Flavor (Flavor, Classic/Regular), Packaging (Plastic Wrap, Gift Boxes/Assorted, Pouches, Board Box, Sachets, and Others), Distribution Channel (Store Based Retailers And Non-Store Retailers) |

|

Countries Covered |

Germany, the U.K., France, Italy, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, and the Rest of Europe. |

|

Market Players Covered |

Mars, Incorporated y sus afiliadas (Virginia), Mondelēz International (EE. UU.), THE HERSHEY COMPANY (EE. UU.), Ferrero (Italia), Nestlé (Suiza), General Mills, Inc. (EE. UU.), Meiji Holdings Co., Ltd. (Japón), Chocoladefabriken Lindt & Sprüngli AG (Suiza), Barry Callebaut (Suiza), The Kraft Heinz Company (EE. UU.), Cargill, Incorporated. (EE. UU.), Cloetta AB (Suecia), ORION CORP. (Corea), Ghirardelli Chocolate Company (una subsidiaria de Lindt & Sprüngli AG) (EE. UU.), Ezaki Glico Co., Ltd. (Japón), MORINAGA & CO., LTD (Japón) y Arcor (Argentina), entre otros. |

|

Puntos de datos incluidos en el informe |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de cartera, análisis de precios y marco regulatorio. |

Definición de mercado

El chocolate premium es un tipo de chocolate que tiene un porcentaje más alto de sólidos de cacao que la leche con chocolate normal. Puede referirse a varias cosas, como la gran cantidad de cacao utilizada en la barra; si es de comercio justo y de origen sostenible; si combina otros ingredientes, como trozos de frambuesa o alcohol; y si el envase tiene un toque más sofisticado. También se elabora con leche entera en lugar de leche desnatada y tiene un mayor contenido de grasa. La leche con chocolate premium tiene un sabor más rico y una consistencia más espesa que la leche con chocolate normal.

Dinámica del mercado del chocolate premium en Europa

CONDUCTORES

- Aumento de la popularidad de los chocolates veganos, orgánicos y sin gluten.

La concienciación sobre el consumo de chocolates veganos, orgánicos y sin gluten ha ido evolucionando lentamente entre los consumidores de todo el mundo. El chocolate vegano ayuda a mejorar la función cerebral y se considera mucho mejor para la salud que el chocolate estándar. Está elaborado con ingredientes de origen vegetal en lugar de lácteos, huevos y gelatina , lo que significa que contiene menos grasa, menos calorías y nada de colesterol.

El consumo de productos derivados del cacao ha aportado importantes beneficios para la salud, lo que se espera que impulse el crecimiento del mercado de productos premium a base de chocolate. Entre los beneficios para la salud se incluyen la disminución de la hipertensión , la reducción del síndrome de fatiga crónica y la protección contra las quemaduras solares, entre otros. El cacao también es rico en polifenoles que ayudan a proteger los tejidos del cuerpo contra el estrés oxidativo y las patologías asociadas, como el cáncer y la inflamación.

El cacao en polvo se utiliza para elaborar chocolates veganos, que proceden de semillas de cacao que no han sido tostadas. Como estas semillas no se calientan a una temperatura alta durante el procesamiento, esto ayuda a mantener intactas todas sus vitaminas y minerales. Además, los chocolates veganos no contienen leche, por lo que tienen mucha fibra, proteínas y antioxidantes.

Los chocolates veganos contienen anandamida y cacao crudo, que se unen a los receptores del cerebro y te hacen sentir feliz y en paz. El chocolate vegano ayuda a reducir la presión arterial. Además de reducir la presión arterial, el chocolate vegano tiene otras propiedades que pueden reducir el riesgo de sufrir un ataque cardíaco o un derrame cerebral. Además del impacto positivo del cacao en la degeneración mental relacionada con la edad, su efecto en el cerebro también puede mejorar el estado de ánimo y los síntomas de la depresión.

Una dieta sin gluten es una alternativa para quienes padecen la enfermedad celíaca. El consumo de gluten provoca inflamación y daño intestinal, lo que puede provocar diversos problemas de salud, como deficiencias vitamínicas, anemia y osteoporosis. El chocolate negro puro sin azúcar, derivado de semillas de cacao tostadas, no contiene gluten de forma natural. Por lo tanto, la preferencia por el chocolate sin gluten es una alternativa sabrosa y saludable al chocolate normal debido a sus beneficios para la salud.

El consumo de productos veganos, orgánicos y sin gluten a base de chocolate puede ayudar a controlar enfermedades cardíacas y de presión arterial. Por lo tanto, se espera que el aumento de la concienciación sobre los productos de cacao para la salud impulse el mercado del chocolate de primera calidad en Europa.

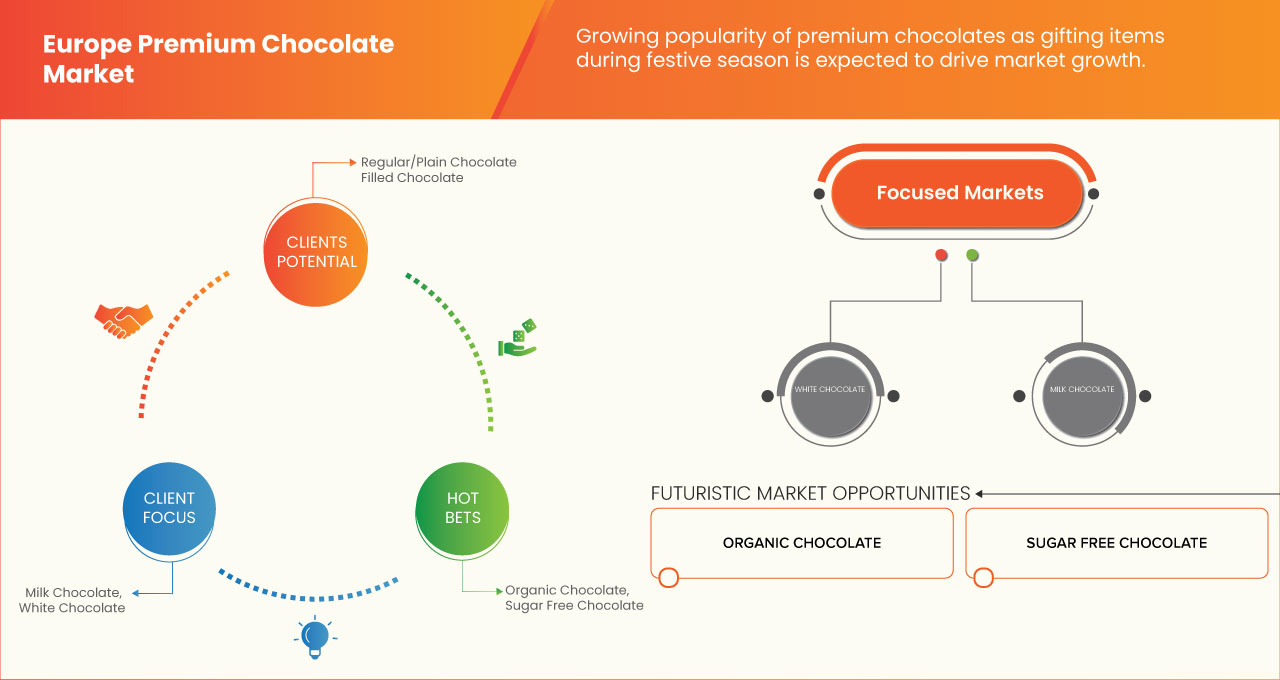

- Gran demanda de chocolates premium en las temporadas festivas.

La demanda estacional juega un papel importante en las ventas de chocolates de primera calidad. En el mercado europeo, el regalo de chocolates juega un papel importante y eso lleva al aumento de las temporadas festivas, especialmente en Semana Santa, San Valentín, Navidad y otras. La creciente influencia del comercio minorista en línea también se considera una de las principales razones para aumentar las ventas de chocolates de temporada. La occidentalización de la cultura ha hecho que los millennials sean conscientes de la cultura del regalo.

Varias empresas de chocolate de temporada lanzan una amplia gama de chocolates artesanales con nuevos sabores y variaciones de empaquetado durante estas ocasiones especiales. También están siguiendo una comunicación de marketing integrada utilizando varios otros modos de plataformas de redes sociales para aumentar la popularidad de sus ofertas de chocolate de temporada. Esto ayuda a generar conciencia sobre los chocolates de temporada a nivel mundial.

La cambiante preferencia y aceptación del chocolate y su atractivo empaque, la adopción de la cultura del regalo, la consistencia en la calidad, la afluencia de la urbanización entre los jóvenes y los altos ingresos disponibles están impulsando el mercado de la cultura del chocolate premium.

Factores como el poder adquisitivo de los millennials, el auge de la industria del comercio electrónico, el auge del mercado de regalos y la influencia de la occidentalización y los enfoques no convencionales de las marcas minoristas han impulsado el mercado del chocolate premium en Europa.

OPORTUNIDADES

- Enfoque continuo en el desarrollo de chocolates nuevos y únicos.

La tendencia emergente de productos orgánicos y de etiqueta limpia para mantener la salud y el bienestar general ha llevado a un rápido aumento de la demanda de chocolates especiales o de primera calidad. La introducción de sabores y gustos únicos se ha considerado un factor clave que ha captado la atención de los clientes.

Además, las empresas están introduciendo sus productos con ideas innovadoras para asegurar su posición en el mercado europeo del chocolate premium.

De esta manera, para aumentar la base de consumidores, la introducción de chocolates con texturas mejoradas y con sabores creará oportunidades potenciales para los productores de chocolate de primera calidad. Las empresas deberían introducir sabores locales y de temporada para atraer a los consumidores de todo el mundo, centrándose tanto en la salud como en el sabor. Esto podría abrir un área completamente nueva para la innovación en sabores, lo que se espera que cree una oportunidad para el mercado.

- Tendencia creciente de la distribución en línea

El comercio electrónico está redefiniendo las actividades comerciales en todo el mundo. A lo largo de los años, el comercio electrónico ha evolucionado de manera profunda. Los numerosos beneficios para la salud del chocolate, junto con el fuerte deseo de agregar sabores innovadores al chocolate, impulsan la venta de los mismos. El canal de distribución anterior eran únicamente las tiendas que funcionaban principalmente sin el uso de medios electrónicos, pero con el aumento del uso de Internet, los canales de distribución han cambiado. Dado que Internet continúa influyendo en la vida cotidiana, el comercio electrónico es necesario para el crecimiento de cualquier mercado y ayuda a extender un negocio más allá de su ubicación física.

El canal de distribución online beneficia al fabricante al aprovechar el entusiasmo de los clientes online por probar nuevos productos. Las campañas de publicidad y marketing intensas de chocolates veganos, sin gluten y bajos en azúcar en los sitios web aumentarán las ventas de los chocolates. El comercio electrónico también es un éxito entre los consumidores debido a las múltiples ofertas que ofrecen las plataformas online en festivales y clientes habituales, e incluso en pedidos al por mayor.

La creciente digitalización y la migración de los consumidores a los canales de distribución en línea seguirán impulsando el crecimiento del comercio electrónico, lo que hace que el canal de distribución en línea sea una tendencia creciente, lo que se espera que cree oportunidades para el mercado.

RESTRICCIONES/DESAFÍOS

- Precios fluctuantes de las materias primas

El precio del chocolate ha cambiado, pero la mayoría de los consumidores no lo sabían. La volatilidad del precio del chocolate está influenciada principalmente por la oferta de los impulsores del chocolate. El componente principal en la producción de chocolate es el cacao, que se utiliza en una variedad de productos. Para hacer chocolate, también se requieren otros ingredientes como azúcar, productos lácteos, nueces, edulcorantes de maíz y energía. El mercado de materias primas, que establece el precio en función de los niveles de oferta y demanda y puede causar diferentes niveles de volatilidad en los precios de las materias primas, es el principal responsable de los precios de estas materias primas.

El cacao en polvo y la manteca de cacao son los dos componentes del cacao que se utilizan para elaborar chocolate. Dado que produce los chocolates más ricos y se utiliza en dulces de chocolate fino, la manteca de cacao es, con diferencia, la más deseable de las dos. Sin embargo, como es más difícil y más cara de producir, cualquier interrupción en el suministro de cacao acabará por filtrarse y elevar los precios al consumidor. Se espera que la fluctuación del precio de la materia prima para la producción limite el crecimiento del chocolate de primera calidad en el mercado.

- Aumento del coste de la cadena de suministro

La volatilidad de los precios del chocolate está influenciada principalmente por la oferta de chocolate. El componente principal en la producción de chocolate es el cacao, que se utiliza en una variedad de productos. Otros ingredientes necesarios para la producción de productos de chocolate incluyen azúcar, productos lácteos, nueces, edulcorantes de maíz y energía. El precio se basa en los niveles de oferta y demanda y puede causar diferentes niveles de volatilidad en los precios, es el principal responsable de los precios de estos productos básicos. El proceso por el cual el cacao se convierte en el ingrediente de los productos que se venden en los estantes de los supermercados es complicado. En varias etapas del ciclo de producción, el cacao cultivado por varios agricultores, principalmente pequeños agricultores, se mezcla. Dado que la mayoría de los riesgos de la cadena de suministro se originan a nivel de cada granja, es difícil rastrear el cacao hasta esas ubicaciones debido a esta mezcla. Además, la complejidad de esta cadena de suministro crea desigualdades a lo largo de la cadena de valor.

Además, los problemas más importantes en las cadenas de suministro de cacao son la expansión de la producción de cacao hacia reservas forestales protegidas y el uso de mano de obra infantil. Debido al aumento previsto de la frecuencia de plagas, enfermedades y sequías, el cambio climático también plantea una amenaza a la viabilidad a largo plazo de la industria del cacao.

La interrupción en la cadena de suministro conduce a un aumento del precio de la cadena de suministro, lo que se espera que desafíe el crecimiento del mercado en el período de pronóstico.

Acontecimientos recientes

- 10 de febrero de 2023, Morinaga Nutritional Foods, Inc. (una subsidiaria) anunció la adquisición de Turtle Island Foods Holdings, Inc. Turtle Island Foods es un fabricante de productos alimenticios de origen vegetal. Como resultado de esta adquisición, Turtle Islands Foods se convertirá en una subsidiaria completa de Morinaga Nutritional Foods, Inc. Esto creará una oportunidad para desarrollar chocolates nutricionales para el mercado del chocolate premium.

- En 2021, Lindt y Sprüngli invirtieron alrededor de 80,95 millones de dólares para ampliar su planta de pasta de cacao en Olten. Se considera la planta de pasta de cacao más grande e importante con red de producción en Europa.

Panorama del mercado del chocolate premium en Europa

El mercado europeo de chocolate premium está segmentado en nueve segmentos notables según el tipo, el tipo de producto, la inclusión, la naturaleza, la categoría, el contenido de cacao, el sabor, el empaque y el canal de distribución. El crecimiento entre estos segmentos lo ayudará a analizar los principales segmentos de crecimiento en las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

TIPO

- Chocolate con leche

- Chocolate oscuro

- Chocolate blanco

Según el tipo, el mercado está segmentado en chocolate con leche, chocolate negro y chocolate blanco.

TIPO DE PRODUCTO

- Regular/Simple

- Completado

En función del tipo de producto, el mercado se segmenta en regular/simple y relleno.

INCLUSIÓN

- Con Chocolates de Inclusión y Regular

- Sin inclusiones Chocolate

En base a la inclusión, el mercado está segmentado en chocolates con inclusiones y chocolate regular, sin inclusiones.

NATURALEZA

- Convencional

- Orgánico

En función de la naturaleza, el mercado se segmenta en convencional y orgánico.

CATEGORÍA

- Estándar Premium

- Súper Premium

Según la categoría, el mercado está segmentado en premium estándar y súper premium.

CONTENIDO DE CACAO

- 50-60%

- 71-80%

- 61-70%

- 81-90%

- 91-100%

Según el contenido de cacao, el mercado se segmenta en 50-60%, 71-80%, 61-70%, 81-90% y 91-100%.

SABOR

- Sabor

- Clásico/Regular

En función del sabor, el mercado está segmentado en sabor clásico/regular.

EMBALAJE

- Envoltura de plástico

- Cajas de regalo/surtidas

- Bolsas

- Caja de tablero

- Bolsitas

- Otros

En función del embalaje, el mercado está segmentado en envoltorios de plástico, cajas de regalo/surtidas, bolsas, cajas de cartón, bolsitas y otros.

CANAL DE DISTRIBUCIÓN

- Minorista basado en tienda

- Minoristas que no tienen tiendas físicas

Sobre la base del canal de distribución, el mercado está segmentado en minoristas con tiendas físicas y minoristas sin tiendas físicas.

Análisis y perspectivas regionales del mercado de chocolate premium en Europa

El mercado europeo de chocolate premium está segmentado en función del tipo, tipo de producto, inclusión, naturaleza, categoría, contenido de cacao, sabor, embalaje y canal de distribución.

Los países del mercado europeo de chocolate premium son Alemania, Reino Unido, Francia, Italia, España, Rusia, Turquía, Suiza, Bélgica, Países Bajos y el resto de Europa.

Alemania domina el mercado europeo de chocolate premium en términos de participación de mercado e ingresos de mercado debido a la creciente conciencia sobre las propiedades de las tecnologías de alquilación en esta región.

La sección de países del informe también proporciona factores individuales que impactan en el mercado y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. El análisis de los puntos de datos de la cadena de valor aguas abajo y aguas arriba, las tendencias técnicas, el análisis de las cinco fuerzas de Porter y los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas europeas y los desafíos que enfrentan debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Competitive Landscape and Europe Premium Chocolate Market Share Analysis

The Europe premium chocolate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe premium chocolate market.

Some of the major players operating in the Europe premium chocolate market are Mars, Incorporated and its Affiliates, Mondelēz International, THE HERSHEY COMPANY, Ferrero, Nestlé, General Mills, Inc., Meiji Holdings Co., Ltd., Lindt & Sprungli AG, Barry Callebaut, The Kraft Heinz Company, Cargill, Incorporated. , Cloetta AB, ORION CORP., Ghirardelli Chocolate Company (A Subsidiary of Lindt & Sprüngli AG), Ezaki Glico Co., Ltd., MORINAGA & CO., LTD, Arcor among others.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PREMIUM CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF HAZELNUT CONTENT FOR TOP EUROPE PREMIUM CHOCOLATE BRANDS

4.2 BRAND COMPARATIVE ANALYSIS

4.2.1 FERRERO

4.2.2 NESTLE

4.2.3 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PACKAGING FACTOR

4.3.2 TASTE

4.3.3 HEALTH

4.3.4 BRAND LOYALTY

4.3.5 GENDER AND AGE

4.3.6 INCOME

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING CONSUMER PREFERENCE TOWARD DARK AND VEGAN CHOCOLATE

4.4.2 CONSUMERS ARE INTERESTED IN NEW INNOVATIVE FLAVOURS AND TEXTURE

4.4.3 RISING DEMAND FOR PREMIUM CHOCOLATES FOR GIFTING PURPOSES

4.4.4 FUTURE PERSPECTIVE

4.5 MEETING CONSUMER REQUIREMENT

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END-USERS

4.7 SHOPPING BEHAVIOR AND DYNAMICS

4.7.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.7.2 RESEARCH

4.7.3 IMPULSIVE

4.7.4 ADVERTISEMENT

4.7.5 TELEVISION ADVERTISEMENT

4.7.6 ONLINE ADVERTISEMENT

4.7.7 IN-STORE ADVERTISEMENT

4.7.8 OUTDOOR ADVERTISEMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.2 LINE EXTENSION

4.8.3 NEW PACKAGING

4.8.4 RE-LAUNCHED

4.8.5 NEW FORMULATION

4.8.6 DIFFERENTIAL PRODUCT OFFERING

4.8.7 PACKAGE DESIGNING

4.8.8 PRICING ANALYSIS

4.9 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATES

5.1.2 HIGH DEMAND FOR PREMIUM CHOCOLATES IN FESTIVE SEASONS

5.1.3 DEMAND FOR PREMIUM CHOCOLATES OWING TO THE SHIFT TOWARDS A HEALTHY LIFESTYLE

5.1.4 USE OF PREMIUM CHOCOLATE IN THE BAKING INDUSTRY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF VARIOUS SUBSTITUTE

5.3 OPPORTUNITIES

5.3.1 CONTINUOUS FOCUS ON DEVELOPING NEW FLAVORED AND UNIQUE CHOCOLATES

5.3.2 RISING TREND OF ONLINE DISTRIBUTION

5.4 CHALLENGES

5.4.1 RISING COST OF SUPPLY CHAIN

5.4.2 RULES AND REGULATIONS ASSOCIATED WITH PREMIUM CHOCOLATES

6 EUROPE PREMIUM CHOCOLATE MARKET, BY REGION

6.1 EUROPE

6.1.1 GERMANY

6.1.2 U.K.

6.1.3 FRANCE

6.1.4 ITALY

6.1.5 SPAIN

6.1.6 RUSSIA

6.1.7 TURKEY

6.1.8 SWITZERLAND

6.1.9 BELGIUM

6.1.10 NETHERLANDS

6.1.11 REST OF EUROPE

7 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: EUROPE

7.2 ACQUISITION

7.3 NEW PRODUCT DEVELOPMENT

7.4 FACILITY EXPANSION

7.5 NEW APPOINTMENT

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 MARS, INCORPORATED AND ITS AFFILIATES

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT UPDATES

9.2 MONDELĒZ INTERNATIONAL

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 THE HERSHEY COMPANY

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENT

9.4 FERRERO

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT UPDATES

9.5 NESTLÉ

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 ARCOR

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 BARRY CALLEBAUT

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT UPDATES

9.8 CARGILL, INCORPORATED

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT UPDATES

9.9 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG (2022)

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 CLOETTA AB

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 EZAKI GLICO CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENT

9.12 GENERAL MILLS, INC.

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 GHIRARDELLI CHOCOLATE COMPANY

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 MEIJI HOLDINGS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 MORINAGA & CO., LTD.

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENT

9.16 ORION CORP.

9.16.1 COMPANY SNAPSHOT

9.16.2 REVENUE ANALYSIS

9.16.3 PRODUCT PORTFOLIO

9.16.4 RECENT DEVELOPMENTS

9.17 THE KRAFT HEINZ COMPANY

9.17.1 COMPANY SNAPSHOT

9.17.2 REVENUE ANALYSIS

9.17.3 PRODUCT PORTFOLIO

9.17.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Lista de Tablas

TABLE 1 ESTIMATED HAZELNUT CONTENT FOR TOP EUROPE PREMIUM CHOCOLATE COMPANIES

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE PREMIUM CHOCOLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 10 EUROPE ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 11 EUROPE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 12 EUROPE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 13 EUROPE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 14 EUROPE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 15 EUROPE CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 16 EUROPE CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 17 EUROPE RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 18 EUROPE RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 19 EUROPE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 20 EUROPE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 21 EUROPE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 22 EUROPE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 23 EUROPE INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 EUROPE PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 25 EUROPE PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 EUROPE PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 27 EUROPE PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 28 EUROPE FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 EUROPE PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 30 EUROPE PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 31 EUROPE STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 EUROPE NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GERMANY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 GERMANY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GERMANY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 36 GERMANY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 GERMANY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GERMANY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 39 GERMANY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 40 GERMANY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 41 GERMANY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 42 GERMANY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 43 GERMANY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 44 GERMANY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 45 GERMANY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 46 GERMANY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 47 GERMANY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 48 GERMANY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 49 GERMANY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 50 GERMANY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 51 GERMANY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 52 GERMANY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 GERMANY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 GERMANY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 55 GERMANY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 56 GERMANY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 57 GERMANY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 GERMANY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 59 GERMANY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 60 GERMANY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 GERMANY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.K. PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.K. PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.K. PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 65 U.K. WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.K. INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.K. ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 68 U.K. ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 69 U.K. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 70 U.K. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 71 U.K. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 72 U.K. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 73 U.K. CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 74 U.K. CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 75 U.K. RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 76 U.K. RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 77 U.K. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 78 U.K. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 79 U.K. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 80 U.K. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 81 U.K. INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.K. PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 83 U.K. PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 84 U.K. PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 85 U.K. PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 86 U.K. FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.K. PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 88 U.K. PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 89 U.K. STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.K. NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 FRANCE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 FRANCE PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 FRANCE PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 94 FRANCE WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 FRANCE INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 FRANCE ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 97 FRANCE ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 98 FRANCE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 99 FRANCE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 100 FRANCE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 101 FRANCE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 102 FRANCE CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 103 FRANCE CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 104 FRANCE RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 105 FRANCE RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 106 FRANCE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 107 FRANCE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 108 FRANCE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 109 FRANCE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 110 FRANCE INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 FRANCE PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 112 FRANCE PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 113 FRANCE PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 114 FRANCE PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 115 FRANCE FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 FRANCE PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 117 FRANCE PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 118 FRANCE STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 FRANCE NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 ITALY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 ITALY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 ITALY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 123 ITALY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 ITALY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 ITALY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 126 ITALY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 127 ITALY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 128 ITALY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 129 ITALY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 130 ITALY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 131 ITALY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 132 ITALY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 133 ITALY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 134 ITALY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 135 ITALY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 136 ITALY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 137 ITALY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 138 ITALY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 139 ITALY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 ITALY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 141 ITALY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 142 ITALY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 143 ITALY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 144 ITALY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 ITALY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 146 ITALY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 147 ITALY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 ITALY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SPAIN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 SPAIN PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 SPAIN PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 152 SPAIN WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SPAIN INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 SPAIN ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 155 SPAIN ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 156 SPAIN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 157 SPAIN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 158 SPAIN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 159 SPAIN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 160 SPAIN CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 161 SPAIN CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 162 SPAIN RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 163 SPAIN RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 164 SPAIN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 165 SPAIN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 166 SPAIN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 167 SPAIN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 168 SPAIN INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 SPAIN PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 170 SPAIN PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 171 SPAIN PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 172 SPAIN PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 173 SPAIN FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 SPAIN PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 175 SPAIN PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 176 SPAIN STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 SPAIN NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 RUSSIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 RUSSIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 RUSSIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 181 RUSSIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 RUSSIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 RUSSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 184 RUSSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 185 RUSSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 186 RUSSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 187 RUSSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 188 RUSSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 189 RUSSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 190 RUSSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 191 RUSSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 192 RUSSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 193 RUSSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 194 RUSSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 195 RUSSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 196 RUSSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 197 RUSSIA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 RUSSIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 199 RUSSIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 200 RUSSIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 201 RUSSIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 202 RUSSIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 RUSSIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 204 RUSSIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 205 RUSSIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 RUSSIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 TURKEY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 TURKEY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 209 TURKEY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 210 TURKEY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 TURKEY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 TURKEY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 213 TURKEY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 214 TURKEY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 215 TURKEY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 216 TURKEY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 217 TURKEY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 218 TURKEY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 219 TURKEY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 220 TURKEY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 221 TURKEY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 222 TURKEY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 223 TURKEY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 224 TURKEY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 225 TURKEY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 226 TURKEY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 227 TURKEY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 228 TURKEY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 229 TURKEY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 230 TURKEY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 231 TURKEY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 232 TURKEY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 233 TURKEY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 234 TURKEY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 TURKEY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 239 SWITZERLAND WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 SWITZERLAND INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 241 SWITZERLAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 242 SWITZERLAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 243 SWITZERLAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 244 SWITZERLAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 245 SWITZERLAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 246 SWITZERLAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 247 SWITZERLAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 248 SWITZERLAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 249 SWITZERLAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 250 SWITZERLAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 251 SWITZERLAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 252 SWITZERLAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 253 SWITZERLAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 254 SWITZERLAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 255 SWITZERLAND INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 257 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 258 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 259 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 260 SWITZERLAND FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 261 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 262 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 263 SWITZERLAND STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 SWITZERLAND NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 265 BELGIUM PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 266 BELGIUM PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BELGIUM PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 268 BELGIUM WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 BELGIUM INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 BELGIUM ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 271 BELGIUM ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 272 BELGIUM HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 273 BELGIUM HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 274 BELGIUM PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 275 BELGIUM PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 276 BELGIUM CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 277 BELGIUM CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 278 BELGIUM RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 279 BELGIUM RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 280 BELGIUM PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 281 BELGIUM PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 282 BELGIUM OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 283 BELGIUM OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 284 BELGIUM INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 285 BELGIUM PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 286 BELGIUM PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 287 BELGIUM PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 288 BELGIUM PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 289 BELGIUM FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 BELGIUM PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 291 BELGIUM PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 292 BELGIUM STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 BELGIUM NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 294 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 297 NETHERLANDS WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 NETHERLANDS INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 NETHERLANDS ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 300 NETHERLANDS ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 301 NETHERLANDS HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 302 NETHERLANDS HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 303 NETHERLANDS PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 304 NETHERLANDS PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 305 NETHERLANDS CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 306 NETHERLANDS CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 307 NETHERLANDS RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 308 NETHERLANDS RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 309 NETHERLANDS PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 310 NETHERLANDS PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 311 NETHERLANDS OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 312 NETHERLANDS OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 313 NETHERLANDS INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 315 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 316 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 317 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 318 NETHERLANDS FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 320 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 321 NETHERLANDS STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 322 NETHERLANDS NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 REST OF EUROPE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Lista de figuras

FIGURE 1 EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 2 EUROPE PREMIUM CHOCOLATE MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE PREMIUM CHOCOLATE MARKET : DROC ANALYSIS

FIGURE 4 EUROPE PREMIUM CHOCOLATE MARKET : EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PREMIUM CHOCOLATE MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 EUROPE PREMIUM CHOCOLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PREMIUM CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PREMIUM CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PREMIUM CHOCOLATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE PREMIUM CHOCOLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PREMIUM CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PREMIUM CHOCOLATE MARKET : SEGMENTATION

FIGURE 14 THE RISE IN POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATE ACROSS THE GLOBE IS EXPECTED TO DRIVE THE EUROPE PREMIUM CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE MILK CHOCOLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PREMIUM CHOCOLATE MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN OF THE EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 18 EUROPE PREMIUM CHOCOLATE MARKET: SNAPSHOT (2022)

FIGURE 19 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022)

FIGURE 20 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 EUROPE PREMIUM CHOCOLATE MARKET: BY TYPE (2023 - 2030)

FIGURE 23 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY SHARE 2022 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.