Europe Premium Chocolate Market Analysis and Size

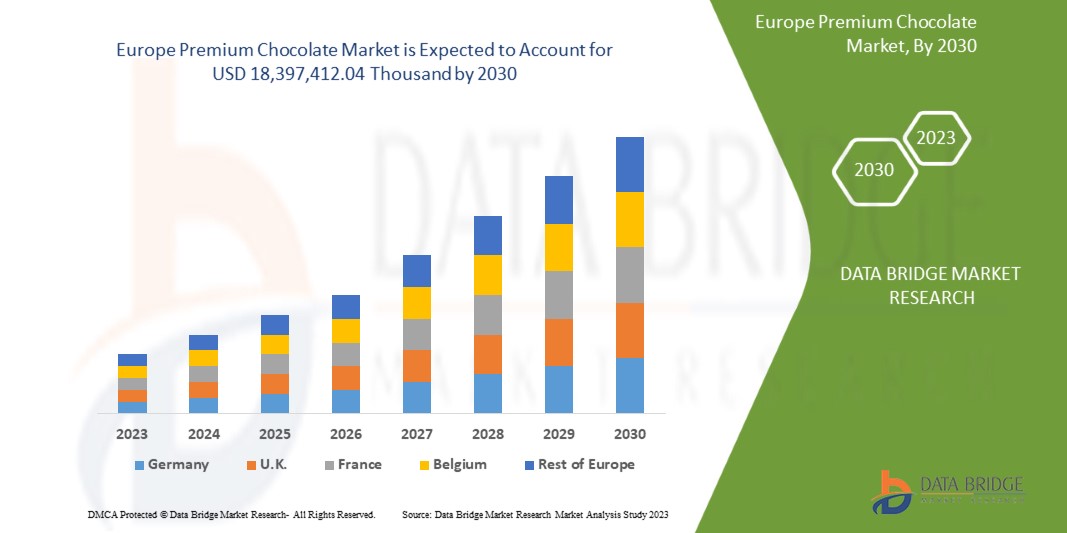

The Europe premium chocolate market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.4% in the forecast period of 2023 to 2040 and is expected to reach USD 18,397,412.04 thousand by 2030. The major factor driving the growth of the Europe premium chocolate market is the rise in demand for highly luxurious chocolates.

Premium chocolates are known to have more cocoa content compared to regular ones. It comes in varieties like infused with nuts, fruits, and sometimes alcohol. The presence of all these ingredients gives the premium chocolates a better and more luxurious feel. Customers can get a smoother and richer taste.

The Europe premium chocolate market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in Thousand and Pricing in USD |

|

Segments Covered |

Type (Milk Chocolate, Dark Chocolate and White Chocolate), Product Type (Regular/Plain Chocolate and Filled Chocolate), Inclusion (With Inclusions Chocolates and Regular/No Inclusions Chocolates), Nature (Conventional, And Organic), Category (Standard Premium, and Super Premium), Cocoa Content (50-60%, 71-80%, 61-70%, 81-90%, and 91-100%), Flavor (Flavor, Classic/Regular), Packaging (Plastic Wrap, Gift Boxes/Assorted, Pouches, Board Box, Sachets, and Others), Distribution Channel (Store Based Retailers And Non-Store Retailers) |

|

Countries Covered |

Germany, the U.K., France, Italy, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, and the Rest of Europe. |

|

Market Players Covered |

Mars, Incorporated and its Affiliates (Virginia), Mondelēz International(U.S.), THE HERSHEY COMPANY (U.S.), Ferrero (Italy), Nestlé (Switzerland), General Mills, Inc.(USA), Meiji Holdings Co., Ltd.(Japan), Chocoladefabriken Lindt & Sprüngli AG (Switzerland), Barry Callebaut (Switzerland), The Kraft Heinz Company(USA), Cargill, Incorporated. (U.S.), Cloetta AB(Sweden), ORION CORP.(Korea), Ghirardelli Chocolate Company (A Subsidiary of Lindt & Sprüngli AG) (U.S.), Ezaki Glico Co., Ltd.(Japan), MORINAGA & CO., LTD(Japan), and Arcor(Argentina) among others. |

|

Data Points Covered in the Report |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Market Definition

Premium chocolate is a type of chocolate that has a higher percentage of cocoa solids than regular chocolate milk. It can refer to a number of things, such as the high quantity of cocoa used in the bar; whether it is Fairtrade and sustainably sourced; if it combines other ingredients, such as raspberry chunks or alcohol; and if the packaging has a more sophisticated feel. It is also made with whole milk instead of skim milk and has a higher fat content. Premium chocolate milk has a richer flavor and a thicker consistency than regular chocolate milk.

Europe Premium Chocolate Market Dynamics

DRIVERS

- Rise in popularity of vegan, organic, and gluten free chocolates.

The awareness of the consumption of vegan, organic, and gluten free chocolates has slowly evolved among consumers all over the globe. Vegan chocolate helps in improving brain function and is considered much better for health than the standard one. It is made from plant-based ingredients instead of dairy, eggs, and gelatin, which means it contains less fat, fewer calories, and no cholesterol.

The consumption of cocoa products has led to major health benefits, which is expected to drive the growth of the premium chocolate based products market. The health benefits include decreased hypertension, reduced chronic fatigue syndrome, and protection against sunburn, among others. Cocoa is also rich in polyphenols that help in protecting the body's tissues against oxidative stress and associated pathologies such as cancers and inflammation.

Cacao powder is used in making vegan chocolates which come from cacao beans that haven’t been roasted. Since these beans aren’t heated to a high temperature during processing, it helps in keeping all their vitamins and minerals intact. Also, vegan chocolates don’t have any milk in them, so they have a lot of fiber, protein, and antioxidants.

Vegan chocolates have anandamide and raw cacao in them, which bind to the receptors in your brain and make you feel happy and at peace. Vegan chocolate helps in lowering blood pressure. Besides lowering blood pressure, vegan chocolate has other properties that can reduce your risk of heart attack and stroke. Other than cocoa’s positive impact on age-related mental degeneration, its effect on the brain may also improve mood and symptoms of depression.

A gluten-free diet is an alternative for those who have celiac disease. Eating gluten will cause your intestines to become inflamed and damaged, leading to various health problems, including vitamin deficiencies, anemia, and osteoporosis. Pure dark chocolate that is unsweetened and derived from roasted cacao beans doesn't contain gluten naturally. Therefore preference of gluten-free chocolate is a tasty and healthy alternative to regular chocolate due to its health benefits

The consumption of vegan, organic, and gluten-free chocolate based products can help to control heart and blood pressure diseases. So, the increase in the awareness of cocoa products on health is expected to drive the Europe premium chocolate market.

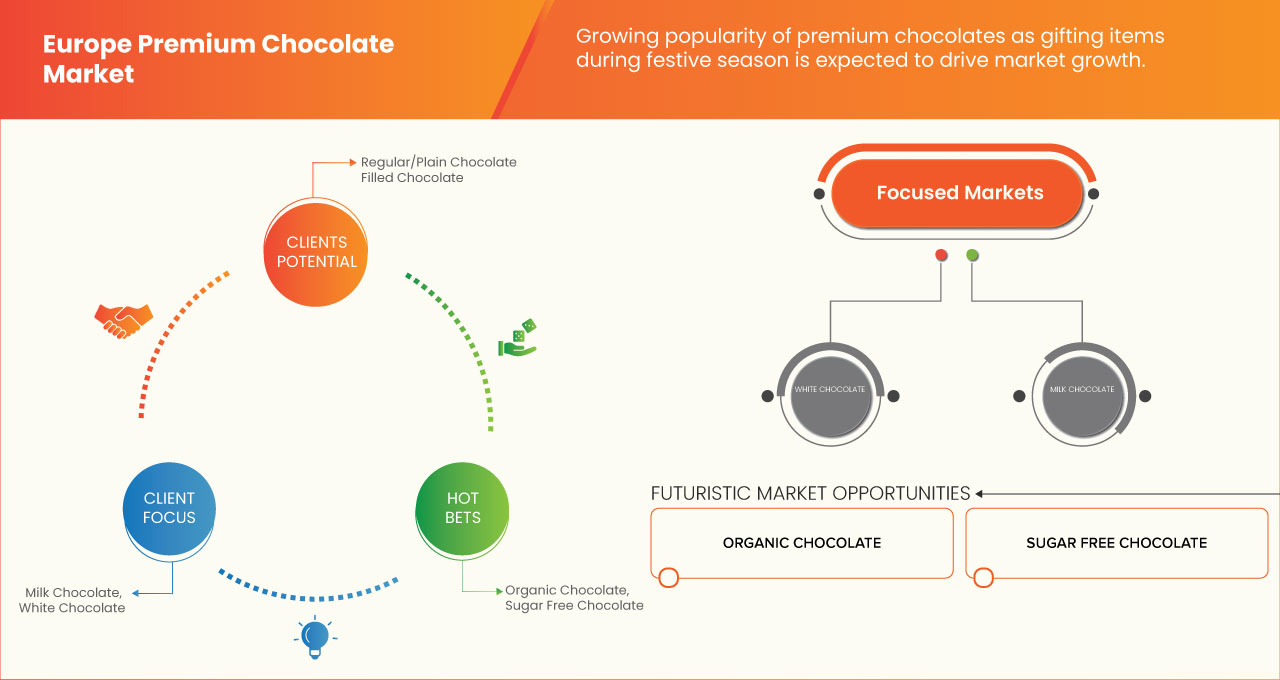

- High demand for premium chocolates in the festive seasons.

Seasonal demand plays an important role in the sales of premium chocolates. In the Europe market, the gifting of chocolates plays a major role and which leads to the increase in the festive seasons, especially on Easter, Valentine’s Day, Christmas, and others. The growing influence of online retailing is also considered one of the prime reasons to increase the sales of seasonal chocolates. Westernization in the culture has become millennials aware of the gifting culture.

Various seasonal chocolate players launch a wide range of crafted chocolates with new flavors and packaging variations during such special occasions. They are also following integrated marketing communication using various other modes of social media platforms to increase the popularity of their seasonal chocolate offerings. This helps in generating awareness about seasonal chocolates globally.

The shifting preference and acceptance of chocolate and its attractive packaging, adopting the gifting culture, Consistency in quality, affluence of urbanization amid youth, and high disposable income is driving the market of premium chocolate culture.

The factors such as the purchasing power of the millennials, the booming e-commerce industry, the soar in the gifting market, and the influence of Westernization and unconventional approaches by retailing brands have spanned which is expected to drive the Europe premium chocolate market

OPPORTUNITIES

- Continuous focus on developing new flavored and unique chocolates

The emerging trend of clean-label and organic products to maintain overall health and wellness has led to the rapid escalation in demand for premium or specialty chocolates. The introduction of unique taste and flavors have been seen to be a key factor that has been grabbing the attention of customers.

Moreover, companies are introducing their products with innovative ideas to secure their position in the Europe premium chocolate market.

Thus to increase the consumer base, introducing flavored and improved textures of chocolates will create potential opportunities for premium chocolate producers. The companies should introduce local and seasonal flavors to attract consumers all around the globe, focusing both on health and taste. This could open up a whole new area for flavor innovation which is expected to create an opportunity for the market.

- Rising trend of online distribution

E-commerce is redefining commercial activities around the world. Over the years, e-commerce has evolved in profound ways. There are so many health benefits of chocolate, along with the strong desire to add innovative flavors to chocolate drives up the sale of the chocolates. The distribution channel earlier was solely the stores that mainly run without any electronic media usage, but with the increased internet usage, the distribution channels are changed. Since the internet continues influencing everyday lives, e-commerce is necessary for any market's growth and helps extend a business beyond its physical location.

Online distribution channel benefits the manufacturer by exploiting the eagerness of online customers to try new goods. Strong advertising and marketing campaigns for vegan, gluten-free, low sugar chocolates on the online sites will add to the sales of the chocolates. E-commerce is also a hit among consumers due to the multiple offers provided by online platforms on festivals and regular customers, and even on bulk orders.

The increased digitalization and migration of consumers to online distribution channels will continue to spur the growth of e-commerce, the makes the rising trend of online distribution channel, which is expected to create opportunity for the market.

RESTRAINTS/CHALLENGES

- Fluctuating prices of raw materials

The cost of chocolate has changed, but most consumers were unaware of it. The price volatility of chocolate is primarily influenced by the supply of chocolate drivers. The main component in chocolate production is cocoa, which is used in a variety of products. To make chocolate, other ingredients like sugar, dairy products, nuts, corn sweeteners, and energy are also required. The commodities market, which sets the price based on supply and demand levels and can cause varying levels of volatility on commodity prices, is primarily responsible for these commodities' prices.

Cocoa powder and cocoa butter are the two parts of cocoa that are used to make chocolate. Since it produces the richer chocolates and is used in thin chocolate confectionery treats, cocoa butter is by far the more desirable of the two. However, because it is the harder and more expensive to produce, any disruption in the supply of cocoa will eventually filter down and raise consumer prices. The fluctuating price of raw material for production is expected to restraint the premium chocolate growth in the market.

- Rising cost of supply chain

The price volatility of chocolate is primarily influenced by the supply of chocolate. The main component in chocolate production is cocoa, which is used in a variety of products. Other ingredients required for the production of chocolate products include sugar, dairy products, nuts, corn sweeteners, and energy. The price are based on supply and demand levels and can cause varying levels of volatility on prices, is primarily responsible for these commodities' prices. The process by which cocoa becomes the ingredients for goods that are sold on supermarket shelves is a complicated one. At various stages of the production cycle, cocoa grown by a number of farmers, primarily smallholders, is blended together. Since most supply chain risks originate at the individual farm level, it is challenging to trace cocoa back to those locations because of this mixing. Additionally, this supply chain's complexity creates inequities throughout the value chain.

Moreover, the most important problems in cocoa supply chains are the expansion of cocoa production into protected forest reserves and the use of child labor. Due to the anticipated rise in the frequency of pests, diseases, and droughts, climate change also poses a threat to the long-term viability of the cocoa industry.

The disruption in the supply chain leads to the increasing price of the supply chain, which is expected to challenge the market growth in the forecast period

Recent Developments

- Feb 10, 2023, Morinaga Nutritional Foods, Inc. (a subsidiary) announced the acquisition of Turtle Island Foods Holdings, Inc. Turtle Island Foods is a manufacturer of plant-based food products. As a result of this acquisition, Turtle Islands Foods will become a whole subsidiary of Morinaga Nutritional Foods, Inc. This will create an opportunity to develop nutritional chocolates for the premium chocolate market

- In 2021, Lindt and Sprüngli invested around USD 80.95 Million in order to expand its cocoa mass plant in Olten. It is considered the largest and most important cocoa mass plant with the Europe production network

Europe Premium Chocolate Market Scope

Europe Premium Chocolate Market is segmented into nine notable segments based on type, product type, inclusion, nature, category, cocoa content, flavor, packaging, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

TYPE

- Milk Chocolate

- Dark Chocolate

- White Chocolate

On the basis of type, the market is segmented into milk chocolate, dark chocolate, and white chocolate.

PRODUCT TYPE

- Regular/Plain

- Filled

On the basis of product type, the market is segmented into regular/plain and filled.

INCLUSION

- With Inclusion Chocolates And Regular

- No Inclusions Chocolate

On the basis of inclusion, the market is segmented into with inclusion chocolates and regular, no inclusions chocolate.

NATURE

- Conventional

- Organic

On the basis of nature, the market is segmented into conventional and organic.

CATEGORY

- Standard Premium

- Super Premium

On the basis of category, the market is segmented into standard premium and super premium.

COCOA CONTENT

- 50-60%

- 71-80%

- 61-70%

- 81-90%

- 91-100%

On the basis of cocoa-content, the market is segmented into 50-60%, 71-80%, 61-70%, 81-90%, and 91-100%.

FLAVOR

- Flavor

- Classic/Regular

On the basis of flavor, the market is segmented into flavor, classic/regular.

PACKAGING

- Plastic Wrap

- Gift Boxes/Assorted

- Pouches

- Board Box

- Sachets

- Others

On the basis of packaging, the market is segmented into plastic wrap, gift boxes/assorted, pouches, board box, sachets, and others.

DISTRIBUTION CHANNEL

- Store Based Retailer

- Non-Store Retailers

On the basis of distribution channel, the market is segmented into store based retailers and non-store retailers.

Europe Premium Chocolate Market Regional Analysis/Insights

The Europe premium chocolate market is segmented on the basis of type, product type, inclusion, nature, category, cocoa content, flavor, packaging, and distribution channel.

The countries in the Europe premium chocolate market are Germany, the U.K., France, Italy, Spain, Russia, Turkey, Switzerland, Belgium, Netherlands, and the Rest of Europe.

Germany is dominating the Europe premium chocolate market in terms of market share and market revenue due to the growing awareness regarding the properties of the Alkylation technologies in this region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Premium Chocolate Market Share Analysis

The Europe premium chocolate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Europe premium chocolate market.

Some of the major players operating in the Europe premium chocolate market are Mars, Incorporated and its Affiliates, Mondelēz International, THE HERSHEY COMPANY, Ferrero, Nestlé, General Mills, Inc., Meiji Holdings Co., Ltd., Lindt & Sprungli AG, Barry Callebaut, The Kraft Heinz Company, Cargill, Incorporated. , Cloetta AB, ORION CORP., Ghirardelli Chocolate Company (A Subsidiary of Lindt & Sprüngli AG), Ezaki Glico Co., Ltd., MORINAGA & CO., LTD, Arcor among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE PREMIUM CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF HAZELNUT CONTENT FOR TOP EUROPE PREMIUM CHOCOLATE BRANDS

4.2 BRAND COMPARATIVE ANALYSIS

4.2.1 FERRERO

4.2.2 NESTLE

4.2.3 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PACKAGING FACTOR

4.3.2 TASTE

4.3.3 HEALTH

4.3.4 BRAND LOYALTY

4.3.5 GENDER AND AGE

4.3.6 INCOME

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING CONSUMER PREFERENCE TOWARD DARK AND VEGAN CHOCOLATE

4.4.2 CONSUMERS ARE INTERESTED IN NEW INNOVATIVE FLAVOURS AND TEXTURE

4.4.3 RISING DEMAND FOR PREMIUM CHOCOLATES FOR GIFTING PURPOSES

4.4.4 FUTURE PERSPECTIVE

4.5 MEETING CONSUMER REQUIREMENT

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END-USERS

4.7 SHOPPING BEHAVIOR AND DYNAMICS

4.7.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.7.2 RESEARCH

4.7.3 IMPULSIVE

4.7.4 ADVERTISEMENT

4.7.5 TELEVISION ADVERTISEMENT

4.7.6 ONLINE ADVERTISEMENT

4.7.7 IN-STORE ADVERTISEMENT

4.7.8 OUTDOOR ADVERTISEMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.2 LINE EXTENSION

4.8.3 NEW PACKAGING

4.8.4 RE-LAUNCHED

4.8.5 NEW FORMULATION

4.8.6 DIFFERENTIAL PRODUCT OFFERING

4.8.7 PACKAGE DESIGNING

4.8.8 PRICING ANALYSIS

4.9 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATES

5.1.2 HIGH DEMAND FOR PREMIUM CHOCOLATES IN FESTIVE SEASONS

5.1.3 DEMAND FOR PREMIUM CHOCOLATES OWING TO THE SHIFT TOWARDS A HEALTHY LIFESTYLE

5.1.4 USE OF PREMIUM CHOCOLATE IN THE BAKING INDUSTRY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF VARIOUS SUBSTITUTE

5.3 OPPORTUNITIES

5.3.1 CONTINUOUS FOCUS ON DEVELOPING NEW FLAVORED AND UNIQUE CHOCOLATES

5.3.2 RISING TREND OF ONLINE DISTRIBUTION

5.4 CHALLENGES

5.4.1 RISING COST OF SUPPLY CHAIN

5.4.2 RULES AND REGULATIONS ASSOCIATED WITH PREMIUM CHOCOLATES

6 EUROPE PREMIUM CHOCOLATE MARKET, BY REGION

6.1 EUROPE

6.1.1 GERMANY

6.1.2 U.K.

6.1.3 FRANCE

6.1.4 ITALY

6.1.5 SPAIN

6.1.6 RUSSIA

6.1.7 TURKEY

6.1.8 SWITZERLAND

6.1.9 BELGIUM

6.1.10 NETHERLANDS

6.1.11 REST OF EUROPE

7 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: EUROPE

7.2 ACQUISITION

7.3 NEW PRODUCT DEVELOPMENT

7.4 FACILITY EXPANSION

7.5 NEW APPOINTMENT

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 MARS, INCORPORATED AND ITS AFFILIATES

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT UPDATES

9.2 MONDELĒZ INTERNATIONAL

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 THE HERSHEY COMPANY

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENT

9.4 FERRERO

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT UPDATES

9.5 NESTLÉ

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 ARCOR

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 BARRY CALLEBAUT

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT UPDATES

9.8 CARGILL, INCORPORATED

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT UPDATES

9.9 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG (2022)

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 CLOETTA AB

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 EZAKI GLICO CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENT

9.12 GENERAL MILLS, INC.

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 GHIRARDELLI CHOCOLATE COMPANY

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 MEIJI HOLDINGS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 MORINAGA & CO., LTD.

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENT

9.16 ORION CORP.

9.16.1 COMPANY SNAPSHOT

9.16.2 REVENUE ANALYSIS

9.16.3 PRODUCT PORTFOLIO

9.16.4 RECENT DEVELOPMENTS

9.17 THE KRAFT HEINZ COMPANY

9.17.1 COMPANY SNAPSHOT

9.17.2 REVENUE ANALYSIS

9.17.3 PRODUCT PORTFOLIO

9.17.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

List of Table

TABLE 1 ESTIMATED HAZELNUT CONTENT FOR TOP EUROPE PREMIUM CHOCOLATE COMPANIES

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE PREMIUM CHOCOLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 EUROPE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 EUROPE PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 EUROPE PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 7 EUROPE WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 EUROPE INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 EUROPE ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 10 EUROPE ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 11 EUROPE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 12 EUROPE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 13 EUROPE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 14 EUROPE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 15 EUROPE CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 16 EUROPE CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 17 EUROPE RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 18 EUROPE RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 19 EUROPE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 20 EUROPE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 21 EUROPE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 22 EUROPE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 23 EUROPE INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 EUROPE PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 25 EUROPE PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 EUROPE PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 27 EUROPE PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 28 EUROPE FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 EUROPE PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 30 EUROPE PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 31 EUROPE STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 EUROPE NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 GERMANY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 GERMANY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 GERMANY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 36 GERMANY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 GERMANY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 GERMANY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 39 GERMANY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 40 GERMANY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 41 GERMANY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 42 GERMANY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 43 GERMANY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 44 GERMANY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 45 GERMANY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 46 GERMANY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 47 GERMANY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 48 GERMANY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 49 GERMANY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 50 GERMANY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 51 GERMANY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 52 GERMANY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 GERMANY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 GERMANY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 55 GERMANY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 56 GERMANY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 57 GERMANY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 GERMANY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 59 GERMANY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 60 GERMANY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 GERMANY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 U.K. PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 U.K. PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 U.K. PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 65 U.K. WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 U.K. INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 U.K. ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 68 U.K. ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 69 U.K. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 70 U.K. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 71 U.K. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 72 U.K. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 73 U.K. CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 74 U.K. CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 75 U.K. RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 76 U.K. RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 77 U.K. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 78 U.K. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 79 U.K. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 80 U.K. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 81 U.K. INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 U.K. PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 83 U.K. PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 84 U.K. PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 85 U.K. PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 86 U.K. FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.K. PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 88 U.K. PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 89 U.K. STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.K. NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 FRANCE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 FRANCE PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 FRANCE PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 94 FRANCE WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 FRANCE INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 FRANCE ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 97 FRANCE ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 98 FRANCE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 99 FRANCE HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 100 FRANCE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 101 FRANCE PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 102 FRANCE CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 103 FRANCE CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 104 FRANCE RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 105 FRANCE RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 106 FRANCE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 107 FRANCE PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 108 FRANCE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 109 FRANCE OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 110 FRANCE INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 FRANCE PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 112 FRANCE PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 113 FRANCE PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 114 FRANCE PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 115 FRANCE FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 FRANCE PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 117 FRANCE PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 118 FRANCE STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 FRANCE NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 ITALY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 ITALY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 ITALY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 123 ITALY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 ITALY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 ITALY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 126 ITALY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 127 ITALY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 128 ITALY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 129 ITALY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 130 ITALY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 131 ITALY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 132 ITALY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 133 ITALY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 134 ITALY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 135 ITALY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 136 ITALY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 137 ITALY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 138 ITALY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 139 ITALY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 ITALY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 141 ITALY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 142 ITALY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 143 ITALY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 144 ITALY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 145 ITALY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 146 ITALY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 147 ITALY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 ITALY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 SPAIN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 150 SPAIN PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 SPAIN PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 152 SPAIN WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 SPAIN INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 154 SPAIN ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 155 SPAIN ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 156 SPAIN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 157 SPAIN HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 158 SPAIN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 159 SPAIN PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 160 SPAIN CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 161 SPAIN CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 162 SPAIN RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 163 SPAIN RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 164 SPAIN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 165 SPAIN PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 166 SPAIN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 167 SPAIN OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 168 SPAIN INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 SPAIN PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 170 SPAIN PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 171 SPAIN PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 172 SPAIN PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 173 SPAIN FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 SPAIN PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 175 SPAIN PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 176 SPAIN STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 177 SPAIN NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 RUSSIA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 179 RUSSIA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 RUSSIA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 181 RUSSIA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 RUSSIA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 183 RUSSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 184 RUSSIA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 185 RUSSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 186 RUSSIA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 187 RUSSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 188 RUSSIA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 189 RUSSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 190 RUSSIA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 191 RUSSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 192 RUSSIA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 193 RUSSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 194 RUSSIA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 195 RUSSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 196 RUSSIA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 197 RUSSIA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 198 RUSSIA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 199 RUSSIA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 200 RUSSIA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 201 RUSSIA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 202 RUSSIA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 RUSSIA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 204 RUSSIA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 205 RUSSIA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 206 RUSSIA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 207 TURKEY PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 208 TURKEY PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 209 TURKEY PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 210 TURKEY WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 211 TURKEY INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 212 TURKEY ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 213 TURKEY ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 214 TURKEY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 215 TURKEY HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 216 TURKEY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 217 TURKEY PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 218 TURKEY CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 219 TURKEY CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 220 TURKEY RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 221 TURKEY RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 222 TURKEY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 223 TURKEY PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 224 TURKEY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 225 TURKEY OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 226 TURKEY INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 227 TURKEY PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 228 TURKEY PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 229 TURKEY PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 230 TURKEY PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 231 TURKEY FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 232 TURKEY PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 233 TURKEY PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 234 TURKEY STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 235 TURKEY NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 236 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 237 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 238 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 239 SWITZERLAND WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 240 SWITZERLAND INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 241 SWITZERLAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 242 SWITZERLAND ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 243 SWITZERLAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 244 SWITZERLAND HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 245 SWITZERLAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 246 SWITZERLAND PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 247 SWITZERLAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 248 SWITZERLAND CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 249 SWITZERLAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 250 SWITZERLAND RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 251 SWITZERLAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 252 SWITZERLAND PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 253 SWITZERLAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 254 SWITZERLAND OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 255 SWITZERLAND INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 256 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 257 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 258 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 259 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 260 SWITZERLAND FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 261 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 262 SWITZERLAND PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 263 SWITZERLAND STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 264 SWITZERLAND NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 265 BELGIUM PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 266 BELGIUM PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 267 BELGIUM PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 268 BELGIUM WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 269 BELGIUM INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 270 BELGIUM ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 271 BELGIUM ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 272 BELGIUM HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 273 BELGIUM HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 274 BELGIUM PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 275 BELGIUM PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 276 BELGIUM CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 277 BELGIUM CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 278 BELGIUM RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 279 BELGIUM RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 280 BELGIUM PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 281 BELGIUM PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 282 BELGIUM OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 283 BELGIUM OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 284 BELGIUM INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 285 BELGIUM PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 286 BELGIUM PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 287 BELGIUM PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 288 BELGIUM PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 289 BELGIUM FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 290 BELGIUM PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 291 BELGIUM PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 292 BELGIUM STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 293 BELGIUM NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 294 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 295 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 296 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 297 NETHERLANDS WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 298 NETHERLANDS INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 299 NETHERLANDS ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 300 NETHERLANDS ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 301 NETHERLANDS HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 302 NETHERLANDS HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 303 NETHERLANDS PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 304 NETHERLANDS PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 305 NETHERLANDS CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 306 NETHERLANDS CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 307 NETHERLANDS RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 308 NETHERLANDS RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 309 NETHERLANDS PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 310 NETHERLANDS PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 311 NETHERLANDS OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 312 NETHERLANDS OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 313 NETHERLANDS INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 314 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 315 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 316 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 317 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 318 NETHERLANDS FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 319 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 320 NETHERLANDS PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 321 NETHERLANDS STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 322 NETHERLANDS NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 323 REST OF EUROPE PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 2 EUROPE PREMIUM CHOCOLATE MARKET : DATA TRIANGULATION

FIGURE 3 EUROPE PREMIUM CHOCOLATE MARKET : DROC ANALYSIS

FIGURE 4 EUROPE PREMIUM CHOCOLATE MARKET : EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE PREMIUM CHOCOLATE MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 EUROPE PREMIUM CHOCOLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE PREMIUM CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE PREMIUM CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE PREMIUM CHOCOLATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE PREMIUM CHOCOLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE PREMIUM CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE PREMIUM CHOCOLATE MARKET : SEGMENTATION

FIGURE 14 THE RISE IN POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATE ACROSS THE GLOBE IS EXPECTED TO DRIVE THE EUROPE PREMIUM CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE MILK CHOCOLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE PREMIUM CHOCOLATE MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN OF THE EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE PREMIUM CHOCOLATE MARKET

FIGURE 18 EUROPE PREMIUM CHOCOLATE MARKET: SNAPSHOT (2022)

FIGURE 19 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022)

FIGURE 20 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 EUROPE PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 EUROPE PREMIUM CHOCOLATE MARKET: BY TYPE (2023 - 2030)

FIGURE 23 EUROPE PREMIUM CHOCOLATE MARKET: COMPANY SHARE 2022 (%)

Europe Premium Chocolate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Europe Premium Chocolate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Europe Premium Chocolate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.