The expanding trend of homemade culinary practices significantly boosts demand for sauces, dressings, and condiments as more consumers actively prepare meals at home and experiment with diverse cuisines. With increased time spent in home kitchens, individuals seek convenient yet flavorful solutions to enhance taste without investing excessive time in complex cooking processes. Sauces and condiments serve as essential flavor enhancers, allowing home cooks to recreate restaurant-style dishes, regional specialties, and international cuisines with minimal effort. This growing interest in cooking from scratch directly translates into higher household consumption of packaged sauces, dressings, and condiments.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-sauces-dressings-and-condiments-market

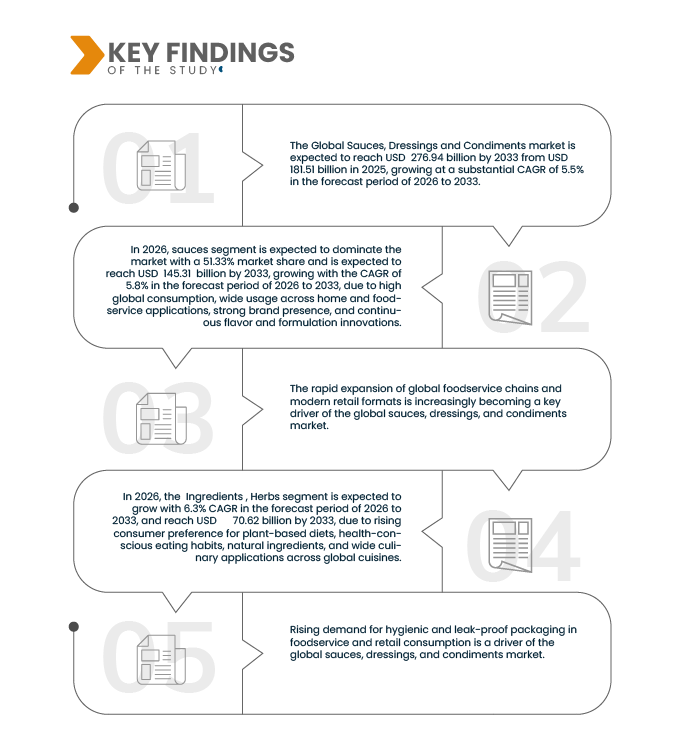

Data Bridge market research analyzes that The Global Sauces, Dressings and Condiments Market is expected to reach U.S.D 276.94 billion by 2033 from U.S.D 181.51 billion in 2025, growing at a substantial CAGR of 5.5% in the forecast period of 2026 to 2033.

Key Findings of the Study

Rising Preference For Global Flavor Exploration

The rising preference for global flavor exploration significantly boosts demand for sauces, dressings, and condiments by expanding consumers’ taste preferences beyond traditional and local cuisines. As people become more exposed to international food cultures through travel, social media, food blogs, cooking shows, and restaurant experiences, they increasingly seek to recreate these global flavors at home. Sauces and condiments serve as the most accessible and convenient way to experience international cuisines such as Asian, Mediterranean, Middle Eastern, Latin American, and African foods without requiring complex cooking techniques. This drives higher consumption of products like soy sauce, chili sauces, tahini, pesto, peri-peri, and specialty dressings. Additionally, global flavor exploration encourages experimentation and repeat purchases, directly increasing consumption frequency. Consumers often buy multiple sauce variants to try different cuisines, leading to basket expansion and premiumization.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable to 2018-2024)

|

|

Quantitative Units

|

Revenue in U.S.D Billion

|

|

Segments Covered

|

By Grade (Sauces, Condiments, and Dressings), by Ingredients (Vegetable, Fruits, Spices, Food Additives, and Herbs), by Packaging Type (Bottles, Pouch, Sachets, Containers, Cans, Boxes, Cups, Bag In Box, and Packs), by Packaging Material (Plastic, Glass, Paper and Paperboard, and Metal ), by Packaging Size (250 ML – 500 ML, 50 ML – 250 ML, 500 ML – 1L, 1L – 5L, Less than 50 ML, and More than 5L) by End-use (Retail Food, Food Services, and Food Processors,) By Distribution Channel (Offline-Trade and Online Trade)

|

|

Countries Covered

|

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework..

|

Segment Analysis

The global sauces, dressings and condiments market is segmented into seven segments based on type, ingredients, packaging type, packaging material, packaging size, end-use, and distribution channel.

- On the basis of Type, the market is segmented into sauces, condiments, dressings.

In 2026, the sauces segment is expected to dominate the market

In 2026, the sauces segment is expected to dominate with 51.33% market share. The sauces segment is driven by rising global consumption of convenience foods, expanding quick-service restaurant chains, and growing preference for ready-to-use flavor solutions. Increasing urbanization, busy lifestyles, and experimentation with international cuisines are boosting demand for cooking sauces, table sauces, and specialty variants across both developed and emerging markets.

- On the basis of Ingredients, the global sauces, dressings and condiments market is segmented into vegetable, fruits, spices, food additives, herbs, others.

In 2026, the vegetable segment is expected to dominate the market

In 2026, the vegetable segment is expected to dominate with 25.88% market share and U.S., growing with the highest CAGR of 5.3% in the forecast period of 2026 to 2033. Vegetable-based sauces are gaining traction due to increasing health consciousness, clean-label preferences, and demand for plant-forward diets. Consumers favor products made from tomatoes, peppers, onions, and herbs due to their natural taste, nutritional value, and perceived freshness, supporting strong adoption in household cooking and foodservice applications.

- On the basis of packaging type, the global sauces, dressings and condiments market is segmented into bottles, pouch, sachets, containers, cans, boxes, cups, bag in box, packs, others.

In 2026, the bottles segment is expected to dominate the market

In 2026, the bottles segment is expected to dominate with 29.40% market share and, growing with the highest CAGR of 6.0%in the forecast period of 2026 to 2033. Bottle packaging dominates due to its convenience, resealability, controlled dispensing, and suitability for both retail shelves and foodservice use. Bottles provide strong product visibility, branding space, and protection against contamination. Their compatibility with automated filling lines and multiple material options supports large-scale production and wide market penetration.

- On the basis of packaging material, the global sauces, dressings and condiments market is segmented into plastic, glass, paper and paperboard, metal, others.

In 2026, the plastic segment is expected to dominate the market

In 2026, the plastic segment is expected to dominate with 46.31% market share and, growing with the highest CAGR of 5.6% in the forecast period of 2026 to 2033. Plastic packaging is driven by its lightweight nature, cost efficiency, durability, and ease of transportation. Compared to glass, plastic reduces breakage losses and logistics costs, making it ideal for mass-market sauces. Advancements in recyclable and food-grade plastics further support adoption amid sustainability-driven packaging innovations.

- On the basis of Packaging Size, the Global Sauces, dressings and condiments Market is segmented into 250 ML – 500 ML, 50 ML – 250 ML, 500 ML – 1L, 1L – 5L, less than 50 ML, More than 5L.

In 2026, the 250 ML – 500 ML segment is expected to dominate the market

In 2026, the 250 ML – 500 ML segment is expected to dominate with 32.81% market share and U.S., growing with the highest CAGR of 5.4% in the forecast period of 2026 to 2033. The 250–500 ml pack size is driven by its balance between affordability, convenience, and household consumption needs. This size suits regular usage without frequent repurchasing, making it popular among urban families. It also aligns well with retail pricing strategies and shelf optimization across supermarkets and neighbourhood stores.

- On the basis of end-U.S.er, the global sauces, dressings and condiments market is segmented into 2 retail food, food services, food processors, others.

In 2026, the retail food segment is expected to dominate the market

In 2026, the retail food segment is expected to dominate with 59.27% market share and U.S., growing with the highest CAGR of 5.5% in the forecast period of 2026 to 2033. Retail food consumption drives the market due to increasing home cooking, growth of modern retail formats, and wider product availability. Consumers prefer retail sauces for daily meal preparation, flavor customization, and cost savings compared to dining out. Promotional pricing and private-label expansion further support retail segment growth.

- On the basis of distribution channel, the global sauces, dressings and condiments market is segmented into offline-trade, online trade.

In 2026, the offline-trade segment is expected to dominate the market

In 2026, the offline-trade segment is expected to dominate with 77.89% market share and, growing with the highest CAGR of 5.4% in the forecast period of 2026 to 2033. Offline trade remains strong due to consumer preference for physical inspection, immediate availability, and brand familiarity. Supermarkets, hypermarkets, and convenience stores offer extensive product assortments, in-store promotions, and impulse purchase opportunities. In emerging economies, traditional retail networks continue to dominate sauce and condiment sales volumes.

Major Players

Kikkoman Corporation (Japan), Bolton Group (Italy), TAS Gourmet Sauce Co (U.S.), Del Monte Foods (U.S.), Nestlé (Switzerland), McCormick & Company (U.S.), The Kraft Heinz Company (U.S.), General Mills (U.S.), Unilever Group (UK), Kerry Group plc (Ireland), Kewpie Corporation (Japan), Tatua (New Zealand), Funacho Soy Sauce (Japan), Bay Valley Foods (U.S.), AFP Advanced Food Products (U.S.), Berner Foods (U.S.), Conagra Brands (U.S.), Ragu (U.S.), Ricos (U.S.), Prego (U.S.), and Barilla Group (Italy)among others.

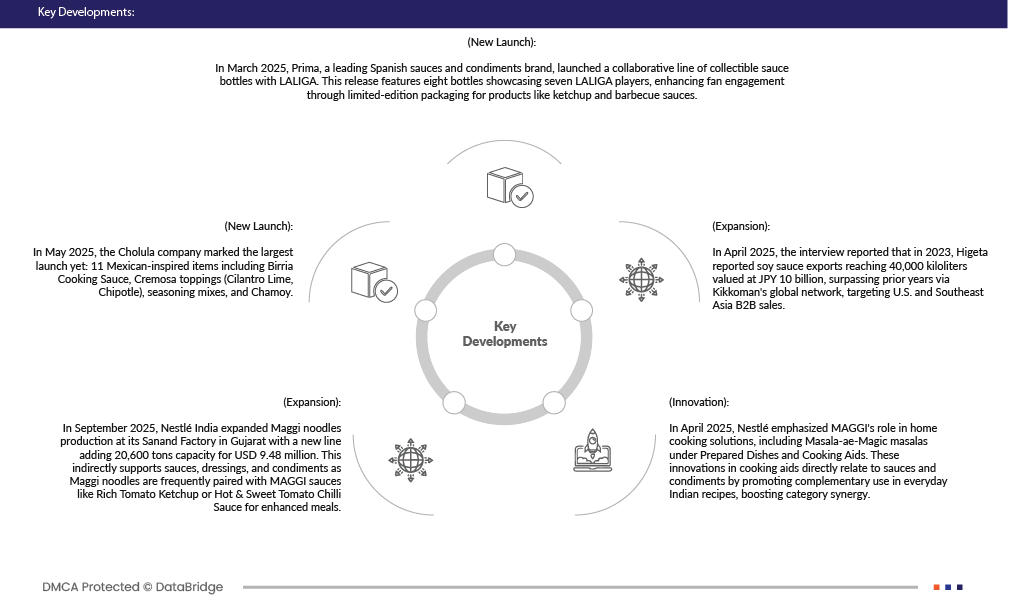

Market Developments

- In March 2025, Prima, a leading Spanish sauces and condiments brand, launched a collaborative line of collectible sauce bottles with LALIGA. This release features eight bottles showcasing seven LALIGA players, enhancing fan engagement through limited-edition packaging for products like ketchup and barbecue sauces.

- In July 2025, Del Monte Foods announced it has voluntarily initiated Chapter 11 proceedings to pursue a value-maximizing sale process.

- In September 2025, Nestlé India expanded Maggi noodles production at its Sanand Factory in Gujarat with a new line adding 20,600 tons capacity for U.S.D 9.48 million. This indirectly supports sauces, dressings, and condiments as Maggi noodles are frequently paired with MAGGI sauces like Rich Tomato Ketchup or Hot & Sweet Tomato Chilli Sauce for enhanced meals.

- In April 2025, Nestlé emphasized MAGGI's role in home cooking solutions, including Masala-ae-Magic masalas under Prepared Dishes and Cooking Aids. These innovations in cooking aids directly relate to sauces and condiments by promoting complementary use in everyday Indian recipes, boosting category synergy.

As per Data Bridge Market Research analysis:

For more detailed information about the Global Sauces, Dressings and Condiments Market report, click here – https://www.databridgemarketresearch.com/reports/global-sauces-dressings-and-condiments-market