The rapid expansion of data centers and cloud computing infrastructure in the U.S. is a major driver for the twisted pair Copper cable market. Accelerating adoption of cloud-based services across industries such as IT, finance, healthcare, retail, and government has led to large-scale investments in hyperscale and colocation data centers. These facilities require reliable, high-performance, and cost-efficient networking solutions to support high data traffic, low latency, and continuous connectivity. Twisted pair copper cables are widely used within data centers for structured cabling systems, including horizontal cabling, patch cords, and equipment connections. Moreover, the twisted pair cable come with several feature and advantages such as durability, ease of installation, and compatibility with existing network infrastructure which drive its demand in the market.

Additionally, the rollout of edge data centers to support applications such as artificial intelligence, IoT, and real-time analytics further increases demand for twisted pair cabling across urban and suburban locations. Continuous upgrades to higher-category twisted pair cables to support faster data transmission rates also contribute to rising consumption. This sustained expansion of cloud computing and data center construction acts as a strong driver for the growth of the market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-copper-cable-market

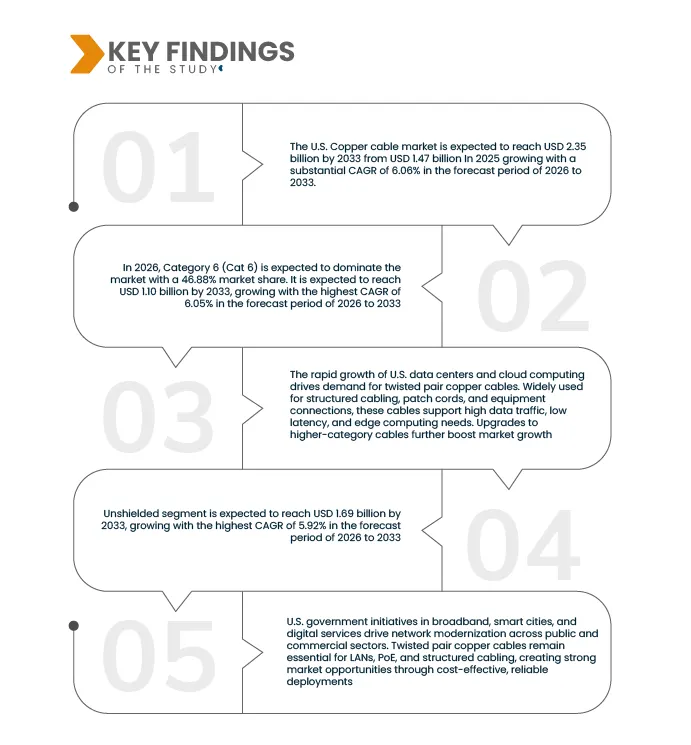

The U.S. Copper Cable Market is expected to reach USD 2.35 billion by 2033 from USD 1.47 billion In 2025 growing with a substantial CAGR of 6.06% in the forecast period of 2026 to 2033.

Key Findings of the Study

the Rapid Rise of Smart Buildings and Widespread IOT Deployments Across the U.S.

Increasing adoption of smart home technologies and intelligent commercial buildings is accelerating demand for reliable, low-latency connectivity to support automation, monitoring, and control systems. Twisted pair cables are extensively used to connect IoT devices, sensors, and controllers within buildings, enabling stable data transmission for applications such as access control, surveillance systems, HVAC management, lighting control, and energy optimization. These cabling systems support high device density and continuous data flow while maintaining cost efficiency and ease of integration with existing network infrastructure. As enterprises, residential developers, and facility managers prioritize smart infrastructure to improve operational efficiency, security, and user experience, structured cabling installations continue to expand. The growing emphasis on digital building management systems and connected environments further strengthens the role of twisted pair copper cables in short- and medium-distance communication networks. With smart technologies becoming standard across residential, commercial, and institutional sectors, the sustained growth of smart buildings and IoT deployments acts as a strong driver for the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

By Product (Category 6 (Cat 6), Category 5e (Cat 5e), Category 6a (Cat 6a), Category 7 (Cat 7), Category 6e, and Others), Type (Unshielded, and Shielded), Application (Datacom, Commercial Buildings, Video & Security, and Others), Installation Environment (Indoor, and Outdoor), Distribution Channel (Direct Tender, Online, Offline)

|

|

Countries Covered

|

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

U.S. Copper cable market is categorized into five notable segments which are based on product, type, application, installation environment, and distribution channel.

- On the basis of product, the market is segmented into category 6 (cat 6), category 5e (cat 5e), category 6a (cat 6a), category 7 (cat 7), category 6e, and others.

In 2026, Category 6 (Cat 6) segment is expected to dominate the market

In 2026, Category 6 (Cat 6) segment is expected to dominate due to its balanced combination of cost-effectiveness, enhanced performance, and widespread adoption across commercial and residential applications. Cat 6 cables support higher data transfer speeds and improved bandwidth compared to older standards like Cat 5e, making them ideal for modern networking demands such as high-speed internet, VoIP, and multimedia streaming.

- On the basis of type, the market is segmented into unshielded, and shielded.

In 2026, unshielded segment is expected to dominate the market

In 2026, unshielded segment is expected to dominate the market due to its cost-effectiveness, ease of installation, and sufficient performance for most standard networking environments. Unshielded cables (UTP) are widely preferred in commercial and residential settings where electromagnetic interference (EMI) is minimal, reducing the need for additional shielding.

- On the basis of application, the market is segmented into datacom, commercial buildings, video & security, and others.

In 2026, Datacom segment is expected to dominate the market

In 2026, Datacom segment is expected to dominate the market due to the rapid expansion of data centers, cloud computing, and high-speed internet infrastructure across the U.S. The growing demand for faster and more reliable data transmission to support bandwidth-intensive applications such as video streaming, online gaming, and large-scale enterprise networking drives the need for advanced copper cabling solutions in datacom environments.

- On the basis of installation environment, the market is segmented into indoor, and outdoor.

In 2026, Indoor segment is expected to dominate the market

In 2026, Indoor segment is expected to dominate the market due to the increasing deployment of structured cabling systems within commercial buildings, data centers, and residential complexes. Indoor environments typically require extensive network infrastructure to support high-speed data communication, voice, and video services, driving demand for reliable and easy-to-install copper cables.

- On the basis of distribution channel, the market is segmented into direct tender, online, and offline.

In 2026, Direct Tender segment is expected to dominate the market

In 2026, Direct Tender segment is expected to dominate the market due to the increasing preference of large enterprises, government bodies, and infrastructure projects for bulk procurement through negotiated contracts. Direct tendering allows buyers to secure competitive pricing, ensure consistent supply, and customize orders according to specific technical requirements.

Major Players

CommScope (U.S.), Prysmian (U.S.), Nexans (U.S.), Belden Inc. (U.S.), and Panduit Corp (U.S.)

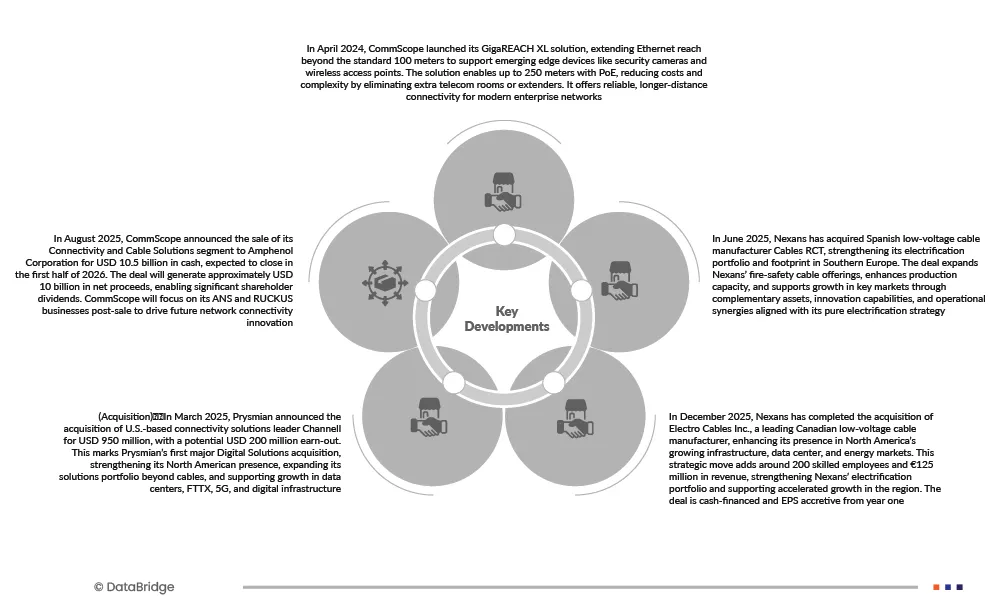

Market Developments

- In April 2024, CommScope launched its GigaREACH XL solution, extending Ethernet reach beyond the standard 100 meters to support emerging edge devices like security cameras and wireless access points. The solution enables up to 250 meters with PoE, reducing costs and complexity by eliminating extra telecom rooms or extenders. It offers reliable, longer-distance connectivity for modern enterprise networks.

- In August 2025, CommScope announced the sale of its Connectivity and Cable Solutions segment to Amphenol Corporation for USD 10.5 billion in cash, expected to close in the first half of 2026. The deal will generate approximately USD 10 billion in net proceeds, enabling significant shareholder dividends. CommScope will focus on its ANS and RUCKUS businesses post-sale to drive future network connectivity innovation.

- In March 2025, Prysmian announced the acquisition of U.S.-based connectivity solutions leader Channell for USD 950 million, with a potential USD 200 million earn-out. This marks Prysmian’s first major Digital Solutions acquisition, strengthening its North American presence, expanding its solutions portfolio beyond cables, and supporting growth in data centers, FTTX, 5G, and digital infrastructure.

- In December 2025, Nexans has completed the acquisition of Electro Cables Inc., a leading Canadian low-voltage cable manufacturer, enhancing its presence in North America’s growing infrastructure, data center, and energy markets. This strategic move adds around 200 skilled employees and €125 million in revenue, strengthening Nexans’ electrification portfolio and supporting accelerated growth in the region. The deal is cash-financed and EPS accretive from year one.

- In June 2025, Nexans has acquired Spanish low-voltage cable manufacturer Cables RCT, strengthening its electrification portfolio and footprint in Southern Europe. The deal expands Nexans’ fire-safety cable offerings, enhances production capacity, and supports growth in key markets through complementary assets, innovation capabilities, and operational synergies aligned with its pure electrification strategy.

As per Data Bridge Market Research analysis:

For more detailed information about the U.S. Copper cable market report, click here – https://www.databridgemarketresearch.com/reports/us-copper-cable-market