Rapid expansion in construction and infrastructure activities across India significantly increases the consumption of SBS polymer, particularly in modified bitumen used for road surfacing, highways, bridges, and roofing applications. Large-scale government investments in transportation infrastructure, urban development, and smart city projects have led to higher adoption of polymer-modified bitumen, where SBS is preferred for its ability to enhance elasticity, temperature resistance, and long-term durability.

At the same time, rising footwear production, supported by growing domestic consumption and export-oriented manufacturing, drives demand for SBS in shoe soles and components that require flexibility, abrasion resistance, and comfort. Expanding automotive manufacturing further strengthens SBS usage in applications such as interior components, seals, and polymer blends, where performance and resilience are critical. In parallel, steady growth in the adhesives and sealants sector, fueled by construction, packaging, and industrial assembly, increases the use of SBS due to its superior bonding strength and elastic recovery. Collectively, sustained demand from these high-growth end-use industries directly drives higher consumption volumes, improved capacity utilization, and continued market expansion for SBS polymer in India.

Access Full Report @ https://www.databridgemarketresearch.com/reports/india-sbs-polymer-market

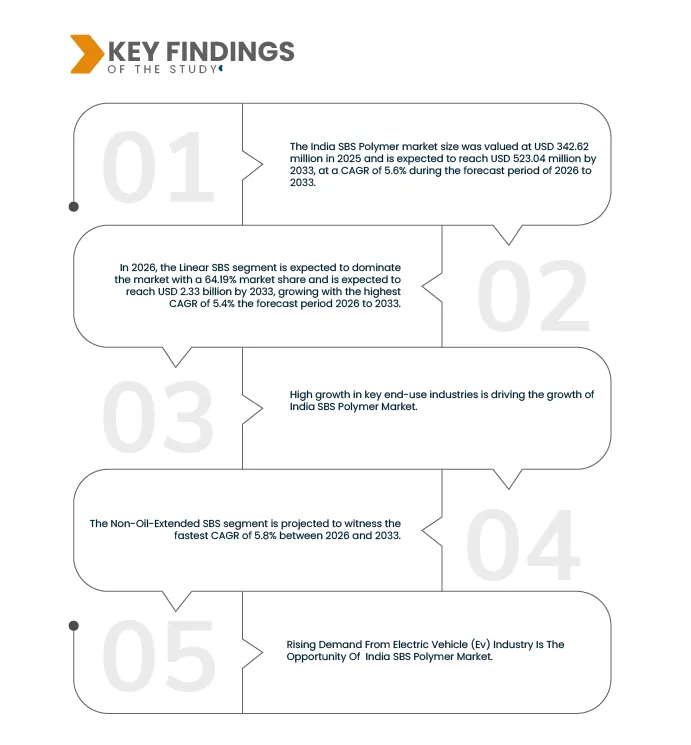

Data Bridge market research analyzes that the India SBS Polymer Market size was valued at USD 342.62 million in 2025 and is expected to reach USD 523.04 million by 2033, at a CAGR of 5.6% during the forecast period of 2026 to 2033.

Key Findings of the Study

High growth in key end-use industries

Rapid expansion in construction and infrastructure activities across India significantly increases the consumption of SBS polymer, particularly in modified bitumen used for road surfacing, highways, bridges, and roofing applications. Large-scale government investments in transportation infrastructure, urban development, and smart city projects have led to higher adoption of polymer-modified bitumen, where SBS is preferred for its ability to enhance elasticity, temperature resistance, and long-term durability. At the same time, rising footwear production, supported by growing domestic consumption and export-oriented manufacturing, drives demand for SBS in shoe soles and components that require flexibility, abrasion resistance, and comfort. Expanding automotive manufacturing further strengthens SBS usage in applications such as interior components, seals, and polymer blends, where performance and resilience are critical. In parallel, steady growth in the adhesives and sealants sector, fueled by construction, packaging, and industrial assembly, increases the use of SBS due to its superior bonding strength and elastic recovery. Collectively, sustained demand from these high-growth end-use industries directly drives higher consumption volumes, improved capacity utilisation, and continued market expansion for SBS polymer in India.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product (Linear SBS and Radial SBS / Star SBS [R-SBS]), Type (Non-Oil-Extended SBS and Oil-Extended SBS), Styrene Content (Low Styrene SBS, Medium Styrene SBS, and High Styrene SBS), Application (Asphalt Modification, Road Mastics, Shoe Soles & Footwear Components, Polymer Modified Bitumen, Adhesives & Sealants, Construction Chemicals, Roofing Membrane, and Others), End User (Footwear Industry, Road Construction & Infrastructure, Adhesives & Sealants Industry, Automotive Industry, Construction Industry, Packaging Industry, and Others), Distribution Channel (Direct and Indirect)

|

|

Countries Covered

|

India

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

The India SBS Polymer Market is segmented into six notable segments based on the product, type, styrene content, application, end user and distribution channel.

- On the basis of product, the India SBS Polymers Market is segmented into Linear SBS and Radial SBS / Star SBS (R-SBS).

In 2026, the Linear SBS segment is expected to dominate the market

In 2026, the Linear SBS segment is expected to dominate the market with 64.31% share and 5.4% of CAGR due widespread availability, cost-effectiveness, simpler molecular structure, and ease of processing, which make it the preferred choice for high-volume applications such as footwear components, general-purpose adhesives, and construction materials.

- On the basis of type, the India SBS Polymers Market is segmented into non-oil-extended SBS and oil-extended SBS.

In 2026, the Non-Oil-Extended SBS furnace segment is expected to dominate the market

In 2026, the Non-Oil-Extended SBS segment is expected to dominate the market with 61.02% share and 5.8% CAGR due to owing to its superior mechanical strength, better resistance to deformation, and consistent long-term performance, making it suitable for road construction and infrastructure projects requiring durability and reliability.

- On the basis of styrene content, the India SBS Polymers Market is segmented into low styrene SBS, medium styrene SBS, and high styrene SBS.

In 2026, the medium styrene SBS segment is expected to dominate the market

In 2026, the medium styrene SBS segment is expected to dominate the market with 69.93% share and 5.7% of CAGR due to its balanced properties of flexibility and stiffness, allowing broad adoption across footwear, adhesives, construction, and asphalt modification applications s.

- On the basis of application, the India SBS Polymers Market is segmented into asphalt modification, road mastics, shoe soles & footwear components, polymer-modified bitumen, adhesives & sealants, construction chemicals, roofing membrane, and others

In 2026, the Road Mastics segment is expected to dominate the market

In 2026, the Road Mastics segment is expected to dominate the market with 32.09% share and 5.7% of CAGR due to as SBS polymers significantly improve pavement durability, fatigue resistance, and service life.

- On the basis of end user, the India SBS Polymers Market is segmented into footwear industry, road construction & infrastructure, adhesives & sealants industry, automotive industry, construction industry, packaging industry, and others.

In 2026, the road construction & infrastructure segment is expected to dominate the market

In 2026, the road construction & infrastructure segment is expected to dominate the market with 32.09% share and 5.8% of CAGR due to continued investments in highway expansion, urban road upgrades, and adoption of polymer-modified materials in public infrastructure projects.

- On the basis of distribution channel, the India SBS Polymers Market is segmented into direct and indirect channels.

In 2026, the direct segment is expected to dominate the market

In 2026, the direct segment is expected to dominate the market with 78.83% share and 5.6% of CAGR due to direct procurement by large contractors and manufacturers, enabling better pricing control, consistent supply, and technical collaboration

Major Players

Sinopec (China), LG Chem Ltd. (South Korea), Kraton Corporation (U.S.), TSRC Corporation (Taiwan), Versalis S.p.A. (Italy)

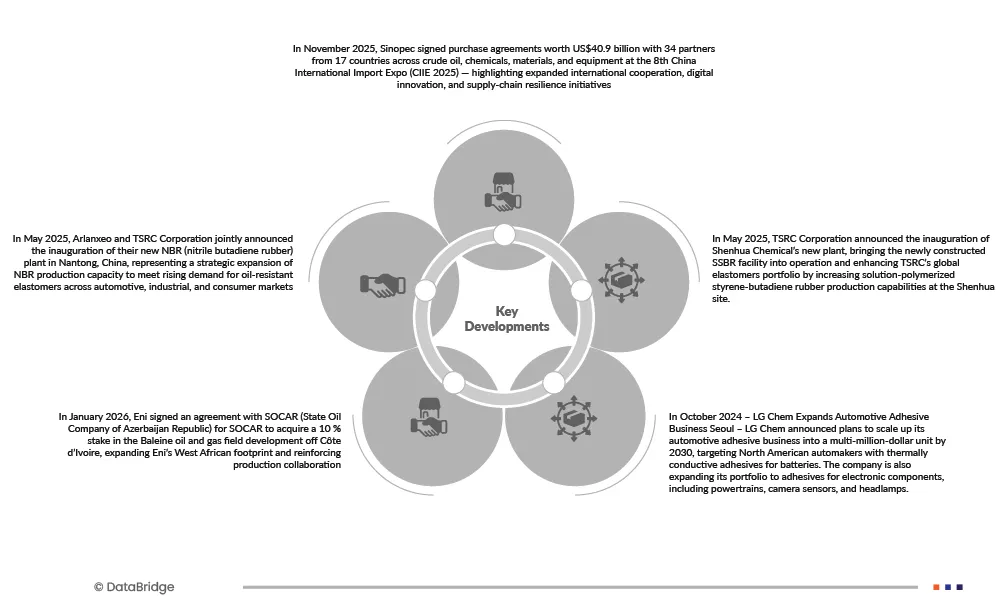

Market Developments

- In November 2025, Sinopec signed purchase agreements worth US$40.9 billion with 34 partners from 17 countries across crude oil, chemicals, materials, and equipment at the 8th China International Import Expo (CIIE 2025) — highlighting expanded international cooperation, digital innovation, and supply-chain resilience initiatives..

- In October 2024, LG Chem Expands Automotive Adhesive Business Seoul – LG Chem announced plans to scale up its automotive adhesive business into a multi-million-dollar unit by 2030, targeting North American automakers with thermally conductive adhesives for batteries. The company is also expanding its portfolio to adhesives for electronic components, including powertrains, camera sensors, and headlamps.

- In September 2025, a groundbreaking ceremony was held for a new SSBR (Solution-SBR) production line at Shenhua Chemical, marking the start of construction of expanded elastomer manufacturing capacity in response to growing global demand for performance rubber materials used in high-performance tires and industrial applications.

- In May 2025, Arlanxeo and TSRC Corporation jointly announced the inauguration of their new NBR (nitrile butadiene rubber) plant in Nantong, China, representing a strategic expansion of NBR production capacity to meet rising demand for oil-resistant elastomers across automotive, industrial, and consumer markets.

- In January 2026, Eni signed an agreement with SOCAR (State Oil Company of Azerbaijan Republic) for SOCAR to acquire a 10 % stake in the Baleine oil and gas field development off Côte d’Ivoire, expanding Eni’s West African footprint and reinforcing production collaboration.

As per Data Bridge Market Research analysis:

For more detailed information about the India SBS Polymer Market report, click here – https://www.databridgemarketresearch.com/reports/india-sbs-polymer-market