Europe Feed Yeast Market

Taille du marché en milliards USD

TCAC :

%

USD

461.83 Million

USD

658.16 Million

2024

2032

USD

461.83 Million

USD

658.16 Million

2024

2032

| 2025 –2032 | |

| USD 461.83 Million | |

| USD 658.16 Million | |

|

|

|

|

Segmentation du marché européen des levures alimentaires par type ( levures vivantes /probiotiques, levures usées, dérivés de levures, levures autolysées et autres), forme (sèches, liquides et granulés), type d'élevage (volailles, porcs, ruminants, bovins, aquaculture, animaux de compagnie, équidés et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la levure alimentaire

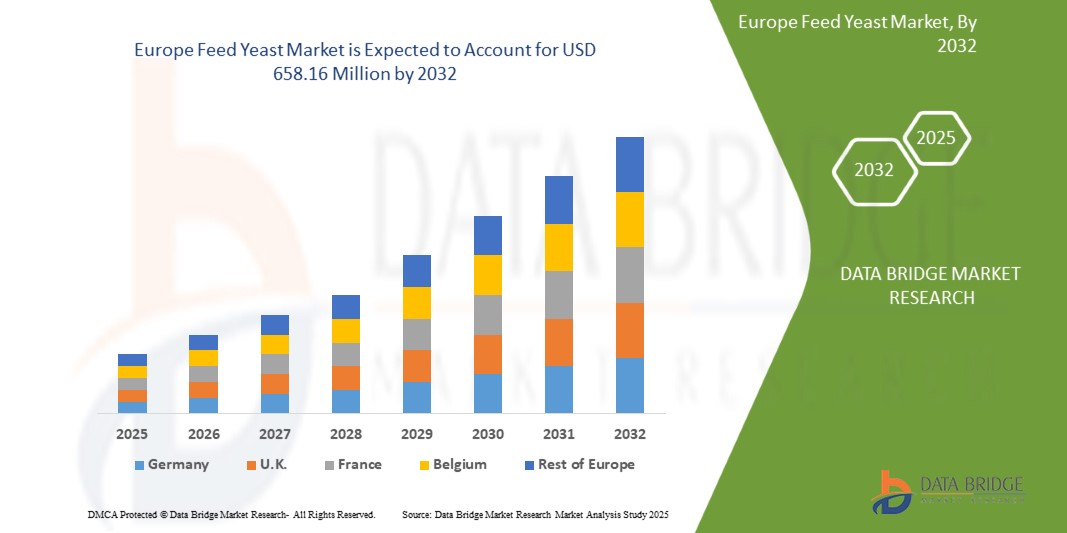

- La taille du marché européen de la levure alimentaire était évaluée à 461,83 millions USD en 2024 et devrait atteindre 658,16 millions USD d'ici 2032 , à un TCAC de 4,75 % au cours de la période de prévision.

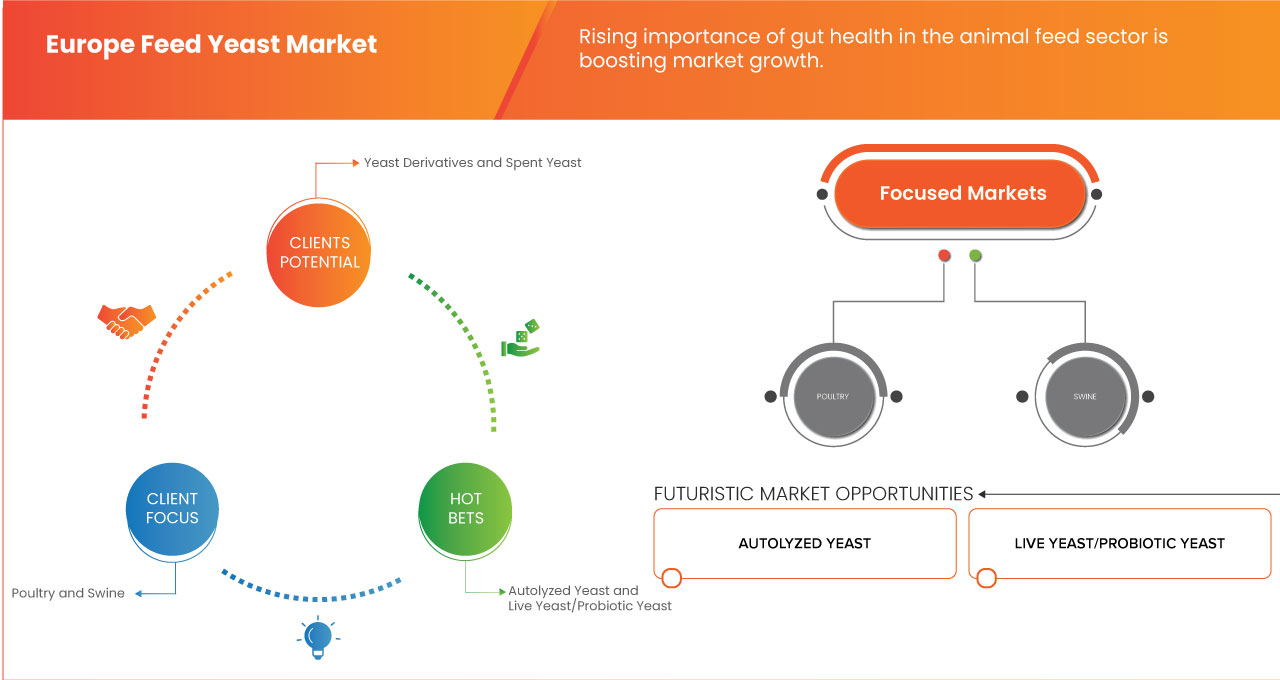

- Cette croissance est tirée par des facteurs tels que la croissance du marché des levures alimentaires, l'évolution de la tendance vers l'incorporation d'additifs alimentaires naturels comme solutions durables et l'importance croissante de la santé intestinale dans le secteur de l'alimentation animale.

Analyse du marché des levures alimentaires

- En Europe, les éleveurs privilégient de plus en plus l'enrichissement en protéines dans l'alimentation animale pour stimuler la croissance animale, le développement musculaire et la productivité globale.

- La demande croissante d'une production animale efficace, en particulier dans les secteurs porcin, avicole et laitier, entraîne un besoin de sources de protéines digestibles de haute qualité.

- L'industrie européenne de l'élevage connaît une forte évolution vers la durabilité et les pratiques d'alimentation naturelles, motivée par la sensibilisation croissante des consommateurs aux impacts environnementaux et sanitaires de la production alimentaire.

- Le segment des levures vivantes/levures probiotiques devrait dominer le marché en raison de ses avantages avérés dans l'amélioration de la santé intestinale, de l'absorption des nutriments et de la fonction immunitaire du bétail, ce qui améliore directement l'efficacité alimentaire et les performances animales.

- L'évolution croissante vers des additifs alimentaires naturels et sans antibiotiques, ainsi que la demande accrue de produits animaux durables et de haute qualité, soutiennent davantage l'adoption croissante de levures vivantes dans l'alimentation animale sur le marché européen.

- Le segment sec devrait dominer le marché des formes grâce à sa durée de conservation plus longue, sa facilité de stockage et son rapport coût-efficacité par rapport aux formes liquides et granulées. La levure sèche pour aliments pour animaux offre également une plus grande polyvalence en termes de manipulation, de mélange et d'incorporation dans les aliments pour animaux, ce qui en fait un choix privilégié pour les fabricants d'aliments à grande échelle.

- L'Allemagne devrait dominer le marché européen de la levure alimentaire en raison des progrès réalisés dans le développement de produits à base de levure dans le pays.

Portée du rapport et segmentation du marché de la levure alimentaire

|

Attributs |

Informations clés sur le marché des levures alimentaires |

|

Segments couverts |

|

|

Pays couverts |

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des levures alimentaires

« Adoption croissante d'additifs de levure enrichis en protéines pour optimiser la croissance et la productivité animales »

- En Europe, les éleveurs privilégient de plus en plus l'enrichissement en protéines dans l'alimentation animale pour stimuler la croissance animale, le développement musculaire et la productivité globale.

- Les protéines sont essentielles au développement des tissus corporels, au soutien du système immunitaire et à la fonction métabolique chez les animaux.

- La demande croissante d'une production animale efficace, en particulier dans les secteurs porcin, avicole et laitier, entraîne un besoin de sources de protéines digestibles de haute qualité.

- La levure alimentaire, y compris la levure hydrolysée et les extraits de levure, fournit une source biodisponible d'acides aminés essentiels

- Les protéines à base de levure sont facilement digestibles, améliorant l'absorption des nutriments et favorisant une prise de poids plus rapide par rapport aux apports alimentaires traditionnels.

Par exemple,

- Dans un article publié dans WATT Global Media, il a été souligné que Leiber GmbH, spécialiste allemand majeur de la levure, a lancé « Leiber YeaFi Plus », une levure de nouvelle génération combinant des complexes de levure et de fibres pour améliorer l'apport en protéines et la digestibilité des aliments pour animaux. Cette innovation reflète la tendance du marché vers des additifs alimentaires fonctionnels enrichis en protéines.

- Les protéines de levure améliorent le profil d'acides aminés des aliments composés, améliorant ainsi l'efficacité alimentaire globale

- L'accent accru mis sur l'enrichissement en protéines alimente la demande de levures alimentaires en Europe, grâce à sa digestibilité, sa teneur en acides aminés et son impact sur la croissance animale et la qualité de la production.

Dynamique du marché des levures alimentaires

Conducteur

« Évolution de la tendance vers l'intégration d'additifs alimentaires naturels comme solutions durables »

- L'industrie européenne de l'élevage connaît une forte évolution vers la durabilité et les pratiques d'alimentation naturelles, motivée par la sensibilisation croissante des consommateurs aux impacts environnementaux et sanitaires de la production alimentaire.

- Cette tendance alimente la demande de produits animaux sans antibiotiques, produits naturellement, augmentant l'adoption d'additifs alimentaires naturels comme la levure alimentaire comme alternatives aux produits chimiques synthétiques et aux antibiotiques.

- La levure alimentaire gagne en popularité en raison de son profil écologique et de ses avantages fonctionnels, notamment une meilleure santé intestinale, une meilleure absorption des nutriments, une immunité renforcée et une efficacité digestive chez les animaux.

- Les réglementations de l'UE telles que le Green Deal accélèrent les pratiques durables, et les additifs à base de levure soutiennent les principes de l'économie circulaire en utilisant des sous-produits d'autres industries pour la culture de la levure, réduisant ainsi les déchets et l'empreinte carbone.

Par exemple ,

- Lallemand Animal Nutrition, entreprise française, a étendu sa gamme de levures probiotiques à toute l'Europe afin de soutenir la santé des ruminants et l'efficacité alimentaire. Son produit Levucell SC, à base de Saccharomyces cerevisiae, connaît un succès croissant grâce à sa capacité à améliorer la digestion des fibres et à réduire les émissions de méthane.

- La Commission européenne a publié un article soulignant que le Pacte vert pour l'Europe et la stratégie « De la ferme à la table » poussent les éleveurs à adopter des pratiques alimentaires durables, notamment l'utilisation d'additifs naturels comme la levure autolysée et probiotique, afin de réduire l'impact environnemental de l'agriculture et d'atteindre les objectifs de neutralité carbone.

- Alors que la durabilité devient essentielle à la production animale, le marché européen de la levure alimentaire est appelé à croître, offrant une solution fonctionnelle, efficace et respectueuse de l'environnement, conforme aux attentes des consommateurs et aux réglementations.

Opportunité

« Innovation dans les ingrédients alimentaires fonctionnels »

- L'industrie européenne de l'élevage se concentre sur l'amélioration de la santé animale, de l'efficacité alimentaire et de la productivité, ce qui stimule la demande d'ingrédients alimentaires fonctionnels comme la levure enrichie en composés bioactifs tels que les nucléotides, les β-glucanes et les mannanes.

- Avec des réglementations plus strictes sur l'utilisation des antibiotiques, on observe une évolution notable vers des additifs naturels et biosourcés comme la levure alimentaire qui favorise la santé intestinale, l'immunité et l'absorption des nutriments sans contribuer à la résistance aux antimicrobiens.

- Les producteurs investissent dans des produits innovants à base de levure ciblant des fonctionnalités spécifiques telles que la réduction du stress, l'amélioration des taux de conversion alimentaire et la résistance aux maladies, en accord avec les tendances de l'agriculture durable et des produits animaux haut de gamme.

- La demande croissante des consommateurs pour des produits sans antibiotiques pousse les fabricants d'aliments pour animaux à adopter des ingrédients avancés dérivés de levure, tandis que les entreprises répondent avec des solutions personnalisées pour la volaille, les porcs et les ruminants afin d'accroître leur présence sur le marché.

Par exemple,

- Le Crédit Agricole Centre France a lancé la Plateforme Ouverte Biotech pour faire progresser la technologie de fermentation de précision. Cette technologie de pointe, utilisant des micro-organismes comme la levure pour produire des protéines et des enzymes spécifiques, gagne du terrain en Europe. Cette avancée permet le développement de nouveaux ingrédients fonctionnels pour l'alimentation animale, améliorant ainsi le profil nutritionnel et l'efficacité des aliments pour animaux.

- Une étude récente publiée en novembre 2024 a démontré l'efficacité des levures probiotiques pour améliorer la santé du rumen et l'efficacité alimentaire des vaches laitières. Par exemple, une supplémentation en levures probiotiques a entraîné une augmentation de 3,2 % de la digestibilité de la matière sèche et de 6,2 % de la digestibilité des fibres au détergent neutre, soulignant ainsi le potentiel des ingrédients alimentaires fonctionnels à base de levure pour améliorer les performances animales.

- L'innovation dans le domaine des aliments fonctionnels à base de levure devient un moteur de croissance clé en Europe, offrant de nouvelles opportunités de revenus et une valeur ajoutée à l'ensemble de la chaîne d'approvisionnement en aliments pour le bétail grâce à une nutrition et une durabilité améliorées.

Retenue/Défi

« Complexité réglementaire et contraintes de normalisation »

- L'Union européenne applique des réglementations strictes sur les ingrédients des aliments pour animaux afin de garantir la santé animale, la sécurité et la durabilité environnementale, ce qui crée une charge de conformité élevée pour les fabricants d'aliments pour animaux.

- L'approbation de nouveaux additifs à base de levure nécessite le respect de plusieurs réglementations de l'UE, telles que le règlement (CE) n° 183/2005 (sécurité des aliments pour animaux) et le règlement (UE) n° 68/2013 (commercialisation des matières premières pour aliments des animaux), impliquant des évaluations longues et coûteuses de la sécurité, de l'efficacité et de la valeur nutritionnelle.

- La complexité réglementaire est accentuée par le manque de normalisation entre les différents produits à base de levure, tels que la levure vivante, la levure hydrolysée et les dérivés de levure, qui peuvent nécessiter des approbations distinctes ou être soumis à des normes réglementaires différentes.

- Les incohérences dans les cadres réglementaires nationaux des États membres de l’UE compliquent encore davantage l’accès au marché, certains pays imposant des normes plus strictes que d’autres, ce qui entrave l’approbation uniforme des produits dans toute la région.

Par exemple,

- Selon un article publié par la Commission européenne, les produits à base de levure alimentaire doivent être conformes au règlement (CE) n° 1831/2003 relatif aux additifs destinés à l'alimentation animale, mais les États membres interprètent parfois différemment les souches microbiennes autorisées, ce qui entraîne des retards d'approbation et des exigences de certification supplémentaires.

- En 2023, des divergences réglementaires entre l'Allemagne et la France concernant les niveaux acceptables de cellules de levure vivantes dans les additifs alimentaires ont conduit à des incohérences dans les normes d'étiquetage des produits, entraînant des complications pour les entreprises tentant de commercialiser un seul produit sur les deux marchés.

- Ces défis peuvent retarder le lancement de produits, augmenter les coûts de conformité et limiter l'adoption rapide de solutions d'alimentation animale innovantes à base de levure sur le marché européen.

Portée du marché de la levure alimentaire

Le marché européen de la levure alimentaire est segmenté en trois segments en fonction du type, de la forme et du type de bétail.

|

Segmentation |

Sous-segmentation |

|

Par type |

|

|

Par formulaire |

|

|

Par type de bétail |

|

En 2025, le segment des levures vivantes/levures probiotiques devrait dominer le marché avec une part de marché plus importante dans le segment des types

En 2025, le segment des levures vivantes et probiotiques devrait dominer le marché grâce à ses bénéfices avérés pour l'amélioration de la santé intestinale, de l'absorption des nutriments et du système immunitaire des animaux d'élevage, ce qui améliore directement l'efficacité alimentaire et les performances animales. La tendance croissante vers des additifs alimentaires naturels et sans antibiotiques, ainsi que la demande croissante de produits animaux durables et de haute qualité, soutiennent l'adoption croissante des levures vivantes en nutrition animale sur le marché européen.

En 2025, le segment sec devrait représenter la plus grande part au cours de la période de prévision dans le segment des formes

En 2025, le segment sec devrait dominer le marché des formes grâce à sa durée de conservation plus longue, sa facilité de stockage et son rapport coût-efficacité par rapport aux formes liquides et granulées. La levure sèche pour aliments pour animaux offre également une plus grande polyvalence en termes de manipulation, de mélange et d'incorporation dans les aliments pour animaux, ce qui en fait un choix privilégié pour les fabricants d'aliments à grande échelle.

Analyse régionale du marché européen des levures alimentaires

« L'Allemagne est le pays dominant sur le marché européen des levures alimentaires »

- L'Allemagne est leader sur le marché européen de la levure alimentaire, grâce à son secteur de l'élevage bien établi, à son infrastructure de production d'aliments avancée et à sa forte concentration sur la nutrition animale sans antibiotiques.

- Le pays bénéficie de l'adoption précoce de solutions d'alimentation animale durables, les principaux fabricants d'aliments pour animaux intégrant des additifs à base de levure pour améliorer la santé et la productivité animales.

- Des réglementations strictes concernant l'utilisation d'antibiotiques et une forte demande de produits carnés biologiques et de qualité supérieure soutiennent l'utilisation généralisée d'additifs alimentaires fonctionnels tels que la levure.

- Le rôle de l'Allemagne en tant que leader technologique dans l'innovation en matière d'alimentation animale et de pratiques d'élevage renforce encore sa domination sur le marché régional des levures alimentaires.

« L'Espagne devrait enregistrer le taux de croissance le plus élevé »

- L'Espagne devrait connaître la croissance la plus rapide du marché européen de la levure alimentaire, alimentée par l'expansion des industries porcine et avicole et par l'augmentation des investissements dans les solutions d'alimentation naturelle.

- La production croissante de viande du pays, orientée vers l'exportation, stimule la demande d'additifs alimentaires à haute efficacité qui répondent aux normes de qualité internationales.

- Les initiatives gouvernementales de soutien favorisant les pratiques d’élevage durables accélèrent la transition vers des ingrédients alimentaires naturels comme la levure.

- La prise de conscience croissante des producteurs et des consommateurs espagnols quant aux avantages des produits animaux sans antibiotiques stimule encore davantage l'adoption de solutions alimentaires à base de levure.

Part de marché de la levure alimentaire

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence régionale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- Nutreco (Pays-Bas)

- Phileo (Partie de Lesaffre) (France)

- DSM-Firmenich (Suisse)

- Alltech (États-Unis)

- ADM (États-Unis)

- Lallemand Inc (Canada)

- Associated British Foods plc (Royaume-Uni)

- Biorigin (Brésil)

- Leiber (Allemagne)

- CPI (Brésil)

- Diamond V (Cargill, Incorporated) (États-Unis)

- Baffeed (Turquie)

- Arm & Hammer Animal Nutrition (Church & Dwight Co.) (États-Unis)

- Aleris (Brésil)

Derniers développements sur le marché européen des levures alimentaires

- En février 2025, Nutreco a reçu une subvention OPZuid pour collaborer avec les producteurs laitiers néerlandais afin de réduire les émissions d'azote. Ce financement permet de développer des solutions agricoles adaptées aux exigences environnementales du secteur laitier néerlandais, nous préparant ainsi aux défis mondiaux futurs. Le projet se concentre sur des stratégies d'alimentation innovantes, des technologies d'agriculture de précision et des outils basés sur les données pour réduire l'impact environnemental sans compromettre la productivité. En travaillant en étroite collaboration avec les producteurs, Nutreco vise à co-créer des solutions évolutives et scientifiques qui serviront de modèle pour une production laitière durable dans le monde entier.

- En octobre 2024, Lesaffre a finalisé avec succès l'acquisition de l'activité extraits de levure de dsm-firmenich, renforçant ainsi sa position sur le marché des ingrédients salés. Grâce à cette acquisition, Biospringer, la Business Unit de Lesaffre, acquiert les technologies de transformation des dérivés de levure de dsm-firmenich, 46 collaborateurs spécialisés dans les extraits de levure et une gamme de produits innovants. Cette opération stratégique renforce la capacité de Biospringer à servir ses clients dans les applications salées et fermentées. L'expertise de Lesaffre en bioproduction, en tendances de consommation et sur les marchés locaux soutiendra la croissance continue et le succès de ses nouveaux clients. Le processus d'intégration est en cours, garantissant une transition fluide pour les collaborateurs, les clients et les partenaires, tout en préservant la qualité des produits.

- En avril 2024, DSM-Firmenich a finalisé la cession de son activité d'extraits de levure, y compris son site de production de Delft, aux Pays-Bas, à Lesaffre. Cette cession stratégique permet à DSM-Firmenich de se concentrer sur ses segments clés – santé, nutrition et beauté – en rationalisant son portefeuille. Pour Lesaffre, acteur mondial de la fermentation, cette acquisition renforce sa position dans les solutions d'ingrédients naturels et élargit ses capacités dans les secteurs de l'alimentation et des boissons.

- En septembre 2023, Alltech lance Microbuild, une nouvelle fibre prébiotique pour la santé intestinale des animaux de compagnie. Microbuild s'appuie sur la science de pointe de la nutrigénomique, qui étudie la relation unique entre génétique et nutrition. Sa souche de levure spécifique, Saccharomyces cerevisiae, a été spécifiquement sélectionnée par les scientifiques d'Alltech pour une efficacité maximale dans la promotion de la santé intestinale.

- En octobre 2023, Aleris Nutrition a augmenté sa capacité de production de 60 % avec le lancement de deux nouvelles unités de production, renforçant ainsi sa position de fournisseur leader d'additifs à base de levure pour la nutrition animale multi-espèces. Cette expansion vise à garantir un approvisionnement régulier, à répondre à la demande nationale et internationale croissante et à réduire les risques liés à la saisonnalité des cultures, renforçant ainsi l'engagement d'Aleris en faveur de la qualité et de l'innovation en matière de santé et de nutrition animales.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPACT OF ECONOMIC SLOWDOWN ON THE EUROPE FEED YEAST MARKET

4.1.1 IMPACT OF PRICE

4.1.2 IMPACT ON SUPPLY CHAIN

4.1.3 IMPACT ON SHIPMENT

4.1.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.1.5 CONCLUSION

4.2 CONSUMER-LEVEL TRENDS

4.2.1 REFERENCE FOR NATURAL AND ORGANIC FEED ADDITIVES

4.2.2 DEMAND FOR FUNCTIONAL BENEFITS IN FEED

4.2.3 TRANSPARENCY AND LABEL LITERACY

4.2.4 INFLUENCE OF ANIMAL WELFARE ON PURCHASE DECISIONS

4.2.5 TECHNOLOGICAL INTEGRATION IN PRODUCT SELECTION

4.2.6 CONCLUSION

4.3 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.3.1 KEY FACTORS INFLUENCING FEED YEAST PRICES

4.3.1.1 RAW MATERIAL COSTS:

4.3.1.2 LIVESTOCK INDUSTRY DEMAND:

4.3.1.3 ENERGY AND MANUFACTURING COSTS:

4.3.1.4 TRADE AND IMPORT DYNAMICS:

4.3.1.5 REGULATORY AND SUSTAINABILITY PRESSURES:

4.3.2 CONCLUSION

4.4 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.5 BRAND OUTLOOK

4.5.1 PRODUCT VS BRAND OVERVIEW

4.5.2 PRODUCT OVERVIEW

4.5.3 BRAND OVERVIEW

4.5.4 CONCLUSION

4.6 FACTORS INFLUENCING PURCHASING DECISIONS

4.6.1 RECOMMENDATION FROM FAMILY & FRIENDS

4.6.2 RESEARCH

4.6.3 IMPULSIVE PURCHASES

4.6.4 ADVERTISEMENT

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVES IN EUROPE FEED YEAST MARKET

4.7.1 RISING DEMAND FOR FUNCTIONAL FEED INGREDIENTS

4.7.2 INCREASING ADOPTION OF SUSTAINABLE FEED SOLUTIONS

4.7.3 TECHNOLOGICAL ADVANCEMENTS IN FERMENTATION AND PROCESSING

4.7.4 GROWTH OF ORGANIC AND NON-GMO FEED SEGMENTS

4.7.5 EXPANSION OF AQUACULTURE AND PET FOOD SECTORS

4.7.6 FUTURE PERSPECTIVES

4.8 CONSUMER-LEVEL TRENDS

4.8.1 REFERENCE FOR NATURAL AND ORGANIC FEED ADDITIVES

4.8.2 DEMAND FOR FUNCTIONAL BENEFITS IN FEED

4.8.3 TRANSPARENCY AND LABEL LITERACY

4.8.4 INFLUENCE OF ANIMAL WELFARE ON PURCHASE DECISIONS

4.8.5 TECHNOLOGICAL INTEGRATION IN PRODUCT SELECTION

4.8.6 CONCLUSION

4.9 NEW PRODUCT LAUNCH STRATEGY

4.9.1 OVERVIEW

4.9.2 INNOVATION THROUGH ADVANCED RESEARCH AND DEVELOPMENT

4.9.3 STRATEGIC ACQUISITIONS TO EXPAND PRODUCT OFFERINGS

4.9.4 EMPHASIS ON SUSTAINABILITY AND ENVIRONMENTAL IMPACT

4.9.5 DIVERSIFICATION INTO COMPANION ANIMAL NUTRITION

4.9.6 INNOVATIVE YEAST-BASED SOLUTIONS FOR HEALTH AND SUSTAINABILITY

4.9.7 EXPANSION INTO THE U.S. MARKET WITH SUSTAINABLE PRACTICES

4.9.8 SIGNIFICANT EXPANSION TO MEET GROWING DEMAND

4.1 PRIVATE LABEL VS. BRAND ANALYSIS

4.10.1 MARKET PRESENCE AND BRAND POSITIONING

4.10.2 INNOVATION AND PRODUCT DEVELOPMENT

4.10.3 PRICING AND MARGIN STRATEGY

4.10.4 DISTRIBUTION AND MARKET PENETRATION

4.10.5 CONSUMER PERCEPTION AND LOYALTY

4.10.6 REGULATORY AND QUALITY ASSURANCE

4.10.7 CONCLUSION

4.11 PROMOTIONAL ACTIVITIES

4.11.1 PARTICIPATION IN AGRICULTURAL TRADE FAIRS AND LIVESTOCK EXPOS

4.11.2 TECHNICAL SEMINARS AND ON-FARM DEMONSTRATIONS

4.11.3 DISTRIBUTION OF FREE SAMPLES AND TRIAL PACKS

4.11.4 DIGITAL MARKETING CAMPAIGNS

4.11.5 PRODUCT BRANDING AND PACKAGING INNOVATIONS

4.11.6 COLLABORATIONS WITH VETERINARY PROFESSIONALS

4.11.7 LOYALTY AND REFERRAL PROGRAMS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 FOCUS ON PRODUCT QUALITY AND EFFICACY

4.12.2 SUSTAINABILITY AND ECO-FRIENDLY PREFERENCES

4.12.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATION

4.12.4 PRICE SENSITIVITY AND BULK BUYING PREFERENCES

4.12.5 REGULATORY INFLUENCE AND COMPLIANCE

4.12.6 CONSUMER ENGAGEMENT AND DECISION-MAKING PROCESS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 OVERVIEW

4.13.2 RAW MATERIAL SOURCING

4.13.3 MANUFACTURING & PROCESSING

4.13.4 LOGISTICS & DISTRIBUTION

4.13.5 END-USE & MARKET DEMAND

4.13.6 CHALLENGES & FUTURE OUTLOOK

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING IMPORTANCE OF PROTEIN ENRICHMENT IN THE ANIMAL FEED SEGMENT

6.1.2 SHIFTING INCLINATION TOWARDS INCORPORATION OF NATURAL FEED ADDITIVES AS SUSTAINABLE SOLUTIONS

6.1.3 RISING IMPORTANCE OF GUT HEALTH IN THE ANIMAL FEED SECTOR

6.2 RESTRAINTS

6.2.1 HIGH PRICE ASSOCIATED WITH PREMIUM YEAST PRODUCTS

6.2.2 REGULATORY COMPLEXITY AND STANDARDIZATION CONSTRAINTS

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN FUNCTIONAL FEED INGREDIENTS

6.3.2 ADVANCEMENTS IN YEAST PRODUCT DEVELOPMENT

6.4 CHALLENGES

6.4.1 COMPETITION FROM ALTERNATIVE FEED ADDITIVES

6.4.2 VOLATILITY IN RAW MATERIAL PRICING AND SUPPLY CHAIN DYNAMICS

7 EUROPE FEED YEAST MARKET, BY TYPE

7.1 OVERVIEW

7.2 LIVE YEAST/PROBIOTIC YEAST

7.3 SPENT YEAST

7.4 YEAST DERIVATIVES

7.5 AUTOLYZED YEAST

7.6 OTHERS

8 EUROPE FEED YEAST MARKET, BY FORM

8.1 OVERVIEW

8.2 DRY

8.3 LIQUID

8.4 PELLET

9 EUROPE FEED YEAST MARKET, BY LIVESTOCK TYPE

9.1 OVERVIEW

9.2 POULTRY

9.3 SWINE

9.4 RUMINANTS

9.5 CATTLE

9.6 AQUACULTURE

9.7 PETS

9.8 EQUINE

9.9 OTHERS

10 EUROPE FEED YEAST MARKET BY COUNTRIES

10.1 EUROPE

10.1.1 GERMANY

10.1.2 SPAIN

10.1.3 FRANCE

10.1.4 ITALY

10.1.5 NETHERLANDS

10.1.6 U.K.

10.1.7 ROMANIA

10.1.8 POLAND

10.1.9 TURKEY

10.1.10 RUSSIA

10.1.11 GREECE

10.1.12 IRELAND

10.1.13 BELGIUM

10.1.14 SWEDEN

10.1.15 DENMARK

10.1.16 SWITZERLAND

10.1.17 CZECH REPUBLIC

10.1.18 FINLAND

10.1.19 AUSTRIA

10.1.20 PORTUGAL

10.1.21 BULGARIA

10.1.22 SERBIA

10.1.23 HUNGARY

10.1.24 CROATIA

10.1.25 CYPRUS

10.1.26 ESTONIA

10.1.27 LITHUANIA

10.1.28 LATVIA

10.1.29 SLOVAKIA

10.1.30 SLOVENIA

10.1.31 NORWAY

10.1.32 LUXEMBOURG

10.1.33 MALTA

10.1.34 REST OF EUROPE

11 EUROPE FEED YEAST MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 NUTRECO

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENT

13.2 PHILEO (PART OF LESAFFRE)

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 DSM-FIRMENICH

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT/NEWS

13.4 ALLTECH

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 ADM

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 ALERIS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ARM & HAMMER ANIMAL NUTRITION (CHURCH & DWIGHT CO., INC)

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 ASSOCIATED BRITISH FOODS PLC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAFFEED

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 BIORIGIN

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 DIAMOND V (CARGILL INCORPORATED)

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 ICC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 LALLEMAND INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 LEIBER

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT/NEWS

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 BRAND COMPARATIVE ANALYSIS OF EUROPE FEED YEAST MARKET

TABLE 3 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 4 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 EUROPE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD/KG)

TABLE 7 EUROPE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 EUROPE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 EUROPE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 EUROPE FEED YEASTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 11 EUROPE FEED YEASTS MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 EUROPE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 EUROPE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 EUROPE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 EUROPE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 EUROPE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 EUROPE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 EUROPE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 EUROPE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 EUROPE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 EUROPE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 EUROPE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 EUROPE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 EUROPE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 EUROPE FEED YEAST MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 26 EUROPE FEED YEAST MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 27 GERMANY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 GERMANY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 29 GERMANY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 GERMANY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 GERMANY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 GERMANY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 33 GERMANY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 GERMANY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 GERMANY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 GERMANY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 GERMANY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 GERMANY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 GERMANY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 GERMANY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 GERMANY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 GERMANY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 GERMANY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 GERMANY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 GERMANY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 GERMANY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 SPAIN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 SPAIN FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 SPAIN LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 SPAIN YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SPAIN SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 SPAIN FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 53 SPAIN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SPAIN POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 SPAIN POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 SPAIN SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SPAIN RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SPAIN RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SPAIN CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SPAIN AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SPAIN FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 SPAIN AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 SPAIN PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 SPAIN PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SPAIN EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SPAIN OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 FRANCE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 FRANCE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 69 FRANCE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 FRANCE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 FRANCE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 FRANCE FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 73 FRANCE FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 FRANCE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 FRANCE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 FRANCE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 FRANCE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 FRANCE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 FRANCE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 FRANCE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 FRANCE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 FRANCE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 FRANCE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 FRANCE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 FRANCE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 FRANCE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 ITALY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 ITALY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 89 ITALY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 ITALY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 ITALY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 ITALY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 93 ITALY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 ITALY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 ITALY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 ITALY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 ITALY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 ITALY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 ITALY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 ITALY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 ITALY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 ITALY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 ITALY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 ITALY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 ITALY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 ITALY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NETHERLANDS FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NETHERLANDS FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 109 NETHERLANDS LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NETHERLANDS YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NETHERLANDS SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 NETHERLANDS FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 113 NETHERLANDS FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NETHERLANDS POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NETHERLANDS POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NETHERLANDS SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NETHERLANDS RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NETHERLANDS RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NETHERLANDS CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NETHERLANDS AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NETHERLANDS FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 NETHERLANDS AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 NETHERLANDS PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 NETHERLANDS PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 NETHERLANDS EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 NETHERLANDS OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 U.K. FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 U.K. FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 129 U.K. LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 U.K. YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 U.K. SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 U.K. FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 133 U.K. FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 U.K. POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 U.K. POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 ROMANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 ROMANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 149 ROMANIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 ROMANIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 ROMANIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 ROMANIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 153 ROMANIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 ROMANIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 ROMANIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 ROMANIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 ROMANIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 ROMANIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 ROMANIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 ROMANIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 ROMANIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 ROMANIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 ROMANIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ROMANIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ROMANIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ROMANIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 POLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 POLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 169 POLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 POLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 POLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 POLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 173 POLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 POLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 POLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 POLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 POLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 POLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 POLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 POLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 POLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 POLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 POLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 POLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 POLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 POLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 TURKEY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 TURKEY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 189 TURKEY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 TURKEY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 TURKEY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 TURKEY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 193 TURKEY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 TURKEY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 TURKEY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 TURKEY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 TURKEY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 TURKEY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 TURKEY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 TURKEY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 TURKEY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 TURKEY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 TURKEY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 TURKEY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 TURKEY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 TURKEY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 RUSSIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 RUSSIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 209 RUSSIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 RUSSIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 RUSSIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 RUSSIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 213 RUSSIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RUSSIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RUSSIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RUSSIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 GREECE FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 GREECE FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 229 GREECE LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 GREECE YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 GREECE SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 GREECE FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 233 GREECE FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 GREECE POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 GREECE POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 GREECE SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 GREECE RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 GREECE RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 GREECE CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 GREECE AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 GREECE FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 GREECE AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 GREECE PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 GREECE PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 GREECE EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 GREECE OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 IRELAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 IRELAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 249 IRELAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 IRELAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 IRELAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 IRELAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 253 IRELAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 IRELAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 IRELAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 IRELAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 IRELAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 IRELAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 IRELAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 IRELAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 IRELAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 IRELAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 IRELAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 IRELAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 IRELAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 IRELAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 BELGIUM FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 BELGIUM FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 269 BELGIUM LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 BELGIUM YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 BELGIUM SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 BELGIUM FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 273 BELGIUM FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 BELGIUM POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 BELGIUM POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 BELGIUM SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 BELGIUM RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 BELGIUM RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 BELGIUM CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 BELGIUM AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 BELGIUM FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 BELGIUM AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 BELGIUM PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 BELGIUM PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 BELGIUM EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 BELGIUM OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 SWEDEN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 SWEDEN FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 289 SWEDEN LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 SWEDEN YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 SWEDEN SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 SWEDEN FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 293 SWEDEN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWEDEN POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWEDEN POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWEDEN SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWEDEN RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWEDEN RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWEDEN CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWEDEN AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWEDEN FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWEDEN AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SWEDEN PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWEDEN PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWEDEN EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWEDEN OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 DENMARK FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 DENMARK FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 309 DENMARK LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 DENMARK YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 DENMARK SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 DENMARK FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 313 DENMARK FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 314 DENMARK POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 DENMARK POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 316 DENMARK SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 317 DENMARK RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 DENMARK RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 DENMARK CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 DENMARK AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 DENMARK FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 DENMARK AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 DENMARK PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 DENMARK PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 DENMARK EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 DENMARK OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SWITZERLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 SWITZERLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 329 SWITZERLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 SWITZERLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 SWITZERLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 SWITZERLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 333 SWITZERLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 SWITZERLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 SWITZERLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 SWITZERLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 SWITZERLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 SWITZERLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 SWITZERLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 340 SWITZERLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 341 SWITZERLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 342 SWITZERLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 SWITZERLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 344 SWITZERLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 345 SWITZERLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SWITZERLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 347 CZECH REPUBLIC FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 348 CZECH REPUBLIC FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 349 CZECH REPUBLIC LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 350 CZECH REPUBLIC YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 351 CZECH REPUBLIC SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 352 CZECH REPUBLIC FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 353 CZECH REPUBLIC FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 354 CZECH REPUBLIC POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 355 CZECH REPUBLIC POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 356 CZECH REPUBLIC SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 357 CZECH REPUBLIC RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 358 CZECH REPUBLIC RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 359 CZECH REPUBLIC CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 360 CZECH REPUBLIC AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 361 CZECH REPUBLIC FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 362 CZECH REPUBLIC AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 363 CZECH REPUBLIC PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 364 CZECH REPUBLIC PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 365 CZECH REPUBLIC EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 366 CZECH REPUBLIC OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 367 FINLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 368 FINLAND FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 369 FINLAND LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 370 FINLAND YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 371 FINLAND SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 372 FINLAND FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 373 FINLAND FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 374 FINLAND POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 375 FINLAND POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 376 FINLAND SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 377 FINLAND RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 378 FINLAND RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 379 FINLAND CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 380 FINLAND AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 381 FINLAND FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 382 FINLAND AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 383 FINLAND PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 384 FINLAND PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 385 FINLAND EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 386 FINLAND OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 387 AUSTRIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 388 AUSTRIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 389 AUSTRIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 390 AUSTRIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 391 AUSTRIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 392 AUSTRIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 393 AUSTRIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 394 AUSTRIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 395 AUSTRIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 396 AUSTRIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 397 AUSTRIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 398 AUSTRIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 399 AUSTRIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 400 AUSTRIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 401 AUSTRIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 402 AUSTRIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 403 AUSTRIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 404 AUSTRIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 405 AUSTRIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 406 AUSTRIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 407 PORTUGAL FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 408 PORTUGAL FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 409 PORTUGAL LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 410 PORTUGAL YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 411 PORTUGAL SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 412 PORTUGAL FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 413 PORTUGAL FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 414 PORTUGAL POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 415 PORTUGAL POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 416 PORTUGAL SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 417 PORTUGAL RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 418 PORTUGAL RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 419 PORTUGAL CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 420 PORTUGAL AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 421 PORTUGAL FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 422 PORTUGAL AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 423 PORTUGAL PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 424 PORTUGAL PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 425 PORTUGAL EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 426 PORTUGAL OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 427 BULGARIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 428 BULGARIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 429 BULGARIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 430 BULGARIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 431 BULGARIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 432 BULGARIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 433 BULGARIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 434 BULGARIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 435 BULGARIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 436 BULGARIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 437 BULGARIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 438 BULGARIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 439 BULGARIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 440 BULGARIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 441 BULGARIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 442 BULGARIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 443 BULGARIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 444 BULGARIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 445 BULGARIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 446 BULGARIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 447 SERBIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 448 SERBIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 449 SERBIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 450 SERBIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 451 SERBIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 452 SERBIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 453 SERBIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 454 SERBIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 455 SERBIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 456 SERBIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 457 SERBIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 458 SERBIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 459 SERBIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 460 SERBIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 461 SERBIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 462 SERBIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 463 SERBIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 464 SERBIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 465 SERBIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 466 SERBIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 467 HUNGARY FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 468 HUNGARY FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 469 HUNGARY LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 470 HUNGARY YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 471 HUNGARY SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 472 HUNGARY FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 473 HUNGARY FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 474 HUNGARY POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 475 HUNGARY POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 476 HUNGARY SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 477 HUNGARY RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 478 HUNGARY RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 479 HUNGARY CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 480 HUNGARY AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 481 HUNGARY FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 482 HUNGARY AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 483 HUNGARY PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 484 HUNGARY PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 485 HUNGARY EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 486 HUNGARY OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 487 CROATIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 488 CROATIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 489 CROATIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 490 CROATIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 491 CROATIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 492 CROATIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 493 CROATIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 494 CROATIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 495 CROATIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 496 CROATIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 497 CROATIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 498 CROATIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 499 CROATIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 500 CROATIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 501 CROATIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 502 CROATIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 503 CROATIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 504 CROATIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 505 CROATIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 506 CROATIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 507 CYPRUS FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 508 CYPRUS FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 509 CYPRUS LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 510 CYPRUS YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 511 CYPRUS SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 512 CYPRUS FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 513 CYPRUS FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 514 CYPRUS POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 515 CYPRUS POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 516 CYPRUS SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 517 CYPRUS RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 518 CYPRUS RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 519 CYPRUS CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 520 CYPRUS AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 521 CYPRUS FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 522 CYPRUS AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 523 CYPRUS PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 524 CYPRUS PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 525 CYPRUS EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 526 CYPRUS OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 527 ESTONIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 528 ESTONIA FEED YEAST MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 529 ESTONIA LIVE YEAST/PROBIOTIC YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 530 ESTONIA YEAST DERIVATIVES IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 531 ESTONIA SPENT YEAST IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 532 ESTONIA FEED YEAST MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 533 ESTONIA FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 534 ESTONIA POULTRY IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 535 ESTONIA POULTRY IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 536 ESTONIA SWINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 537 ESTONIA RUMINANTS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 538 ESTONIA RUMINANTS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 539 ESTONIA CATTLE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 540 ESTONIA AQUACULTURE IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 541 ESTONIA FISH IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 542 ESTONIA AQUACULTURE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 543 ESTONIA PETS IN FEED YEAST MARKET, BY LIVESTOCK TYPE, 2018-2032 (USD THOUSAND)

TABLE 544 ESTONIA PETS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 545 ESTONIA EQUINE IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 546 ESTONIA OTHERS IN FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 547 LITHUANIA FEED YEAST MARKET, BY TYPE, 2018-2032 (USD THOUSAND)