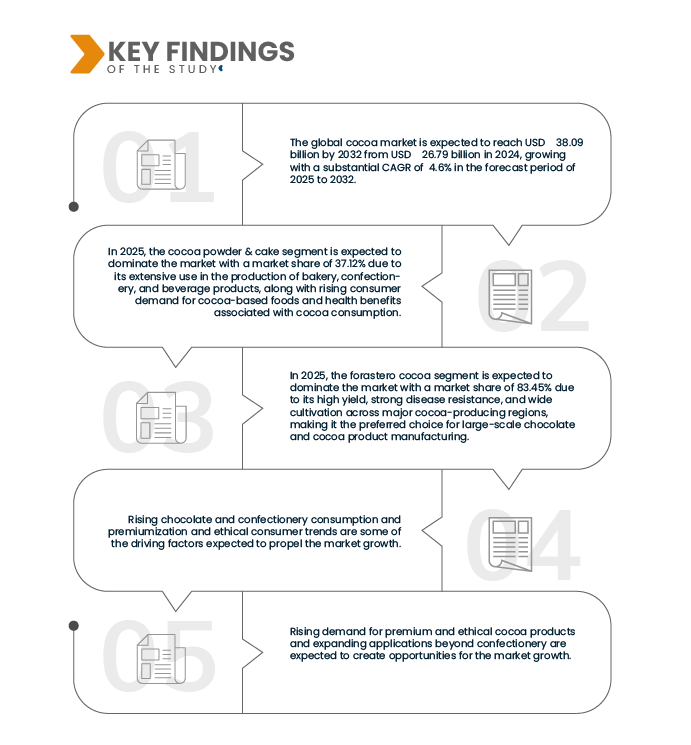

The global cocoa market is significantly driven by the rising demand for chocolate and confectionery products across diverse consumer segments. Chocolate remains one of the most popular indulgence products worldwide, with consumption steadily increasing in both developed and emerging economies. Cocoa, being the primary raw material for chocolate production, experiences a direct surge in demand in line with the growing chocolate industry. Factors such as evolving consumer lifestyles, increasing disposable incomes, and the expansion of premium and artisanal chocolate segments are further fueling this trend.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-cocoa-market

Data Bridge market research analyzes that the Global Cocoa Market is expected to reach USD 38.09 billion by 2032 from USD 26.79 billion in 2024, growing with a substantial CAGR of 4.6% in the forecast period of 2025 to 2032.

Key Findings of the Study

Expanding Use of Cocoa in Cosmetics and Personal Care

The expanding application of cocoa in cosmetics and personal care products is emerging as a promising driver for the global cocoa market. Cocoa butter, extracted from cocoa beans, is widely recognized for its moisturizing, emollient, and skin-repairing properties, making it a key ingredient in lotions, creams, lip balms, and body butters. Its high content of natural fatty acids and antioxidants helps nourish the skin, improve elasticity, and protect against environmental damage, which aligns with growing consumer demand for natural and plant-based beauty products.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2032

|

|

Base Year

|

2024

|

|

Historic Years

|

2018-2023 (Customizable to 2013-2017)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Product Type (Cocoa Powder & Cake, Cocoa Butter, Cocoa Beans, Cocoa Liquor & Paste, Cocoa Nibs, Others), Nature (Conventional and Organic), Type of Cocoa (Forastero Cocoa, Trinitario Cocoa, Criollo Cocoa), Distribution Channel (Indirect and Direct), Application (Dietary Supplements, Food and Beverage, Beverage, Pharmaceuticals, and Personal Care and Cosmetics)

|

|

Countries Covered

|

Germany, Netherlands, France, U.K., Belgium, Italy, Switzerland, Spain, Poland, Russia, Turkey, Sweden, Denmark, Norway, Finland, Rest of Europe, U.S., Canada, Mexico, Japan, China, Australia, India, South Korea, Thailand, Singapore, Malaysia, Indonesia, New Zealand, Hong Kong, Taiwan, Rest of Asia-Pacific, U.A.E., South Africa, Israel, Saudi Arabia, Kuwait, Egypt, Qatar, Bahrain, Oman and rest of middle east and Africa, Brazil, Argentina, Colombia, Peru, Bolivia, Chile, Ecuador, Paraguay, Uruguay, Rest of South America

|

|

Market Players Covered

|

Neogric Limited (Nigeria), Macofa Chocolate Factory (India), Toutan S.A (France), Olam International Limited (Singapore), Blommer Chocolate Company (U.S.), Deprama Cocoa (Indonesia), PT GRAND KAKAO INDONESIA (Indonesia), Jaya Saliem Industri (Indonesia), INDCRE S.A (Spain), PT ANDOW NGENSOWIDJAJA (Indonesia), INDOCOCOA (Indonesia), Guan Chong Berhad (Malaysia), ECUAKAO GROUP LTD (Ecuador), CocoaCraft (India), Sucden (France), Cargill, Incorporated (U.S.), Cocoa Processing Company Limited (Ghana), Uncommon Cacao (U.S./Netherlands), Puratos (Belgium), ECOM Agroindustrial Corp. Limited (Switzerland), Kokoa Kamili (Tanzania), Barry Callebaut (Switzerland), JB Cocoa (Malaysia), Cocoa Hub (Ghana), Duc d’O (Belgium), Natra (Spain), MONER COCOA, S.A. (Spain), Pacari Chocolate (Ecuador), Icam Spa (Italy), ALTINMARKA (Turkey)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global cocoa market is segmented into five notable segments based on product type, nature, type of cocoa, distribution channel and application.

- On the basis of product type, the market is segmented into cocoa powder & cake, cocoa butter, cocoa beans, cocoa liquor & paste, cocoa nibs, others

In 2025, the cocoa powder & cake segment is expected to dominate the global cocoa market

In 2025, the cocoa powder & cake segment is expected to dominate the market with a market share of 37.12% due to its wide use in bakery, beverages, and confectionery. Cost-effectiveness, long shelf life, and rising consumer demand for cocoa-flavored food products further drive growth. Expanding usage in dairy, ready-to-drink beverages, and functional foods, alongside rising urban snacking culture, will strongly boost the market share of this segment globally.

- On the basis of Nature, the market is segmented into conventional, organic.

In 2025, the conventional segment is expected to dominate the global cocoa market

In 2025, the conventional segment is expected to dominate the market with a market share of 92.84% as it remains more affordable, widely available, and preferred by large-scale chocolate and food manufacturers. Its established supply chain and high production volume ensure steady adoption and industrial demand. Furthermore, conventional cocoa supports consistent flavor and quality, making it suitable for mass-market applications, which strengthens its dominance in both developing and developed consumer markets worldwide.

- On the basis of type of cocoa, the market is segmented into forastero cocoa, trinitario cocoa, criollo cocoa. In 2025, the forastero cocoa segment is expected to dominate the market with a market share of 83.45%

- On the basis of distribution channel, the market is segmented into indirect, direct. In 2025, the indirect segment is expected to dominate the market with a market share of 77.35%

- On the basis of application, the market is segmented into dietary supplements, food and beverage, beverage, pharmaceuticals, personal care and cosmetics. In 2025, the dietary supplements segment is expected to dominate the market with a market share of 39.51%

Major Players

Data Bridge Market Research Analyses that Olam International Limited (Singapore), ECOM Agroindustrial Corp. Limited (Switzerland), Barry Callebaut (Switzerland), Puratos (Belgium), Guan Chong Berhad (Malaysia) as the major players operating in the market.

Recent Developments

- In October 2024, a new cocoa production line was launched by Cargill at its Gresik plant in Indonesia to address the growing Asian appetite for indulgent foods, especially in bakery, ice cream, chocolate confectionery, and café-style beverages. The line was designed to enhance customization, enabling production of specialty cocoa powders and liquors with differentiated flavor profiles tailored to regional preferences.

- In October 2024, ICAM Cioccolato has launched a redesigned e-shop built on Shopify, offering a mobile-friendly, intuitive, and secure shopping experience. The platform showcases ICAM, Vanini, and Otto products while emphasizing sustainability and inclusivity. Featuring customer profiling for personalized marketing, the project was developed with Ecommerce School and supported by promotional campaigns to boost visibility and online sales.

- In June 2025, Kokoa Kamili, operating in Tanzania's Kilombero Valley since 2013, reaffirmed its mission to position the country as a global leader in fine-flavor cocoa. Co-founder Siman Bindra emphasized that while Tanzania produces only about 14,000 tons annually-far below major producers like Ivory Coast and Ghana-the nation's strength lies in its genetics, climate, and quality. Kokoa Kamili partners with 1,500 organic-certified farmers, has distributed over 600,000 seedlings, and is developing grafting programs from top-yielding, high-flavor trees. The company has won the Cocoa of Excellence award three times and seeks International Cocoa Organization recognition for its fine-flavor status to secure higher prices for all Tanzanian cocoa. Facing climate change challenges, Kokoa Kamili explores solar-powered irrigation and calls for national irrigation strategies to include cocoa. Bindra also aims to break the misconception that Africa produces only bulk, low-quality cocoa, stressing Tanzania's proven excellence in premium markets.

- In March 2025, Natra Cacao S.L. launched a project, supported by the European Regional Development Fund (FEDER) and the Valencian Agency of Innovation, to develop fermented products analogous to cocoa for chocolate production. The initiative explores alternative plant-based raw materials with the same organoleptic profile and functionality as fermented cocoa, aiming to create value-added products with health benefits, shorter and more resilient supply chains, and reduced dependence on volatile cocoa markets. The project also seeks to lower carbon footprint, mitigate deforestation risks, and drive innovation across the Natra group's value chain.

- In June 2025, Touton showcases how collaboration, operational intelligence, and targeted innovation have driven meaningful results in forest protection, sustainable production, and community engagement in the 2023-2024 crop year. The report highlights achievements such as the distribution of hundreds of thousands of improved cocoa and multi-purpose trees in Ghana and Côte d'Ivoire, and the training of over 112,000 farmers in climate-smart practices.

Geographical Analysis:

Geographically, the countries covered in the global cocoa market report are Germany, Netherlands, France, U.K., Belgium, Italy, Switzerland, Spain, Poland, Russia, Turkey, Sweden, Denmark, Norway, Finland, rest of Europe, U.S., Canada, Mexico, Japan, China, Australia, India, South Korea, Thailand, Singapore, Malaysia, Indonesia, New Zealand, Hong Kong, Taiwan, rest of Asia-Pacific, U.A.E., South Africa, Israel, Saudi Arabia, Kuwait, Egypt, Qatar, Bahrain, Oman and rest of middle east and Africa, Brazil, Argentina, Colombia, Peru, Bolivia, Chile, Ecuador, Paraguay, Uruguay, rest of South America.

As per Data Bridge Market Research analysis:

Europe is the dominating and fastest growing region in the global cocoa market

Europe is the dominating and fastest-growing region in the global cocoa market. The region leads the market due to its large cocoa grinding and processing capacity, extensive chocolate manufacturing base, strong consumption market, advanced logistics and industrial infrastructure, and the presence of major global grinders and ingredient companies. Moreover, Europe is expected to witness significant growth in the coming years, driven by high per-capita chocolate consumption, a robust domestic manufacturing and grinding base, premiumization trends, continuous product innovation, consumers’ willingness to pay premium prices, and well-established import and processing infrastructure, all of which collectively boost cocoa demand in the region.

For more detailed information about the Global Cocoa Market report, click here – https://www.databridgemarketresearch.com/reports/global-cocoa-market