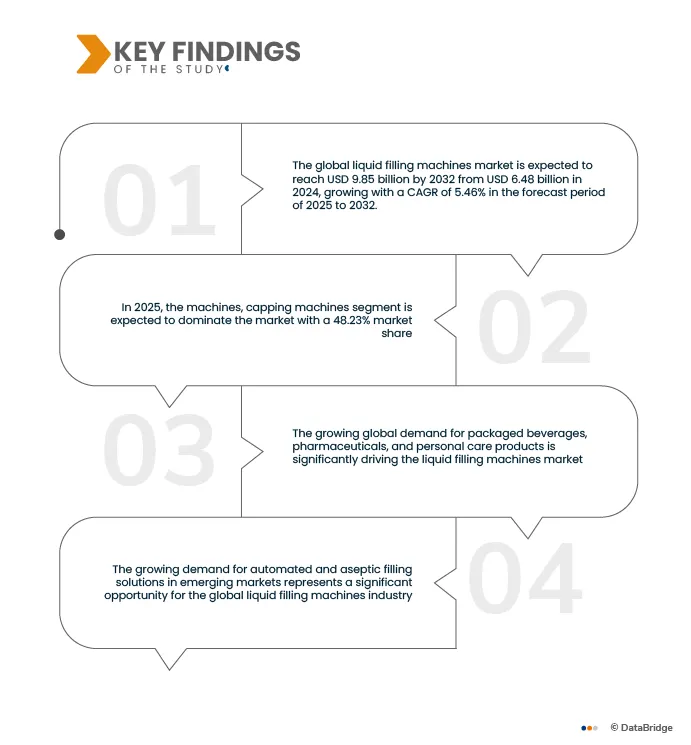

The growing global demand for packaged beverages, pharmaceuticals, and personal care products is significantly driving the liquid filling machines market. Rising consumer preference for hygienic, convenient, and ready-to-use liquid products is prompting manufacturers to expand production capacities and adopt advanced, automated filling systems. In the fields of beverages, pharmaceuticals, and cosmetics, precision, speed, and flexibility in handling diverse container types and viscosities are crucial. Moreover, increasing healthcare needs, eco-friendly packaging trends, and product diversification across industries are accelerating the adoption of efficient, contamination-free, and adaptable filling technologies to ensure quality, compliance, and high productivity in modern packaging operations.

For instance,

- In April 2025, Krones AG unveiled a modular filling line engineered explicitly for low-viscosity beverages, emphasizing enhanced energy efficiency, operational flexibility, and container versatility. This development reflects the company’s strategic response to escalating market demand for high-speed, adaptable, and sustainable filling solutions within the beverage sector. The innovation underscores a broader industry trend, wherein manufacturers of beverages, pharmaceuticals, and personal care products are increasingly investing in advanced, automated liquid filling systems to boost productivity, optimize operational efficiency, and align with sustainability objectives, thereby reinforcing the overall expansion of the global liquid filling machines market.

- In July 2024, ProMach, Inc. announced the acquisition of MBF (Italy) to expand its bottle-filling and closing machine capabilities for the global wine & spirits segment. This strategic move underscores how equipment suppliers are investing in and scaling up their filling solutions, particularly for beverage applications, thereby reinforcing the broader growth driver of the liquid filling machines market, linked to the rising demand for packaged beverages.

- In September 2024, ACASI Machinery Inc. completed the acquisition of Filling Equipment Co. Inc., adding over six decades of engineering expertise and an extensive range of filling‑nozzle solutions for both rotary and straight‑line liquid‑filling machines. This strategic move strengthens ACASI’s ability to deliver automated filling solutions across low- to high-speed lines, supporting manufacturers of beverages, personal-care liquids, and other packaged fluids.

- In April 2025, Sidel introduced the EvoFILL Can Compact, a high‑performance, versatile filling solution for beer and carbonated drinks. The launch underscores how machine-equipment suppliers are responding to rising packaged-liquid demand, in this case, beverages, by developing new filling systems tailored for increased throughput, multiple container formats (cans), faster changeovers, and higher precision.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-liquid-filling-machines-market

The continued growth of the Packaged Beverage, Pharmaceutical, and Personal Care Sectors, Fueled by factors such as urbanization, higher disposable incomes, evolving consumer lifestyles, and a heightened focus on health and hygiene, is driving strong demand for advanced liquid filling solutions. Automated, efficient, and flexible filling machines are becoming essential for manufacturers to enhance operational productivity, maintain product quality, and ensure regulatory compliance. As a result, liquid filling technology is increasingly recognized as a strategic enabler of scalable, high-quality, and cost-effective packaging operations across global markets.

Key Findings of the Study

Increasing Adoption of Automation and Precision Filling Technologies

The rising demand for automated and precision liquid filling solutions is driven by manufacturers’ need to improve production efficiency, ensure consistent product quality, reduce human error, and comply with strict hygiene and regulatory standards. Companies across the food, beverage, pharmaceutical, and cosmetic industries are increasingly investing in automated filling machines and precision dosing systems to achieve higher throughput, minimize wastage, and maintain product safety, which is especially critical in sectors like pharmaceuticals and beverages where accuracy is paramount. Automated and precision filling machines capable of handling multiple container formats, diverse viscosities, and stringent hygiene standards enable manufacturers to optimize throughput, reduce waste, and maintain consistent product quality.

For instance,

- As reported by food manufacturing in October 2024, JBT Bevcorp launched the REVolution EV Filler, a highly automated rotary filler equipped with digital valve and cycle‑control, modular drive assembly, and RFID‑based part tracking. This launch reflects how filling‑machine suppliers are responding to escalating beverage‑manufacturing demands, including higher throughput, more formats, and greater precision, thereby reinforcing the growth of automated, precision‑oriented liquid‑filling solutions

- In November 2023, according to Dairy Industries SEE introduced the CRYOVAC 308A CE vertical form‑fill‑seal system for liquids, a sophisticated, automated packaging solution that underscores how equipment suppliers are broadening capabilities beyond filling to full-line automation for liquid product manufacturing, while the system emphasizes packaging, it illustrates the growing investment in integrated automation and precision systems that support filling, format changes, sealing, and downstream handling in high-volume liquid manufacturing operations.

- In September 2025, GEA Group launched a modular beverage-filling system at drinktec 2025, capable of handling PET, aluminum, and glass containers, enabling fully automatic format changeovers and featuring AI-enabled digital control. This product release highlights how filling-machine manufacturers are investing in automation and precision technologies to support the increasing complexity and scale of beverage manufacturing, thereby reinforcing the growth potential of the global liquid-filling machines market.

- In December 2024, GST Technology unveiled its Automatic Liquid Quantitative Filling Machine, targeting the food & beverage, chemical, pharmaceutical, and daily-care liquid sectors. The machine emphasizes automation (intelligent sensors, servo-control, PLC interface) and precision filling (errors within ±1%, flow/weight metering), catering to manufacturers of high-volume, high-quality packaged liquids.

The strong growth of the liquid-based food, beverage, and cosmetic industries, coupled with increasing demands for operational efficiency, hygiene, and production flexibility, is driving the widespread adoption of automated, precision liquid filling machines. These technologies have become essential for manufacturers to enhance throughput, maintain consistent product quality, and scale operations effectively, solidifying liquid filling solutions as a strategic investment and key enabler of competitive, modern manufacturing.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2025 to 2035

|

|

Base Year

|

2024

|

|

Historic Years

|

2023 (Customizable to 2018-2022)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

Product Type (Bottling Machines, Capping Machines, Labeling Machines, Pouch Filling Machines, Injectable Liquid Vials Filling Machines, Prefilled Syringe Filling Machines & Others); Machine Type (Automatic, Semi-automatic & Manual); Filling Technology (Piston Filling, Pump Filling, Vacuum Filling, Gravity Filling, Net Weight Filling, Over Flow Filling, Corrosive Filling & Others); Liquid Type (Water Based Liquid, Viscous Liquids & Oils & Lubricants); Fill Type (Cold Fill, Aseptic Fill, Hot/Warm Fill); Container Type (Plastic, Glass & Metal)); Application (Food & Beverages, Chemicals, Pharmaceuticals & Medical Devices, Personal Care & Cosmetics & Others)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include Porter’s five forces analysis, company evaluation quadrant, industry ecosystem analysis, climate change scenario , Supply Chain Analysis, value chain analysis by manufacturers, regulatory framework.

|

Segment Analysis

The Global Liquid Filling Machines Market is segmented into seven notable segments based on the Product Type, Machine Type, Fill Type, Filling Technology, Liquid Type, Container Type, and Application.

- On the basis of Product Type, the market is segmented into Bottling Machines, Capping Machines, Labeling Machines, Pouch Filling Machines, Injectable Liquid Vials Filling Machines, Prefilled Syringe Filling Machines and Others.

In 2025, the bottling machines segment is expected to dominate the market

In 2025, the bottling machines segment is projected to dominate the Global Liquid Filling Machines Market with the largest market share of 48.23%, due to their extensive adoption across food & beverage, pharmaceutical, and chemical industries for high-speed and precise filling operations. Bottling machines offer enhanced automation, reduced spillage, and compatibility with a wide range of container materials, making them a preferred choice for large-scale production facilities. Additionally, the rising demand for packaged beverages and liquid consumer goods further supports the growth of this segment.

- On the basis of Machine Type, the market is segmented into Automatic, Semi-Automatic and Manual.

In 2025, the Automatic segment is expected to dominate the market

In 2025, the Automatic segment is projected to dominate the Global Liquid Filling Machines Market with a market share of 64.76%, owing to its ability to deliver high production efficiency, accuracy, and minimal human intervention. Automatic filling machines are increasingly used in high-volume production lines in industries such as food, beverages, pharmaceuticals, and cosmetics. Their integration with IoT, PLC control systems, and robotic automation also enhances operational precision and reduces downtime, driving higher adoption among manufacturers seeking cost-effective, continuous production solutions.

- On the basis of Fill Type, the market is segmented into Cold Fill, Aseptic Fill and Hot/Warm Fill.

In 2025, the Cold Fill segment is expected to dominate the market

In 2025, the Cold Fill segment is projected to dominate the Global Liquid Filling Machines Market with a market share of 50.19%, driven by its wide use in filling non-carbonated beverages, dairy products, and other heat-sensitive liquids. Cold filling reduces thermal stress on products, preserving flavor, nutrients, and texture, which is critical in the food and beverage sector. Moreover, lower energy consumption compared to hot fill processes and the increasing preference for eco-friendly, cost-efficient packaging operations are contributing to the segment’s expansion.

- On the basis of Filling Technology, the market is segmented into piston filling, pump filling, vacuum filling, gravity filling, net weight filling, over flow filling, corrosive filling, and others

In 2025, the piston filling segment is expected to dominate the market

In 2025, the Piston Filling segment is projected to dominate the Global Liquid Filling Machines Market with the largest market share of 44.76%, owing to its accuracy in handling both viscous and semi-viscous liquids such as sauces, creams, and oils. Piston filling technology ensures consistent fill volumes and minimal product wastage, making it ideal for industries where precision and cleanliness are critical. Increasing demand for flexible filling systems that can handle a variety of liquid viscosities in food, cosmetics, and pharmaceuticals is further propelling segment growth.

- On the basis of Liquid Type, the market is segmented into water based liquid, viscous liquids and oils & lubricants

In 2025, the water based segment is expected to dominate the market

In 2025, the Water-Based Liquid segment is projected to dominate the Global Liquid Filling Machines Market with the largest market share of 57.24%, due to the high consumption of beverages, dairy, and pharmaceutical solutions that primarily use water as a base. The growing demand for bottled water, soft drinks, and ready-to-drink products, coupled with the expansion of the pharmaceutical and personal care sectors, continues to drive demand for efficient and hygienic liquid filling solutions for water-based products.

- On the basis of Container Type, the Global Liquid Filling Machines Market is segmented into Plastic, Glass and Metal.

In 2025, the Plastic segment is expected to dominate the market

In 2025, the Plastic segment is expected to dominate the Global Liquid Filling Machines Market with a market share of 57.46%, due to the widespread use of lightweight, durable, and cost-effective plastic containers across multiple industries. Plastic bottles and pouches are preferred for ease of transportation, design flexibility, and recyclability. The rising demand for PET and HDPE bottles in beverages, detergents, and personal care products continues to fuel the segment’s growth, alongside increasing innovations in sustainable and biodegradable plastic packaging materials.

- On the basis of Application, the Global Liquid Filling Machines Market is segmented into food & beverages, chemicals, pharmaceuticals & medical devices, personal care & cosmetics and others.

In 2025, the food & beverages segment is expected to dominate the market

In 2025, the Food & Beverages segment is projected to dominate the Global Liquid Filling Machines Market with a market share of 46.36%, owing to the rising demand for packaged and ready-to-drink beverages, sauces, and dairy products. Manufacturers in this sector are increasingly adopting automated filling systems for enhanced hygiene, speed, and product consistency. Moreover, the growth of convenience foods, expansion of retail channels, and adoption of sustainable packaging are key drivers supporting the segment’s dominance in 2025.

Major Players

Krones AG (Germany), I.M.A. Industria Macchine Automatiche S.p.A (Italy), GEA Group Aktiengesellschaft (Germany), Barry-Wehmiller Companies (U.S.), and JBT Corporation (U.S.).

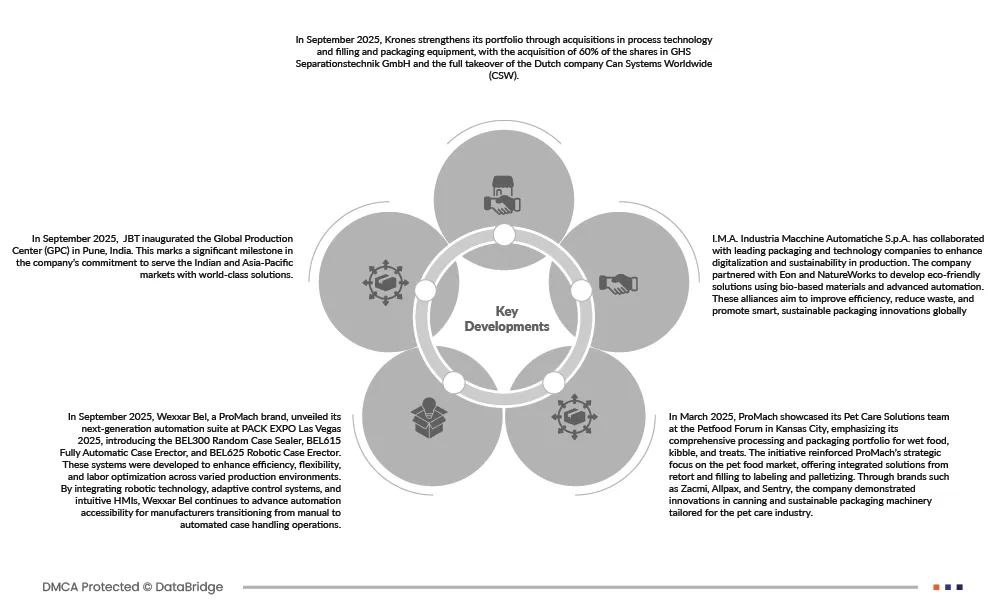

Latest Developments in Global Liquid Filling Machines Market

- In March 2025, as reported by Marchesini Group Beauty, a series of advanced filling and packaging lines for liquid cosmetic products was presented at Cosmopack 2025, featuring a filling machine with servo-dosing nozzles, suction systems for precise fill levels, and rapid-change monobloc filling and capping systems. The showcase highlighted the importance of precision dosing and flexible changeover capabilities, which are key features of modern liquid filling machines designed to handle high‑variety, low‑volume cosmetic production efficiently.

- In November 2024, SIG Group launched the SIG Neo Slimline 15 Aseptic – a high‑speed aseptic carton‑filling machine designed for multi‑serve formats (500 mL to 1 L) and capable of up to 15,000 packs/hour. This development exemplifies how filling-machine providers are responding to the rapid expansion of liquid-based food and beverage manufacturing by offering automated, flexible, and high-throughput solutions that enable manufacturers to scale operations, diversify packaging formats, and improve operational efficiency.

- In May 2025, Syntegon Technology introduced its SynTiso line concept for liquid pharmaceutical filling, a fully automated, high-throughput system capable of handling up to 600 containers per minute. The launch reflects the growing demand from rapidly expanding manufacturing sectors, such as pharmaceuticals, food, beverage, and cosmetics, where higher production volumes and diverse product formats are driving investment in advanced filling solutions. This trend underscores how industry growth is driving the adoption of modern liquid filling machines, enabling efficient, high-volume operations that meet quality and regulatory requirements.

- In July 2025, according to Contract Pharma, TurboFil, a specialist in liquid-filling and assembly machines, became the exclusive U.S. distributor for RAVONA’s aseptic containment and fill-finish systems. This partnership reflects the increasing demand from the rapidly expanding food, beverage, and cosmetic manufacturing sectors, where higher production volumes and stricter hygiene requirements are driving investment in integrated, turnkey liquid filling solutions. By providing precise, high-throughput systems that support hygienic and efficient operations, equipment suppliers are responding directly to the growth of these industries and their need for scalable, reliable liquid production lines.

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the Global Liquid Filling Machines Market report are North America, Europe, Asia-Pacific, Middle East and Africa, South America. North America is further segmented into U.S., Canada and Mexico Europe is further segmented into Germany, U.K., Italy, France, Spain, Switzerland, Russia, Turkey, Belgium, Netherlands, Rest of Europe. The Asia-Pacific is further segmented into China, Japan, South Korea, India, Thailand, Singapore, Malaysia, Indonesia, Australia, Philippines, rest of Asia-Pacific. The North America is further segmented into U.S., Canada, and Mexico. The South America is further segmented into Brazil, Argentina, and rest of South America. The Middle East and Africa is further segmented into South Africa, Egypt, Saudi Arabia, U.A.E, Israel, Rest of Middle East and Africa.

Asia-Pacific is the dominating region in Global Liquid Filling Machines Market

Asia-Pacific dominates the Global Liquid Filling Machines Market, driven by rapid industrialization, growing food & beverage production, and the expansion of pharmaceutical and personal care manufacturing across the region. Countries such as China, India, Japan, and South Korea are witnessing substantial investments in automated packaging and filling technologies to meet the surging demand for packaged consumer goods. The presence of a large manufacturing base, cost-effective labor, and increasing adoption of modern automation systems in production facilities further strengthen Asia-Pacific’s leadership in the global market.

Asia-Pacific is expected to be the fastest growing region in Global Liquid Filling Machines Market

Asia-Pacific is projected to witness the fastest growth in the Global Liquid Filling Machines Market during the forecast period, supported by rising consumption of packaged beverages, pharmaceuticals, and cosmetics, coupled with accelerating industrial automation trends. The region’s expanding e-commerce sector, changing lifestyle preferences, and increasing investments in modern packaging infrastructure are driving demand for efficient, high-speed liquid filling systems. Additionally, local manufacturers’ focus on technology upgrades and exports of packaging machinery from countries like China and Japan continue to boost regional market growth.

For more detailed information about the Global Liquid Filling Machines Market report, click here – https://www.databridgemarketresearch.com/reports/global-liquid-filling-machines-market