In the U.S., the growing emphasis on energy-efficient power distribution systems across industrial and commercial sectors is significantly driving the expansion of the busway market, as organizations face mounting pressure to comply with stringent environmental regulations while reducing operational costs. Industries with high power consumption, such as manufacturing facilities, data centers, and commercial buildings—are increasingly adopting busway systems due to their ability to deliver efficient energy transfer with lower electrical losses compared to traditional cable systems. The strong focus on sustainability and green building initiatives further accelerates adoption, as busways optimize space utilization, enhance operational performance, and reduce environmental impact while offering flexible, scalable designs that integrate seamlessly into modern infrastructure. This trend is reinforced by ongoing innovations, such as Vertiv’s 2021 launch of the Liebert RXA remote power panel and Liebert MBX busway system for high-density data center applications, Schneider Electric’s April 2024 introduction of the I-Line Track medium power distribution busway designed for scalable and energy-efficient data centers, and Elsewedy Electric’s 2022 launch of advanced busway dielectric epoxy insulation systems that support safe, compact, and sustainable power distribution for large-scale facilities. Collectively, these developments highlight how the rising focus on energy efficiency, sustainability, and operational optimization is positioning busway systems as a critical component of energy management strategies in the U.S., driving sustained demand, innovation, and market growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-busway-market

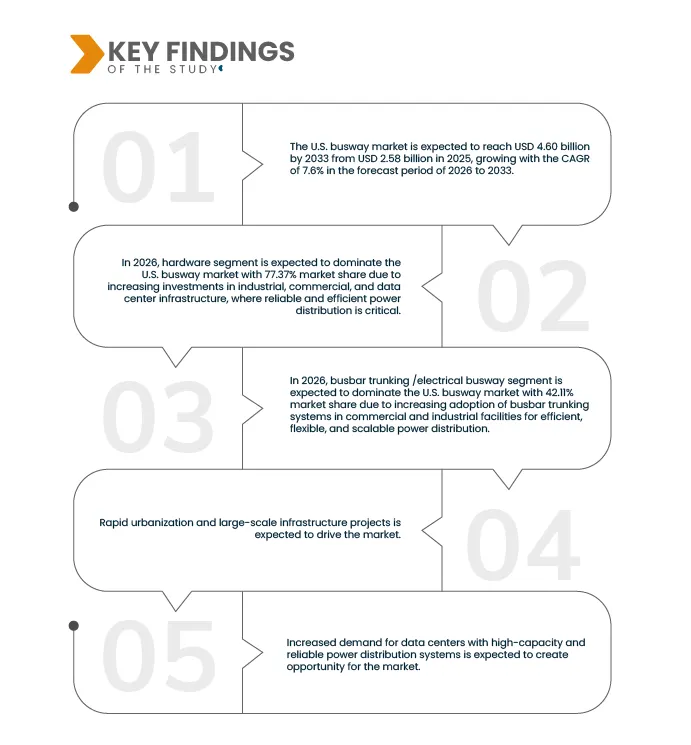

Data Bridge Market Research analyses that the U.S. Busway Market is expected to reach USD 4.60 billion by 2033 from USD 2.58 billion in 2025, growing with the CAGR of 7.6% in the forecast period of 2026 to 2033.

Key Findings of the Study

Rapid Urbanization and Large-Scale Infrastructure Projects

Rapid urbanization and large-scale infrastructure development in the U.S. are significantly increasing the demand for reliable, scalable, and efficient power distribution solutions, positioning busway systems as a critical enabler of modern urban growth. As cities expand and new residential, commercial, and industrial projects emerge, the need for power systems capable of handling high loads while optimizing space and ensuring reliability has intensified, making busways an ideal choice. Their flexibility, scalability, and ability to support expanding energy demands with minimal disruption align well with fast-paced construction and infrastructure upgrades. This trend is reinforced by major industry investments, such as Vertiv’s plan announced in January 2024 to double global manufacturing capacity for switchgear and busway solutions by 2025 to meet rising data center and critical infrastructure demand, Eaton’s August 2023 investment of over USD 500 million to expand North American production of electrical solutions including busway systems to support urban electrification and grid modernization, and LS Cable & System’s May 2024 announcement to build a new bus duct factory in Mexico to serve U.S. and Canadian markets amid growing demand from data centers, EVs, and semiconductor facilities. Collectively, these developments highlight how rapid urbanization and large-scale infrastructure projects are accelerating the adoption of busway systems in the U.S., as they offer a future-ready, cost-effective, and efficient solution to power modern cities and support continued industrial and urban evolution.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable from 2013-2027)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Offering (Hardware and Service), Components (Busbar Trunking /Electrical Busway, Enclosures, Tap-off Units, Joint Connectors, Grounding Systems, End Caps and End Feeds, and Others), Type (3-Phase 4-Wire, 3-Phase 5-Wire, and Others), Implementation (Ceiling Overhead and Raised Floor), Insulation (Air-Insulated, Isolated Phase, and Busway), Conductor Materials (Copper Busway, Aluminum Busway, and Hybrid Busway), Phase Type ( Segregated Phase, Non-Segregated Phase, and Plug-In), Function (Feeder Busway, Lighting Busway, Distribution Busway, Trunking / Vertical Busway, and Others), Power Rating (Low Power Busway, Medium Power Busway, and High Power Busway), Vertical (IT (Telecommunication and Broadcasting), Residential, Commercial Buildings, Industrial Facilities, Healthcare, Transportation, Educational Institutions, Energy, Government and Military, Entertainment and Sports Venues, and Others), Distribution Channel (Indirect and Direct)

|

|

Market Players Covered

|

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), EAE ELECTRIK (Turkey), Furukawa Electric Co., Ltd. (Japan), Honeywell International Inc. (U.S.), Powell Industries (U.S.), Starline Holdings, LLC. (U.S.), Chatsworth Products (U.S.), Panduit Corp. (U.S.), Delta Power Solutions (Taiwan), Rittal Pvt. Ltd. (Germany), Vertiv Group Corp. (U.S.), Legrand (France), Anord Mardix (Ireland), MEGABARRE Group (Italy), USPWR (U.S.), LS Cable & System USA (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

|

Segment Analysis

The U.S. busway market is segmented into eleven notable segments which are based on offering, components, type, implementation, insulation, conductor material, phase type, function, power rating, vertical, distribution channel.

- On the basis of offering, the market is segmented into hardware and service.

In 2026, hardware segment is expected to dominate the U.S. busway market

In 2026, hardware segment is expected to dominate the U.S. busway market with 77.37% market share due to increasing investments in industrial, commercial, and data center infrastructure, where reliable and efficient power distribution is critical.

- On the basis of components, the market is segmented into busbar trunking / electrical busway, enclosures, tap-off units, joint connectors, grounding systems, end caps and end feeds, and others.

In 2026, busbar trunking /electrical busway segment is expected to dominate the U.S. busway market

In 2026, busbar trunking /electrical busway segment is expected to dominate the U.S. busway market with 42.11% market share due to increasing adoption of busbar trunking systems in commercial and industrial facilities for efficient, flexible, and scalable power distribution.

- On the basis of type, the market is segmented into 3-phase 4-wire, 3-phase 5-wire, and others. In 2026, 3-phase 4-wire segment is expected to dominate the Market with 63.96% market share

- On the basis of implementation, the market is segmented into ceiling overhead and raised floor. In 2026, ceiling overhead segment is expected to dominate the market with 59.24% market share

- On the basis of insulation, the market is segmented into air-insulated and isolated phase busway. In 2026, air-insulated segment is expected to dominate the market with 77.69% market share

- On the basis of conductor material, the market is segmented into copper busway, aluminum busway, and hybrid busway. In 2026, copper busway segment is expected to dominate the market with 54.92% market share

- On the basis of phase type, the market is segmented into segregated phase, non-segregated phase, and plug-in. In 2026, non-segregated phase segment is expected to dominate the market with 48.67% market share

- On the basis of function, the market is segmented into feeder busway, lighting busway, distribution busway, trunking / vertical busway, and others. In 2026, feeder busway segment is expected to dominate the market with 36.92% market share

- On the basis of power rating, the market is segmented into low power busway, medium power busway, and high power busway. In 2026, medium power busway segment is expected to dominate the market with 49.66% market share

- On the basis of vertical, the market is segmented into it (telecommunication and broadcasting), residential, commercial buildings, industrial facilities, healthcare, transportation, educational institutions, energy, government and military, entertainment and sports venues, and others. In 2026, industrial facilities segment is expected to dominate the market with 24.63% market share

- On the basis of distribution channel, the market is segmented into indirect and direct. In 2026, indirect segment is expected to dominate the market with 74.54% market share

Major Players

Data Bridge Market Research Analyses Schneider Electric (France), Eaton (Ireland), Delta Power Solutions (Taiwan), Vertiv Group Corp. (U.S.), Legrand (France) as the major players operating in the market.

Market Developments

- In December 2024, Legrand has acquired Power Bus Way, a North American leader in Cable Bus power busbars for data centers. This marks the company’s eighth acquisition of the year, strengthening its position in the growing data center market with a focus on energy and digital transition.

- In September 2024, Legrand has announced the acquisition of UPSistemas in Colombia and APP in Australia, expanding its presence in the data center and cable management markets. These acquisitions bring total external growth operations this year to seven, contributing nearly Euro 350 million in annualized revenue.

- In October 2024, Schneider Electric has partnered with Noida International Airport to implement advanced building and energy management solutions, including Electrical SCADA and ADMS. These solutions will enhance energy efficiency, sustainability, and operational performance, supporting seamless airport operations while reducing carbon emissions.

- In October 2024, Eaton has expanded its Puducherry manufacturing facility, adding 120,000 square feet for Power Distribution products and an R&D center. The expansion doubles production capacity for critical products, supports India's "Make in India" initiative, and creates over 300 new jobs.

As per Data Bridge Market Research analysis:

For more detailed information about Busway Market click here – https://www.databridgemarketresearch.com/reports/us-busway-market